Слайд 2

*

Introduction-

SCHEDULING AUDITS

EQUIPMENT LISTS

DISTANCE/MPG ANALYSIS

AUDIT NOTIFICATION/ ENGAGEMENT LETTERS

PRE-AUDIT QUESTIONNAIRE

/ INTERNAL CONTROL QUESTIONNAIRE

2.

3.

4.

5.

1.

Слайд 3

*

PURPOSE OF AUDIT PLANNING

WORK IS TO BE ADEQUATELY

PLANNED. (IRP A204.1 IFTA A220.200).

The fieldwork standard related to

planning for performance audits conducted in accordance with Generally Accepted Auditing Standards are:

In planning the audit, auditors should define the audit objectives as well as the scope and methodology to achieve those objectives. Audit objectives, scope, and methodologies are not determined in isolation. Auditors determine these three elements of the audit plan together, as the considerations in determining each-- often overlap. Planning is a continuous process throughout the audit. Therefore, auditors should consider the need to make adjustments to the audit objectives, scope, and methodology as the work is being completed.

Слайд 4

*

The objectives (evaluation of the

taxpayer’s system, ensure continued compliance, ensure proper revenue) are

what the audit is intended to accomplish. They identify the audit subjects and performance aspects to be included, as well as the potential finding and reporting elements that the auditors expect to develop. Audit objectives can be thought of as questions about the program that auditors seek to answer.

Слайд 5

*

Scope is the boundary of the audit and

should be directly tied to the audit objectives.

For

example, the scope defines parameters of the audit such as the period of time reviewed, the availability of necessary documentation or records, and the locations at which fieldwork will be performed. Keep in mind that the scope can be expanded and should, if certain issues arise that places the integrity or the objectives of the audit in question.

Слайд 6

*

The methodology comprises the work involved in gathering

and analyzing data to achieve the objectives. Audit procedures

are the specific steps and tests auditors will carry out to address the audit objectives. Auditors should design the methodology to provide sufficient, competent, and relevant evidence to achieve the objectives of the audit. Methodology includes both the types and extent of audit procedures used to achieve the audit objectives. Planning should be documented.

Слайд 7

*

SELECTING THE CARRIER AND THE AUDIT PERIODS-

How

does your jurisdiction select audits?

Random selection- Taxpayers maybe randomly

selected from jurisdictional IFTA/IRP list(s) using a variety of simple methods. Some might use tools such as random number generator--- or a sophisticated tool like a dart.

Some pick according to size, location, the number of units, or all the above.

Some use a systematic selection- for example, every 10th carrier.

Слайд 8

*

SELECTING THE CARRIER AND THE AUDIT

PERIODS-

All jurisdictions have a certain amount

of-

Audit for cause-- “Problem accounts”.

Rounded miles

Rounded fuel

Estimated distances

Backing into a MPG

Fuel calculated by “consumption”

Same exact number of miles for jurisdictions per quarter/year

Non-connecting states

IFTA and IRP yearly totals don’t match

Past audits

Excessive number of decals when compared to units

Calls from past and current employees

Residency questions

Etc, etc, etc, etc.

Do any of these look familiar?

Yes, there are more….

