- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Depreciation and Income Taxes

Содержание

- 2. ObjectiveThe objective is to introduce some of

- 3. General AccountingGeneral Accounting:Preparation of financial statements for

- 4. General AccountingBalance sheet:Static picture of assets, liabilities

- 5. It is comprised of the following 3

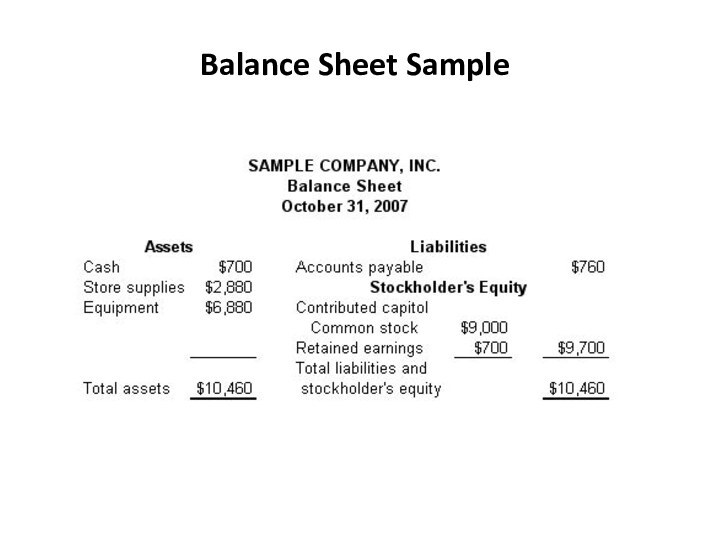

- 6. Balance Sheet Sample

- 7. General AccountingProfit and loss statement:Also called “income

- 8. Income StatementIncome Statement is composed of the

- 9. Cost AccountingCosts incurred to produce and sell

- 10. Direct CostsDirect material:Material whose cost is directly

- 11. Manufacturing CostsFactory Overhead:Indirect labor costs (sick leaves,

- 12. Administrative and Selling CostsAdministrative costs:Salaries of executive

- 13. Depreciation As time passes, the assets lose

- 14. DEPRECIATIONDecrease in value of physical properties with

- 15. PROPERTY IS DEPRECIABLE IF IT MUST :be

- 16. DEPRECIABLE PROPERTYTANGIBLE - can be seen or

- 17. WHEN DEPRECIATION STARTS AND STOPSDepreciation starts when

- 18. DEPRECIATION CONCEPTSThe following terms are used in

- 19. Value of an assetMarket valueThe actual value

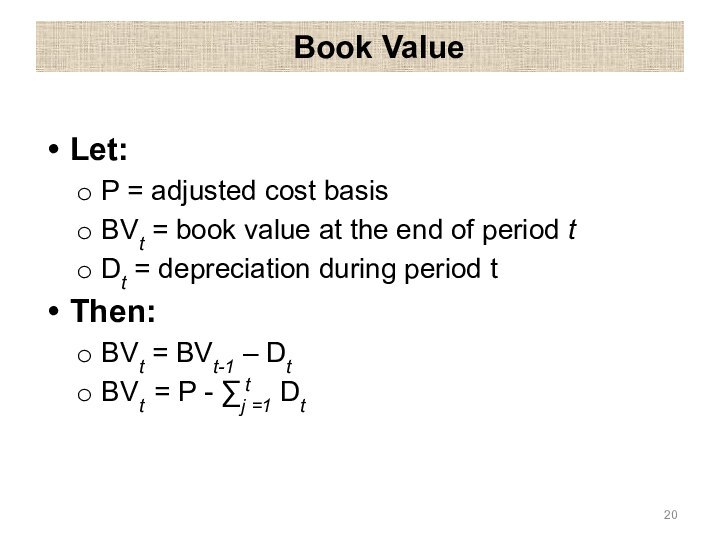

- 20. Book ValueLet:P = adjusted cost basisBVt =

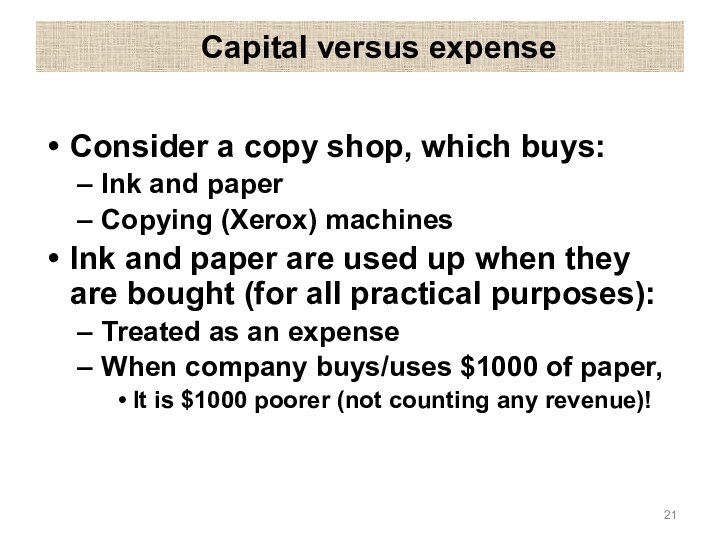

- 21. Capital versus expenseConsider a copy shop, which

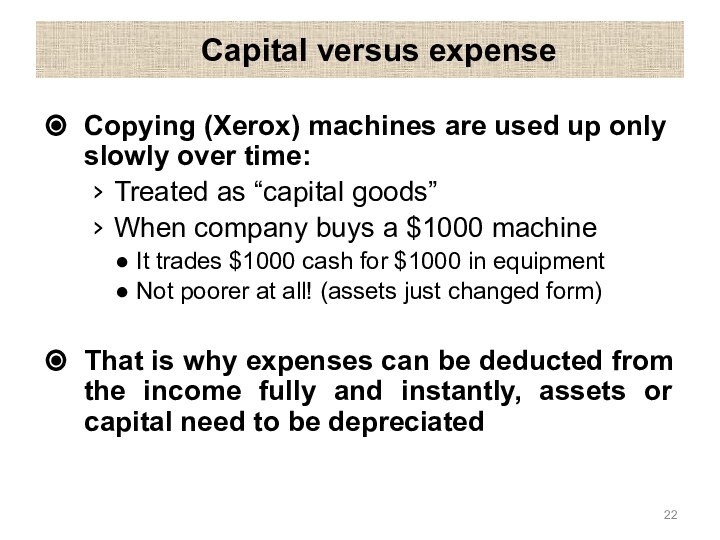

- 22. Capital versus expenseCopying (Xerox) machines are used

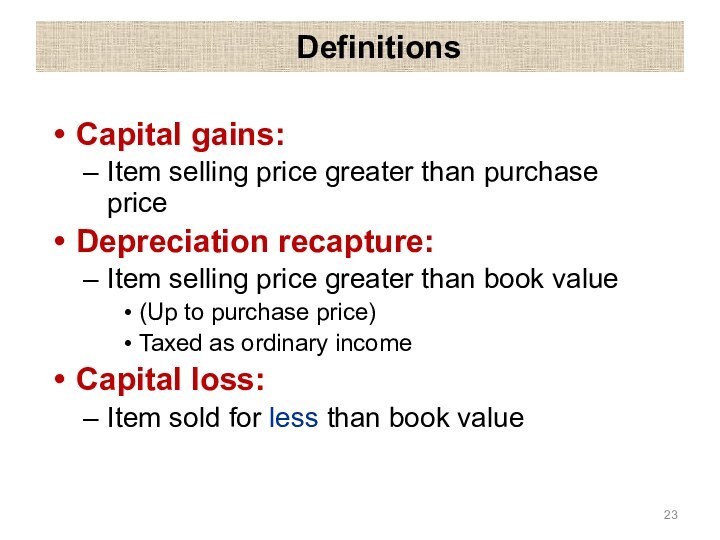

- 23. DefinitionsCapital gains:Item selling price greater than purchase

