- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Growth theory: the economy in the very long run

Содержание

- 2. ECONOMIC GROWTH I: CAPITAL ACCUMULATION &POPULATION GROWTH8

- 3. 8-1 The Accumulation of Capital 8-2 The Golden Rule Level of Capital8-3 Population Growth

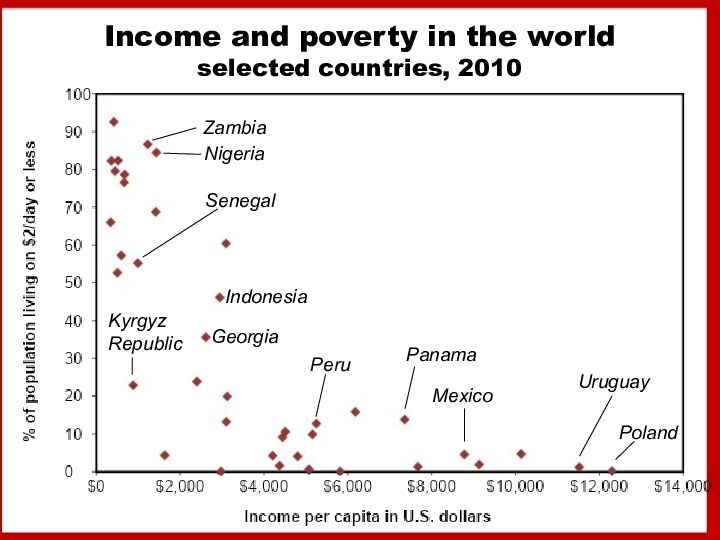

- 4. The Solow growth model shows how saving,

- 5. Income and poverty in the world selected countries, 2010IndonesiaUruguayPolandSenegalKyrgyz RepublicNigeriaZambiaPanamaMexicoGeorgiaPeru

