- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Fundamentals of Business English. Introduction to the specialty.

Содержание

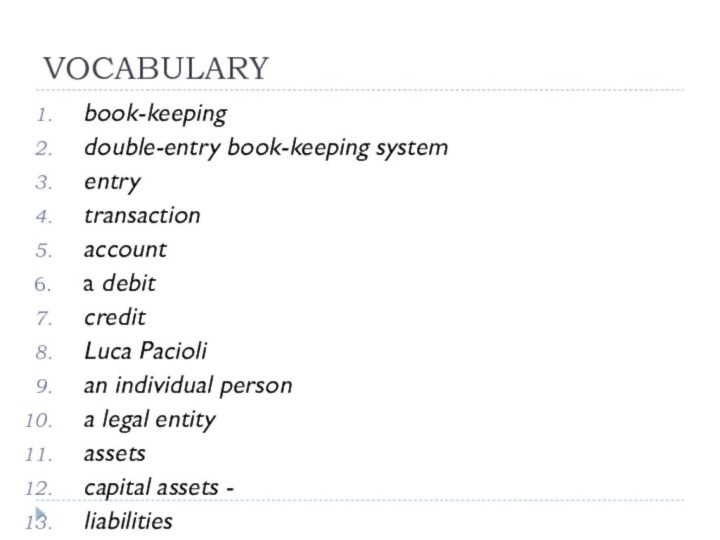

- 2. VOCABULARYbook-keeping double-entry book-keeping systementrytransactionaccounta debit credit Luca Pacioli an individual persona legal entity assets capital assets -liabilities equity balance sheet income expensesProfit and Loss Statement, income statement

