should be able to:

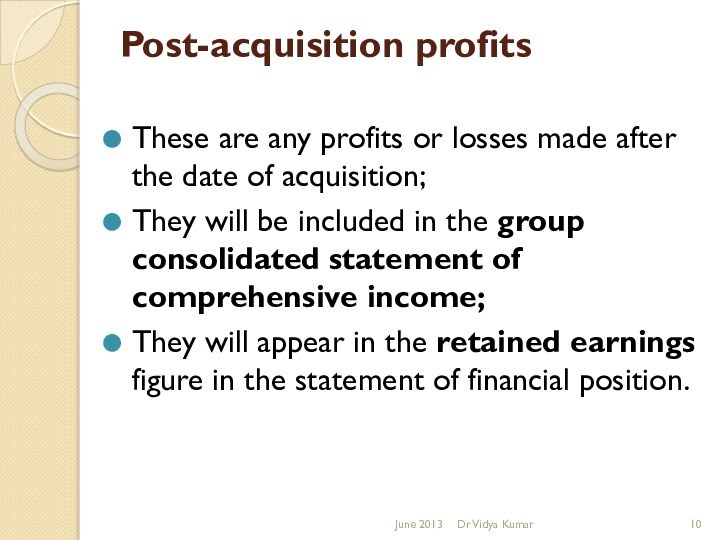

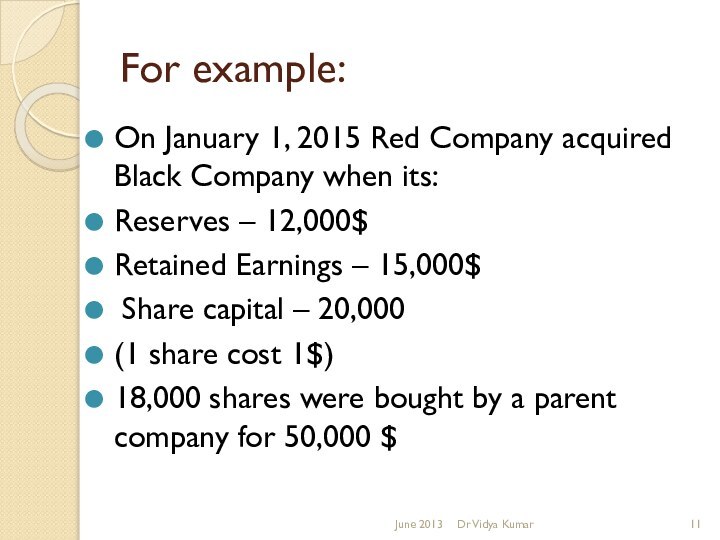

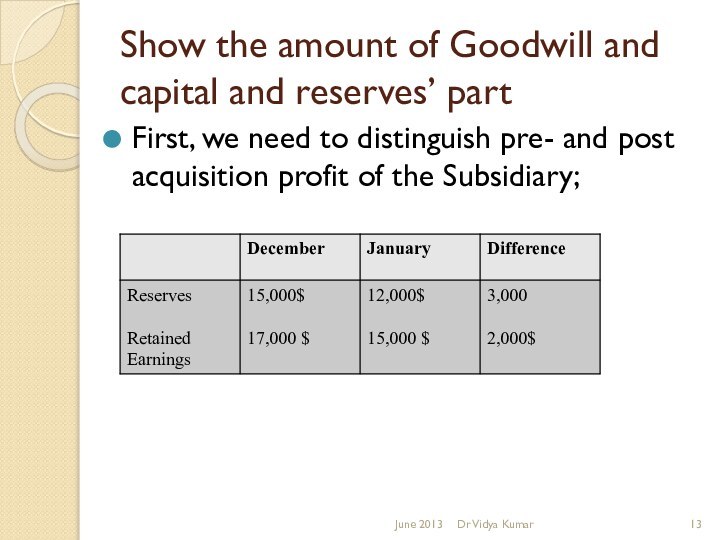

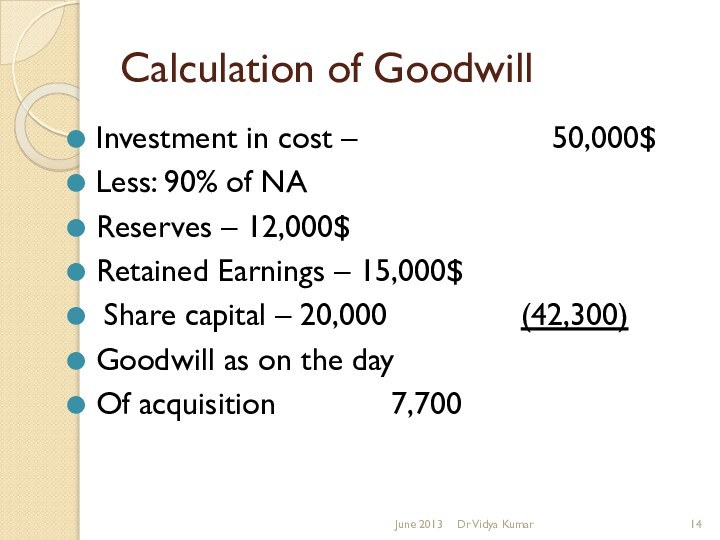

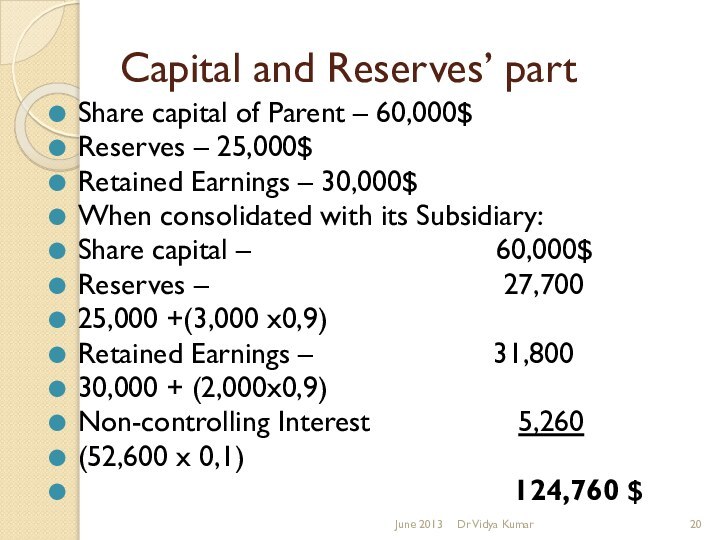

