Слайд 2

Schedule:

Money Laundering Defined

Effective Due Diligence – Know

your Client

Trusts – Foundations - Complex Structures

Politically Exposed Persons

- Private Banking

ML in Real Estate – Trade Based ML

Professional Intermediaries – Business Associates

Sanctions Compliance

Terrorist Financing

Effective Transaction Monitoring

Customer Review Process

Suspicious Activity Reports

Closing Remarks – Conclusion

Слайд 3

Money Laundering Defined

When committed intentionally, Money Laundering, is

defined as:

the conversion or transfer of property, knowing that

such property is derived from criminal activity or from an act of participation in such activity, for the purpose of concealing or disguising the illicit origin of the property or of assisting any person who is involved in the commission of such an activity to evade the legal consequences of that person's action;

the concealment or disguise of the true nature, source, location, disposition, movement, rights with respect to, or ownership of, property, knowing that such property is derived from criminal activity or from an act of participation in such an activity;

the acquisition, possession or use of property, knowing, at the time of receipt, that such property was derived from criminal activity or from an act of participation in such an activity;

participation in, association to commit, attempts to commit and aiding, abetting, facilitating and counselling the commission of any of the actions referred to in points (a), (b) and (c).

(4th EU AML Directive)

Слайд 4

The stages of Money Laundering explained

Layering

Integration

Слайд 5

The stages of Money Laundering explained

Placement is the

introduction of unlawful proceeds into the financial system. Structuring,

which is considered a type of placement activity, is any attempt to evade legal reporting requirements for cash/currency transactions conducted with a financial institution. Examples of structuring may include, but are not limited to:

Cashing checks for amounts just below reporting or recordkeeping thresholds.

Dividing large amounts of cash/currency into smaller sums that fall below reporting or recordkeeping thresholds (smurfing) and then depositing the funds directly into a bank account on one or more days, in any manner.

Слайд 6

The stages of Money Laundering explained

Layering involves moving

funds around in the financial system in order to

conceal the origin of the funds. Examples include, but are not limited to:

Exchanging monetary instruments for larger or smaller amounts.

Wiring or transferring funds.

Buying or selling securities through numerous accounts.

Obtaining a loan in one or more financial institutions.

Integration is the ultimate goal of the money laundering process. In this stage, the illicit funds may appear legitimate and are often used to purchase other assets, for example:

Real estate or other assets

Securities investments

Cash Intensive Businesses

Слайд 8

BOC Risk Appetite Statement Policy

The Bank of

Cyprus´ (“BOC” or “the Bank”) Risk Appetite Statement makes

reference to “Compliance Risk” and states that:

“the Bank maintains a zero tolerance for regulatory / compliance risk. It aims to comply with all regulatory requirements and thus avoid all penalties. The Bank must ensure that it adopts all regulatory, legal and compliance requirements in a proportionate way that satisfies the requirements of the regimes in a pragmatic, cost effective fashion. The on-going cost of compliance is a cost of doing business and should not be material in terms of annual income.”

Going a step further, the Board’s risk appetite with respect to ML/TF risk is as follows:

“the Bank maintains a zero tolerance for ML/TF risk. The Bank is obliged to transact its business so as to ensure it minimizes the risk of its systems and processes, and those of its affiliates, being used for ML or TF purposes. BOC adopts risk appetite and practices which place it at the “best practice” end of international standards, in relation to preventing Money Laundering and Terrorism Financing abuses.”

Слайд 9

It all comes down to: KNOW YOUR CLIENT

Know

your client (KYC) is the process of an institution verifying

the identity of its clients. It is important to help prevent identity theft, financial fraud, money laundering and terrorist financing. The objective of KYC is to enable banks and other institutions to know and understand their customers better and help them manage their risks prudently.

*Side effect: It is also great for identifying business development opportunities!*

Слайд 10

KNOW YOUR CLIENT – the client profile

Customer

Due Diligence(CDD) – one of the measures to prevent

money laundering and terrorist financing, by ensuring that we understand who the customer really is and what the expected relationship with them will be. (part of FATF 40 Recommendations).

A complete client profile contains detailed information about:

The customer (KYC)

The customer’s business (KYCB)

The customer’s clients / counterparties (KYCC)

Due diligence must be performed to the organization's satisfaction before engaging in a new client relationship and reviewed/updated periodically in accordance with the risk profile of the client

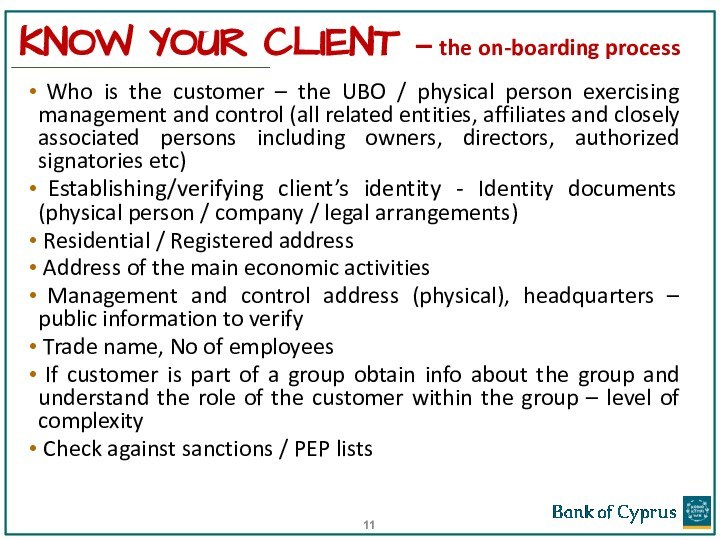

Слайд 11

Who is the customer – the UBO

/ physical person exercising management and control (all related

entities, affiliates and closely associated persons including owners, directors, authorized signatories etc)

Establishing/verifying client’s identity - Identity documents (physical person / company / legal arrangements)

Residential / Registered address

Address of the main economic activities

Management and control address (physical), headquarters – public information to verify

Trade name, No of employees

If customer is part of a group obtain info about the group and understand the role of the customer within the group – level of complexity

