Слайд 2

Learning Objectives

Make good buying decisions.

Choose a vehicle that

suits your needs and budget.

Choose housing that meets your

needs.

Decide whether to rent or buy housing.

Calculate the costs of buying a home.

Get the most out of your mortgage.

Слайд 3

Smart Buying

Step 1: Differentiate Want From Need

Smart

buying requires separating wants from needs.

“Want” purchases require

a trade-off.

Before buying a “want,” determine whether the purchase will interfere with your ability to pay for your future needs.

Слайд 4

Smart Buying

Step 2: Do Your Homework

After deciding

to make a purchase, comparison shop.

Start your research

with publications that provide unbiased ratings and recommendations such as:

Consumer Reports at www.consumerreports.org

Consumer’s Resource Handbook from the U.S. Office of Consumer Affairs at www.pueblo.gsa.gov

Слайд 5

Smart Buying

Step 3: Make Your Purchase

Getting the best

price might involve negotiations.

Conduct research before haggling.

Know what the

product’s mark-up is.

This is the price dealers add on above what they paid for the product.

Consider what fits your monthly budget.

Слайд 6

Smart Buying

Step 4: Maintain Your Purchase

Maintain your

purchase after the deal is complete.

Resolve complaints or issues.

First

contact the seller, then the company headquarters that made or sold the product.

Work with the Better Business Bureau and other local, state, and federal organizations.

Слайд 7

Smart Buying

Checklist 8.1 Before You Buy

Decide in

advance what you need and can afford.

Take advantage of

sales but compare prices.

Be aware of extra charges that increase the total price.

Ask about refund or exchange policy.

Read and understand the contract before signing.

Learn about your cancellation rights.

Don’t succumb to high pressure tactics or do business over the phone with unknown companies.

Get everything in writing.

Слайд 8

Smart Buying

Checklist 8.2 Making a Complaint

Keep a

record of your efforts to resolve the problem.

Contact the

seller, then go to the manufacturer.

Type letters, keep copies, and send letters with return receipt requested.

Allow time for the company to resolve the problem, then file a complaint with your local consumer protection office or Better Business Bureau.

Don’t give up until you are satisfied.

Слайд 9

Smart Buying in Action:

Buying a Vehicle

Vehicles are your

largest purchase, next to buying a house.

Choices to consider:

Buy new

Buy used

Lease the vehicle

Leasing is renting for an extended period with a small down payment and low monthly rates.

Слайд 10

Smart Buying in Action:

Buying a Vehicle

Step 1: Differentiate

Want From Need

Determine which features you need.

Make a

list of the features you want.

Consider your employment, family, lifestyle.

Слайд 11

Smart Buying in Action:

Buying a Vehicle

Step 2: Do

Your Homework

How much can you afford?

Typical family spends 4-6

months of annual income on a new car.

Determine size of down payment.

Determine an affordable monthly payment.

Which vehicle is right for you?

Comparison shop, looking at choices and trade-offs.

Consider operating and insurance costs, and warranty.

Слайд 12

Smart Buying in Action:

Buying a Vehicle

Step 3: Make

Your Purchase

Be sure to get a fair price.

Know the

dealer cost or invoice price.

Research using Edmund’s Car Buying Guide at www.edmund.com at www.edmund.com or AutoSite at their web site www.autosite.com/content/home.

Most car dealers receive a “holdback,” amounting to

2-3% of the price, when selling a car.

Слайд 13

Smart Buying in Action:

Buying a Vehicle

Step 3: Make

Your Purchase

Financing Alternatives:

Cheapest way to buy a car is

with cash, but investigate all financing options before buying.

Keep financing out of the negotiations.

The shorter the term, the higher the monthly payments.

Слайд 14

Smart Buying in Action:

Buying a Vehicle

Step 3: Make

Your Purchase

Leasing:

Appeals to those who are financially stable, like

a new car every few years, drive less than 15,000 miles annually, and don’t want hassle of trading in car.

Popular with those with good credit but not enough up-front money to buy.

1/3 of all new vehicles are leased.

Слайд 15

Smart Buying in Action:

Buying a Vehicle

Step 4: Maintain

Your Purchase

Keep vehicle in best running condition.

Read owner’s manual

and follow regular maintenance.

Don’t ignore signs of trouble.

Listen for unusual sounds, drips, or warning lights.

Your first line of protection is the warranty.

Know your rights under the Lemon laws.

Слайд 16

Smart Buying in Action: Housing

Many people equate home

ownership with financial success.

Housing costs can take up

over 25% of after-tax income.

Home ownership is also an investment – likely the biggest investment you will ever make.

Consider lifestyle, wants and needs, and budget constraints when making choices.

Слайд 17

Your Housing Options

A House:

Popular choice for most individuals.

Offers

space and privacy.

Offers greater control over style decoration and

home improvement.

Requires more work than the other choices, including maintenance, repair, and renovations.

Most potential for capital appreciation.