- 6. 8-1 The Accumulation of CapitalThe Supply and

- 7. y = Y/L is output per worker

- 8. The Production FunctionThe PF shows how the

- 9. 8-1 The Accumulation of CapitalThe Supply and

- 10. 8-1 The Accumulation of CapitalThe Supply and

- 11. 8-1 The Accumulation of CapitalThe Supply and

- 12. 8-1 The Accumulation of CapitalThe Supply and

- 13. Output, Consumption, and InvestmentThe saving rate s

- 14. Depreciation is a constant fraction of the

- 15. Capital accumulationChange in capital stock = investment –

- 16. The equation of motion for kThe Solow

- 17. The steady stateIf investment is just enough

- 18. The steady state

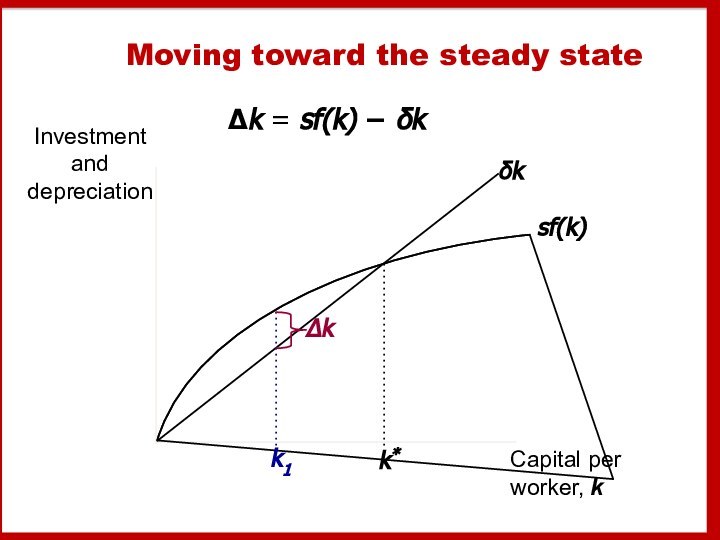

- 19. Moving toward the steady stateΔk = sf(k) − δk

- 20. Moving toward the steady stateΔk = sf(k) − δk

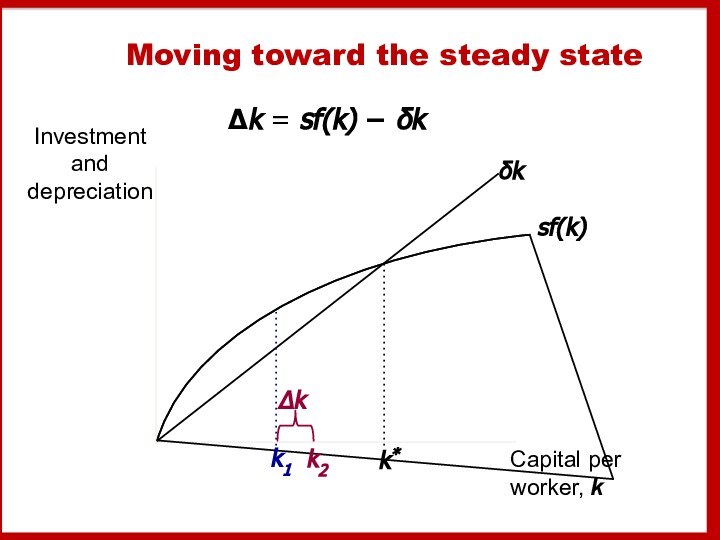

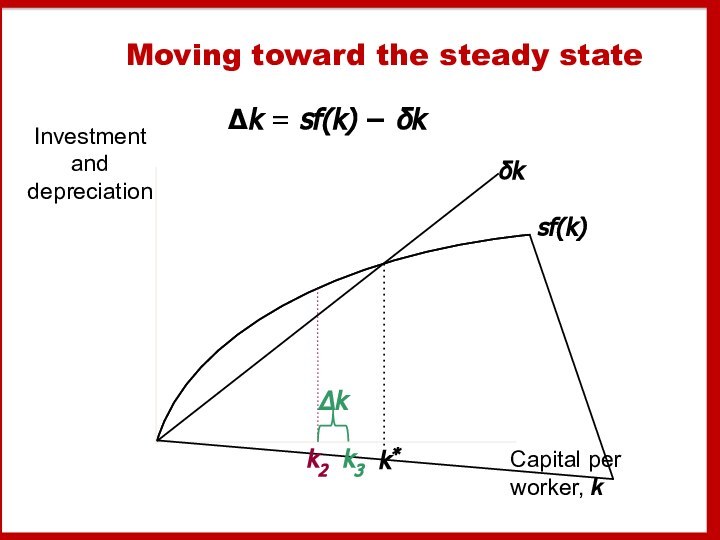

- 21. Moving toward the steady stateΔk = sf(k) − δkk2

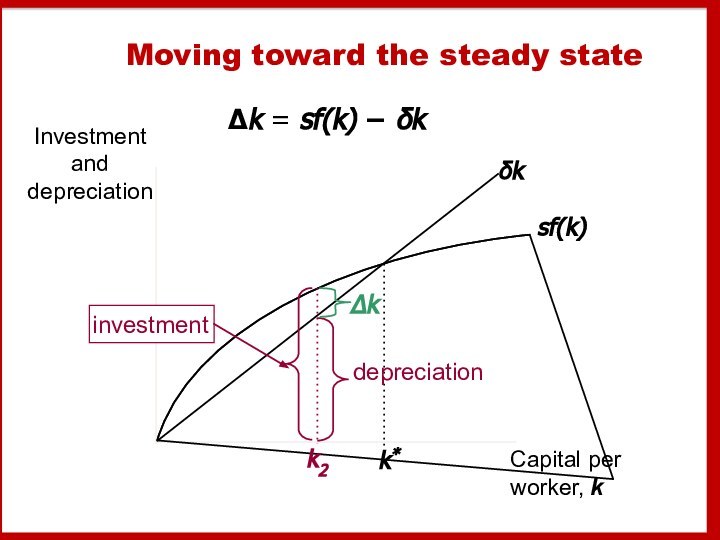

- 22. Moving toward the steady stateΔk = sf(k) − δkk2

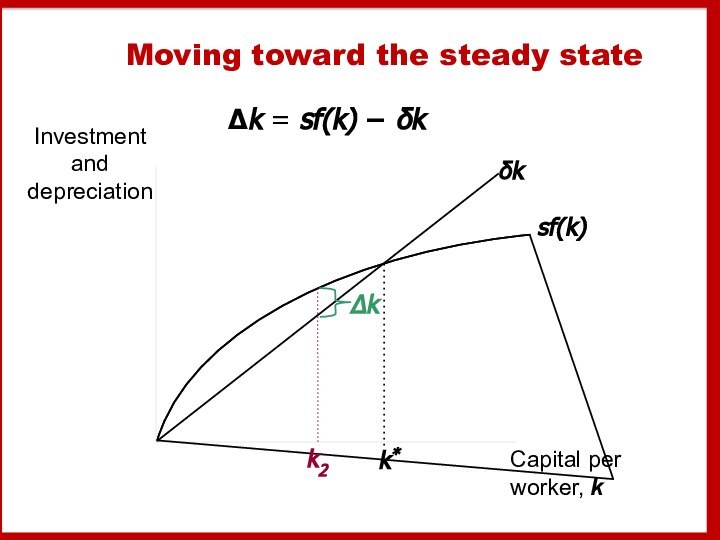

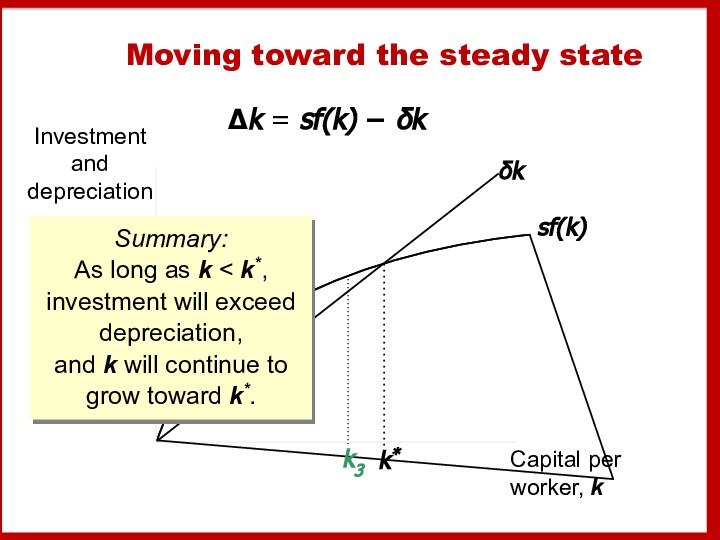

- 23. Moving toward the steady stateΔk = sf(k) − δk

- 24. Moving toward the steady stateΔk = sf(k) − δkk2k3

- 25. Moving toward the steady stateΔk = sf(k)

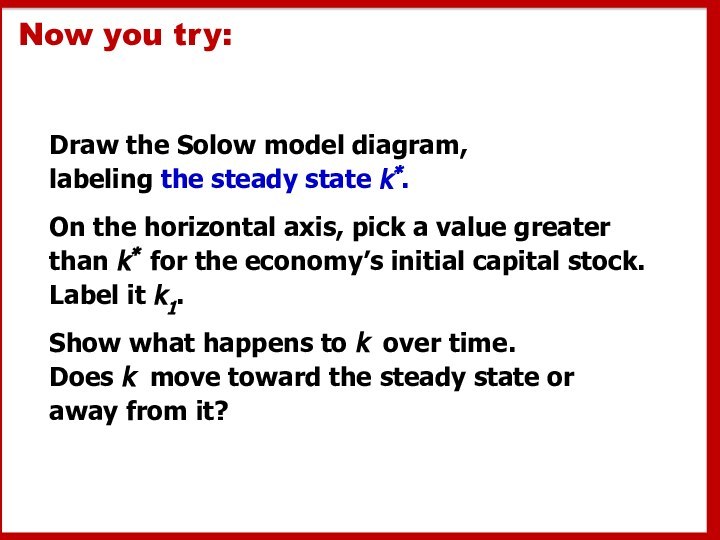

- 26. Now you try:Draw the Solow model diagram,

- 27. A numerical exampleProduction function (aggregate):To derive the

- 28. A numerical example, cont.Assume:s = 0.3δ= 0.1initial value of k = 4.0

- 29. Approaching the steady state: A numerical

- 30. Exercise: Solve for the steady stateContinue to

- 31. Solution to exercise:

- 32. An increase in the saving rateAn increase

- 33. Prediction:Higher s ⇒ higher k*. And

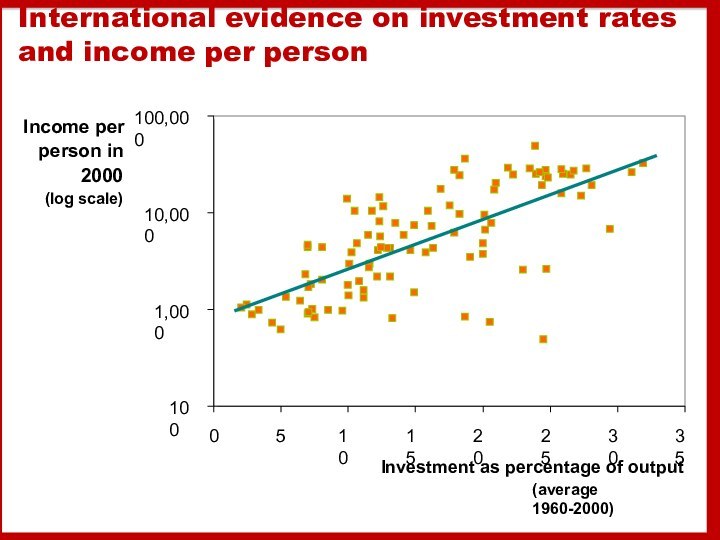

- 34. International evidence on investment rates and income

- 35. The Golden Rule: IntroductionDifferent values of s

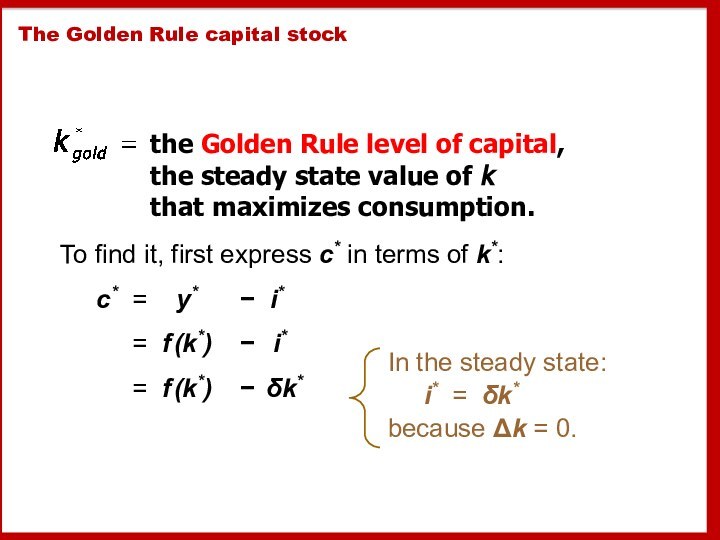

- 36. The Golden Rule capital stockthe Golden Rule

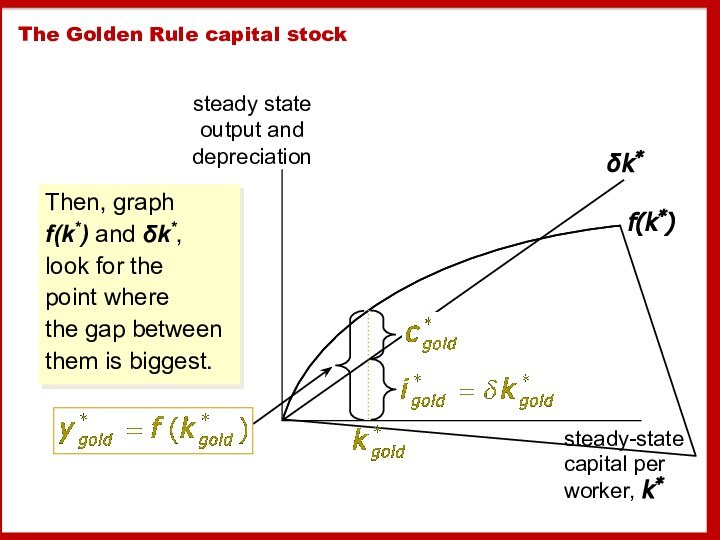

- 37. Then, graph f(k*) and δk*,

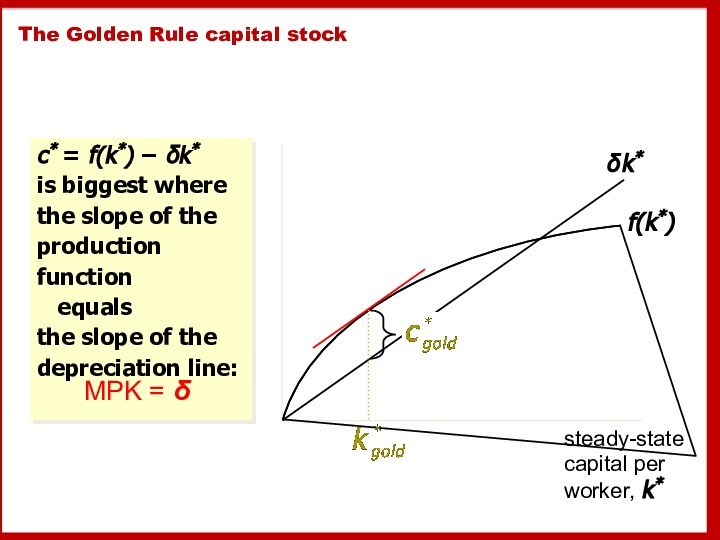

- 38. The Golden Rule capital stockc* = f(k*)

