decisions include:

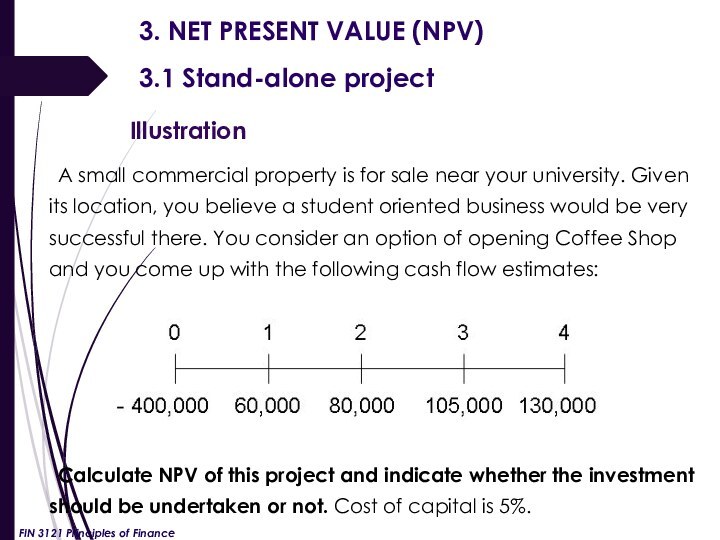

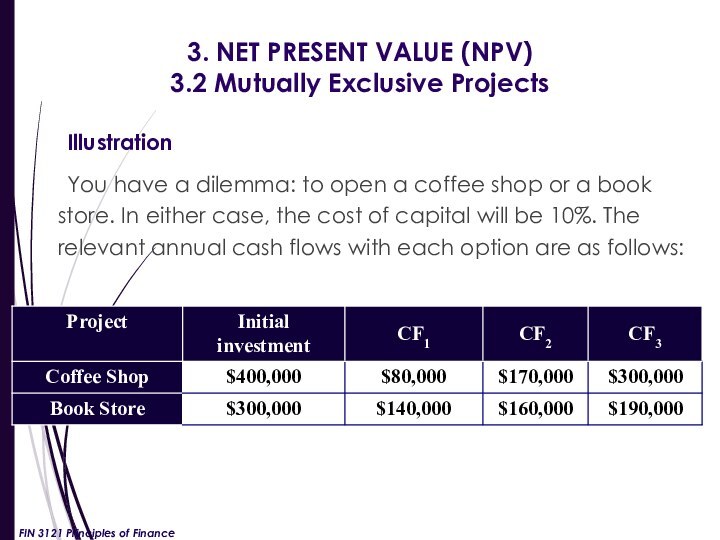

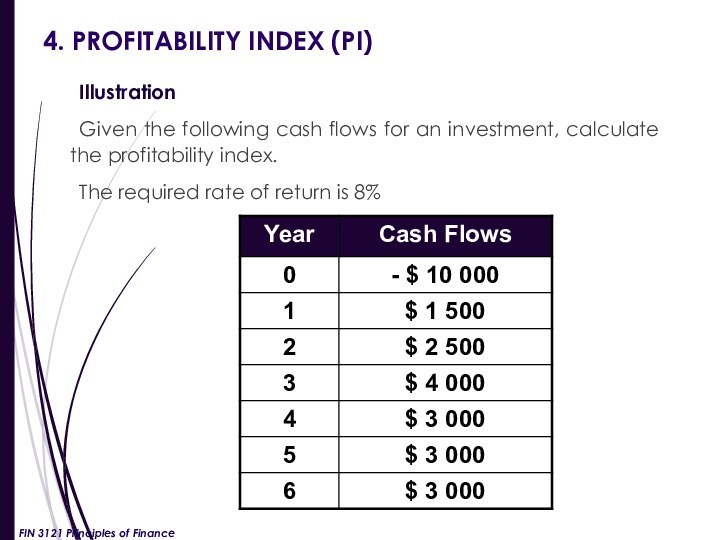

Typically, a go or no-go decision on a

product, service, facility, or activity of the firm. Requires sound estimates of the timing and amount of cash flow for the proposal.

