Слайд 2

PLAN FOR THE DAY

Part 1: Discuss the different

types of resources and the nature of firm capabilities

Relate

resources and capabilities to the value chain

Part 2: Barney’s VRIO framework for analyzing resources and capabilities’ potential for improving firm performance

Part 3: Domestic vs International capabilities

To offshore or not offshore

Слайд 3

PART 1:

RESOURCES AND CAPABILITIES AND

THE VALUE CHAIN

Слайд 4

Resource-based View (RBV) of the Firm

Tangible and intangible

resources/ assets

Tangibility implies we can observe or quantify (measure/

count)

Intangibility implies that the resource/ asset is not observable and difficult if not impossible to quantify

Capabilities

These are the things the firm is able to do as a result of combining resources (and capabilities) together to perform a specific task

How useful is it to try and separate resources and capabilities from one another, when they interact to such a great degree?

Слайд 5

Resources, Capabilities and the Value Chain

Value chain =

the vertical activities that create value

Upstream (sourcing/ manufacturing) to

down stream (selling)

Primary and secondary areas of activity in the value chain

Слайд 6

The Airbus A380 Value Chain?

Source: http://www.flightglobal.com/airspace/media/cutawayposters/airbus-a380-microcutaway-14474.aspx

Слайд 7

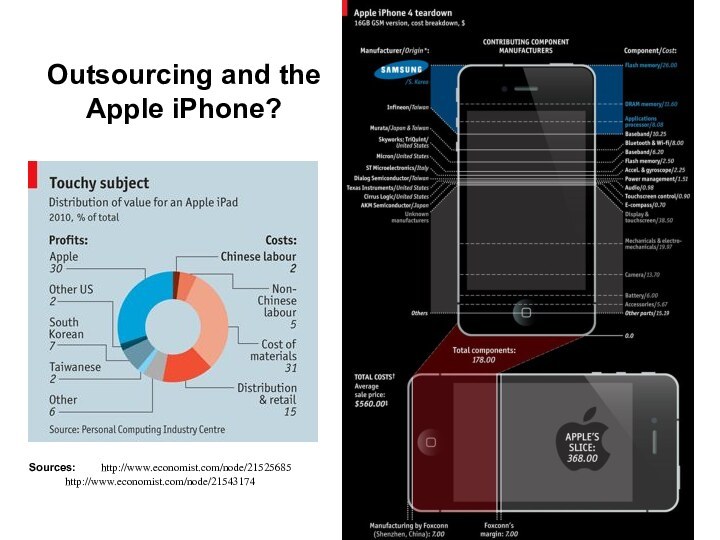

Outsourcing and the Apple iPhone?

Sources: http://www.economist.com/node/21525685

http://www.economist.com/node/21543174

Слайд 8

What does Apple Keep In-House?

Apple Campus 2 Project

Amsterdam

Apple Store

Слайд 9

Example of a Value Chain with Outsourcing

From the

example companies that are included, which could be described

as onshore and which offshore?

Слайд 10

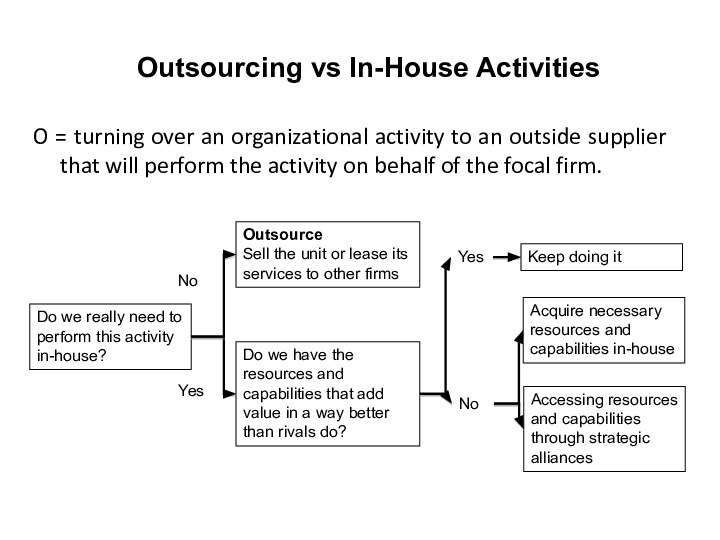

Outsourcing vs In-House Activities

O = turning over an

organizational activity to an outside supplier that will perform

the activity on behalf of the focal firm.

