Слайд 2

Chapter Outline

8.1 Decision Trees

8.2 Sensitivity Analysis, Scenario Analysis,

and

Break-Even

Analysis

8.3 Monte Carlo Simulation

8.4 Options

8.5 Summary and Conclusions

Слайд 3

8.1 Decision Trees

Allow us to graphically represent the

alternatives available to us in each period and the

likely consequences of our actions.

This graphical representation helps to identify the best course of action.

Слайд 4

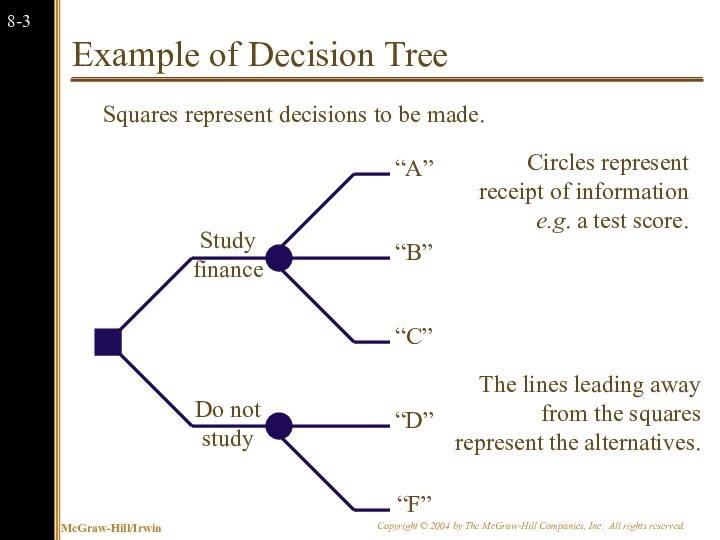

Example of Decision Tree

Do not study

Study finance

Squares represent

decisions to be made.

Circles represent receipt of information e.g.

a test score.

The lines leading away from the squares represent the alternatives.

Слайд 5

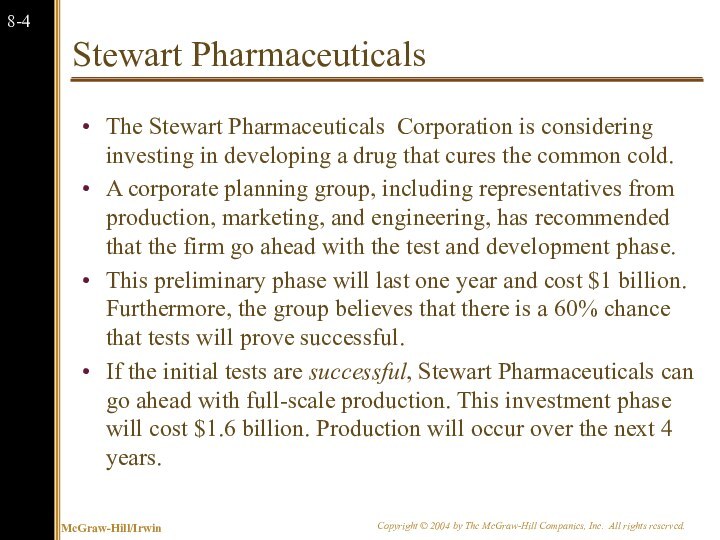

Stewart Pharmaceuticals

The Stewart Pharmaceuticals Corporation is considering

investing in developing a drug that cures the common

cold.

A corporate planning group, including representatives from production, marketing, and engineering, has recommended that the firm go ahead with the test and development phase.

This preliminary phase will last one year and cost $1 billion. Furthermore, the group believes that there is a 60% chance that tests will prove successful.

If the initial tests are successful, Stewart Pharmaceuticals can go ahead with full-scale production. This investment phase will cost $1.6 billion. Production will occur over the next 4 years.

Слайд 6

Stewart Pharmaceuticals NPV of Full-Scale Production following Successful

Test

Note that the NPV is calculated as of date

1, the date at which the investment of $1,600 million is made. Later we bring this number back to date 0.

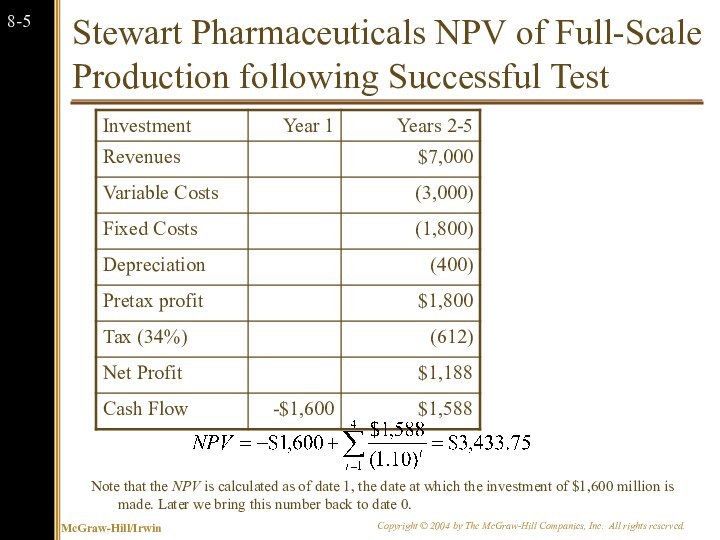

Слайд 7

Stewart Pharmaceuticals NPV of Full-Scale Production following Unsuccessful

Test

Note that the NPV is calculated as of date

1, the date at which the investment of $1,600 million is made. Later we bring this number back to date 0.

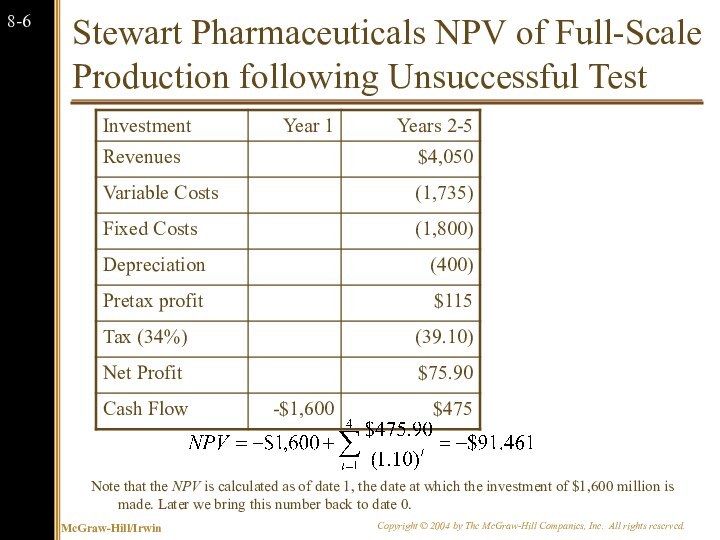

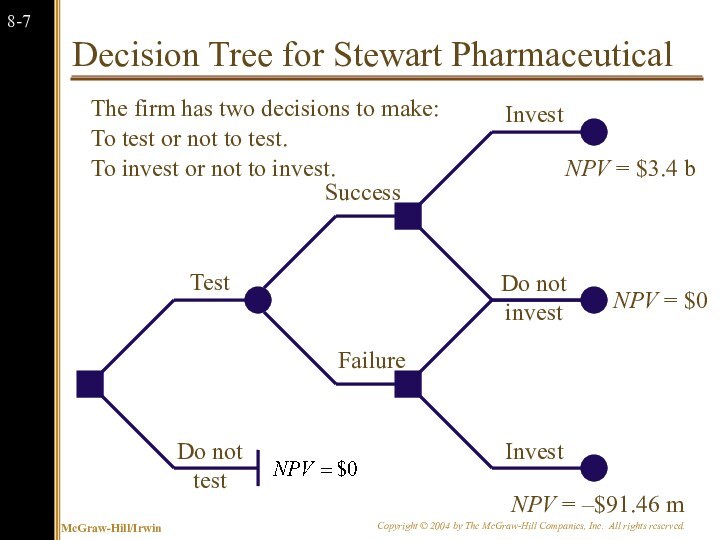

Слайд 8

Decision Tree for Stewart Pharmaceutical

Do not test

Test

Failure

Success

Do not

invest

Invest

The firm has two decisions to make:

To test or

not to test.

