- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

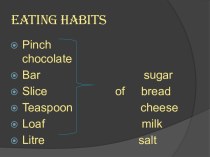

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Corporate income tax

Содержание

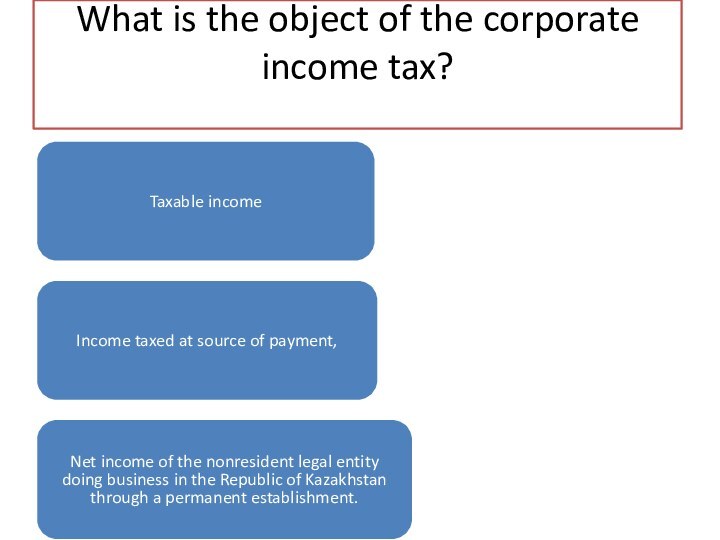

What is the object of the corporate income tax?

Слайд 6

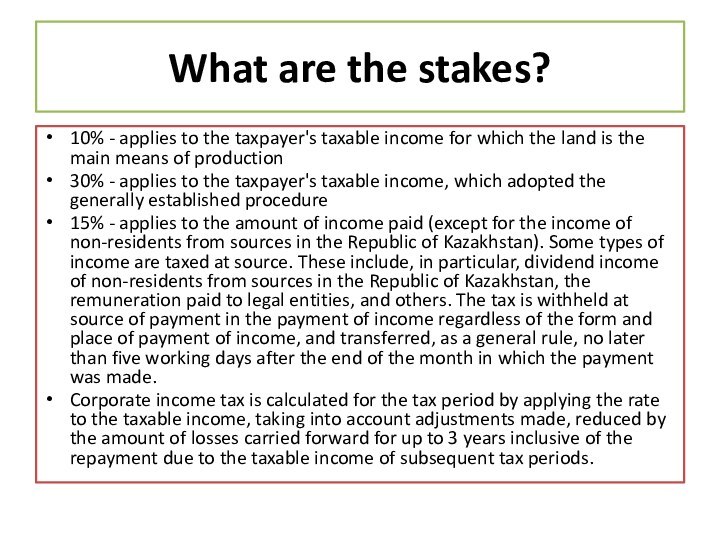

What are the stakes?

10% - applies to the

taxpayer's taxable income for which the land is the

main means of production30% - applies to the taxpayer's taxable income, which adopted the generally established procedure

15% - applies to the amount of income paid (except for the income of non-residents from sources in the Republic of Kazakhstan). Some types of income are taxed at source. These include, in particular, dividend income of non-residents from sources in the Republic of Kazakhstan, the remuneration paid to legal entities, and others. The tax is withheld at source of payment in the payment of income regardless of the form and place of payment of income, and transferred, as a general rule, no later than five working days after the end of the month in which the payment was made.

Corporate income tax is calculated for the tax period by applying the rate to the taxable income, taking into account adjustments made, reduced by the amount of losses carried forward for up to 3 years inclusive of the repayment due to the taxable income of subsequent tax periods.