- 39. The transition to the Golden Rule

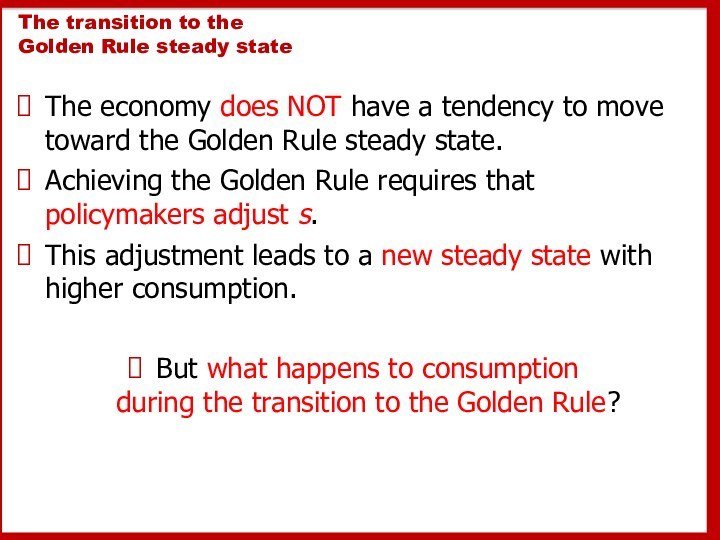

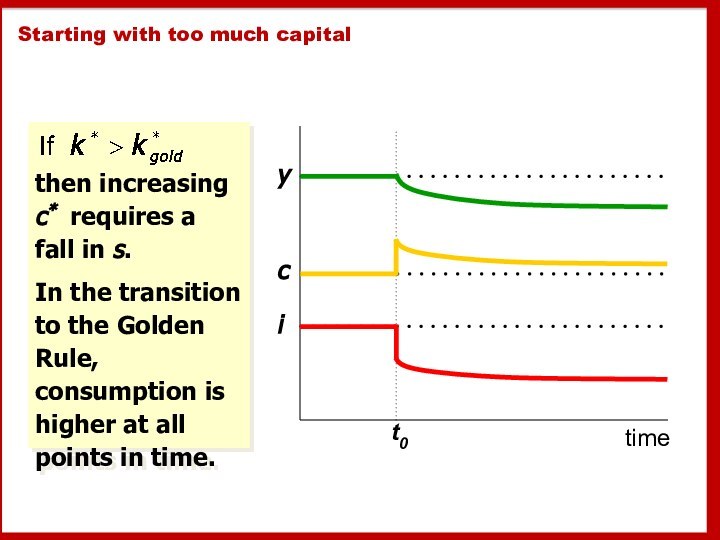

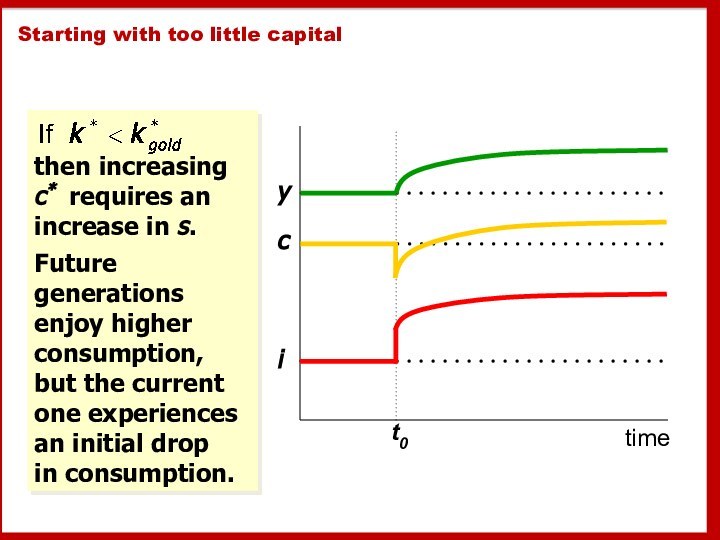

- 40. Starting with too much capitalthen increasing c*

- 41. Starting with too little capitalthen increasing c*

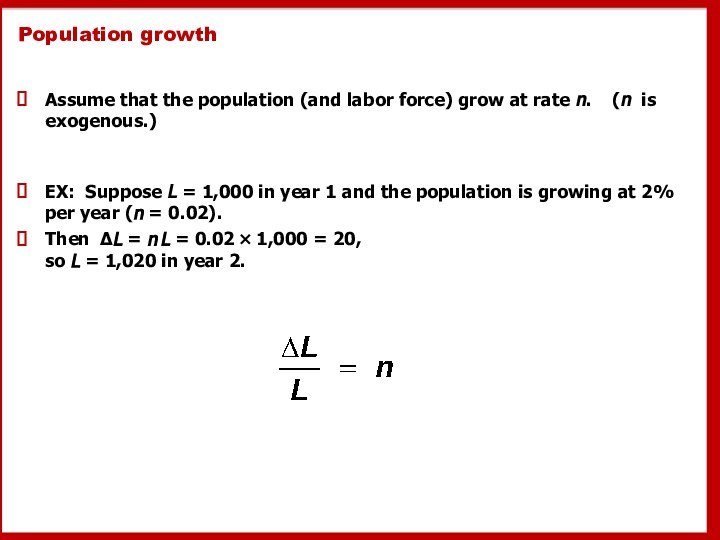

- 42. Population growthAssume that the population (and labor

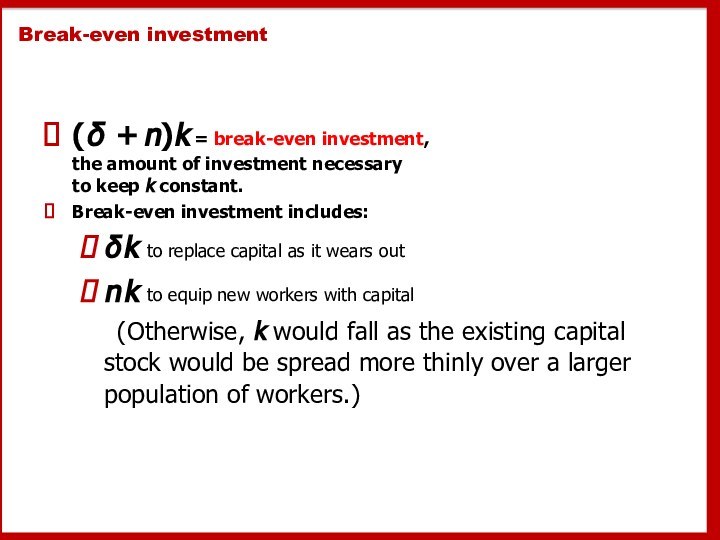

- 43. Break-even investment(δ + n)k = break-even investment,

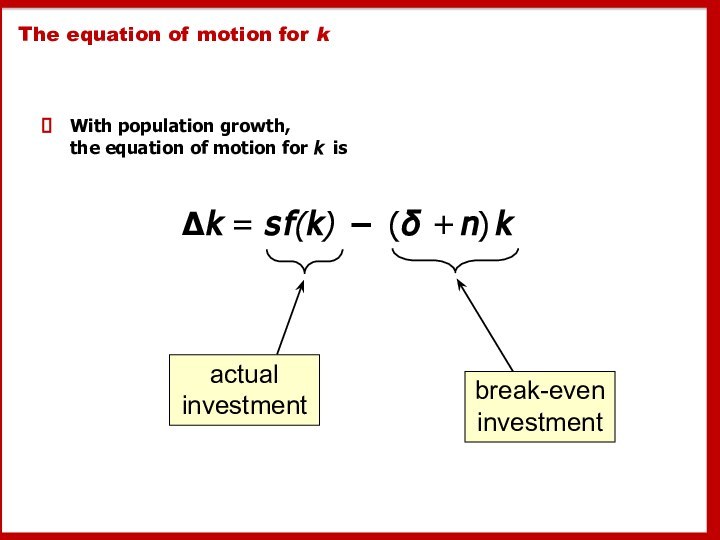

- 44. The equation of motion for kWith population

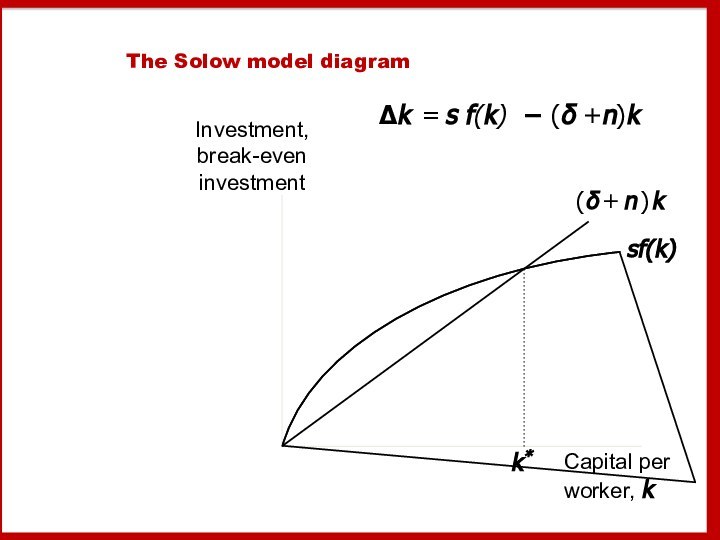

- 45. The Solow model diagramΔk = s f(k) − (δ +n)k

- 46. The impact of population growthInvestment, break-even investmentCapital

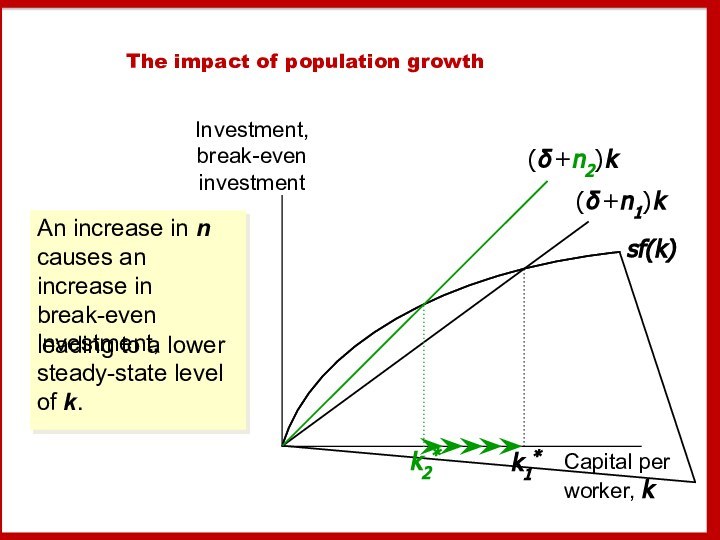

- 47. Prediction:Higher n ⇒ lower k*. And

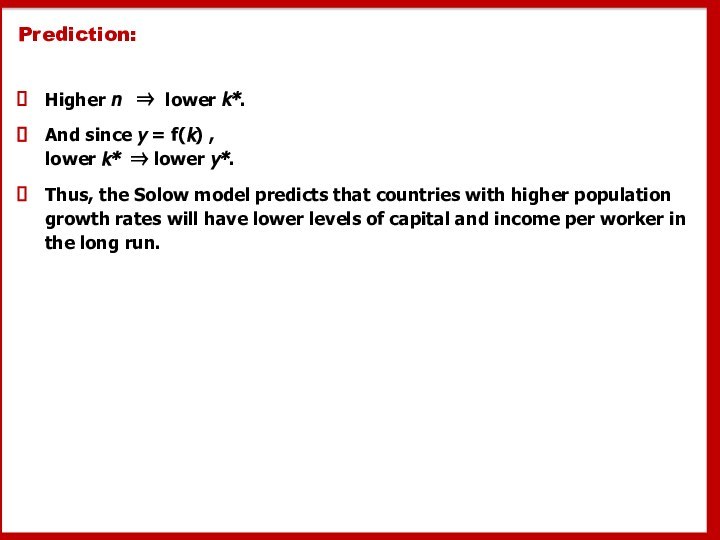

- 48. International evidence on population growth and income

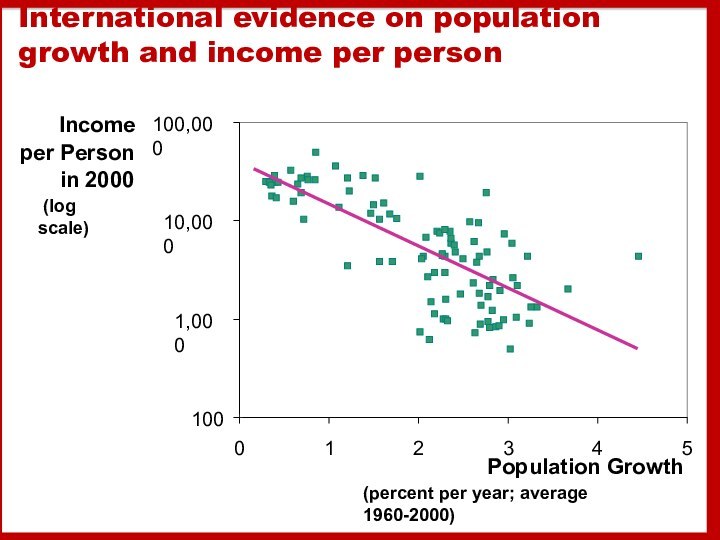

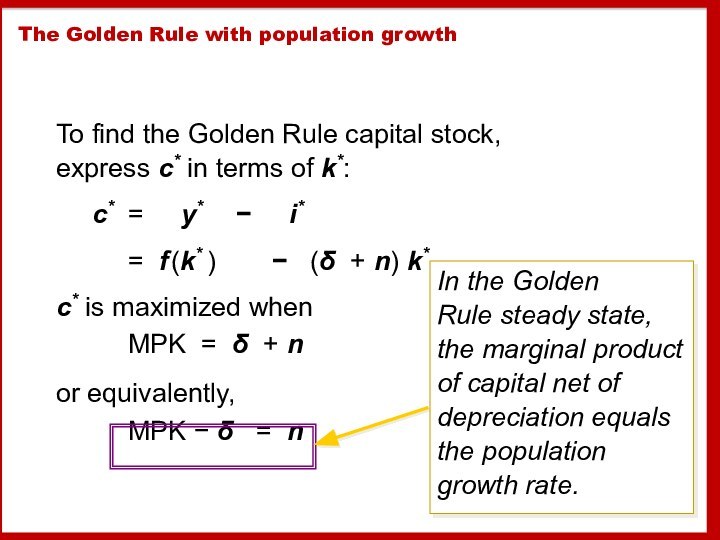

- 49. The Golden Rule with population growthTo find

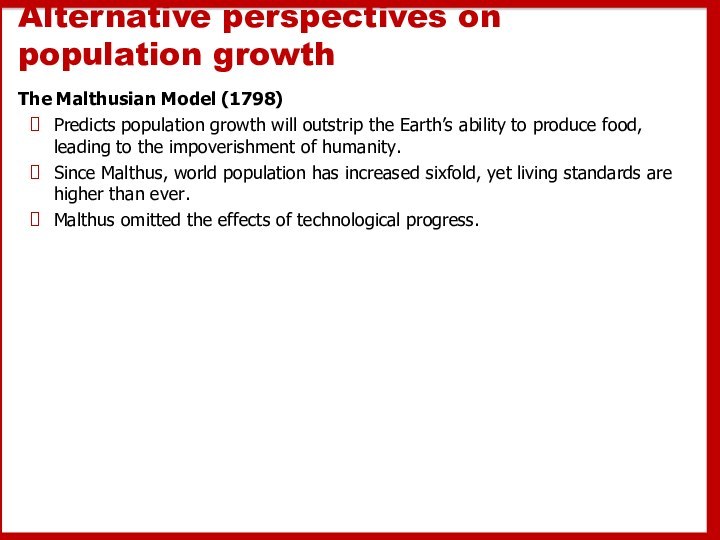

- 50. Alternative perspectives on population growthThe Malthusian Model

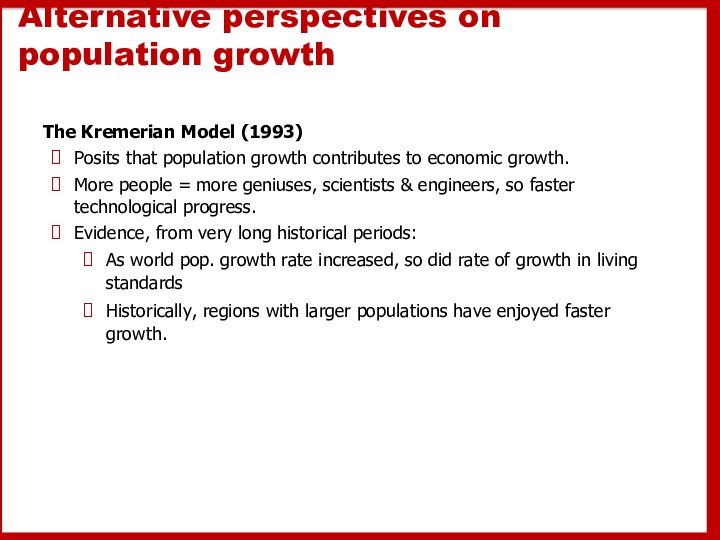

- 51. Alternative perspectives on population growthThe Kremerian Model

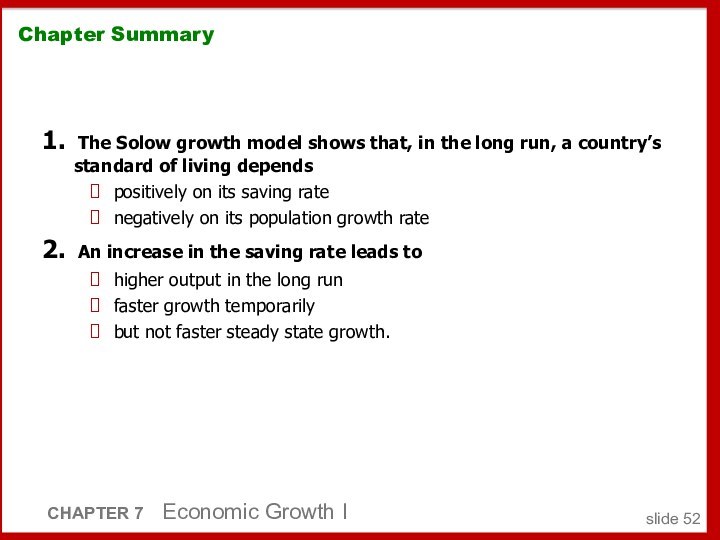

- 52. Chapter Summary1. The Solow growth model shows that,

- 53. Скачать презентацию

- 54. Похожие презентации

Слайд 4

The Solow growth model shows how

