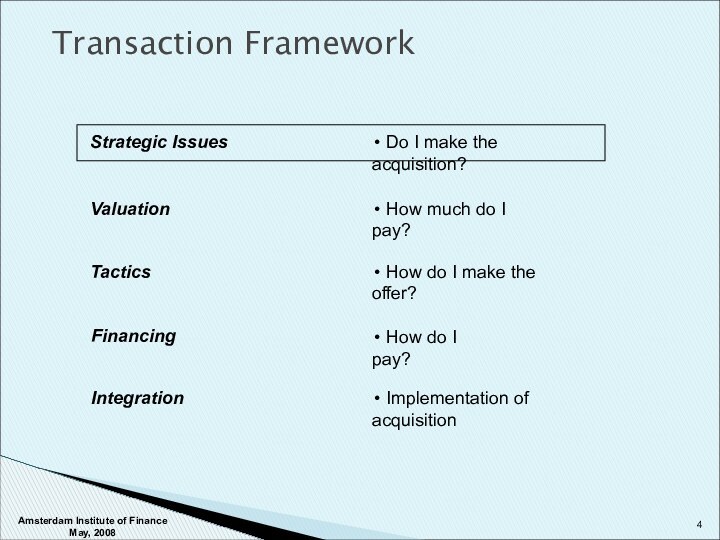

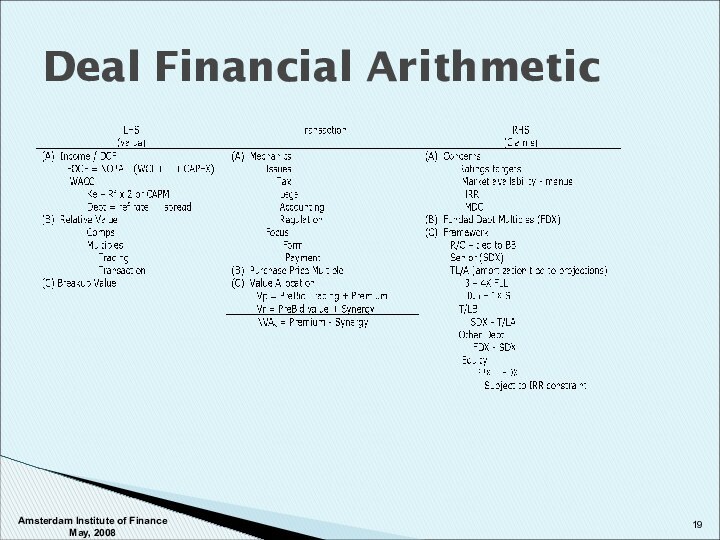

How much do I pay?

Financing

How do I pay?

Integration

Implementation of acquisitionTactics

How do I make the offer?

Amsterdam Institute of Finance May, 2008

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

Tactics

How do I make the offer?

