Слайд 3

Igor Merkulov, Director

Sales and marketing department

Chief: Maria Cheremnykh

Irina

Makarenko: Invitrogen and marketing (forecast).

Elena Savchik: CE and QPCR,

HID reagents.

Alexander Bayunov: NGS instruments.

Dmitry Sirotkin: QST

Vladimir Tomashuk: Pharma

Svetlana Morozova: Service

Vacancies: two people

Clinics and marketing

Logistic department:

Maria Semina

Tender department:

Chief: Tatiana Sirotkina

Sergey Selivanov

Warehouse manager:

Alexander Meschankin,

(Regional logistic)

vacancies:

warehouse personal, 2-3 persons

Purchasing and Order handling:

Dmitry Vorobiev

(market analysis)

vacancy: order handling specialist

Expeditor:

Vladimir Zhezherun

Accounting department:

Chief: Natalia Vasilchenko

Artem Stepanov

Raisa Semina

Custom clearance department:

Chief: Dmitry Skipnikov

Vladimir Sokolov

Alexander Gorshkov

Business Development

Tatiana Meschankina

Support Specialists:

Natalia Selivanova : LT Alexander Kirilluk: Pharma

Vacancy – NGS support

Sales, Support and Marketing Organization

Слайд 4

DEMO LAB

The facility for demo lab is ready.

But at the end of 2012 we came to

conclusion that we need support from scientific organizations.

For better usage of investments and promotion of LT equipment in various fields we need to collaborate with certain significant scientific centers.

Currently we negotiate with many organizations to find out possible ways of practical applications to be established in demo lab: AlcorBio, SCMG, MFTI, Investigation committee, Novosibirsk’s Scientific center.

Our aim – to organize demo lab acting as scientific and practical application center.

Слайд 5

Top Priorities to drive growth in 2013

Organizing seminars

and workshops for educating customers

Developing position in Applied Markets

– clinical, pharma, food testing, etc

Developing new markets by bringing NGS solutions into clinical research (partnership with AlcorBio)

Developing strategy and structure for Invitrogen sales

Regional structure development

DemoLab opening

Слайд 6

Market Analysis and Situation

Слайд 7

NGS Instruments and Consumables

Fast growing market – big

interest to IonProton and IonTorrent:

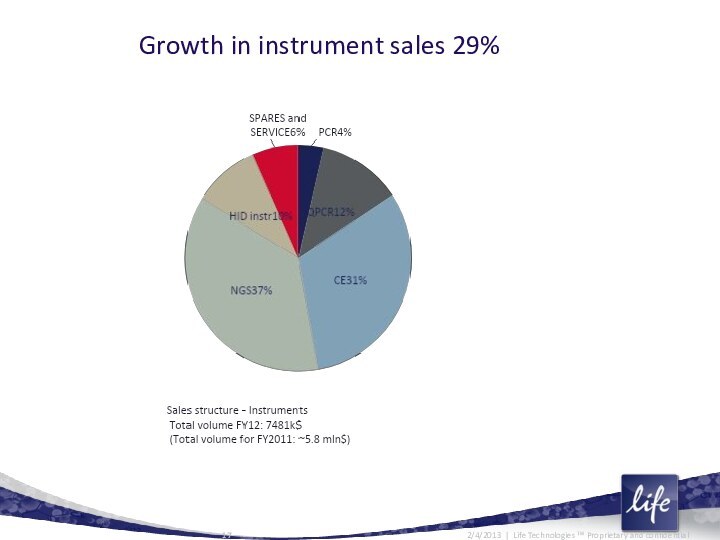

Total instruments sales in FY

2012 ~2740k$ (in FY11 - 2020k$), >35% growth.

Major competitors – Roche and Illumina. Their argument – weak support of LifeTech products. Roche has got medical registration in July 2012. Illumina has an exclusive distributor Interlabservice who has strong aggressive and sometimes unfair sales strategy.

Our priorities - Developing knowledge and educating existing and potential customers. Being fast with newest instruments and consumables available at the market.

“Our” activities – support to existing customers, promotion at all major scientific events, exhibitions, marketing activities. Creating of strong NGS support team.

Receive medical registrations for IonTorrent and IonProton.

