Слайд 2

What To Do With Income?

Pay taxes

Spend it (consume

today)

Save it (delay consumption to future)

Invest it

Using money you

have saved to purchase a product that will create benefits in the future

Saving and investing involves trade-offs

Слайд 3

Saving and Investment

Saving

Not consuming all current income

Examples:

Savings Account, Certificate of Deposit

Business Investment

Production and purchase of

capital goods

Examples: machines, buildings and equipment that can be used to produce more goods and services in the future

Personal investment

Purchasing financial securities

Examples: stocks, bonds, real estate, mutual funds

Pay a higher rate of return in the long run than the interest paid on savings accounts.

Слайд 4

Return, Risk and Liquidity

Rate of Return -Type of

profit or loss you are getting on your investment

(Interest on savings)

Liquidity – ease of turning assets into money

Return and Risk (direct relationship)

Greater risk, higher returns (NASDAQ stocks)

Less risk, lower returns (CD)

Return and Liquidity (inverse relationship)

Greater liquidity, lower return (CD)

Less liquidity, greater return (Bonds)

Слайд 5

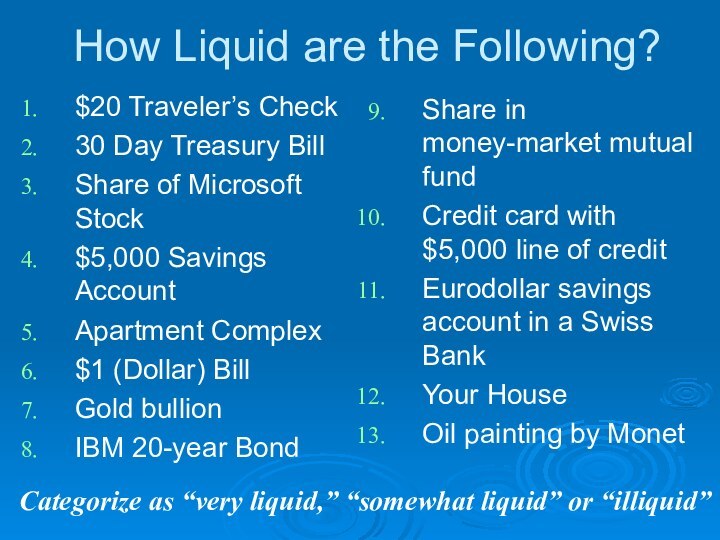

How Liquid are the Following?

$20 Traveler’s Check

30 Day

Treasury Bill

Share of Microsoft Stock

$5,000 Savings Account

Apartment Complex

$1 (Dollar)

Bill

Gold bullion

IBM 20-year Bond

Share in money-market mutual fund

Credit card with $5,000 line of credit

Eurodollar savings account in a Swiss Bank

Your House

Oil painting by Monet

Categorize as “very liquid,” “somewhat liquid” or “illiquid”

Слайд 6

$20 Traveler’s Check

30 Day Treasury Bill

Share of Microsoft

Stock

$5,000 Savings Account

Apartment Complex

$1 (Dollar) Bill

Gold bullion

IBM 20-year Bond

Share

in money-market mutual fund

Credit card with $5,000 line of credit

Eurodollar savings account in a Swiss Bank

Your House

Oil painting by Monet

Categorize as “very liquid,” “somewhat liquid” or “illiquid”

Слайд 7

Major Exchanges

NYSE - New York Stock Exchange –

“The Big Board”

Founded in 1792, the oldest and most

prestigious stock exchange in the U.S. – 3,000 mostly large-cap companies

NASDAQ - National Association of Securities Dealers Automated Quotation System - computerized national trading system that lists more than 5300 small-cap & technology companies

AMEX - The American Stock Exchange founded in 1842 as the New York Curb Exchange – 700 companies

Слайд 8

Blue Chips

Largest most consistently profitable companies that usually

pay dividends

Coca-Cola

General Electric

McDonald’s

Exxon-Mobile

Wal-Mart

Gillette

Слайд 9

Types of Stocks

Common Stock

The most basic form

of ownership that a corporation issues.

It designates that

you own a fraction of the company.

The value of a common stock is directly influenced by the successes and failures of the issuing company.

It may or may not pay a dividend, which is the portion of the company's profits paid out to its shareholders.

Слайд 10

Preferred Stock

They receive their dividends before common stock

owners

If the company goes out of business, preferred stockholders

are paid back the money they invested before the common stockholders

For these reasons, preferred stock is generally less risky than common stock

The main drawback of preferred stock is that it cannot benefit as much from company profits because it only pays a fixed dividend

Слайд 11

Capital Gains and Dividends

Capital Gains

A profit made when

selling stock at a higher price than they paid

for it. Most people buy stock to make money from capital gains.

For example, if you buy 100 shares of Company XYZ at $100.00 a share (a total $10,000 investment) and sold it for $125.00 a share ($12,500), you’ve realized a capital gain of $25.00 a share, or $2,500.00.

Слайд 12

Dividends

Dividends are the distribution of profits from a

company to the stockholders

Investors buy stock for the dividend

payments.

For example, if Company XYZ declares an annual dividend of $10.00 a share and you own 100 shares, you’ll earn $1000.00 a year, or, $250.00 paid each quarter.

Слайд 13

Who Decides Dividends?

A companies board of directors decides

how large a dividend the company will pay, or

whether it will pay one at all.

Quarterly dividend payments are the most common; annual and semiannual payments are less common.