Слайд 18

Your Housing Options

A Cooperative (Co-op) is a building

owned by a corporation in which residents are stockholders.

Residents

buy stock, giving them the right to occupy a unit in the building.

The larger the space and the more desirable the location, the more shares you have to buy.

Difficult to get a mortgage.

Pay monthly homeowner’s fee for taxes and maintenance.

Слайд 19

Your Housing Options

A Condominium (Condo) is an apartment

complex that allows individual ownership of the unit and

joint ownership of land, common areas, and facilities.

Allows direct ownership of the unit with a proportionate ownership in land and common areas.

Pay monthly fee for interest, taxes, utilities, and groundskeeping.

Слайд 20

Your Housing Options

Apartments and other rental housing offer:

Affordability

Low

maintenance situations

Little financial commitment

Chosen by young, single people.

May

be a lifestyle decision.

Limited upkeep and no long-term commitment.

Offers lack of choice regarding pets or remodeling.

Слайд 21

Smart Buying in Action: Housing

Step 1: Differentiate Want

From Need

Determine what you need versus what you want.

Decide

what is important to you:

Consider location – country, suburbs, or city

Consider the neighborhood – safety, convenience, schools

Слайд 22

Smart Buying in Action: Housing

Step 2: Do Your

Homework

Investigate the potential home and all that goes along

with it:

Neighborhood, community lifestyle, satisfy needs.

www.homes.com/Content/NeighborhoodSearchMain.cfm

www.homefair.com

Understand how much you can afford to pay.

Слайд 23

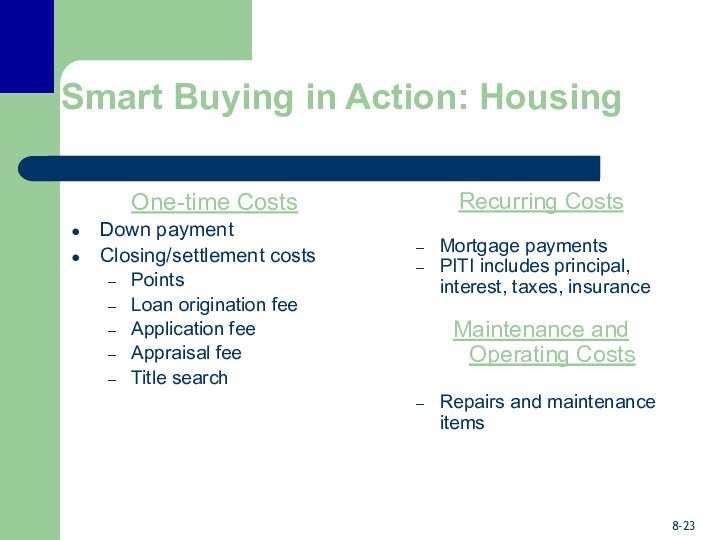

Smart Buying in Action: Housing

One-time Costs

Down payment

Closing/settlement

costs

Points

Loan origination fee

Application fee

Appraisal fee

Title search

Recurring Costs

Mortgage payments

PITI includes principal, interest, taxes, insurance

Maintenance and Operating Costs

Repairs and maintenance items

Слайд 24

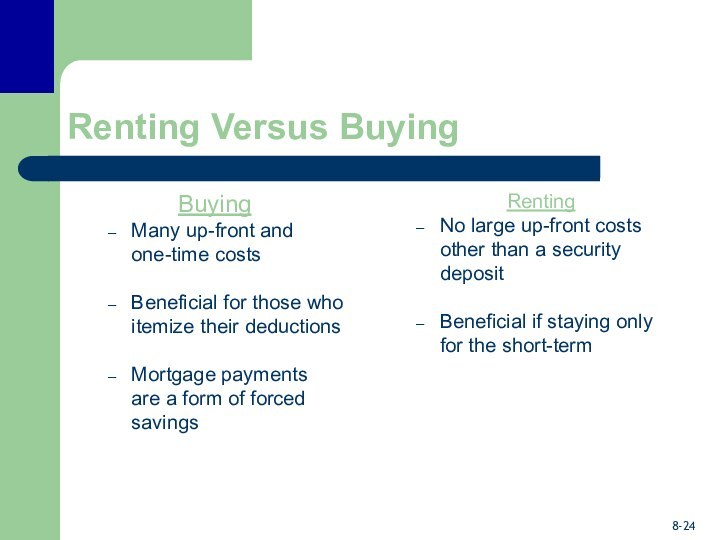

Renting Versus Buying

Buying

Many up-front and

one-time costs

Beneficial for

those who itemize their deductions

Mortgage payments

are a form of

forced savings

Renting

No large up-front costs other than a security deposit

Beneficial if staying only for the short-term

Слайд 25

Determining What You

Can Afford

Before house hunting, ask yourself:

What

is the maximum amount the bank will lend me?

Should

I borrow up to this maximum?

How big a down payment can I afford?

