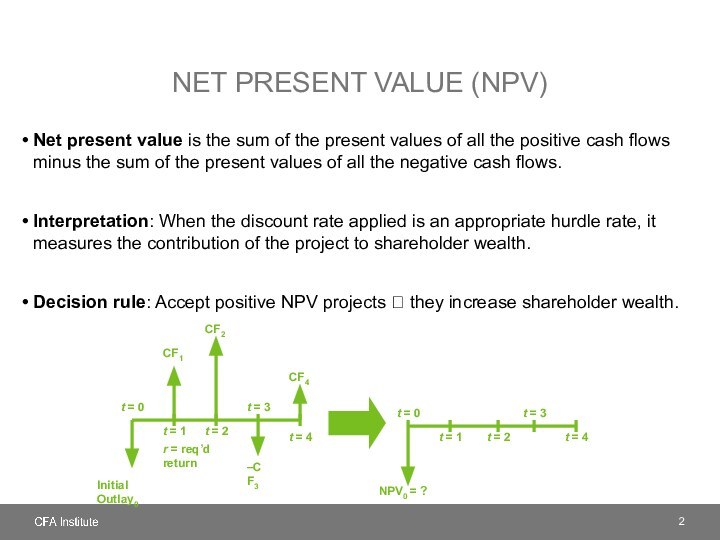

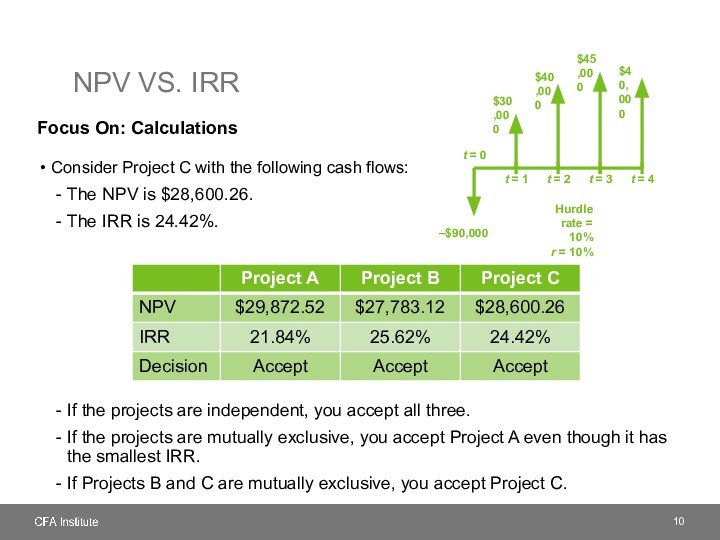

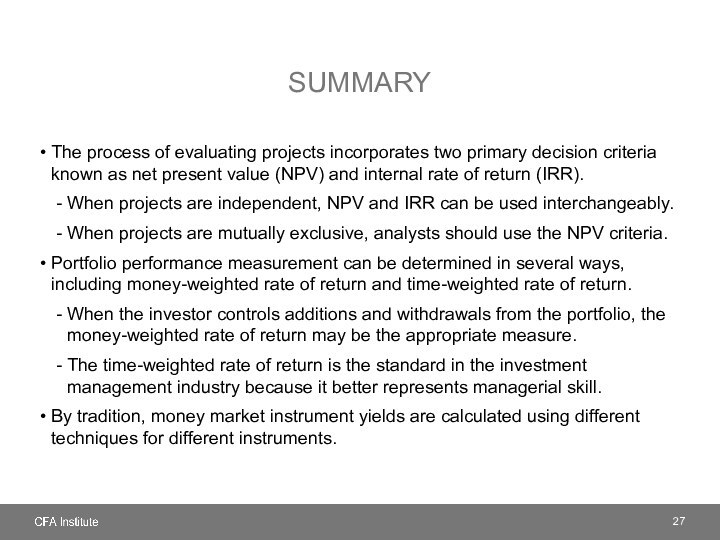

sum of the present values of all the positive

cash flows minus the sum of the present values of all the negative cash flows.Interpretation: When the discount rate applied is an appropriate hurdle rate, it measures the contribution of the project to shareholder wealth.

Decision rule: Accept positive NPV projects ? they increase shareholder wealth.

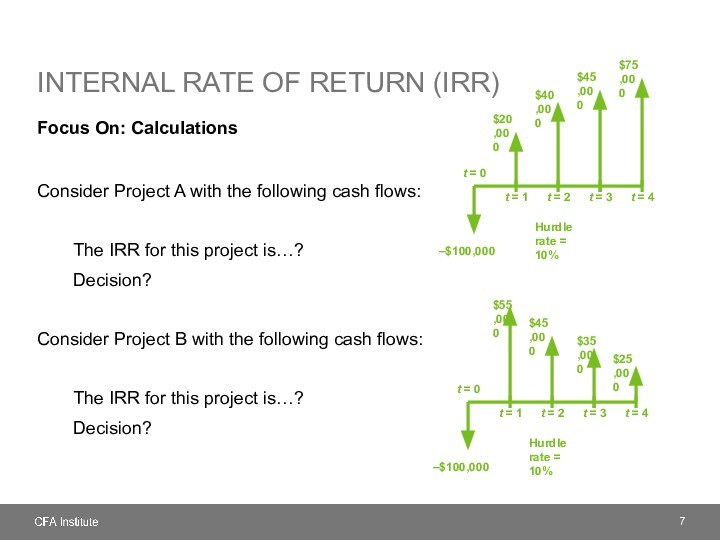

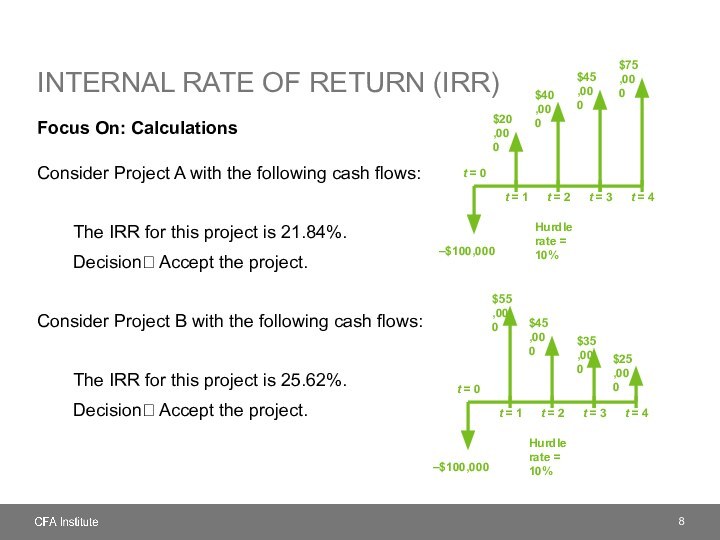

t = 0

t = 1

t = 2

t = 0

t = 2

t = 4

Initial Outlay0

NPV0 = ?

r = req’d return

t = 4

t = 3

t = 1

t = 3

CF1

CF2

–CF3

CF4