Usually only large, established companies pay dividends.

This is because smaller companies need to reinvest their profits to continue growing.

Слайд 14

IPO – Initial Public Offerings

Taking a company through

a public offering on the U.S. securities markets is

a major undertaking

It is a source of pride, an opportunity for business growth, and a serious legal responsibility.

Great way to get growth money for expansion.

Downside – give up control

Слайд 15

Why Invest in Stock?

Earn regular income – dividend

payments

Buy low, sell high…hopefully ☺

Sell at higher price than

you bought?

Capital gain

Sell at lower price than you bought?

Capital loss

When do you reap the benefits?

Слайд 16

Market Cycles

Ups and Downs

Throughout its history, the

stock market has tended to move in cycles of

activity.

The stock market is greatly affected by economics, social, and political factors.

While it's impossible to predict the market's future activity, one thing is certain: The stock market will continue to experience ups and downs.

Слайд 17

Bull and Bear Markets

Bull: attacks by thrusting horns

up (positive)

Optimistic outlook, investor confidence

Prices rising or expected to

rise

Can apply to anything that is traded

Bear: attacks by swiping paw down (negative)

Prices falling or expected to fall

Enter a downturn of 15-20% in multiple indexes

Psychological effects & speculation

Слайд 18

Indexes

Each exchange calculates an index, or benchmark, based

on the activity of its member companies' stock prices.

"The market's up" or “the market's down," refers to the Dow Jones Industrial Average. It is considered a reliable indicator of the strength - or weakness - of stocks in general. Composite of 30 companies.

Слайд 19

Market Indices & Averages

A short list of the

major U.S. indices:

Dow Jones Industrial Average (DJIA)

Dow Transports

(DJTA)

Dow Utilities (DJUA)

DJ Wilshire 5000

NASDAQ Composite / NASDAQ 100

S&P 500 Index (S&P 500) / S&P 100

Russell 2000

NYSE and AMEX Composites

Слайд 20

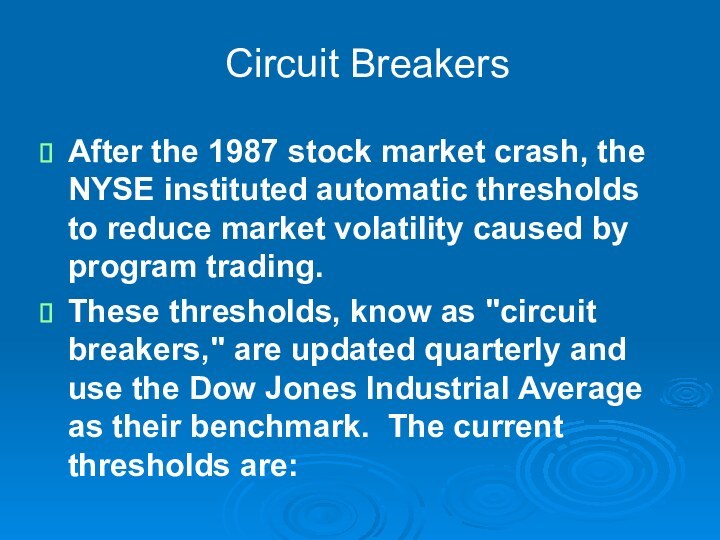

Circuit Breakers

After the 1987 stock market crash, the

NYSE instituted automatic thresholds to reduce market volatility caused

by program trading.

These thresholds, know as "circuit breakers," are updated quarterly and use the Dow Jones Industrial Average as their benchmark. The current thresholds are:

Слайд 21

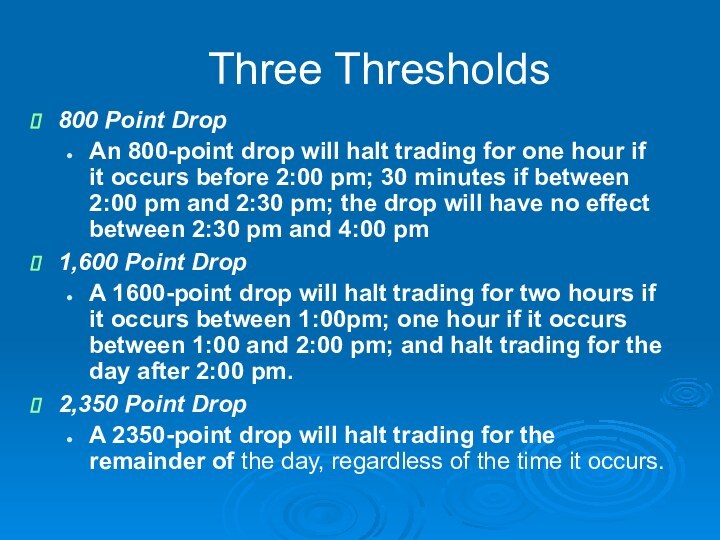

Three Thresholds

800 Point Drop

An 800-point drop will halt

trading for one hour if it occurs before 2:00

pm; 30 minutes if between 2:00 pm and 2:30 pm; the drop will have no effect between 2:30 pm and 4:00 pm

1,600 Point Drop

A 1600-point drop will halt trading for two hours if it occurs between 1:00pm; one hour if it occurs between 1:00 and 2:00 pm; and halt trading for the day after 2:00 pm.

2,350 Point Drop

A 2350-point drop will halt trading for the remainder of the day, regardless of the time it occurs.

Слайд 22

Days with Greatest Percentage Lost