Слайд 26

What is the Maximum Amount the Bank Will

Lend Me?

Lenders look at:

Your financial history –

steadiness of income, credit report, and FICO score

Your ability to pay – lenders use ratio of a maximum 28% PITI: monthly gross income

Appraised value of home – limit mortgage loan to 80%.

Слайд 27

How Much Should You Borrow?

A mortgage is a

large financial commitment of future earnings.

Look at your

overall financial plan before deciding on how much to borrow.

Prequalifying – lender confirms the loan size based on ability to pay and down payment.

Слайд 28

Financing the Purchase:

The Mortgage

Sources of mortgages:

S&Ls and commercial

banks are the primary sources of mortgage loans.

Mortgage bankers

originate loans, sell them to banks or pension funds, have fixed rate mortgages.

Mortgage brokers are middlemen who place loans with lenders for a fee but do not originate those loans. They do the comparison shopping.

Слайд 29

Conventional and Government-Backed Mortgages

Conventional loans - from a

bank or S&L and secured by the property.

If

default - lender seizes property, sells it to recover funds owed.

Слайд 30

Conventional and Government-Backed Mortgages

Government-backed loans – lender makes

loan and government insures it. VA and FHA account

for 25% of all mortgage loans.

Advantages:

Lower interest rate

Smaller down payment

Less strict financial requirements

Disadvantages:

Increased paperwork

Higher closing costs

Limits amount borrowed

Слайд 31

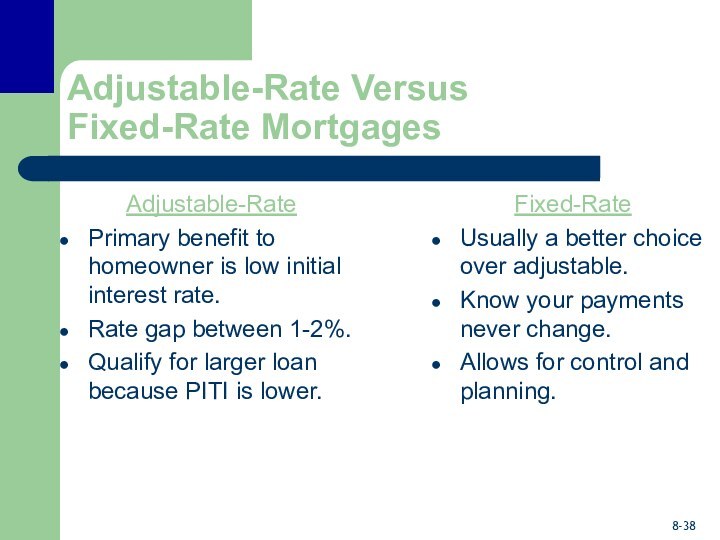

Fixed-Rate Mortgages

Monthly payment doesn’t change regardless of changes

in market interest rates.

If rates are low, a

fixed rate mortgage locks in the low rates for the life of the loan.

An assumable loan can be transferred to a new buyer.

Prepayment privilege allows early cash payments to be applied to principal.

Слайд 32

Adjustable-Rate Mortgages

With an ARM, the interest rate fluctuates

based on current market interest rates within limits at

specified intervals.

Borrowers are better off with an ARM if interest rates drop.

Initial Rate - “teaser rate” can be deceptively low and available for only a short time period.

Слайд 33

Adjustable-Rate Mortgages

Interest Rate Index – rates on ARMs

are tied to an index not controlled by the

lender, such as 6- or 12-month U.S. Treasuries.

Margin – the amount over the index rate that the ARM is set.

Adjustment Interval – how frequently the rate can be reset.

Слайд 34

Adjustable-Rate Mortgages

Payment Cap – sets dollar limit on

how much the monthly payment can increase during any

adjustment period.

If interest rates go up, the monthly payment may be too small to cover the interest due.

This results in negative amortization. The unpaid interest is added to the unpaid loan balance, increasing its size.

Слайд 35

Adjustable-Rate Mortgages

ARM Innovations:

Convertible ARM – convert traditional ARM

to a fixed rate loan during 2nd – 5th

years.

Reduction-option ARM – one-time optional interest rate adjustment to market interest during 2nd – 6th years.

Two-step ARM – interest rate is adjusted at end of 7th year, then constant for life.

Price level adjusted mortgage – low initial rate, payments and interest change with inflation.

Слайд 36

Other Mortgage Loan Options

Balloon Payment Loan – small

monthly payments for 5-7 years, then entire loan due.

Graduated

Payment Mortgage – payments set in advance, rising for 5-10 years, then level off.

Growing Equity Mortgage – designed to let homebuyer pay off mortgage early.

Слайд 37

Other Mortgage Loan Options

Shared Appreciation Mortgage – borrower

receives below-market interest rate and lender receives a portion

of future appreciation.

Interest Only Mortgage – combination of interest only payment at beginning, then pay both interest and principal for remainder of loan.