- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Structured products

Содержание

- 2. What are Structured ProductsStructured Product is a

- 3. DerivativesAn option gives its owner the right

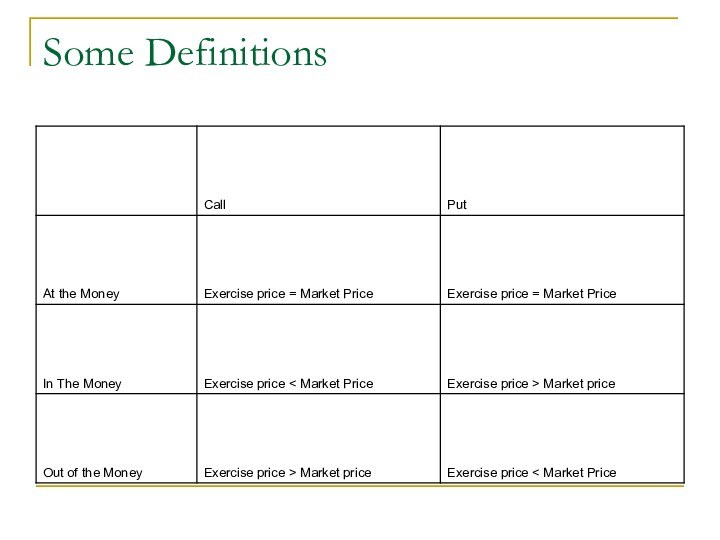

- 4. Some Definitions

- 5. Types of Structured ProductsCPPI ( Constant Proportion

- 6. CPPI Constant Proportion Portfolio Insurance (CPPI)

- 7. CPPI-JargonFloor : Present Value of desired capital

- 8. How CPPI operatesEssentially the strategy involves continuously

- 10. Example of CPPIInitial Investment : 100Minimum Guarantee

- 11. Example of CPPISame example if market rises

- 12. Risk in CPPI-Cash Locked In the worst

- 13. Risk in CPPI-Model RiskAnother risk is known

- 14. Risk in CPPI-Trading Band Width According to the

- 15. Gap Protection Banks that provide CPPI underwrite this

- 16. The difference between CPPI and standard

- 17. Some Indian Structured Products

- 18. HSBC Capital Guard Portfolio The key features of

- 19. JM Financial’s Triple AAAce Scheme JM Financial’s Triple

- 20. Structured Products in Global MarketsSome Examples

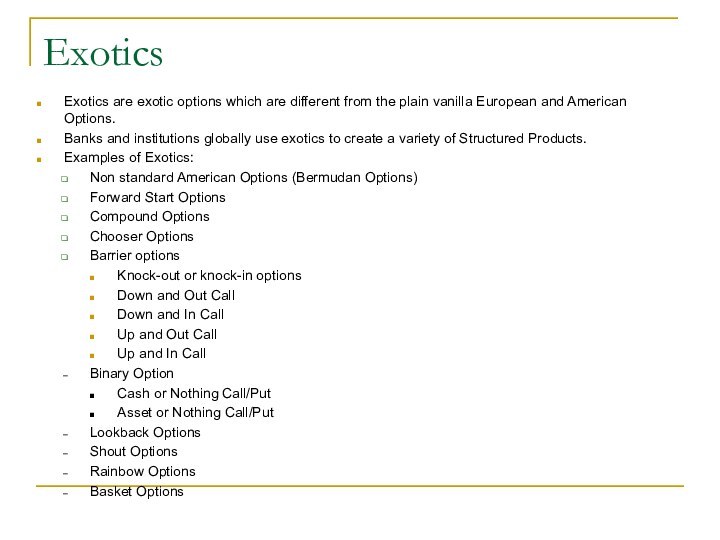

- 21. ExoticsExotics are exotic options which are different

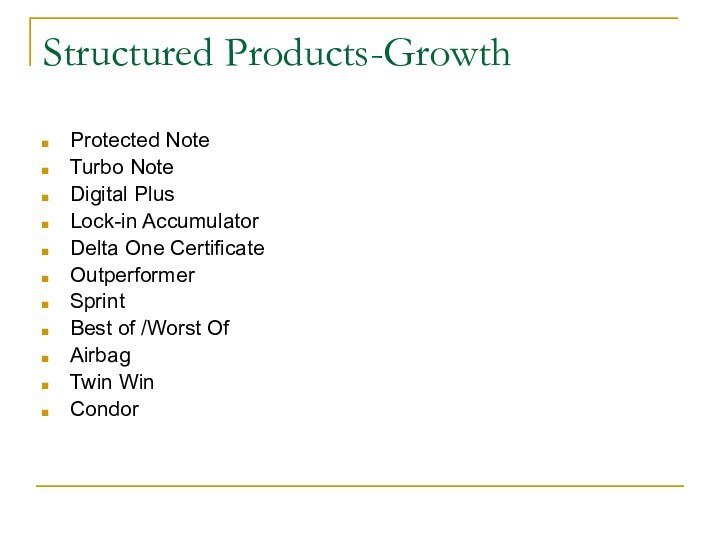

- 22. Structured Products-GrowthProtected NoteTurbo NoteDigital PlusLock-in AccumulatorDelta One CertificateOutperformerSprintBest of /Worst OfAirbagTwin WinCondor

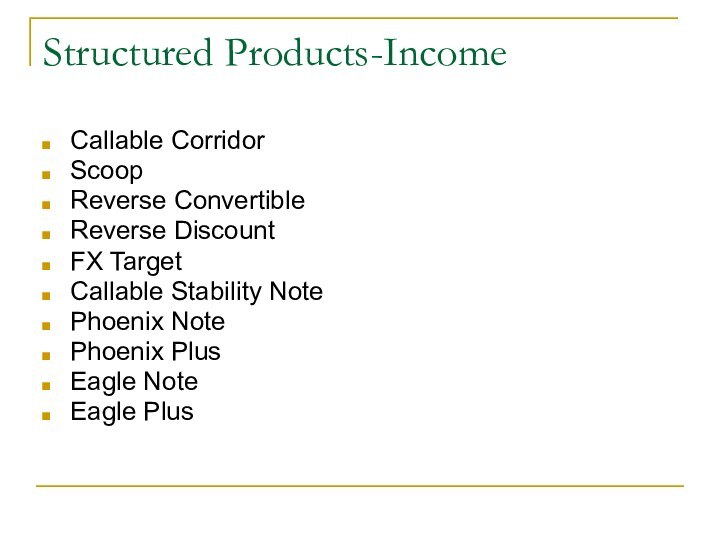

- 23. Structured Products-IncomeCallable CorridorScoopReverse ConvertibleReverse DiscountFX TargetCallable Stability NotePhoenix NotePhoenix PlusEagle NoteEagle Plus