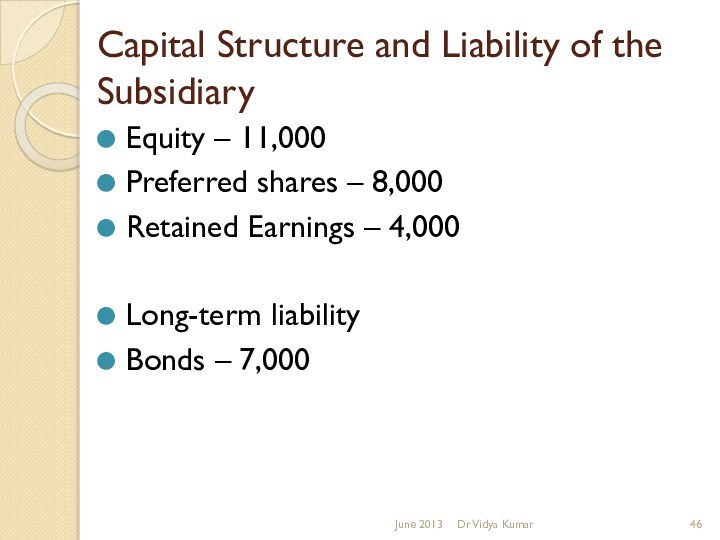

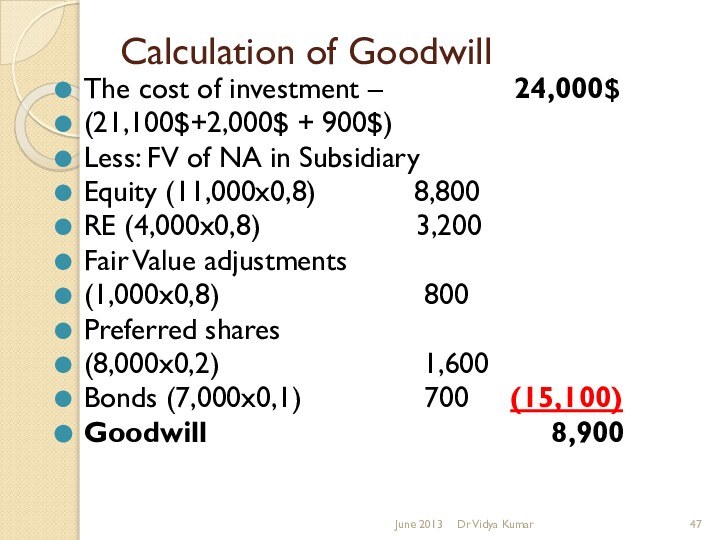

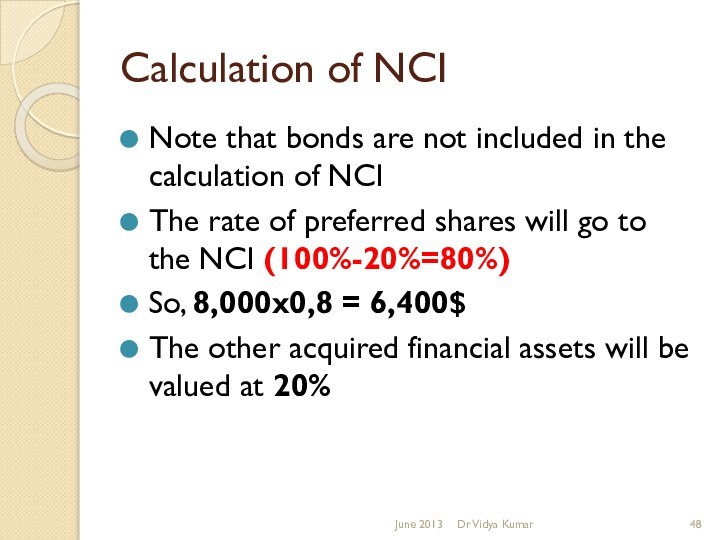

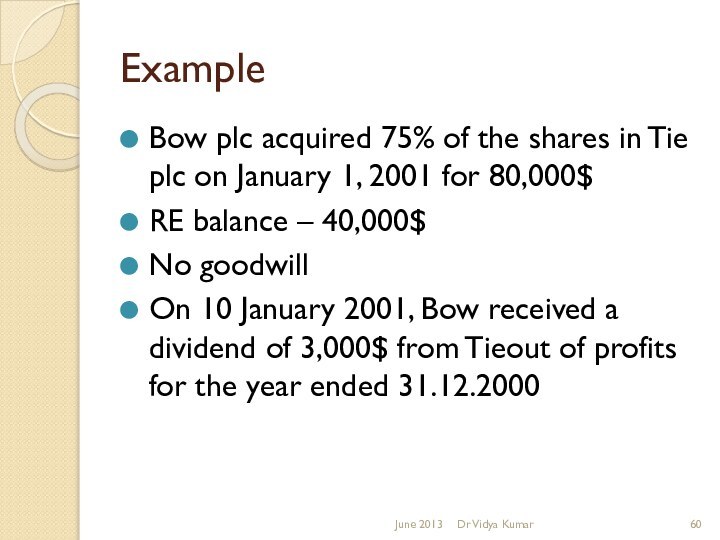

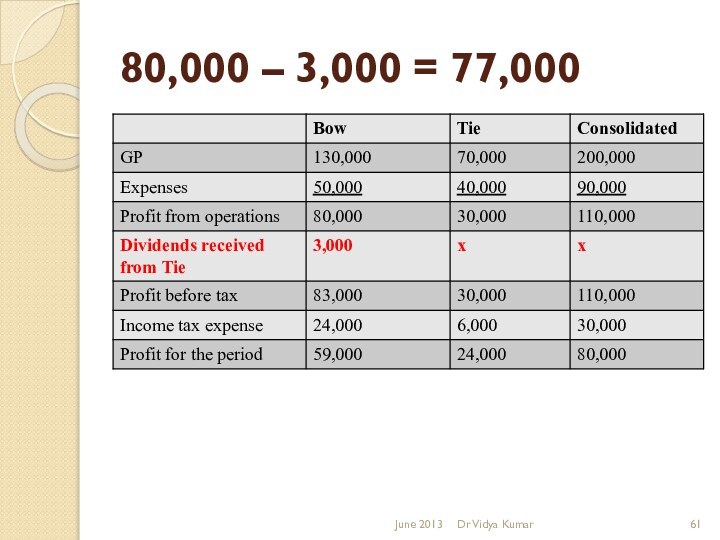

