Слайд 2

What is international business?

Exchange of capital or

goods or services between companies across national borders.

Sometimes

it is also called Cross-Border Business.

National Business= Domestic Business ≠ international Business

INTRODUCTION

Слайд 3

What can be exchanged in IB?

Goods ≡

Money

Technology ≡ Money

Services ≡ Money

Intellectual assets ≡ Money

Capitalistic assets

≡ Money

INTRODUCTION

Слайд 4

What is the difference between International Business and

International Economics ?

IE studies the “macroeconomic” nature of

international Business

IB studies the “micro-economic” nature of international Business

INTRODUCTION

Слайд 5

Why study International Business

To impress your future boy

or girl friend

To become rich quickly

To learn foreign

cultures

To work in foreign places

To speak foreign languages

To start an Internet Export Import Business buying cheap goods from China and selling them with a profit in France online- making tons of money without working much

Because of the nice professor

To help local companies to reap the profits of Internationalization

To help foreign companies to sell their goods in France

To please your parents

Because you want to help poor countries to develop

Слайд 6

What is Globalisation ?

Ongoing economic integration and growing

independency of countries worldwide on a macroeconomic point of

view.

13 000 000 000 000 USD exchanged annually between countries.

Substantial flow of capital, goods, ideas, technology around the world!

INTRODUCTION

Слайд 7

What is Globalisation

Ongoing economic integration and growing independency

of countries worldwide on a macroeconomic point of view.

READ

FINANCIAL TIMES AT THE LIBRARY OF ESC TO SEE HOW MACRO-EVENTS IN FOREIGN COUNTRIES AFFECT NATIONAL ECONOMIES !

http://www.ft.com/intl/global-economy

INTRODUCTION

Слайд 8

What is Globalisation

Financial crisis 2012 = Example for

Globalization

INTRODUCTION

Слайд 9

What are the key concepts in international Business

International

Trade = Export and Import

Exporting= Goods & Services against

Money

Importing= Sourcing =Money against Goods & Services

International investment = Money against assets

FDI = Acquisition of productive assets

Portfolio Investment = Acquisition of financial assets

http://www.ft.com/intl/global-economy

INTRODUCTION

Слайд 10

The Nature of Trade

Trade is growing very fast

, faster than GDP growth

For Belgium: Total annual value

of products trade (Export+Imports)/GDP= 150%

=== > (Exports+Imports)> GDP !!

For USA the ratio is about 20%. Why???

INTRODUCTION

Слайд 11

The state of international Business In Europe

http://ec.europa.eu/eurostat/statistical-atlas/gis/viewer/

http://ec.europa.eu/trade/

file:///C:\Users\utilisateur\Dropbox\Yakeexport\Yakaexportcours\IB%20Introduction%20et%20economie%20internationale\KS-GI-10-002-EN.PDF

www.intracen.org

The

state of international Business In France

http://www.douane.gouv.fr/

The state of international

Business In Auvergne

http://lekiosque.finances.gouv.fr/Appchiffre/Etudes/Brochures/Reg_18.pdf

Introduction

INTRODUCTION

Слайд 12

The Nature of Trade

SERVICE versus PRODUCT TRADE

Services are

intangible.

25% of all trade is in Services

75 %

of all trade is in Products

Why is it difficult to export services?

Service companies have to make FDI in the countries to sell their services.

INTRODUCTION

Слайд 13

International Investment

Portfolio Investment= Passive ownership of foreign securities

for the purpose of financial returns. Generally Non-controlling.

Foreign Direct Investment= Active ownership of foreign productive assets such as factories the objective is to take operational control of the assets

INTRODUCTION

Слайд 14

FDI or Portfolio Investment?

Daimler is taking a participation

of 5% in a Swedish car maker Volvo

A Russian

company is buying 95% of the shares of GEFCO from PSA.

Toyota buys 100.000 kg of steel from a Chinese company for 100 Million JPY.

Your Father buys 5 Stocks of Google at the NYSE.

INTRODUCTION

Слайд 15

How does IB differ from Domestic Business

To the

usual risk of business we have to add on

the following risks:

Cross Cultural Risks

Cultural differences, Negotiation…

Commercial risks

Non-payment, competition,….

Currency Risks

Asset valuation, Currency exposure

Country Risks

Political risk

Foreign taxation, Corruption, Protectionism

INTRODUCTION

Слайд 16

Potential harm that arises from changes in the

price of one currency relative to another.

What currencies

to you know? USD, EUR, AUD, JPY,CAD, CNY,CHF,GBP….