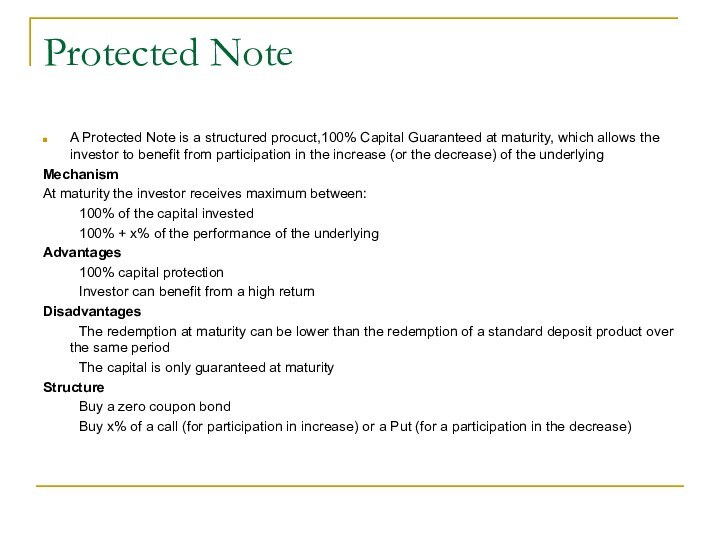

- 24. Protected NoteA Protected Note is a structured

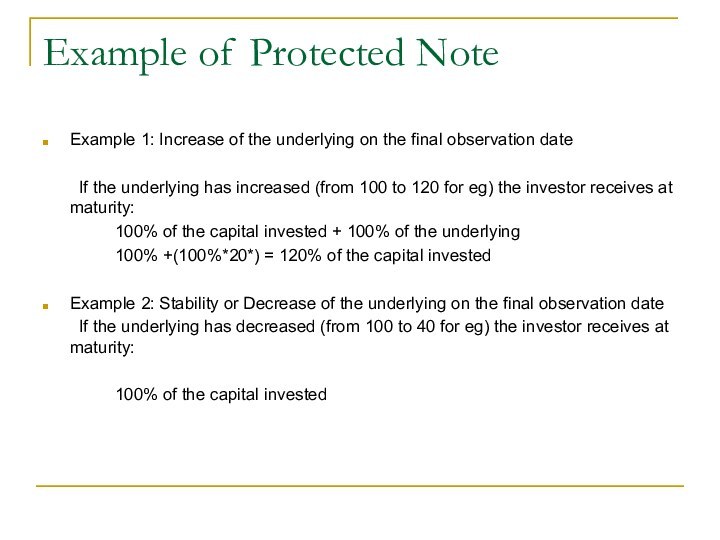

- 25. Example of Protected NoteExample 1: Increase of

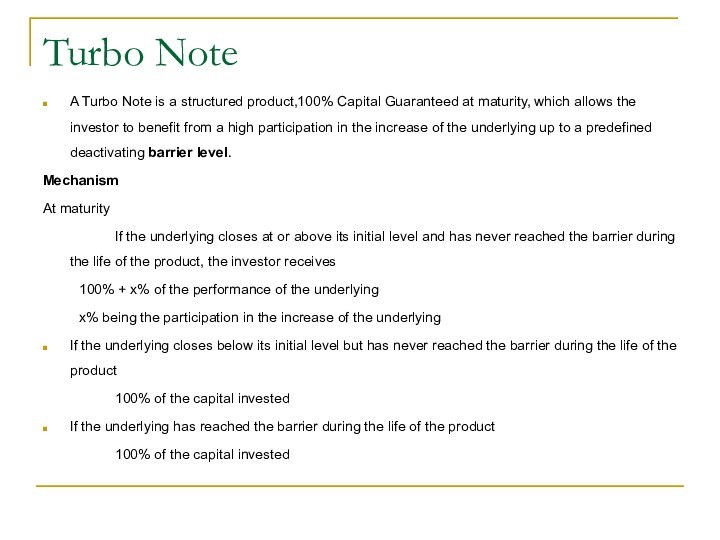

- 26. Turbo NoteA Turbo Note is a structured

- 27. Turbo NoteAdvantages 100% capital protection The product provides higher

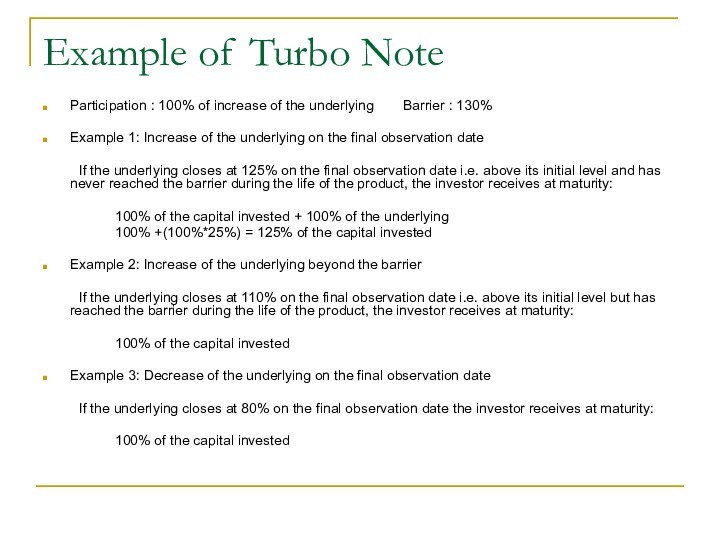

- 28. Example of Turbo NoteParticipation : 100% of

- 29. Digital PlusA Digital Plus is a structured

- 30. Digital PlusAdvantagesThe investor can benefit from the

- 31. Example of Digital PlusMaturity 2years Participation 100% of

- 32. Lock-in AccumulatorA lock-in Accumulator is a structured

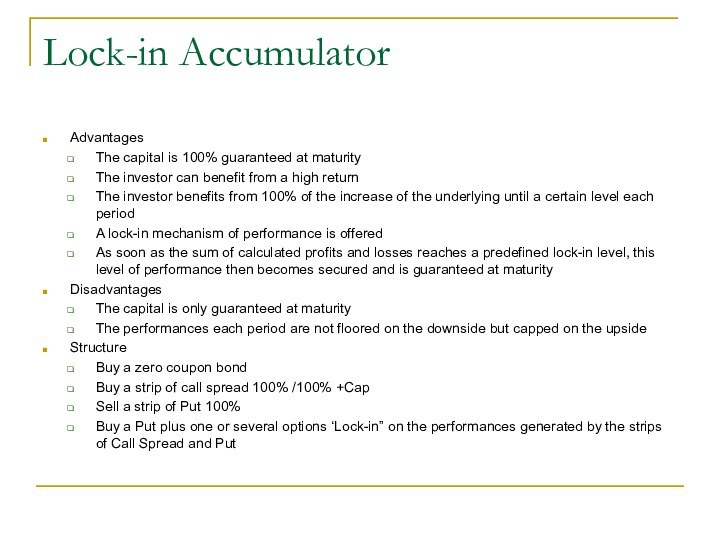

- 33. Lock-in AccumulatorAdvantagesThe capital is 100% guaranteed at

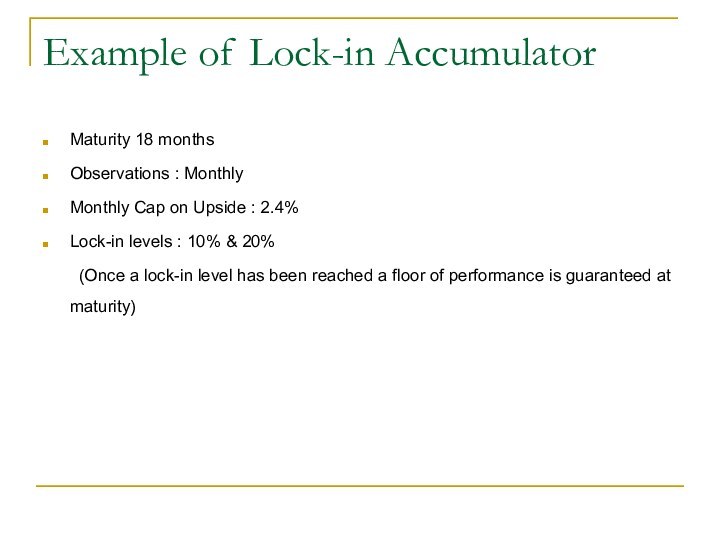

- 34. Example of Lock-in AccumulatorMaturity 18 monthsObservations :