Amsterdam Institute of Finance May, 2008

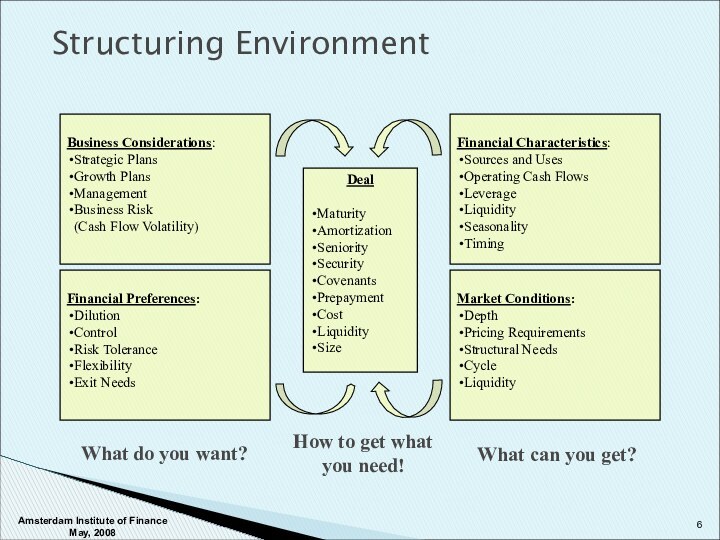

Deal

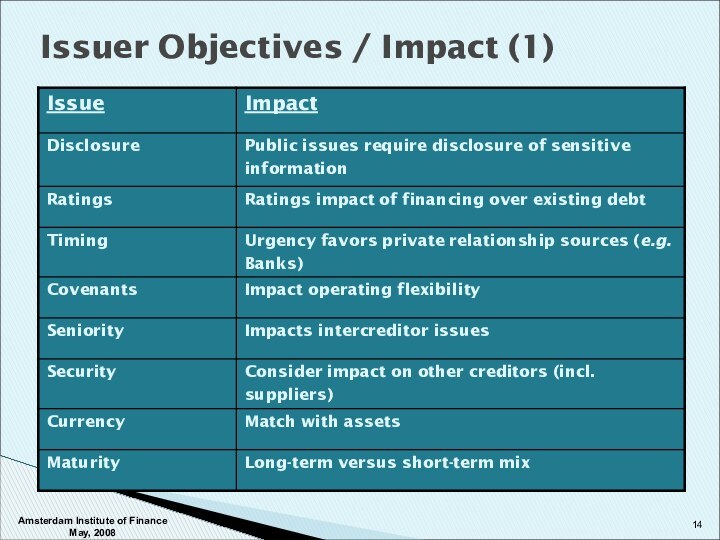

Maturity

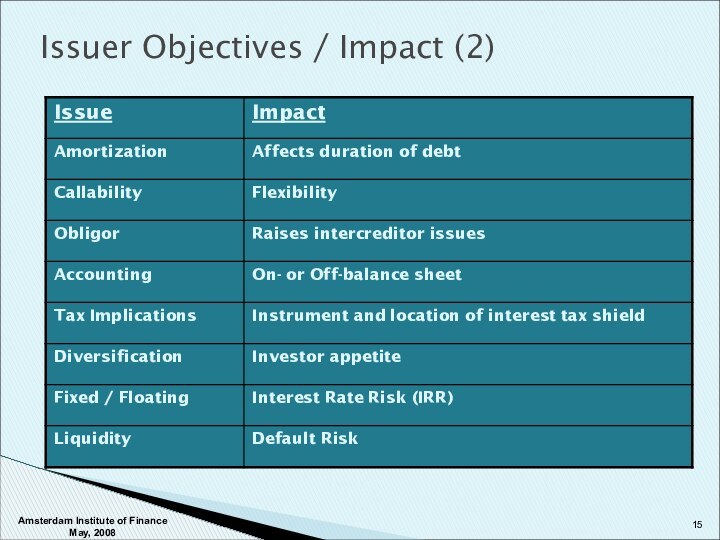

Amortization

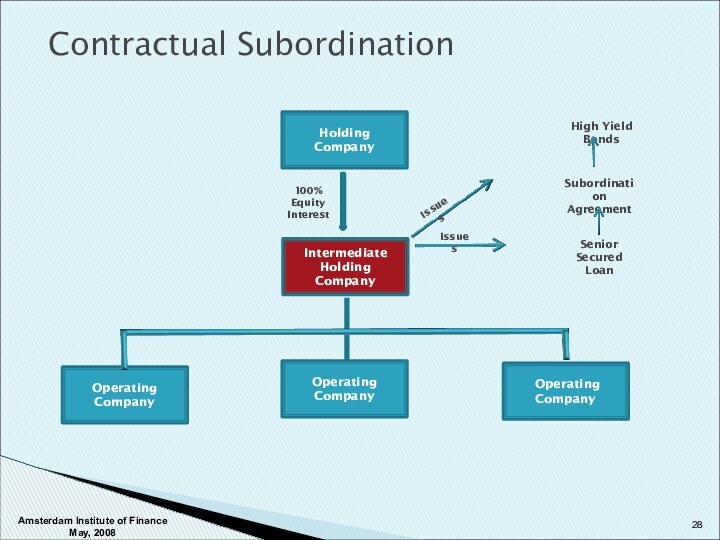