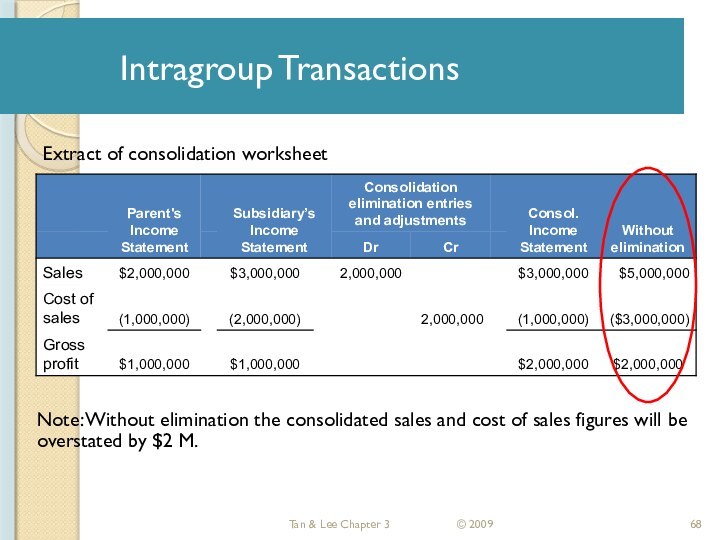

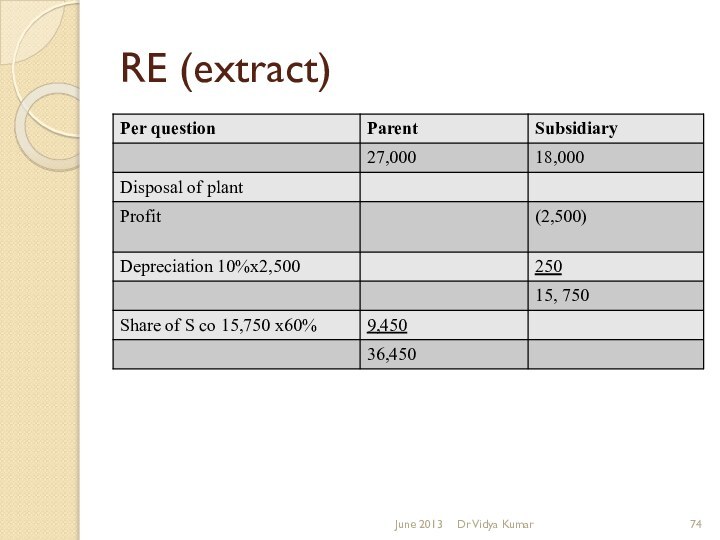

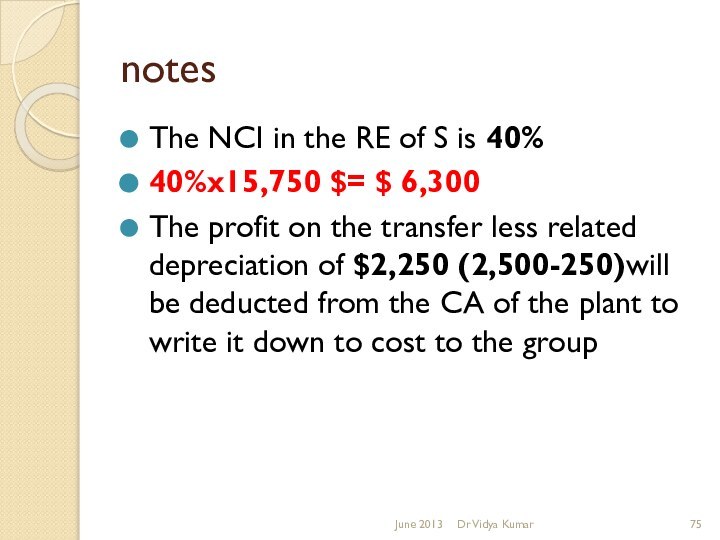

account for post –acquisition profits of

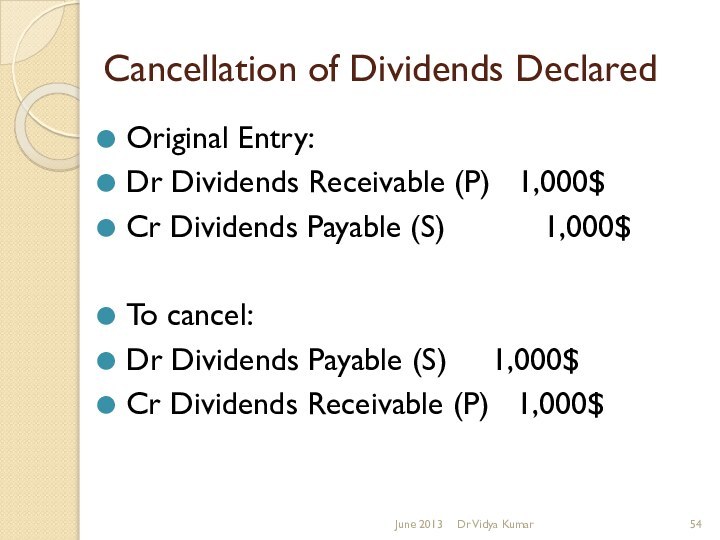