saving,

population

growth,

technological progress

Level & Growth of output

A

f f e c t Слайд 5 Income and poverty in the world selected countries,

2010

Indonesia

Uruguay

Poland

Senegal

Kyrgyz Republic

Nigeria

Zambia

Panama

Mexico

Georgia

Peru

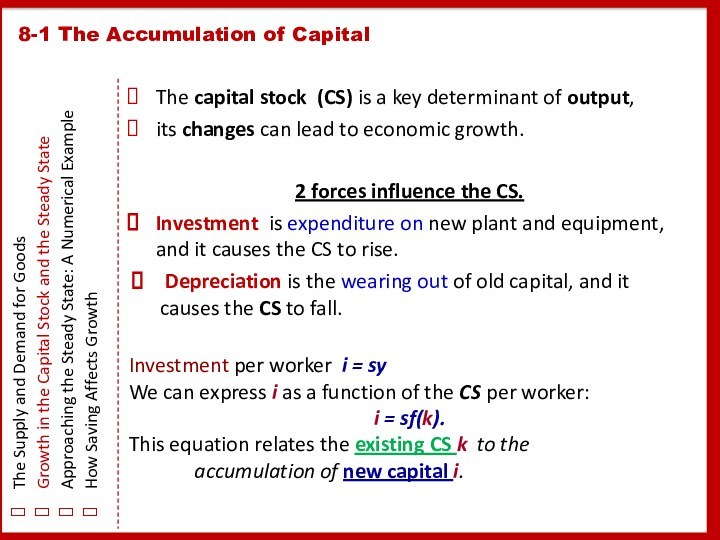

Слайд 6

8-1 The Accumulation of Capital

The Supply and Demand

for Goods

Growth in the Capital Stock and the Steady

StateApproaching the Steady State: A Numerical Example

How Saving Affects Growth

The Supply in the Solow model is based on the PF:

Y = F(K, L).

Assumption:

the PF has constant returns to scale:

zY = F(zK, zL), for any positive number z.

If z = 1/L →

Y/L = F(K/L, 1).

Слайд 7

y = Y/L is output per worker

k

= K/L is capital per worker

f(k) = F(k,

1)y = f(k)

MPK = f(k + 1) − f(k)

k is low →

the average worker has only a little capital →

an extra unit of capital is very useful and →

He produces a lot of additional output.

k is high →

the average worker has a lot of capital already, →

so an extra unit increases production only slightly.

8-1 The Accumulation of Capital

The Supply and Demand for Goods

Growth in the Capital Stock and the Steady State

Approaching the Steady State: A Numerical Example

How Saving Affects Growth

Y/L = F(K/L, 1)

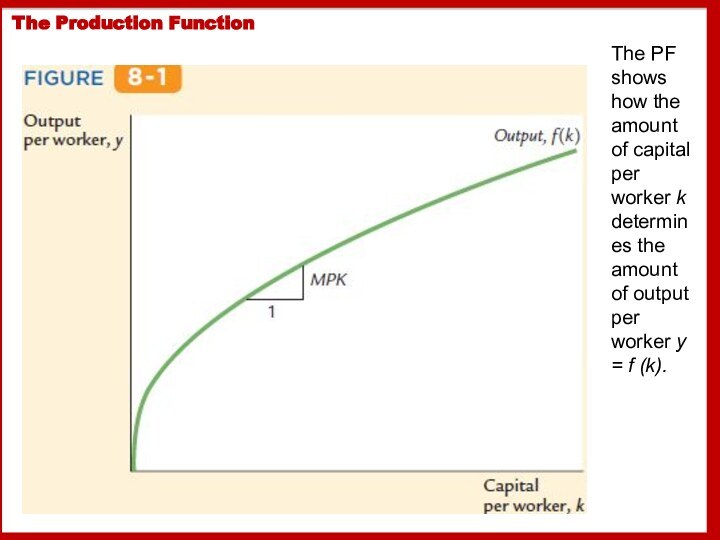

Слайд 8

The Production Function

The PF shows how the amount

of capital per worker k determines the amount of

output per worker y = f (k).