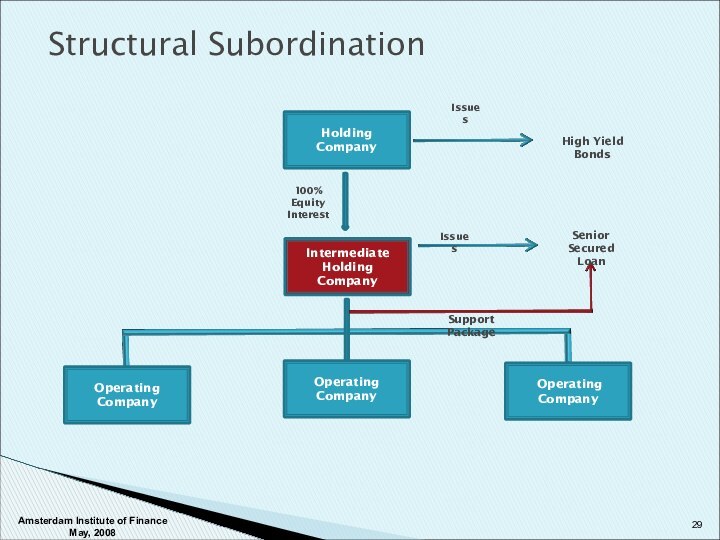

Seniority

Security

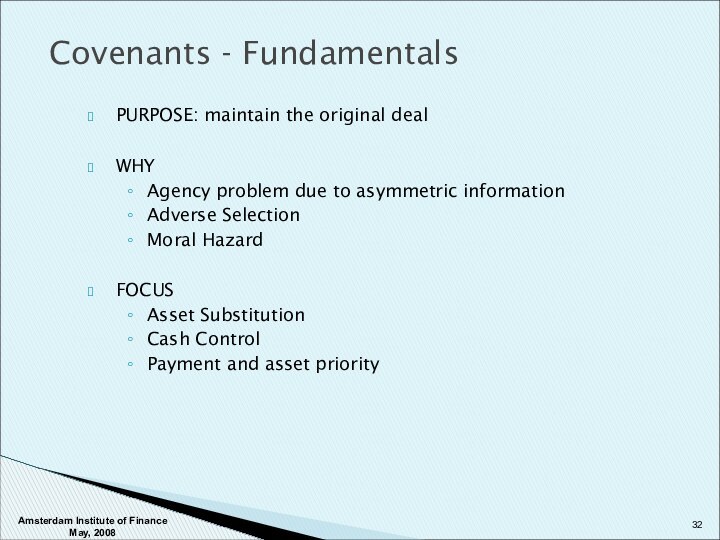

Covenants

Prepayment

Cost

Liquidity

Size

What do you want?

How to get what

you need!

What can you get?