- 24. ExampleIf at the end of 1 yearI

- 25. Salvage valueIf a salvage value is expected,Depreciation

- 26. Depreciation and taxesDepreciation is treated as an

- 27. ObservationsDepreciation methods are conventionsNot based strictly on

- 28. Some Depreciation SchedulesStraight line method (SL)Declining Balance

- 29. SL DepreciationConstant rate of loss in the

- 30. SL depreciationRecovery period = nDepreciation rate =

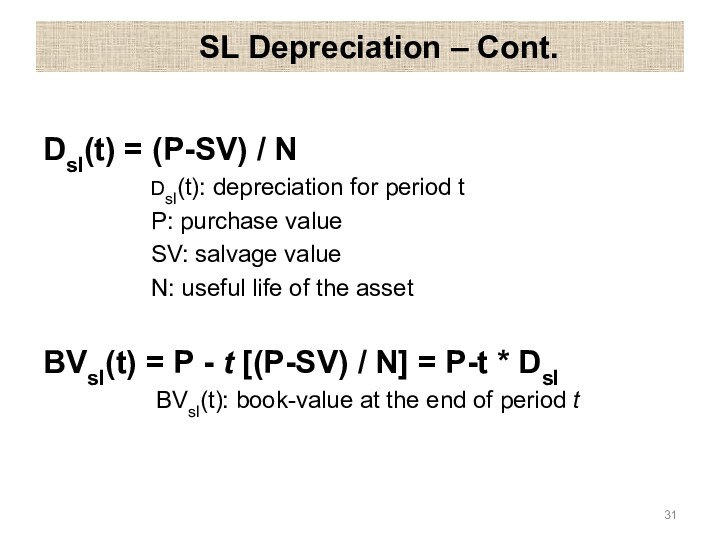

- 31. SL Depreciation – Cont.Dsl(t) = (P-SV) /

- 32. Example 1Small computers purchased by a company

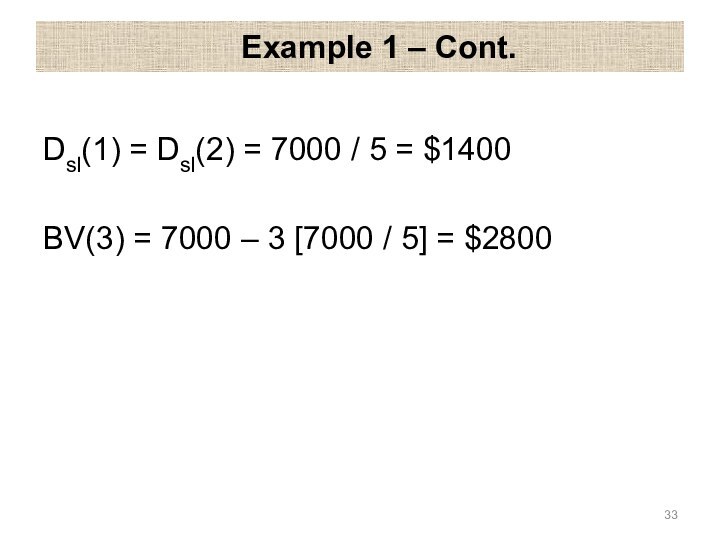

- 33. Example 1 – Cont.Dsl(1) = Dsl(2) =

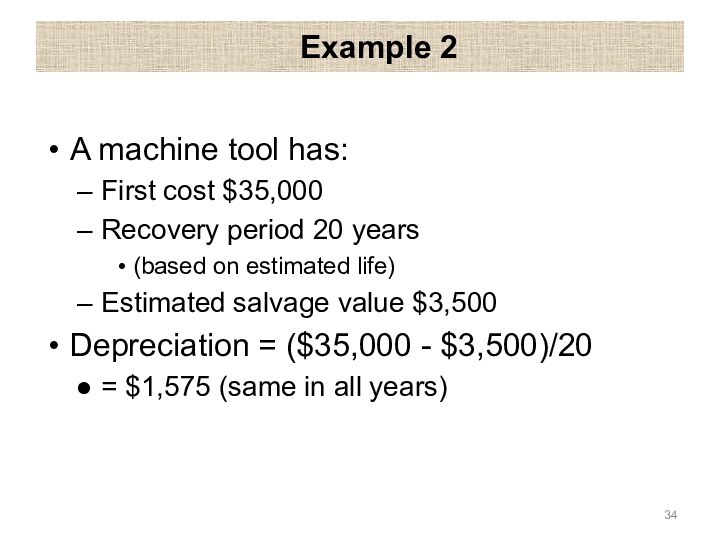

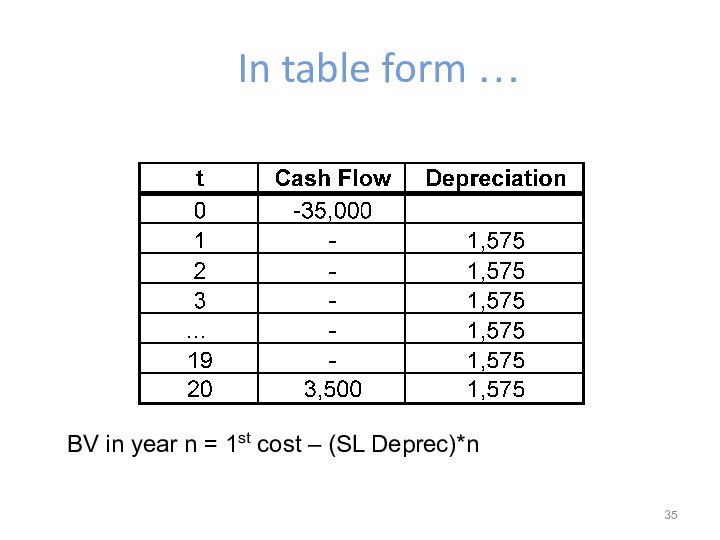

- 34. Example 2A machine tool has:First cost $35,000Recovery

- 35. In table form …BV in year n = 1st cost – (SL Deprec)*n

- 36. Straight line depreciationWrites off capital investment linearlyEstimated

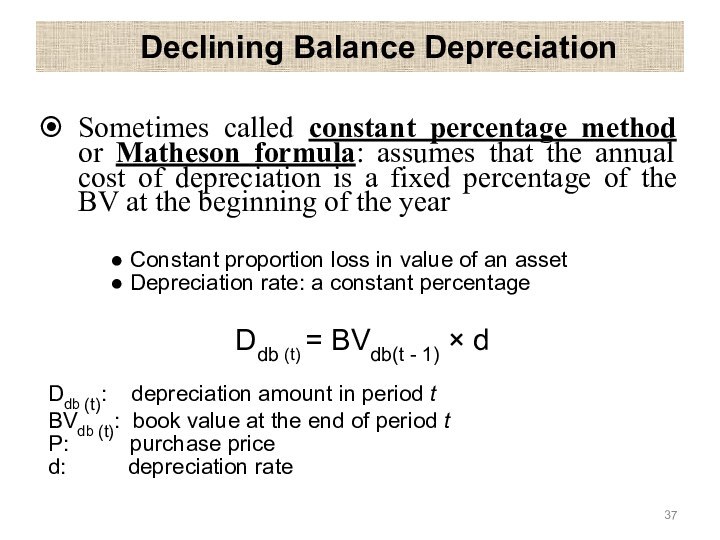

- 37. Declining Balance DepreciationSometimes called constant percentage method

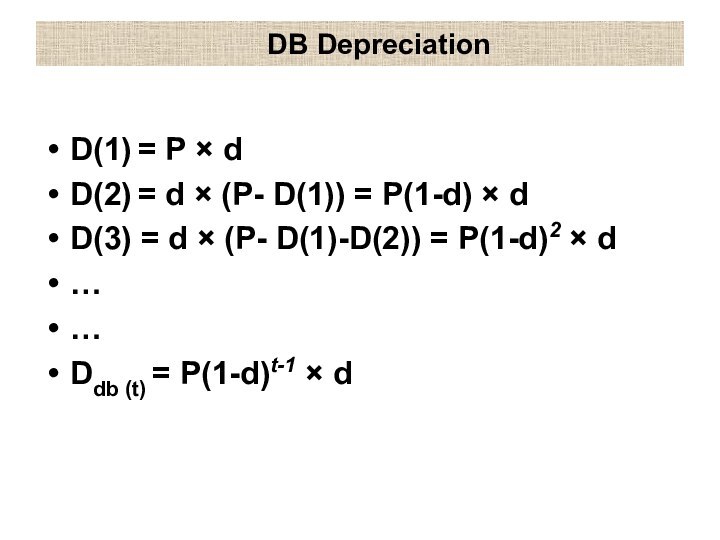

- 38. DB DepreciationD(1) = P × dD(2) =

- 39. DB DepreciationD1 = P × dDdb (t)

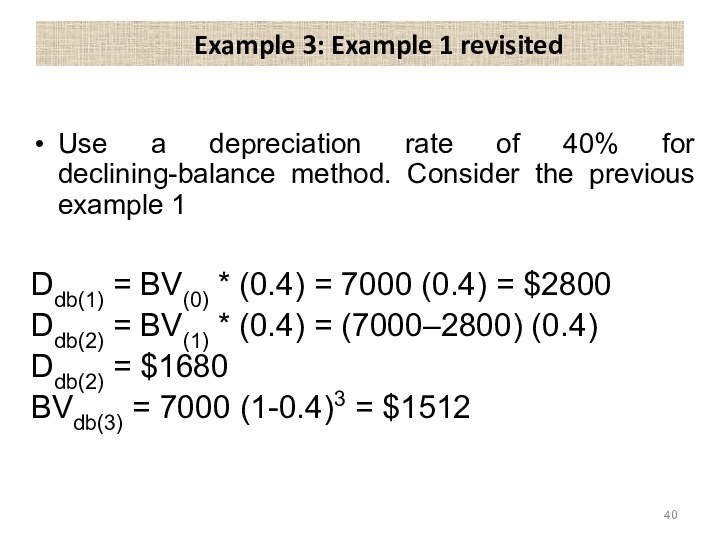

- 40. Example 3: Example 1 revisitedUse a depreciation

- 41. Double declining balance (DDB)Most common form of

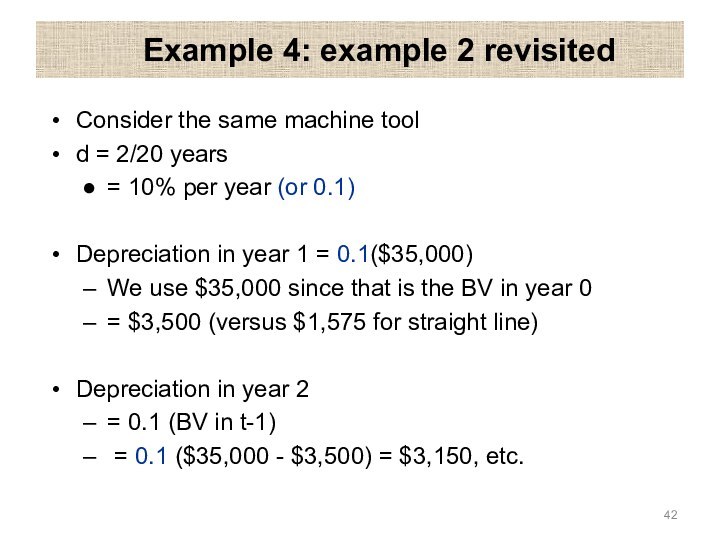

- 42. Example 4: example 2 revisitedConsider the same

- 43. In table form

- 44. DDB With Conversion to SL at the

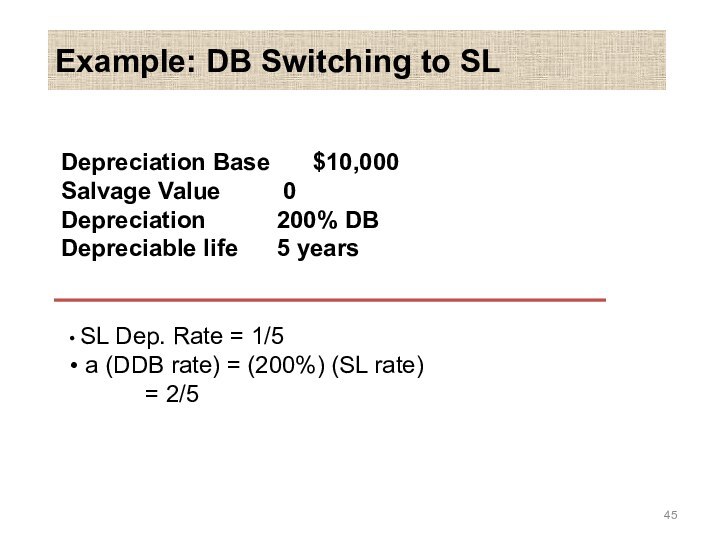

- 45. Example: DB Switching to SL SL Dep.