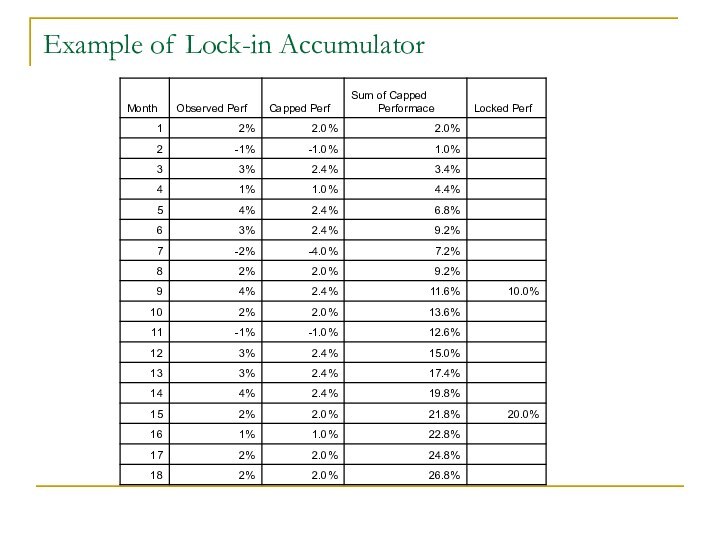

- 35. Example of Lock-in Accumulator

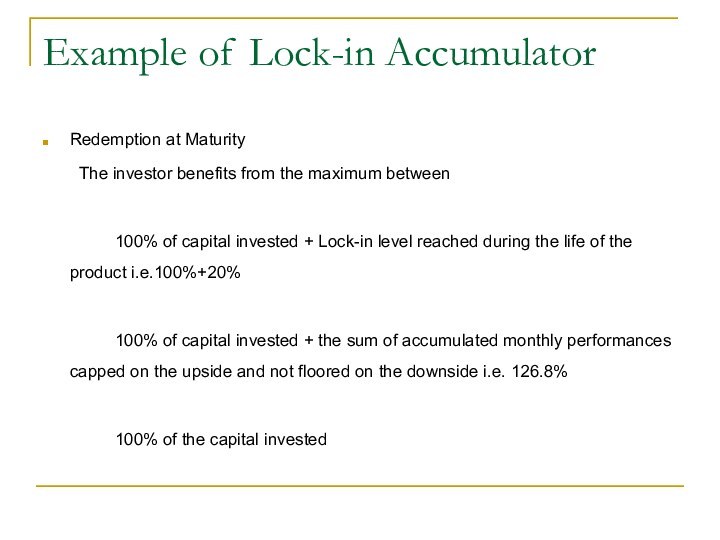

- 36. Example of Lock-in AccumulatorRedemption at Maturity The investor

- 37. Delta One Certificate A Delta One Certificate I

- 38. Example of Delta One CertificateExample 1: Increase

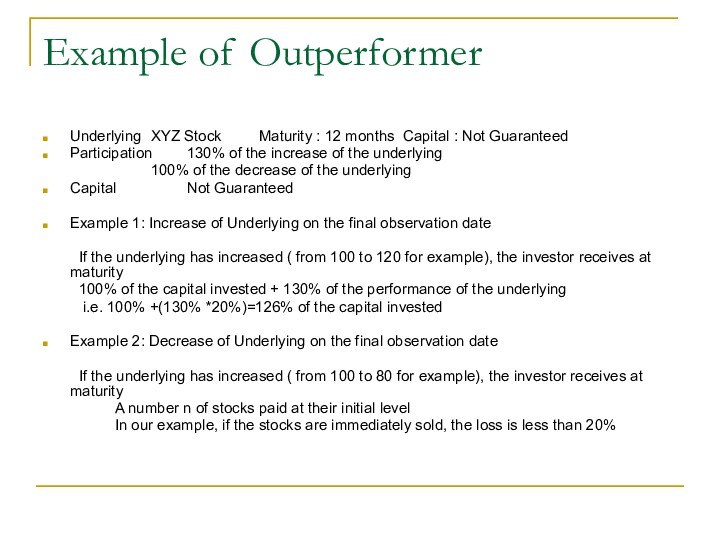

- 39. OutperformerAn outperformer is a structured product which

- 40. OutperformerStructureBuy a Call Zero (in order to

- 41. Example of OutperformerUnderlying XYZ Stock Maturity : 12 months Capital

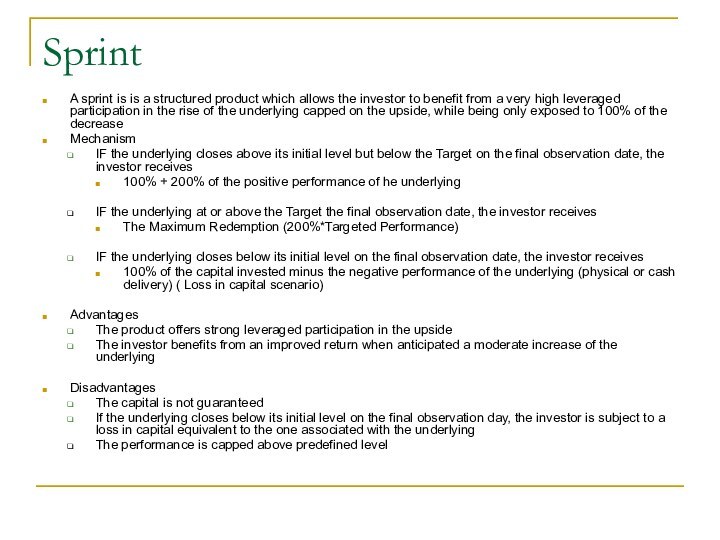

- 42. SprintA sprint is is a structured product

- 43. SprintStructureBuy a Call Zero ( In order

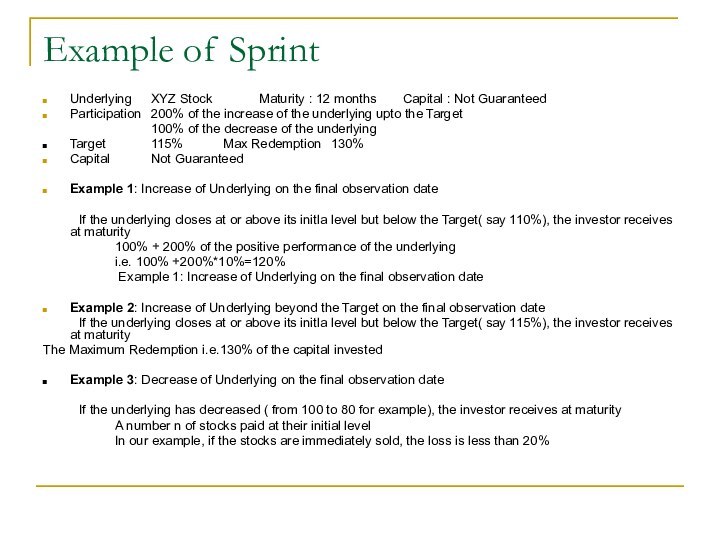

- 44. Example of SprintUnderlying XYZ Stock Maturity : 12 months Capital

- 45. Best of / Worst ofA Best Of/

- 46. Best of / Worst ofAdvantagesThe investor benefits

- 47. Example of Best Of/Worst OfUnderlying: ABC Stock

- 48. Callable CorridorA Callable Corridor is a structured

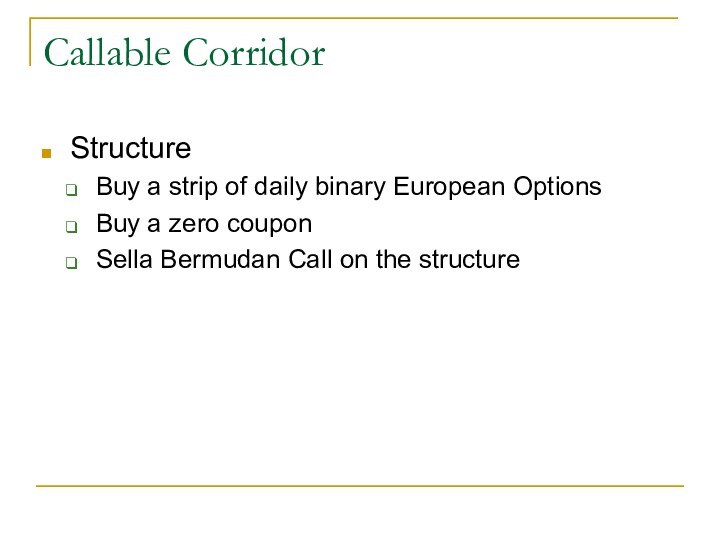

- 49. Callable CorridorStructureBuy a strip of daily binary

- 50. Example of Callable CorridorCurrency USD Maturity 6yearsBonus A maximum quarterly

