Слайд 2

Takeover bids: legal and regulatory issues

Economic considerations affecting

takeover bids: the ‘market for corporate control’

Differences in the

nature and extent of hostile takeover activity across countries

The regulatory framework in the UK, compared to that in the US, EU and Japan

Empirical research on takeover bids ‘from the inside’

Hedge fund activism: substitute for or complement to for takeover bids?

Слайд 3

Economic considerations affecting takeover bids

Agency cost considerations: the

hostile bid as the ‘great white shark’ of the

corporate world encouraging ‘all the fish in the ocean to swim a little more quickly’ (UK investment banker interviewed in mid-1990s as part of Cambridge project)

Macroeconomic considerations: ‘[i]t was impatient, value-focused shareholders who did America a great favour by forcing capital out of its traditional companies, and thereby making it available to fund the venture capitalists and the Ciscos and Microsofts that are now in a position to propel our economy very rapidly forward’ (Larry Summers, 2001)

Слайд 4

What is the source of takeover premiums?

Premiums paid

by hostile bidders are on average in excess of

30% of the pre-bid price

Is greater operating efficiency the source of the surplus? Merged firms resulting from hostile bids show small, positive gains over time to bidder shareholders (mergers from agreed bids show, on average, declining performance)

Or is the premium generated by wealth transfers from other stakeholders (breach of trust hypothesis)? Laid-off employees on average suffer significant losses of earning capacity over time: evidence of firm-specific human capital?