Check against sanctions / PEP lists

KNOW YOUR CLIENT – the on-boarding process

Слайд 12

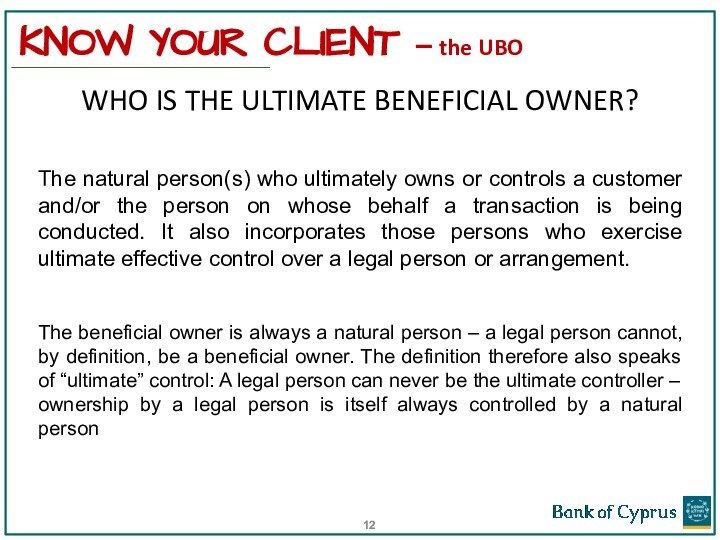

WHO IS THE ULTIMATE BENEFICIAL OWNER?

The natural person(s)

who ultimately owns or controls a customer and/or the

person on whose behalf a transaction is being conducted. It also incorporates those persons who exercise ultimate effective control over a legal person or arrangement.

The beneficial owner is always a natural person – a legal person cannot, by definition, be a beneficial owner. The definition therefore also speaks of “ultimate” control: A legal person can never be the ultimate controller – ownership by a legal person is itself always controlled by a natural person

KNOW YOUR CLIENT – the UBO

Слайд 13

Client take-on – On-boarding

Good practice examples

Files

contain a customer overview

Establishing and documenting PEP and other

HRCs’ source of wealth.

Understanding/documenting complex ownership structures and the reasons for them.

Face-to-face meetings and discussions with high-risk and PEP prospects before accepting them as a customer.

Making clear judgments on money-laundering risk which are not compromised by the potential profitability of new or existing relationships.

Documenting who the counterparties are by establishing that they are in the same line of business

Ensure declared turnover makes sense (Financial Statements, expected contracts etc.)

Poor practice examples

Failing to consider certain political connections which fall outside the definition of a PEP (e.g. wider family) which might mean that certain customers still need to be treated as HRC and subject to EDD

Failing to record adequately face-to-face meetings that form part of CDD.

Failing to carry out EDD for high-risk/PEP customers.

Failing to conduct adequate CDD before customer relationships are approved.

Over-reliance on undocumented ‘staff knowledge’ during the CDD process.

SOURCE: UK FSA MGT OF HIGH ML RISK SITUATIONS, BOC

Слайд 14

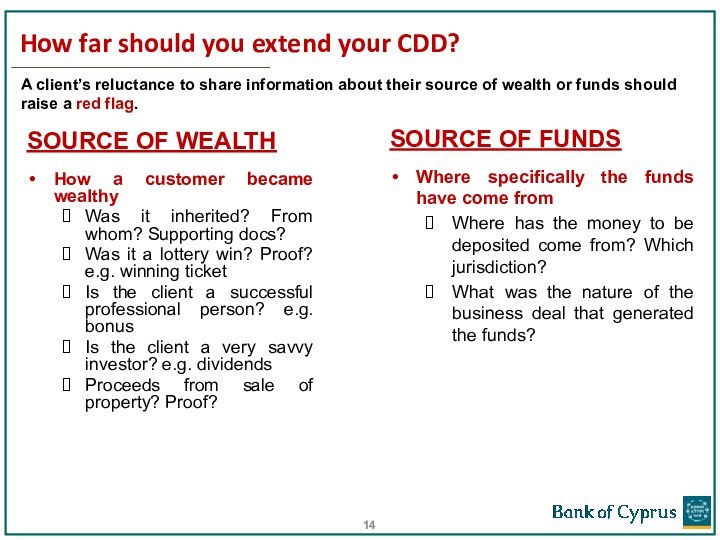

How far should you extend your CDD?

SOURCE

OF WEALTH

How a customer became wealthy

Was it

inherited? From whom? Supporting docs?

Was it a lottery win? Proof? e.g. winning ticket

Is the client a successful professional person? e.g. bonus

Is the client a very savvy investor? e.g. dividends

Proceeds from sale of property? Proof?

SOURCE OF FUNDS

Where specifically the funds have come from

Where has the money to be deposited come from? Which jurisdiction?

What was the nature of the business deal that generated the funds?

A client’s reluctance to share information about their source of wealth or funds should raise a red flag.

Слайд 15

Source of Wealth:

Generic source of wealth descriptions are

not acceptable e.g. “savings”, “from family”, “from work”, “lottery”,

“profits from investments”, “inheritance”, “business dealing”, “sale of business” or “funds held in Banks” etc. This information is, on its own, considered insufficient as a proof of the legitimacy of wealth.

Are you convinced that the funds and wealth can be reasonably established to be legitimate?

Can you independently obtain the evidence of the client’s source of wealth for higher-risk accounts and relationships?

Are you able to establish or verify the relationship between the client and the third party where accounts are funded by a third party? (restricted to the absolute minimum)

Do you go all the way in seeking clarity wherever the circumstances are unclear or account structures are complex?

Слайд 16

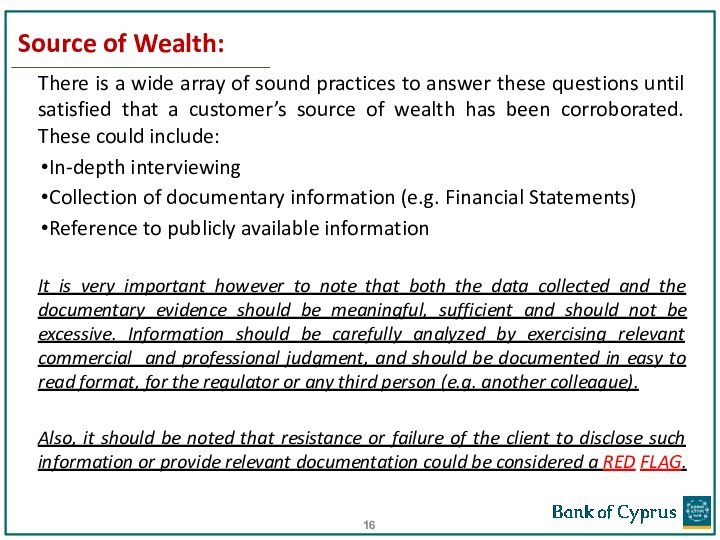

Source of Wealth:

There is a wide array of

sound practices to answer these questions until satisfied that

a customer’s source of wealth has been corroborated. These could include:

In-depth interviewing

Collection of documentary information (e.g. Financial Statements)

Reference to publicly available information

It is very important however to note that both the data collected and the documentary evidence should be meaningful, sufficient and should not be excessive. Information should be carefully analyzed by exercising relevant commercial and professional judgment, and should be documented in easy to read format, for the regulator or any third person (e.g. another colleague).

