sentiment, country/sector/target risk factors and requirements, tax and accounting,

and the nature of buyer (financial v strategic) and seller and those who stand behind themDeal Components. From an economic perspective = valuation (unless it is distress or special situation driven by other factors eg sanctions)

Relationship between Structure & Valuation. Structure as a time release of value and mechanism to test that value

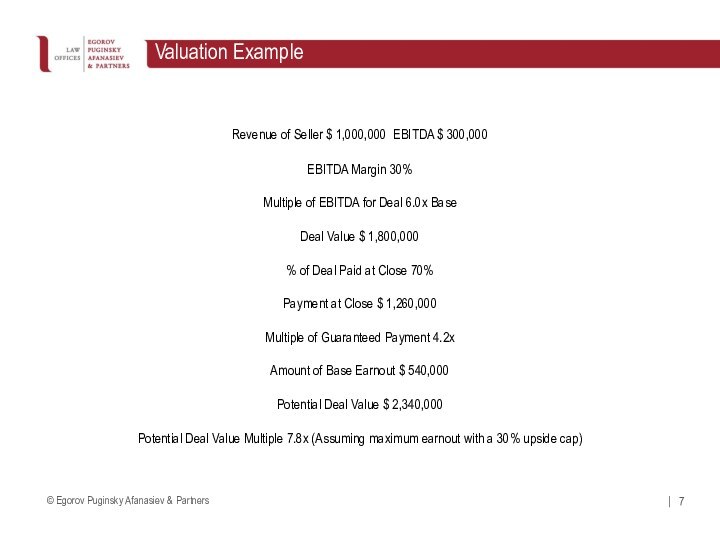

Seller EBITDA x EBITDA Multiple = Base Value of Deal. “Cash Free Debt Free Valuation”

Completion Accounts v Locked Box. Pros and cons and the “comfort” required by buyer v bargaining position of seller

Earnout Mechanic. The importance of alignment

Seller Motivation v Buyer Motivation. The role of lawyers in bridging the gap(s) and uncertainties because valuation is not science and valuation is only a part (albeit a big part) of the deal

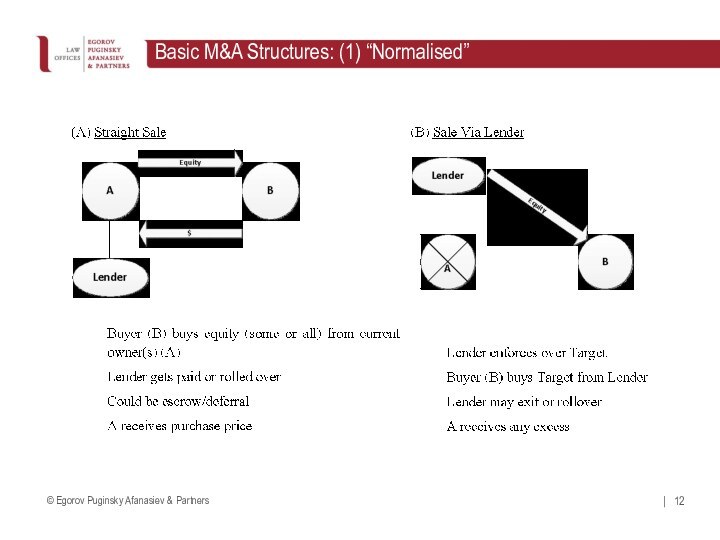

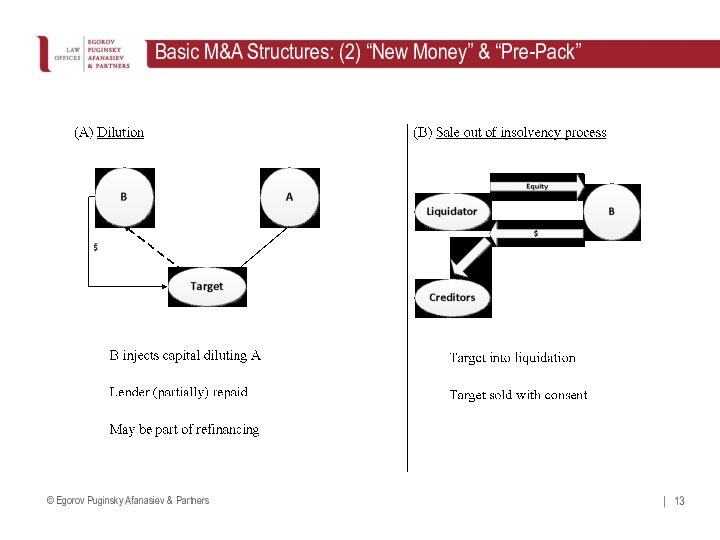

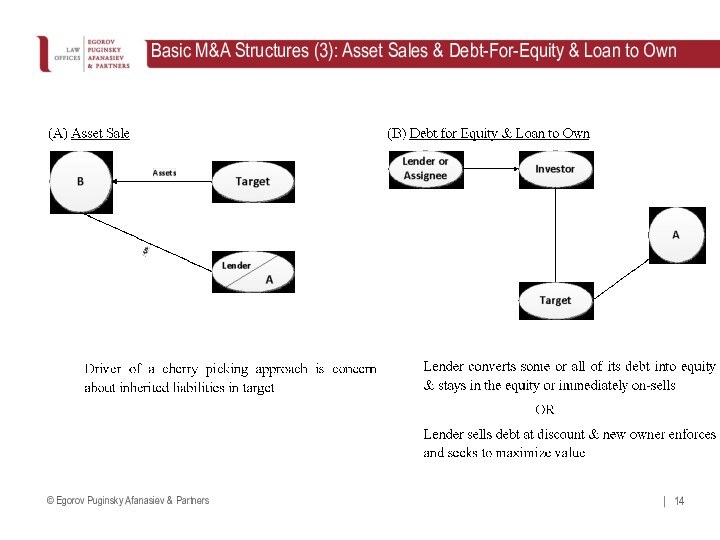

Deal Types & Basic M&A Structure Diagrams. Normalised v distress/special situation

Topics