Слайд 9

*

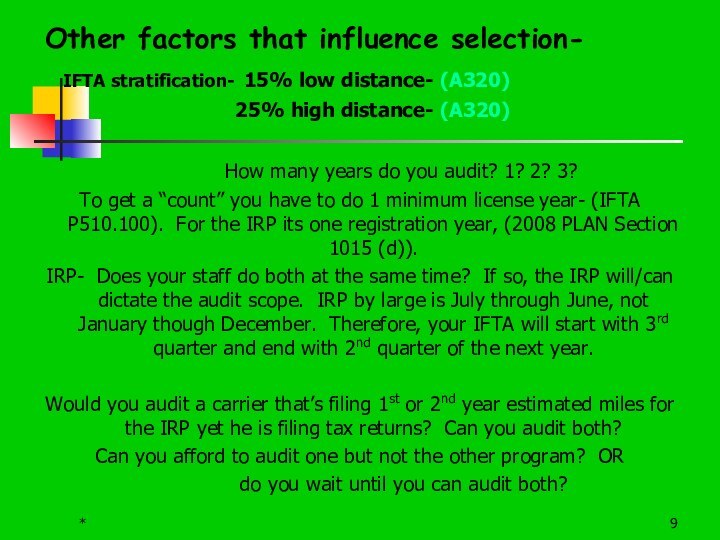

Other factors that influence selection-

IFTA stratification- 15% low distance- (A320)

25% high distance- (A320)

How many years do you audit? 1? 2? 3?

To get a “count” you have to do 1 minimum license year- (IFTA P510.100). For the IRP its one registration year, (2008 PLAN Section 1015 (d)).

IRP- Does your staff do both at the same time? If so, the IRP will/can dictate the audit scope. IRP by large is July through June, not January though December. Therefore, your IFTA will start with 3rd quarter and end with 2nd quarter of the next year.

Would you audit a carrier that’s filing 1st or 2nd year estimated miles for the IRP yet he is filing tax returns? Can you audit both?

Can you afford to audit one but not the other program? OR

do you wait until you can audit both?

Слайд 10

IRP gives 1 audit credit per audit year,

IFTA doesn’t. Would you then expand a one year

IFTA audit to a 2 or 3 year audit if you found reoccurring issues, yet you don’t receive an audit count for the extra time? This brings to question the next issue---- Budgeting time…

To attempt to successfully complete an “in-compliance yearly audit count” an audit manager has to take additional factors in consideration when selecting audits and allocating time in relationship to the resources they have available. Auditors performing the audit have to be aware of the time they have to complete the audit.

contact. All communication should be documented in the audit

file (IRP A600 & IFTA A600).

Suggested and/or required pre-audit documentation includes, but not limited to:

Pre-audit questionnaire

Internal controls report

Equipment lists

Audit notification letter

Audit location or where you're going to conduct the audit

The audit date and time

Records needed for the audit

Telephone and correspondence should be retained and documented.

(think possible protest, hearing and court).

As we all know- (IFTA A600 and IRP A600) states we should communicate to the taxpayer the scope and estimated time frame for which the audit will be conducted.

So…What's our next step?

Слайд 12

*

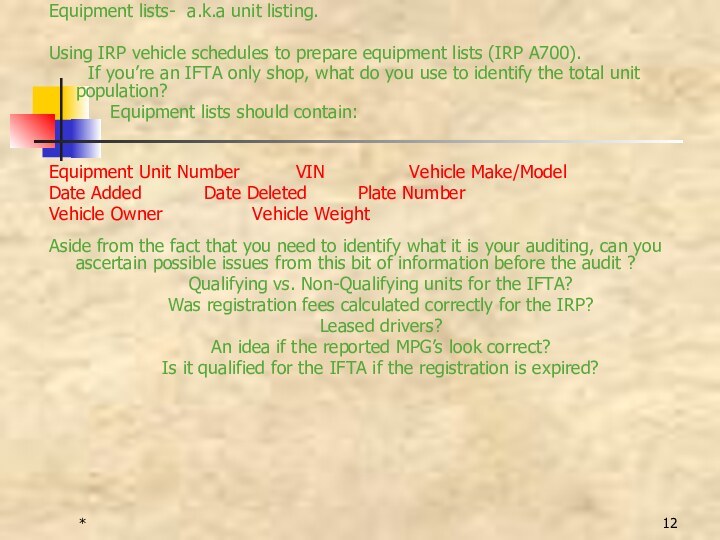

Equipment lists- a.k.a unit listing.

Using IRP vehicle schedules

to prepare equipment lists (IRP A700).

If you’re an IFTA only shop, what do you use to identify the total unit population?