Also, it should be noted that resistance or failure of the client to disclose such information or provide relevant documentation could be considered a RED FLAG.

Слайд 17

Enhanced Due Diligence (EDD)

EDD: A greater level

of CDD undertaken for high risk entities. It typically

involves independent verification of information e.g. obtaining audited company accounts

Indicators for EDD:

High / Significant risk clients (ie PEPs, Private Banking clients)

High / Significant risk activities (ie oil trading, online services)

High risk transactions (ie non intra group lending)

Слайд 18

Enhanced Due Diligence (EDD)

Before a client is

opened in the system check:

Legal & commercial reason for

the existence of a complex structure

Verification of a client's ID (obtain copies)

Economic profile

World check etc

Counterparties (are they in the same line of business?)

Declared Turnover

The above need to be updated at regular intervals.

For all credit transactions check the source and origin of funds.

Слайд 19

Customer Profile - Enhanced CDD measures -

examples

Obtaining additional information on the customer (e.g. occupation, volume

of assets, information available through public databases, internet, etc.), and updating more regularly the identification data of customer and beneficial owner.

Obtaining additional information on the intended nature of the business relationship.

Obtaining information on the reasons for intended or performed transactions.

Obtaining the approval of senior management to commence or continue the business relationship.

Conducting enhanced monitoring of the business relationship, by increasing the number and timing of controls applied, and selecting patterns of transactions that need further examination.

Requiring the first payment to be carried out through an account in the customer’s name with a bank subject to similar CDD standards.

Obtaining information on the source of funds or source of wealth of the customer.

Obtaining information on the customers counterparties.

Слайд 20

Politically Exposed Persons (PEPs)

FATF Definition

PEPs are

individuals who are or have been entrusted with prominent

public functions by a foreign country, for example Heads of State or of government, senior politicians, senior government, judicial or military officials, senior executives of state owned corporations, important political party officials. The definition of PEPs is not intended to cover middle ranking or more junior individuals in the foregoing categories.

Family members are individuals who are related to a PEP either directly (consanguinity) or through marriage or similar (civil) forms of partnership.

Close associates are individuals who are closely connected to a PEP, either socially or professionally.

4MLD

In one of the situations where enhanced due diligence should always be conducted, namely for politically exposed persons, the Directive has been strengthened to include politically exposed persons who are entrusted with prominent public functions domestically, as well as those who work for international organizations.

Слайд 21

Identifying PEPs

(i) Natural persons who have, or

had a prominent public function in the Republic or

in a foreign country:

1. heads of State, heads of Governments, ministers and deputy or assistant ministers;

2. members of parliaments;

3. members of supreme courts, of constitutional courts or of other high-level judicial bodies whose decisions are not subject to further appeal, except in exceptional circumstances;

4. members of courts of auditors or of the boards of central banks;

5. ambassadors, chargés d'affaires and high-ranking officers in the armed forces;

6. members of the administrative, management or supervisory bodies of State-owned enterprises.

None of the categories set out above shall be understood as covering middle ranking or more junior officials

Слайд 22

Identifying PEPs (cont’d)

(ii) “Immediate family members” of

PEPs include the following persons:

1. the spouse;

2.

any partner considered by national law as equivalent to the spouse;

3. the children and their spouses or partners;

4. the parents.

(iii) Persons known to be “close associates” of a PEP include the following:

1. any natural person who is known to have joint beneficial ownership of legal entities or legal arrangements, or any other close business relations with a person referred to in subparagraph (i) above or who is known to be connected with that person in any other close business relationship.

2. any natural person who has sole beneficial ownership of a legal entity (e.g. a company) or legal arrangement (e.g. a trust) which is known to have been set up de facto for the benefit of the person referred to in subparagraph (i) above.

? In case of companies, we should check whether the BNOs, directors, authorised signatories are PEPs.

? Where a person has ceased to be entrusted with a prominent public function for a period of at least one year, credit institutions shall not be obliged to consider such a person as politically exposed

Слайд 23

PEPs

Informal, undocumented processes for identifying, classifying and

declassifying customers as PEPs.

People cease to be PEPs

once they are no longer influential. Any decision to declassify a PEP should be made carefully and supported with ample evidence to prove the case. MLCO approval is required to declassify customers as PEPs

Failing to give due consideration to certain political connections which fall outside the Money Laundering Regulations definition of a PEP (e.g. wider family) which might mean that certain customers still need to be treated as high risk and subject to enhanced due diligence.

The PEP definition extends to family members who are either blood relatives or connected via civil partnerships. Nonetheless, this should not rule out EDD on a family member who is not a blood relative or civil partner, for example, yet still exerts an influence on the PEP. Any indicators of suspicion should immediately raise alarm bells and trigger further investigations. Although someone may not meet the legal definition of a PEP, they could still pose a high ML/TF risk.

Source: FSA 2011 report

Слайд 24

Definition of Private Banking client for AML purposes

Private Banking clients are considered to be high risk

for AML purposes.

BOC interpretation: a Private Banking client is one that keeps an investment portfolio equal to or greater than EUR200k.

Factors that may contribute to the vulnerabilities of PB as regards ML

Powerful clientele

• The high level of confidentiality associated with private banking

• The close relationship of trust developed between relationship managers and their clients,

• A culture of secrecy and discretion developed by the relationship managers for their clients, and

• The relationship managers becoming client advocates to protect their clients.