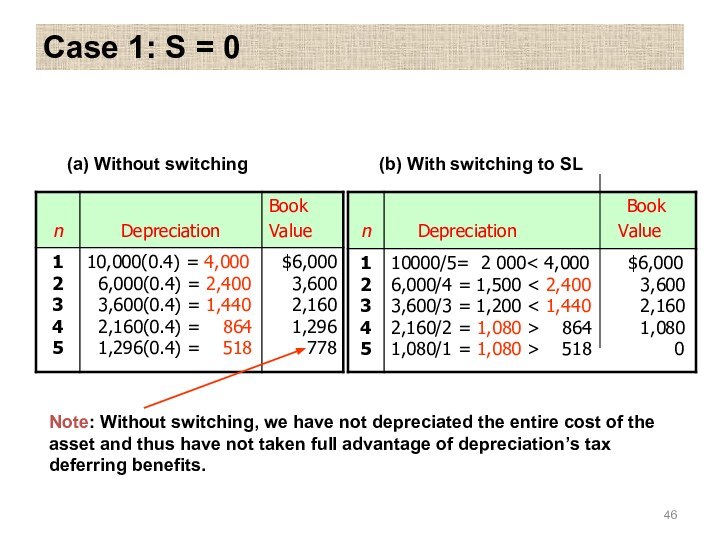

- 46. (a) Without switching(b) With switching to SLNote:

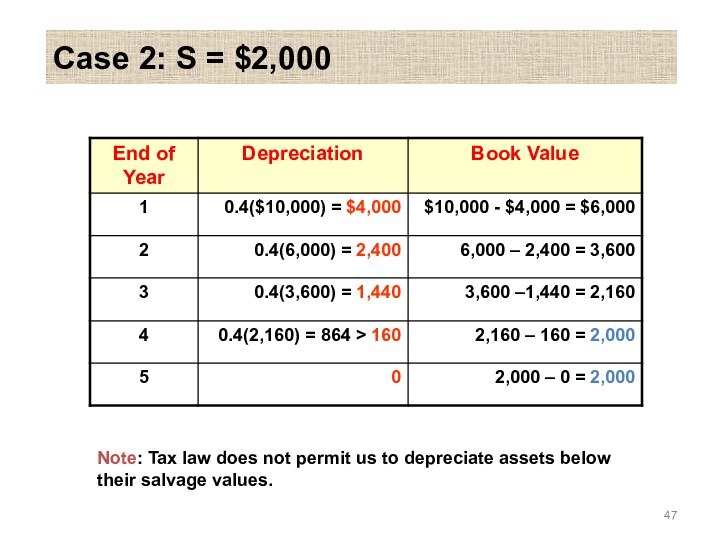

- 47. Case 2: S = $2,000Note: Tax law

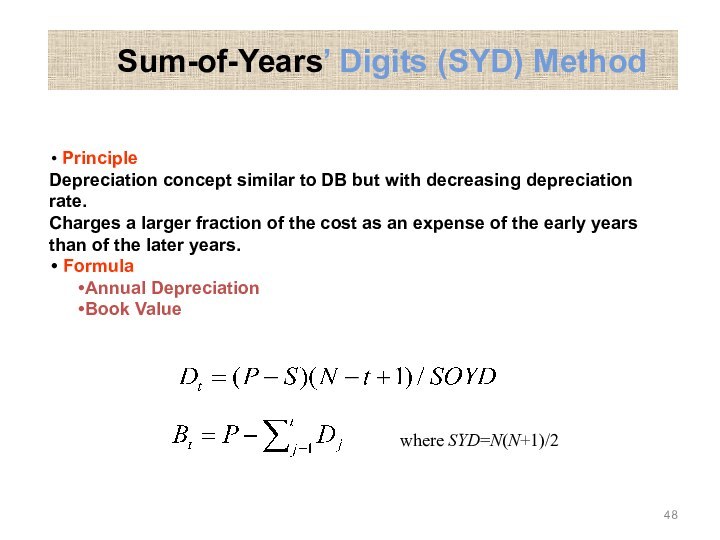

- 48. Sum-of-Years’ Digits (SYD) Method PrincipleDepreciation concept similar

- 49. Example 10.7 – SYD methodD1D2D3D4B1B2B3B4B5$10,000 $8,000 $6,000

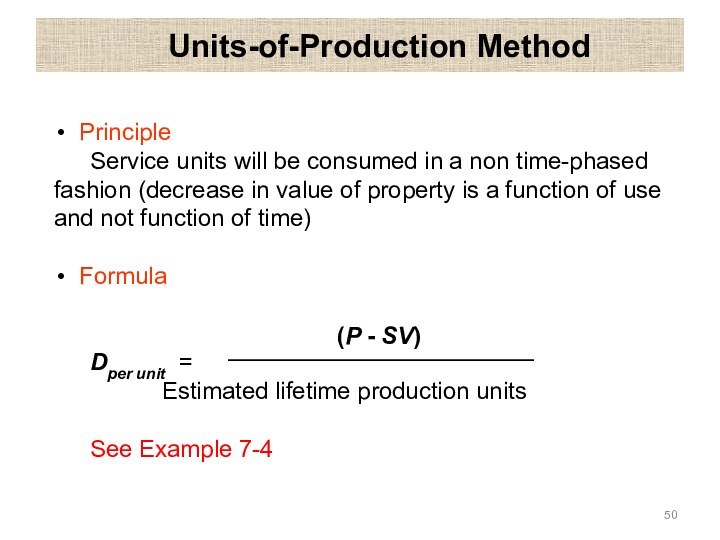

- 50. Units-of-Production Method Principle Service units will be consumed

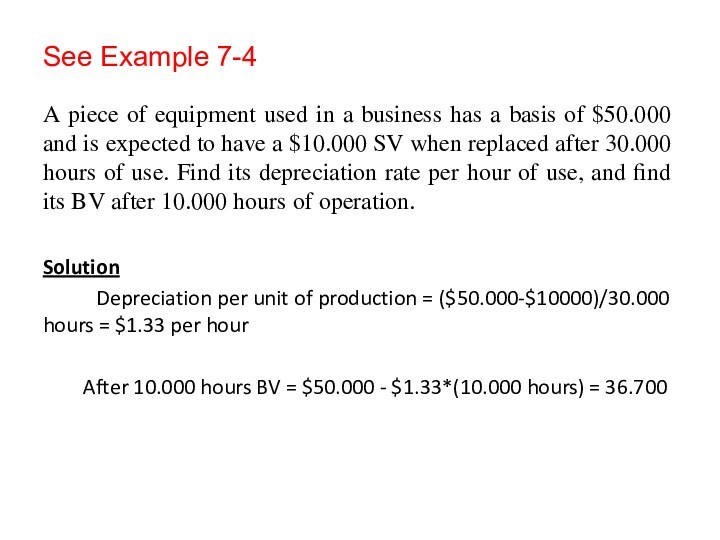

- 51. See Example 7-4 A piece of

- 52. DepletionTwo methods of natural resource depletion Cost or factor depletion Percentage depletion