Слайд 11

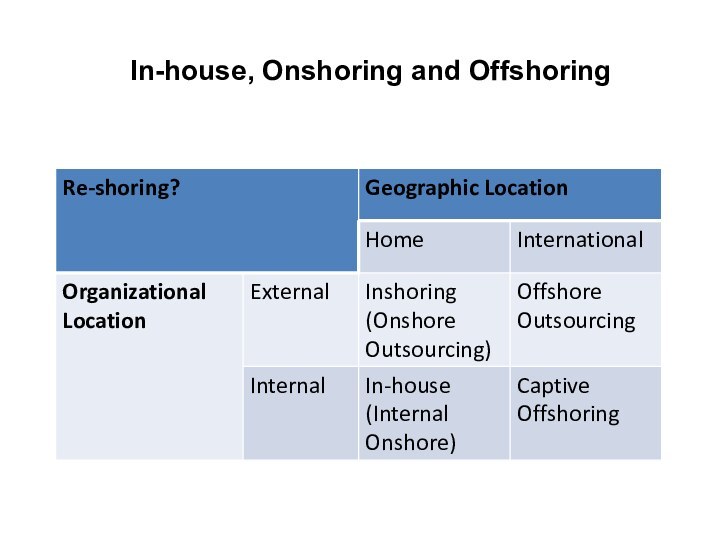

In-house, Onshoring and Offshoring

Слайд 12

PART 2:

Jay Barney’s VRIO Framework

Слайд 13

VRIO and (Sustained) Competitive Advantage

Source: Barney J.B. (1995)

Looking Inside for Competitive Advantage. Academy of Management Executive,

9(4): 49-61.

Barney, Jay. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17(1): 99-120.

Слайд 14

Core Assumptions of the VRIO Framework

These are the

two foundation assumptions for the resource-based view of the

firm and strategic management

Firm Resource Heterogeneity

Firm Resource Immobility

Слайд 15

Resource Attributes for Achieving Sustained Competitive Advantage

Not all

resources will give a firm a SCA

A resource must

have four attributes to provide a SCA

It must be valuable

It must be rare

It must be imperfectly imitable

The firm needs to be organized to exploit the resource

Слайд 16

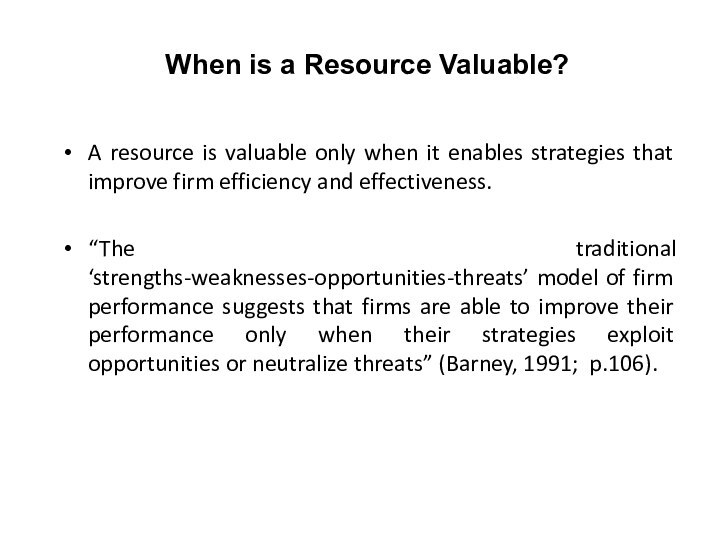

When is a Resource Valuable?

A resource is valuable

only when it enables strategies that improve firm efficiency

and effectiveness.

“The traditional ‘strengths-weaknesses-opportunities-threats’ model of firm performance suggests that firms are able to improve their performance only when their strategies exploit opportunities or neutralize threats” (Barney, 1991; p.106).