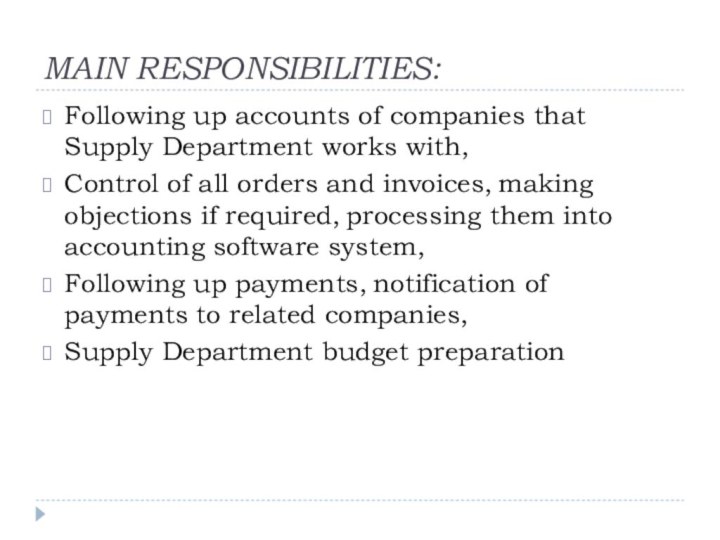

- 3. MAIN RESPONSIBILITIES:Following up accounts of companies that

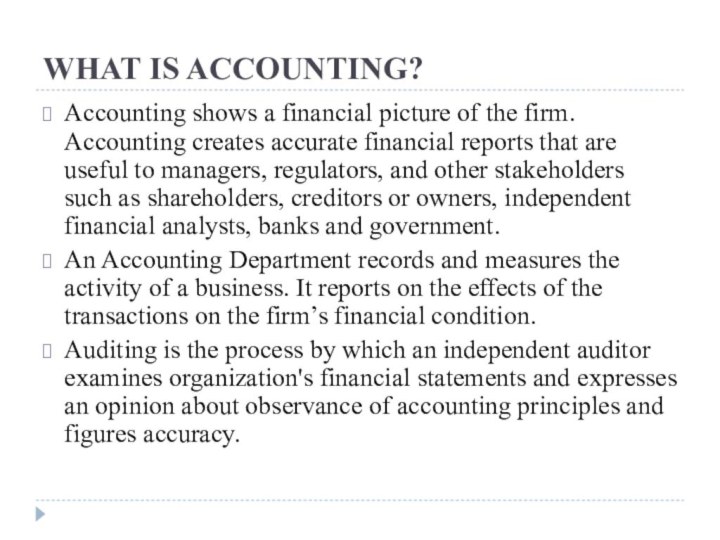

- 4. WHAT IS ACCOUNTING?Accounting shows a financial picture

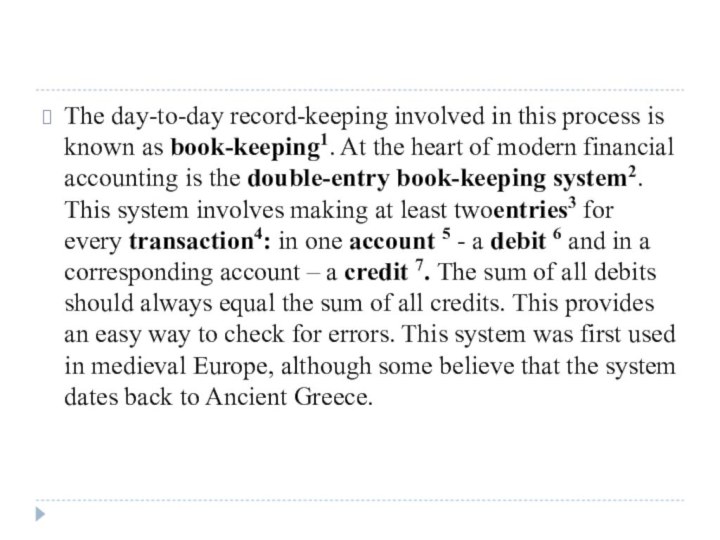

- 5. The day-to-day record-keeping involved in this process

- 6. Text 1. Part B. BASIC CONCEPTS OF

- 7. The liabilities6 of a business are things that will

- 8. Задание 1. Ответьте на вопросы по тексту.1. Who

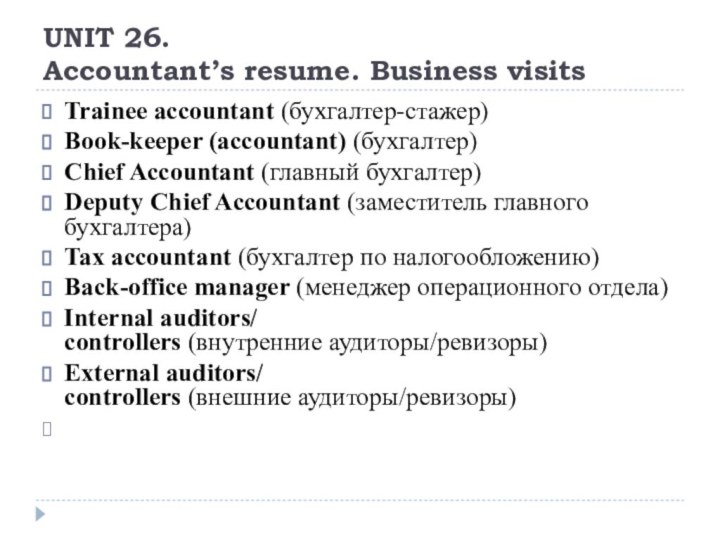

- 9. Ниже представлены названия и определения профессий специалистов-бухгалтеров.