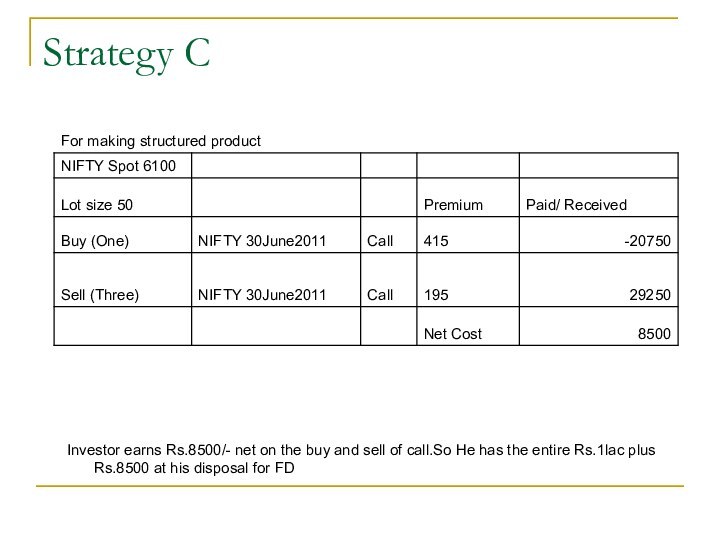

- 51. Hw to Create Your Own Structured ProductStrategy

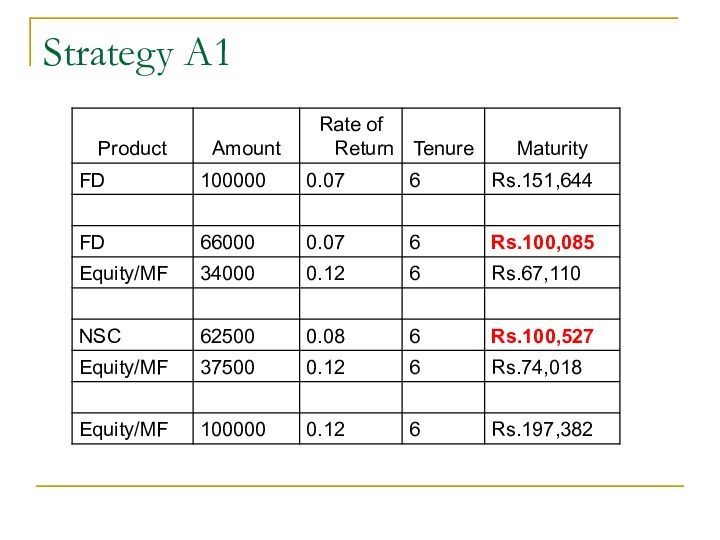

- 52. Strategy A1

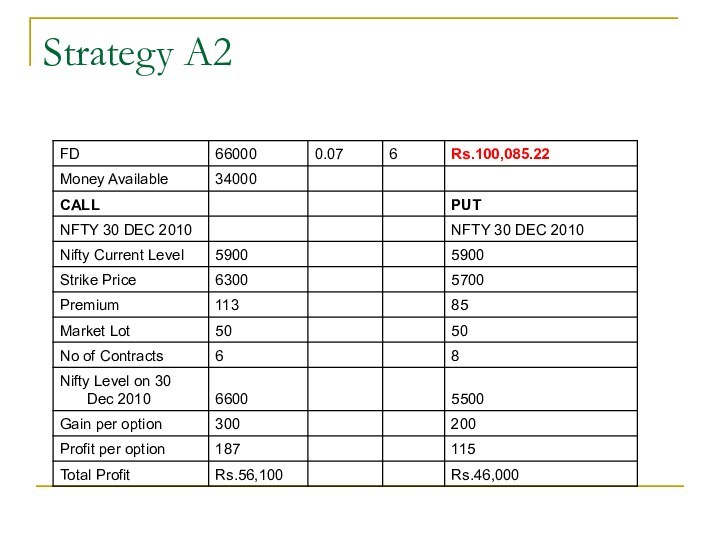

- 53. Strategy A2

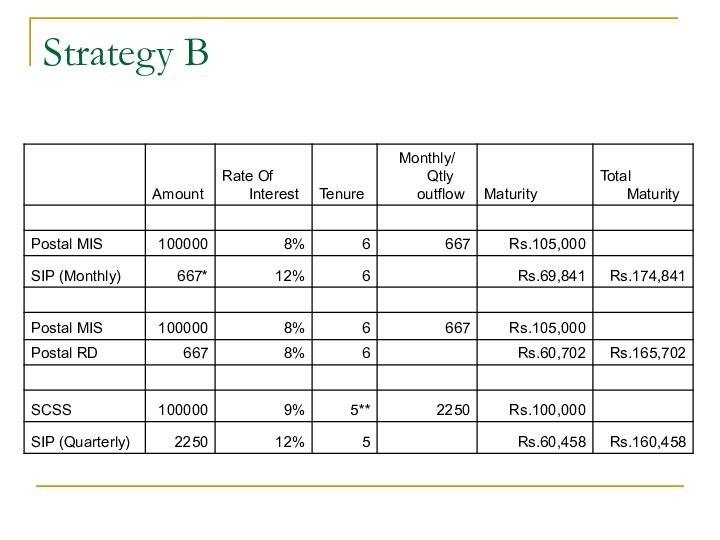

- 54. Strategy B

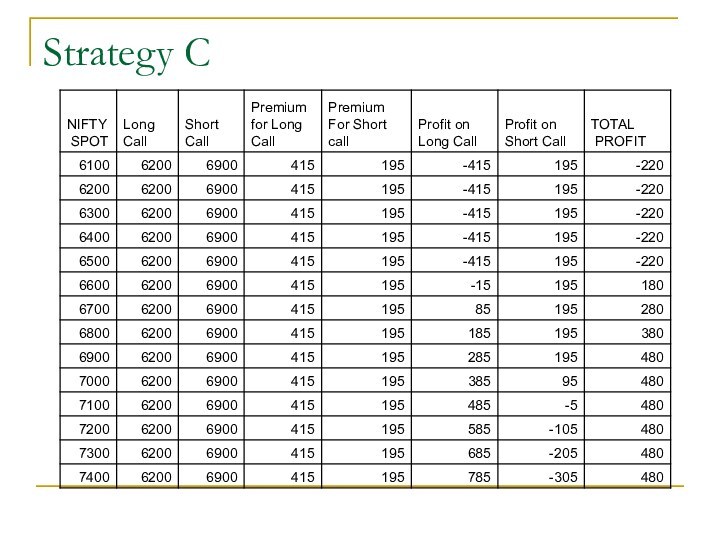

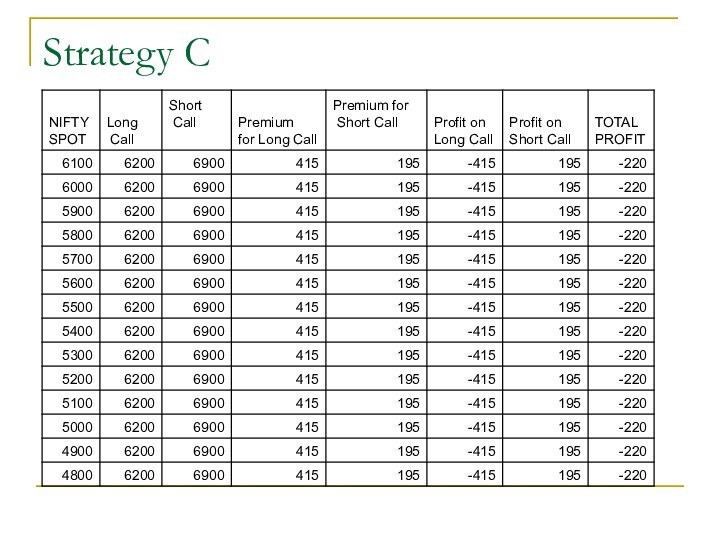

- 55. Strategy C

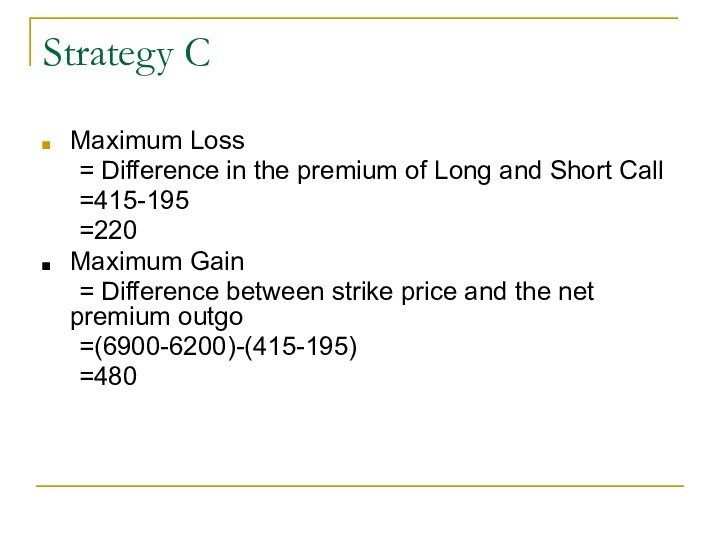

- 56. Strategy CMaximum Loss = Difference in the

- 57. Strategy C

- 58. Strategy C

- 59. Strategy CMaximum Loss = Difference in the

- 60. Risk in Structured ProductsIssuers Credit Risk Market

- 61. Distribution Platforms in IndiaPMS :FMP/InsuranceDirect DistributionIssuers are NBFC’sPlatform providers are MF’s, PMS providers, insurance companies

- 62. Скачать презентацию

- 63. Похожие презентации

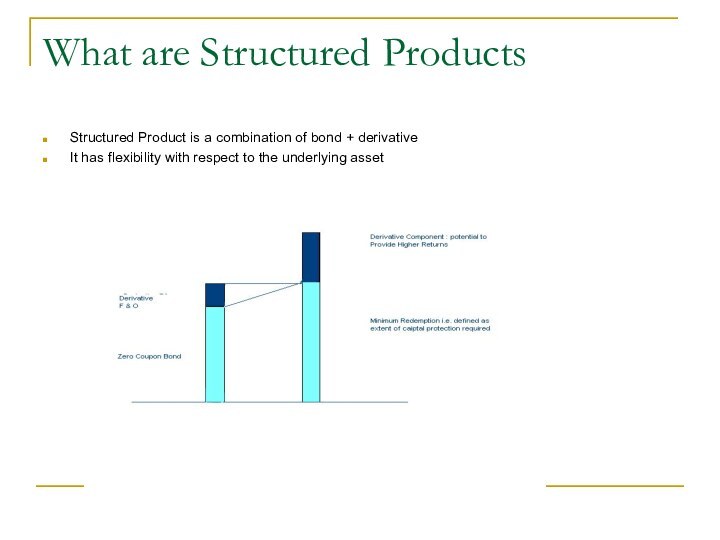

What are Structured ProductsStructured Product is a combination of bond + derivativeIt has flexibility with respect to the underlying asset

Слайд 2

What are Structured Products

Structured Product is a combination

of bond + derivative

the underlying asset

Слайд 3

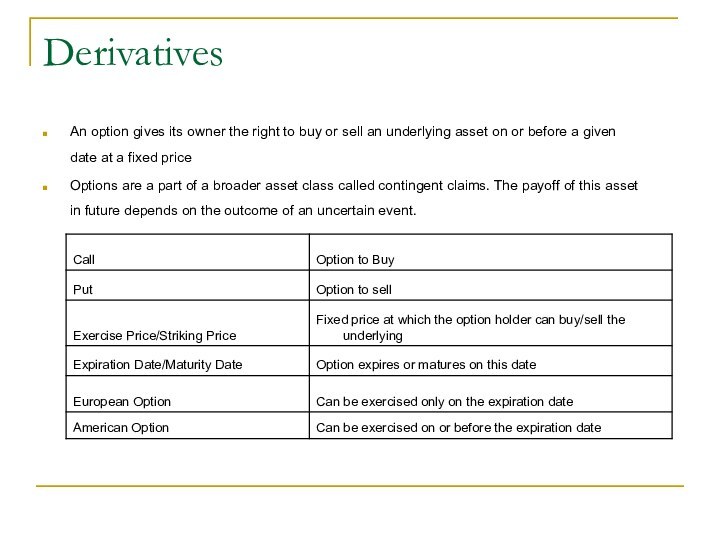

Derivatives

An option gives its owner the right to

buy or sell an underlying asset on or before

a given date at a fixed priceOptions are a part of a broader asset class called contingent claims. The payoff of this asset in future depends on the outcome of an uncertain event.