Слайд 8

CE Instruments and Consumables

Market situation – still growth:

Total

instruments sales 2357k$ (in 2011 2095k$, ~12% growth)

Competitive landscape

– less competitive area. Therefore lot of resellers ready to sell this type of equipment

In several cases Ministry of Health has purchased Beckman

“Our” priorities – shortening delivery time, increasing the volume of consumables available at our warehouse in Moscow

“Our” activities – support to existing customers, promotion at all major scientific events, exhibitions, marketing activities + demo laboratory development

Issues and Needs with LIFE – medical registrations for some kits applicable in clinics (KRAS/BRAF, Cystic Fibrosis etc.).

Слайд 9

QPCR Instruments, Assay and Reagents

Market situation – growth

due to aggressive pricing

Good discounts for instruments bought on

stock gives us a possibility to compete with other vendors.

Total sales for instruments ~900k$ (in 2011 633k$, 42% growth)

Competitive landscape – still tough to sell stand-alone.

To promoting QPCRs into clinics we need complete solution: instrument, software and kits with medical registration.

We gave 7500 and StepOne Plus to test and check their diagnostic kits. Their conclusion:

Instruments are to difficult to medics because of complicated s/w.

They used in diagnostics only after optimization.

Слайд 10

PCR Instruments, Assay and Reagents

Market situation – very

competitive market. Instruments usually sold as part of package

of LiteTech instruments.

Total sales in 2012 ~270k$ (in 2011 233k$, 16% growth)

Sales of 9700G model is forced by growing HID market

Veriti is competitive on the market only with good discount.

We have an ability to sale this model only when we buying pack of 5 units minimum with special discount.

Слайд 11

HID Kits and Instruments

Market situation – still very

centralized market. Most of all customers are government structures.

Our

sales in 2012: instruments 720k$, consumables 1481k$, COPAN cards 966k$.

Together with Copan and LT achieved good reputation in FSIN

Waiting for announce of tender for this year.

Together with LT achieved good reputation in IC.

Waiting for opening of three new regional labs.

Successful participation in regional tenders for HID consumables in the end of 2012. Established good relationship with many of regional ECC MOI (20 from 36 expert criminalistics centers).

Our priorities: to continue our work with all customers.

Слайд 12

Invitrogen products: Cell Biology, Protein Analysis, Cloning, Transfection.

Working with this products just half of year.

Sales ~85k$

(lots of small orders)

Complicated products from point of customer clearance (needs many permissions for serum)

“Our” activities – promoting Invitrogen on conferences, prepare printed materials for mailing, organize small seminars in regions.

Issues and Needs with LIFE:

Shortest time of delivery

Special discounts to be competitive

Help with some documents for customs clearance

Слайд 13

Extraction and Purification

Market situation – mainly HID

market due to the high volume of analysis (manual

extraction is used in areas where low volume of analysis is required)

Competitive landscape: Thermo Fisher (registered analogue of MagMax), Tecan, Epimotion, Qiagen.

Issue with LT: medical registration for MagMax to promote in clinical market.

Слайд 14

Food Safety and Animal Health

Market situation

Competitive landscape

“Our” priorities

“Our”

activities

Participated in Obolensk and Stavropol seminars (Obolensk and

Stavropol as a part of Russian Committee of consumer supervision structure)

Issues and Needs with LIFE:

registration of sets required;

reliable delivery terms for GMO kits.

Слайд 15

Biologics and Pharma Analytics - analysis in progress

Market

situation – emerging market with high potential

Competitive landscape

“Our”

priorities

“Our” activities

Issues and Needs with LIFE: not enough information form LT about key sales potentials.