Слайд 9

8-1 The Accumulation of Capital

The Supply and Demand

for Goods

Growth in the Capital Stock and the Steady

StateApproaching the Steady State: A Numerical Example

How Saving Affects Growth

Output per worker y is divided between consumption per worker c and investment per worker i:

y = c + i.

G - we can ignore here and NX – we assumed a closed economy.

The Solow model assumes that people

save a fraction s of their income

consume a fraction (1 − s).

We can express this idea with the following CF:

c = (1 − s)y,

0 < s (the saving rate) < 1

Gnt. policies can influence a nation’s s

What s is desirable ?

Слайд 10

8-1 The Accumulation of Capital

The Supply and Demand

for Goods

Growth in the Capital Stock and the Steady

StateApproaching the Steady State: A Numerical Example

How Saving Affects Growth

Assamption:

We take the saving rate s as given.

To see what this CF implies for I,

we substitute (1 − s)y for c

in the national income accounts identity:

y = (1 − s)y + i =>

i = sy

s is the fraction of y devoted to i.

Слайд 11

8-1 The Accumulation of Capital

The Supply and Demand

for Goods

Growth in the Capital Stock and the Steady

StateApproaching the Steady State: A Numerical Example

How Saving Affects Growth

The 2 main ingredients of the Solow model—

the PF and the CF.

For any given capital stock k,

y = f(k)

determines how much Y the economy produces, and

s (i = sy)

determines the allocation of that Y between C & I.

Слайд 12

8-1 The Accumulation of Capital

The Supply and Demand

for Goods

Growth in the Capital Stock and the Steady

StateApproaching the Steady State: A Numerical Example

How Saving Affects Growth

The capital stock (CS) is a key determinant of output,

its changes can lead to economic growth.

2 forces influence the CS.

Investment is expenditure on new plant and equipment, and it causes the CS to rise.

Depreciation is the wearing out of old capital, and it causes the CS to fall.

Investment per worker i = sy

We can express i as a function of the CS per worker:

i = sf(k).

This equation relates the existing CS k to the

accumulation of new capital i.

Слайд 13

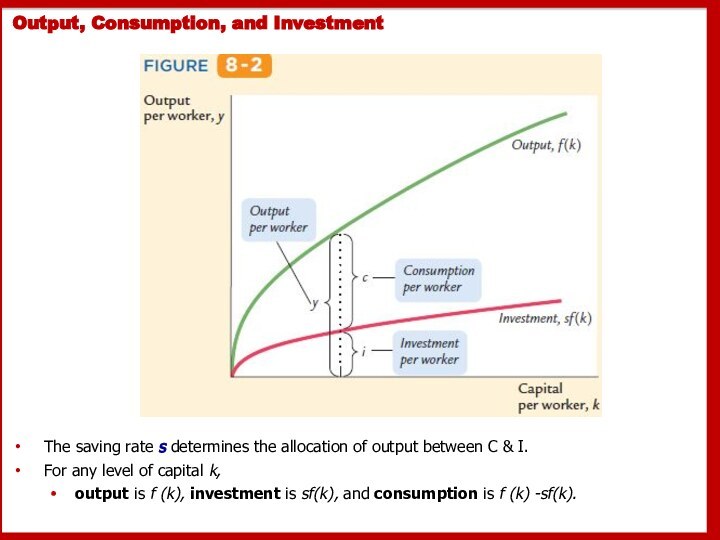

Output, Consumption, and Investment

The saving rate s determines

the allocation of output between C & I.

For

any level of capital k, output is f (k), investment is sf(k), and consumption is f (k) -sf(k).

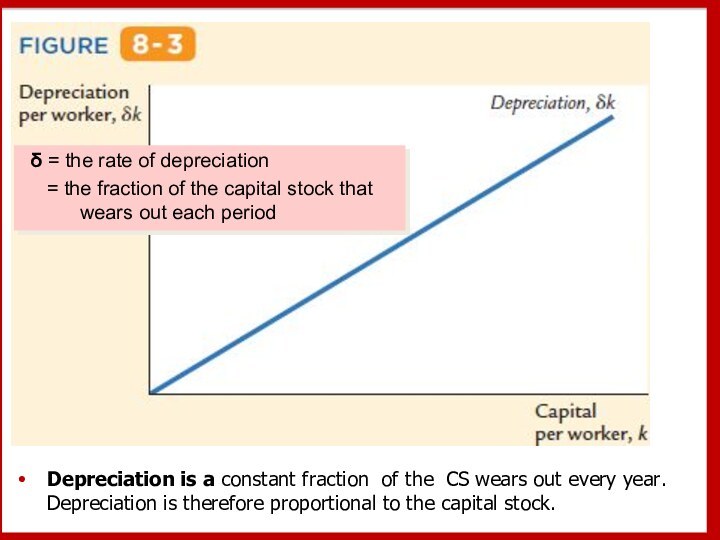

Слайд 14 Depreciation is a constant fraction of the CS

wears out every year. Depreciation is therefore proportional to

the capital stock.δ = the rate of depreciation

= the fraction of the capital stock that wears out each period

Слайд 15

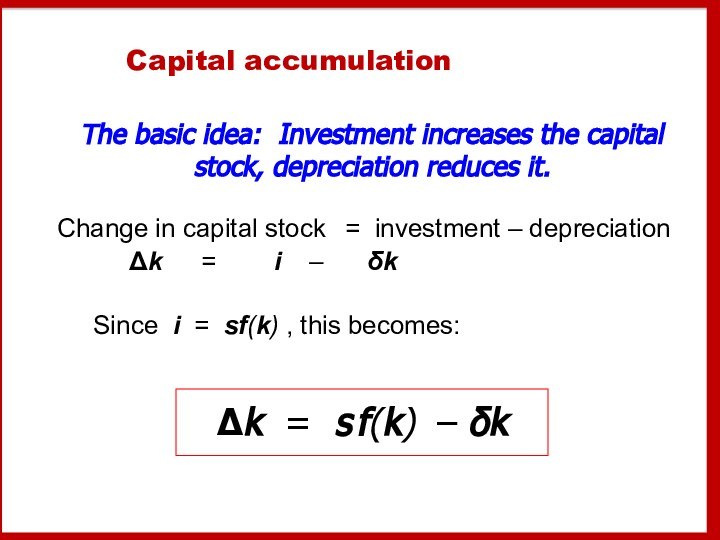

Capital accumulation

Change in capital stock = investment – depreciation

Δk

= i – δk

Since

i = sf(k) , this becomes:Δk = s f(k) – δk

The basic idea: Investment increases the capital stock, depreciation reduces it.

