Слайд 2

The focus of part 3:

strategy in action

Criteria and techniques that can be used to evaluate

possible strategic options.

How strategies develop in organisations; the processes that may give rise to intended strategies or to emergent strategies.

The way in which organisational structures and systems of control are important in organising for strategic success.

The leadership and management of strategic change.

Who strategists are and what they do in practice.

Слайд 3

Strategy in Action

11: Evaluating Strategies

Слайд 4

Learning outcomes

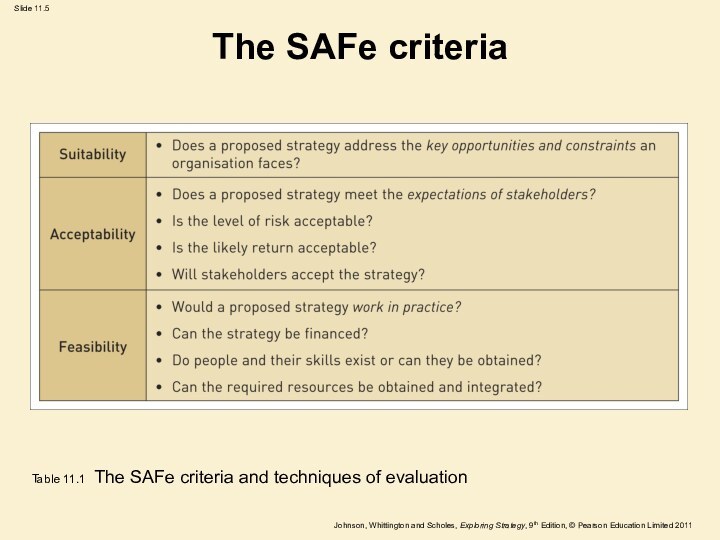

Employ three success criteria for evaluating strategic

options:

– Suitability: whether a strategy addresses the key

issues relating to the opportunities and constraints an organisation faces.

– Acceptability: whether a strategy meets the expectations of stakeholders.

– Feasibility: whether a strategy could work in practice.

For each of these use a range of different techniques for evaluating strategic options, both financial and non-financial.

Слайд 5

The SAFe criteria

Table 11.1 The SAFe criteria and

techniques of evaluation

Слайд 6

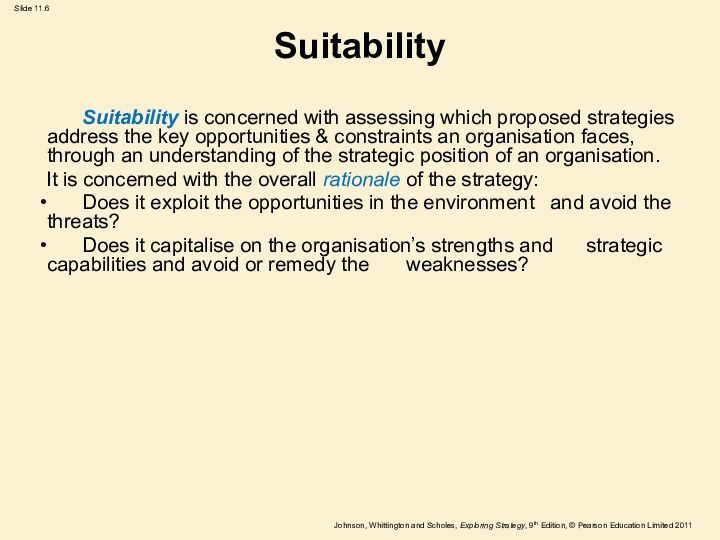

Suitability

Suitability is concerned with assessing which proposed

strategies address the key opportunities & constraints an organisation

faces, through an understanding of the strategic position of an organisation.

It is concerned with the overall rationale of the strategy:

Does it exploit the opportunities in the environment and avoid the threats?