Слайд 18

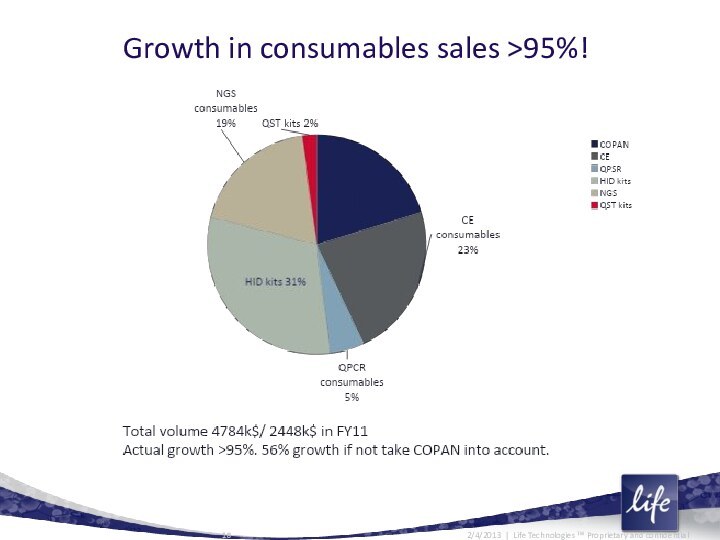

Growth in consumables sales >95%!

Слайд 19

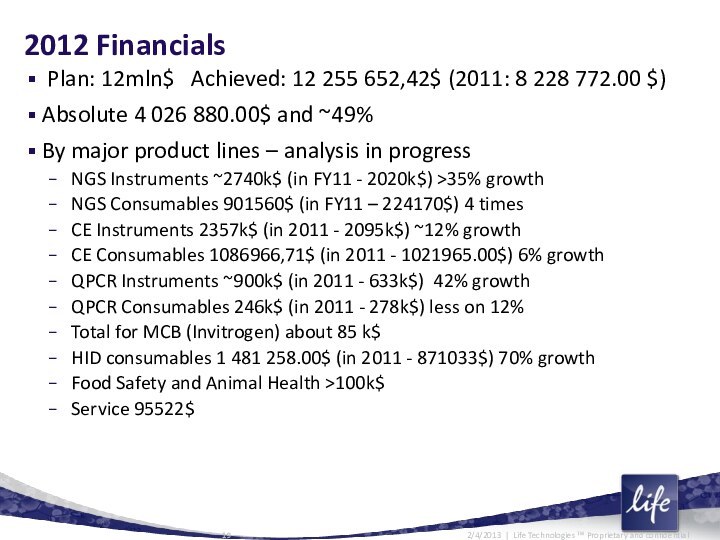

2012 Financials

Plan: 12mln$ Achieved: 12 255

652,42$ (2011: 8 228 772.00 $)

Absolute 4 026 880.00$

and ~49%

By major product lines – analysis in progress

NGS Instruments ~2740k$ (in FY11 - 2020k$) >35% growth

NGS Consumables 901560$ (in FY11 – 224170$) 4 times

CE Instruments 2357k$ (in 2011 - 2095k$) ~12% growth

CE Consumables 1086966,71$ (in 2011 - 1021965.00$) 6% growth

QPCR Instruments ~900k$ (in 2011 - 633k$) 42% growth

QPCR Consumables 246k$ (in 2011 - 278k$) less on 12%

Total for MCB (Invitrogen) about 85 k$

HID consumables 1 481 258.00$ (in 2011 - 871033$) 70% growth

Food Safety and Animal Health >100k$

Service 95522$

Слайд 20

2012 Commentary

Good growth compared to 2011

Good structural development

and shearing responsibilities. Hiring plan successfully performed (hired: 5

Sales/1 Support/1 Tender/1 Logistics specialist)

Good growth in NGS consumables means that our instruments are in use.

Start focusing for clinical field additionally to scientific.

Perfect performance of FSIN project.

Strong growth in HID field. Achieved good reputation for lots of regional MOI labs as performed shipments in short period of delivery.

Слайд 22

Major Projects for 2013

RAS has won the

tender for three end-users.

Brief description: 2 x 3500, 1

x IonProton

$ Value – ~700k$

Expected closing Q1, 100 % of winning

Critical success factors

Actions achieved

Actions planned and timelines

Needs from LIFE – special letter for RAS with pricing.

Слайд 23

Major Projects

Investigation committee plans to open three

new regional labs with complete list of HID instruments.

Next purchase of HID kits in 2013 for IC for already 8 labs.