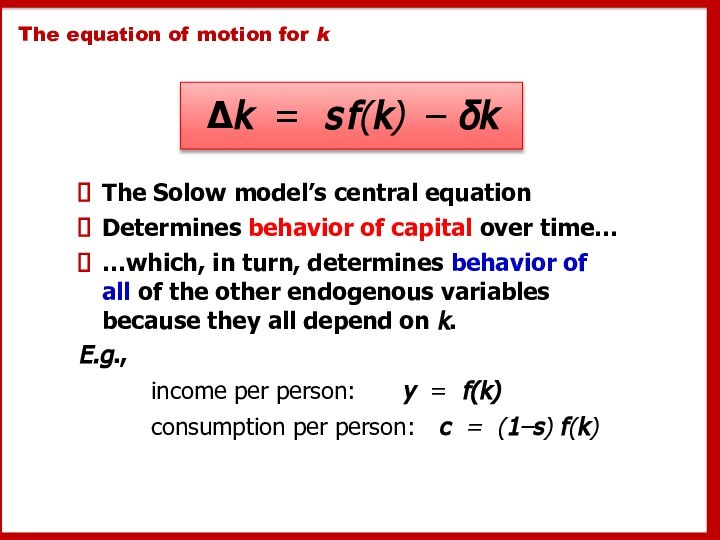

Слайд 16

The equation of motion for k

The Solow model’s

central equation

Determines behavior of capital over time…

…which, in turn,

determines behavior of

all of the other endogenous variables

because they all depend on k. E.g.,

income per person: y = f(k)

consumption per person: c = (1–s) f(k)

Δk = s f(k) – δk

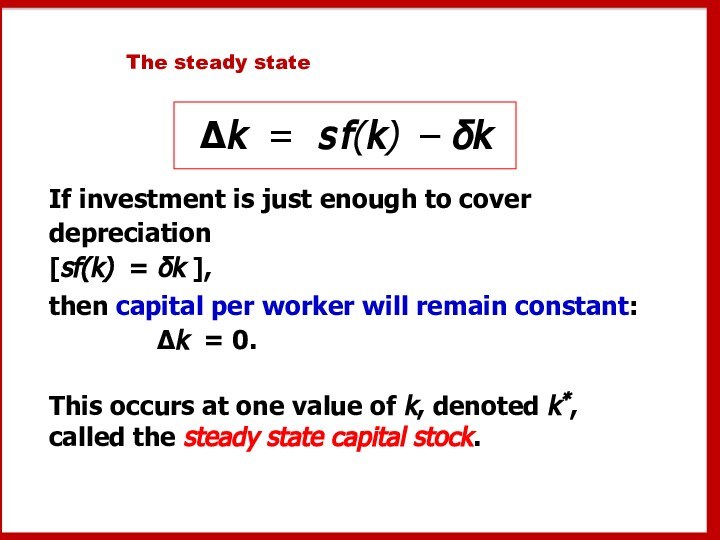

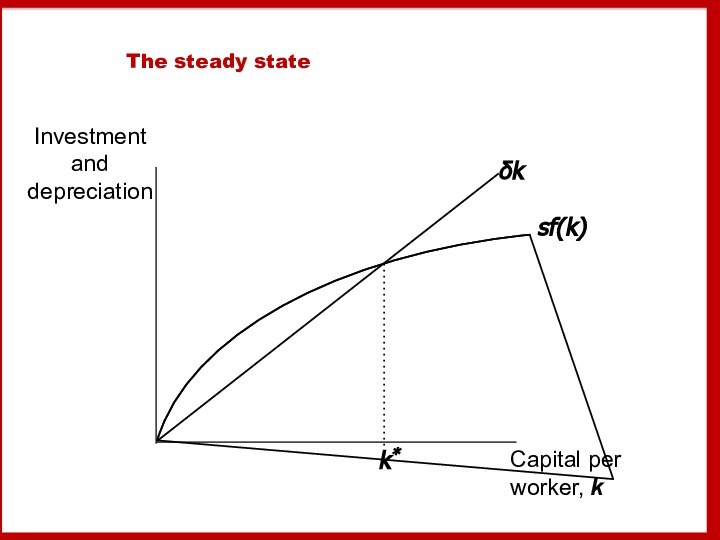

Слайд 17

The steady state

If investment is just enough to

cover depreciation

[sf(k) = δk ],

then capital per

worker will remain constant:

Δk = 0. This occurs at one value of k, denoted k*, called the steady state capital stock.

Δk = s f(k) – δk

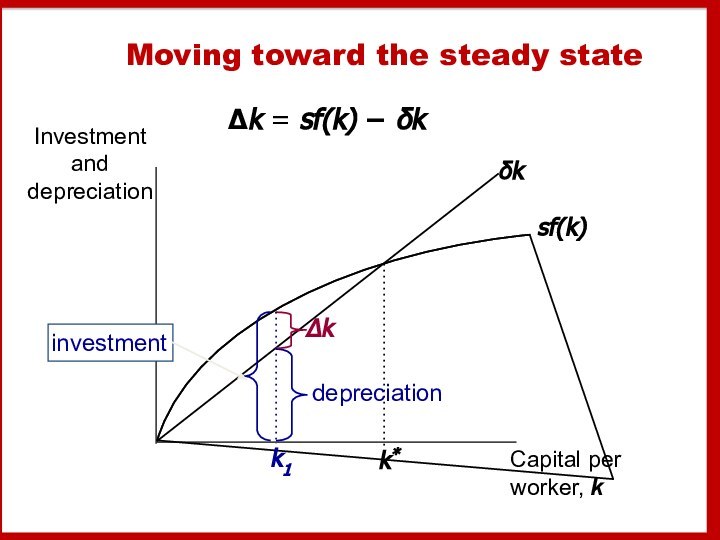

Слайд 25

Moving toward the steady state

Δk = sf(k) −

δk

k3

Summary:

As long as k < k*, investment will exceed

depreciation,

and k will continue to grow toward k*.

Слайд 26

Now you try:

Draw the Solow model diagram,

labeling

the steady state k*.

On the horizontal axis, pick

a value greater than k* for the economy’s initial capital stock. Label it k1. Show what happens to k over time. Does k move toward the steady state or away from it?

Слайд 27

A numerical example

Production function (aggregate):

To derive the per-worker

production function, divide through by L:

Then substitute y =

Y/L and k = K/L to get

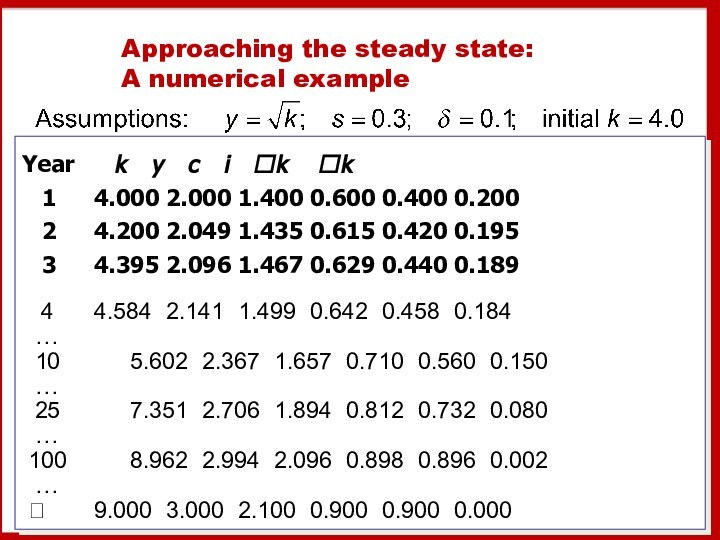

Слайд 29

Approaching the steady state:

A numerical example

Year

k y c i k

k1 4.000 2.000 1.400 0.600 0.400 0.200

2 4.200 2.049 1.435 0.615 0.420 0.195

3 4.395 2.096 1.467 0.629 0.440 0.189

4 4.584 2.141 1.499 0.642 0.458 0.184

…

10 5.602 2.367 1.657 0.710 0.560 0.150

…

25 7.351 2.706 1.894 0.812 0.732 0.080

…

100 8.962 2.994 2.096 0.898 0.896 0.002

…

9.000 3.000 2.100 0.900 0.900 0.000

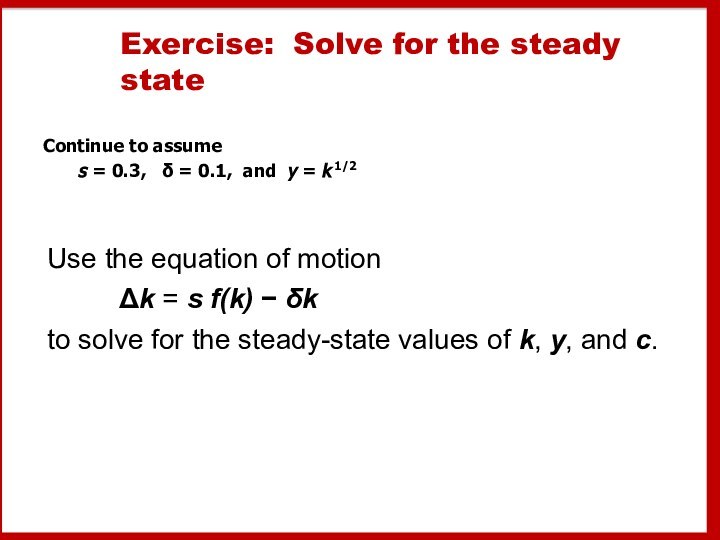

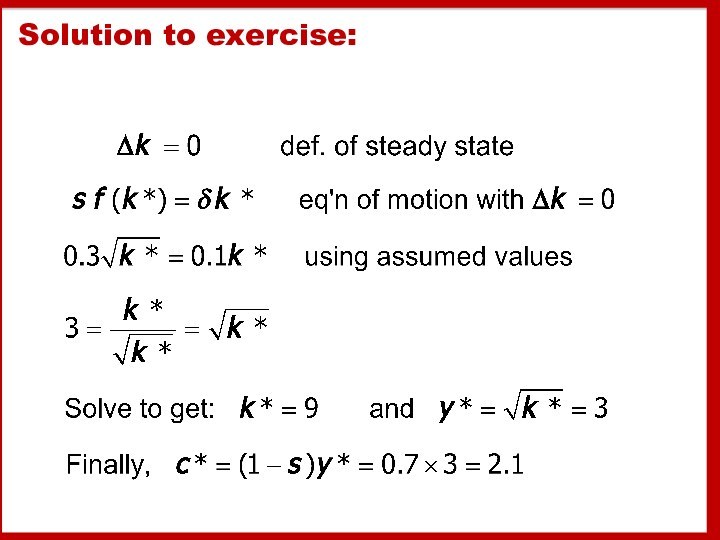

Слайд 30

Exercise: Solve for the steady state

Continue to assume

s = 0.3, δ = 0.1, and y

= k 1/2Use the equation of motion

Δk = s f(k) − δk

to solve for the steady-state values of k, y, and c.

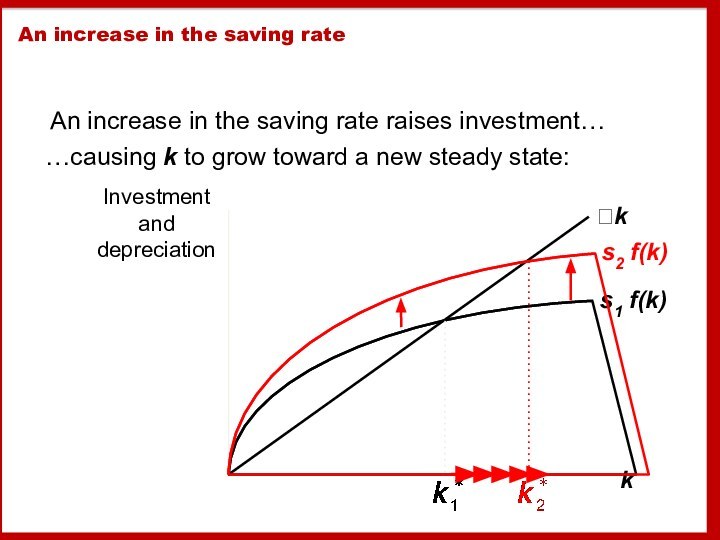

Слайд 32

An increase in the saving rate

An increase in

the saving rate raises investment…

…causing k to grow toward

a new steady state:

Слайд 33

Prediction:

Higher s ⇒ higher k*.

And since

y = f(k) , higher k* ⇒ higher y*

.Thus, the Solow model predicts that countries with higher rates of saving and investment will have higher levels of capital and income per worker in the long run.

Слайд 34 International evidence on investment rates and income per

person

100

1,000

10,000

100,000

0

5

10

15

20

25

30

35

Investment as percentage of output

(average 1960-2000)

Income per

person

in 2000

(log scale)

Слайд 35

The Golden Rule: Introduction

Different values of s lead

to different steady states. How do we know which

is the “best” steady state?The “best” steady state has the highest possible consumption per person: c* = (1–s) f(k*).

An increase in s

leads to higher k* and y*, which raises c*

reduces consumption’s share of income (1–s), which lowers c*.

So, how do we find the s and k* that maximize c*?

Слайд 36

The Golden Rule capital stock

the Golden Rule level

of capital, the steady state value of k that

maximizes consumption.To find it, first express c* in terms of k*:

c* = y* − i*

= f (k*) − i*

= f (k*) − δk*

In the steady state: i* = δk* because Δk = 0.

Слайд 37 Then, graph f(k*) and δk*, look for the

point where

the gap between them is biggest.

The

Golden Rule capital stock

Слайд 38

The Golden Rule capital stock

c* = f(k*) −

δk* is biggest where the slope of the production function

equals the slope of the depreciation line:steady-state capital per

worker, k*

MPK = δ

Слайд 39

The transition to the

Golden Rule steady state

The

economy does NOT have a tendency to move toward

the Golden Rule steady state.Achieving the Golden Rule requires that policymakers adjust s.

This adjustment leads to a new steady state with higher consumption.

But what happens to consumption during the transition to the Golden Rule?

Слайд 40

Starting with too much capital

then increasing c* requires

a fall in s.

In the transition to the

Golden Rule, consumption is higher at all points in time.t0

c

i

y

Слайд 41

Starting with too little capital

then increasing c* requires

an

increase in s.

Future generations

enjoy higher consumption,

but the current

one experiences

an initial drop

in consumption.time

t0

c

i

y

Слайд 42

Population growth

Assume that the population (and labor force)

grow at rate n. (n is exogenous.)

EX: Suppose

L = 1,000 in year 1 and the population is growing at 2% per year (n = 0.02). Then ΔL = n L = 0.02 × 1,000 = 20, so L = 1,020 in year 2.

Слайд 43

Break-even investment

(δ + n)k = break-even investment,

the

amount of investment necessary

to keep k constant.

Break-even

investment includes:δ k to replace capital as it wears out

n k to equip new workers with capital

(Otherwise, k would fall as the existing capital stock would be spread more thinly over a larger population of workers.)

Слайд 44

The equation of motion for k

With population growth,

the equation of motion for k is

Δk = s

f(k) − (δ + n) k

Слайд 46

The impact of population growth

Investment, break-even investment

Capital per

worker, k

(δ +n1) k

k1*

An increase in n

causes an increase in break-even investment,leading to a lower steady-state level of k.

Слайд 47

Prediction:

Higher n ⇒ lower k*.

And since

y = f(k) , lower k* ⇒ lower y*.

Thus, the Solow model predicts that countries with higher population growth rates will have lower levels of capital and income per worker in the long run.

Слайд 48 International evidence on population growth and income per

person

100

1,000

10,000

100,000

0

1

2

3

4

5

Population Growth

(percent per year; average 1960-2000)

Income

per Person

in 2000

(log scale)

Слайд 49

The Golden Rule with population growth

To find the

Golden Rule capital stock, express c* in terms of

k*:c* = y* − i*

= f (k* ) − (δ + n) k*

c* is maximized when MPK = δ + n

or equivalently, MPK − δ = n

In the Golden

Rule steady state,

the marginal product

of capital net of depreciation equals the population

growth rate.

Слайд 50

Alternative perspectives on population growth

The Malthusian Model (1798)

Predicts

population growth will outstrip the Earth’s ability to produce

food, leading to the impoverishment of humanity.Since Malthus, world population has increased sixfold, yet living standards are higher than ever.

Malthus omitted the effects of technological progress.

Слайд 51

Alternative perspectives on population growth

The Kremerian Model (1993)

Posits

that population growth contributes to economic growth.

More people

= more geniuses, scientists & engineers, so faster technological progress.Evidence, from very long historical periods:

As world pop. growth rate increased, so did rate of growth in living standards

Historically, regions with larger populations have enjoyed faster growth.

Слайд 52

Chapter Summary

1. The Solow growth model shows that, in

the long run, a country’s standard of living depends

positively

on its saving ratenegatively on its population growth rate

2. An increase in the saving rate leads to

higher output in the long run

faster growth temporarily

but not faster steady state growth.

CHAPTER 7 Economic Growth I

slide