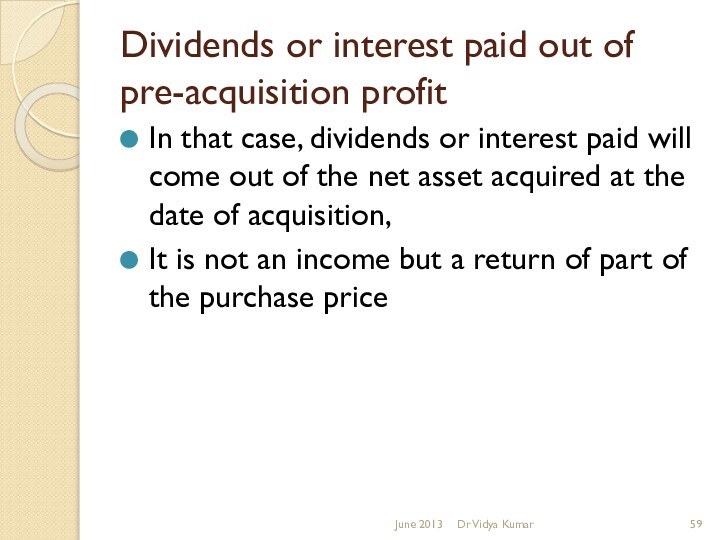

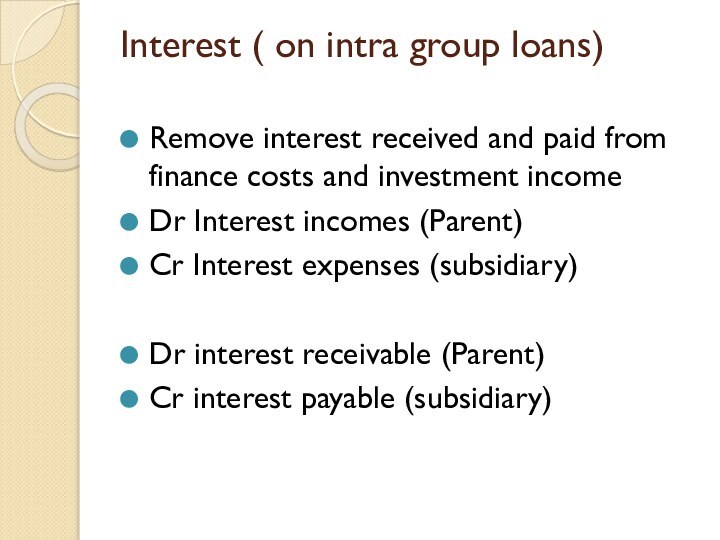

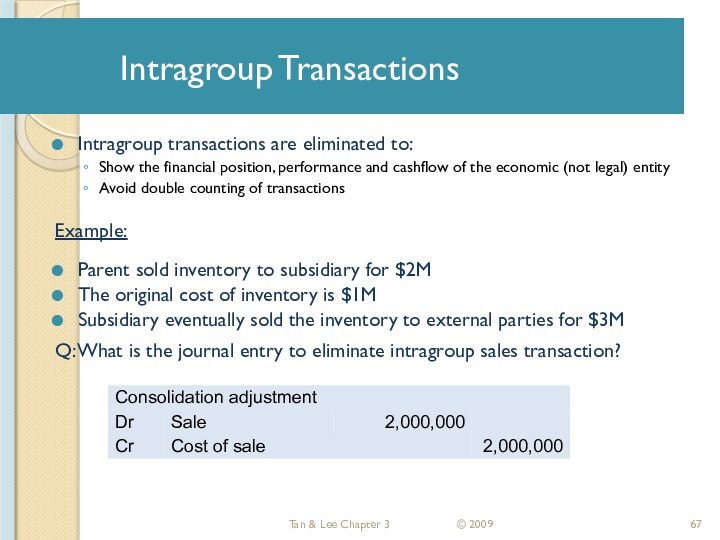

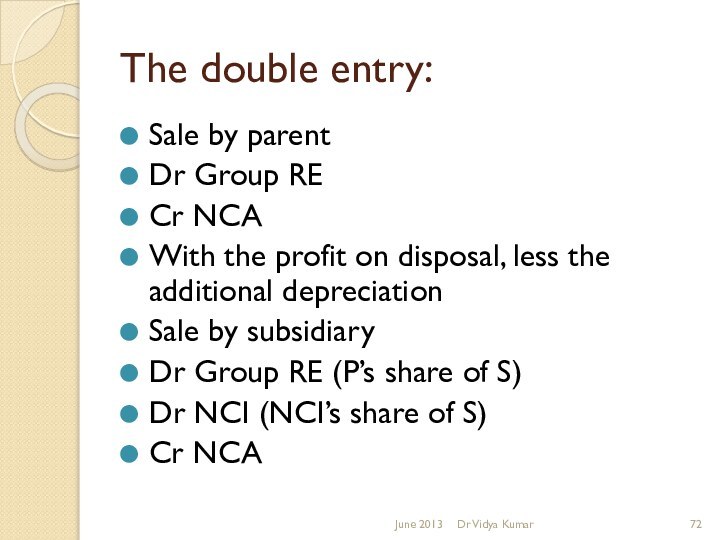

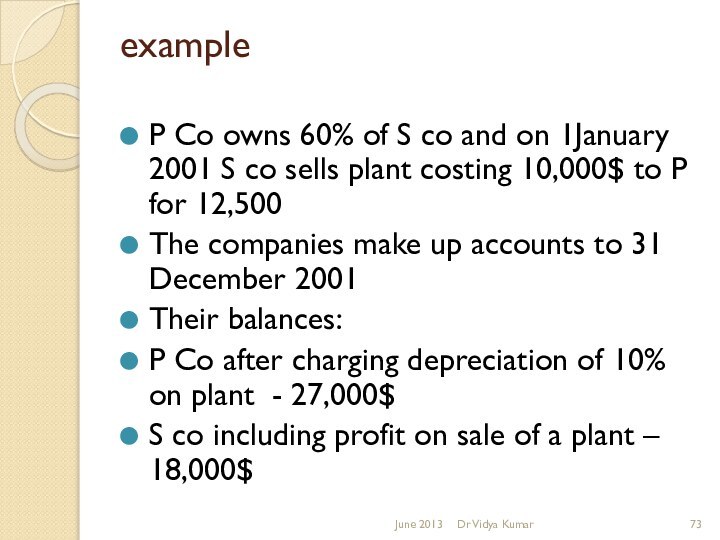