To invest or not to invest.

NPV = $3.4 b

NPV = $0

NPV = –$91.46 m

Слайд 9

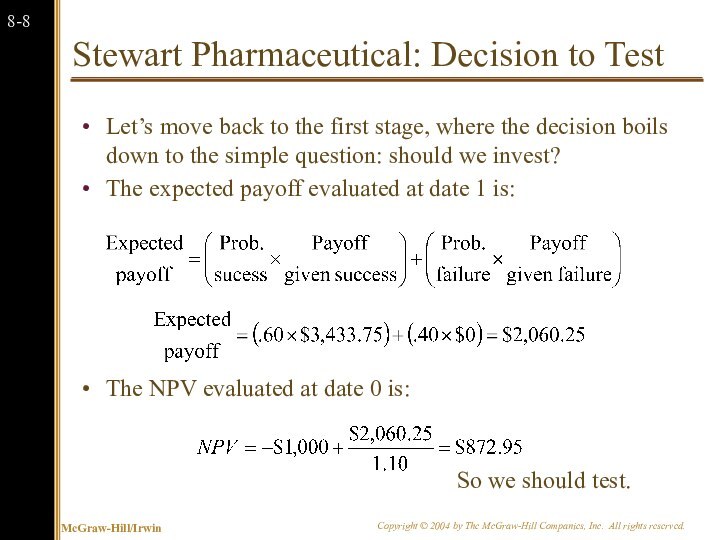

Stewart Pharmaceutical: Decision to Test

Let’s move back to

the first stage, where the decision boils down to

the simple question: should we invest?

The expected payoff evaluated at date 1 is:

The NPV evaluated at date 0 is:

So we should test.

Слайд 10

8.3 Sensitivity Analysis, Scenario Analysis, and Break-Even Analysis

Allows

us to look the behind the NPV number to

see firm our estimates are.

When working with spreadsheets, try to build your model so that you can just adjust variables in one cell and have the NPV calculations key to that.

Слайд 11

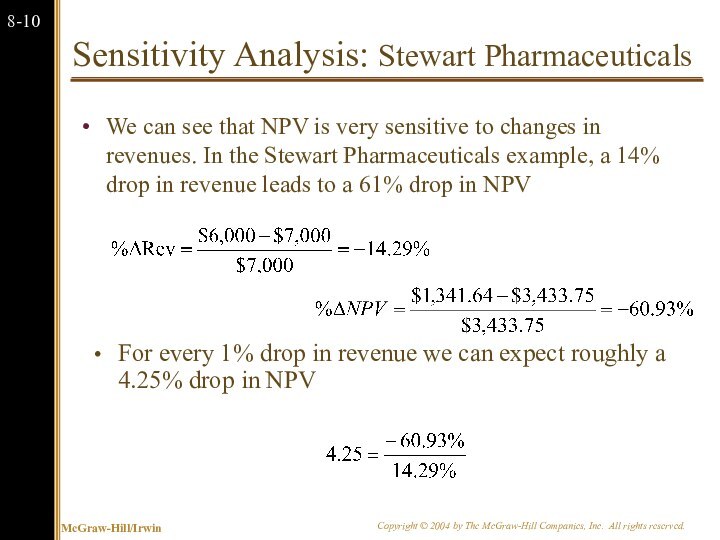

Sensitivity Analysis: Stewart Pharmaceuticals

We can see that

NPV is very sensitive to changes in revenues. In

the Stewart Pharmaceuticals example, a 14% drop in revenue leads to a 61% drop in NPV

For every 1% drop in revenue we can expect roughly a 4.25% drop in NPV

Слайд 12

Scenario Analysis: Stewart Pharmaceuticals

A variation on sensitivity

analysis is scenario analysis.

For example, the following three scenarios

could apply to Stewart Pharmaceuticals:

The next years each have heavy cold seasons, and sales exceed expectations, but labor costs skyrocket.

The next years are normal and sales meet expectations.

The next years each have lighter than normal cold seasons, so sales fail to meet expectations.

Other scenarios could apply to FDA approval for their drug.

For each scenario, calculate the NPV.

Слайд 13

Break-Even Analysis: Stewart Pharmaceuticals

Another way to examine

variability in our forecasts is break-even analysis.

In the Stewart

Pharmaceuticals example, we could be concerned with break-even revenue, break-even sales volume or break-even price.

To find either, we start with the break-even operating cash flow.

Слайд 14

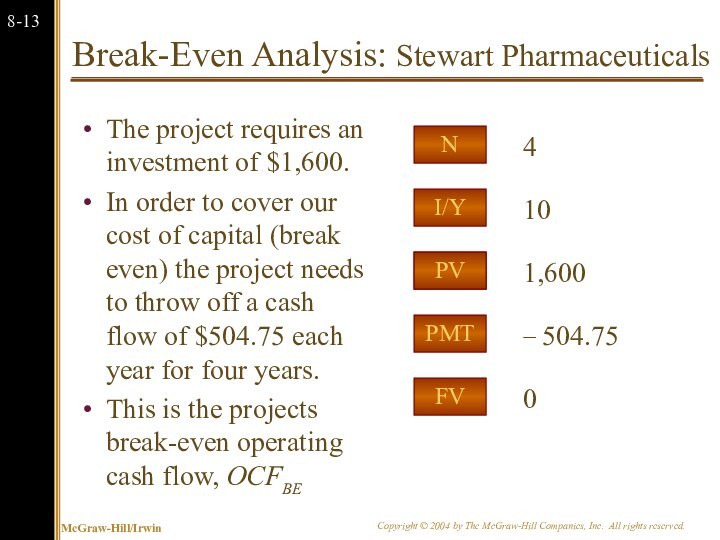

Break-Even Analysis: Stewart Pharmaceuticals

The project requires an investment

of $1,600.

In order to cover our cost of

capital (break even) the project needs to throw off a cash flow of $504.75 each year for four years.

This is the projects break-even operating cash flow, OCFBE

PMT

I/Y

FV

PV

N

− 504.75

10

0

1,600

4

PV

Слайд 15

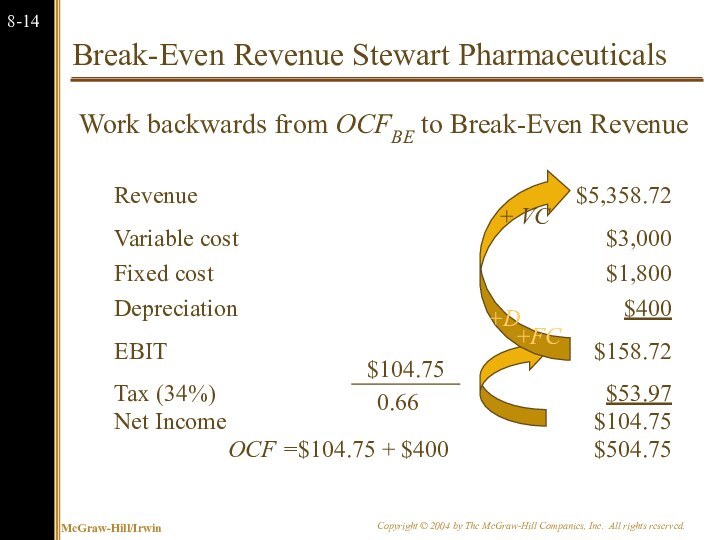

Break-Even Revenue Stewart Pharmaceuticals

Work backwards from OCFBE

to Break-Even Revenue

Revenue

$5,358.72

Variable cost

$3,000

Fixed cost

$1,800

Depreciation

$400

EBIT

$158.72

Tax (34%)

$53.97

Net Income

$104.75

OCF =

$104.75 + $400

$504.75

Слайд 16

Break-Even Analysis: PBE

Now that we have break-even revenue

as $5,358.72 million we can calculate break-even price.

The original

plan was to generate revenues of $7 billion by selling the cold cure at $10 per dose and selling 700 million doses per year,

We can reach break-even revenue with a price of only:

$5,358.72 million = 700 million × PBE

Слайд 17

Break-Even Analysis: Dorm Beds

Recall the “Dorm beds” example

from the previous chapter.