- 53. Cost DepletionDepletion is computed on a per

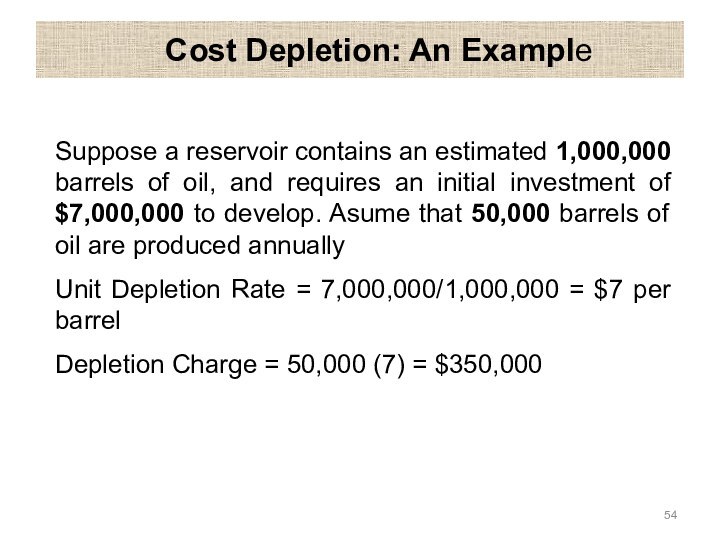

- 54. Cost Depletion: An ExampleSuppose a reservoir contains

- 55. Percentage Depletion Percentage depletion Depletion is computed

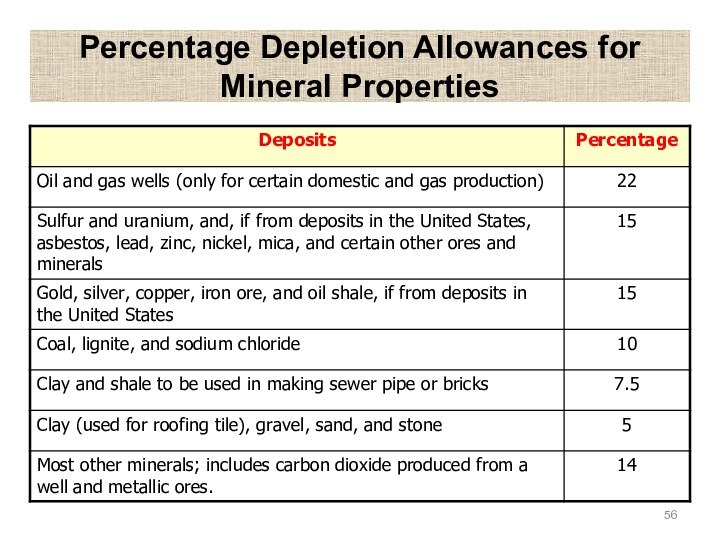

- 56. Percentage Depletion Allowances for Mineral Properties

- 57. Percentage Depletion: An ExampleAssume in the previous

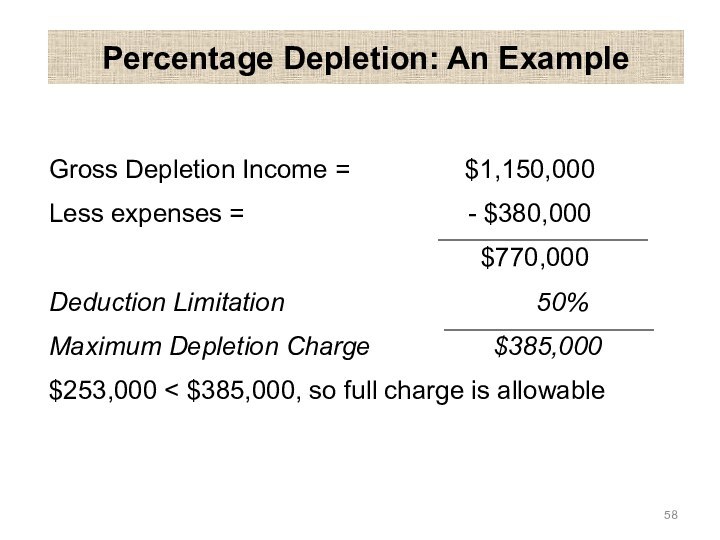

- 58. Percentage Depletion: An ExampleGross Depletion Income =

- 59. Agenda for todayWe will learn how to

- 60. Agenda for todayReview terms and definitionsRate of return (ROR)Tax deductionTax creditCapital gain/lossCharity deductionsBondsExamples

- 61. Why do we calculate depreciation?Since depreciation is

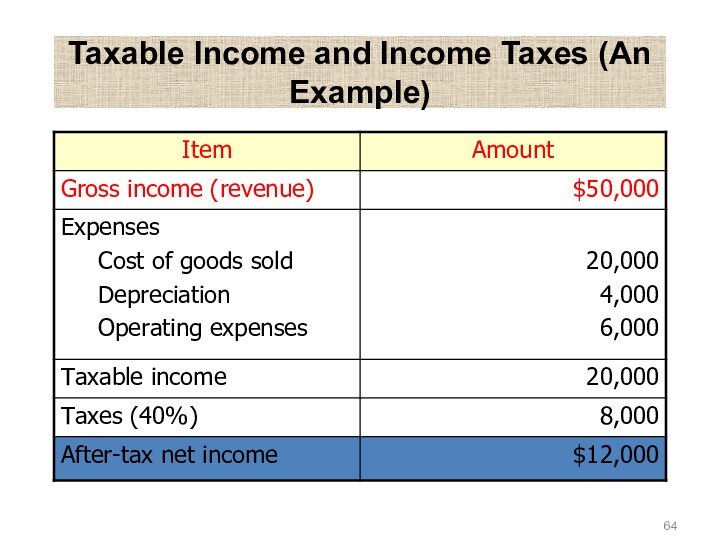

- 62. DefinitionsNet versus gross income:Gross income = revenue

- 63. How to calculate After-Tax Cash Flow?Determine before-tax

- 64. Taxable Income and Income Taxes (An Example)

