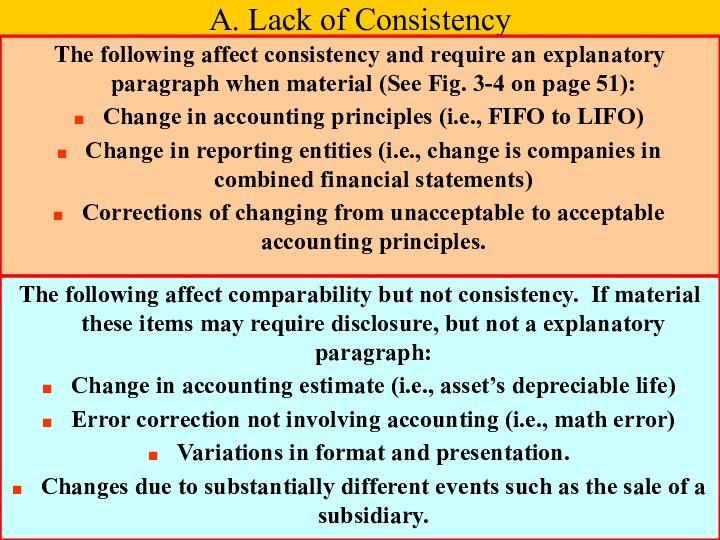

require an explanatory paragraph when material (See Fig. 3-4

on page 51):

Change in accounting principles (i.e., FIFO to LIFO)

Change in reporting entities (i.e., change is companies in combined financial statements)

Corrections of changing from unacceptable to acceptable accounting principles.

The following affect comparability but not consistency. If material these items may require disclosure, but not a explanatory paragraph:

Change in accounting estimate (i.e., asset’s depreciable life)

Error correction not involving accounting (i.e., math error)

Variations in format and presentation.

Changes due to substantially different events such as the sale of a subsidiary.