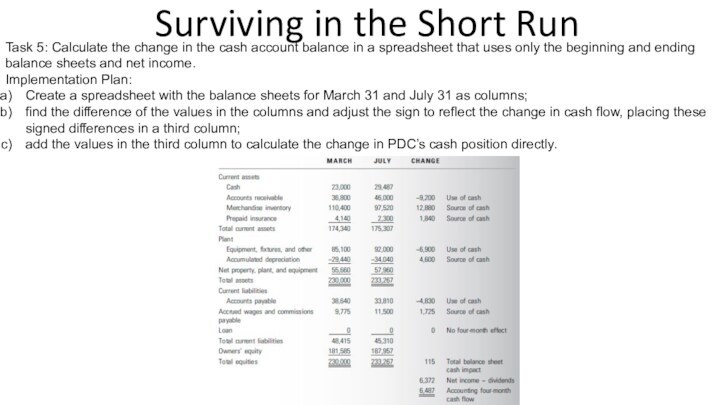

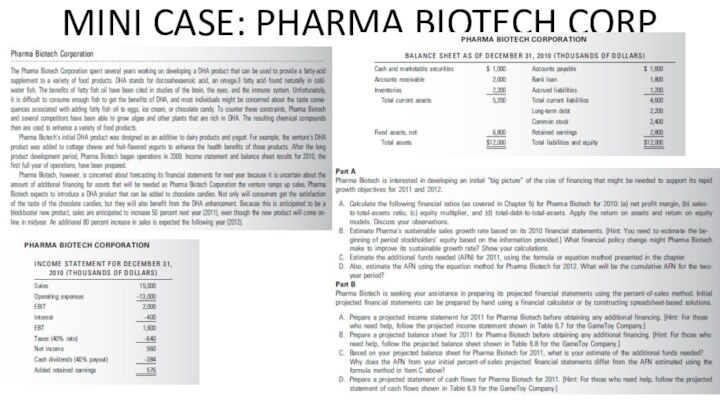

project PDC’s cash balance at the end of each

of the next four months and to create a set of projected financial statements congruent to the projections. We break this daunting task down into smaller pieces.Task 1: Budget PDC’s cash and borrowing position for the next four months (through

July 31).

Implementation Plan:

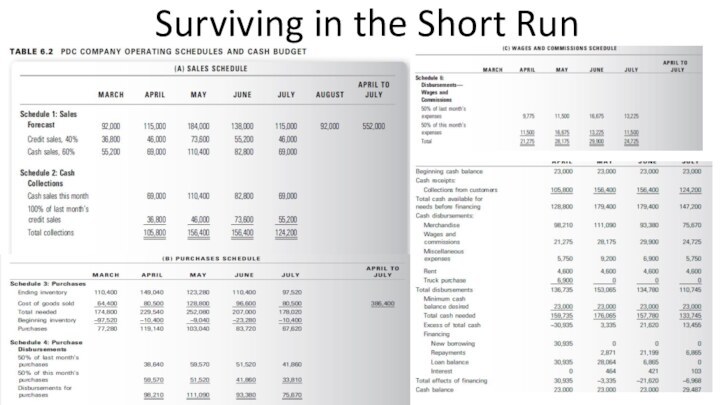

Use the sales forecast to determine the monthly cash collections from the current month’s cash sales and collections of receivables on the previous month’s credit sales,

use the inventory policy to determine the inventory expenses and schedule for their payments,

schedule the wages payments according to the semimonthly pay arrangements,

put these items together with the other assumptions and determine cash needs before financing, and

complete the cash budget by determining the necessary borrowing and repayment provisions, including interest payments, ensuring that $23,000 is available in the checking account.