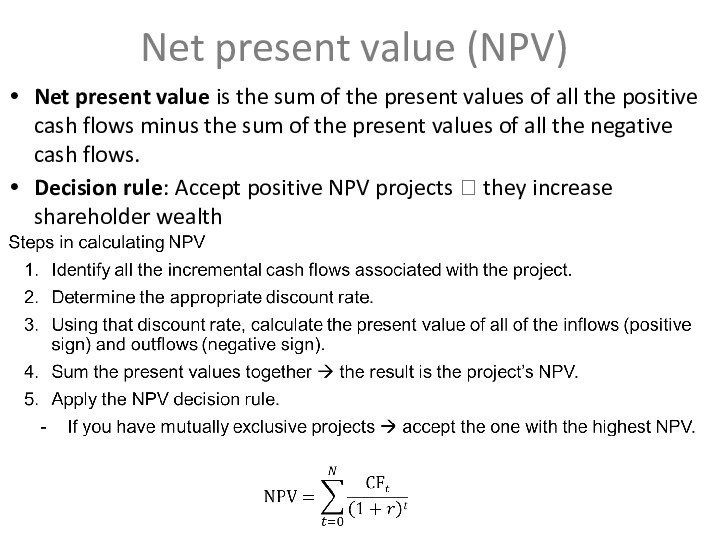

sum of the present values of all the positive

cash flows minus the sum of the present values of all the negative cash flows.Decision rule: Accept positive NPV projects ? they increase shareholder wealth

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

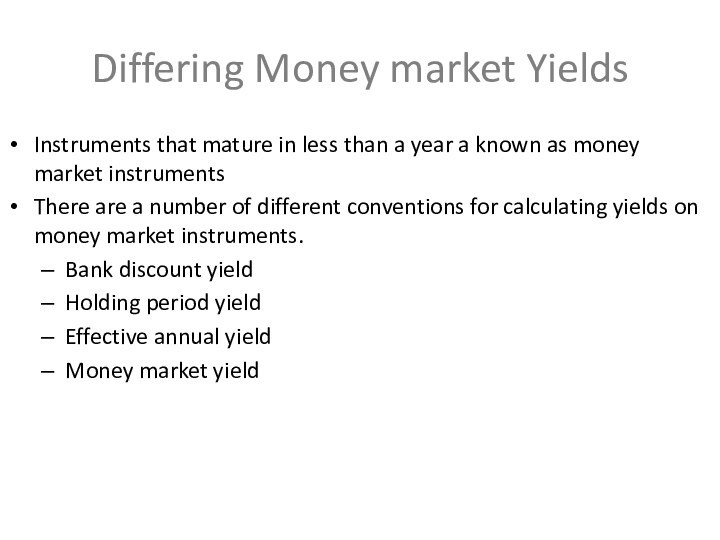

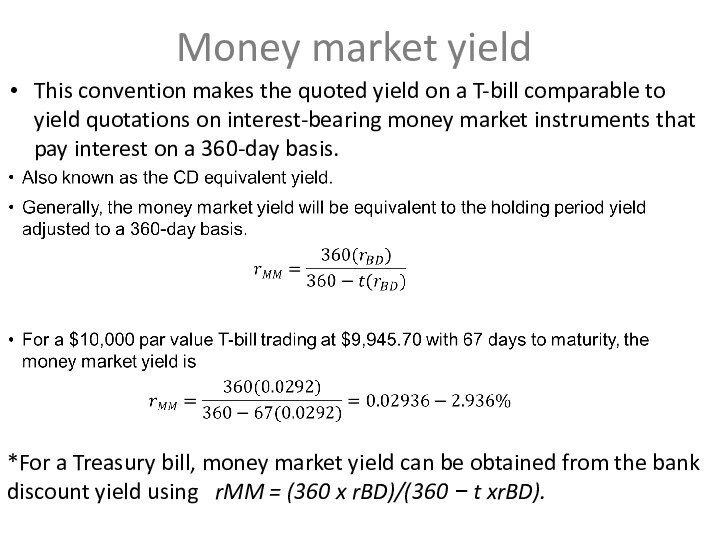

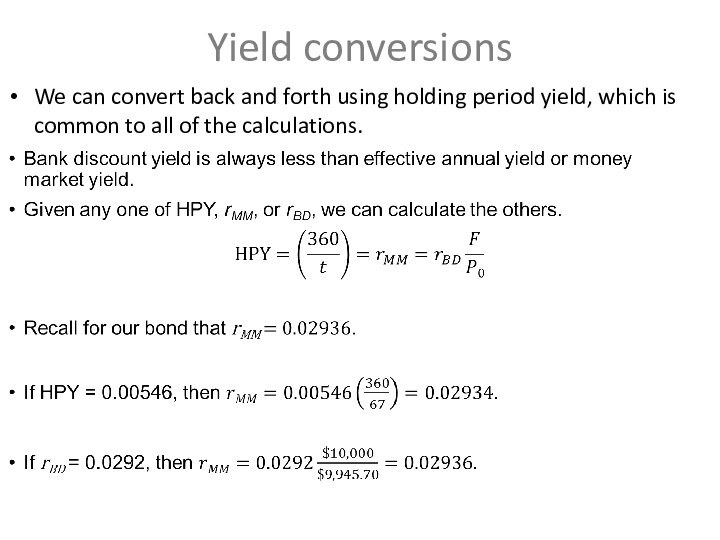

*For a Treasury bill, money market yield can be obtained from the bank discount yield using rMM = (360 x rBD)/(360 − t xrBD).