We could be concerned with break-even

revenue, break-even sales volume or break-even price.

Слайд 18

Dorm Beds Example

Consider a project to supply the

University of Missouri with 10,000 dormitory beds annually for

each of the next 3 years.

Your firm has half of the woodworking equipment to get the project started; it was bought years ago for $200,000: is fully depreciated and has a market value of $60,000. The remaining $100,000 worth of equipment will have to be purchased.

The engineering department estimates you will need an initial net working capital investment of $10,000.

Слайд 19

Dorm Beds Example

The project will last for 3

years. Annual fixed costs will be $25,000 and variable

costs should be $90 per bed.

The initial fixed investment will be depreciated straight line to zero over 3 years. It also estimates a (pre-tax) salvage value of $10,000 (for all of the equipment).

The marketing department estimates that the selling price will be $200 per bed.

You require an 8% return and face a marginal tax rate of 34%.

Слайд 20

Dorm Beds OCF0

What is the OCF in year

zero for this project?

Cost of New Equipment $100,000

Net Working Capital

Investment $10,000

Opportunity Cost of Old Equipment $39,600 = $60,000 × (1-.34)

$149,600

Слайд 21

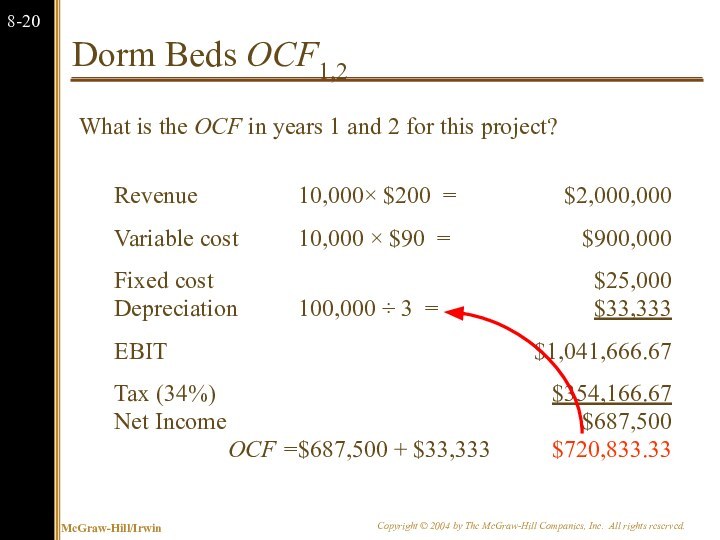

Dorm Beds OCF1,2

What is the OCF in years

1 and 2 for this project?

Revenue

10,000× $200 =

$2,000,000

Variable

cost

10,000 × $90 =

$900,000

Fixed cost

$25,000

Depreciation

100,000 ÷ 3 =

$33,333

EBIT

$1,041,666.67

Tax (34%)

$354,166.67

Net Income

$687,500

OCF =

$687,500 + $33,333

$720,833.33

Слайд 22

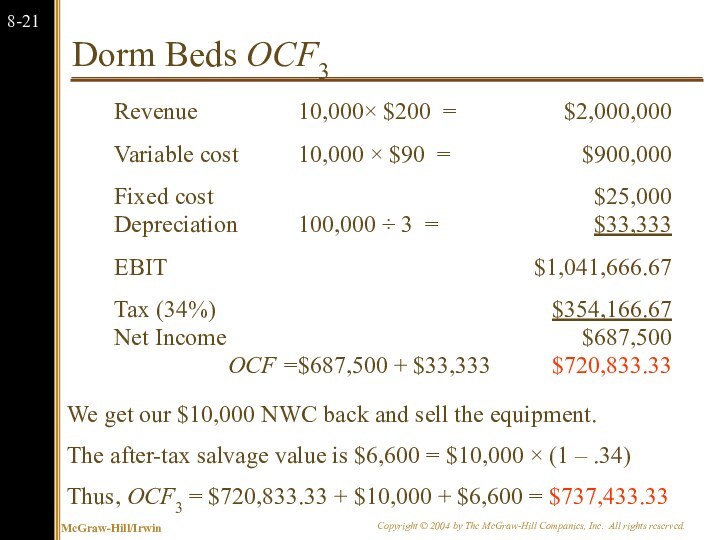

Dorm Beds OCF3

We get our $10,000 NWC back

and sell the equipment.

The after-tax salvage value is $6,600

= $10,000 × (1 – .34)

Thus, OCF3 = $720,833.33 + $10,000 + $6,600 = $737,433.33

Revenue

10,000× $200 =

$2,000,000

Variable cost

10,000 × $90 =

$900,000

Fixed cost

$25,000

Depreciation

100,000 ÷ 3 =

$33,333

EBIT

$1,041,666.67

Tax (34%)

$354,166.67

Net Income

$687,500

OCF =

$687,500 + $33,333

$720,833.33

Слайд 23

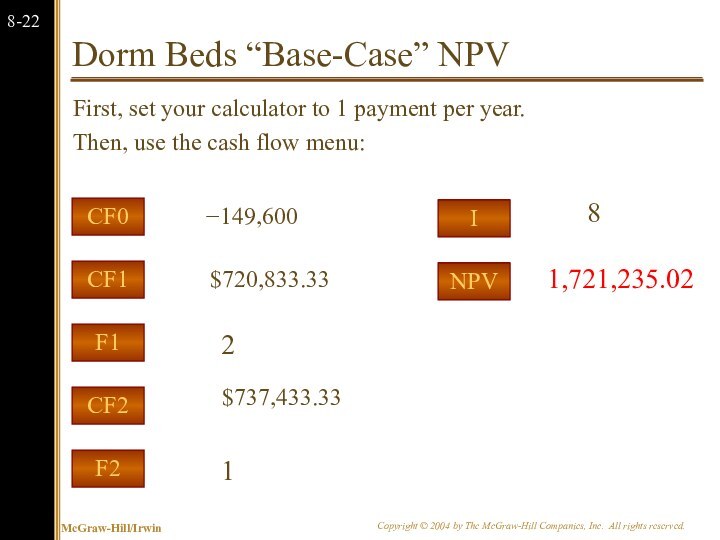

Dorm Beds “Base-Case” NPV

First, set your calculator to

1 payment per year.

Then, use the cash flow menu:

CF2

CF1

F2

F1

CF0

2

$720,833.33

1

1,721,235.02

−149,600

$737,433.33

I

NPV

8

Слайд 24

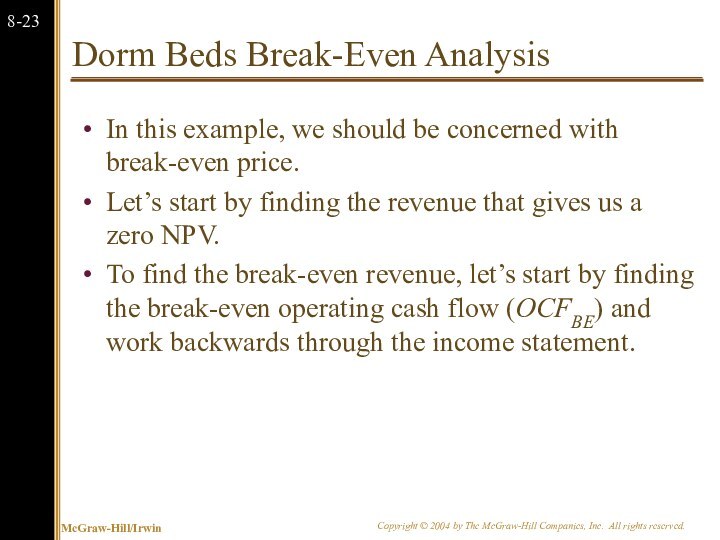

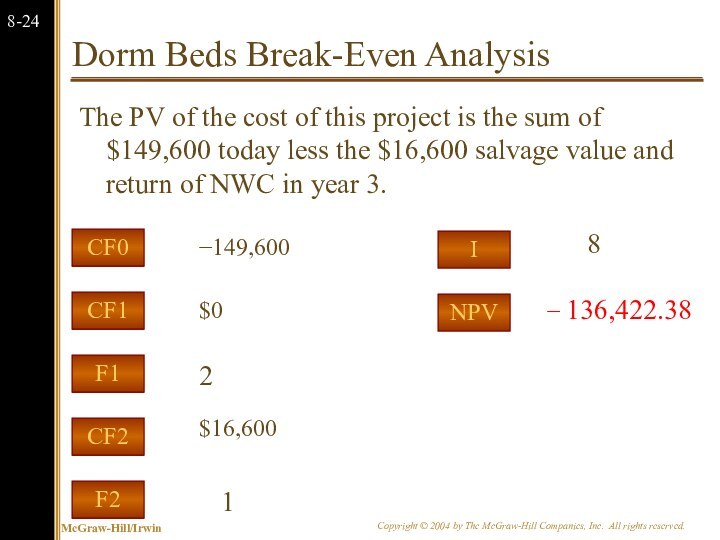

Dorm Beds Break-Even Analysis

In this example, we should

be concerned with break-even price.

