Слайд 2

Agenda

Case Introduction

Background

Project Description

Our Analysis

Recommendation

Questions?

Слайд 3

The Walt Disney Company

Entertainment Conglomerate consisting of Media,

Studio Entertainment, Consumer Products and Theme Parks & Resorts

Theme

Park & Resorts Division

Current Park Locations: Anaheim, Orlando, Tokyo, Paris, Hong Kong (2005)

Also includes: The Disney Cruise Line, Disney Regional Entertainment, The Disney Vacation Club, The Anaheim Angels, and the Mighty Ducks of Anaheim

Revenues of $7 Billion in 2001, or 28% of company-wide revenue

Слайд 4

Disney’s Interest in China

Long-term

Consistently searching for areas

of expansion where there are un-captured markets

Current

Government relations

established through the Hong Kong Disneyland project indicate easier entry into the mainland

Competitive

Universal-Vivendi’s land purchase in Shanghai and proposed expansion into Beijing

Слайд 5

Agenda

Case Introduction

Background

Project Description

Our Analysis

Recommendation

Questions?

Слайд 6

Background: Disney Parks

Disneyland, Anaheim: 1955

Walt Disney World, Orlando:

1971

Tokyo Disneyland:1983

Owned and operated by the Oriental Land Company

Deal

structure indicative of financial turmoil within the company in the early 1980s with a 0% Equity stake

Revenue from royalties and management fees

Disneyland Paris/Euro Disneyland: 1992

Disney retains 39% of Equity Interest and receives management fees as part of reported revenue

Слайд 7

Hong Kong Disneyland

$1.8 Billion USD Project

60% Debt

80% Government

20%

Commercial

40% Equity

43% Disney

57% Government (will eventually sell down ownership

stake)

6 Million Visitors in its first full operating year, and 1.4 Million additional visitors to Hong Kong

$148 Billion value added boost to the Hong Kong economy over the next 40 years

35,800 jobs created in the next 20 years

Слайд 8

Background: China

Largest population in the world with relatively

slow projected population growth

1.26 B (2001) - 1.5 B

(2050F)

63 - 70% Rural

High growth rates in GDP and foreign direct investment (FDI)

Urban income growth of 17.2% in 2002,

Growth in FDI of 14.8% in 2002

2003F: US$58 B

2004F: US$62 B

Accession to the World Trade Organization in December 2001

Increased support for private and foreign investments

Theme parks still fall under Restricted Foreign Investment Industries

Слайд 9

Theme Parks in China

Most parks in China were

American-themed

Few have survived mainly because of transportation issues

Admission Prices:

56 – 100 yuan ($6 – $12)

Park Sizes: 70 – 150 acres

Universal-Vivendi December 2002 agreement to build a park in Shanghai

Projected park opening in 2006, with more than 8 million visitors in the first year

In discussions to build a similar park in Beijing

Слайд 10

Background: Why Shanghai?

China

Shanghai

Shanghai leads in GDP and FDI

in China

GDP US$4,512 (2001)

9% of total FDI in China

Shanghai

residents (2002)

18.4 M, including floating population

Average household size is 2.9

Tourist population (2000)

64.7 mainland domestic

1.5 million foreign overseas

0.5 million

* 2000 figures

Слайд 11

Agenda

Case Introduction

Background

Project Description

Our Analysis

Recommendation

Questions?

Слайд 12

Park Location is Key

Significant infrastructure development is occurring

to support the 2010 Expo

Expo Site and Universal Property

Слайд 13

Target Market

* Based on 2008F Population numbers

Слайд 14

Project Structure

1.27 Billion US$ total capital investment

60% Debt

80%

Government

20% Commercial

40% Equity

43% Disney

57% Government

10.6 Million Visitors in its

first full operating year and average annual growth of 1.5%

Corporate tax rate of 30%, with tax loss carry-forwards permitted for five years

Слайд 15

Operating Cash Flows

Admissions (50%)

Food and beverage (24.5%)

Merchandise (24.5%)

Main

entrance (1%)

Park labor and overhead

Maintenance materials

Entertainment (costuming, labor, etc.)