Слайд 17

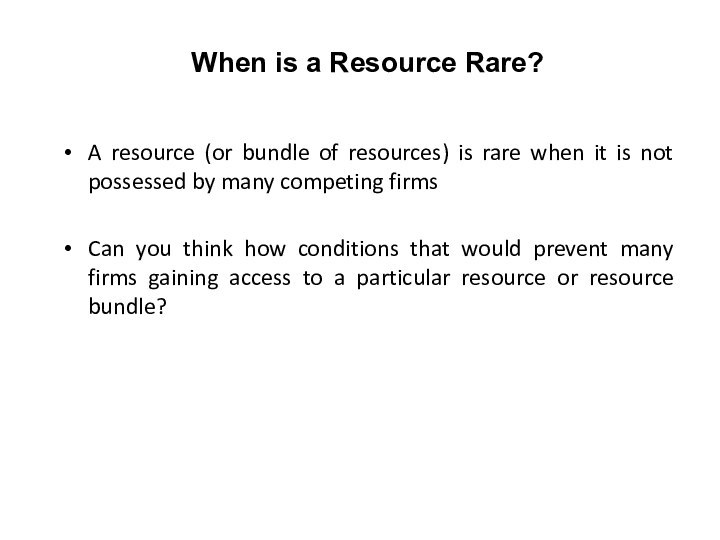

When is a Resource Rare?

A resource (or bundle

of resources) is rare when it is not possessed

by many competing firms

Can you think how conditions that would prevent many firms gaining access to a particular resource or resource bundle?

Слайд 18

When is a Resource Imperfectly Imitable?

For a resource

to give a firm a SCA it must however

not only be valuable and rare, it must also be difficult to imitate or obtain

Three sources of resource imperfect imitability are:

Historical dependence

Causally ambiguity

Social complexity

Слайд 19

When is a Firm Organized to Exploit a

Resource?

Organization of the firm is concerned with (amongst other

things):

The development of new resource(s) / capabilities

The exploitation of current resource(s) / capabilities

Exploration vs exploitation and the multinational enterprise?

Слайд 20

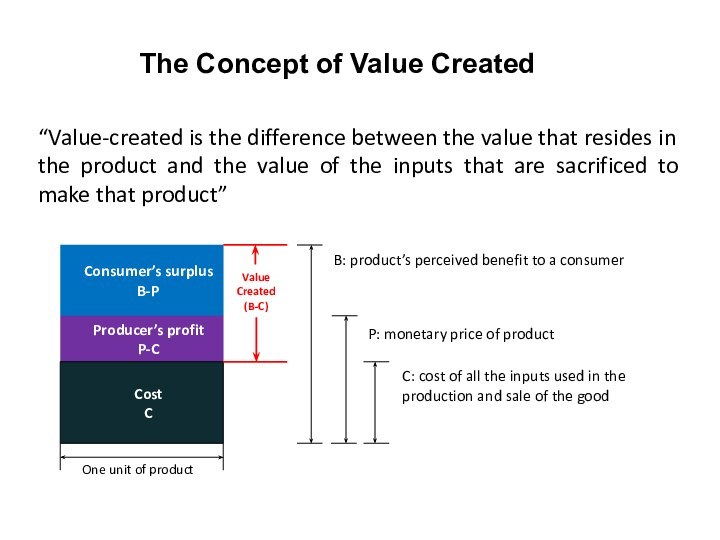

“Value-created is the difference between the value that

resides in the product and the value of the

inputs that are sacrificed to make that product”

The Concept of Value Created

Слайд 21

Describing Performance Outcomes

Comparison of value created (VC) with

a given resource bundle to the expected value (EV)

to be obtained (by the owners of these resources):

Below-Normal Performance: VC < EV

Normal Performance: VC = EV

Above-Normal Performance: VC > EV

This provides a relative conceptualization of how well a firm has performed with a given set of resources.

Слайд 22

PART 3:

DEBATE 1: DOMESTIC VS INTERNATIONAL CAPABILITIES

Слайд 23

RBV of Multinational Management

International diversification (Dess et al.,

1995)

Subsidiary capability development (Birkinshaw & Hood, 1998; Luo &

Peng, 1999)

International strategic human resource management (ISHRM) (Schuler, Dowling & Decieri, 1993; Beechlor and Napier, 1996)

Exploitation vs Exploration?