Слайд 25

Legal Structures and Corporate Vehicles

There are numerous types

of entities, which

Legally make businesses

Own assets

Sue

Open accounts at

Financial Institutions

Are used as part of Legal Structures

The main are:

Corporations

Partnerships

Trusts Corporate

Foundations / Private Foundations Vehicles

Слайд 26

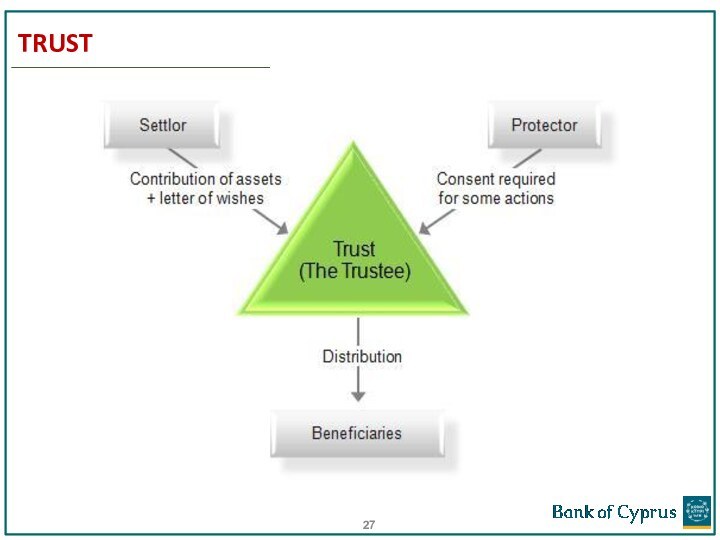

TRUST

A trust is an arrangement where a person

(the settlor) gives money or property to another person

(the trustee), to be held in trust for the benefit of either the trust’s beneficiaries or a purpose recognized by law.

A trust has no “legal personality”, it is not a legal entity.

The Trustee is given legal title to the trust property, but is obligated to act for the good of the beneficiaries.

Trust property can include money, investments, land, buildings, paintings, furniture, jeweler, boats, aircraft, even fine wines.

Слайд 28

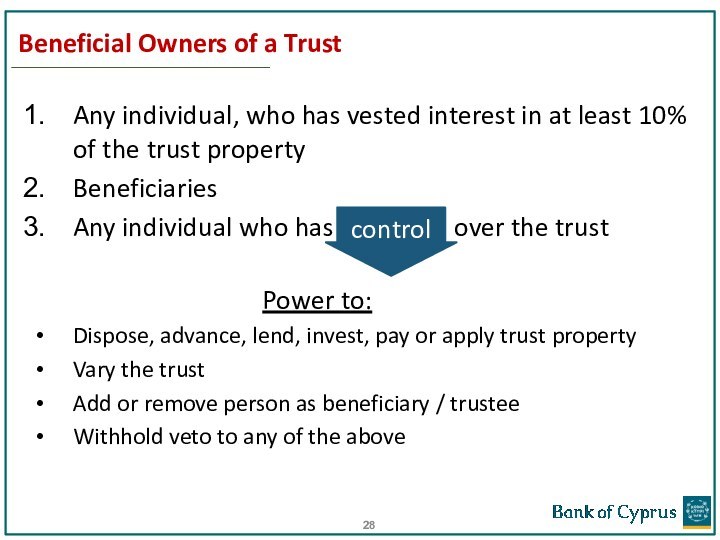

Beneficial Owners of a Trust

Any individual, who has

vested interest in at least 10% of the trust

property

Beneficiaries

Any individual who has over the trust

Power to:

Dispose, advance, lend, invest, pay or apply trust property

Vary the trust

Add or remove person as beneficiary / trustee

Withhold veto to any of the above

control

Слайд 29

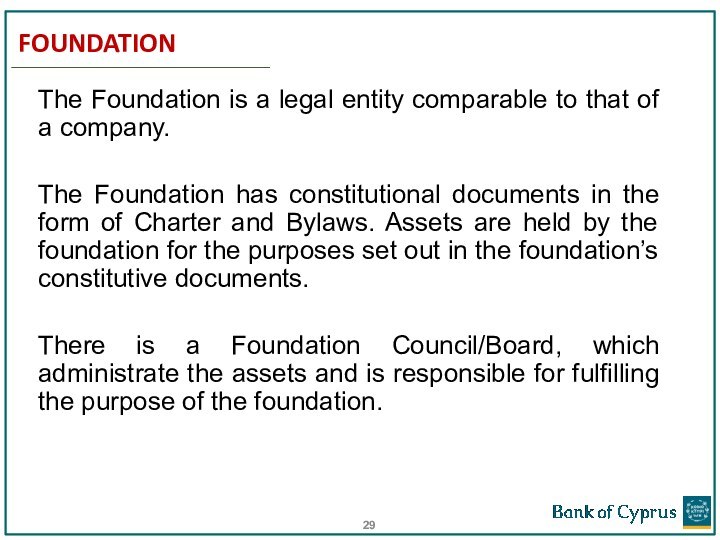

FOUNDATION

The Foundation is a legal entity comparable to

that of a company.

The Foundation has constitutional documents in

the form of Charter and Bylaws. Assets are held by the foundation for the purposes set out in the foundation’s constitutive documents.

There is a Foundation Council/Board, which administrate the assets and is responsible for fulfilling the purpose of the foundation.

Слайд 31

Beneficial Owners of Private Foundations

Where the individuals that

benefit, have been determined:

Anyone who benefits from at least

10%

Where the individuals that benefit, have yet to be determined:

The class of persons in whose main interest the foundation is set up or operates.

An individual who controls at least 10% of the foundation’s property.

Слайд 32

RISKS OF TRUSTS, FOUNDATIONS

Defraud authorities, creditors, commercial disputes

Tax

evasion vehicle (declaring as charitable)

Service providers with no effective

AML procedures

Dummy Settlor (conceal Identity of the actual Settlor)

PEPs (Settlors, beneficiaries)

Beneficiaries who are HR charities

Assets derived from cash based businesses or connected to gambling, armaments, MSB

Settlors / beneficiaries based or conducting business in or through HR countries (AML, sanctions, embargoes...)

Слайд 33

RED FLAGS:

Unexplained relationship between settlor, beneficiaries, controllers,

property and 3rd parties

Change of beneficiaries without notifying

bank

Large payments (for unspecified services) to consultants, related parties, employees, etc

Addition of beneficiary (especially after the death of settlor)

Level of assets / value of transactions inconsistent with the profile of the client