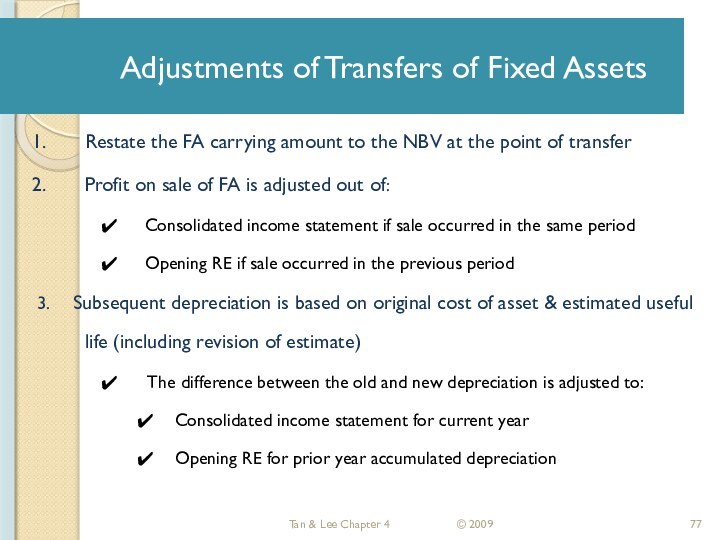

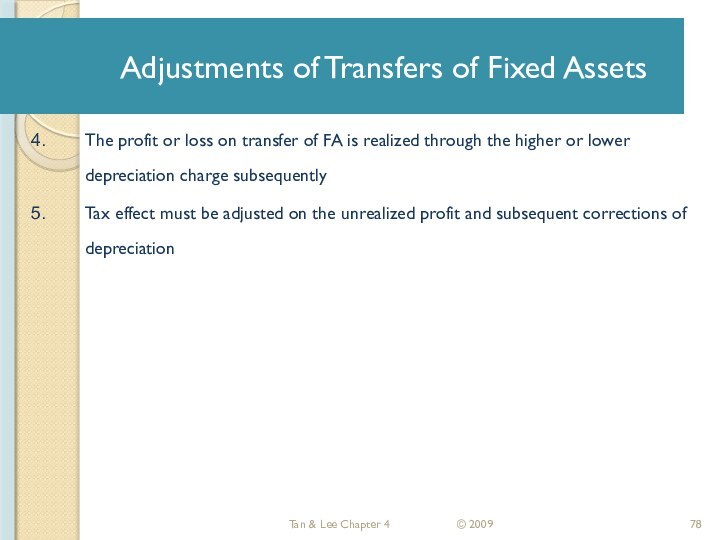

a subsidiaryeliminate inter-company balances and deal with reconciling items

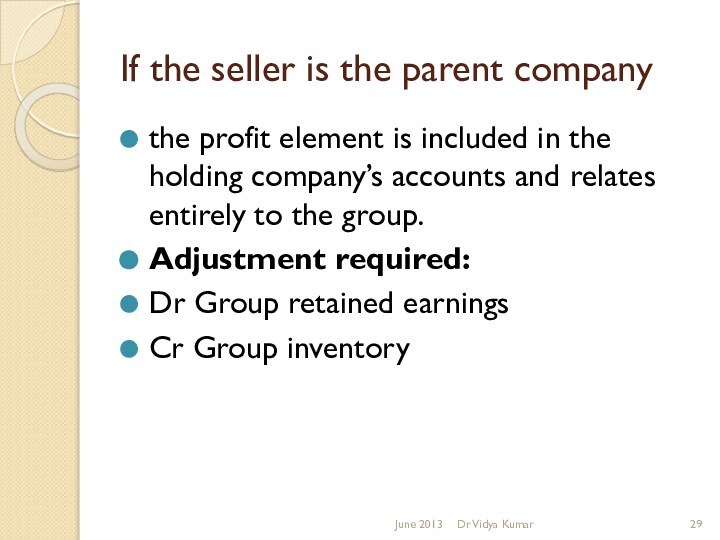