Food

and beverage COGS

Merchandise COGS

Support labor

Miscellaneous

Revenues

Costs

Слайд 17

Agenda

Case Introduction

Background

Project Description

Our Analysis

Recommendation

Questions?

Слайд 18

Risk Analysis - Sovereign

Currency risk is not mitigated

by this project since the majority of cash inflows

and outflows are in local currency

Expropriation risk is mitigated some with the government taking a controlling equity stake

No other commercial or multi-lateral agency partners are involved in the project

Because the project is in the tourism industry and involves an American cultural icon, the susceptibility to strikes or terrorism is slightly higher than average

The project’s location in Shanghai reduces the overall risk of natural disasters when compared to country averages

Слайд 19

Risk Analysis – Operating

and Financial

The technology for this

project will be provided by Disney and is proven

in other locations

Potentially lengthy negotiations with the Chinese government increases start-up risks slightly

Given the project is very service oriented, there is some risk associated with the level of control assumed by the government, but this is difficult to quantify

There are no financial mitigating factors ― rather, this project is closely tied to the government

Real option: A minor amount of cannibalization from the Hong Kong property may be expected

Слайд 20

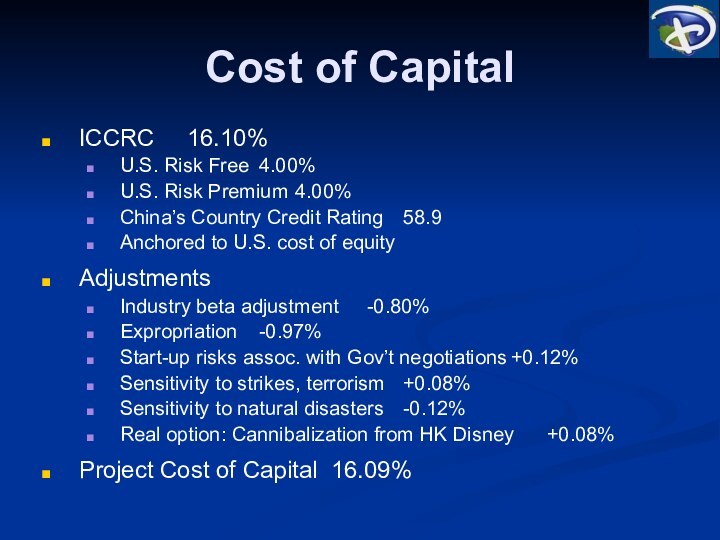

Cost of Capital

ICCRC 16.10%

U.S. Risk Free 4.00%

U.S. Risk Premium 4.00%

China’s Country

Credit Rating 58.9

Anchored to U.S. cost of equity

Adjustments

Industry beta adjustment -0.80%

Expropriation -0.97%

Start-up

risks assoc. with Gov’t negotiations +0.12%

Sensitivity to strikes, terrorism +0.08%

Sensitivity to natural disasters -0.12%

Real option: Cannibalization from HK Disney +0.08%

Project Cost of Capital 16.09%

Слайд 21

Cash Flow Analysis

* Cash flows analyzed through 2029

(per Disney, typical 20-25 year financial analysis time horizon)

Слайд 22

Real Options

Option to wait until Universal Studios opens

Already

losing any first mover advantage

Universal’s track record at opening

resorts is not on par with Disney’s ― lessons learned from Universal may be minimal

Build a resort hotel in conjunction with the park

Build a “Downtown Disney” entertainment center adjacent to park

Build another gate after several years of operation (double park size)

Слайд 23

Agenda

Case Introduction

Background

Project Description

Our Analysis

Recommendation

Questions?

Слайд 24

Recommendation

Begin negotiations with Chinese government

Government equity stake and

debt provisions

Land and infrastructure provisions

Disney must make the argument

that a Shanghai Park would not substantially damage Hong Kong

Escalating political tensions on the Korean peninsula could change the risk assessment