Brief description: three sets of HID instruments

$ Value ~1mln$ (instruments) + 1.5mln$ for HID consumables in 2013

Expected closing Q4, % of winning – 90% winning

Critical success factors

Actions achieved – customer loyalty

Actions planned and timelines

Needs from LIFE – the same pricing policy as in 2012

Слайд 24

Major Projects

FSIN – just the same portion of

FTA cards kits (~210k)

Brief description 210000 FTA card kits

$

Value - 1 mln USD

Expected closing Q2, % of winning – 75% winning

Critical success factors – possible competition

Actions achieved – customer loyalty

Actions planned and timelines – Q2/Q3

Needs from LIFE – the same pricing policy as in 2012

Needs from LIFE – short delivery terms

Слайд 25

Major Projects

Kids Hematological clinical center: already delivered IonProton

from warehouse in Q1

Waiting for 3500xl + PGM +

one more IonProton (probably)

$ Value - USD 500k – 1 mln$

Expected closing Q3/Q4, % of winning – 60% winning

Critical success factors – conection to Mr. Govorun

Actions achieved – already delivered IonProton from warehouse in Q1

Actions planned and timelines – Q4

Слайд 26

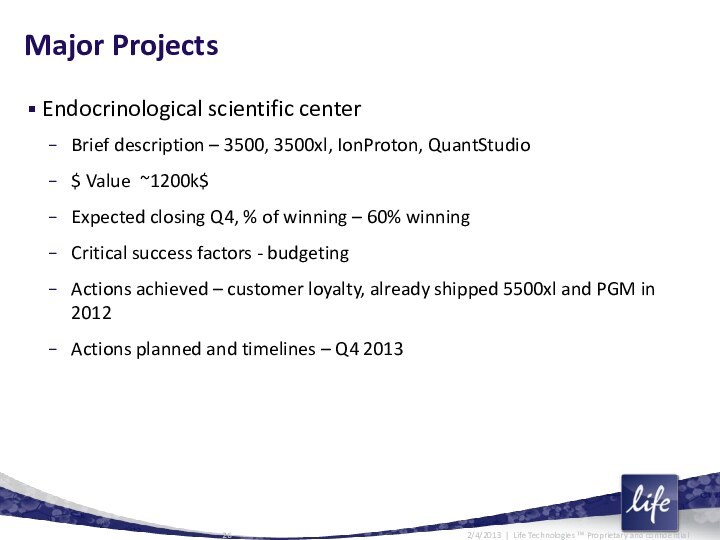

Major Projects

Endocrinological scientific center

Brief description – 3500,

3500xl, IonProton, QuantStudio

$ Value ~1200k$

Expected closing Q4, % of

winning – 60% winning

Critical success factors - budgeting

Actions achieved – customer loyalty, already shipped 5500xl and PGM in 2012

Actions planned and timelines – Q4 2013

Слайд 27

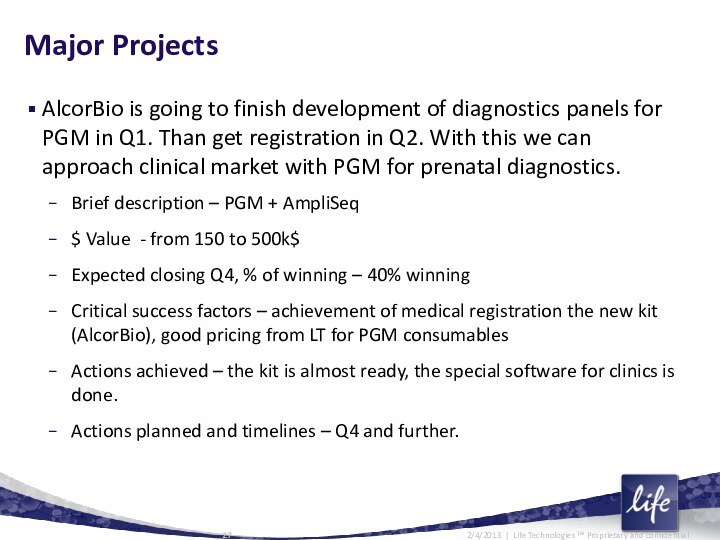

Major Projects

AlcorBio is going to finish development of

diagnostics panels for PGM in Q1. Than get registration

in Q2. With this we can approach clinical market with PGM for prenatal diagnostics.

Brief description – PGM + AmpliSeq

$ Value - from 150 to 500k$

Expected closing Q4, % of winning – 40% winning

Critical success factors – achievement of medical registration the new kit (AlcorBio), good pricing from LT for PGM consumables

Actions achieved – the kit is almost ready, the special software for clinics is done.

Actions planned and timelines – Q4 and further.