are competitors at the same level of production and/or

distribution of a good or service, i.e., in the same relevant market.

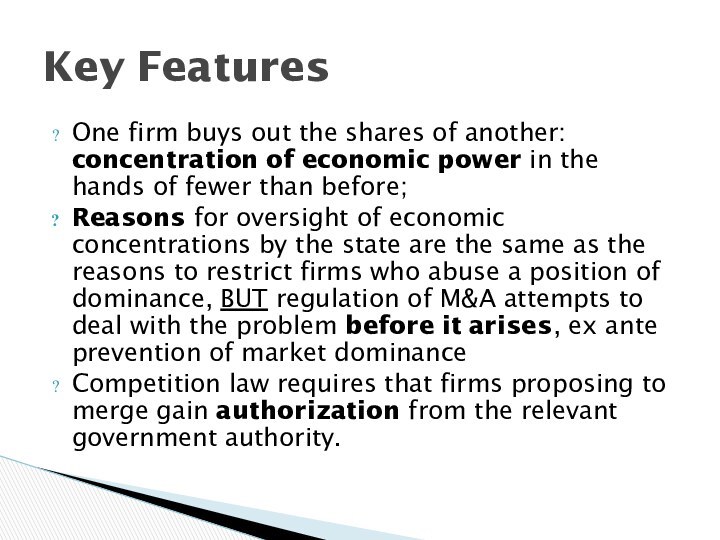

Types of anticompetitive effects associated with horizontal mergers:

unilateral (non-coordinated) effects arise where, as a result of the merger, competition between the products of the merging firms is eliminated, allowing the merged entity to unilaterally exercise market power, for instance by profitably raising the price of one or both merging parties’ products, thus harming consumers

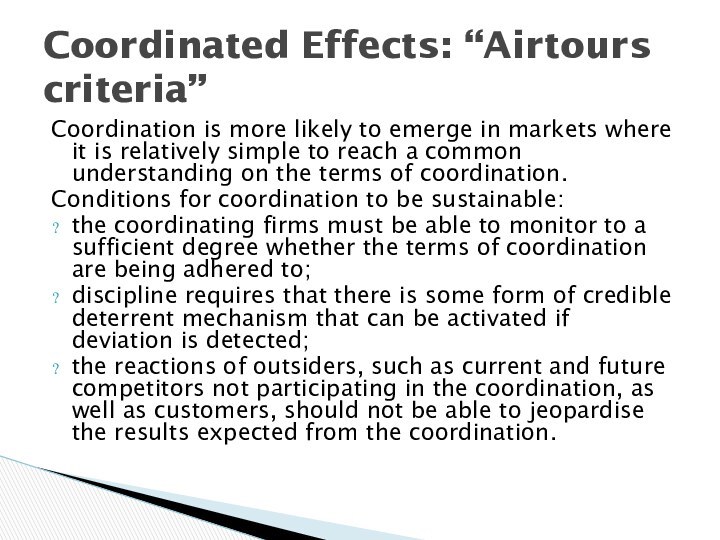

coordinated effects arise where, under certain market conditions (e.g., market transparency, product homogeneity etc.), the merger increases the probability that, post merger, merging parties and their competitors will successfully be able to coordinate their behaviour in an anti-competitive way, for example, by raising prices.

Horizontal Mergers