Слайд 25

RBV of Strategic Alliances

Since the 1980s, both the

corporate world and the academic fields of IB and

strategy have experienced an “alliance revolution” (Dunning, 1995).

While strategic alliances is a multi-faceted phenomenon, the RBV focuses on organizational learning.

RBV advances a core proposition that capabilities to learn from partners may be a tacit resource underlying a firm’s competitive advantage (Hamel, 1991).

For MNCs, the intensity and diversity of learning from local partners facilitate local knowledge acquisition and strengthen firm performance in host countries (Luo & Peng, 1999; Makino & Delios, 1996).

For local firms, learning from MNC parents is likely to enhance survivability and performance (Fahy et al., 2000; Lyles & Salk, 1996).

Слайд 26

RBV of International Entrepreneurship

Historically, IB research focuses on

large MNCs, and entrepreneurship studies concentrate on small and

medium-sized enterprises (SMEs) within a domestic context.

How can some SMEs succeed abroad rapidly without going through different stages suggested by the “stage” model?

The answer typically boils down to the superb tacit knowledge about global opportunities (Peng, Hill & Wang, 2000)

Слайд 27

RBV of Emerging Market Strategies

Emerging markets represent a

unique institutional environment

Emerging market MNEs (EM-MNEs)

Developing capabilities constitutes “one

of the most important SOE strategies during the transitions” (Peng, 2000, p. 100)

Privatized firms

Entrepreneurial start-ups

Conglomerates

Слайд 28

PART 3:

DEBATE 2: TO OFFSHORE OR NOT TO

OFFSHORE

Слайд 29

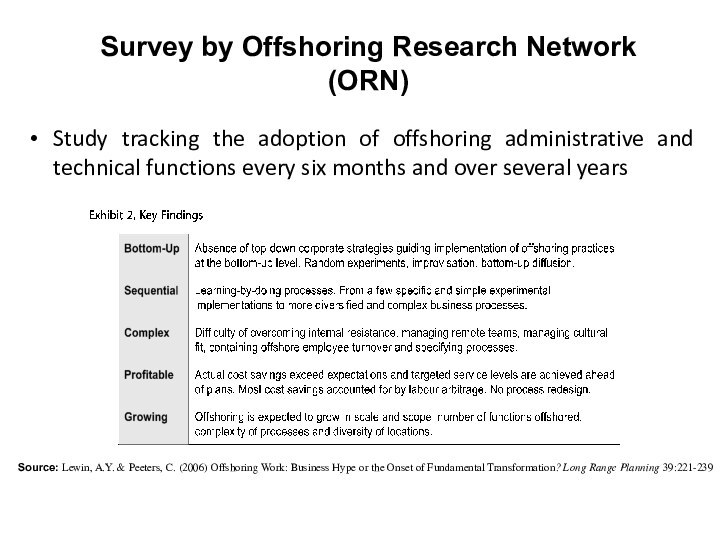

Survey by Offshoring Research Network (ORN)

Study tracking the

adoption of offshoring administrative and technical functions every six

months and over several years

Source: Lewin, A.Y. & Peeters, C. (2006) Offshoring Work: Business Hype or the Onset of Fundamental Transformation? Long Range Planning 39:221-239