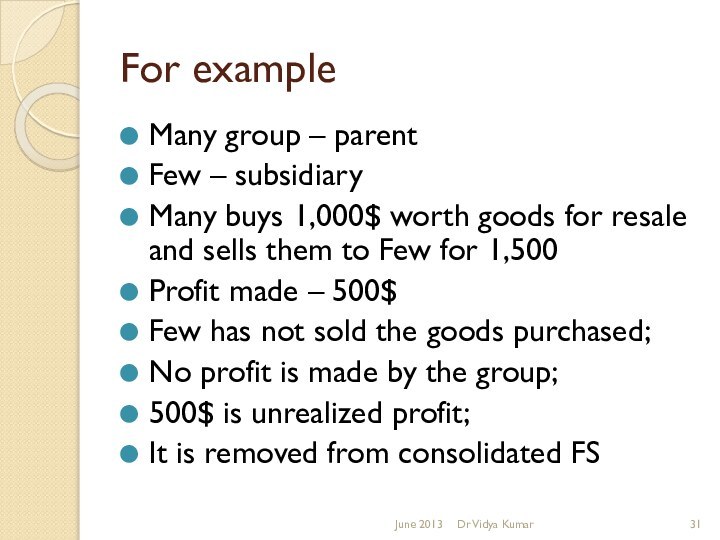

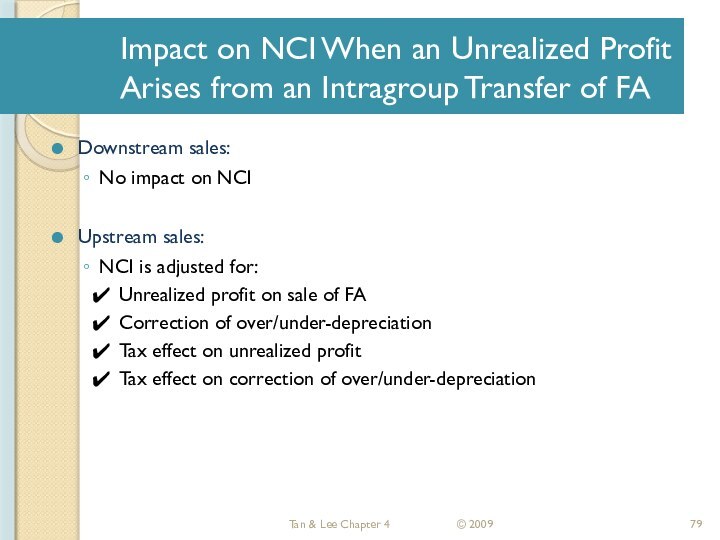

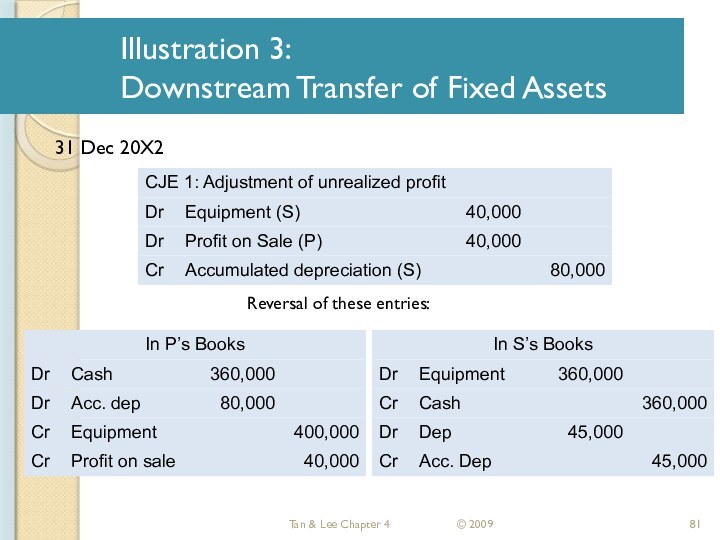

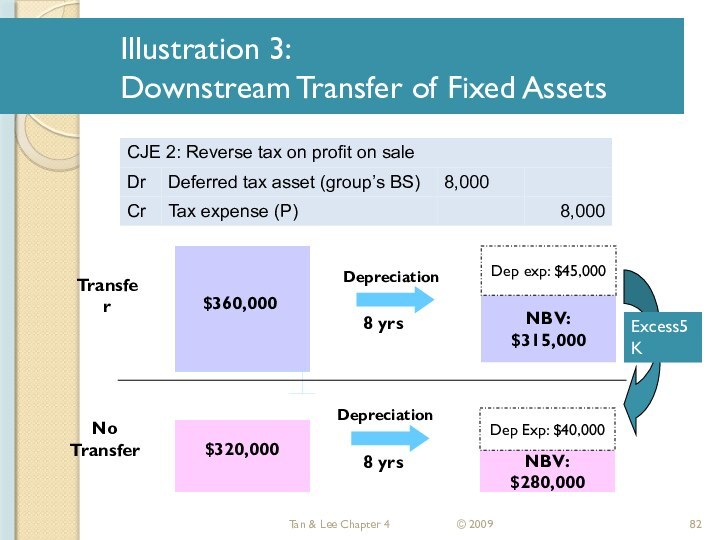

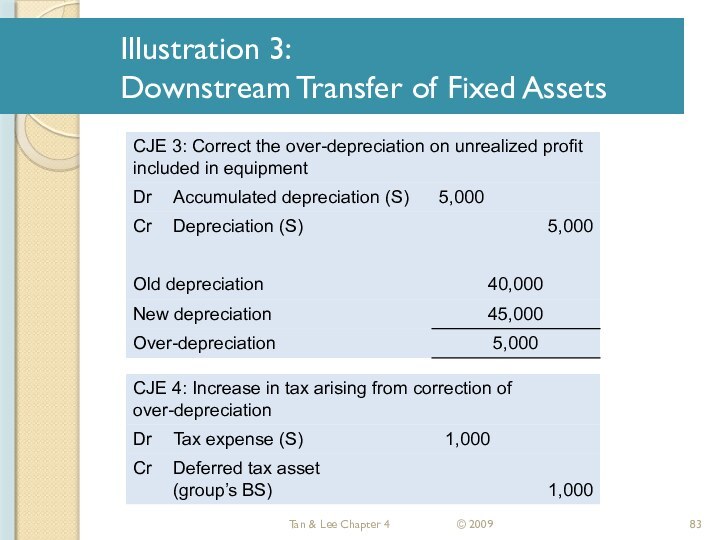