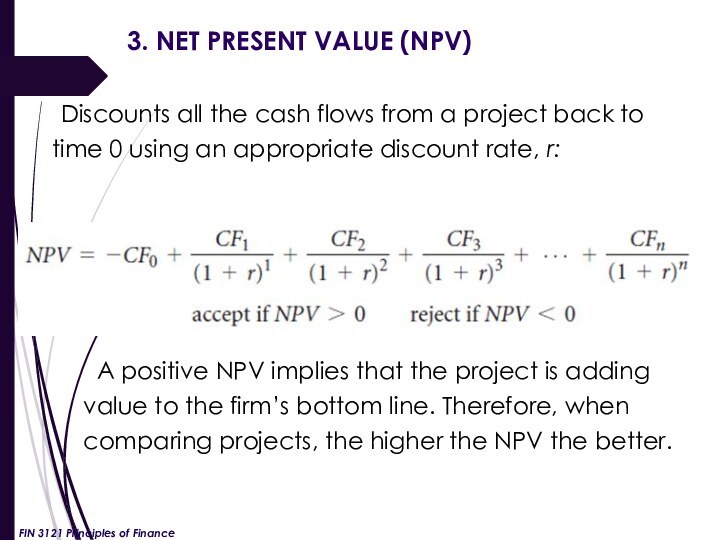

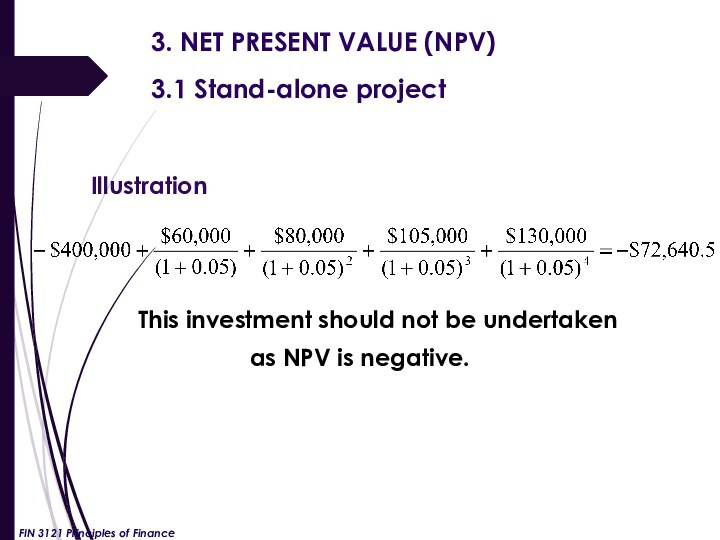

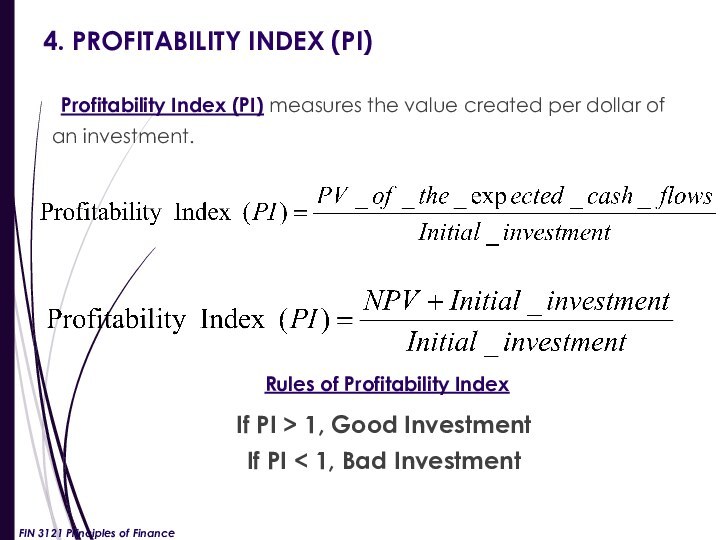

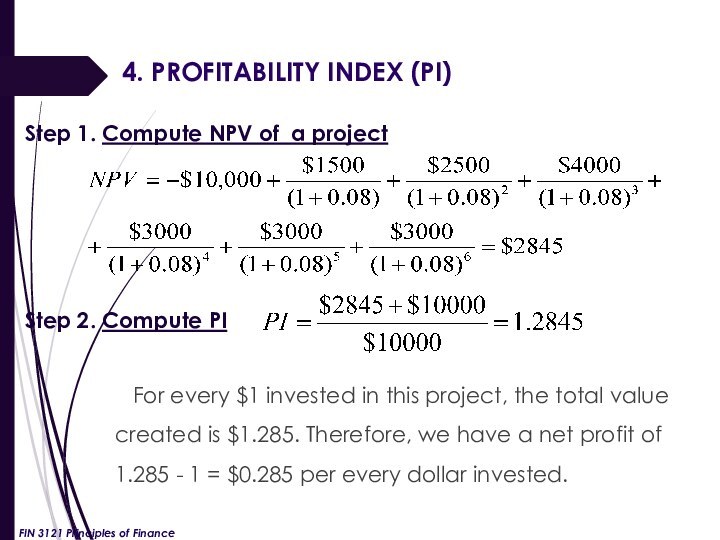