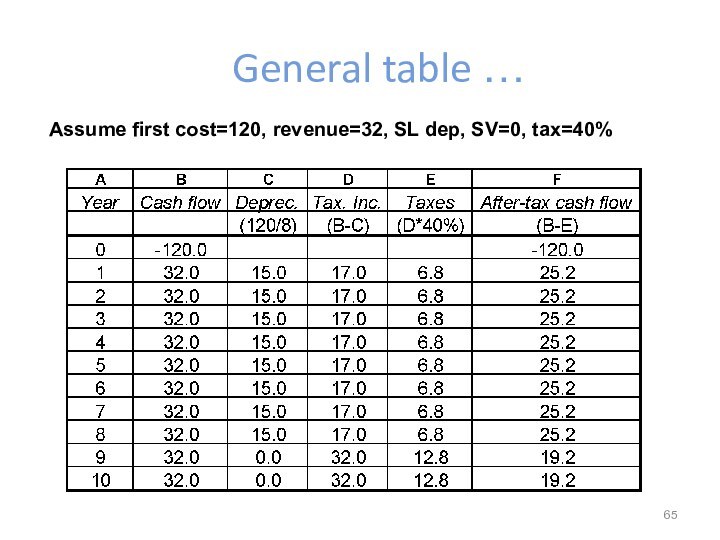

- 65. General table …Assume first cost=120, revenue=32, SL dep, SV=0, tax=40%

- 66. ObservationsLand is capitalLand purchase is not an

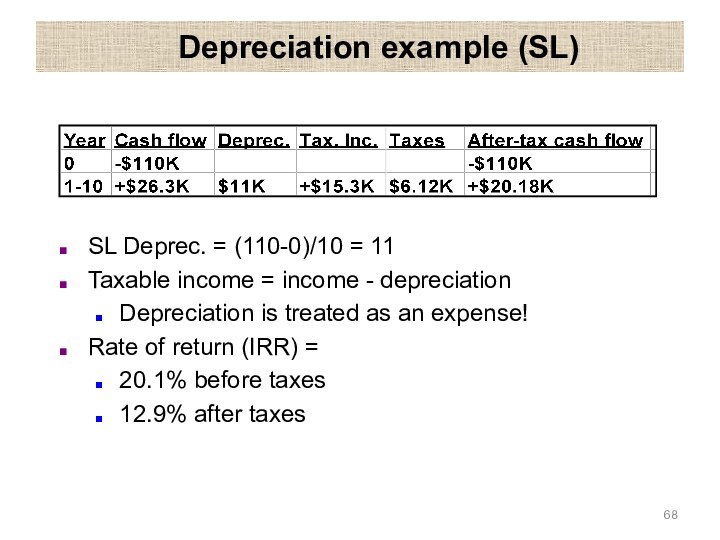

- 67. Depreciation example (SL)Investment with depreciationBuy equipment for

- 68. Depreciation example (SL)SL Deprec. = (110-0)/10 =

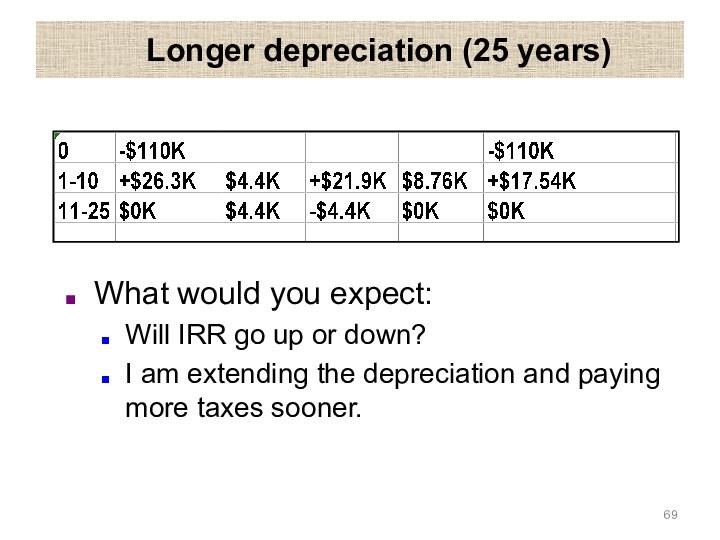

- 69. Longer depreciation (25 years) What would you

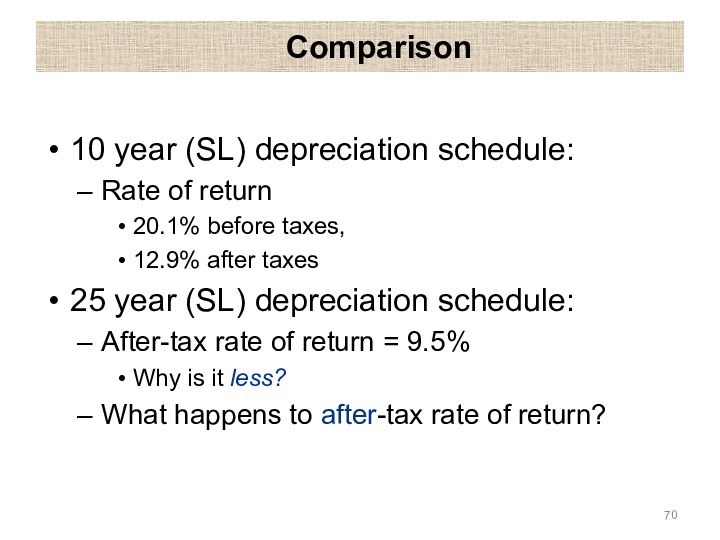

- 70. Comparison10 year (SL) depreciation schedule:Rate of return

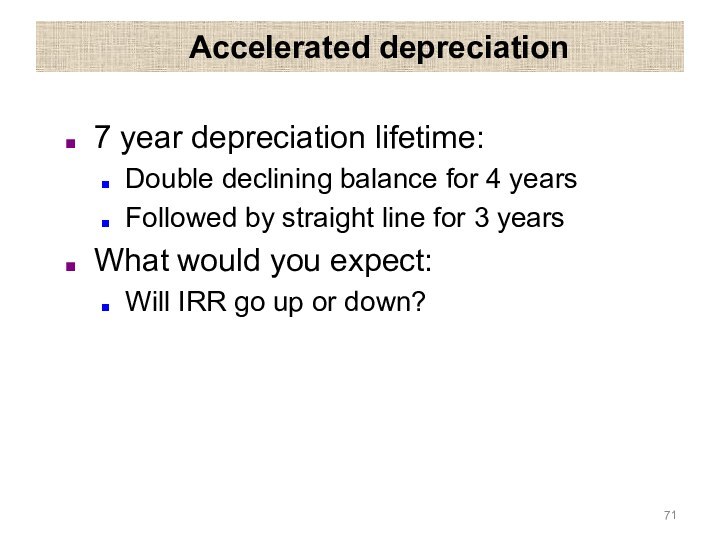

- 71. Accelerated depreciation 7 year depreciation lifetime:Double declining

- 72. Accelerated depreciation

- 73. Accelerated depreciationHow to figure out after-tax IRR?Use

- 74. Net Income vs. Cash FlowNet income is

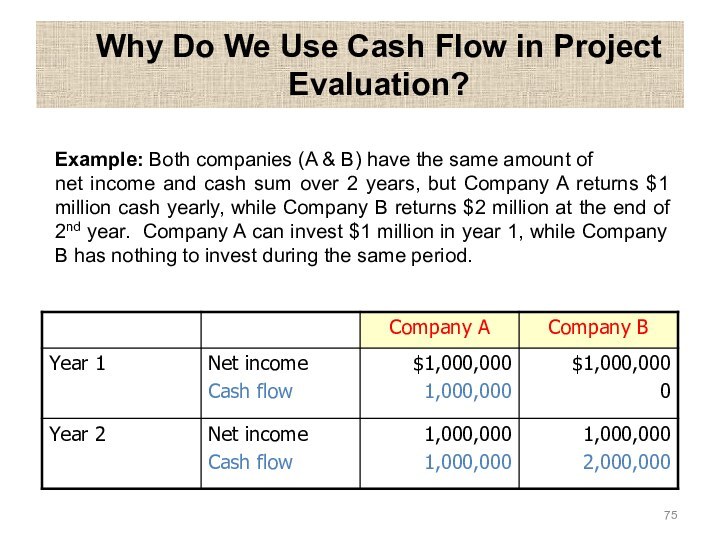

- 75. Why Do We Use Cash Flow in

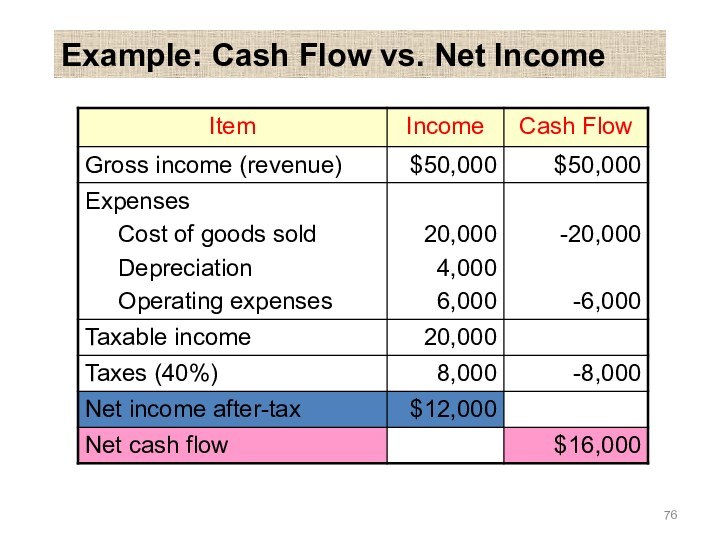

- 76. Example: Cash Flow vs. Net Income

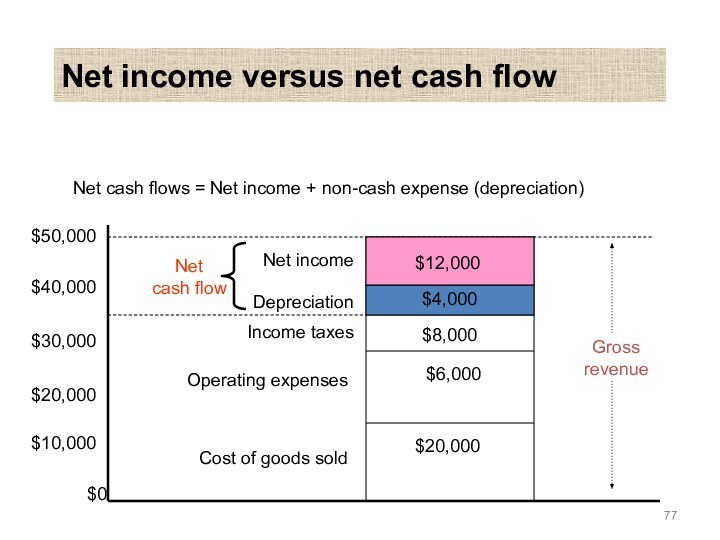

- 77. Net income versus net cash flowNet cash flows = Net income + non-cash expense (depreciation)

- 78. DefinitionsTax deduction:Expense deducted from taxable incomeSaving =

- 79. DefinitionsBook value: Purchase price (for land, stocks,

- 80. DefinitionsCapital gains:Item selling price greater than purchase

- 81. Capital gain/lossGenerally attributed to year of saleLong-term

- 82. Capital gain/lossCarrying backward or forward:Some businesses are

- 83. ExampleInvestment with depreciationBuy equipment for $110K for 10 years:No salvage valueStraight-line depreciation

- 84. ExampleSell for $30K in year 8:Book value

- 85. Non-depreciable exampleInvestment with no depreciationBuy land for

- 86. Capital gain/lossTaxable income = Gross income (i.e.,

- 87. Personal income taxSame general issues as corporate

- 88. Tax-exempt examplePurchase $5K bond (20 years)From phone

- 89. Tax-exempt examplePhone company bond at 11%:$550/year, paid

- 90. ObservationA government bond (tax-exempt) at 7.5% may

- 91. Charitable deduction exampleAssume the following tax rate:tax

- 92. Graduated income taxConstant tax rate:“Flat tax”If tax rate is not constant:“Graduated” income tax

- 93. Graduated income taxExample:15% if taxable income <

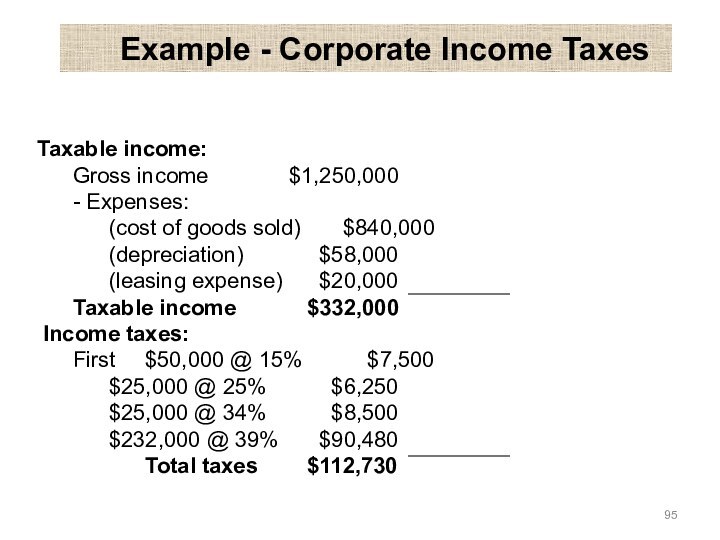

- 94. Example - Corporate Income TaxesFacts:Capital expenditure $100,000(allowed depreciation)

- 95. Example - Corporate Income TaxesTaxable income: Gross income $1,250,000 -

- 96. Average tax rate: Total taxes = $112,730 Taxable income = $332,000

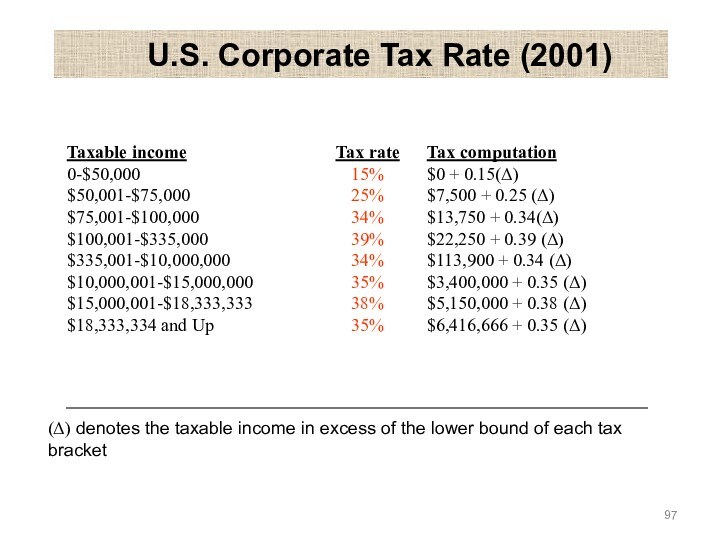

- 97. U.S. Corporate Tax Rate (2001)Taxable income0-$50,000$50,001-$75,000$75,001-$100,000$100,001-$335,000$335,001-$10,000,000$10,000,001-$15,000,000$15,000,001-$18,333,333$18,333,334 and