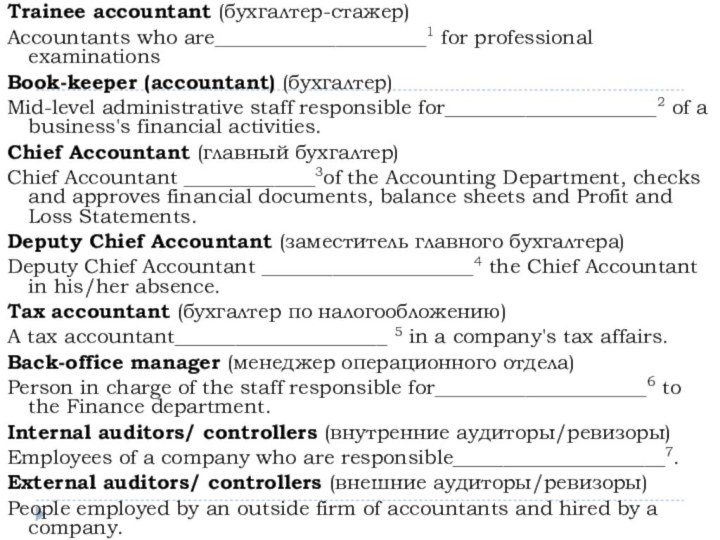

- 10. Trainee accountant (бухгалтер-стажер)Accountants who are_____________________1 for professional examinationsBook-keeper (accountant) (бухгалтер)Mid-level

- 12. Home workTo learn the topic: “My future profession”

- 13. Unit 23 My future professionaccounting – бухгалтерский

- 14. Accountancy бухг.делоMy future profession is accounting and

- 15. In the early 90, when the privatization

- 16. During the last 5 - 7 years

- 17. Ответьте на вопросы, используя текст1. What is

- 18. Скачать презентацию

- 19. Похожие презентации

VOCABULARYbook-keeping double-entry book-keeping systementrytransactionaccounta debit credit Luca Pacioli an individual persona legal entity assets capital assets -liabilities equity balance sheet income expensesProfit and Loss Statement, income statement

Слайд 2

VOCABULARY

book-keeping

double-entry book-keeping system

entry

transaction

account

a debit

credit

Luca Pacioli

an individual person

a legal entity

assets

capital assets -

liabilities

equity

balance sheet

income

expenses

Profit and Loss

Statement, income statement

Слайд 3

MAIN RESPONSIBILITIES:

Following up accounts of companies that Supply

Department works with‚

Control of all orders and invoices‚ making

objections if required‚ processing them into accounting software system‚Following up payments‚ notification of payments to related companies‚

Supply Department budget preparation

Слайд 4

WHAT IS ACCOUNTING?

Accounting shows a financial picture of

the firm. Accounting creates accurate financial reports that are

useful to managers, regulators, and other stakeholders such as shareholders, creditors or owners, independent financial analysts, banks and government.An Accounting Department records and measures the activity of a business. It reports on the effects of the transactions on the firm’s financial condition.

Auditing is the process by which an independent auditor examines organization's financial statements and expresses an opinion about observance of accounting principles and figures accuracy.

Слайд 5 The day-to-day record-keeping involved in this process is

known as book-keeping1. At the heart of modern financial accounting

is the double-entry book-keeping system2. This system involves making at least twoentries3 for every transaction4: in one account 5 - a debit 6 and in a corresponding account – a credit 7. The sum of all debits should always equal the sum of all credits. This provides an easy way to check for errors. This system was first used in medieval Europe, although some believe that the system dates back to Ancient Greece.