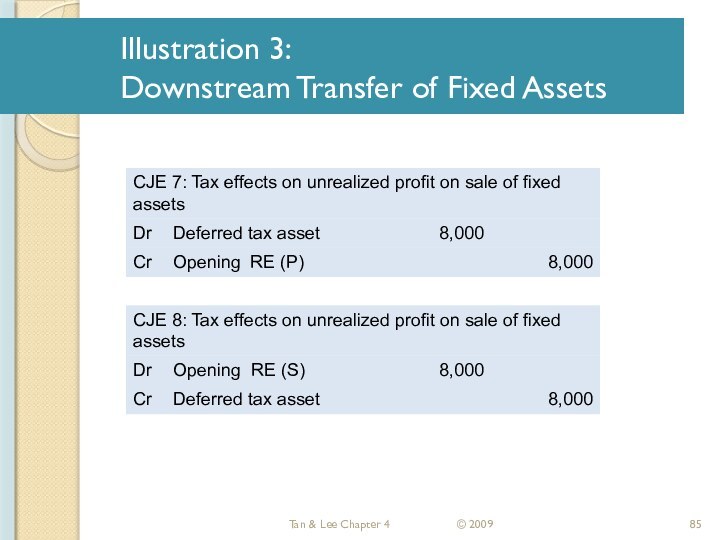

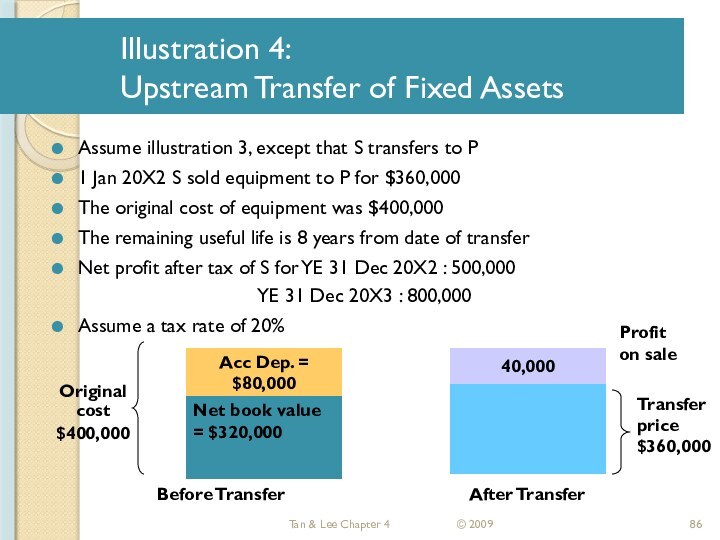

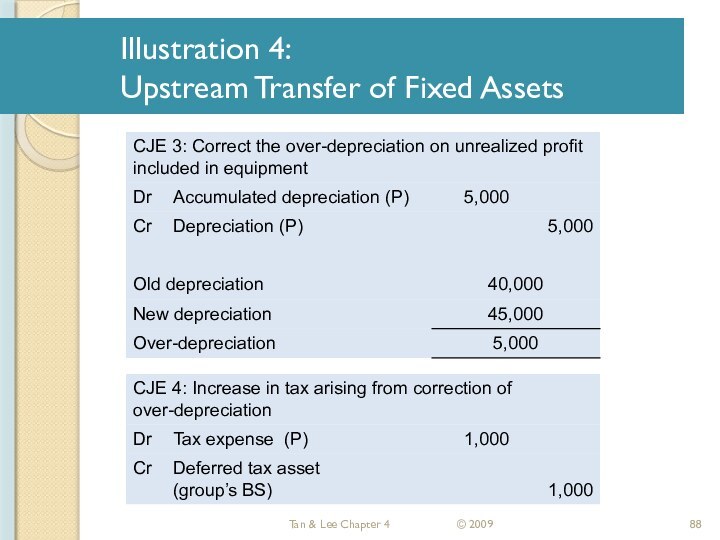

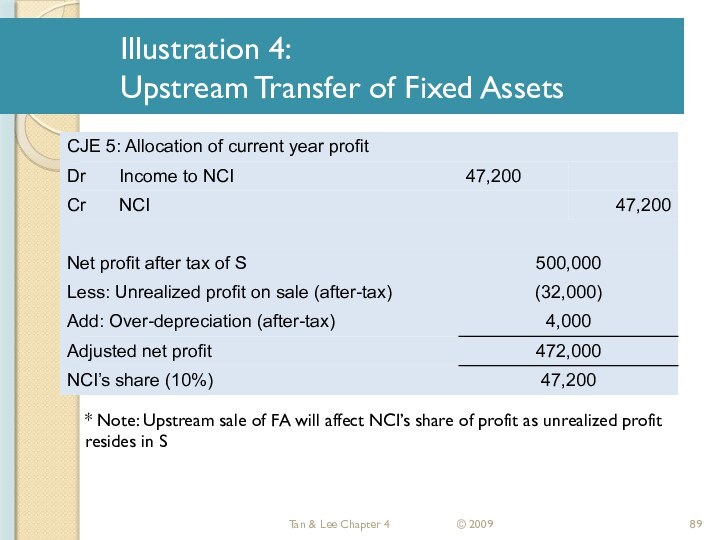

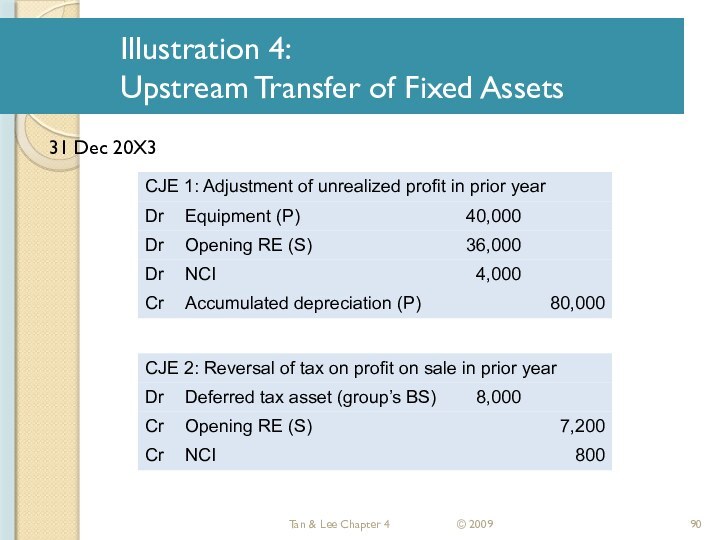