Equipment lists should contain:

Equipment Unit Number VIN Vehicle Make/Model

Date Added Date Deleted Plate Number

Vehicle Owner Vehicle Weight

Aside from the fact that you need to identify what it is your auditing, can you ascertain possible issues from this bit of information before the audit ?

Qualifying vs. Non-Qualifying units for the IFTA?

Was registration fees calculated correctly for the IRP?

Leased drivers?

An idea if the reported MPG’s look correct?

Is it qualified for the IFTA if the registration is expired?

Слайд 13

*

Reconciling equipment lists.

(Government vs. Carriers).

Reconciliation of equipment lists will identify:

Vehicles

that are IFTA licensed by the carrier-

Vehicles that are IRP licensed by the carrier -

Discrepancies in equipment numbers.

Reconciling equipment lists will also assist in:

Vehicle sample selection if you choose to sample.

Identification of additional IRP/IFTA accounts that can be audited.

Слайд 14

*

Contacting the carrier-

a.k.a “your number is up”.

Allow the carrier adequate time to gather records.

(or in some cases, give the carrier time to create the years after the fact, or come up with a good story).

(IRP A601.1) Give 30 day notice.

(IFTA A610) suggests 30-day notification.

Contact the carrier by telephone (if possible) and in writing. Explain what

you want in layman's terms.

What do you do when:

The carrier doesn’t complete the pre-audit questionnaire?

The carrier doesn’t respond to your audit notification letters?

The carrier skips out on you?

The carrier or the service provider continues to postpone the audit?

Starts with telling you how to do the audit, then informs you to take a long walk on a short peer?