Amsterdam Institute of Finance May, 2008

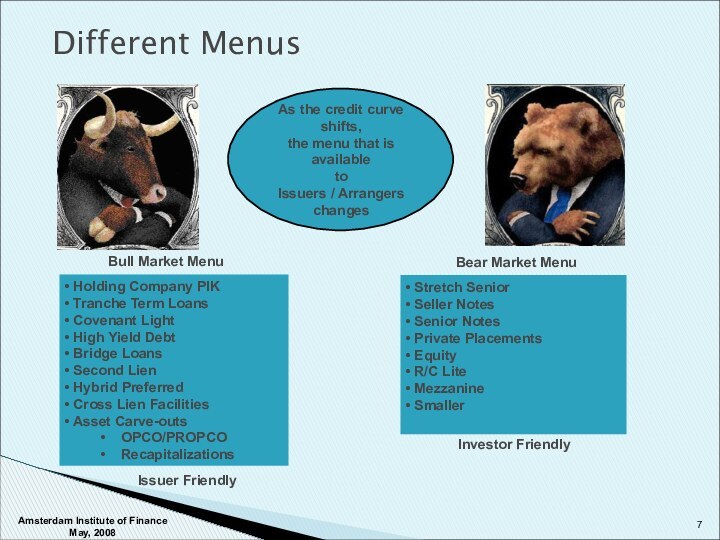

Holding Company PIK

Tranche Term Loans

Covenant Light

High Yield Debt

Bridge Loans

Second Lien

Hybrid Preferred

Cross Lien Facilities

Asset Carve-outs

OPCO/PROPCO

Recapitalizations

Stretch Senior

Seller Notes

Senior Notes

Private Placements

Equity

R/C Lite

Mezzanine

Smaller

Issuer Friendly

Investor Friendly

Amsterdam Institute of Finance May, 2008

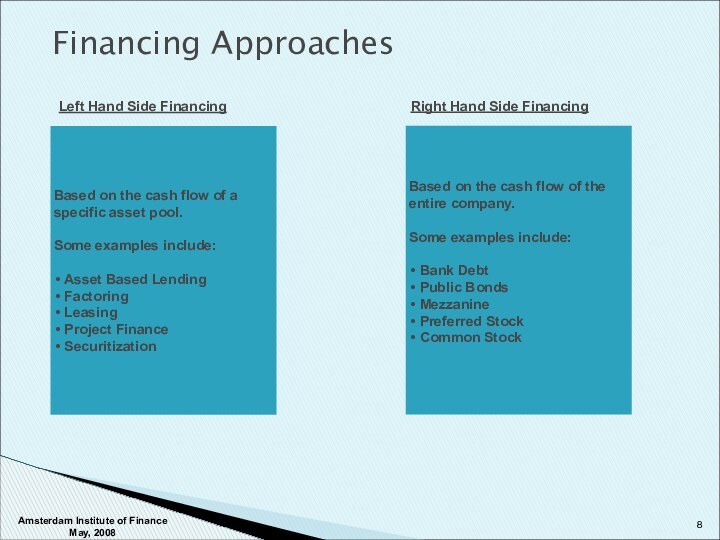

Based on the cash flow of the entire company.

Some examples include:

Bank Debt

Public Bonds

Mezzanine

Preferred Stock

Common Stock

Amsterdam Institute of Finance May, 2008

Structuring Issues

Amsterdam Institute of Finance May, 2008

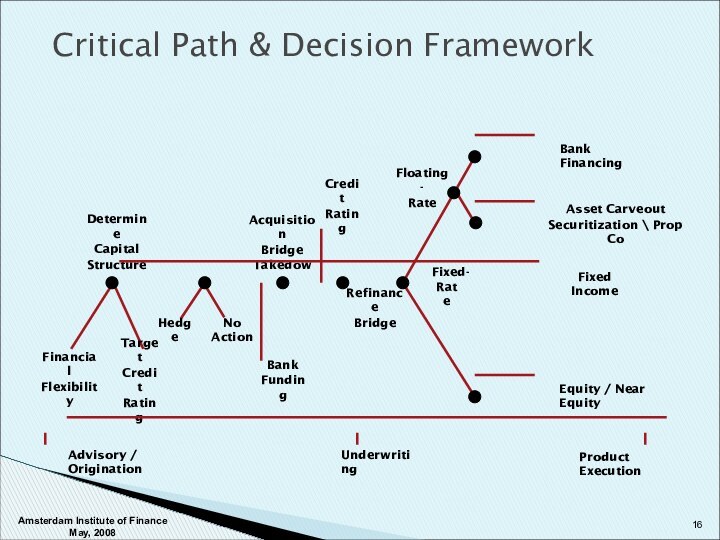

Underwriting

Product Execution

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Structuring Framework

Senior Secured

First Lien

Amsterdam Institute of Finance May, 2008

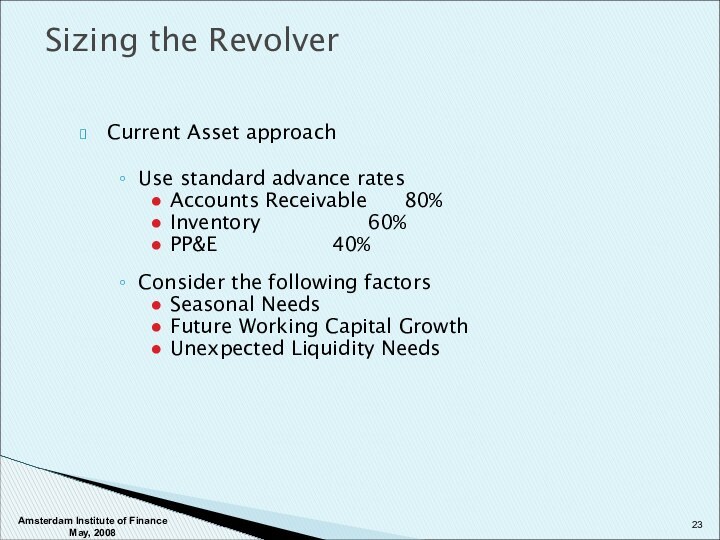

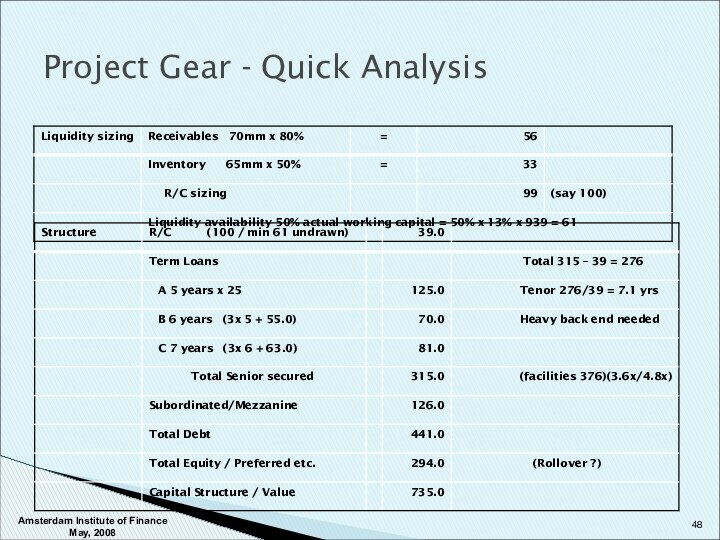

Sizing the Revolver

Amsterdam Institute of Finance May, 2008

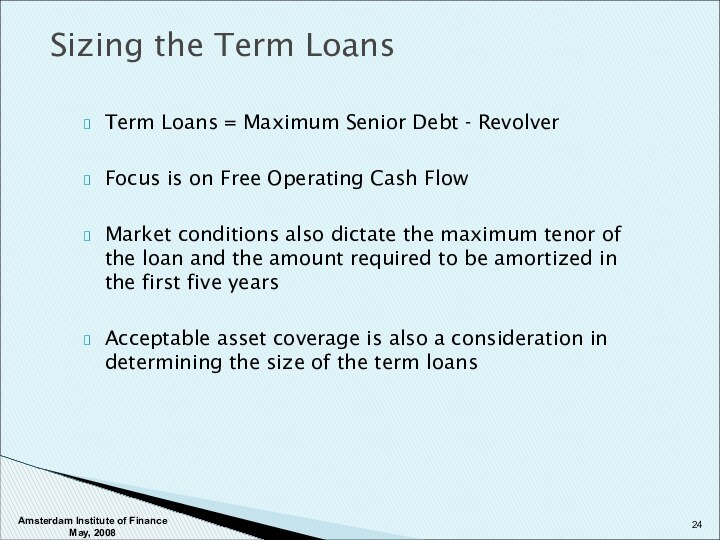

Sizing the Term Loans

Amsterdam Institute of Finance May, 2008

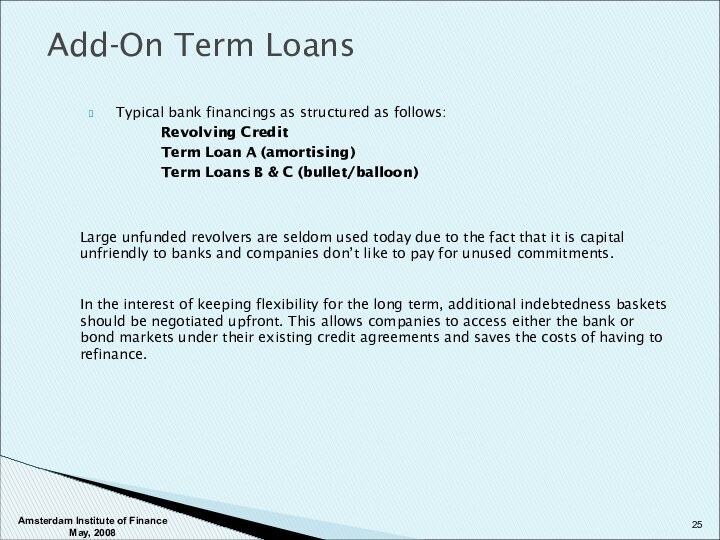

Large unfunded revolvers are seldom used today due to the fact that it is capital unfriendly to banks and companies don’t like to pay for unused commitments.

In the interest of keeping flexibility for the long term, additional indebtedness baskets should be negotiated upfront. This allows companies to access either the bank or bond markets under their existing credit agreements and saves the costs of having to refinance.