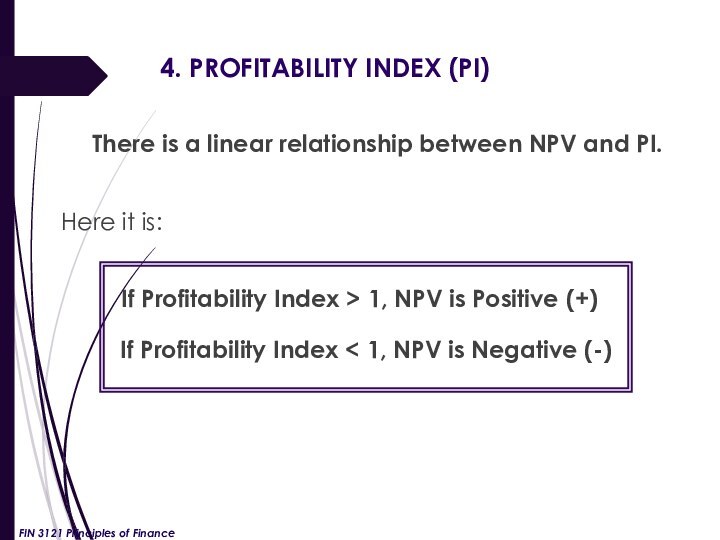

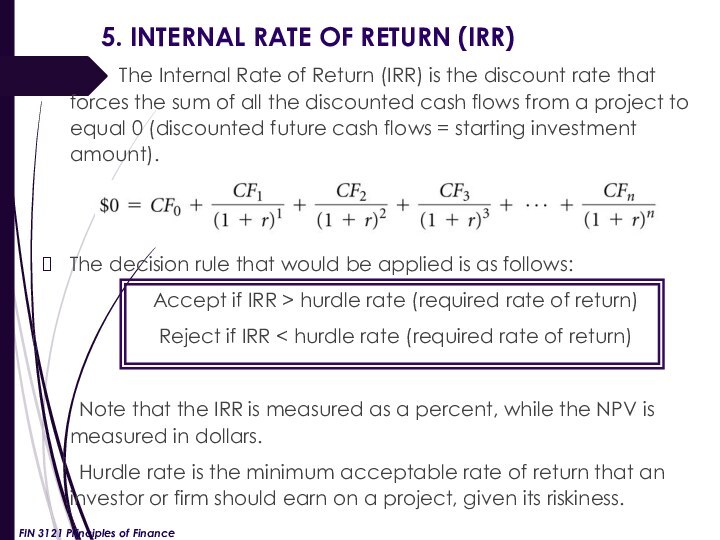

The capital budgeting model has a predetermined accept or reject criterion.

FIN 3121 Principles of Finance