Let’s start by finding the

revenue that gives us a zero NPV.

To find the break-even revenue, let’s start by finding the break-even operating cash flow (OCFBE) and work backwards through the income statement.

Слайд 25

Dorm Beds Break-Even Analysis

The PV of the cost

of this project is the sum of $149,600 today

less the $16,600 salvage value and return of NWC in year 3.

CF2

CF1

F2

F1

CF0

2

$0

1

− 136,422.38

−149,600

$16,600

I

NPV

8

Слайд 26

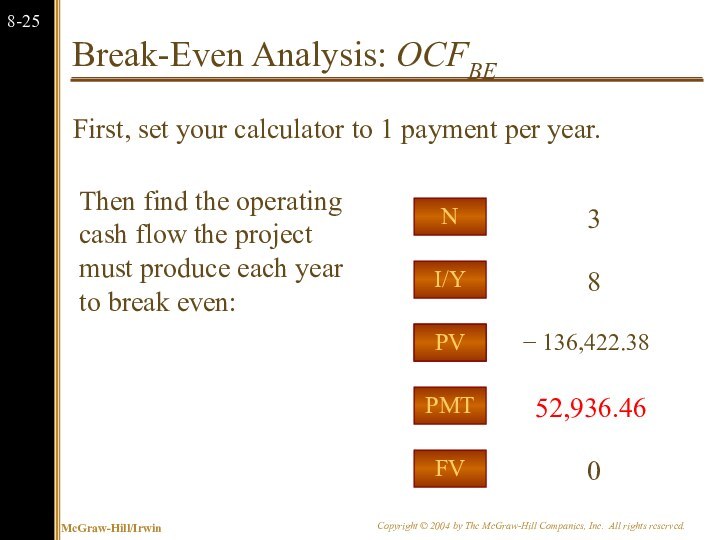

Break-Even Analysis: OCFBE

First, set your calculator to 1

payment per year.

PMT

I/Y

FV

PV

N

52,936.46

8

0

− 136,422.38

3

PV

Then find the operating cash

flow the project must produce each year to break even:

Слайд 27

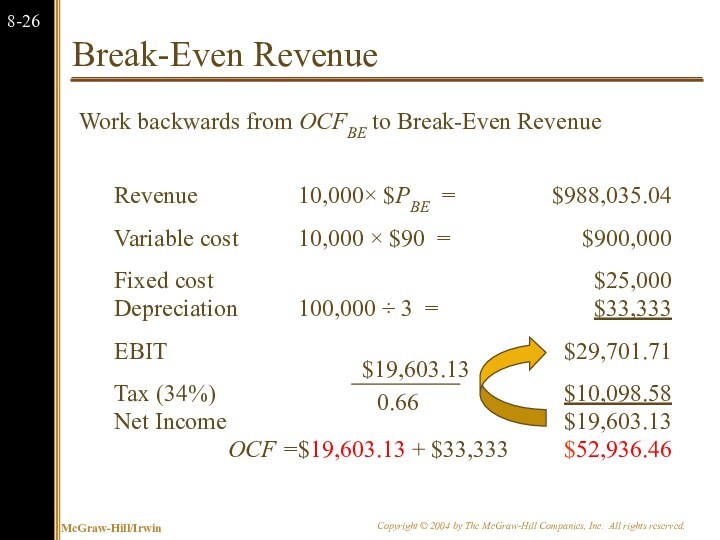

Break-Even Revenue

Work backwards from OCFBE to Break-Even Revenue

Revenue

10,000×

$PBE =

$988,035.04

Variable cost

10,000 × $90 =

$900,000

Fixed cost

$25,000

Depreciation

100,000

÷ 3 =

$33,333

EBIT

$29,701.71

Tax (34%)

$10,098.58

Net Income

$19,603.13

OCF =

$19,603.13 + $33,333

$52,936.46

Слайд 28

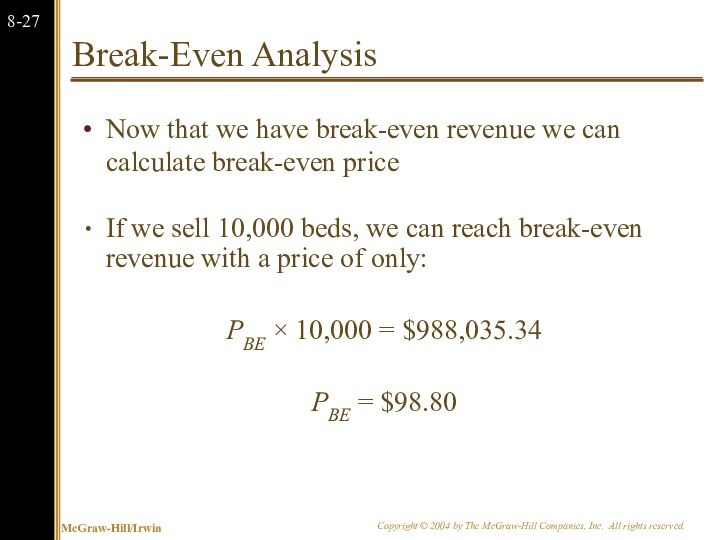

Break-Even Analysis

Now that we have break-even revenue we

can calculate break-even price

If we sell 10,000 beds, we

can reach break-even revenue with a price of only:

PBE × 10,000 = $988,035.34

PBE = $98.80

Слайд 29

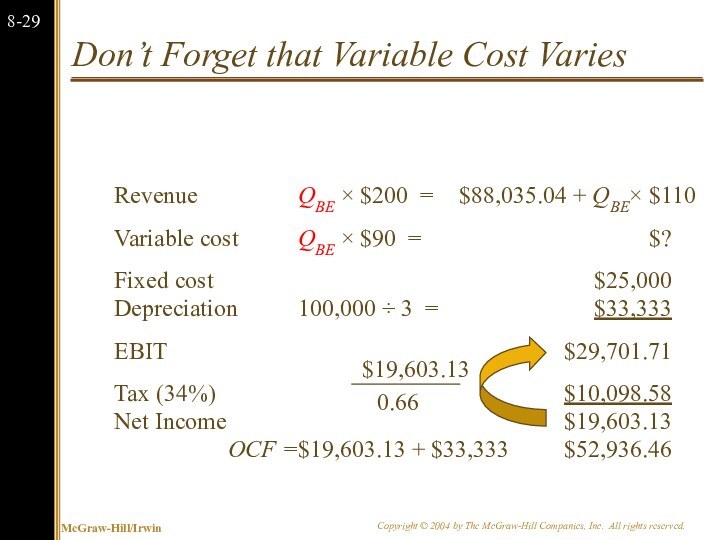

Common Mistake in Break-Even

What’s wrong with this line

of reasoning?

With a price of $200 per bed, we

can reach break-even revenue with a sales volume of only:

As a check, you can plug 4,941 beds into the problem and see if the result is a zero NPV.

Слайд 30

Don’t Forget that Variable Cost Varies

Revenue

QBE × $200

=

$88,035.04 + QBE× $110

Variable cost

QBE × $90 =

$?