Слайд 5

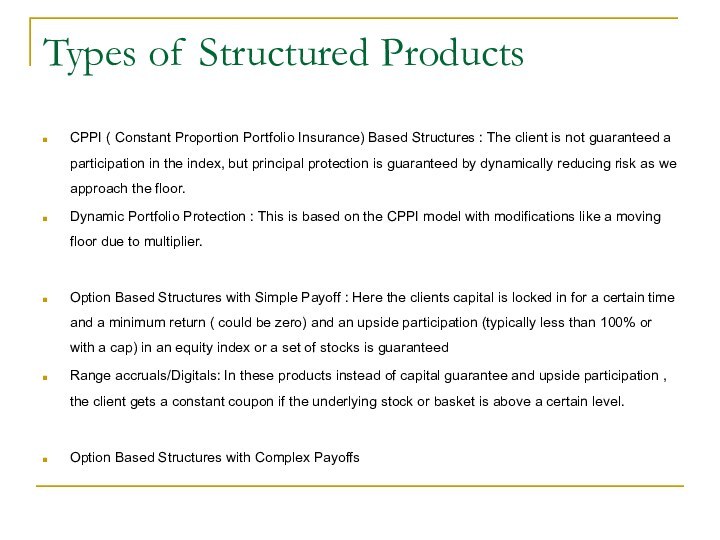

Types of Structured Products

CPPI ( Constant Proportion Portfolio

Insurance) Based Structures : The client is not guaranteed

a participation in the index, but principal protection is guaranteed by dynamically reducing risk as we approach the floor.Dynamic Portfolio Protection : This is based on the CPPI model with modifications like a moving floor due to multiplier.

Option Based Structures with Simple Payoff : Here the clients capital is locked in for a certain time and a minimum return ( could be zero) and an upside participation (typically less than 100% or with a cap) in an equity index or a set of stocks is guaranteed

Range accruals/Digitals: In these products instead of capital guarantee and upside participation , the client gets a constant coupon if the underlying stock or basket is above a certain level.

Option Based Structures with Complex Payoffs

Слайд 6

CPPI

Constant Proportion Portfolio Insurance (CPPI) is

the name given to a trading strategy that is

designed to ensure that a fixed minimum return is achieved either at all times or more typically, at a set date in the future

Слайд 7

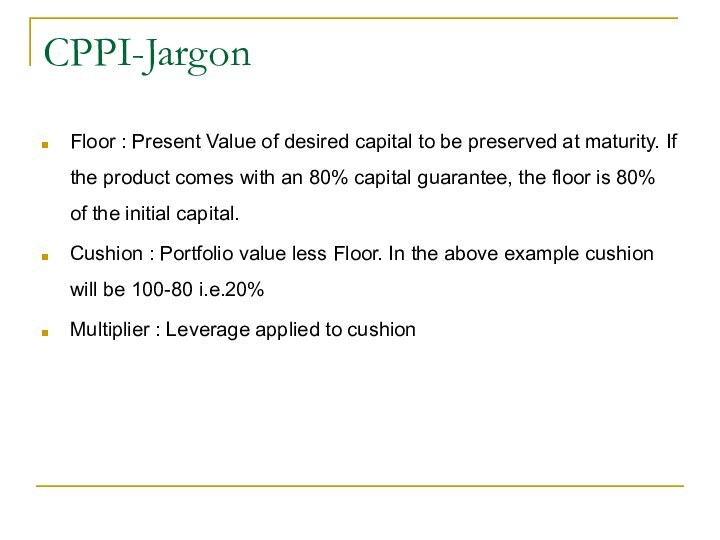

CPPI-Jargon

Floor : Present Value of desired capital to

be preserved at maturity. If the product comes with

an 80% capital guarantee, the floor is 80% of the initial capital.Cushion : Portfolio value less Floor. In the above example cushion will be 100-80 i.e.20%

Multiplier : Leverage applied to cushion

Слайд 8

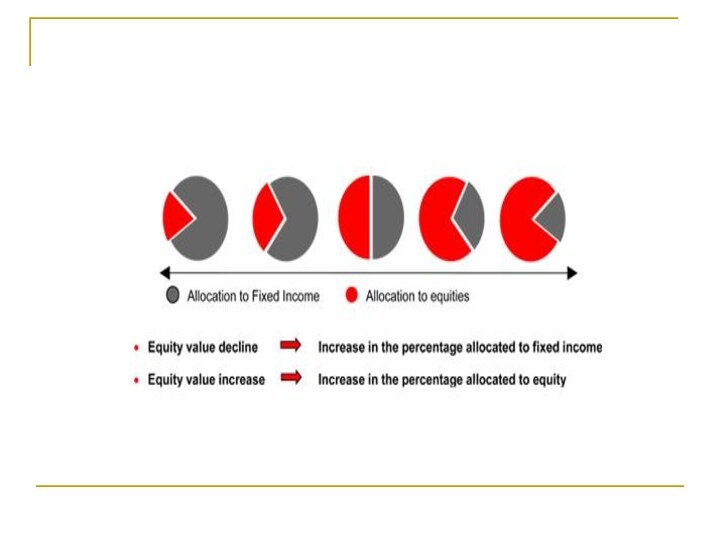

How CPPI operates

Essentially the strategy involves continuously re-balancing

the portfolio of investments during the term of the

product between performance assets and safe assets using a set formula or mathematical algorithm. CPPI is totally rules based and non-discretionary.Principal protection is achieved by adjusting the exposure to the performance assets such that the underlying portfolio (ie the mix of safe assets and performance assets) is able to absorb a defined decrease in value before the value of the portfolio falls below the level required to achieve principal protection.

Слайд 10

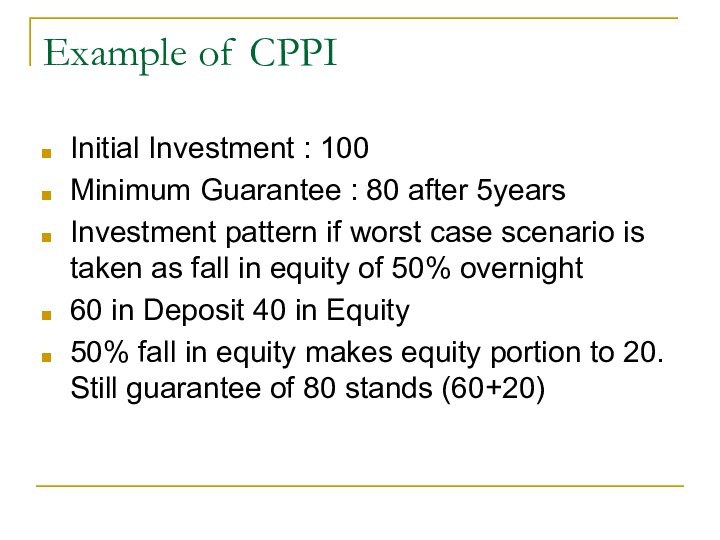

Example of CPPI

Initial Investment : 100

Minimum Guarantee :

80 after 5years

Investment pattern if worst case scenario is

taken as fall in equity of 50% overnight60 in Deposit 40 in Equity

50% fall in equity makes equity portion to 20. Still guarantee of 80 stands (60+20)

Слайд 11

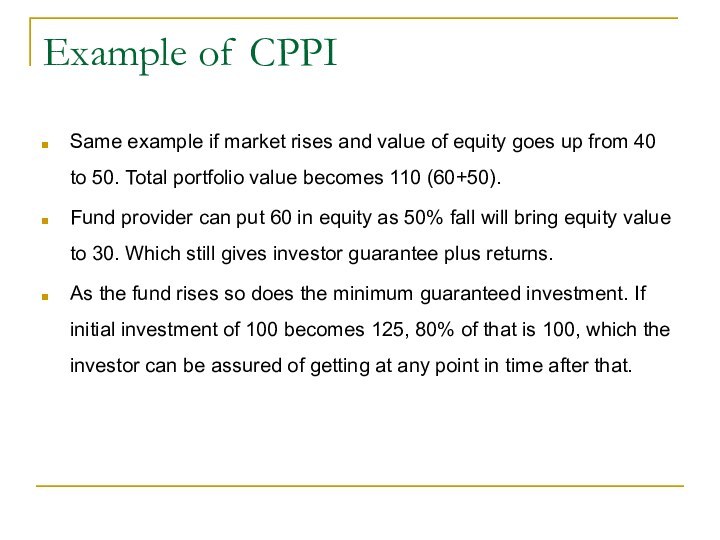

Example of CPPI

Same example if market rises and

value of equity goes up from 40 to 50.