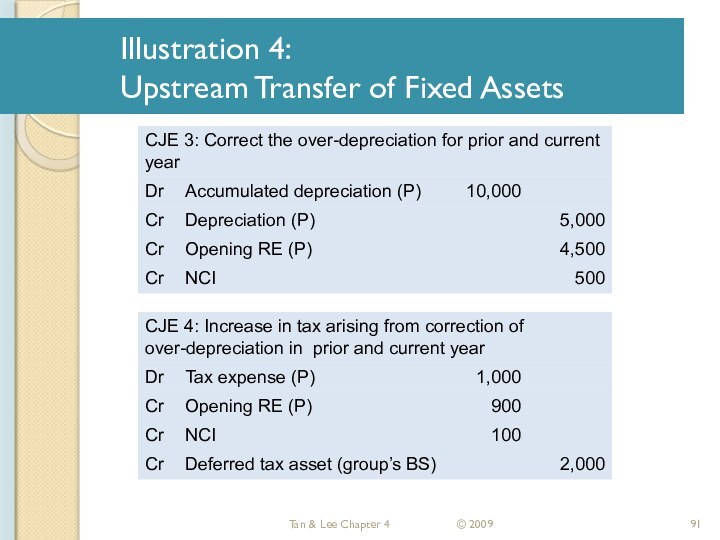

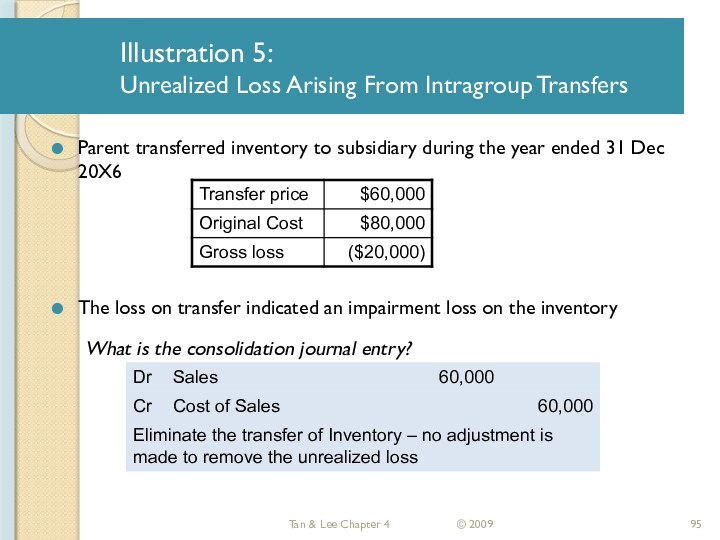

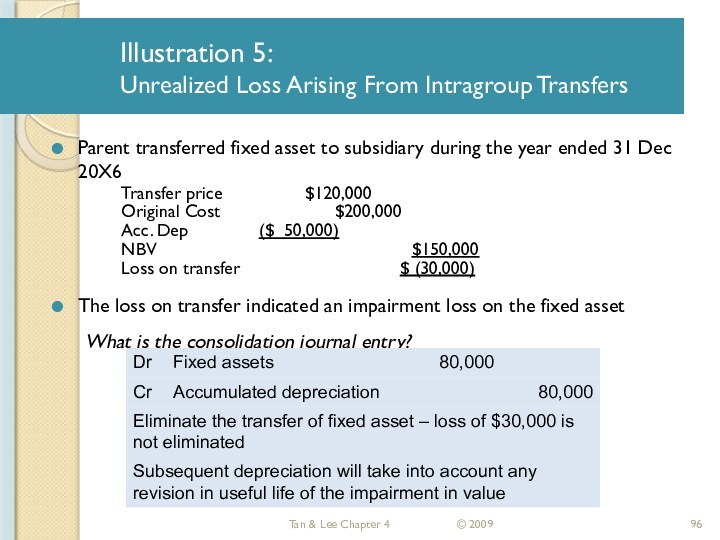

account for unrealized profits on inter-company transactions

June 2013

Dr Vidya Kumar