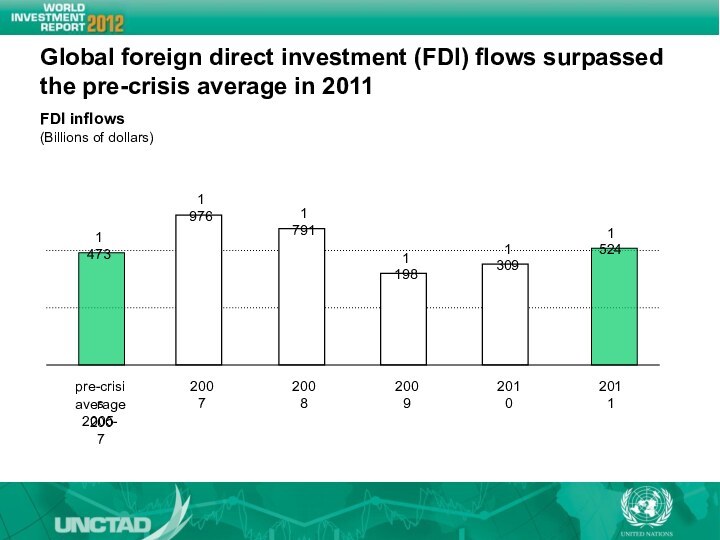

pre-crisis average in 2011

FDI inflows

(Billions of dollars)

1 473

1 976

1

7911 198

1 309

1 524

pre-crisis

average 2005-

2007

2007

2008

2009

2010

2011

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

1 198

1 309

1 524

pre-crisis

average 2005-

2007

2007

2008

2009

2010

2011

51%

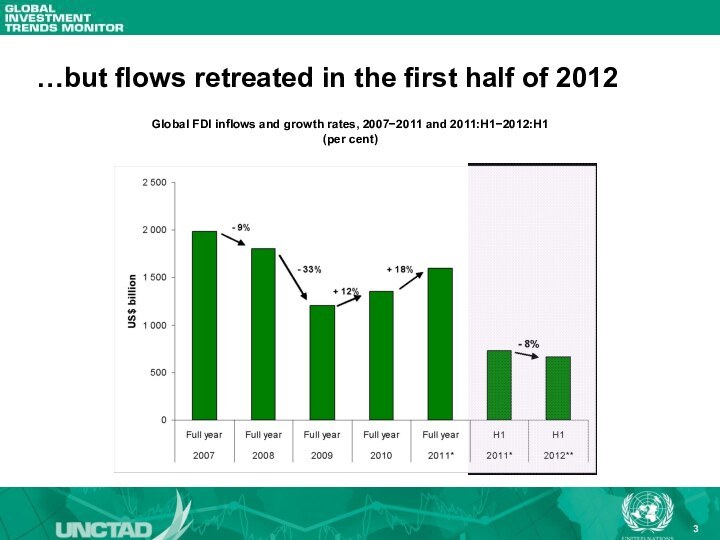

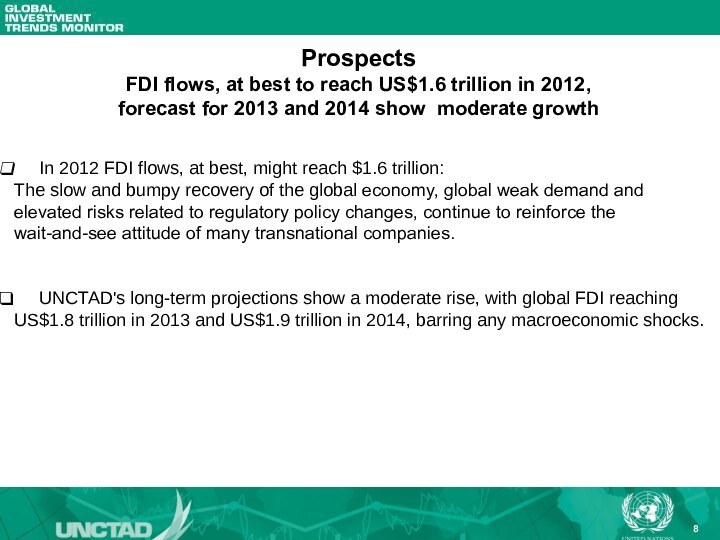

In 2012 FDI flows, at best, might reach $1.6 trillion:

The slow and bumpy recovery of the global economy, global weak demand and elevated risks related to regulatory policy changes, continue to reinforce the wait-and-see attitude of many transnational companies.

UNCTAD's long-term projections show a moderate rise, with global FDI reaching US$1.8 trillion in 2013 and US$1.9 trillion in 2014, barring any macroeconomic shocks.