Does it capitalise on the organisation’s strengths and strategic capabilities and avoid or remedy the weaknesses?

Слайд 7

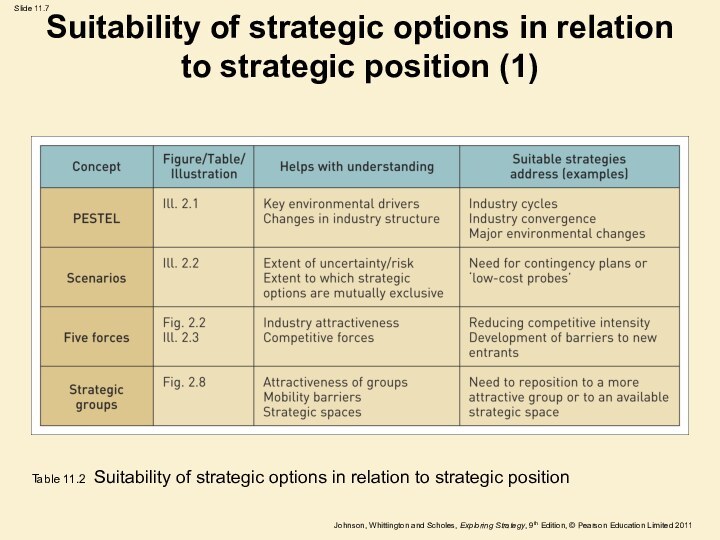

Suitability of strategic options in relation to strategic

position (1)

Table 11.2 Suitability of strategic options in relation

to strategic position

Слайд 8

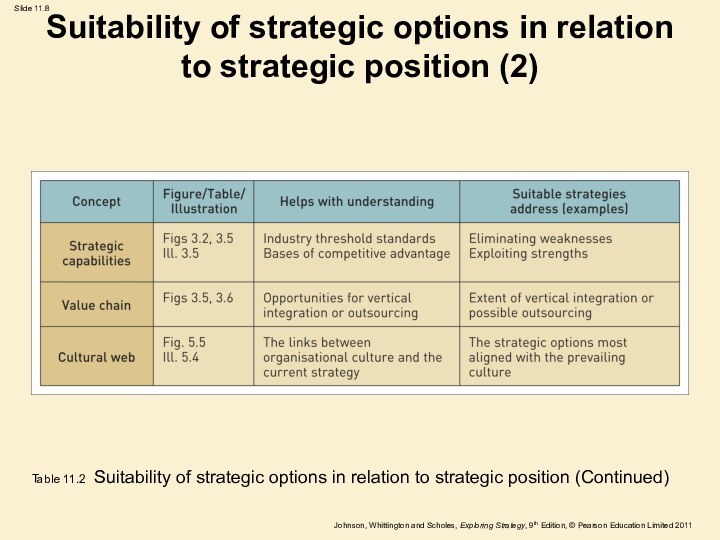

Suitability of strategic options in relation to strategic

position (2)

Table 11.2 Suitability of strategic options in relation

to strategic position (Continued)

Слайд 9

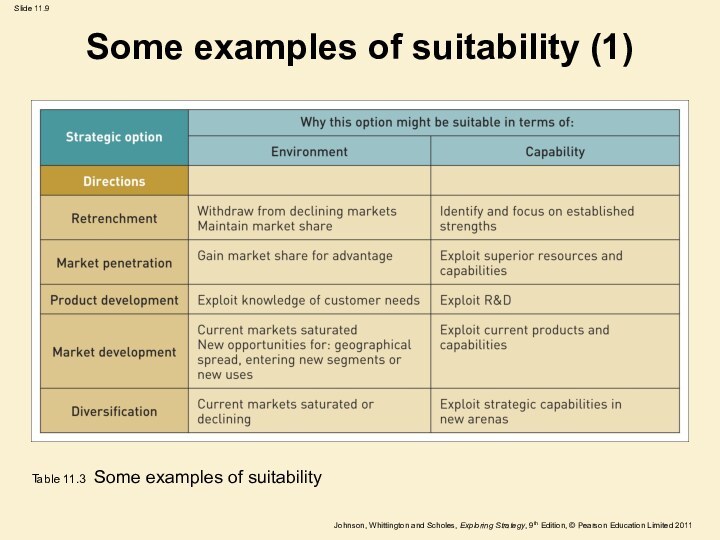

Some examples of suitability (1)