Слайд 6

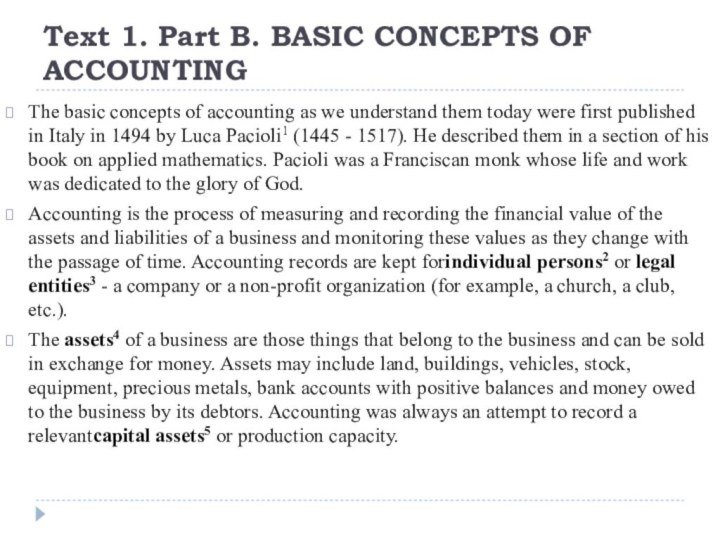

Text 1. Part B. BASIC CONCEPTS OF ACCOUNTING

The

basic concepts of accounting as we understand them today

were first published in Italy in 1494 by Luca Pacioli1 (1445 - 1517). He described them in a section of his book on applied mathematics. Pacioli was a Franciscan monk whose life and work was dedicated to the glory of God.Accounting is the process of measuring and recording the financial value of the assets and liabilities of a business and monitoring these values as they change with the passage of time. Accounting records are kept forindividual persons2 or legal entities3 - a company or a non-profit organization (for example, a church, a club, etc.).

The assets4 of a business are those things that belong to the business and can be sold in exchange for money. Assets may include land, buildings, vehicles, stock, equipment, precious metals, bank accounts with positive balances and money owed to the business by its debtors. Accounting was always an attempt to record a relevantcapital assets5 or production capacity.

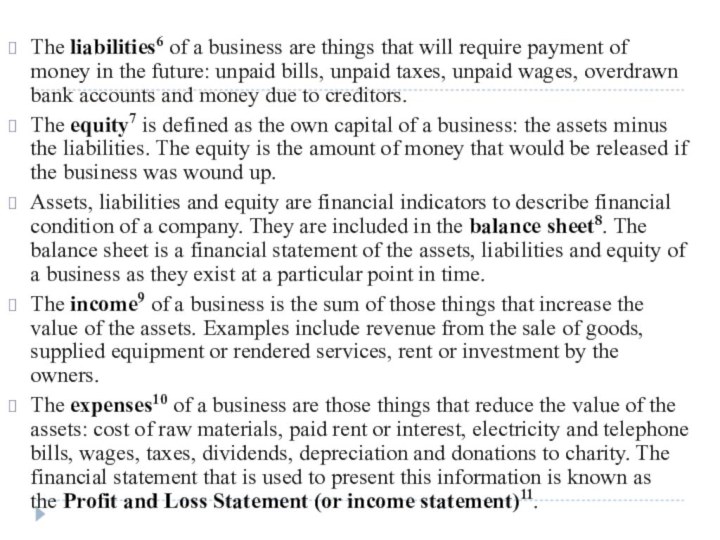

Слайд 7 The liabilities6 of a business are things that will require

payment of money in the future: unpaid bills, unpaid

taxes, unpaid wages, overdrawn bank accounts and money due to creditors.The equity7 is defined as the own capital of a business: the assets minus the liabilities. The equity is the amount of money that would be released if the business was wound up.

Assets, liabilities and equity are financial indicators to describe financial condition of a company. They are included in the balance sheet8. The balance sheet is a financial statement of the assets, liabilities and equity of a business as they exist at a particular point in time.

The income9 of a business is the sum of those things that increase the value of the assets. Examples include revenue from the sale of goods, supplied equipment or rendered services, rent or investment by the owners.

The expenses10 of a business are those things that reduce the value of the assets: cost of raw materials, paid rent or interest, electricity and telephone bills, wages, taxes, dividends, depreciation and donations to charity. The financial statement that is used to present this information is known as the Profit and Loss Statement (or income statement)11.

Слайд 8

Задание 1. Ответьте на вопросы по тексту.

1. Who invented

the basic concepts of modern accounting?

2. Whom are accounting

records kept for?3. What does the assets mean?