Transactions with no link between stated activity and recipient

Frequent cash deposits/withdrawals by unrelated individuals

Distribution to PEPs, HR Charities or unregulated organisations

Слайд 34

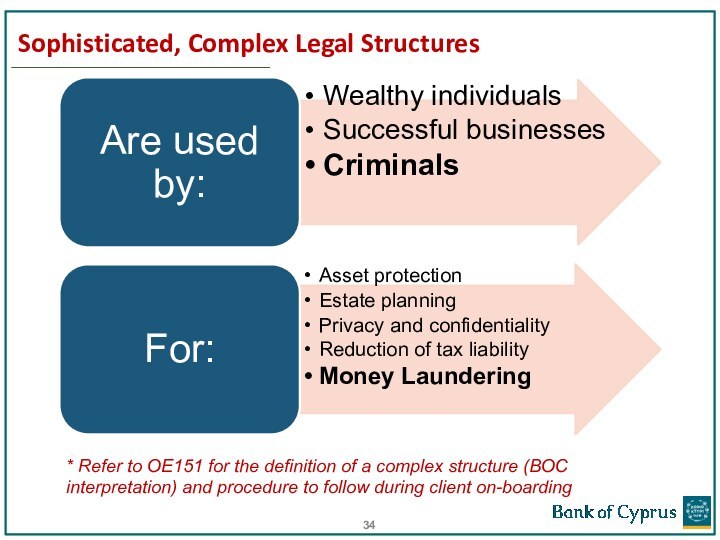

Sophisticated, Complex Legal Structures

* Refer to OE151 for

the definition of a complex structure (BOC interpretation) and

procedure to follow during client on-boarding

Слайд 35

Why are legal structures complicated?

Multiple layers of ownership

with one or more entities (in each layer) some

of them may be different in type incorporated in different jurisdictions and may include trust or PIF.

Existence of services of “nominee shareholders” and “nominee directors”.

Opportunity to launder money, or to move funds to finance terrorism or criminal organizations in complete anonymity

Слайд 36

Why are legal structures complicated and Risky?

Слайд 37

Money laundering through Real Estate sector

Classic method of

laundering dirty money, particularly in countries with political, economic

and monetary stability.

Significant regulatory weaknesses:

Brokers/Agents do not perform DD over buyers

No reporting requirements (brokers/Lawyers)

Foreign company can buy property in any country, without having an in-country presence

Main Reason

Слайд 38

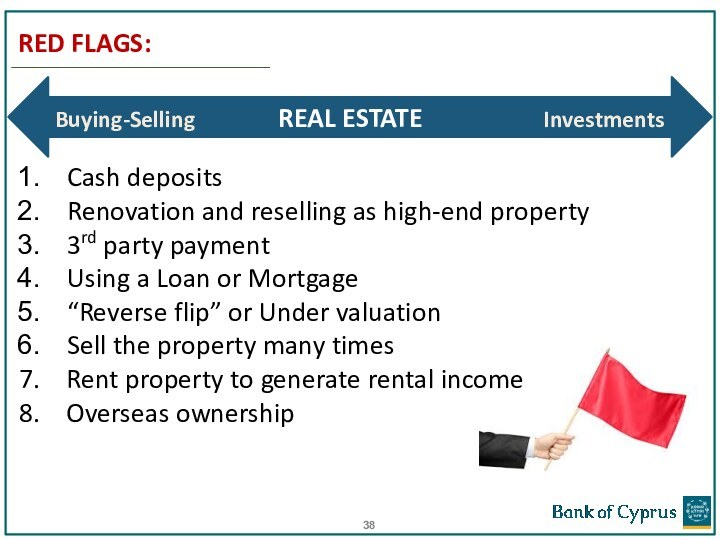

RED FLAGS:

Cash deposits

Renovation and reselling as high-end property

3rd

party payment

Using a Loan or Mortgage

“Reverse flip” or

Under valuation

Sell the property many times

Rent property to generate rental income

Overseas ownership

Buying-Selling REAL ESTATE Investments

Слайд 39

Trade-Based Money laundering

One of the most sophisticated

methods of

cleaning dirty money

Among the hardest to detect

Methods:

Payments to a vendor by unrelated 3rd parties

Repeated import-export

of the same HV commodity

Falsifying documents

Misrepresenting financial transactions

Double invoicing

Commodity over or under valuation

Important: almost 80% of TBML is done through normal current accounts, without the use of LCs, bills of exchange etc. Accordingly, IBU staff should be cautious and aware.

Слайд 40

RED FLAGS:

Significant discrepancies ? bill of lading-invoice (authenticity)

Significant

discrepancies ? value on invoice-market

Type of commodity shipped VS

business activity

Size of shipment Vs regular business transactions

Goods shipped through jurisdictions and unconnected subsidiaries for no apparent reason

Packaging inconsistent with the commodity shipping method

Unusual shipping routes or transhipment

points

Слайд 41

Reliance on third parties for customer identification and

due diligence purposes - Introduction

Article 67 of the

Law permits persons carrying out financial or other business activities to rely on third parties for the implementation of customer identification and due diligence procedures.

The Law (article 67) explicitly provides that the ultimate responsibility for performing the above mentioned measures and procedures remains with the credit institutions or the person who carries out the financial or other business activities which relies on the third person. Consequently, the responsibility to apply customer identification and due diligence procedures cannot be delegated to the third person.

Слайд 42

Definition of ‘third party’

A credit or financial

institution or auditors or accountants or tax consultants or

independent legal professionals or persons providing to third parties trust and company services, governed by the European Union Directive and situated in the European Economic Area or third equivalent country, and who:

(i) are subject to mandatory professional registration by law

and

(ii) are subject to supervision with regard to their compliance with the requirements of the European Union Directive.

It should be noted that the term “financial institutions” does not include dealers in foreign exchange.

Слайд 43

Business Associates

Independent Professionals, natural or legal

persons, who recommend customers to open accounts with the

Bank. Responsibility for the customer identification process and the due diligence procedures remains with the Bank, in accordance with the procedures that are recorded in the relevant circulars.

The Business Associates are approved by the Manager International Business Network or the Manager International Banking & Wealth Management Services or the Director International Banking & Wealth Management Services.

Witnessing Agreement needs to be signed by each individual person in the Associates’ office who will have the authority to witness customers signatures on all Banking documents.

Слайд 44

Definition of Terrorist Financing

By any means, directly or

indirectly,

Unlawfully and willfully, provides or collects funds with the

intention that they should be used or in the knowledge that they are to be used in

Any other act intended to cause death or serious bodily injury to a civilian, or to any other person not taking an active part in the hostilities in a situation of armed conflict

When the purpose of such act, by its nature or context, is to intimidate a population, or to compel a government or an international organization to do or to abstain from doing any act.