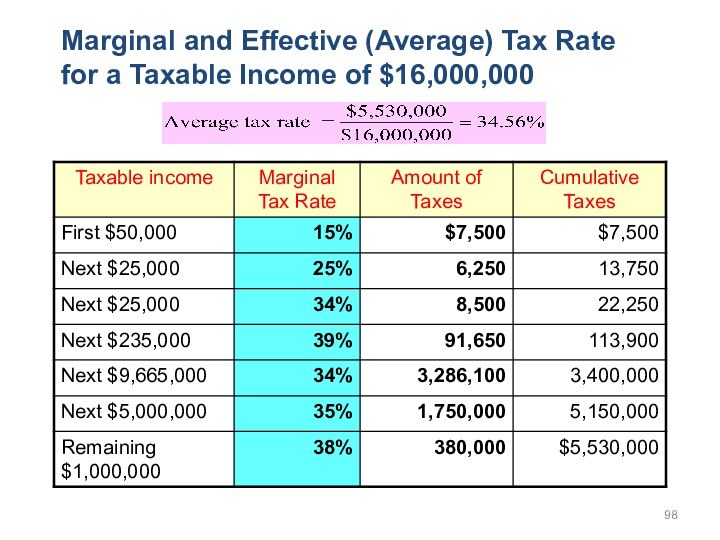

- 98. Marginal and Effective (Average) Tax Rate for a Taxable Income of $16,000,000

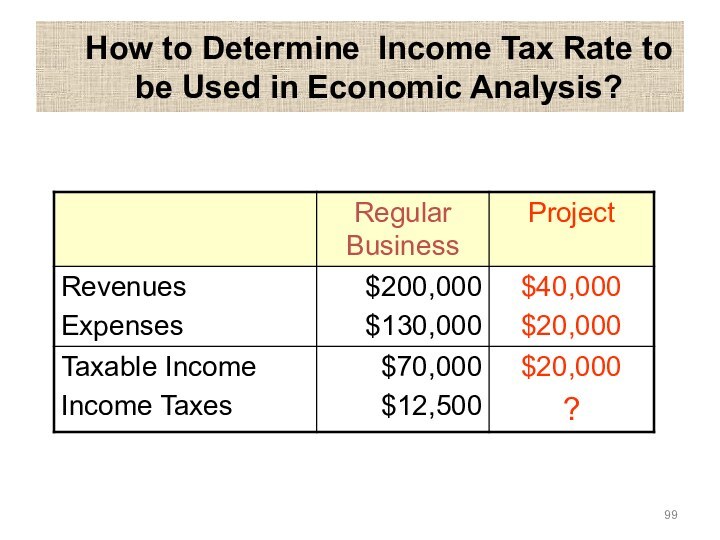

- 99. How to Determine Income Tax Rate to be Used in Economic Analysis?

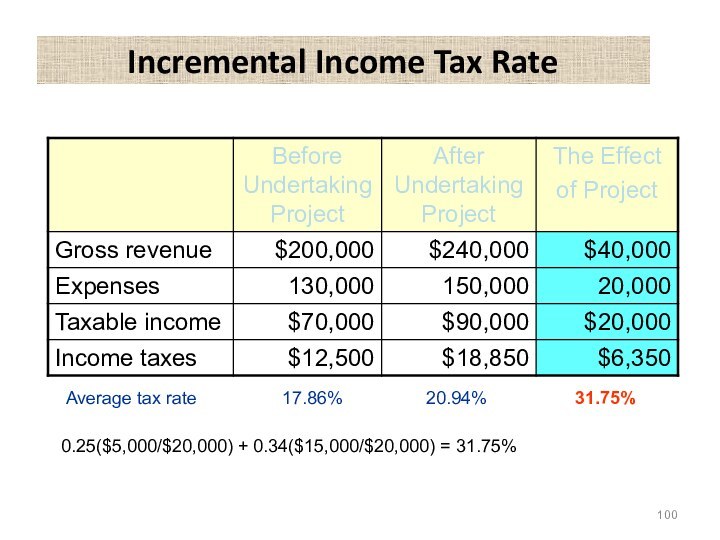

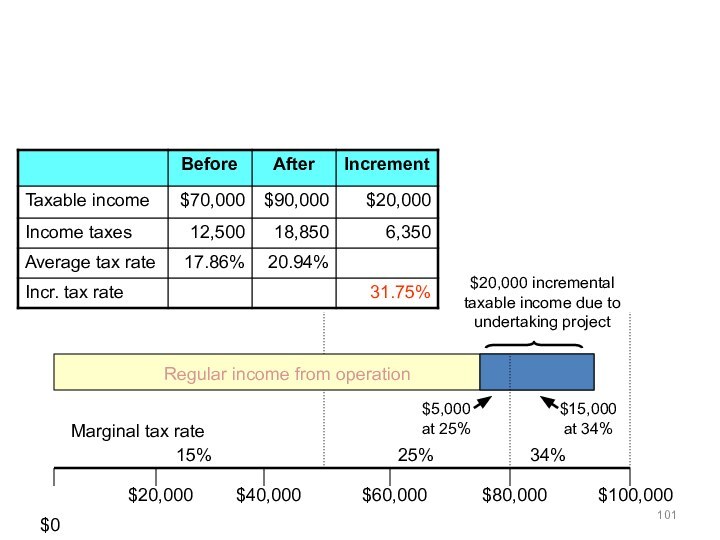

- 100. Incremental Income Tax RateAverage tax rate

- 101. $0$20,000 incrementaltaxable income due toundertaking project

- 102. Скачать презентацию

- 103. Похожие презентации

ObjectiveThe objective is to introduce some of the concepts and mechanics of depreciation and depletion, some historical depreciation methods, as well illustrate different types of taxes

Слайд 3

General Accounting

General Accounting:

Preparation of financial statements for a

firm. A financial statement (or financial report) is a formal record of

financial activities of a business, person, or other entityCost Accounting:

A branch of general accounting that deals with the measurement of costs

Depreciation Accounting:

A branch of general accounting that deals with capital assets depreciation

Слайд 4

General Accounting

Balance sheet:

Static picture of assets, liabilities and

net worth at a single point in time or

a summary of financial balances of a corporationAssets, liabilities and ownership equity (or shareholder’s equity = initial amount of money invested into a business) are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition"

Слайд 5

It is comprised of the following 3 elements:

Assets: Something

a business owns or controls (e.g. cash, inventory, plant

and machinery, etc.)Liabilities: Something a business owes to someone (e.g. creditors, bank loans, etc.)

Equity: What the business owes to its owners. This represents the amount of capital that remains in the business after its assets are used to pay off its outstanding liabilities. Equity therefore represents the difference between the assets and liabilities.

Слайд 7

General Accounting

Profit and loss statement:

Also called “income statement”

Income

Statement reports the company's financial performance in terms of

net profit or loss over a specified period.

Слайд 8

Income Statement

Income Statement is composed of the following

two elements:

Income: What the business has earned over a

period (e.g. sales revenue, dividend income, etc.)Expense: The cost incurred by the business over a period (e.g. salaries and wages, depreciation, rental charges, etc.)

Net profit or loss is arrived by deducting expenses from income.

Слайд 9

Cost Accounting

Costs incurred to produce and sell an

item or product are classified as:

Direct labor

Direct material

Manufacturing cost

Administrative

costSelling cost

Слайд 10

Direct Costs

Direct material:

Material whose cost is directly charged

to a product

Measured as the sum of charges for

materials necessary to produce the productDirect labor:

Labor cost directly attributable to a product

Measured by multiplying direct labor hours by the hourly wage rate

Слайд 11

Manufacturing Costs

Factory Overhead:

Indirect labor costs (sick leaves, vacations,

bonuses as well as labor connected to inspection, cleaning…)

Indirect

material costs (costs of materials that cannot be attributed to a particular product)Fixed costs (taxes, insurance, depreciation, maintenance)

Factory Costs are the sum of:

Direct labor costs

Direct material costs

Factory overhead

Слайд 12

Administrative and Selling Costs

Administrative costs:

Salaries of executive and

clerical personnel, office space, traveling, auditing, necessary to direct

the whole enterprise (not just its production or selling activities)Selling costs

Any expense involved in selling the products or services that tie in directly with sales (selling commissions, market surveys, selling bags, advertising)

Слайд 13

Depreciation

As time passes, the assets lose value

or depreciate

Physical loss

Use related

Time related

Functional loss

Efficiency (technology) related

Demand (changing

tastes) relatedCapacity related

Слайд 14

DEPRECIATION

Decrease in value of physical properties with passage

of time and use

Accounting concept establishing annual deduction against

before-tax income- to reflect effect of time and use on asset’s value in firm’s financial statement

Слайд 15

PROPERTY IS DEPRECIABLE IF IT MUST :

be used

in business or held to produce income

have a determinable

useful life which is longer than one yearwear out, decay, get used up, become obsolete, or lose value from natural causes

not be inventory, stock in trade, or investment property

Слайд 16

DEPRECIABLE PROPERTY

TANGIBLE - can be seen or touched

personal property - includes assets such as machinery,

vehicles, equipment, furniture, etc...real property - anything erected on, growing on, or attached to land

(Since land does not have a determinable life itself, it is not depreciable)

INTANGIBLE - personal property, such as copyright, patent or franchise (out of scope of the lecture)

Слайд 17

WHEN DEPRECIATION STARTS AND STOPS

Depreciation starts when property

is placed in service for use in business or

for production of incomeProperty is considered in service when ready and available for specific use, even if not actually used yet

Depreciation stops when cost of placing it in service has been recovered or it is retired from service

Слайд 18

DEPRECIATION CONCEPTS

The following terms are used in the

classical (historical) depreciation method equations:

N = depreciable life of

the asset in yearsP = adjusted or cost basis, including allowable adjustments (cost of improvement or theft)

D t = annual depreciation deduction in year t (1< t

BV t = book value at the end of year k

BV N = book value at the end of the depreciable (useful) life

SV N = salvage value at the end of year N

d = the ratio of depreciation in any one year to the BV at the beginning of the year

Слайд 19

Value of an asset

Market value

The actual value an

asset can be sold for

Book value

The depreciated value

of an asset as shown on the accounting records of company. Not a useful measure of its market value Salvage value

Actual value of an asset at the end of its useful life. It is the expected selling price of a property when the asset can no longer be used productively by its owner

Слайд 20

Book Value

Let:

P = adjusted cost basis

BVt = book

value at the end of period t

Dt = depreciation

during period t Then:

BVt = BVt-1 – Dt

BVt = P - ∑jt=1 Dt

Слайд 21

Capital versus expense

Consider a copy shop, which buys:

Ink

and paper

Copying (Xerox) machines

Ink and paper are used up

when they are bought (for all practical purposes):Treated as an expense

When company buys/uses $1000 of paper,

It is $1000 poorer (not counting any revenue)!