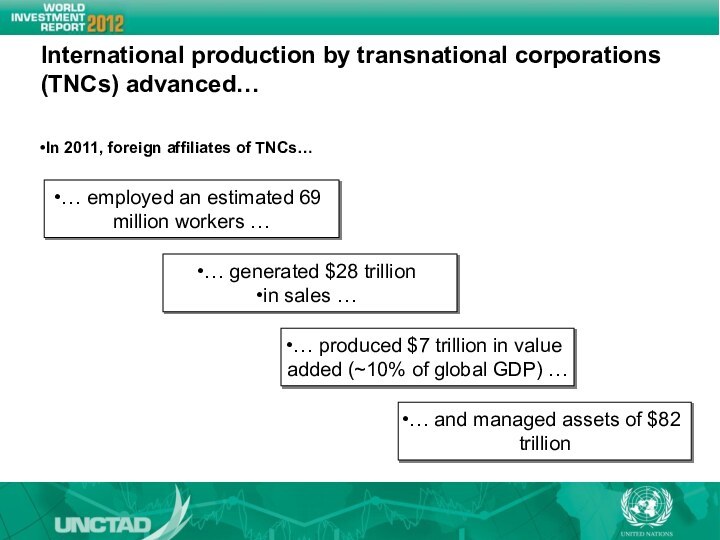

… produced $7 trillion in value added (~10% of global GDP) …

In 2011, foreign affiliates of TNCs…

… and managed assets of $82 trillion

FDI flows to transition economies are expected to

continue to grow in the medium term due to:

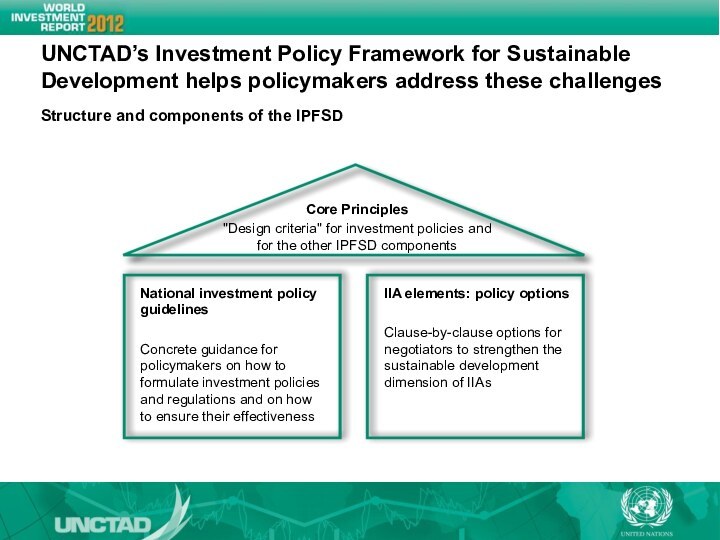

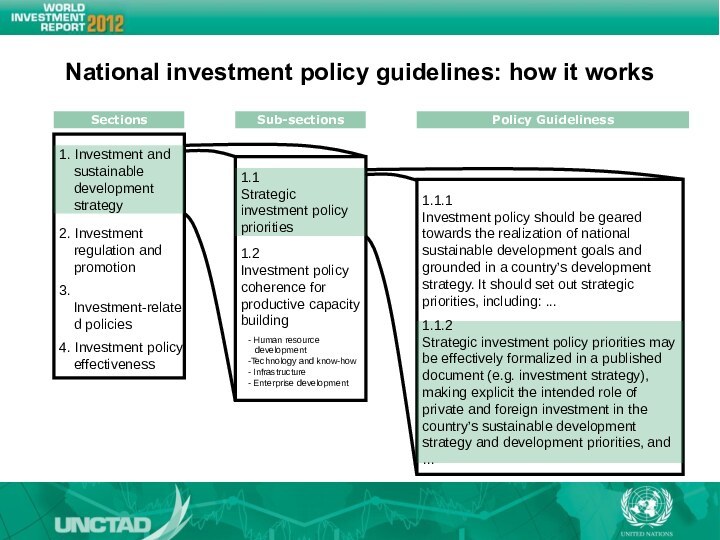

National investment policy guidelines

Concrete guidance for policymakers on how to formulate investment policies and regulations and on how to ensure their effectiveness

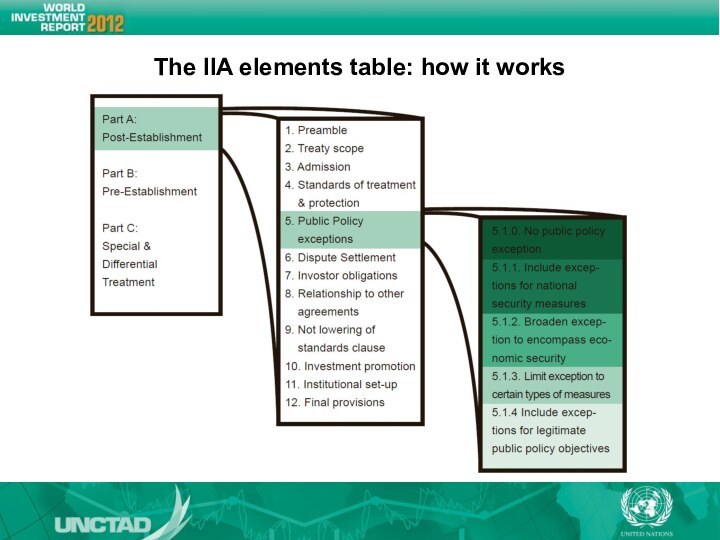

IIA elements: policy options

Clause-by-clause options for negotiators to strengthen the sustainable development dimension of IIAs