Amsterdam Institute of Finance May, 2008

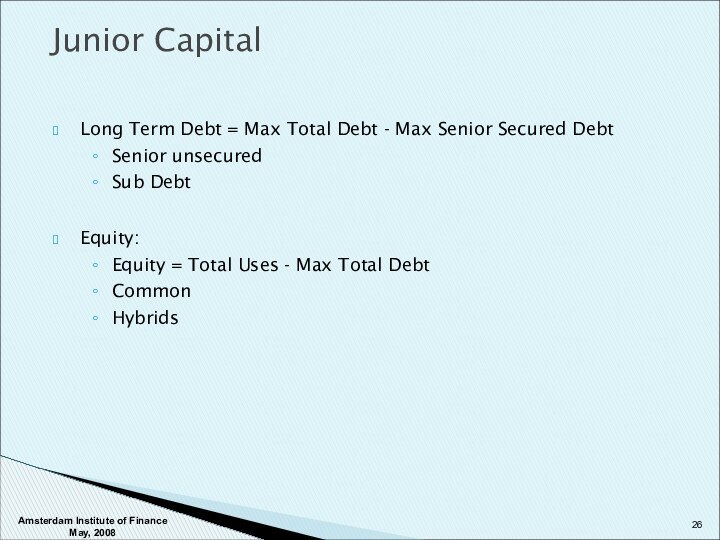

Junior Capital

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

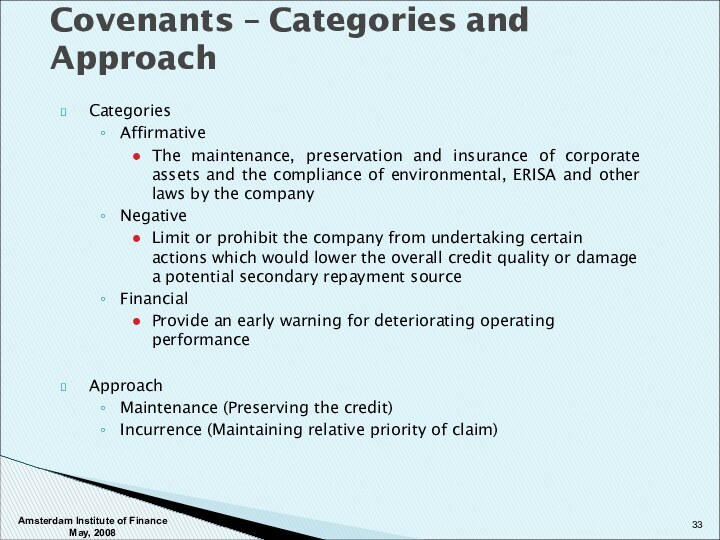

Covenants – Categories and Approach

Amsterdam Institute of Finance May, 2008

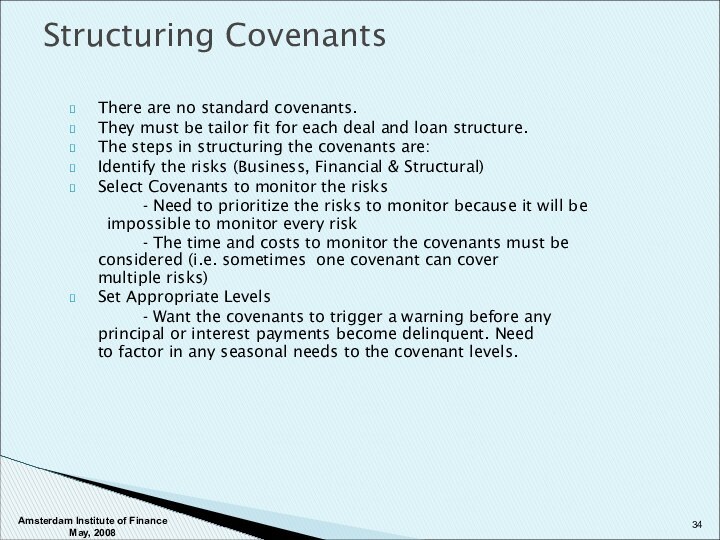