Currency Risk

INTRODUCTION

Слайд 17

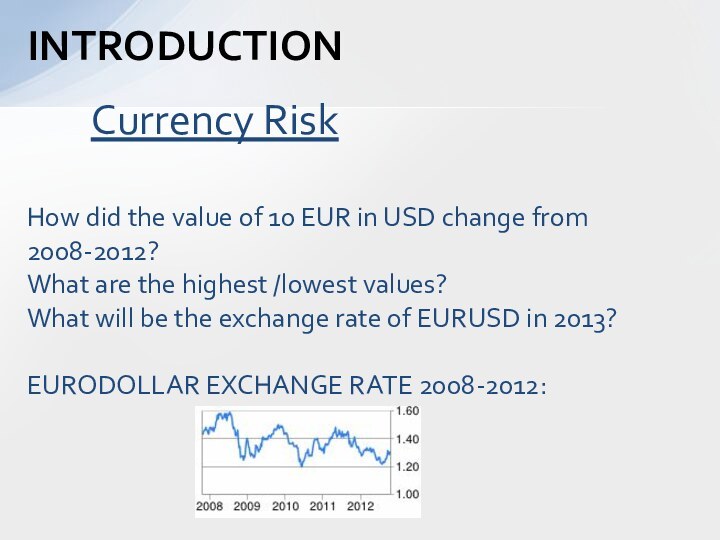

How did the value of 10 EUR in

USD change from 2008-2012?

What are the highest /lowest

values?

What will be the exchange rate of EURUSD in 2013?

EURODOLLAR EXCHANGE RATE 2008-2012:

Currency Risk

INTRODUCTION

Слайд 18

How can I learn more about the currency

market= Forex?

Currency Risk

INTRODUCTION

Слайд 19

Mercury the Roman god of trade.

HISTORY OF INTERNATIONAL BUSINESS

Слайд 20

History of globalization

Globalization is not new: trade always

existed.

Exchange of goods within the Roman Empire

Exchange of technology

in the middle ages

Слайд 21

History of globalization

Phases of globalization : Past

Industrialisation

in Great Britain, The Netherlands, USA

Rise of railroads and

road transport

Rise of Steel and electricity production

GATT after WWII

Слайд 22

History of globalization

Phases of globalization : Presence

BRICS, Emerging

Markets, Regional Integration

Technology: Internet

Container

Слайд 23

History of globalization

Phases of globalization : Future

Technology: Internet,

Knowledge transfer

WTO New Rules (Doha)

“Global consumer”

Improved transportation (Air,

Road, Railway)

New production technology

Further reduction of (non) tariff trade barriers

GDP Growth = Trade Growth

Слайд 25

What are the facilitators in IB ?

Banks

Insurance

Companies

UBIFRANCE (Government agencies)

Logistic service providers

Lawyers

Custom brokers

Слайд 26

What are the classical trade theories?

Mercantilism, Absolute Advantage

Principle, Comparative Advantage Priniciple

What is mercantilism?

With the rise of

nations came the idea that they should amass as much richness = Gold as they can. So they traded. If they have an trade surplus they increase their Gold stock. In case of a trade deficit their gold stock declined.

Why to we trade?

Слайд 27

What is the absolute advantage principle?

A country benefits

by producing the products in which it has an

absolute advantage.

Who invented it?

Adam Smith, Scotsman

Why to we trade?

Слайд 28

What is the comparative advantage principle?

It can be

beneficial for 2 countries to trade as long as

one is relatively more efficient at producing goods or services needed by the other. This is the basis theory of I-Trade.

Who invented it?

David Ricardo, Englishman

Why to we trade?

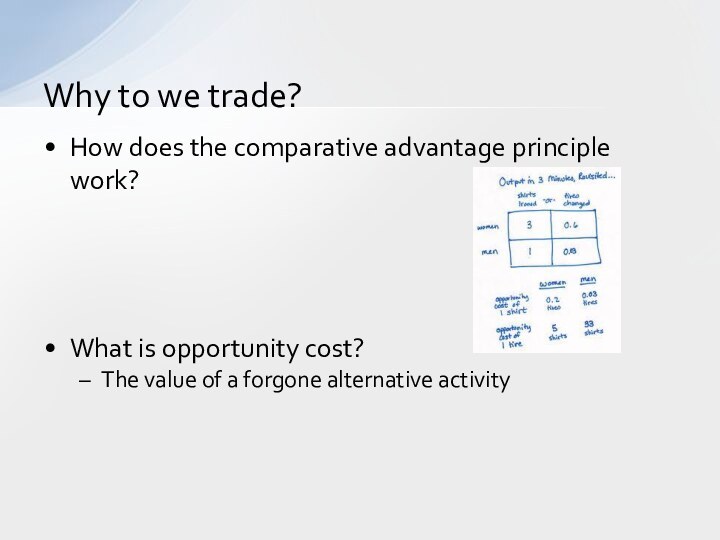

Слайд 29

How does the comparative advantage principle work?

