- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Financial market fragility

Содержание

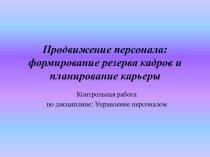

Chart A.8 Advanced economy sovereign bond yields have increased markedlySource: Thomson Reuters Datastream. (a) Yields to maturity.International ten-year nominal government bond yields(a)

Слайд 2 Chart A.8 Advanced economy sovereign bond yields have

increased markedly

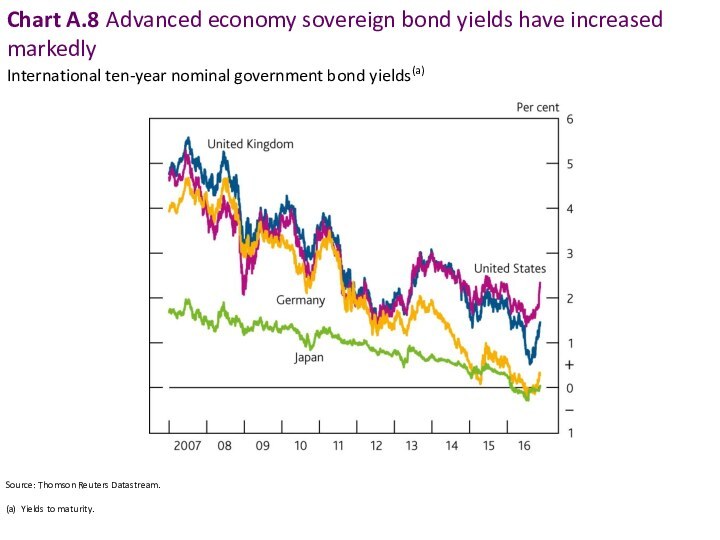

nominal government bond yields(a)Слайд 3 Chart A.9 The causes of changes in nominal

government bond yields differs across economies

Sources: Bloomberg and Bank

calculations.

Zero-coupon rates derived from government bonds. The contribution of real rates and implied inflation to the change in nominal rates is calculated using index-linked gilts (which reference UK RPI) for the United Kingdom and Treasury inflation-protected securities (which reference US CPI) for the United States.

Contributions to the increase in nominal ten-year interest rates since the July Report(a)

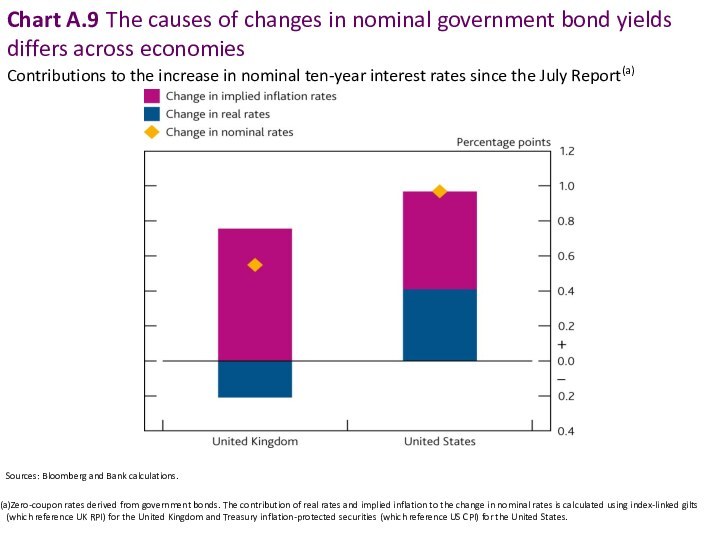

Слайд 4 Chart A.10 Term premia in government bond markets

are low

Sources: Bloomberg, Federal Reserve Bank of New York

and Bank calculations.

UK and German estimates are derived using the model described in Malik, S and Meldrum, A (2016), ‘Evaluating the robustness of UK term structure decompositions using linear regression methods’, Journal of Banking & Finance, Vol. 67, June, pages 85–102. US estimates are available from www.newyorkfed.org/research/data_indicators/term_premia.html

Estimates for the United Kingdom are calculated using data since October 1992. Estimates for Germany are calculated using data since January 1999.

Estimates of term premia in ten-year nominal government bond yields(a)(b)

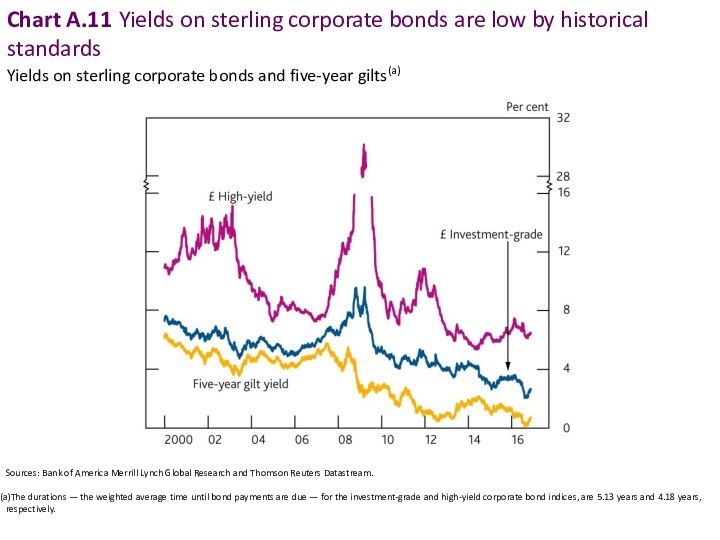

Слайд 5 Chart A.11 Yields on sterling corporate bonds are

low by historical standards

Sources: Bank of America Merrill Lynch

Global Research and Thomson Reuters Datastream.The durations — the weighted average time until bond payments are due — for the investment-grade and high-yield corporate bond indices, are 5.13 years and 4.18 years, respectively.

Yields on sterling corporate bonds and five-year gilts(a)