Structuring Covenants

Amsterdam Institute of Finance May, 2008

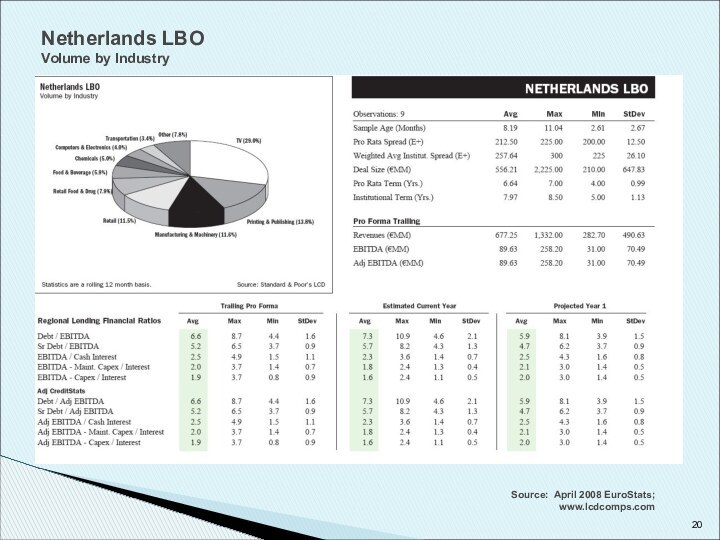

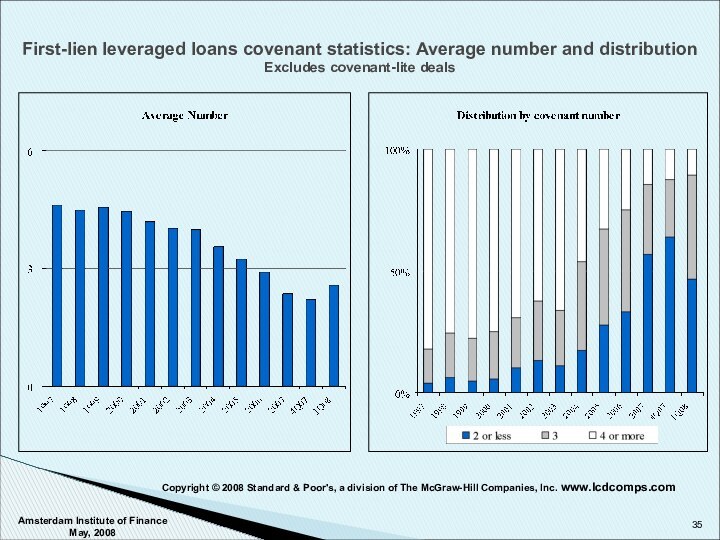

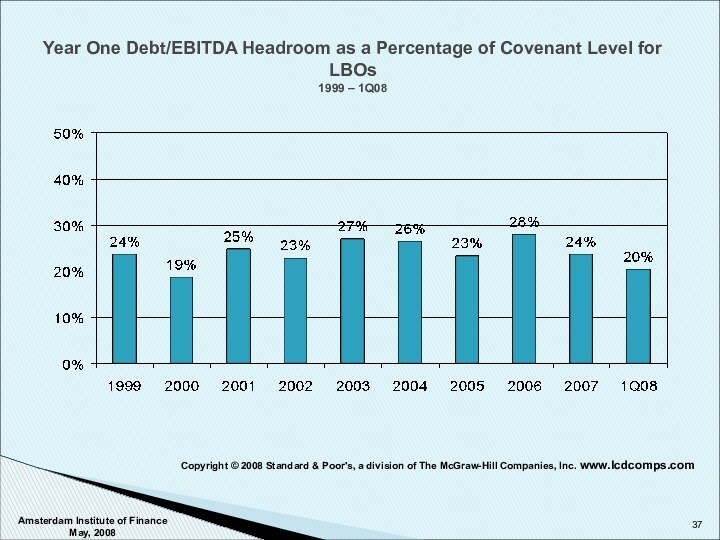

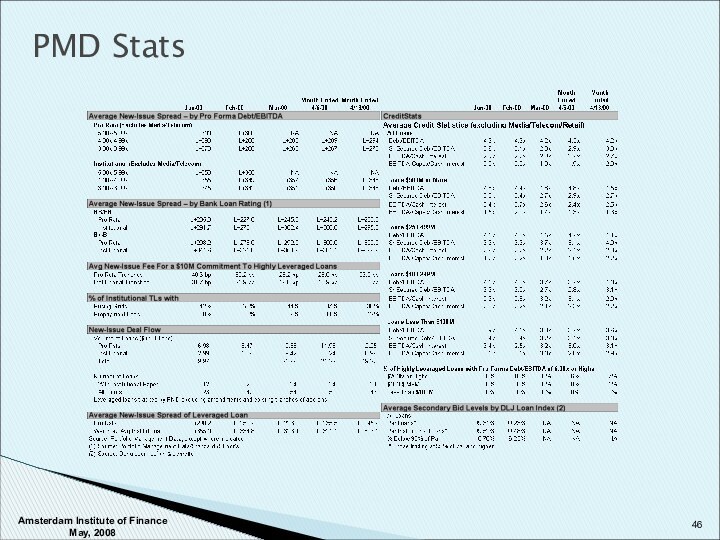

Copyright © 2008 Standard & Poor's, a division of The McGraw-Hill Companies, Inc. www.lcdcomps.com