What is

opportunity cost?

The value of a forgone alternative activity

Why to

we trade?

Слайд 30

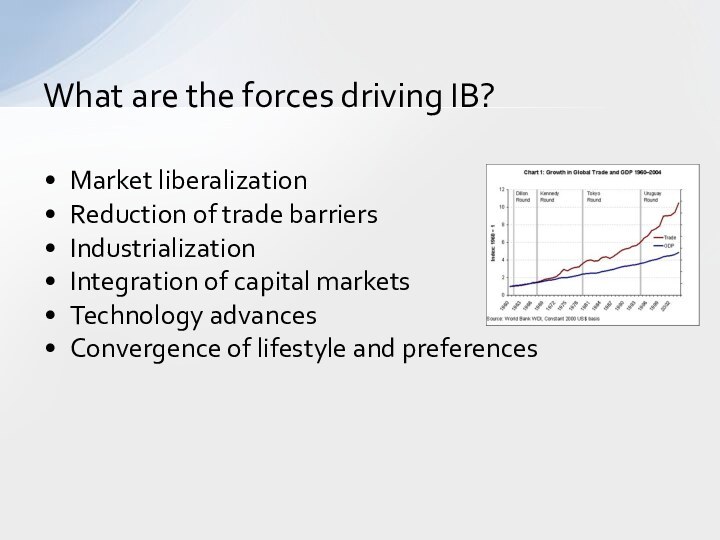

Market liberalization

Reduction of trade barriers

Industrialization

Integration of capital markets

Technology

advances

Convergence of lifestyle and preferences

What are the forces driving

IB?

Слайд 31

Why do companies internationalize?

To make more money by

increasing sales by FDI or exporting

To make more money

by reducing costs by global sourcing or FDI

To make money by selling Intellectual property

To “learn” or copy from competitors

To “follow” customers

To profit of EoS in the various parts of the Value Chain

To attack competitors on their home markets

Слайд 32

Who is participating in IB

MNE = Multinational Enterprise

SME

= Small and medium sized company

(< 500 employees)

BORN

GLOBAL FIRM: The success in local markets depends on the successful presence in international markets.

Слайд 33

How are the companies engaging in international business?

EXPORT

FDI

Collaborative

Agreements

Слайд 34

Value chain of the firm and globalization

Value chain:

sequence of value adding activities performed by the firm.

Слайд 35

Why are companies failing in IB?

Translation errors

Strategy

Production

Слайд 36

What is the export process like?

Export Diagnostics

Export Market

Selection

Market Study

Prospection

Sales/Negociation

Order intake

CRM

Слайд 38

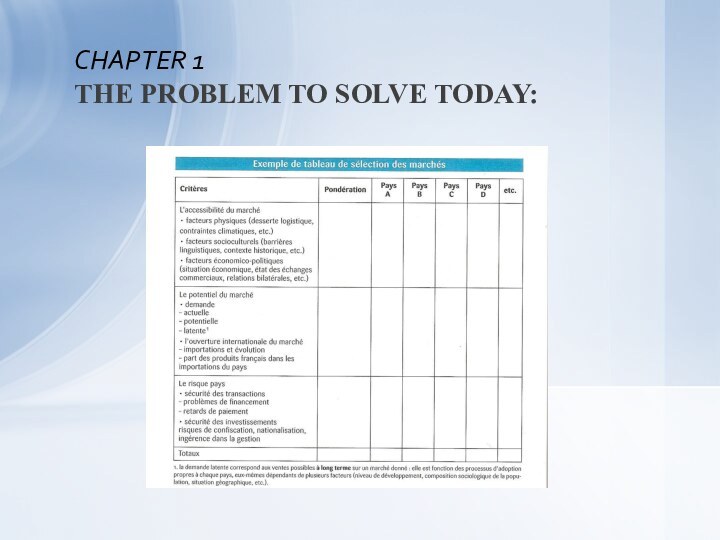

COUNTRY EVALUATION AND SELECTION

Слайд 39

EVALUATION AND COUNTRY SELECTION

Chapter 1. The problem to

solve today

Chapter 2. Ready for export?

Chapter 3. Criteria's to evaluate

countries

Chapter 4. Researching for sources

Chapter 5. Completing the Matrix

Chapter 6. Analysis and Choice

Слайд 40

QUESTION:

“What can happen if people don’t

know about selecting and evaluating countries?“

Слайд 41

CHAPTER 1

THE PROBLEM TO SOLVE TODAY:

Our company is manufacturing goods and wants to export

as to increase its sales.

“Before engaging in selling and buying from abroad, managers need to set up an export operation. In order to do so they need to select the best adapted countries to start operations. The question is, what countries should we choose?”

Today you will learn how to establish a country selection matrix.