(United Nations 1999 International Convention for the Suppression of the Financing of Terrorism)

Слайд 45

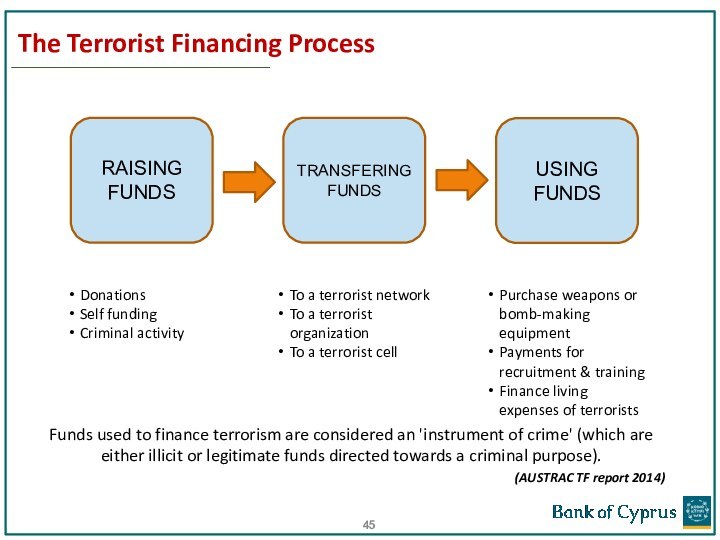

The Terrorist Financing Process

Funds used to finance terrorism

are considered an 'instrument of crime' (which are either

illicit or legitimate funds directed towards a criminal purpose).

(AUSTRAC TF report 2014)

RAISING FUNDS

TRANSFERING FUNDS

USING FUNDS

Donations

Self funding

Criminal activity

To a terrorist network

To a terrorist organization

To a terrorist cell

Purchase weapons or bomb-making equipment

Payments for recruitment & training

Finance living expenses of terrorists

Слайд 47

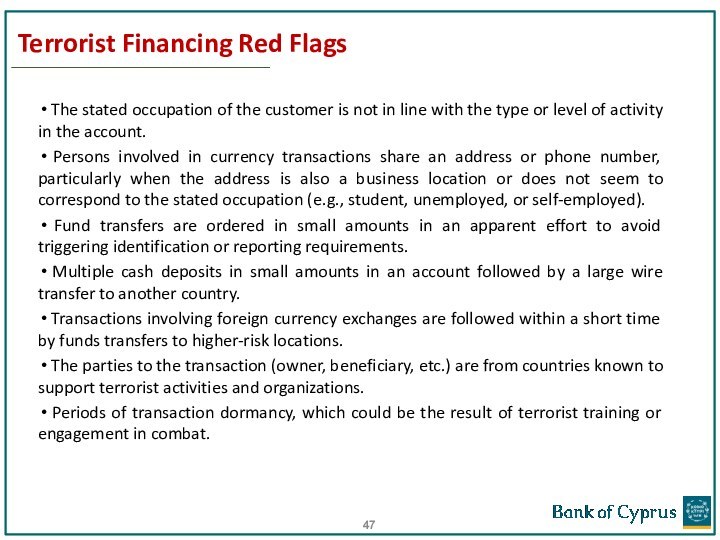

Terrorist Financing Red Flags

The stated occupation of

the customer is not in line with the type

or level of activity in the account.

Persons involved in currency transactions share an address or phone number, particularly when the address is also a business location or does not seem to correspond to the stated occupation (e.g., student, unemployed, or self-employed).

Fund transfers are ordered in small amounts in an apparent effort to avoid triggering identification or reporting requirements.

Multiple cash deposits in small amounts in an account followed by a large wire transfer to another country.

Transactions involving foreign currency exchanges are followed within a short time by funds transfers to higher-risk locations.

The parties to the transaction (owner, beneficiary, etc.) are from countries known to support terrorist activities and organizations.

Periods of transaction dormancy, which could be the result of terrorist training or engagement in combat.

Слайд 48

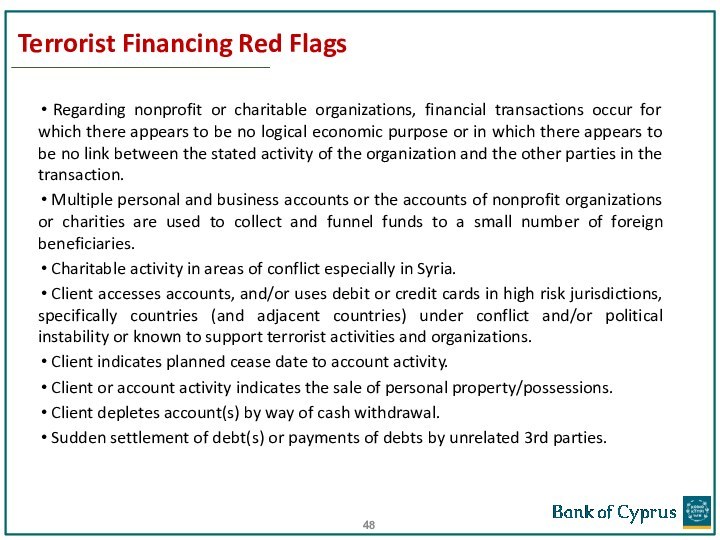

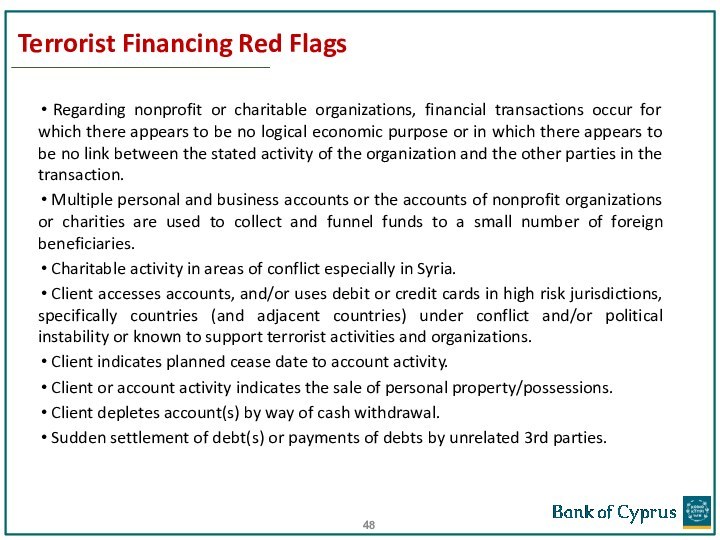

Terrorist Financing Red Flags

Regarding nonprofit or charitable

organizations, financial transactions occur for which there appears to

be no logical economic purpose or in which there appears to be no link between the stated activity of the organization and the other parties in the transaction.

Multiple personal and business accounts or the accounts of nonprofit organizations or charities are used to collect and funnel funds to a small number of foreign beneficiaries.

Charitable activity in areas of conflict especially in Syria.