Table 11.3 Some examples

of suitability

Слайд 10

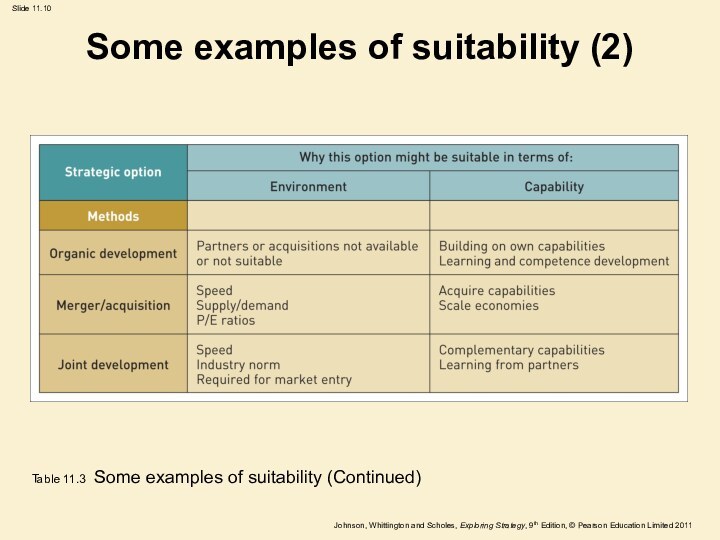

Some examples of suitability (2)

Table 11.3 Some examples

of suitability (Continued)

Слайд 11

Suitability – screening techniques

There are several useful techniques:

Ranking.

Using

scenarios.

Screening for competitive advantage.

Decision trees.

Life cycle analysis.

Слайд 12

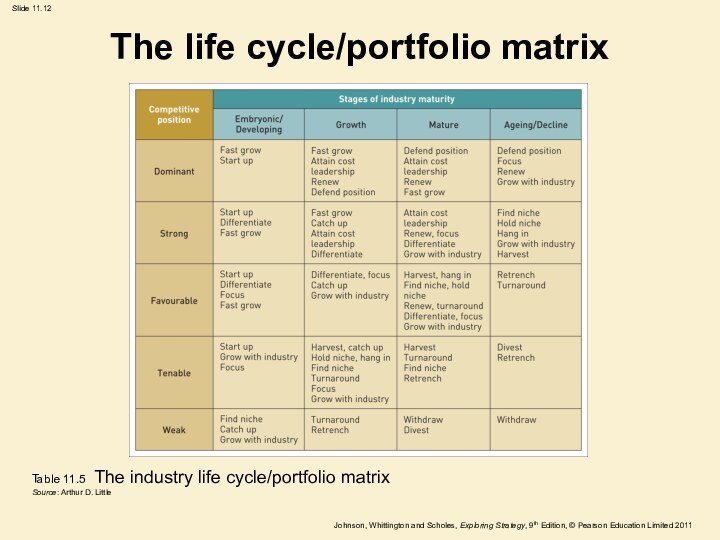

The life cycle/portfolio matrix

Table 11.5 The industry life

cycle/portfolio matrix

Source: Arthur D. Little

Слайд 13

Competitive position within an industry

Competitive position within an

industry can be:

A dominant position which is rare in

the private sector unless there is a quasi-monopoly position. In the public sector there can be a legalised monopoly status.

A strong position where organisations can follow strategies of their own choice without too much concern for competition.