Слайд 5

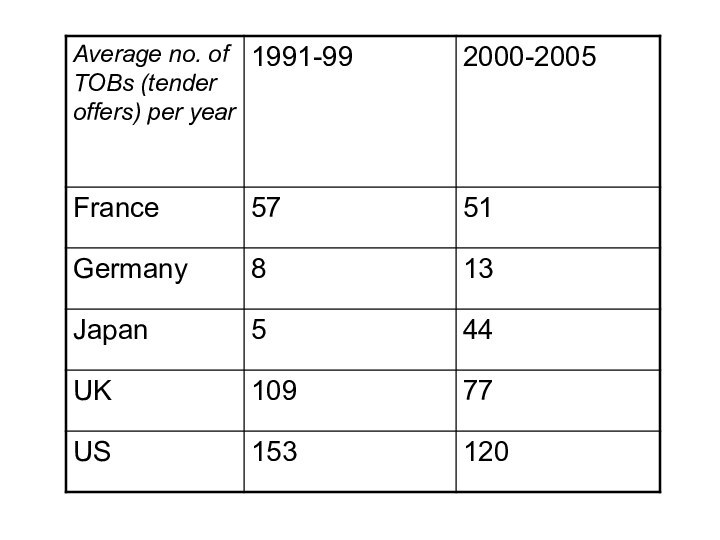

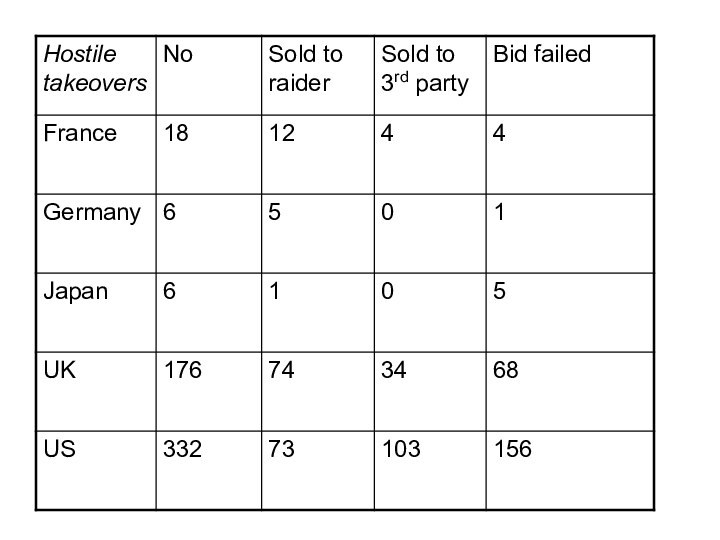

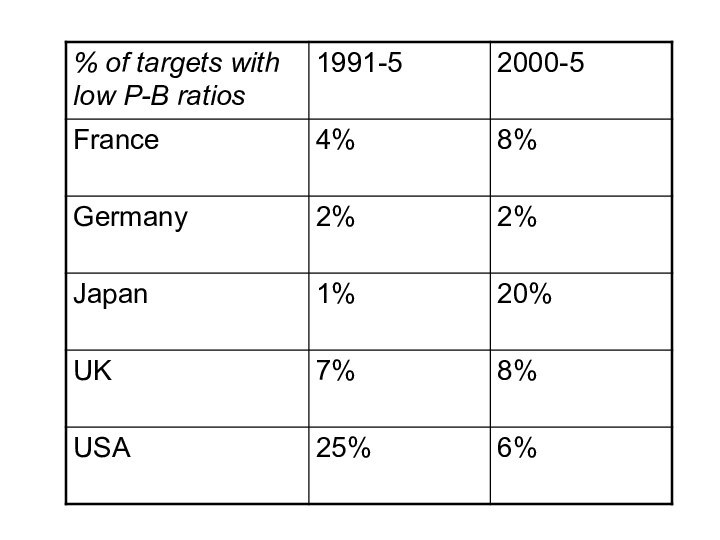

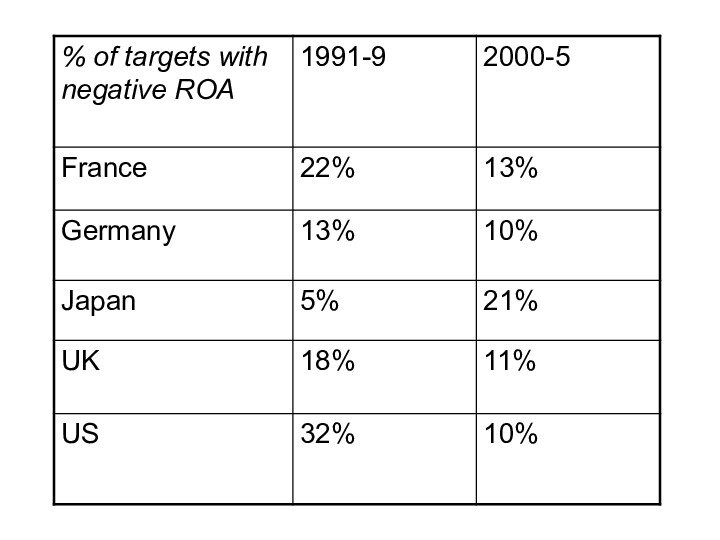

Differences across countries

Hostile takeovers are much more prevalent

and are much more likely to succeed in the

UK and US than in Japan, France, or Germany

In Japan, the number of tender offers has been increasing, but numbers of hostile takeovers remain very low

The percentage of targets targeted for underperformance has gone up over time in Japan (admittedly on very small numbers) but fallen in the UK and US

Слайд 10

The regulatory framework

What should takeover regulation be trying

to achieve?

How should boards respond to bids?

What are the

main differences between countries?

Слайд 11

Aims of takeover regulation

Protecting minority shareholders (cf. UK

equal treatment rule; US rules on fiduciary duties) while

also restricting the scope for shareholder ‘hold out’ (UK rules on squeeze outs)

Protecting companies from repeated bids (cf. UK bid timetable rules)

Ensuring transparency and a ‘level playing field’ in transnational capital markets (cf. ‘breakthrough rule’ in EC Takeover Directive)

Ensuring that managers of listed companies put shareholder interests first both before and during bids (UK ‘no frustration’ rule; EC board neutrality rule)

Protecting the autonomy of the board to respond to bids as it sees fit, if necessary by protecting ‘stakeholder’ interests (US position on ‘poison pills’)

Слайд 12

How should boards respond to hostile takeovers?

Management passivity:

duty of target board does not go beyond advising

shareholders on the financial merits of the bid

Auction rule: poison pill permissible if it encourages a second bidder to enter the fray

‘Breach of trust’: board has right to block bid if it is not in the company’s best long-term interests, given its impact on non-shareholder stakeholders; and/or, employees could be given veto or voice rights in relation to bids

Слайд 13

The regulatory framework for takeover bids in the

UK

Company law: directors owe duty to act in good

faith in the interests of the company (not the shareholders: s. 172 CA 2006), but fiduciary duty law has limited significance in takeover bid context

Takeover Code: ‘soft law’ which imposes a bid timetable, a ‘no frustration’ rule (for post-bid defences), a ‘mandatory bid’ rule with 30% threshold, and a principle of ‘equal treatment’ of target shareholders