Слайд 30

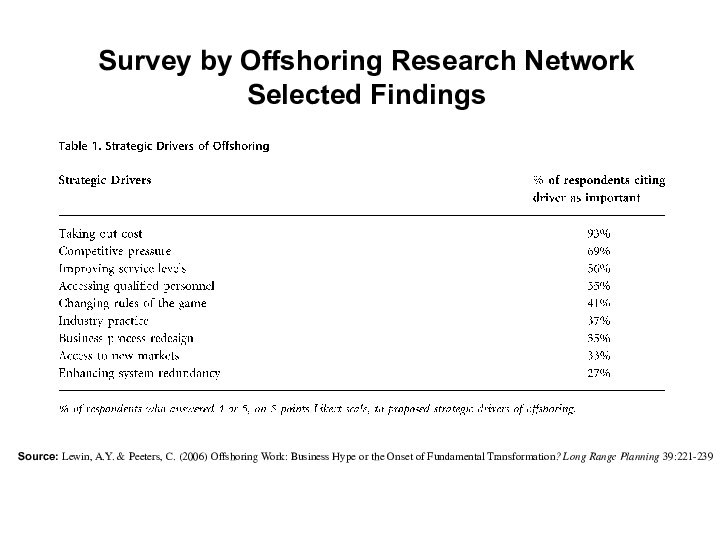

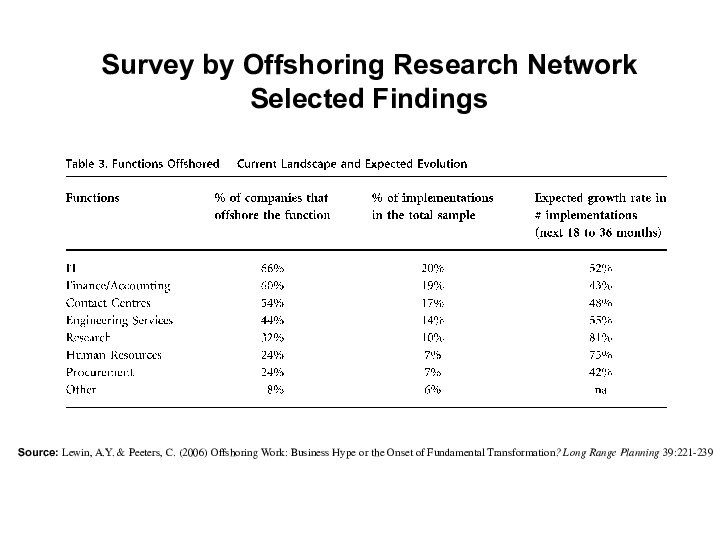

Survey by Offshoring Research Network

Selected Findings

Source: Lewin, A.Y.

& Peeters, C. (2006) Offshoring Work: Business Hype or

the Onset of Fundamental Transformation? Long Range Planning 39:221-239

Слайд 31

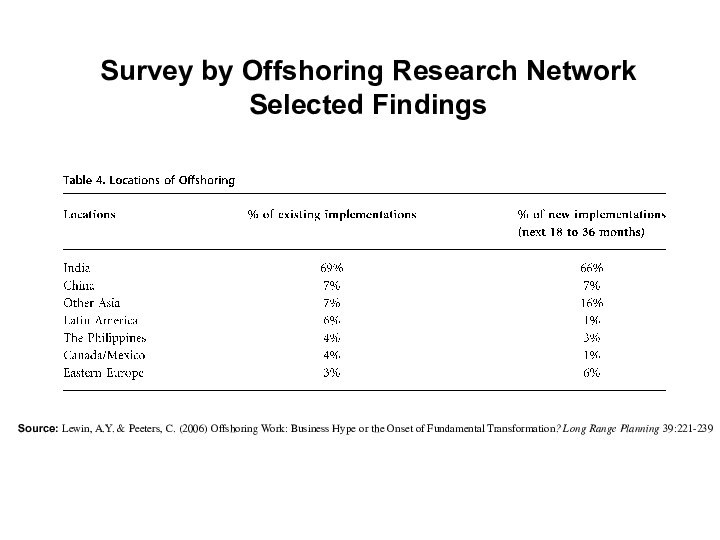

Survey by Offshoring Research Network

Selected Findings

Source: Lewin, A.Y.

& Peeters, C. (2006) Offshoring Work: Business Hype or

the Onset of Fundamental Transformation? Long Range Planning 39:221-239

Слайд 32

Survey by Offshoring Research Network

Selected Findings

Source: Lewin, A.Y.

& Peeters, C. (2006) Offshoring Work: Business Hype or

the Onset of Fundamental Transformation? Long Range Planning 39:221-239

Слайд 33

Survey by Offshoring Research Network

Selected Findings

Source: Lewin, A.Y.

& Peeters, C. (2006) Offshoring Work: Business Hype or

the Onset of Fundamental Transformation? Long Range Planning 39:221-239

Слайд 34

Survey by Offshoring Research Network

Selected Findings

Source: Lewin, A.Y.

& Peeters, C. (2006) Offshoring Work: Business Hype or

the Onset of Fundamental Transformation? Long Range Planning 39:221-239