Fixed cost

$25,000

Depreciation

100,000 ÷ 3 =

$33,333

EBIT

$29,701.71

Tax (34%)

$10,098.58

Net Income

$19,603.13

OCF =

$19,603.13 + $33,333

$52,936.46

Слайд 31

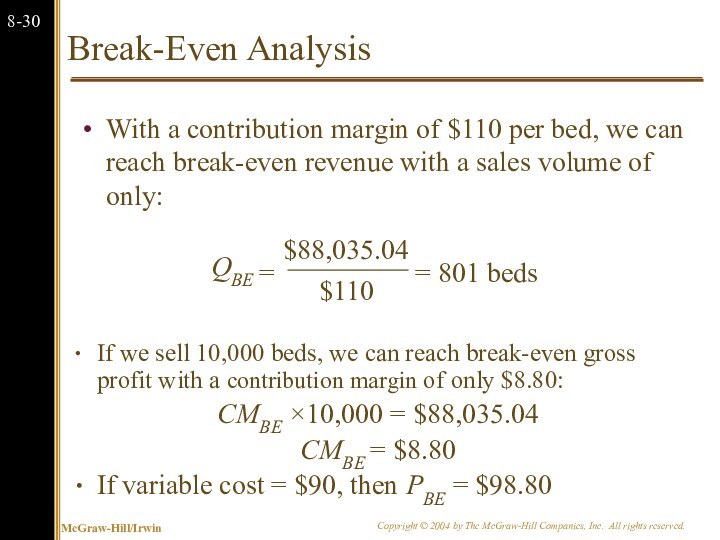

Break-Even Analysis

With a contribution margin of $110 per

bed, we can reach break-even revenue with a sales

volume of only:

If we sell 10,000 beds, we can reach break-even gross profit with a contribution margin of only $8.80:

CMBE ×10,000 = $88,035.04

CMBE = $8.80

If variable cost = $90, then PBE = $98.80

Слайд 32

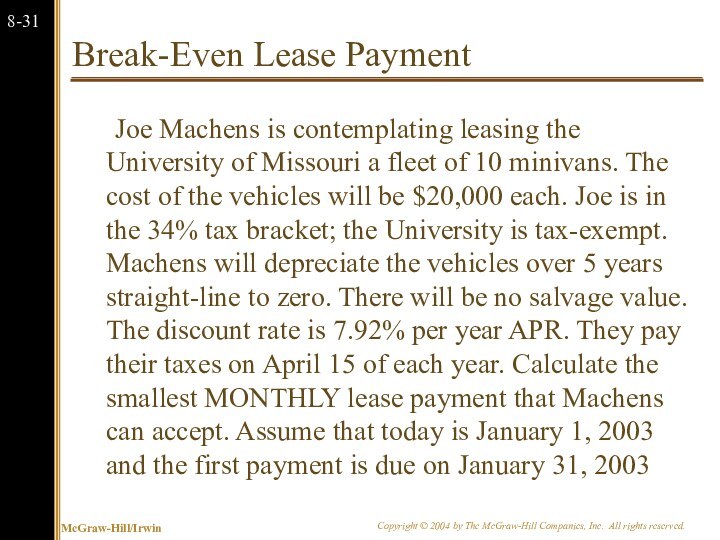

Break-Even Lease Payment

Joe Machens is contemplating leasing the

University of Missouri a fleet of 10 minivans. The

cost of the vehicles will be $20,000 each. Joe is in the 34% tax bracket; the University is tax-exempt. Machens will depreciate the vehicles over 5 years straight-line to zero. There will be no salvage value. The discount rate is 7.92% per year APR. They pay their taxes on April 15 of each year. Calculate the smallest MONTHLY lease payment that Machens can accept. Assume that today is January 1, 2003 and the first payment is due on January 31, 2003

Слайд 33

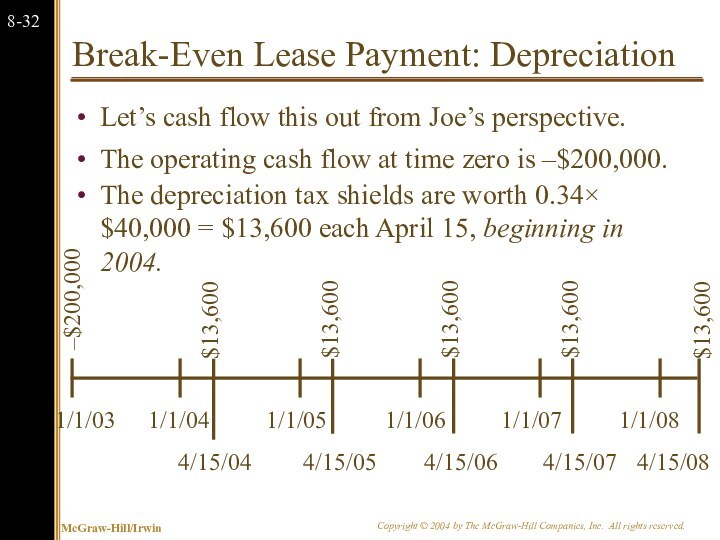

Break-Even Lease Payment: Depreciation

Let’s cash flow this out

from Joe’s perspective.

The operating cash flow at time zero

is –$200,000.

The depreciation tax shields are worth 0.34×$40,000 = $13,600 each April 15, beginning in 2004.

1/1/03

1/1/04

1/1/05

1/1/06

1/1/07

1/1/08

4/15/08

$13,600

4/15/04

$13,600

4/15/05

$13,600

4/15/06

$13,600

4/15/07

$13,600

–$200,000

Слайд 34

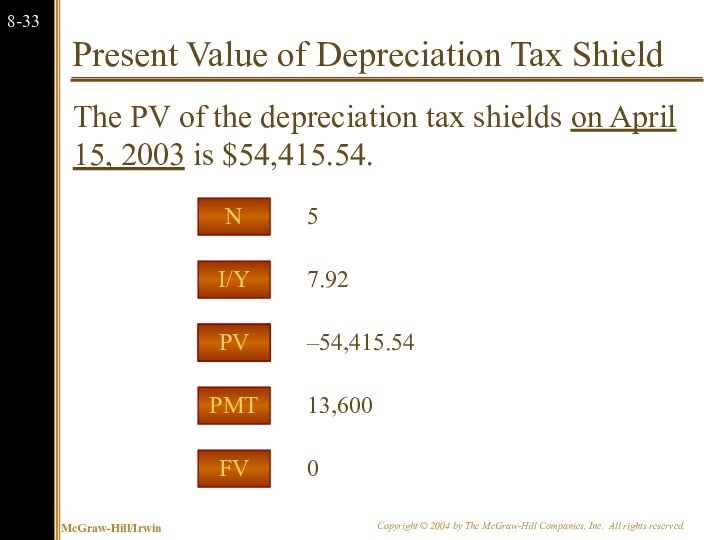

Present Value of Depreciation Tax Shield

The PV of

the depreciation tax shields on April 15, 2003 is

$54,415.54.