Слайд 42

CHAPTER 1

THE PROBLEM TO SOLVE TODAY:

Слайд 43

CHAPTER 1

THE PROBLEM TO SOLVE TODAY:

What kind of conditions should our matrix satisfy?

Fast to

put into place.

A logical approach.

No country should be forgotten

Слайд 44

CHAPTER 1

THE PROBLEM TO SOLVE TODAY:

What

are the advantages of engaging in export for a

company?

Advantage N°1: Increases sales revenues

Advantage N°2: Increases benefices by using economies of scale

Advantage N°3: Becoming less depended on home market

Слайд 45

CHAPTER 2

READY TO EXPORT?

What are in

your opinion the necessary conditions to start exporting?

Слайд 46

CHAPTER 2

READY TO EXPORT?

Production & Logistics

requirements

Capacity?

Storage capacity?

Lead times?

Customs?

Incoterms?

Packing?

Are the transport costs important?

Слайд 47

CHAPTER 2

READY TO EXPORT?

Finance

Investment financing?

Credit risk/payment

risks?

Currency exchange risks?

Слайд 48

CHAPTER 2

READY TO EXPORT?

Domestic Market

Growth market?

Sales

growth?

If sales decline: why?

Is the margin comfortable

Слайд 49

CHAPTER 2

READY TO EXPORT?

Communication

Site web in

English available?

Brochures available in English?

Слайд 50

CHAPTER 2

READY TO EXPORT?

Human Resources

English speaking

personnel available?

Competences concerning legal matters available?

Competences concerning export available?

Слайд 51

CHAPTER 2

READY TO EXPORT?

How to obtain

the information for the diagnostic export?

Internal questionnaire

Internal documents

Face to

Face interviewing

Observation

Слайд 52

CHAPTER 2

READY TO EXPORT?

Conclusion of export

diagnosis: :

-its weaknesses are too great and insurmountable. It must

avoid exporting;

-it presents some gaps, but these difficulties are surmountable.

It does not have any major weaknesses which prevent exporting. Export is possible in the short term.

Слайд 53

CHAPTER 3

CRITERIA’S TO EVALUATE COUNTRIES TO BE

TAKEN INTO CONSIDERATION.

Market growth & Market size

Ease and

compatibility of operations

Cost and Resource availability *

Risks

Слайд 54

CHAPTER 3

CRITERIA’S TO EVALUATE COUNTRIES TO BE

TAKEN INTO CONSIDERATION.

Market growth & Market size

Market

size (Population, GDP level, GDP per capita)

Growth of Gross Domestic Product ( GDP growth rate)

GDP per capita growth rate

Existence of a trading bloc?

Слайд 55

CHAPTER 3

CRITERIA’S TO EVALUATE COUNTRIES TO BE

TAKEN INTO CONSIDERATION.

Ease and compatibility of operations

Nearby location

–distance to domestic market

Share same language

Have similar market conditions as in home market

Слайд 56

CHAPTER 3

CRITERIA’S TO EVALUATE COUNTRIES TO BE

TAKEN INTO CONSIDERATION.

Cost and Resource availability *

Labor costs

Other factor costs: capital, labor, resources

Rare resources are available

Слайд 57

CHAPTER 3

CRITERIA’S TO EVALUATE COUNTRIES TO BE

TAKEN INTO CONSIDERATION.

Risks

Risks and uncertainty

Political risks

Payment risks

Legal

risks

Слайд 58

CHAPTER 4

RESEARCHING FOR SOURCES

Chapter 4. Researching for sources

CIA World Factbook

https://www.cia.gov/library/publications/the-world-factbook/Worldbank:

A must! The "World Fact Book", published

by the CIA, has extremely detailed information, by country, on the following subjects: geography, demography, politico-legal environment, economy, communication and transport infrastructure, transnational problems, etc. for most countries throughout the world. Indispensable when pre-selecting markets. Searches can be carried out by country or by theme.

Слайд 59

Chapter 4

RESEARCHING FOR SOURCES

Chapter 4. Researching for sources

Worldbank: www.worldbank.org

In addition to information on its publications and

reports, the World Bank site offers a "Data and Statistics" section. This allows highly-targeted searches on over 200 countries. These searches can be performed by country or by theme (population, literacy levels, education, health, environment, poverty, GDP, economy, industries, governments, infrastructure, etc.).

Слайд 60

CHAPTER 4

RESEARCHING FOR SOURCES

OECD http://www.oecd.org

The Organisation for

Economic Co-operation and Development offers all documents published since

1990, on-line (systematic and country reports, e-commerce, enterprise spirit, etc).

French and English

Слайд 61

CHAPTER 5

COMPLETING THE MATRIX

Assigning weights to criteria's

(0-5) for important criteria’s (0-3) for less important criteria's