Court of Justice: http://curia.europa.eu

European General Court: http://curia.europa.eu

Directory

of EU Law: http://europa.eu/index_en.htm Internet Resources

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

Internet Resources

Mission of the European Commission on competition issues

Phases of EU Competition Policy development

Evolution of EU Competition Law and Policy

Introduction

Pillars of the EU Competition Policy

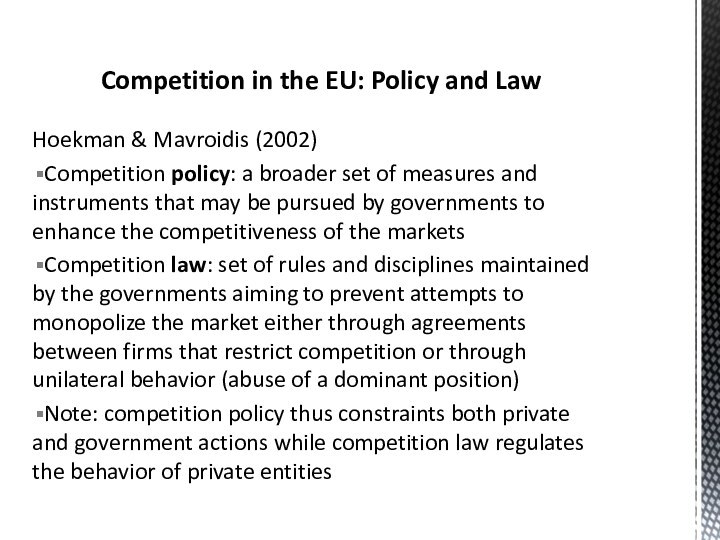

Competition in the EU: Policy and Law

Trade Policy & Competition Policy

Objectives of EU Competition Policy and Law

Summary of EU Competition Law Concepts

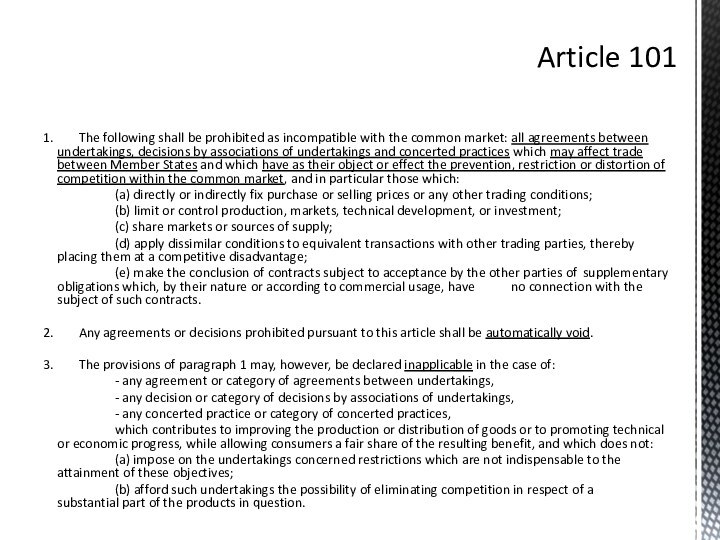

Article 101

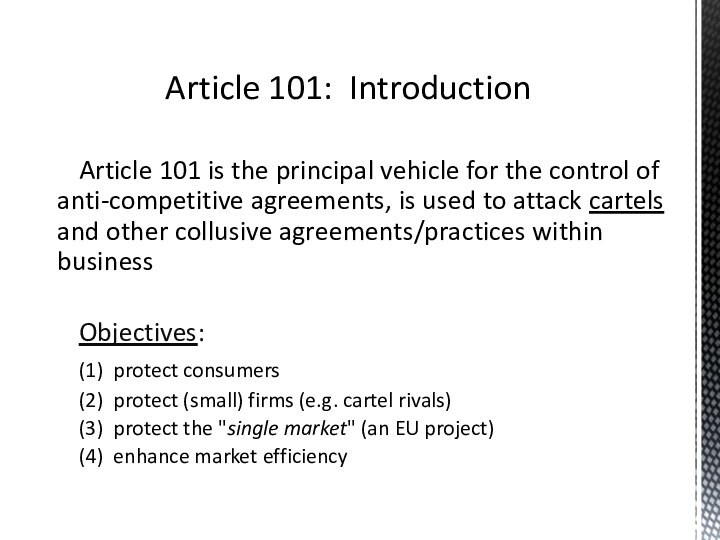

Article 101: Introduction

Article 101: General Scheme

Article 101: key features

Article 101: Key Terminology

Article 101: Effect on Trade

Article 101 (1): the de minimis doctrine

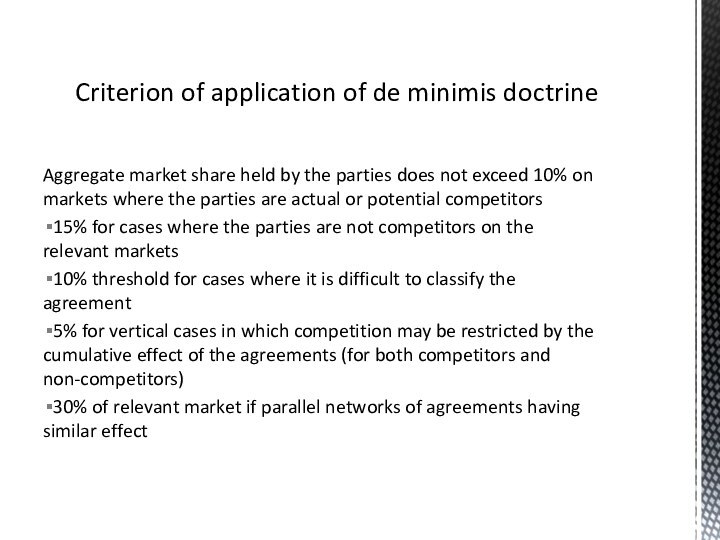

Criterion of application of de minimis doctrine

Article 101: Anti-Competitive Acts

Article 101: Rule of Reason

Article 101: Exemptions

Article 101: Block Exemptions

Article 101: Area of application of block exemptions

Article 101: Area of application of block exemptions

Article 101: Area of application of block exemptions

Article 101: Area of Application of Block Exemptions

Article 101: The Black List

Article 102

Article 102: Introduction

Article 102: General Scheme

Article 102: Steps

Article 102: Relevant Product Market

Article 102: Relevant Geographic Market

Article 102: The Temporal Factor

Article 102: Relevant Market (cont.)

Article 102: Relevant Market – Commission’s Approach

Article 102: Dominance Principle

Article 102: Dominant Position = Market Power

Article 102: Evidence of Market Power

Article 102: Evidence of Market Power – Market Share

Article 102: Evidence of Market Power – Other Factors

Article 102: Evidence of Market Power – Other Factors: Examples

Article 102: Joint Dominance vs Single Firm Dominance

Article 102: Anti-Competitive Acts

Article 102: Abuse

Article 102: Abuse – Problems with Interpretation

Article 102: Abuse – Particular Examples

Article 102: Effect on Trade