Total portfolio value becomes 110 (60+50).Fund provider can put 60 in equity as 50% fall will bring equity value to 30. Which still gives investor guarantee plus returns.

As the fund rises so does the minimum guaranteed investment. If initial investment of 100 becomes 125, 80% of that is 100, which the investor can be assured of getting at any point in time after that.

Слайд 12

Risk in CPPI-Cash Locked

In the worst case

scenario the market trends downwards. Then the risky asset

contentiously loses value and in order to protect the floor, more and more assets are allocated to the risk-free asset. In this worst case scenario, as soon as all assets are allocated to the risk free asset. The total value of all assets equals the floor and the is no room left for an allocation to risky assets. The strategy is “cash locked”. Upside potential disappeared and only the interest earned from the cash position can be invested in the risky asset.

Слайд 13

Risk in CPPI-Model Risk

Another risk is known as

Model risk. This is the risk that the market

overnight collapses and more value is lost then assumed when the multiplier was set. The model risk or gap risk is either ran by the investor or by the manager. In the latter case a gap risk insurance will be charged. This risk is often reduced by a long put option position.

Слайд 14

Risk in CPPI-Trading Band Width

According to the CPPI

methodology, risky assets are being bought in rising markets

and sold in falling markets. If then after a boost, the underlying market corrects downwards to the previous level, the same number of risky assets that were first bought at a high price now needs to be sold at a low price. A loss is recorded and a smaller allocation to the risky asset is necessary. The trading band-with should be set as wide as to prevent this, but at the same time, as small as to reduce the gap risk. Next to the multiplier the trading band-width is a key to a successful CPPI product.

Слайд 15

Gap Protection

Banks that provide CPPI underwrite this so-called

‘Gap Risk’ and guarantee to stand by the stated

minimum return whatever occurs in the market. A non-bank provider of CPPI product would typically purchase Gap Protection from a third party in order to maintain their Minimum Return GuaranteeСлайд 16 The difference between CPPI and standard fixed participation

methodology

Unlike a standard structured product which places a set

amount in a zero coupon deposit on day one and purchases a call option with the remaining funds in order to provide a set participation level, a CPPI based structure varies cash allocation between so-called safe assets (ie bonds and cash) and the performance assets (equities or other ‘risky assets’) depending upon market performance.The key difference between CPPI based capital protected products and option-based products are:

The participation in any rise in the underlying is not fixed at the start

It is possible to have a higher initial participation than with an equivalent option-based product

Слайд 18

HSBC Capital Guard Portfolio

The key features of this

product are:

* 100% Capital Protection Guaranteed – 100%

of initial investment back at maturity (after 4 years). For the guarantee to be applicable, the investor will need to remain invested till maturity 100% Initial Equity Exposure – Optimal allocation to actively managed equities aimed at Capital Appreciation

Profit Lock-in Mechanism – The portfolio endeavours to capture upside by providing a 3% lock-in for every 10% increase in initial portfolio

Easy Liquidity – 4 year tenor with liquidity provided through the tenor of the product (subject to applicable exit loads)

Minimum Investment Amount – Rs 25 lacs

* Guarantee has been provided by HSBC Bank plc subject to terms and conditions..

This portfolio is currently not available for subscription.

Слайд 19

JM Financial’s Triple AAAce Scheme

JM Financial’s Triple AAAce

Scheme, will invest in equity funds for five years

and provide investors at least 85% of the maximum peak value of the underlying portfolio of funds, at the time of maturity. It has tied up with Societe Generale Asset Management and has been rated by Crisil Ltd, a subsidiary of ratings agency Standard & Poor’s

Слайд 21

Exotics

Exotics are exotic options which are different from

the plain vanilla European and American Options.

Banks and

institutions globally use exotics to create a variety of Structured Products.Examples of Exotics:

Non standard American Options (Bermudan Options)

Forward Start Options

Compound Options

Chooser Options

Barrier options

Knock-out or knock-in options

Down and Out Call

Down and In Call

Up and Out Call

Up and In Call

Binary Option

Cash or Nothing Call/Put

Asset or Nothing Call/Put

Lookback Options

Shout Options

Rainbow Options

Basket Options

Слайд 22

Structured Products-Growth

Protected Note

Turbo Note

Digital Plus

Lock-in Accumulator

Delta One Certificate

Outperformer

Sprint

Best

of /Worst Of

Airbag

Twin Win

Condor

Слайд 23

Structured Products-Income

Callable Corridor

Scoop

Reverse Convertible

Reverse Discount

FX Target

Callable Stability Note

Phoenix

Note

Phoenix Plus

Eagle Note

Eagle Plus

Слайд 24

Protected Note

A Protected Note is a structured procuct,100%

Capital Guaranteed at maturity, which allows the investor to

benefit from participation in the increase (or the decrease) of the underlyingMechanism

At maturity the investor receives maximum between:

100% of the capital invested

100% + x% of the performance of the underlying

Advantages

100% capital protection

Investor can benefit from a high return

Disadvantages

The redemption at maturity can be lower than the redemption of a standard deposit product over the same period

The capital is only guaranteed at maturity

Structure

Buy a zero coupon bond

Buy x% of a call (for participation in increase) or a Put (for a participation in the decrease)

Слайд 25

Example of Protected Note

Example 1: Increase of the

underlying on the final observation date

If the underlying has

increased (from 100 to 120 for eg) the investor receives at maturity:100% of the capital invested + 100% of the underlying

100% +(100%*20*) = 120% of the capital invested

Example 2: Stability or Decrease of the underlying on the final observation date

If the underlying has decreased (from 100 to 40 for eg) the investor receives at maturity:

100% of the capital invested

Слайд 26

Turbo Note

A Turbo Note is a structured product,100%

Capital Guaranteed at maturity, which allows the investor to

benefit from a high participation in the increase of the underlying up to a predefined deactivating barrier level.Mechanism

At maturity

If the underlying closes at or above its initial level and has never reached the barrier during the life of the product, the investor receives

100% + x% of the performance of the underlying

x% being the participation in the increase of the underlying

If the underlying closes below its initial level but has never reached the barrier during the life of the product

100% of the capital invested

If the underlying has reached the barrier during the life of the product

100% of the capital invested

Слайд 27

Turbo Note

Advantages

100% capital protection

The product provides higher participation

in the increase of an underlying than other structures

(for eg protected notes)Disadvantages

The capital is only guaranteed at maturity

The investor may no longer benefit from the increase if the underlying reaches the barrier.

Structure

Buy a zero coupon bond

Buy a call At the money Up and Out (American Barrier)

Слайд 28

Example of Turbo Note

Participation : 100% of increase

of the underlying Barrier : 130%

Example 1: Increase of

the underlying on the final observation dateIf the underlying closes at 125% on the final observation date i.e. above its initial level and has never reached the barrier during the life of the product, the investor receives at maturity:

100% of the capital invested + 100% of the underlying

100% +(100%*25%) = 125% of the capital invested

Example 2: Increase of the underlying beyond the barrier

If the underlying closes at 110% on the final observation date i.e. above its initial level but has reached the barrier during the life of the product, the investor receives at maturity:

100% of the capital invested

Example 3: Decrease of the underlying on the final observation date

If the underlying closes at 80% on the final observation date the investor receives at maturity:

100% of the capital invested

Слайд 29

Digital Plus

A Digital Plus is a structured product

,100% capital guaranteed at maturity, which allows the investor

to benefit from the maximum between the entire increase of an underlying and a high Digital Bonus if the underlying closes at or above its initial level on the final observation day.Mechanism

At maturity

If the underlying closes at or above its initial level on the final observation date, the investor receives the maximum between

100% of the capital invested + Digital Bonus

100% of the capital invested + 100% of the performance of the underlying

If the underlying closes below its initial level on the final observation date, the investor receives