A favourable position where no single competitor stands out, but leaders are better placed.

A tenable position can be maintained by specialisation or focus.

A weak position where competitors are too small to survive independently in the long run.

Слайд 14

Acceptability (1)

Acceptability is concerned with whether the

expected performance outcomes of a proposed strategy meet the

expectations of stakeholders.

Слайд 15

Acceptability (2)

There are three key aspects of acceptability

- the ‘3 R’s’:

Risk.

Return.

Reactions (of stakeholders).

Слайд 16

Risk

Risk concerns the extent to which the outcomes

of a strategy can be predicted.

Risk can be assessed

using:

Sensitivity analysis.

Financial ratios – e.g. gearing and liquidity.

Break-even analysis.

Слайд 17

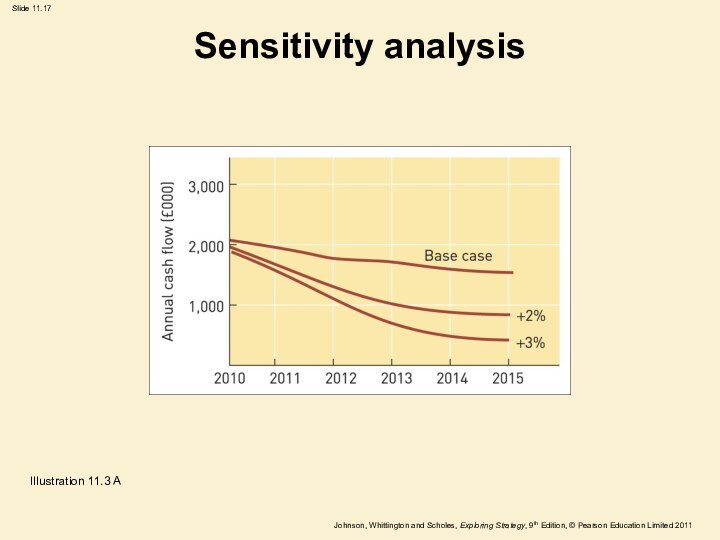

Sensitivity analysis

Illustration 11.3 A

Слайд 18

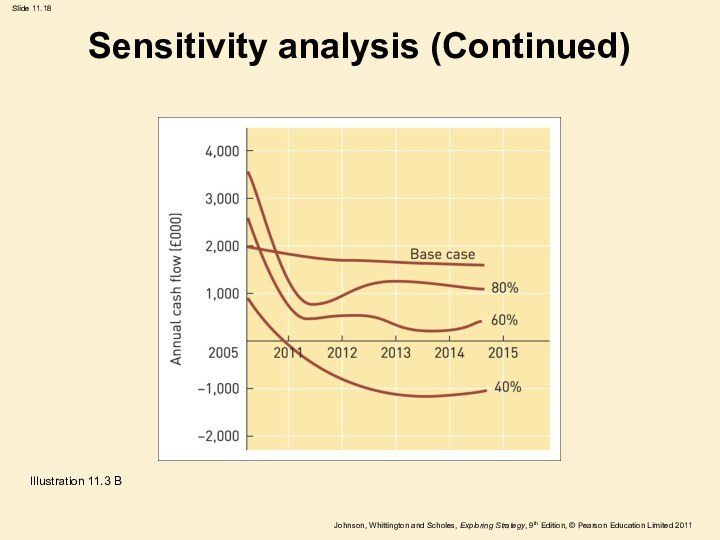

Sensitivity analysis (Continued)