PMT

I/Y

FV

PV

N

13,600

7.92

0

–54,415.54

5

PV

Слайд 35

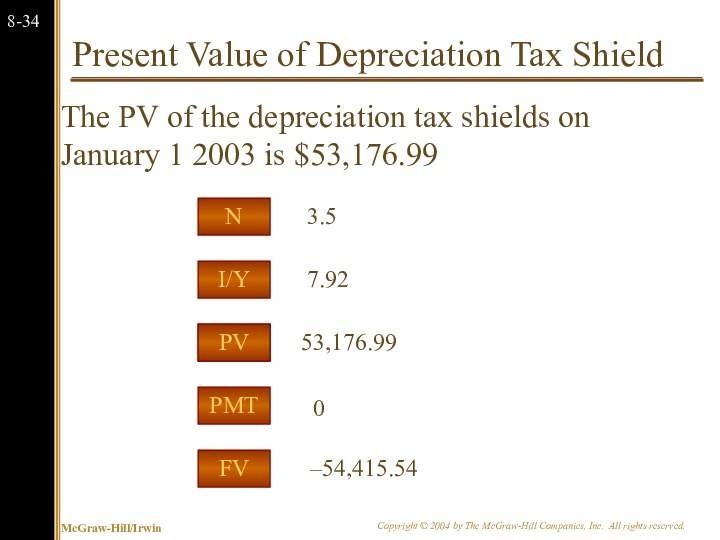

Present Value of Depreciation Tax Shield

The PV of

the depreciation tax shields on January 1 2003 is

$53,176.99

53,176.99

PMT

I/Y

FV

PV

N

7.92

0

–54,415.54

3.5

PV

Слайд 36

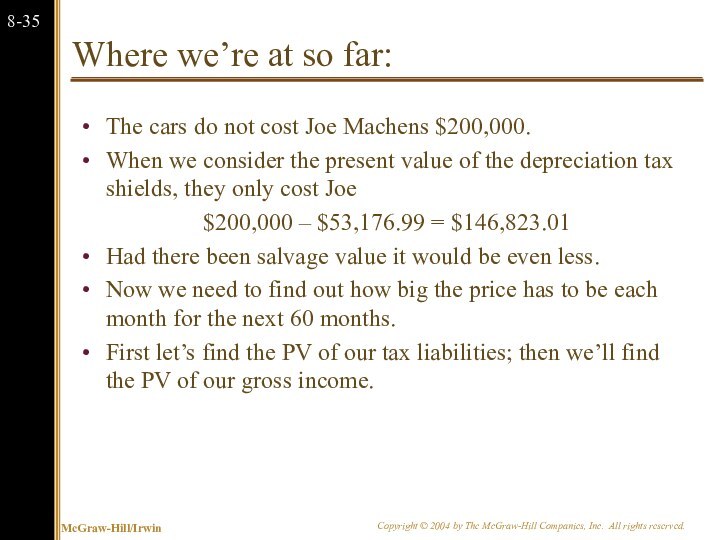

Where we’re at so far:

The cars do not

cost Joe Machens $200,000.

When we consider the present value

of the depreciation tax shields, they only cost Joe

$200,000 – $53,176.99 = $146,823.01

Had there been salvage value it would be even less.

Now we need to find out how big the price has to be each month for the next 60 months.

First let’s find the PV of our tax liabilities; then we’ll find the PV of our gross income.

Слайд 37

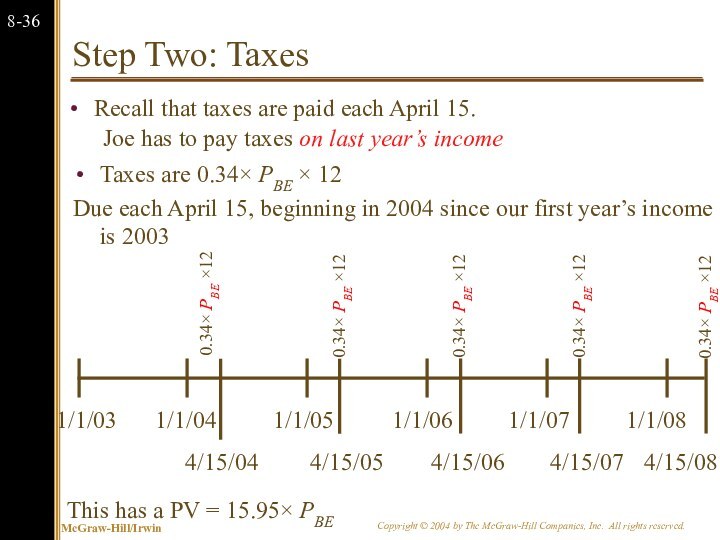

Step Two: Taxes

Joe has to pay taxes on

last year’s income

1/1/03

1/1/04

1/1/05

1/1/06

1/1/07

1/1/08

Taxes are 0.34× PBE × 12

Due each

April 15, beginning in 2004 since our first year’s income is 2003

4/15/08

0.34× PBE ×12

4/15/04

0.34× PBE ×12

4/15/05

0.34× PBE ×12

4/15/06

0.34× PBE ×12

4/15/07

0.34× PBE ×12

This has a PV = 15.95× PBE

Recall that taxes are paid each April 15.

Слайд 38

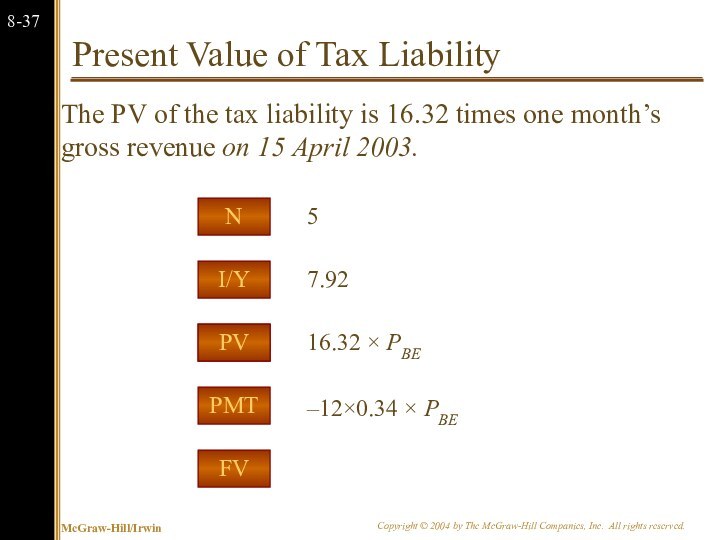

Present Value of Tax Liability

The PV of the

tax liability is 16.32 times one month’s gross revenue

on 15 April 2003.

PMT

I/Y

FV

PV

N

7.92

–12×0.34 × PBE

5

PV

16.32 × PBE

Слайд 39

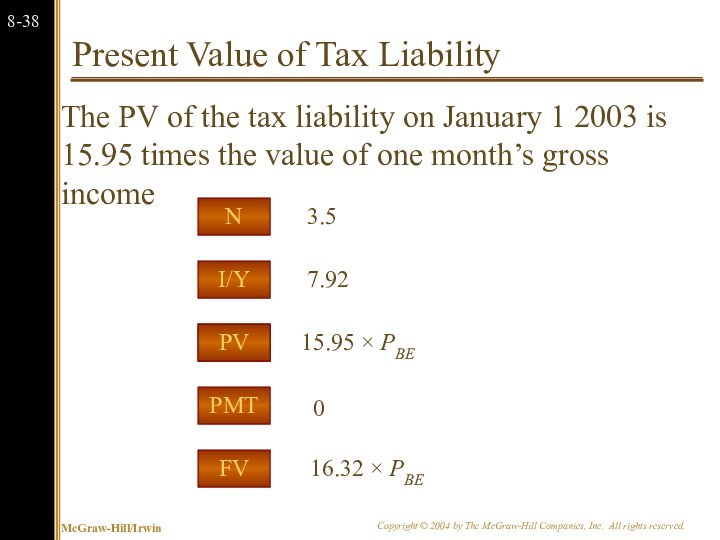

Present Value of Tax Liability

The PV of the

tax liability on January 1 2003 is 15.95 times

the value of one month’s gross income

15.95 × PBE

PMT

I/Y

FV

PV

N

7.92

0

16.32 × PBE

3.5

PV

Слайд 40

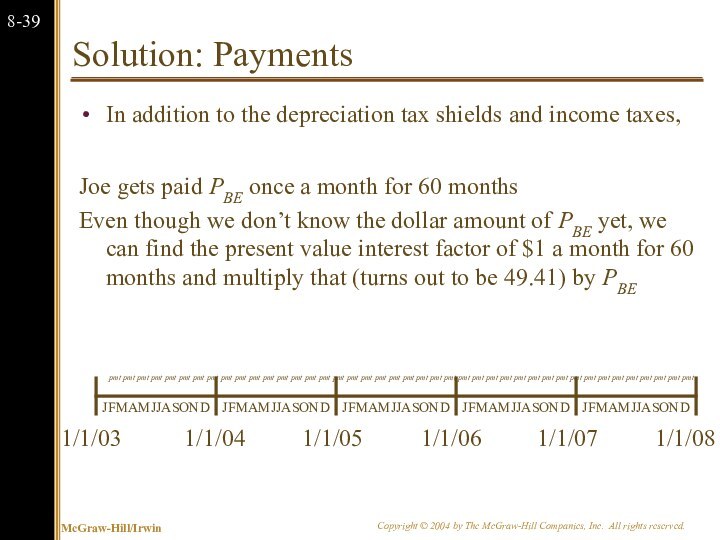

Solution: Payments

In addition to the depreciation tax shields

and income taxes,

Joe gets paid PBE once a

month for 60 months

Even though we don’t know the dollar amount of PBE yet, we can find the present value interest factor of $1 a month for 60 months and multiply that (turns out to be 49.41) by PBE