100% of the capital invested

Слайд 30

Digital Plus

Advantages

The investor can benefit from the entire

positive performance of the underlying

A high Digital bonus is

guaranteed if the underlying closes at or above its initial level on the final observation dateThe capital is 100% guaranteed at maturity

Disadvantages

The capital is 100% guaranteed only at maturity

Structure

Buy a zero coupon bond

Buy a Digital Option

Buy a Call ‘Out of the money’

Слайд 31

Example of Digital Plus

Maturity 2years Participation 100% of the

increase of underlying

Digital Bonus Level 120% Capital 100% Guaranteed

Example 1:

Underlying PerformanceThe basket closes at 125% on the final observation date

The investor receives at maturity 125% of the capital invested

Example 2: Digital Bonus

The basket closes at 110% on the final observation date i.e. above its initial level but below the digital bonus level

The investor receives the digital bonus i.e. 120% of the capital invested

Example 3: Capital Guarantee

The basket closes at 90% on the final observation date i.e. below its intial level

The investor receives 100% of the capital invested

Слайд 32

Lock-in Accumulator

A lock-in Accumulator is a structured product,

100% capital guaranteed , which allows the investor to

benefit from participation in the increase of underlying- periodically capped until a pre-defined level. This product offers a mechanism to set up to lock the accumulated performances when one or several levels of performance are reached.Mechanism

The investor participated in the evolution of the underlying by accumulating positive and negative performances period by period

The performance observed at the end of each period are capped on the upside but not floored on the downside

A lock-in mechanism of accumulated performance at one or several pre-defined levels (lock-in levels) is ensured

The investor benefits at maturity from the maximum between

100% of the capital invested plus the maximum lock-in level reached during the life of the product

100% of the capital invested plus sum of the accumulated performances capped on the upside and not floored on the downside

100% of the capital invested

Слайд 33

Lock-in Accumulator

Advantages

The capital is 100% guaranteed at maturity

The

investor can benefit from a high return

The investor benefits

from 100% of the increase of the underlying until a certain level each periodA lock-in mechanism of performance is offered

As soon as the sum of calculated profits and losses reaches a predefined lock-in level, this level of performance then becomes secured and is guaranteed at maturity

Disadvantages

The capital is only guaranteed at maturity

The performances each period are not floored on the downside but capped on the upside

Structure

Buy a zero coupon bond

Buy a strip of call spread 100% /100% +Cap

Sell a strip of Put 100%

Buy a Put plus one or several options ‘Lock-in” on the performances generated by the strips of Call Spread and Put

Слайд 34

Example of Lock-in Accumulator

Maturity 18 months

Observations : Monthly

Monthly

Cap on Upside : 2.4%

Lock-in levels : 10% &

20%(Once a lock-in level has been reached a floor of performance is guaranteed at maturity)

Слайд 36

Example of Lock-in Accumulator

Redemption at Maturity

The investor benefits

from the maximum between

100% of capital invested + Lock-in

level reached during the life of the product i.e.100%+20%100% of capital invested + the sum of accumulated monthly performances capped on the upside and not floored on the downside i.e. 126.8%

100% of the capital invested

Слайд 37

Delta One Certificate

A Delta One Certificate I a

structured product which allows the investor to be exposed

to 100% of the performance of an underlying (positive or negative)Mechanism

At Maturity

If the underlying closes at or above its initial level on the final observation date, the investor receives 100% of the capital invested + 100% of the positive performance of the underlying

If the underlying closes below its initial level on the final observation date, the investor receives 100% of the capital invested reduced by the negative performance of the underlying (physical delivery or cash settlement) (Loss in capital scenario)

Advantages

The product reflects at anytime the performance of the underlying

Disadvantages

The capital is not guaranteed

If the underlying closes below its initial level on the final observation day, the investor is subject to a loss in capital equivalent to the one associated with the underlying

Слайд 38

Example of Delta One Certificate

Example 1: Increase of

Underlying

The basket closes at 120% on the final observation

date i.e. above its initial levelThe investor receives at maturity 100% of the capital invested + 100% of the performance of the underlying i.e. 120% of the capital invested

Example 2: Decrease in the Underlying

The basket closes at 90% on the final observation date i.e. below its initial level

The investor receives 90% of the capital invested

Слайд 39

Outperformer

An outperformer is a structured product which allows

the investor to benefit from a high level of

participation in the rise of the underlying while being only exposed to 100% of the decreaseMechanism

IF the underlying closes above its initial level on the final observation date, the investor receives

100% + x% of the positive performance of he underlying ( x% being the participation in the rise of the underlying)

IF the underlying closes below its initial level on the final observation date, the investor receives

100% of the capital invested minus the negative performance of the underlying (physical or cash delivery) ( Loss in capital scenario)

Advantages

The product offers strong participation in the upside without any upside limit

The product is very sensitive to the evolution of the underlying on the secondary market

Disadvantages

The capital is not guaranteed

If the underlying closes below its initial level on the final observation day, the investor is subject to a loss in capital equivalent to the one associated with the underlying

Слайд 40

Outperformer

Structure

Buy a Call Zero (in order to arbitrate

the dividends)

Buy x% of a Call At The Money

Слайд 41

Example of Outperformer

Underlying XYZ Stock Maturity : 12 months Capital :

Not Guaranteed

Participation 130% of the increase of the underlying

100% of

the decrease of the underlyingCapital Not Guaranteed

Example 1: Increase of Underlying on the final observation date

If the underlying has increased ( from 100 to 120 for example), the investor receives at maturity

100% of the capital invested + 130% of the performance of the underlying

i.e. 100% +(130% *20%)=126% of the capital invested

Example 2: Decrease of Underlying on the final observation date

If the underlying has increased ( from 100 to 80 for example), the investor receives at maturity

A number n of stocks paid at their initial level

In our example, if the stocks are immediately sold, the loss is less than 20%

Слайд 42

Sprint

A sprint is is a structured product which

allows the investor to benefit from a very high

leveraged participation in the rise of the underlying capped on the upside, while being only exposed to 100% of the decreaseMechanism

IF the underlying closes above its initial level but below the Target on the final observation date, the investor receives

100% + 200% of the positive performance of he underlying

IF the underlying at or above the Target the final observation date, the investor receives

The Maximum Redemption (200%*Targeted Performance)

IF the underlying closes below its initial level on the final observation date, the investor receives

100% of the capital invested minus the negative performance of the underlying (physical or cash delivery) ( Loss in capital scenario)

Advantages

The product offers strong leveraged participation in the upside

The investor benefits from an improved return when anticipated a moderate increase of the underlying

Disadvantages

The capital is not guaranteed

If the underlying closes below its initial level on the final observation day, the investor is subject to a loss in capital equivalent to the one associated with the underlying

The performance is capped above predefined level

Слайд 43

Sprint

Structure

Buy a Call Zero ( In order to

arbitrate the dividends)

Buy 100% of a call At The

MoneySell 2 Calls Out of The money ‘Strike Target’

Слайд 44

Example of Sprint

Underlying XYZ Stock Maturity : 12 months Capital :

Not Guaranteed

Participation 200% of the increase of the underlying upto

the Target100% of the decrease of the underlying

Target 115% Max Redemption 130%

Capital Not Guaranteed

Example 1: Increase of Underlying on the final observation date

If the underlying closes at or above its initla level but below the Target( say 110%), the investor receives at maturity

100% + 200% of the positive performance of the underlying

i.e. 100% +200%*10%=120%

Example 1: Increase of Underlying on the final observation date

Example 2: Increase of Underlying beyond the Target on the final observation date

If the underlying closes at or above its initla level but below the Target( say 115%), the investor receives at maturity

The Maximum Redemption i.e.130% of the capital invested

Example 3: Decrease of Underlying on the final observation date

If the underlying has decreased ( from 100 to 80 for example), the investor receives at maturity

A number n of stocks paid at their initial level

In our example, if the stocks are immediately sold, the loss is less than 20%

Слайд 45

Best of / Worst of

A Best Of/ Worst

Of is a structured product which allows the investor

to benefit from the increase of the Best Performance Underlying of a basket with leverage if the Worst Performing Underlying closes at or above its initial level on the final observation date.Mechanism

On the final observation date, if the Worst Performing Underlying of the basket closes at or above its initial level, the investor receives

100% + x% of the Best Performing Underlying (x% being the participation in the increase of this underlying)

On the final observation date, if the Worst Performing Underlying of the basket closes strictly below its initial level the the investor receives 100% of the capital invested reduced by the negative performance of the Worst Performing Underlying (Loss of Capital Scenario)

Слайд 46

Best of / Worst of

Advantages

The investor benefits from

a high leveraged participation in the increase of the

Best Performing Underlying if the condition if fulfilledDisadvantages

The capital is not guaranteed

The condition to benefit from the leverage is applied on the Worst Performing Underlying. Therefore a high return is possible only if all underlyings close at or above their initial levels. If the Worst Performing Underlying closes below is initial level on the final observation date, the investor is subject to a loss in capital equivalent to the one associated with the underlying.