Illustration 11.3 B

Слайд 19

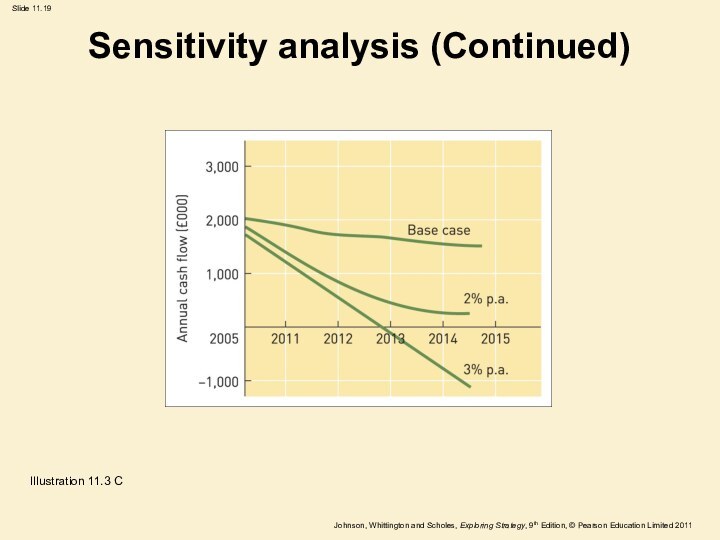

Sensitivity analysis (Continued)

Illustration 11.3 C

Слайд 20

Return

Returns are the financial benefits which stakeholders are

expected to receive from a strategy.

Different approaches to assessing

return:

Financial analysis.

Shareholder value analysis.

Cost–benefit analysis.

Real options.

Слайд 21

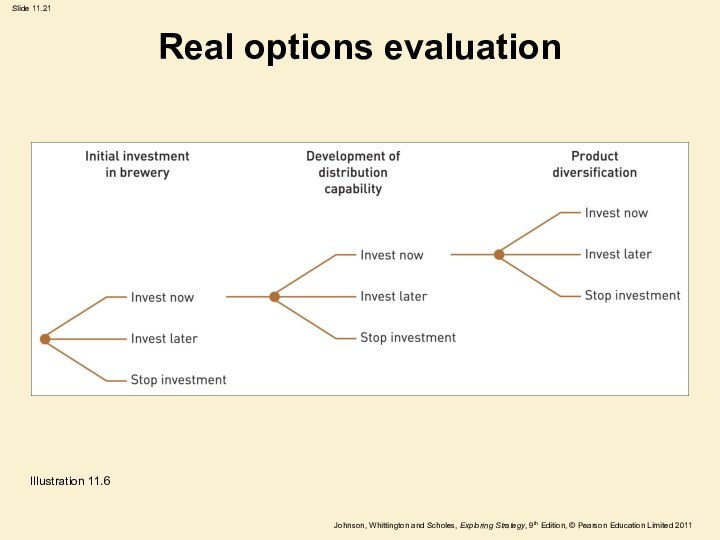

Real options evaluation

Illustration 11.6

Слайд 22

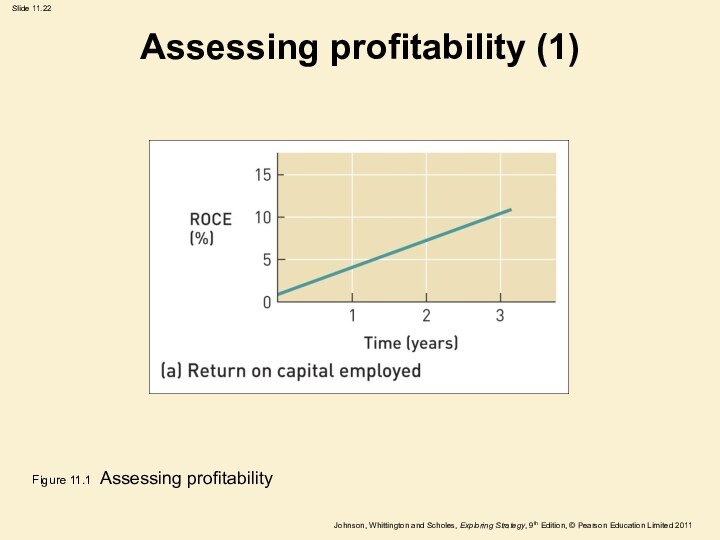

Assessing profitability (1)

