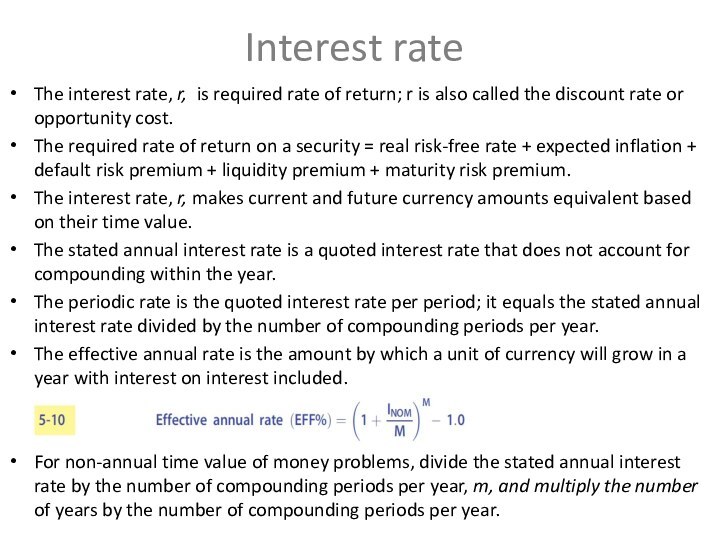

of return; r is also called the discount rate

or opportunity cost.The required rate of return on a security = real risk-free rate + expected inflation + default risk premium + liquidity premium + maturity risk premium.

The interest rate, r, makes current and future currency amounts equivalent based on their time value.

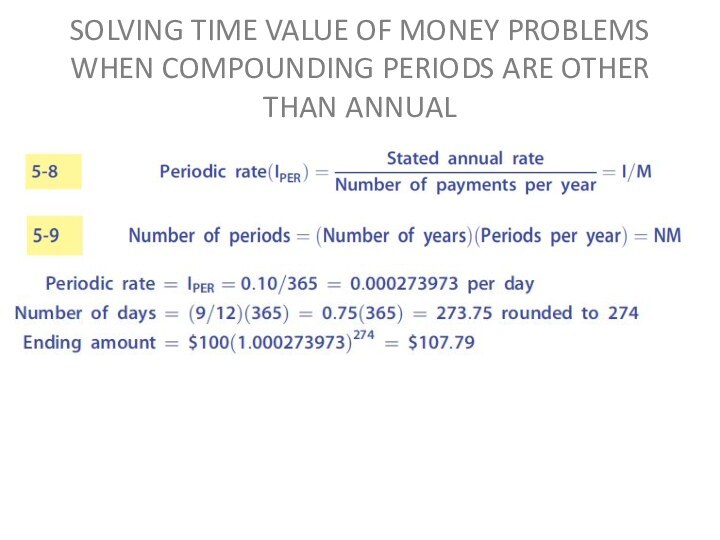

The stated annual interest rate is a quoted interest rate that does not account for compounding within the year.

The periodic rate is the quoted interest rate per period; it equals the stated annual interest rate divided by the number of compounding periods per year.

The effective annual rate is the amount by which a unit of currency will grow in a year with interest on interest included.

For non-annual time value of money problems, divide the stated annual interest rate by the number of compounding periods per year, m, and multiply the number of years by the number of compounding periods per year.