Слайд 15

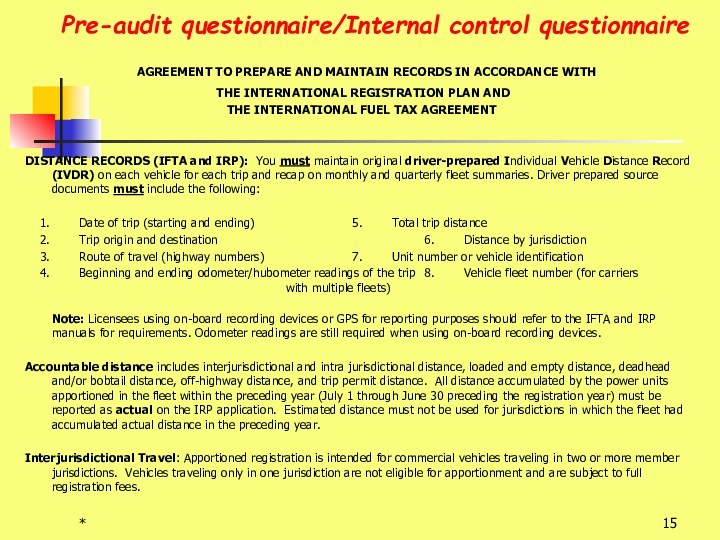

*

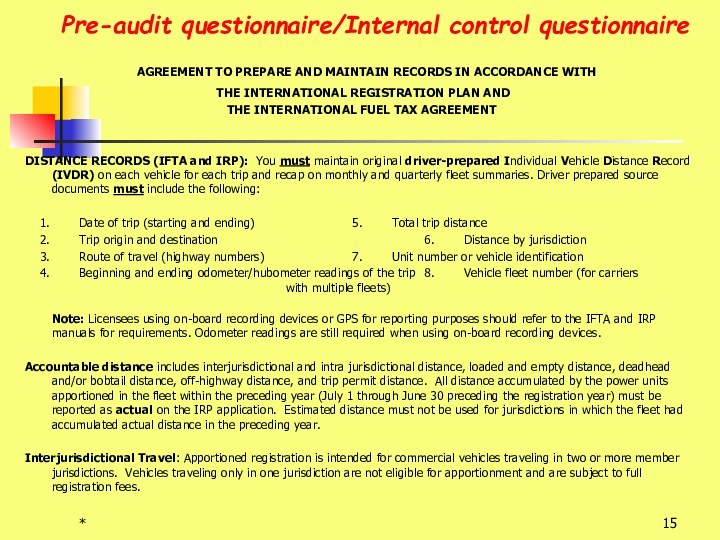

Pre-audit questionnaire/Internal control questionnaire

AGREEMENT TO PREPARE AND

MAINTAIN RECORDS IN ACCORDANCE WITH

THE INTERNATIONAL REGISTRATION PLAN

AND

THE INTERNATIONAL FUEL TAX AGREEMENT

DISTANCE RECORDS (IFTA and IRP): You must maintain original driver-prepared Individual Vehicle Distance Record (IVDR) on each vehicle for each trip and recap on monthly and quarterly fleet summaries. Driver prepared source documents must include the following:

1. Date of trip (starting and ending) 5. Total trip distance

2. Trip origin and destination 6. Distance by jurisdiction

3. Route of travel (highway numbers) 7. Unit number or vehicle identification

4. Beginning and ending odometer/hubometer readings of the trip 8. Vehicle fleet number (for carriers with multiple fleets)

Note: Licensees using on-board recording devices or GPS for reporting purposes should refer to the IFTA and IRP manuals for requirements. Odometer readings are still required when using on-board recording devices.

Accountable distance includes interjurisdictional and intra jurisdictional distance, loaded and empty distance, deadhead and/or bobtail distance, off-highway distance, and trip permit distance. All distance accumulated by the power units apportioned in the fleet within the preceding year (July 1 through June 30 preceding the registration year) must be reported as actual on the IRP application. Estimated distance must not be used for jurisdictions in which the fleet had accumulated actual distance in the preceding year.

Interjurisdictional Travel: Apportioned registration is intended for commercial vehicles traveling in two or more member jurisdictions. Vehicles traveling only in one jurisdiction are not eligible for apportionment and are subject to full registration fees.