Other features of UK corporate governance practice are relevant in limiting pre-bid defences: pre-emption rules (in Listing Rules), widespread practice of one-share, one vote

Squeeze-out right for last 10% of shares: deals with danger of minority shareholder hold-out (CA 2006)

Statutory buy-out right for last 10% protects shareholders who failed to respond to tender offer (CA 2006)

Слайд 14

Anti-poison pill rules: general prohibitions

‘The board of an

offeree company must act in the interests of the

company as a whole and must not deny the holders of securities the opportunity to decide on the merits of the bid.’ (General Principle 3)

‘During the course of an offer, or even before the date of the offer if the board of the offeree company has reason to believe that a bona fide offer might be imminent, the board must not, without the approval of the shareholders in general meeting:— (a) take any action which may result in any offer or bona fide possible offer being frustrated or in shareholders being denied the opportunity to decide on its merits…’

Слайд 15

Specific prohibitions

In addition, the Board must not: ‘(i)

issue any shares or transfer or sell, or agree

to transfer or sell, any shares out of treasury; (ii) issue or grant options in respect of any unissued shares; (iii) create or issue, or permit the creation or issue of, any securities carrying rights of conversion into or subscription for shares; (iv) sell, dispose of or acquire, or agree to sell, dispose of or acquire, assets of a material amount; or (v) enter into contracts otherwise than in the ordinary course of business’ (Rule 21.1)

Слайд 16

The regulatory framework for takeover bids in the

US

Williams Act: imposes disclosure requirements and duty to make

public tender offer under certain circumstances (not a mandatory bid rule, although tendering shareholders must be treated equally i.e. on a pro-rata basis)

A poison pill (shareholder rights plan) is permitted under Delaware law, but subject to general fiduciary duty law (board may have to redeem the pill under certain circumstances)

‘Constituency’ statutes at state level: unclear how effective in practice

Слайд 17

Directors’ duties in the US

Failure of board properly

to evaluate a takeover bid can lead to a

breach of the duty of care, actionable by the shareholders: Smith v. Van Gorkom (note also the aspect of self-dealing in this case)

During a takeover bid, the ‘business judgment rule’ is suspended in favour of an obligation to show ‘good faith and reasonable investigation’: Revlon.

The board may be under a duty to ‘redeem’ the poison pill if a high enough offer is made and a sale becomes inevitable: Revlon

Слайд 18

Treatment of stakeholders under Delaware law

‘A board may

have regard for various constituencies in discharging its responsibilities,

provided that there are rationally related benefits accruing to the stockholders… However, such concern for non-stockholder interests is inappropriate when an auction among active bidders is in process, and the object is no longer to maintain or protect the corporate enterprise but to sell it to the highest bidder’ (Revlon)

Слайд 19

The EC: the Thirteenth Directive

‘actual and potential takeover

bids are an important means to discipline the management

of listed companies with dispersed ownership, who after all are the agents of shareholders. If management is performing poorly or unable to take advantage of wider opportunities the share price will generally under-perform in relation to the company’s potential and a rival company and its management will be able to propose an offer based on their assertion of their greater competence. Such discipline of management and reallocation of resources is in the long term in the best interests of all stakeholders and society at large. These views also form the basis for the Directive’ (High Level Group).

Слайд 20

A level playing field?

Key principles are board neutrality,

shareholder sovereignty, and proportionality between risk and control

Debate prior

to the adoption of the Directive focused on: ‘grandfathering’ multiple voting rights; allowing leeway on poison pills (cf. ‘level playing field’ with US); and employee consultation.

Main features include: board neutrality (no post-bid frustrating action) rule, mandatory bid rule, equitable price rule, ‘modified’ breakthrough rule: substantial use of ‘default rule’ type regulation (‘reflexive’?) throughout

Слайд 21

The modified breakthrough rule (Art. 11)

The rule ‘aims

to prevent boards and controlling shareholders from structuring the

rights of shareholders pre-bid in such a way as to deter bids’ (Davies/Hopt); cf. Volkswagen case in ECJ on freedom of movement (Court struck down ‘Volkswagen law’ providing for stakeholder representation and 20% voting cap)

Restrictions on share transfers cannot operate during the bid period

Restrictions on voting rights are not permitted and multiple voting shares are reduced to one share, one vote at any shareholder meeting called to approve defensive measures and/or at the first general meeting called by a bidder with 75% of capital carrying voting rights