Structure and components of the IPFSD

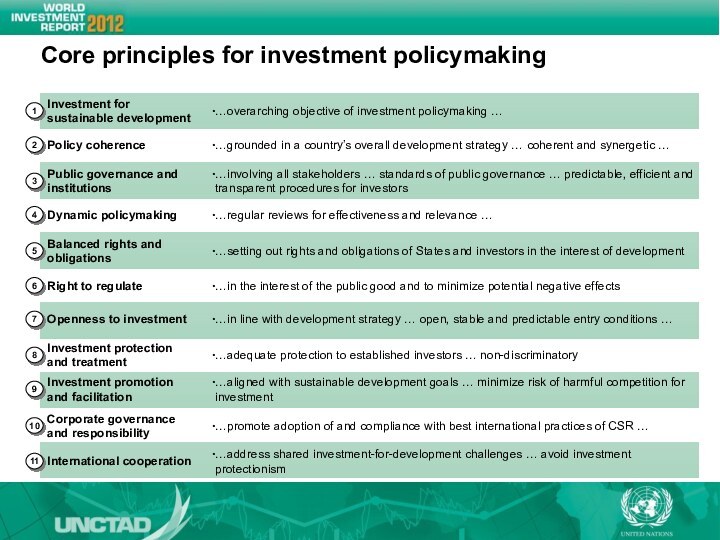

Corporate governance and responsibility

…aligned with sustainable development goals … minimize risk of harmful competition for investment

Investment promotion and facilitation

…adequate protection to established investors … non-discriminatory

Investment protection and treatment

…in line with development strategy … open, stable and predictable entry conditions …

Openness to investment

…in the interest of the public good and to minimize potential negative effects

Right to regulate

…setting out rights and obligations of States and investors in the interest of development

Balanced rights and obligations

…regular reviews for effectiveness and relevance …

Dynamic policymaking

…involving all stakeholders … standards of public governance … predictable, efficient and transparent procedures for investors

Public governance and institutions

…grounded in a country’s overall development strategy … coherent and synergetic …

Policy coherence

…overarching objective of investment policymaking …

Investment for sustainable development

1

3

8

9

11

2

4

5

6

7

10

Core principles for investment policymaking

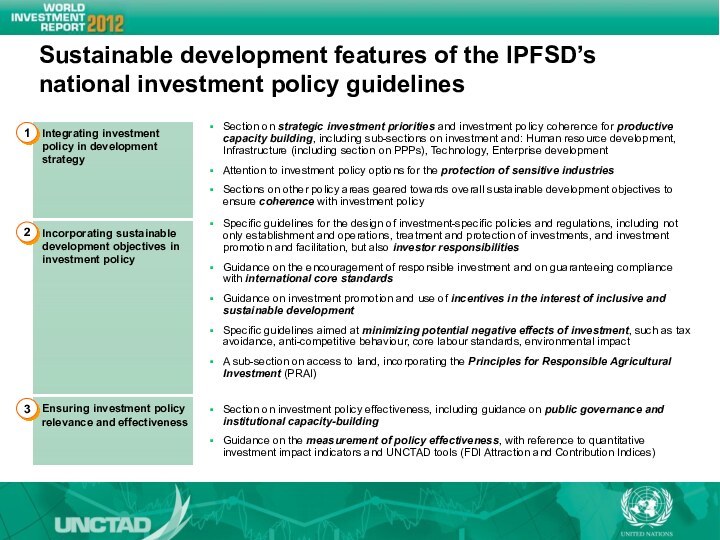

Ensuring investment policy relevance and effectiveness

Specific guidelines for the design of investment-specific policies and regulations, including not only establishment and operations, treatment and protection of investments, and investment promotion and facilitation, but also investor responsibilities

Guidance on the encouragement of responsible investment and on guaranteeing compliance with international core standards

Guidance on investment promotion and use of incentives in the interest of inclusive and sustainable development

Specific guidelines aimed at minimizing potential negative effects of investment, such as tax avoidance, anti-competitive behaviour, core labour standards, environmental impact

A sub-section on access to land, incorporating the Principles for Responsible Agricultural Investment (PRAI)

Incorporating sustainable development objectives in investment policy

Section on strategic investment priorities and investment policy coherence for productive capacity building, including sub-sections on investment and: Human resource development, Infrastructure (including section on PPPs), Technology, Enterprise development

Attention to investment policy options for the protection of sensitive industries

Sections on other policy areas geared towards overall sustainable development objectives to ensure coherence with investment policy

Integrating investment policy in development strategy

1

2

3