1/1/03

1/1/04

1/1/05

1/1/06

1/1/07

1/1/08

JFMAMJJASOND

pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt pmt

JFMAMJJASOND

JFMAMJJASOND

JFMAMJJASOND

JFMAMJJASOND

Слайд 41

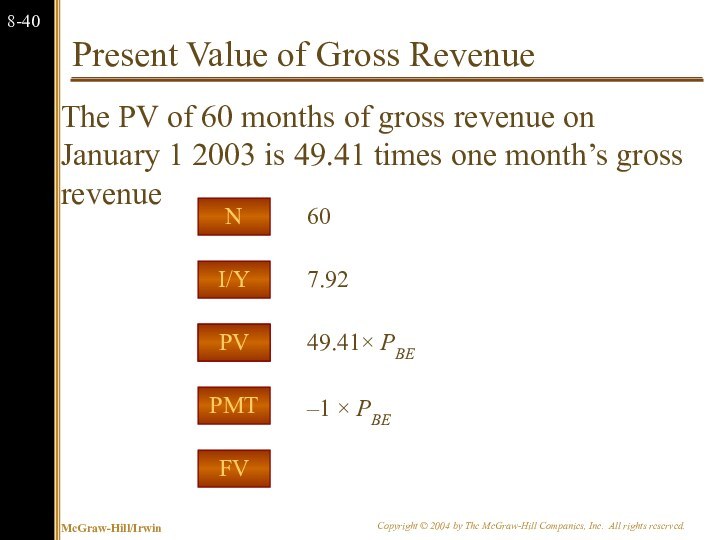

Present Value of Gross Revenue

The PV of 60

months of gross revenue on January 1 2003 is

49.41 times one month’s gross revenue

PMT

I/Y

FV

PV

N

7.92

–1 × PBE

60

PV

49.41× PBE

Слайд 42

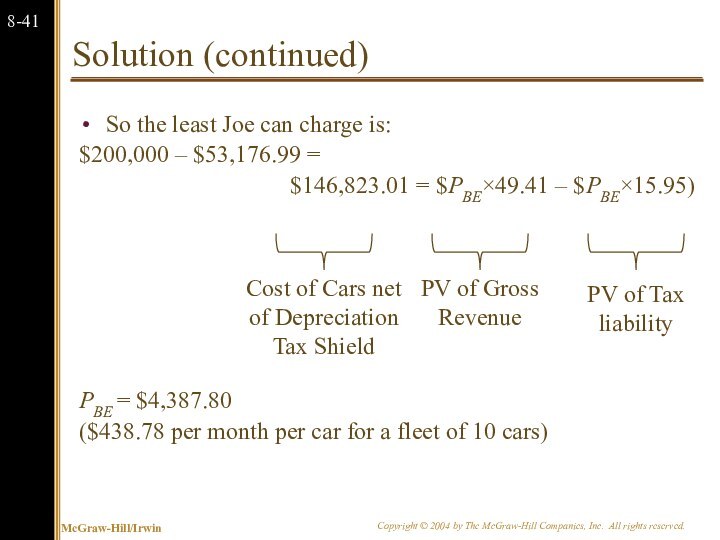

Solution (continued)

So the least Joe can charge is:

$200,000 – $53,176.99 =

$146,823.01 = $PBE×49.41 – $PBE×15.95)

PBE = $4,387.80

($438.78 per month per car for a fleet of 10 cars)

Слайд 43

Summary Joe Machens

This problem was a bit more

complicated than previous problems because of the asynchronous nature

of our tax liabilities.

We get paid every month, but pay taxes once a year, starting in 3½ months.

Other than that, this problem is just like any other break-even problem:

Find the true cost of the project ($146,823.01)

Find the price that gives you an incremental after tax cash flow with that present value.

Слайд 44

8.3 Monte Carlo Simulation

Monte Carlo simulation is a

further attempt to model real-world uncertainty.

This approach takes its

name from the famous European casino, because it analyzes projects the way one might analyze gambling strategies.

Слайд 45

8.3 Monte Carlo Simulation

Imagine a serious blackjack player

who wants to know if he should take the

third card whenever his first two cards total sixteen.

He could play thousands of hands for real money to find out.

This could be hazardous to his wealth.

Or he could play thousands of practice hands to find out.

Monte Carlo simulation of capital budgeting projects is in this spirit.

Слайд 46

8.3 Monte Carlo Simulation

Monte Carlo simulation of capital

budgeting projects is often viewed as a step beyond

either sensitivity analysis or scenario analysis.

Interactions between the variables are explicitly specified in Monte Carlo simulation, so at least theoretically, this methodology provides a more complete analysis.

While the pharmaceutical industry has pioneered applications of this methodology, its use in other industries is far from widespread.

Слайд 47

8.4 Options

One of the fundamental insights of modern

finance theory is that options have value.

The phrase “We

are out of options” is surely a sign of trouble.

Because corporations make decisions in a dynamic environment, they have options that should be considered in project valuation.

Слайд 48

Options

The Option to Expand

Has value if demand turns

out to be higher than expected.

The Option to Abandon

Has

value if demand turns out to be lower than expected.

The Option to Delay

Has value if the underlying variables are changing with a favorable trend.

Слайд 49

The Option to Expand

Imagine a start-up firm, Campusteria,

Inc. which plans to open private (for-profit) dining clubs

on college campuses.

The test market will be your campus, and if the concept proves successful, expansion will follow nationwide.

Nationwide expansion, if it occurs, will occur in year four.

The start-up cost of the test dining club is only $30,000 (this covers leaseholder improvements and other expenses for a vacant restaurant near campus).

Слайд 50

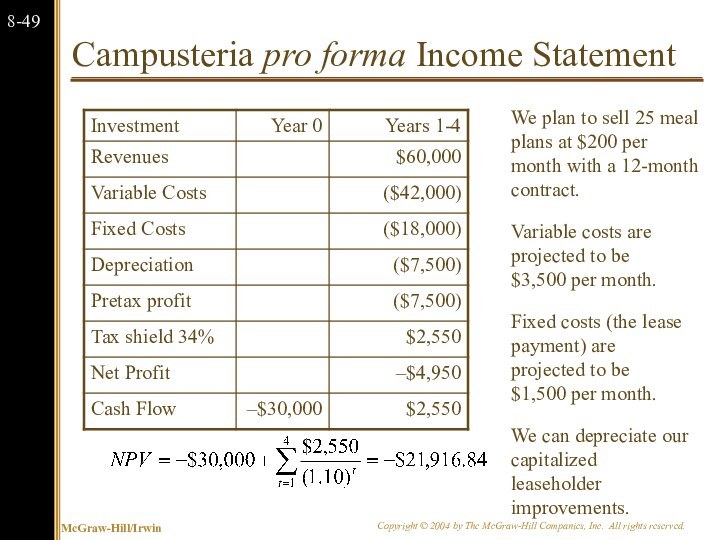

Campusteria pro forma Income Statement

We plan to sell

25 meal plans at $200 per month with a

12-month contract.

Variable costs are projected to be $3,500 per month.

Fixed costs (the lease payment) are projected to be $1,500 per month.

We can depreciate our capitalized leaseholder improvements.

Слайд 51

The Option to Expand: Valuing a Start-Up

Note that

while the Campusteria test site has a negative NPV,

we are close to our break-even level of sales.

If we expand, we project opening 20 Campusterias in year four.

The value of the project is in the option to expand.

If we hit it big, we will be in a position to score large.

We won’t know if we don’t try.