Слайд 22

Limits to the breakthrough rule

Does not do anything

about other obstacles to principle of proportionality between risk

and voting rights (non voting shares, shares with extra voting rights for long-term holders, pyramids, cross-holdings, and so on…)

And, Member State adoption is optional

MS must allow companies to opt into the rule, and may then apply the reciprocity rule: such companies can opt back out again if they receive a bid from a non-BTR compliant company

There is therefore an incentive for a potential bidder to opt in, but will only help if the target is in a MS which has adopted the BTR rule or has given the companies the option of adopting it, and it has done so

Слайд 23

Implementation

Board neutrality rule (control of post-bid defences): majority

of MSs have made it mandatory (so there is

a shareholder approval condition), but some of them have qualified it by allowing companies to opt out on the basis of reciprocity

BTR (control of pre-bid defences): only mandatory in Baltic states and Italy

Mandatory bid rule: subject to different thresholds and to exceptions in a number of MSs

Слайд 24

Takeover bids in Japan

Tension between legal model (joint

stock company), changing ownership structure, and concept of Japanese

firm as ‘social institution’ (or ‘community firm’)?

Significance of court rulings in Livedoor and Bull-Dog Sauce cases

Concept of ‘corporate value’ not the same as ‘shareholder value’

No equivalent to UK Takeover Code or board neutrality principle in EC Directive

Widespread adoption of poison pills by companies following the Livedoor ruling

Closer to US practice on poison pills, but is their function different in the two countries?

Слайд 25

Tokyo High Court on Livedoor bid

‘The issue of

new shares, etc., by the directors – who are

appointed by the shareholders – for the primary purpose of changing the composition of those who appoint them clearly contravenes the intent of the Commercial Code and in principle should not be allowed. The issue of new shares for the entrenchment of management control cannot be countenanced because the authority of the directors derives from trust placed in them by the owners of the company, the shareholders. The only circumstances in which a new rights issue aimed primarily at protecting management control would not be unfair is when, under special circumstances, it aims to protect the interests of shareholders overall.’

But: defences permissible in the cases of greenmail, asset stripping, leveraged buy-out, share price manipulation

Слайд 26

CVSG 2005 report on ‘corporate value’ and CV

Guidelines

‘The price of a company is its corporate value,

and corporate value is based on the company’s ability to generate profits. The ability to generate profits is based not only on managers’ abilities, but is influenced by the quality of human resources of the employees, their commitment to the company, good relations with suppliers and creditors, trust of customers, relationships with the local community, etc. Shareholders select managers for their ability to generate high corporate value, and managers respond to their expectations by raising corporate value through creating good relations with various stakeholders. What is at issue in the case of a hostile takeover is which of the parties - the bidder or the incumbent management - can, through relations with stakeholders, generate higher corporate value.’

Слайд 27

Takeover defences

2005 Company Law contained new powers to

put in place takeover defences, including issuing of shares

issued with special voting rights, poison pills (rights issues), golden shares

In 2005, 118 companies surveyed by Shoji homu (6.0%) had adopted takeover defences in 2005 and 860 (44.4%) were not considering them. In 2006 the proportions were 8.8% and 44.3% respectively, and in 2007 they were 14.5% and 43.3%. In 2008, 213 companies intended to introduce them in June shareholder meetings, one third of which required changes to articles through special resolution

CV Guidelines: defences permissible subject to (Delaware-like) ‘threat’ and proportionality’ principles

Слайд 28

Bull-Dog Sauce Case

May 2007: having acquired a 10.3%

stake, Steel Partners launched an unsolicited tender offer for

100% of Bull-Dog’s shares.

Annual shareholders meeting passed a special resolution proposing the issue of warrants at a ratio of three per share, which could be exercised by all except Steel Partners, who would receive an equivalent amount in cash compensation, but would see its stake diluted to under 3%.