Client accesses accounts, and/or uses debit or credit cards in high risk jurisdictions, specifically countries (and adjacent countries) under conflict and/or political instability or known to support terrorist activities and organizations.

Client indicates planned cease date to account activity.

Client or account activity indicates the sale of personal property/possessions.

Client depletes account(s) by way of cash withdrawal.

Sudden settlement of debt(s) or payments of debts by unrelated 3rd parties.

Слайд 49

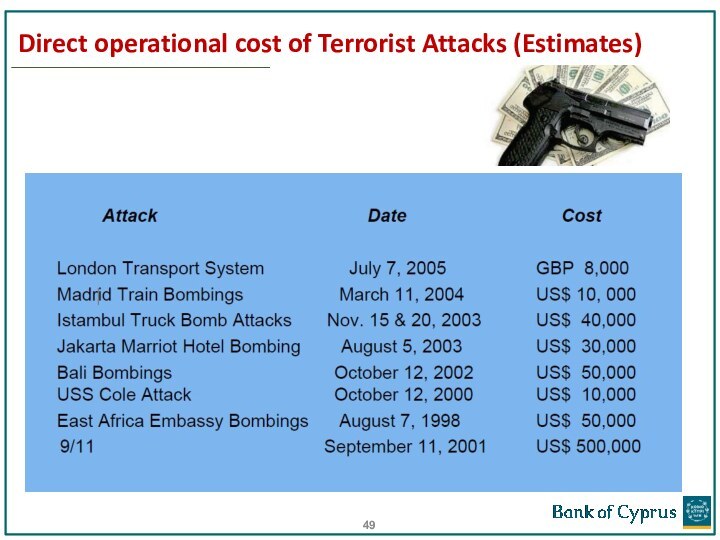

Direct operational cost of Terrorist Attacks (Estimates)

Слайд 50

Real – Life Case: The 9/11 Terrorist Attacks

Funding

for the 9/11 terrorist attacks has been estimated at

a total cost of somewhere between $400,000 and $500,000. The 24 accounts of the 19 hijackers carried average balances of only $3,000 to $5,000. The wires in and out of the accounts and the other activity was relatively modest and not suspicious.

However, the accounts were opened with visas from foreign countries; the account holders were not permanent residents; many accounts had the same address and phone number; most addresses used were not permanent addresses, but mail boxes, and were changed frequently; there were frequent international wires in and out of the accounts; there were numerous balance inquiries; there were immediate withdrawals after deposits were made; and ATMs were frequently used, and often by individuals who did not own the accounts.

Слайд 51

What are Sanctions?

Sanctions are

unilateral or multilateral

economic

actions

taken against a target

to influence their actions.

Four

primary things sanctions prohibit of restrict: - Diplomatic

- Financial

- Trade

- Travel

Слайд 52

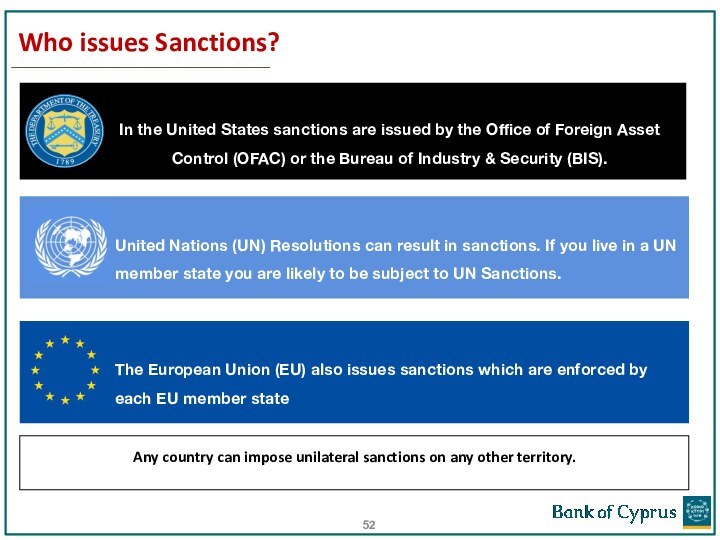

Who issues Sanctions?

United Nations (UN) Resolutions can result

in sanctions. If you live in a UN member

state you are likely to be subject to UN Sanctions.

The European Union (EU) also issues sanctions which are enforced by each EU member state

Any country can impose unilateral sanctions on any other territory.

Слайд 53

EU Sanctions

General

The European Commission proposes restrictive

measures and adopts a Common Position.

Sanctions are given

effect in Council Regulations, Council Decisions and Commission Regulations.

Sanctions are then enforced by Member States.

EU Sanctions apply to:

Everyone in the EU, including foreign entities or individuals acting in the EU.

Imports to or exports from the EU.

EU registered companies and citizens anywhere in the world

Слайд 54

OFAC Sanctions

General

The US Treasury Department’s Office

of Foreign Assets Control (OFAC) administers and enforces US

economic and trade sanctions.

OFAC sanctions generally prohibit:

Transactions with, payments to or investments in entities located in a country/ies that is/are subject to an OFAC embargo.

Transactions with, payments to or dealings with persons or entities identified on OFAC Specially Designated Nationals (SDN) List.

OFAC SDN List: (www.treasury.gov/resource-center/sanctions/SDN-List)

List of roughly 4,000 entities– terrorists, drug traffickers and others

Includes individuals, entities, vessels and aircrafts

Frequently updated

Слайд 55

OFAC Sanctions (cont.)

OFAC Sanctions apply to:

Everyone in

the US, including foreign entities or individuals acting in

the US.

Imports to or exports from the US.

US companies, including foreign offices or branches, anywhere in the world.

US citizens or permanent residents anywhere in the world, even if working for a foreign company.