Слайд 52

Discounted Cash Flows and Options

We can calculate the

market value of a project as the sum of

the NPV of the project without options and the value of the managerial options implicit in the project.

M = NPV + Opt

A good example would be comparing the desirability of a specialized machine versus a more versatile machine. If they both cost about the same and last the same amount of time the more versatile machine is more valuable because it comes with options.

Слайд 53

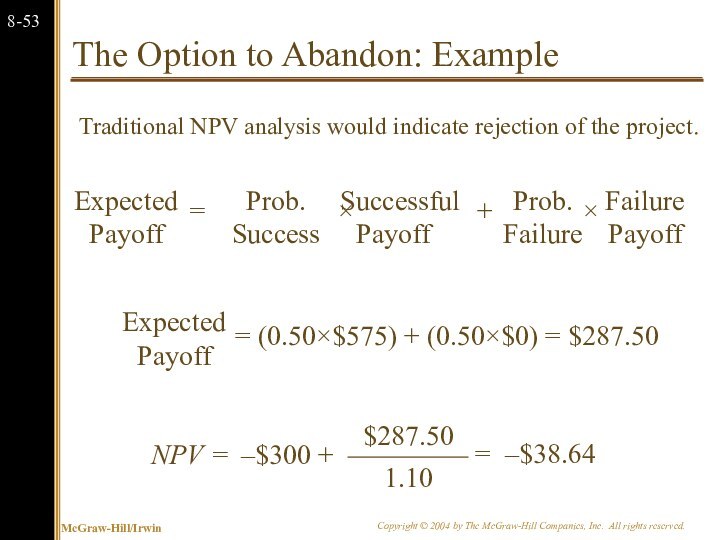

The Option to Abandon: Example

Suppose that we are

drilling an oil well. The drilling rig costs $300

today and in one year the well is either a success or a failure.

The outcomes are equally likely. The discount rate is 10%.

The PV of the successful payoff at time one is $575.

The PV of the unsuccessful payoff at time one is $0.

Слайд 54

The Option to Abandon: Example

Traditional NPV analysis

would indicate rejection of the project.

Слайд 55

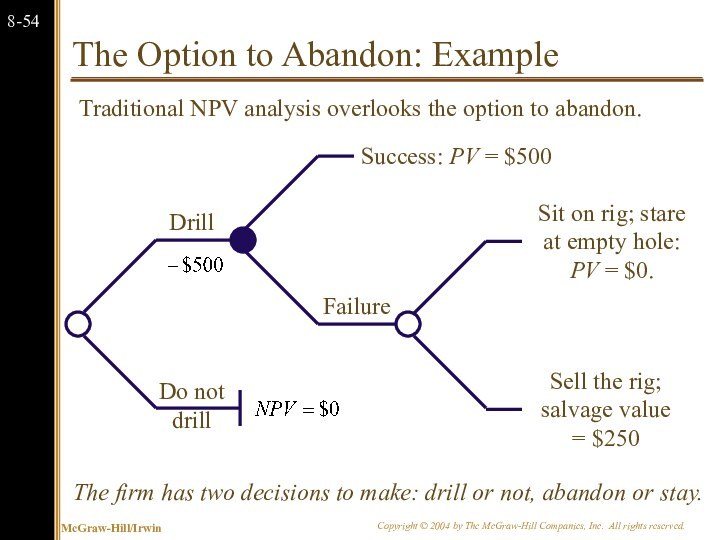

The Option to Abandon: Example

The firm has two

decisions to make: drill or not, abandon or stay.

Traditional

NPV analysis overlooks the option to abandon.

Слайд 56

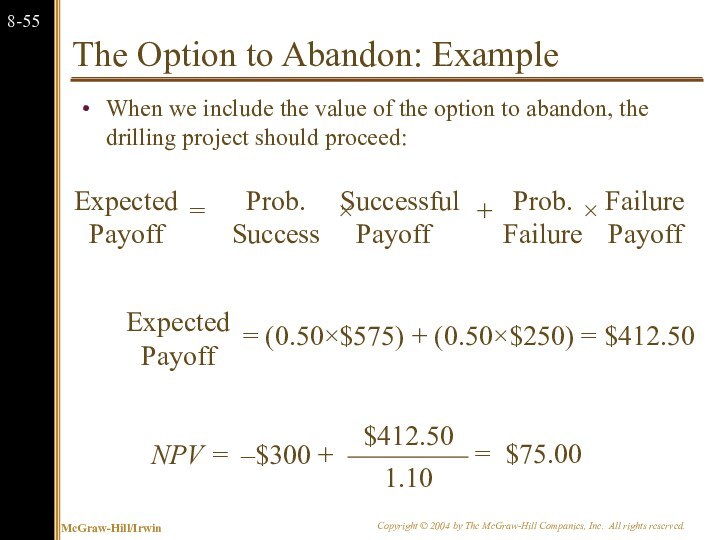

The Option to Abandon: Example

When we include

the value of the option to abandon, the drilling

project should proceed:

Слайд 57

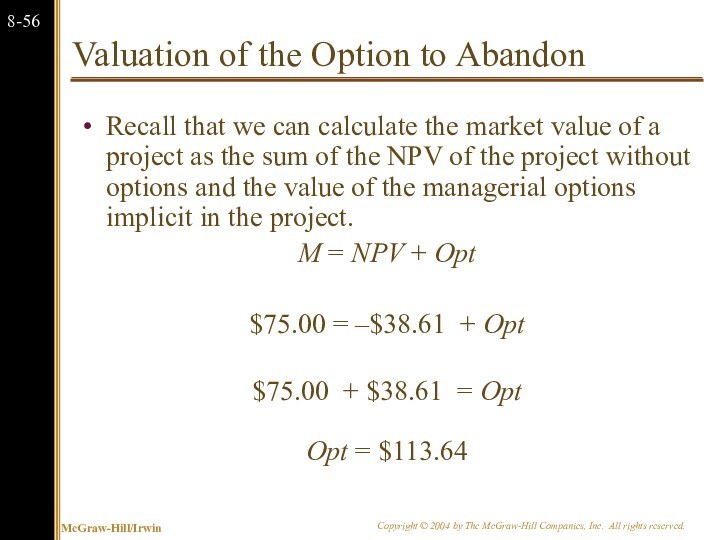

Valuation of the Option to Abandon

Recall that we

can calculate the market value of a project as

the sum of the NPV of the project without options and the value of the managerial options implicit in the project.

M = NPV + Opt

$75.00 = –$38.61 + Opt

$75.00 + $38.61 = Opt

Opt = $113.64

Слайд 58

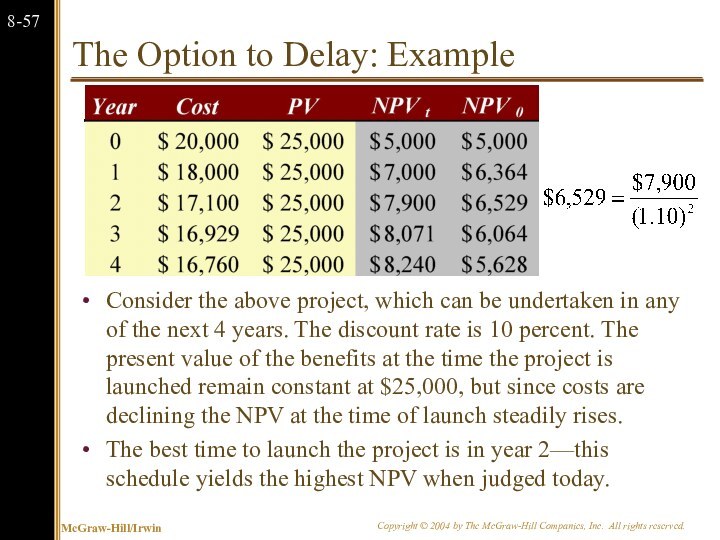

The Option to Delay: Example

Consider the above project,

which can be undertaken in any of the next

4 years. The discount rate is 10 percent. The present value of the benefits at the time the project is launched remain constant at $25,000, but since costs are declining the NPV at the time of launch steadily rises.

The best time to launch the project is in year 2—this schedule yields the highest NPV when judged today.