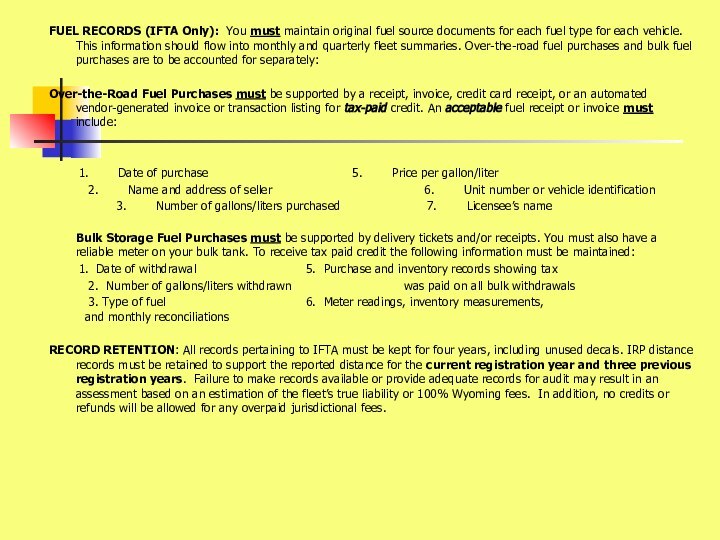

Слайд 16

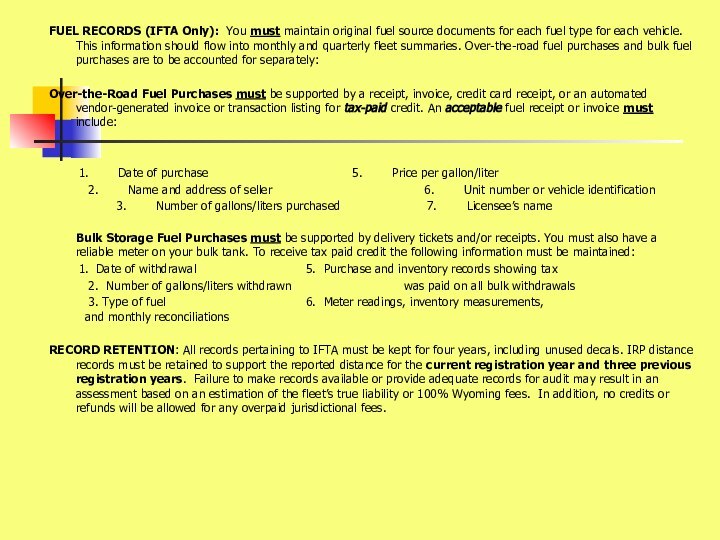

FUEL RECORDS (IFTA Only): You must maintain

original fuel source documents for each fuel type for

each vehicle. This information should flow into monthly and quarterly fleet summaries. Over-the-road fuel purchases and bulk fuel purchases are to be accounted for separately:

Over-the-Road Fuel Purchases must be supported by a receipt, invoice, credit card receipt, or an automated vendor-generated invoice or transaction listing for tax-paid credit. An acceptable fuel receipt or invoice must include:

1. Date of purchase 5. Price per gallon/liter

2. Name and address of seller 6. Unit number or vehicle identification

3. Number of gallons/liters purchased 7. Licensee’s name

Bulk Storage Fuel Purchases must be supported by delivery tickets and/or receipts. You must also have a reliable meter on your bulk tank. To receive tax paid credit the following information must be maintained:

1. Date of withdrawal 5. Purchase and inventory records showing tax

2. Number of gallons/liters withdrawn was paid on all bulk withdrawals

3. Type of fuel 6. Meter readings, inventory measurements, and monthly reconciliations

RECORD RETENTION: All records pertaining to IFTA must be kept for four years, including unused decals. IRP distance records must be retained to support the reported distance for the current registration year and three previous registration years. Failure to make records available or provide adequate records for audit may result in an assessment based on an estimation of the fleet’s true liability or 100% Wyoming fees. In addition, no credits or refunds will be allowed for any overpaid jurisdictional fees.

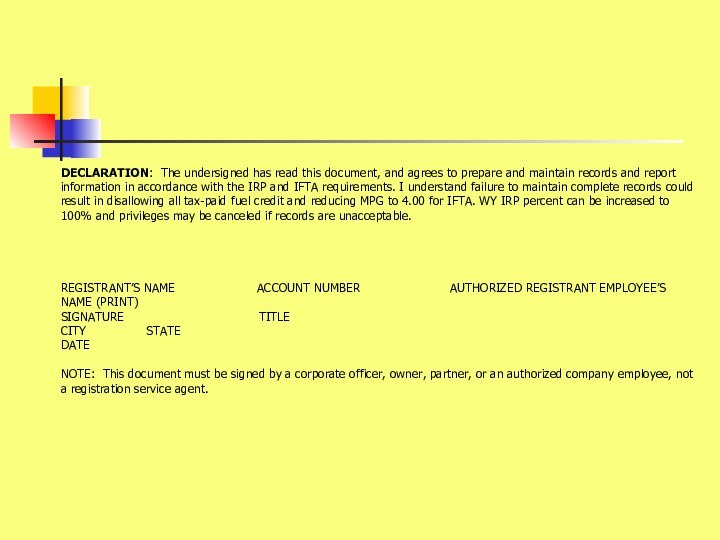

Слайд 17

DECLARATION: The undersigned has read this document, and

agrees to prepare and maintain records and report information

in accordance with the IRP and IFTA requirements. I understand failure to maintain complete records could result in disallowing all tax-paid fuel credit and reducing MPG to 4.00 for IFTA. WY IRP percent can be increased to 100% and privileges may be canceled if records are unacceptable.

REGISTRANT’S NAME ACCOUNT NUMBER AUTHORIZED REGISTRANT EMPLOYEE’S NAME (PRINT)

SIGNATURE TITLE

CITY STATE

DATE

NOTE: This document must be signed by a corporate officer, owner, partner, or an authorized company employee, not a registration service agent.