Слайд 22

Capital versus expense

Copying (Xerox) machines are used up

only slowly over time:

Treated as “capital goods”

When company buys

a $1000 machine It trades $1000 cash for $1000 in equipment

Not poorer at all! (assets just changed form)

That is why expenses can be deducted from the income fully and instantly, assets or capital need to be depreciated

Слайд 23

Definitions

Capital gains:

Item selling price greater than purchase price

Depreciation

recapture:

Item selling price greater than book value

(Up to purchase

price)Taxed as ordinary income

Capital loss:

Item sold for less than book value

Слайд 24

Example

If at the end of 1 year

I go

out of business and sell my tools for $40K.

I bought them for $35K and Book Value=$25

How much capital gain (or loss) do I have?

If at the end of 5 years

I go out of business and sell my tools for $5K

I bought them for $35K and Book Value=$10

How much capital gain (or loss) do I have?

Note that book value may be 0 even when market value is positive!

Слайд 25

Salvage value

If a salvage value is expected,

Depreciation applies

to P - SV

Example:

If P = $35K and I

expected $5K salvage value in year 5,I would depreciate $30K over 5 years

(only $6K per year)

That is, ($35K-$5K)/5 instead of $35K/5

Ending book value would be $5K

No capital gain/loss unless real salvage value differs

Слайд 26

Depreciation and taxes

Depreciation is treated as an expense

(i.e.,

a tax deduction) in computation of income taxes

It is

a fictitious expense!No cash changes hands

Would you rather have that “expense” occur sooner or later?

Слайд 27

Observations

Depreciation methods are conventions

Not based strictly on market

value!

Different types of assets have:

Different recovery periods

(Only partially

related to actual lifetime)Different allowable depreciation schedules

(Usually codified in lookup tables)

Слайд 28

Some Depreciation Schedules

Straight line method (SL)

Declining Balance method

(DB)

Double Declining Balance (DDB)

There are more schedules used

Слайд 29

SL Depreciation

Constant rate of loss in the value

of an asset

Graphically: straight line between the first

cost and the salvage or scrap value of the asset0

8

200

800

Years

Book Value ($)

Слайд 30

SL depreciation

Recovery period = n

Depreciation rate = 1/n

(Same

for all years!)

It depreciates (1/n)% each year

SL Depreciation =

(first cost - salvage)/n(Same in all years)

Book value in period (t)

= book value in period (t-1) – depreciation(t)

Слайд 31

SL Depreciation – Cont.

Dsl(t) = (P-SV) / N

Dsl(t):

depreciation for period t

P: purchase value

SV: salvage value

N: useful

life of the assetBVsl(t) = P - t [(P-SV) / N] = P-t * Dsl

BVsl(t): book-value at the end of period t

Слайд 32

Example 1

Small computers purchased by a company cost

$7000 each. Past records indicate that they should have

a useful life of 5 years, after which they will be disposed of, with no salvage value. Determine:The depreciation charge during year 1

The depreciation charge during year 2

The book value of the computers at the end of year 3

Слайд 34

Example 2

A machine tool has:

First cost $35,000

Recovery period

20 years

(based on estimated life)

Estimated salvage value $3,500

Depreciation

= ($35,000 - $3,500)/20= $1,575 (same in all years)

Слайд 36

Straight line depreciation

Writes off capital investment linearly

Estimated salvage

value is considered:

Only estimated!

Actual (future) salvage value is not

known when depreciation schedule is setSL Depreciation gives you a constant amount each year

Слайд 37

Declining Balance Depreciation

Sometimes called constant percentage method or

Matheson formula: assumes that the annual cost of depreciation

is a fixed percentage of the BV at the beginning of the yearConstant proportion loss in value of an asset

Depreciation rate: a constant percentage

Ddb (t) = BVdb(t - 1) × d

Ddb (t): depreciation amount in period t

BVdb (t): book value at the end of period t

P: purchase price

d: depreciation rate

Слайд 38

DB Depreciation

D(1) = P × d

D(2) = d

× (P- D(1)) = P(1-d) × d

D(3) = d

× (P- D(1)-D(2)) = P(1-d)2 × d…

…

Ddb (t) = P(1-d)t-1 × d

Слайд 39

DB Depreciation

D1 = P × d

Ddb (t) =

P(1-d)t-1 × d

Ddb (t) = BVdb(t - 1) ×

dBVdb(t) = BVdb(t-1) - Ddb(t) = BVdb(t-1) (1-d)

BVdb(t) = P(1-d)t

Слайд 40

Example 3: Example 1 revisited

Use a depreciation rate

of 40% for declining-balance method. Consider the previous example

1Ddb(1) = BV(0) * (0.4) = 7000 (0.4) = $2800

Ddb(2) = BV(1) * (0.4) = (7000–2800) (0.4)

Ddb(2) = $1680

BVdb(3) = 7000 (1-0.4)3 = $1512

Слайд 41

Double declining balance (DDB)

Most common form of declining

balance is double declining balance or 200% declining balance

(it would have been the triple and more, if the law permitted it, but the double was the maximum rate allowed):d = 2/n, where n = recovery period

Слайд 42

Example 4: example 2 revisited

Consider the same machine

tool

d = 2/20 years

= 10% per year (or

0.1)Depreciation in year 1 = 0.1($35,000)

We use $35,000 since that is the BV in year 0

= $3,500 (versus $1,575 for straight line)

Depreciation in year 2

= 0.1 (BV in t-1)

= 0.1 ($35,000 - $3,500) = $3,150, etc.

Слайд 44 DDB With Conversion to SL at the Most

Desirable Time

Since DDB does not use a value for

Salvage, we have three possible scenarios at time of disposal:Over depreciation: Book Value < Salvage Value. Tax savings realized early. Small gain upon sale of the asset and taxes on the gain.

Exact depreciation: Book value = Salvage value. There are no tax consequences upon sale of the asset.

Under depreciation: Book Value > Salvage Value. Did not deduct as much as you could have and lost tax savings.

To allow companies take advantage of all the depreciation charges they are entitled to, they can switch from DDB to straight line at the most favorable time.

Слайд 45

Example: DB Switching to SL

SL Dep. Rate

= 1/5

a (DDB rate) = (200%) (SL rate)

= 2/5Depreciation Base $10,000

Salvage Value 0

Depreciation 200% DB

Depreciable life 5 years

Слайд 46

(a) Without switching

(b) With switching to SL

Note: Without

switching, we have not depreciated the entire cost of

the asset and thus have not taken full advantage of depreciation’s tax deferring benefits.Case 1: S = 0

Слайд 47

Case 2: S = $2,000

Note: Tax law does

not permit us to depreciate assets below

their salvage values.

Слайд 48

Sum-of-Years’ Digits (SYD) Method

Principle

Depreciation concept similar to

DB but with decreasing depreciation rate.

Charges a larger fraction

of the cost as an expense of the early years than of the later years.Formula

Annual Depreciation

Book Value

where SYD=N(N+1)/2

Слайд 49

Example 10.7 – SYD method

D1

D2

D3

D4

B1

B2

B3

B4

B5

$10,000

$8,000

$6,000

$4,000

$2,000

0

0 1

2 3 4 5 Total depreciation at end of life

P = $10,000

N = 5 years

S = $2,000

SOYD = 15

n

Слайд 50

Units-of-Production Method

Principle

Service units will be consumed in

a non time-phased fashion (decrease in value of property

is a function of use and not function of time)Formula

Dper unit =

Estimated lifetime production units

See Example 7-4

Слайд 51

See Example 7-4

A piece of equipment used

in a business has a basis of $50.000 and

is expected to have a $10.000 SV when replaced after 30.000 hours of use. Find its depreciation rate per hour of use, and find its BV after 10.000 hours of operation.Solution

Depreciation per unit of production = ($50.000-$10000)/30.000 hours = $1.33 per hour

After 10.000 hours BV = $50.000 - $1.33*(10.000 hours) = 36.700

Слайд 52

Depletion

Two methods of natural resource depletion

Cost or

factor depletion

Percentage depletion

Слайд 53

Cost Depletion

Depletion is computed on a per unit

basis

Per unit amount is determined by dividing the basis

of the resource (FC) by the estimated recoverable units of resourceNumber of units sold in year × per unit depletion = depletion for year

Total depletion can not exceed total cost of the property

Слайд 54

Cost Depletion: An Example

Suppose a reservoir contains an

estimated 1,000,000 barrels of oil, and requires an initial

investment of $7,000,000 to develop. Asume that 50,000 barrels of oil are produced annuallyUnit Depletion Rate = 7,000,000/1,000,000 = $7 per barrel

Depletion Charge = 50,000 (7) = $350,000

Слайд 55

Percentage Depletion

Percentage depletion

Depletion is computed by

using the statutory percentage rate for the type of

resourceRate is applied to the gross income from the property

Percentage depletion

Percentage depletion cannot exceed 50% of the taxable income (before depletion) from the property

Percentage depletion reduces basis in property

However, total percentage depletion may exceed the total cost of the property

Слайд 57

Percentage Depletion: An Example

Assume in the previous (oil)

example that the price for oil is $23 per

barrel and the expenses to produce oil (apart from the initial cost) are $380,000Gross Depletion Income = 50,000*23 = $1,150,000

Depletion Rate = 22%

Percentage Depletion Charge = $253,000

Now check if that amount exceeds the maximum depletion charge allowed by law

Слайд 58

Percentage Depletion: An Example

Gross Depletion Income =

$1,150,000

Less expenses =

- $380,000$770,000

Deduction Limitation 50%

Maximum Depletion Charge $385,000

$253,000 < $385,000, so full charge is allowable

Слайд 59

Agenda for today

We will learn how to determine:

Before-tax cash flows

Taxable income

Income taxes

After-tax cash flow

We will

see the effects of depreciation schedule on after-tax IRRExamples

Слайд 60

Agenda for today

Review terms and definitions

Rate of return

(ROR)

Tax deduction

Tax credit

Capital gain/loss

Charity deductions

Bonds

Examples

Слайд 61

Why do we calculate depreciation?