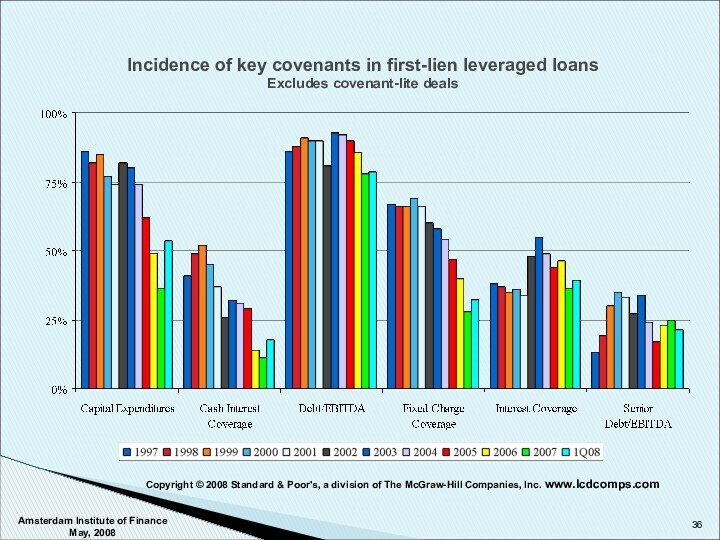

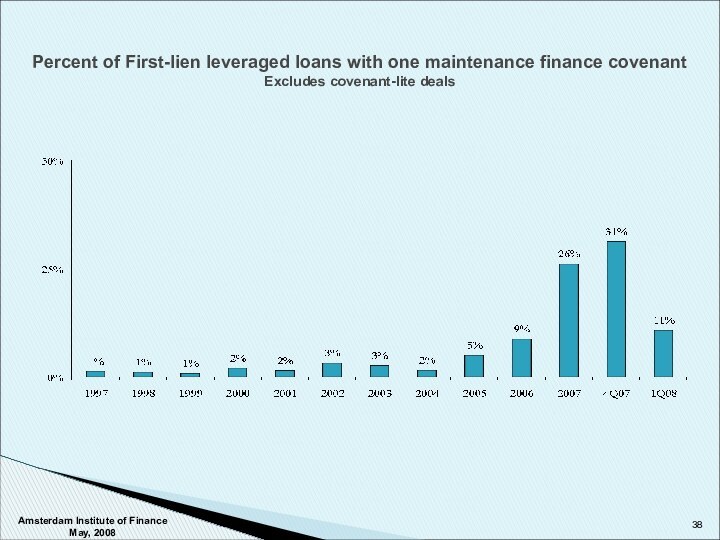

Copyright © 2008 Standard & Poor's, a division of The McGraw-Hill Companies, Inc. www.lcdcomps.com

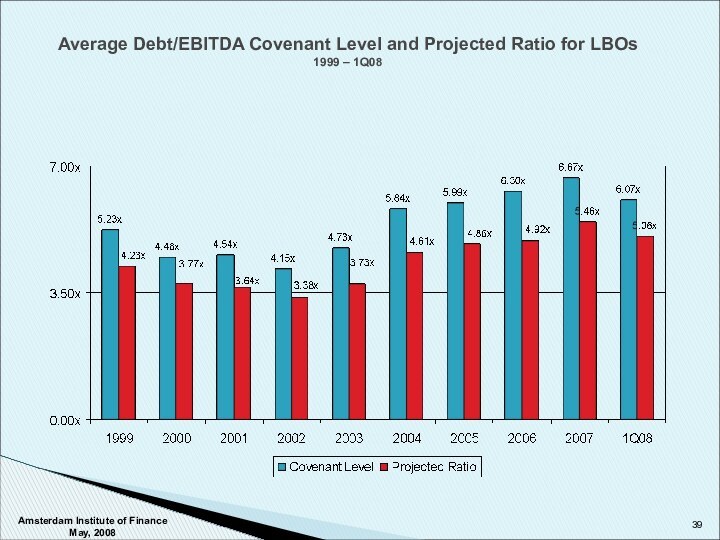

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008

Amsterdam Institute of Finance May, 2008