Слайд 29

Tokyo District Court ruling

‘Even if a particular shareholder

suffers a decline in its shareholder ratio owing to

discriminatory terms placed on the exercise or acquisition of stock warrants distributed to shareholders, when the decision to issue said stock warrants is made by special resolution at the general shareholders’ meeting, and shareholders are properly and equally compensated in proportion to the number of shares they own, said stock warrants do not violate the principle of equal treatment of shareholders’

Слайд 30

Tokyo High Court ruling

‘An “abusive” acquirer, with the

intention of buying up shares for its own benefit

as a majority shareholder, engages in abusive company management or control, without due regard to the sound management of the company. This leads to a damaging of said company’s enterprise value or a harming of the common interests of shareholders. That such an abusive acquirer would be subject to discriminatory treatment as a shareholder is unavoidable’

Слайд 31

Supreme Court ruling

‘To protect the interests of individual

shareholders, the company is obligated to treat shareholders fairly

based on the type and number of shares they hold, but since individual shareholders’ interests are normally inconceivable without an ongoing and thriving company, if there is a risk that the acquisition of management control by a particular shareholder would damage the company’s enterprise value, such as interfering with the company’s survival or growth, or would harm the company’s interests or the common interests of shareholders, discriminatory treatment of said shareholder aimed at preventing such acquisition cannot be immediately construed as a violation of the intent of said principle unless said treatment is unreasonable and contrary to the equal treatment principle’

Слайд 32

J-Power

2006-2008 TCI intervened in J-Power

Large company: market cap

exceeded net assets, net debt, low ratio of assets

in cash or investments

2007 AGM proposal: more than double dividend ~ defeated

2008 AGM proposal: increased dividend, share buy-back, reduced corporate holdings, appointment of external directors ~ defeated

Request to exceed 10% limit on utility shares held by a non-resident rejected by authorities

TCI exited at a loss in October 2008

Слайд 33

Reactions to hedge fund activism in Japan

Managers opposed

concept of quest for higher returns:

“We realize that, obviously,

they chose [us] as an investment target purely as a means to raise their own returns and that all this talk of ‘improving the company’ was just talk”

Managers opposed concept of shareholder priority:

“There’s not a single employee in our company who thinks he is working for the shareholders. The attitude is that this is hard work and we’re doing it for our customers.”

Stable shareholders value relationships, not dividends:

“…since their shareholder value is being maximised they have no complaints and, in that sense, from the viewpoint of these shareholders, ‘maximising shareholder value’ is the wrong way to manage things”

Слайд 34

The aftermath

TCI gone; Steel Partners retrenched from late

2008

Other funds less obviously active, though still present

Financial crisis

appears to vindicate cautious strategies; concept of stripping out “excess” value discredited.

But some issues remain:

How to regard portfolio investors? Fund partner: “To call the funds ‘short-term’ is to have a massive neglect for why you have a stock market in the first place. The stock market is to trade, so if you push their logic to the very end, which is that everyone is ‘long-term’ – meaning they don’t sell their shares – then there is no stock market”

Trend to higher distribution - Target CEO: “After all, there’s no such thing as an investor that says he does not want an increased dividend”

The external supervision debate has been revived - Press comment: “Equity investors and corporate management are at odds over the question of how to ensure an adequacy of external directors”

Слайд 35

CVSG 2008 report

Role of takeover defences should be

to protect shareholder interests

Board should take a view on

the merits of the bid and not pass the buck to shareholders

Unsolicited bids can improve corporate value and governance

Corporate value should be defined with reference to cash flow and not be used to entrench management

Слайд 36

Takeover bids from the inside: evidence for the

UK and Japan

Inconclusiveness of econometric studies suggests role for

qualitative research

Non-random sample of 15 bids mounted in period 1993-96 (hostile and agreed; UK only, international; cash only, shares (and cash))

Interviews with directors, bankers, lawyers, institutional investors, union representatives, aimed at understanding perceptions of bid process

Sample re-examined 5 years on to see how the merged firm was perceived to have performed

Слайд 37

Attitudes to TOBs in Japan

‘I’m not quite sure

whether shutting out these sorts of opportunities [i.e. bid

approaches] can really be called “corporate defence”. However - this is a Japanese sort of environment - the fact is that 6,000 people are working in our group and hitherto they have always had a great feeling of confidence and attachment towards the management. Accordingly, with regard to philosophy, even if for the sake of argument someone were to appear with a philosophy that was even more elevated than ours, I would be very worried and doubtful as to whether these employees who are currently contributing their confidence and attachment to us would continue to do so in the same way for them’ (executive interviewed by Buchanan and Deakin)

‘It is a mistake to think only of the interests of shareholders. Raising benefits to stakeholders such as employees, suppliers, customers and the local community accords with the overall interests of shareholders’ (Tokyo District Court judge in Livedoor case)