Since depreciation is an

“expense” we can use that expense to reduce our

taxable income, and therefore reduce the amount of taxes we pay.We have to know how much our equipment has depreciated to determine the deductions to be made.

Слайд 62

Definitions

Net versus gross income:

Gross income = revenue or

receipts

Net income = revenue minus expenses

Corporate tax is on

net income (profit)Individual tax is on gross income

Income taxes are an additional expense

Слайд 63

How to calculate After-Tax Cash Flow?

Determine before-tax cash

flows (BTCF)

Determine taxable income (TI):

Revenues – (depreciation & other

expenses)Compute income taxes (Tax):

(Taxable income) * (tax rate)

Determine after-tax cash flow (ATCF):

Before-tax cash flow - income taxes

Слайд 66

Observations

Land is capital

Land purchase is not an expense!

Land

sale proceeds are not revenue!

Just convert cash assets into

land, vice versaCapital gains are revenue.

Income taxes are an additional expense

But the timing of this expense is critical!

Results can vary a great deal depending on the timing of depreciation

Слайд 67

Depreciation example (SL)

Investment with depreciation

Buy equipment for $110K

for 10 years:

No salvage value

Straight-line depreciation

Savings of $32K per

yearCosts of $5.7K per year

Net savings of $26.3K per year

Tax is 40%

Слайд 68

Depreciation example (SL)

SL Deprec. = (110-0)/10 = 11

Taxable

income = income - depreciation

Depreciation is treated as an

expense!Rate of return (IRR) =

20.1% before taxes

12.9% after taxes

Слайд 69

Longer depreciation (25 years)

What would you expect:

Will

IRR go up or down?

I am extending the depreciation

and paying more taxes sooner.

Слайд 70

Comparison

10 year (SL) depreciation schedule:

Rate of return

20.1%

before taxes,

12.9% after taxes

25 year (SL) depreciation schedule:

After-tax

rate of return = 9.5%Why is it less?

What happens to after-tax rate of return?

Слайд 71

Accelerated depreciation

7 year depreciation lifetime:

Double declining balance

for 4 years

Followed by straight line for 3 years

What

would you expect:Will IRR go up or down?

Слайд 73

Accelerated depreciation

How to figure out after-tax IRR?

Use column

for after-tax cash flow (just that column!)

Calculate IRR as

usualAfter-tax IRR = 14.7%

Tax benefit of depreciation accelerated,

So after-tax IRR went up (>12.9%)

Слайд 74

Net Income vs. Cash Flow

Net income is an

accounting means of measuring a firm’s profitability based on

the matching concept. Costs become expenses as they are matched against revenue. The actual timing of cash inflows and outflows are ignored.Cash flow: Given the time value of money, it is better to receive cash now than later, because cash can be invested to earn more money. That is why cash flows are relevant data to use in project evaluation.

Слайд 75 Why Do We Use Cash Flow in Project

Evaluation?

Example: Both companies (A & B) have the same

amount ofnet income and cash sum over 2 years, but Company A returns $1 million cash yearly, while Company B returns $2 million at the end of 2nd year. Company A can invest $1 million in year 1, while Company B has nothing to invest during the same period.

Слайд 77

Net income versus net cash flow

Net cash flows

= Net income + non-cash expense (depreciation)

Слайд 78

Definitions

Tax deduction:

Expense deducted from taxable income

Saving = (deduction)

x (tax rate)

Savings are not equal to deductions, just

a %Tax credit:

Expense deducted from taxes

Saving = 100% of tax credit

Tax exemption:

Income that is not taxable

Слайд 79

Definitions

Book value:

Purchase price

(for land, stocks, other

non-depreciable assets)

Depreciated value

(for physical assets, patents, other depreciable assets)

Слайд 80

Definitions

Capital gains:

Item selling price greater than purchase price

Depreciation

recapture:

Item selling price greater than book value

(Up to purchase

price)Taxed as ordinary income

Capital loss:

Item sold for less than book value

Слайд 81

Capital gain/loss

Generally attributed to year of sale

Long-term capital

gains (> 1 year)

Can be taxed less than ordinary

incomeCapital loss not deducted from income:

Only from capital gains (for companies)

Losses can be carried over to future years!

Слайд 82

Capital gain/loss

Carrying backward or forward:

Some businesses are very

volatile

E.g., oil prospecting!

Some years may have net losses

Can use

past losses to offset future gainsCan carry forward for up to 5 years

Слайд 83

Example

Investment with depreciation

Buy equipment for $110K for 10

years:

No salvage value

Straight-line depreciation

Слайд 84

Example

Sell for $30K in year 8:

Book value =

$22K

Depreciation recapture = $8K

Sell for $20K in year 8:

Capital

loss = $2KCannot deduct from ordinary income

Deduct from gain (now or in another year)

Слайд 85

Non-depreciable example

Investment with no depreciation

Buy land for $110K

Sell

for $130K:

Capital gain = $20K

Sell for $100K:

Capital loss =

$10K (offset against gains)Note: with land there can’t be Depreciation Recapture. Why?

Слайд 86

Capital gain/loss

Taxable income =

Gross income (i.e., revenues

or receipts)

Minus operating expenses

Minus depreciation

Plus depreciation recapture

Plus capital gains

Minus

capital losses (up to size of capital gains, but no greater)

Слайд 87

Personal income tax

Same general issues as corporate tax:

Tax

exempt income

(E.g., government bonds)

Tax deductions

(E.g., charitable donations, interest

payments)

Слайд 88

Tax-exempt example

Purchase $5K bond (20 years)

From phone company

at 11%:

$550/year, paid as $275 every 6 months

Municipal bond

from …. at 7.5%:$375/year, paid as $187.50 every 6 months

Assume a tax rate:

tax rate = 33.8%

Слайд 89

Tax-exempt example

Phone company bond at 11%:

$550/year, paid as

$275 every 6 months

Tax = ($550) x (33.8%) =

$185.9After-tax income

$550 - $185.9 = $364.10

Municipal bond at 7.5% (tax exempt):

$375/year (after-tax income greater!)

Слайд 90

Observation

A government bond (tax-exempt) at 7.5% may give

higher income than a private 11% bond!

Desirability will vary

with income:Higher income gives higher tax rate

Tax exemption becomes more desirable

Слайд 91

Charitable deduction example

Assume the following tax rate:

tax rate

= 38.4%

Charitable gift of $1000:

Tax deduction = ($1000) x

(38.4%) = $384True cost of gift = $1000 - $384 = $616

Government is encouraging charity!

Слайд 92

Graduated income tax

Constant tax rate:

“Flat tax”

If tax rate

is not constant:

“Graduated” income tax

Слайд 93

Graduated income tax

Example:

15% if taxable income < $50K

$7.5K

+ 25% of amount above $50K

If taxable income between

$50K and $75K$13.75K + 34% of excess over $75K

If taxable income > $75K

Слайд 94

Example - Corporate Income Taxes

Facts:

Capital expenditure $100,000

(allowed depreciation)

$58,000

Gross Sales revenue

$1,250,000Expenses:

Cost of goods sold $840,000

Depreciation $58,000

Leasing warehouse $20,000

Question: Taxable income?

Слайд 95

Example - Corporate Income Taxes

Taxable income:

Gross income $1,250,000

- Expenses:

(cost

of goods sold) $840,000

(depreciation) $58,000

(leasing expense)

$20,000Taxable income $332,000

Income taxes:

First $50,000 @ 15% $7,500

$25,000 @ 25% $6,250

$25,000 @ 34% $8,500

$232,000 @ 39% $90,480

Total taxes $112,730

Слайд 96

Average tax rate:

Total taxes = $112,730

Taxable income = $332,000

Marginal

tax rate:

Tax rate that is applied to the last

dollar earned = 39%Example - Corporate Income Taxes

Слайд 97

U.S. Corporate Tax Rate (2001)

Taxable income

0-$50,000

$50,001-$75,000

$75,001-$100,000

$100,001-$335,000

$335,001-$10,000,000

$10,000,001-$15,000,000

$15,000,001-$18,333,333

$18,333,334 and Up

Tax

rate

15%

25%

34%

39%

34%

35%

38%

35%

Tax computation

$0 + 0.15(Δ)

$7,500 + 0.25 (Δ)

$13,750 + 0.34(Δ)

$22,250

+ 0.39 (Δ)$113,900 + 0.34 (Δ)

$3,400,000 + 0.35 (Δ)

$5,150,000 + 0.38 (Δ)

$6,416,666 + 0.35 (Δ)

(Δ) denotes the taxable income in excess of the lower bound of each tax bracket

Слайд 100

Incremental Income Tax Rate

Average tax rate

17.86%

20.94% 31.75%0.25($5,000/$20,000) + 0.34($15,000/$20,000) = 31.75%