Слайд 56

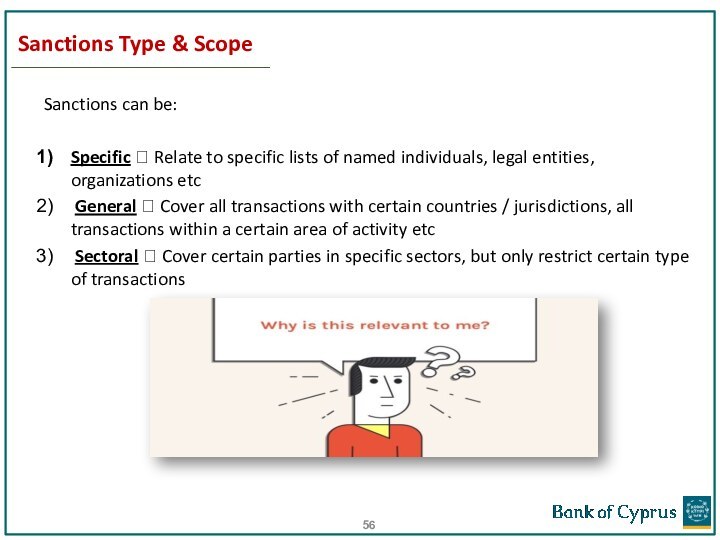

Sanctions Type & Scope

Sanctions can be:

Specific ? Relate

to specific lists of named individuals, legal entities, organizations

etc

General ? Cover all transactions with certain countries / jurisdictions, all transactions within a certain area of activity etc

Sectoral ? Cover certain parties in specific sectors, but only restrict certain type of transactions

Слайд 58

Sanctions Evasions

Forgery of documents

Nested accounts

Stripping wires

Restructuring of corporate

entities

Re-routing of transactions

Withholding or providing false information

Using client accounts

to conceal origin of funds

Слайд 59

Sanctions & Embargoes

Regulators are very serious – fines

can be huge:

Слайд 60

Effective Transaction Monitoring

Article 58(e) of the Law

What

is required is a “detailed examination of each transaction

which by its nature may be considered to be particularly vulnerable to be associated with money laundering offences or terrorist financing and in particular complex or unusually large transactions and all other unusual patters of transactions which have no apparent economic or visible lawful purpose”

Слайд 61

Effective Transaction Monitoring

In practice, where a client’s

instruction or transaction or behavior is not consistent with

what is anticipated i.e. if it does not make sense or appears logical then an explanation must be sought by contacting the client.

If there are unexpected jurisdictions or organizations/ counterparties/ associates involved, again explanations should be sought.

It should be noted that failure to provide satisfactory answers or cancelling transactions when pertinent questions are asked are reasons for concern.

One main method for documenting the exercise of judgment/reasonableness during ongoing transaction monitoring is the collection of sufficient (not excessive) supporting documentation, which should be kept in the client file.

Слайд 62

CUSTOMER REVIEW PROCESS

Financial regulators require banks and non-banking

financial institutions to perform AML KYC due diligence when

onboarding a new customer and also on a periodic basis throughout the life of the relationship.

Periodic KYC CTF reviews are conducted on a periodic basis:

to ensure that existing customer information is kept updated.

to confirm that each customer’s assigned risk rating continues to reflect the appropriate AML risk rating.

to capture any material change in the customer’s profile or any potentially suspicious activity that was not detected by the firm’s real-time transaction monitoring platforms.

Слайд 63

CUSTOMER REVIEW PROCESS

A review should be performed when

an unusual and/or significant transaction takes place, when the

customer documentation changes substantially or when there is a material change in the way the account is operated. Events for review may include changes in the legal/ownership structure, new accounts, dormant accounts, changes in risk category, negative information (internet, press, regulator, MOKAS, foreign bank) etc.

When a client is being reviewed, one should ask himself/herself: “if this customer had come to me today, in this form, is this the KYC/CDD information that I would have asked for? Or had I known then what I know now, would I have asked for more information or different information?”

In other words, is the KYC/CDD information that the organization holds on the customer still appropriate and proportionate to the money laundering risk now presented by that customer?.

Слайд 64

CUSTOMER REVIEW PROCESS

Review each customer's information: name, address, ID

number, certificate of good standing (if applicable), and the

customer’s original information to determine if there are any material changes

Check customer file for insufficient information – request updated documents from client

Rescreen each customer’s information against specially designated and country-based sanctions lists (OFAC lists)

Periodic VS circumstantial (large transaction, change in legal/ownership structure, change in signatories, new accounts, dormant accounts)

In instances where there is a substantive change (i.e., a different country of residence), reassess and reapply the risk rating for that customer

Re-evaluate cooperation - exercise judgment!

Слайд 65

CUSTOMER REVIEW PROCESS

The number of enquiries received from

Correspondent Banks

The number of filtering alerts handled during the

period examined

Determine any potentially suspicious activities that were not detected by the Bank’s real-time transaction monitoring platforms.

Change in risk category can also be due to negative information (internet, press, regulator, MOKAS, another bank)

Important to evaluate the quality of supporting documentation provided

The level of responsiveness and willingness of the client to provide additional supporting documentation or clarification when requested

If a client refuses to provide information the Bank should consider terminating the relationship, closing any accounts, filing a suspicion report.

Frequency: Once a year for high risk clients, every two years for significant risk clients, every three years for medium risk clients, every five years for low risk clients

Слайд 66

CUSTOMER REVIEW PROCESS

Transaction Monitoring during the review:

Need to

check that the transactions processed in the period examined:

Are in line with the nature of transactions that relate to the declared business activities

Involve counterparties, both for in/out funds, that match the declared ones and if not, discuss with the clients to seek explanation and, if necessary, update their profile accordingly

If the actual turnover is in line with declared / historic turnover

Involve reasonable amounts that can be expected for the kind of business activities that the clients are engaged in – REASONABLENESS & JUDGEMENT

Слайд 67

A SAR is born!

All should be aware of

when and how to submit a suspicion report

They

should understand that if they have reason to suspect that a person may be involved in money laundering or have relevant information it is their duty to report it to the designated MLCO (Suspicious Activity Report - SAR) => protect themselves and protect their organization

Delaying or not performing a transaction is not illegal if the client refuses to provide the necessary information / comfort or where there is a reason to suspect illegal or fraudulent actions

Serious tax offence (element of fraud) has been included in the law as a predicate offence (punishable with imprisonment exceeding one year) to money laundering charges

The MLCO should encourage appropriate reporting – quality of SARs is the clearest demonstration of an effective AML program

SARs should be made in good faith and genuine suspicion – protected by the law – defensive, malicious or frivolous SARs are not welcomed

Слайд 68

The “Suspicion Spectrum”

It is important to understand the

above so that there is comfort when making a

suspicion report

For example, a client that “looks untrustworthy” should not be a foundation for suspicion

BUT, a client that was uncomfortable when asking to respond to routine CDD questions, should be considered a foundation for suspicion

Not requested to confirm beyond doubt that assets or funds may represent the proceeds of crime….a suspicion of criminality in general is sufficient

But does the suspicion have a rational foundation?

If you decide not to report and there is money laundering can you explain your decision NOT to report?

Comfort….curiocity.....unease.....doubt.....concern.....suspicion.....knowledge