4. What are the liabilities of a business?

5. What is the equity?

6. What is a balance sheet?

7. What is the income of a business?

8. What are the expenses of a business?

9. What is the income statement?

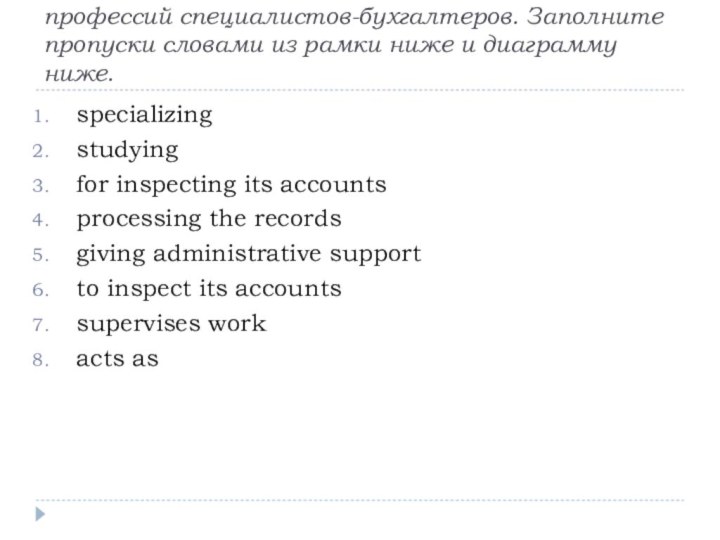

Слайд 9 Ниже представлены названия и определения профессий специалистов-бухгалтеров. Заполните

пропуски словами из рамки ниже и диаграмму ниже.

specializing

studying

for inspecting its accounts

processing the records

giving administrative support

to inspect its accounts

supervises work

acts as

Слайд 10

Trainee accountant (бухгалтер-стажер)

Accountants who are_____________________1 for professional examinations

Book-keeper (accountant) (бухгалтер)

Mid-level administrative

staff responsible for_____________________2 of a business's financial activities.

Chief Accountant (главный бухгалтер)

Chief

Accountant _____________3of the Accounting Department, checks and approves financial documents, balance sheets and Profit and Loss Statements.Deputy Chief Accountant (заместитель главного бухгалтера)

Deputy Chief Accountant _____________________4 the Chief Accountant in his/her absence.

Tax accountant (бухгалтер по налогообложению)

A tax accountant_____________________ 5 in a company's tax affairs.

Back-office manager (менеджер операционного отдела)

Person in charge of the staff responsible for_____________________6 to the Finance department.

Internal auditors/ controllers (внутренние аудиторы/ревизоры)

Employees of a company who are responsible_____________________7.

External auditors/ controllers (внешние аудиторы/ревизоры)

People employed by an outside firm of accountants and hired by a company.

Слайд 13

Unit 23 My future profession

accounting – бухгалтерский учет

auditing

- аудит

to consider – рассматривать

ownership – собственность

demand – спрос

fixed

assets – основные средстваsuppliers – поставщики

tax – налоги

attentiveness - внимательность

Слайд 14

Accountancy бухг.дело

My future profession is accounting and auditing.

Accountancy profession is one of the most ancient in

the world. It appeared 6000 years ago, when primitive people began to control and register their economic activity. The ancient Egypt is considered to be a motherland of accounting. And Ancient Greece is well-known as a birthplace of accounting tools as abacus, just there the first money and coins were created.Слайд 15 In the early 90, when the privatization and

various types of ownership forms widely spread, accounting became

the most popular specialty, and now it is in high demand. Neither huge company and factory nor shops and banks can't work without accountant. The accountant does the work of the various types of accounting: accounting of fixed assets, the cost of production, payment to suppliers and customers, payroll and taxes. Accountant can work in enterprises of different ownership forms: public, shareholder, cooperative, private, carries out work on various types of accounting. The accountant conducts economic analysis of production processes, as a result he identifies reserves, losses and eliminates non- productive expenses. While the state exists with tax system and financial reporting, accountants will be needed.Слайд 16 During the last 5 - 7 years the

demand in accountants is fairly stable. No doubts, its

character, scope, requirements for specialists are changing but demand naturally remains. I think that the best candidate for this profession is a person who has such skills as responsibility, attentiveness, also he needs not to forget about good memory and logical thinking, he should be good at math and of course to be keen on accounting.From childhood I was very keen on math and like to work with numbers, economy was always interesting sphere for me so I attended economical classes at high school. When the time came I easily chose the major at university. So I haven't complain about my choice yet.

Слайд 17

Ответьте на вопросы, используя текст

1. What is the

future profession of the main character?

2. What is the

history of this profession?3. Is the work of accountant important or not?

4. What work does the accountant?