Слайд 47

Example of Best Of/Worst Of

Underlying: ABC Stock and

XYZ Stock

Maturity : 12months

Participation : 200% of the increase

of the Best Performing StockExample 1 : Participation in increase

If ABC stock closes at 120% and XYZ at 105% on the final observation date. Then, the investor receives

100% of capital invested+200%of increase of ABC Stock

i.e. 100%+200%*20%=140% of the capital invested

Example 2 : Loss in Capital

If ABC stock closes at 105% and XYZ at 95% on the final observation date. Then, the investor receives

N number of XYZ stocks paid at their initial level ( in the example, if the stocks are immediately sold, the loss is less than 5%)

Слайд 48

Callable Corridor

A Callable Corridor is a structured product

, 100% capital protected at maturity, which allows the

investor to accumulate a bonus every day where the underlying has remained within a predefined range.The product can be early redeemed by the issuer at its sole discretion at 100% +accrued bonus

Mechanism

At the end of each period, we observe the number of days where the underlying has remained within the predefined range to calculate the bonus for that period.

Advantages

The capital is 100% guaranteed at maturity

The investor can benefit from a high return

Even if the underlying exitsthe range, the mechanism of bonus payment does not deactivate. The investor receives on each payment date a bonus weighted according to the number of days where the underlying remains within the predefined ranges

Disadvantages

The return can be lower than a classical monetary deposit if the underlying reamins within the predefined ranges for an insufficient amount of time.

The product may be redeemed by the issuer in the case of a favourable evolution of the underlying (Callable Effect)

Слайд 49

Callable Corridor

Structure

Buy a strip of daily binary European

Options

Buy a zero coupon

Sella Bermudan Call on the structure

Слайд 50

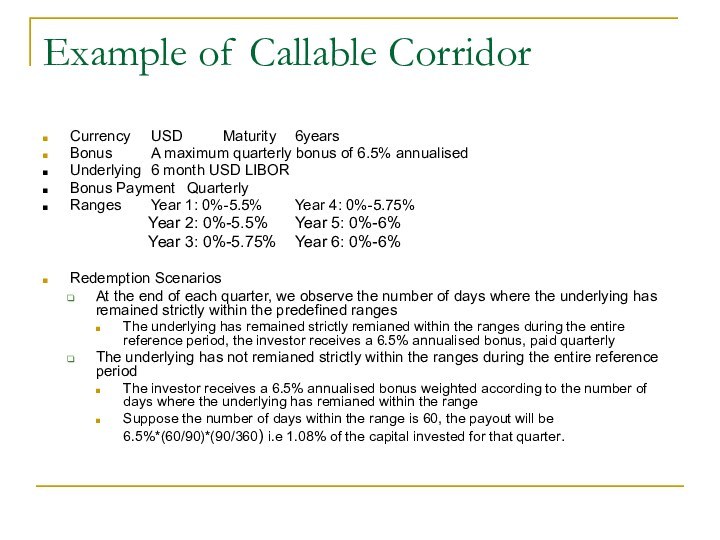

Example of Callable Corridor

Currency USD Maturity 6years

Bonus A maximum quarterly bonus

of 6.5% annualised

Underlying 6 month USD LIBOR

Bonus Payment Quarterly

Ranges Year 1: 0%-5.5% Year

4: 0%-5.75%Year 2: 0%-5.5% Year 5: 0%-6%

Year 3: 0%-5.75% Year 6: 0%-6%

Redemption Scenarios

At the end of each quarter, we observe the number of days where the underlying has remained strictly within the predefined ranges

The underlying has remained strictly remianed within the ranges during the entire reference period, the investor receives a 6.5% annualised bonus, paid quarterly

The underlying has not remianed strictly within the ranges during the entire reference period

The investor receives a 6.5% annualised bonus weighted according to the number of days where the underlying has remianed within the range

Suppose the number of days within the range is 60, the payout will be

6.5%*(60/90)*(90/360) i.e 1.08% of the capital invested for that quarter.

Слайд 51

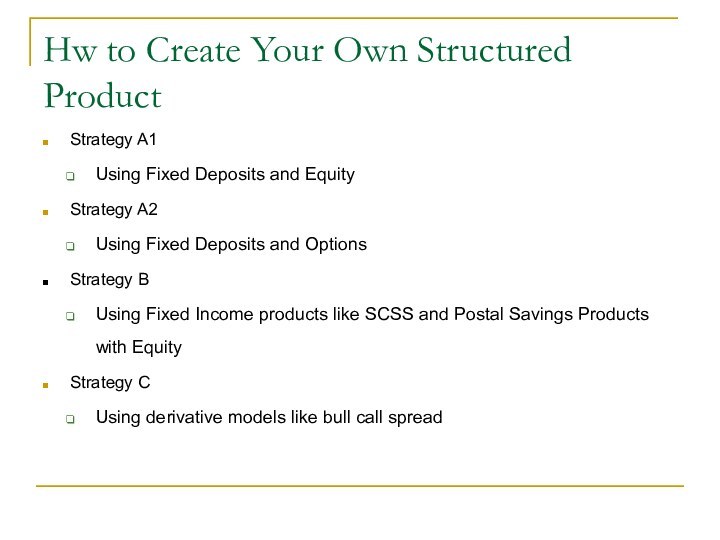

Hw to Create Your Own Structured Product

Strategy A1

Using

Fixed Deposits and Equity

Strategy A2

Using Fixed Deposits and Options

Strategy

BUsing Fixed Income products like SCSS and Postal Savings Products with Equity

Strategy C

Using derivative models like bull call spread

Слайд 56

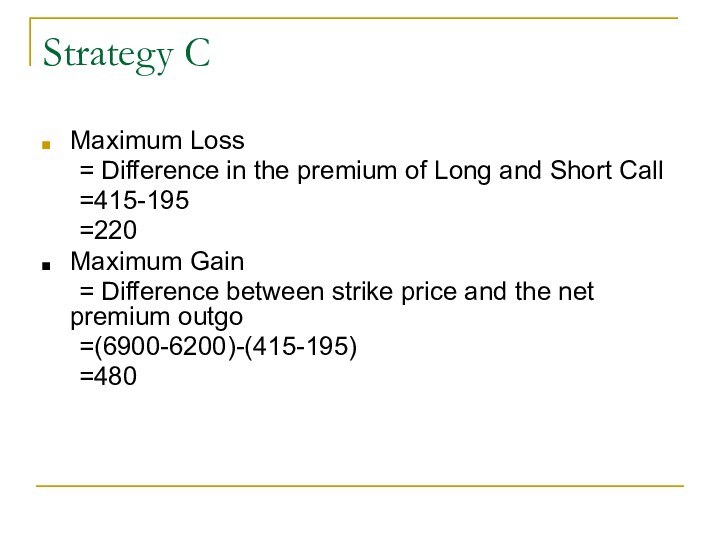

Strategy C

Maximum Loss

= Difference in the premium

of Long and Short Call

=415-195

=220

Maximum Gain

= Difference between strike

price and the net premium outgo=(6900-6200)-(415-195)

=480

Слайд 59

Strategy C

Maximum Loss

= Difference in the premium

of Long and Short Call

=415-195

=220

Maximum Gain

= Difference between strike

price and the net premium outgo=(6900-6200)-(415-195)

=480

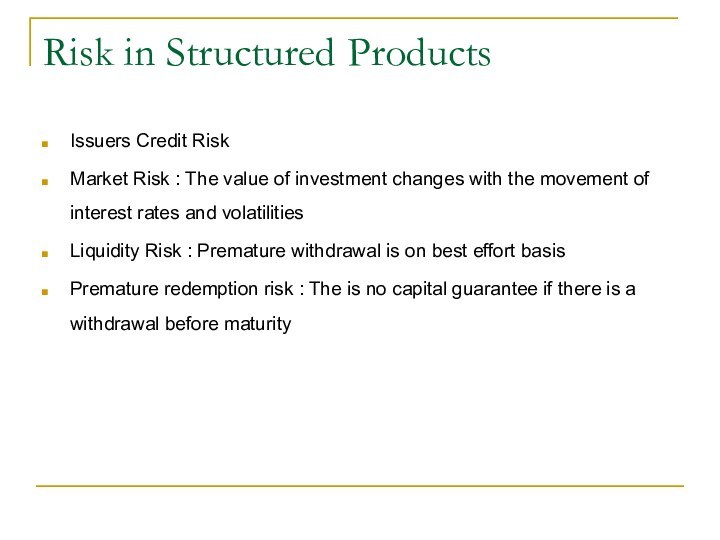

Слайд 60

Risk in Structured Products

Issuers Credit Risk

Market Risk

: The value of investment changes with the movement

of interest rates and volatilitiesLiquidity Risk : Premature withdrawal is on best effort basis

Premature redemption risk : The is no capital guarantee if there is a withdrawal before maturity