Figure 11.1 Assessing profitability

Слайд 23

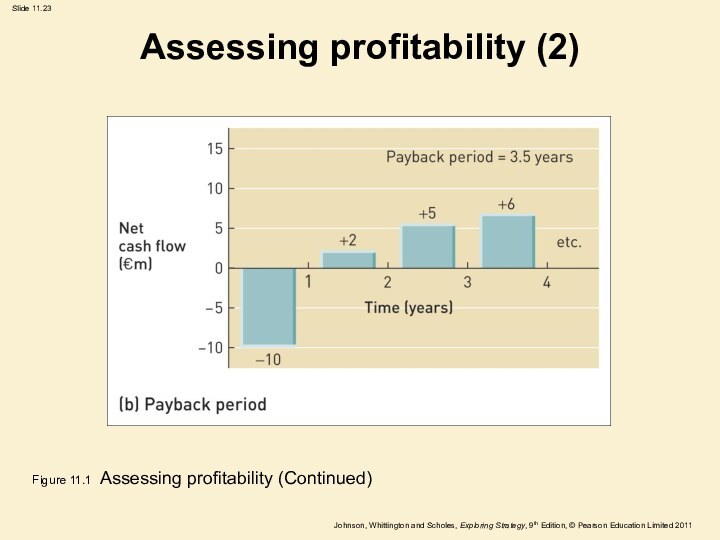

Assessing profitability (2)

Figure 11.1 Assessing profitability (Continued)

Слайд 24

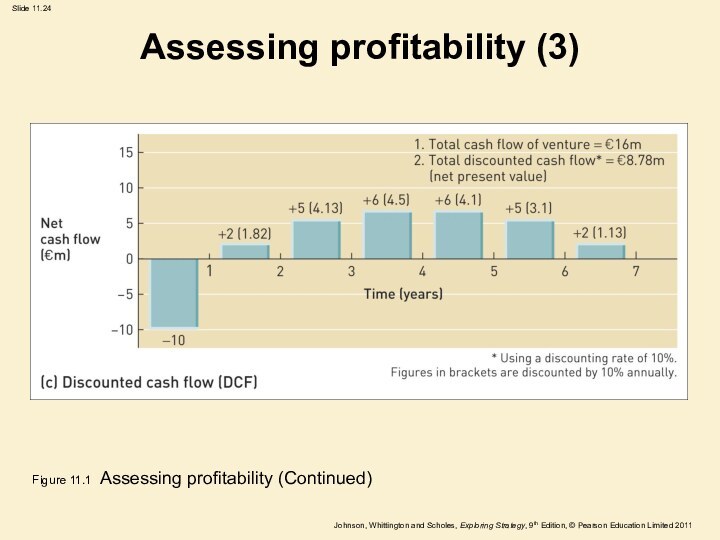

Assessing profitability (3)

Figure 11.1 Assessing profitability (Continued)

Слайд 25

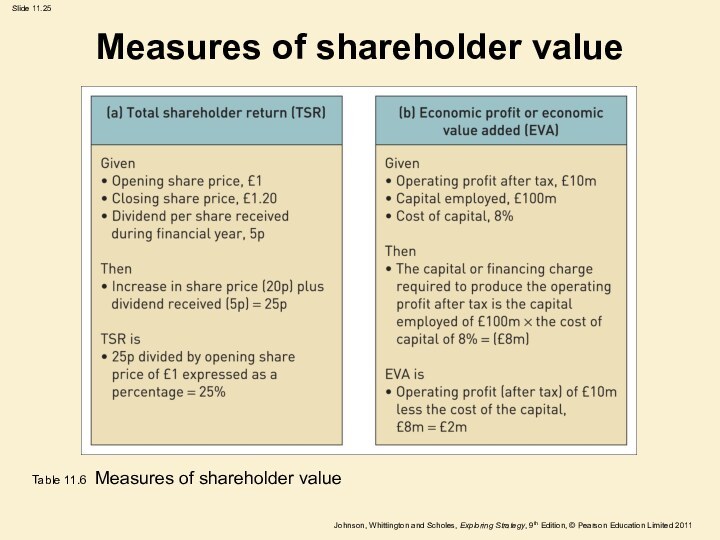

Measures of shareholder value

Table 11.6 Measures of shareholder

value

Слайд 26

Advantages of real options

There are four main benefits:

Bringing

strategic and financial evaluation closer together.

Valuing emerging options.

Coping

with uncertainty.

Offsetting conservatism.

Слайд 27

Reaction of stakeholders

Stakeholder mapping and the power/interest matrix

can be used to:

understand the political context of

strategies.

understand the political agenda.

gauge the likely reaction of stakeholders to specific strategies.

If key stakeholders find a strategy to be unacceptable then it is likely to fail

Слайд 28

Feasibility

Feasibility is concerned with whether a strategy

could work in practice i.e. whether an organisation has

the capabilities to deliver a strategy

Two key questions:

Do the resources and competences currently exist to implement the strategy effectively?

If not, can they be obtained?

Слайд 29

Financial feasibility

Need to consider:

The funding required.

Cash flow analysis

and forecasting.

Financial strategies needed for the different ‘phases’ of

the life cycle of a business.

Слайд 30

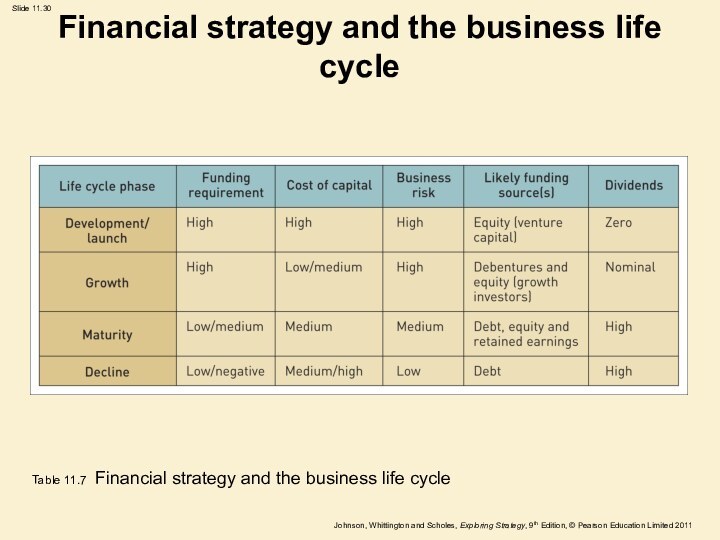

Financial strategy and the business life cycle

Table 11.7

Financial strategy and the business life cycle

Слайд 31

People and skills (1)

Three questions arise:

Do people

in the organisation currently have the competences to deliver

a proposed strategy?

Are the systems to support those people fit for the strategy?

If not, can the competences be obtained or developed?

Слайд 32

People and skills (2)

Critical issues that need to

be considered:

Work organisation – will this need to change?

Rewards

– are the incentives appropriate?

Relationships – will people interact differently?

Training and development – are current systems appropriate?

Staffing – are the levels and skills of the staff appropriate?

Слайд 33

Integrating resources

The success of a strategy depends on

the management of many resource areas, for example:

people,

finance,

physical

resources,

information,

technology and

resources provided by suppliers and partners.

It is essential to integrate resources – inside the organisation and in the wider value network.

Слайд 34

Evaluation criteria

Four qualifications:

Conflicting conclusions and the need for

management judgement.

Consistency between the different elements of a strategy

is essential.

The implementation and development of strategies might reveal unanticipated problems.

Strategy development in practice – it isn’t always a logical or even rational process.