Слайд 2

What is the Eurozone Debt Crisis?

This is also

known as Eurozone sovereign debt crisis

The term indicates the

financial woes caused due to overspending by come European countries

When a nation lives beyond its means by borrowing heavily and spending freely, there comes a point when it cannot manage its financial situation.

When that country faces insolvency. (Insolvency: when it is unable to repay its debts and lenders start demanding higher interest rates, the cornered nation begins to get swallowed up by what is known as the Sovereign Debt Crisis

Слайд 3

What are the causes of a debt crisis?

What

causes a debt crisis to occur are a stopped

or slowed economic growth, declined tax revenues, increased government spending, or a combination of the factors.

Слайд 4

Brief History

The Eurozone debt crisis seems to surround

Greece the most.

The actual beginning is how the

European Union (EU) began in 1993 where 27 European nations "agreed to form an alliance that could compete economically with larger nations such as the US". This is what created the currency of the euro.

The euro's value has decreased over the past few years due to the European Debt Crisis.

Слайд 5

Brief History

The EDC began in 2008 with the

crash of Iceland’s banking system, which spread to Greece.

Greece had experienced corruption and spending as its government continued borrowing money despite not being able to produce sufficient income through work and goods.

It was admitted that Greece's debts had reached 300bn euros, the highest in modern history

Spain, Portugal, and the other nations later followed Greece.

Слайд 6

Data Collection

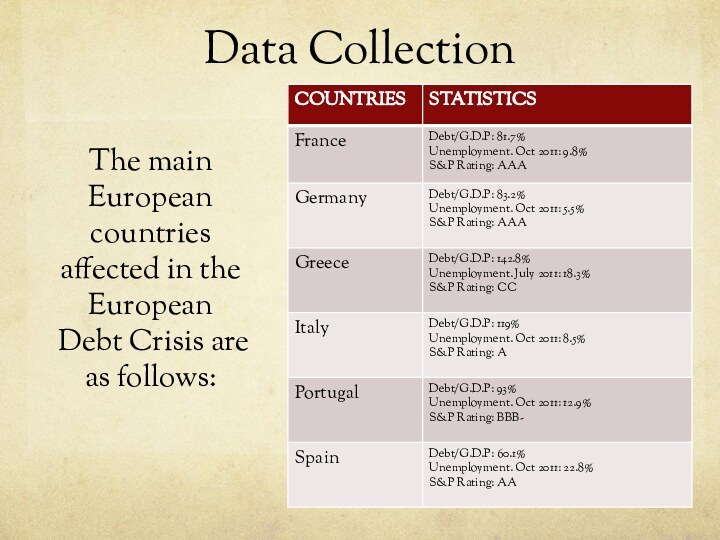

The main European countries affected in the

European Debt Crisis are as follows:

Слайд 7

Latest Developments

PORTUGAL

In the first quarter of 2010 Portugal

had one of the best rates of economic recovery

in the EU. The country matched or even surpassed its neighbors in Western Europe.

A report was released that the Portuguese government public debt has increased due to mismanaged structural and cohesion funds which then resulted to the verge of bankruptcy of the country.

Bonuses and wages of head officers also resulted to their economic situation

Слайд 8

Latest Developments

May 16 2011- Eurozone leaders officially approved

a €78 billion bailout package for Portugal, which became the

third Eurozone country, after Ireland and Greece, to receive emergency funds.

According to the Portuguese finance minister, the average interest rate on the bailout loan is expected to be 5.1 percent

As part of the deal, the country agreed to cut its budget deficit from 9.8 percent of GDP in 2010 to 5.9 percent in 2011, 4.5 percent in 2012 and 3 percent in 2013.

Слайд 9

Latest Developments

The Portuguese government also agreed to eliminate

its golden share in Portugal Telecom to pave the

way for privatization

July 6 2011- Rating’s agency Moody had cut Portugal’s credit rating to junk status

December 2011- it was reported that Portugal's estimated budget deficit of 4.5 percent in 2011 will be substantially lower than expected, due to a one-off transfer of pension funds. This way the country will meet its 2012 target already a year earlier.

Слайд 10

Latest Developments

SPAIN

The country's public debt relative to GDP

in 2010 was only 60%

Spain's public debt was approximately

U.S. $820 billion in 2010

As one of the largest euro zone economies the condition of Spain's economy is of particular concern to international observers, and faced pressure from the United States, the IMF, other European countries and the European Commission to cut its deficit more aggressively

Слайд 11

Latest Developments

May 2010- Spain announces the new austerity

measures designed to further reduce the country's budget deficit,

in order to signal financial markets that it was safe to invest in the country

Spain succeeded in minimizing its deficit from 11.2% of GDP in 2009 to 9.2% in 2010 and around 6% in 2011

To build up additional trust in the financial markets, the government amended the Spanish ConstitutionTo build up additional trust in the financial markets, the government amended the Spanish Constitution in 2011 to require a balanced budget at both the national and regional level by 2020.

The amendment states that public debt cannot exceed 60% of GDP, though exceptions would be made in case of a natural catastrophe, economic recession or other emergencies.

Слайд 12

Latest Developments

GREECE

October 4 2009-With the new president, Papandreou

November

5 2009-Greece reveals that their budget deficit is 1207

percent of GDP

December 8 2009- Greece's long-term debt to BBB+, from A-.

March 3 2010- Greece tries to persuade the financial market that they can repay their debts

April 23 2010- Papandreou asks help from International Monetary Fund after Greece is priced out of the international bond markets.

May 2 2010- European finance ministers lend €110bn which covers until 2013. Greece pledges to bring its budget deficit into line, through unprecedented budget cuts.

Слайд 13

Latest Developments

April 17 2011- Greek borrowing costs start

rising sharply again, on fears that its austerity measures

are failing to work. Greece is now deep in recession.

June 19 2011- Admits that they need to borrow money again

June 29, 2011- EU leaders agree on €109bn bailout – which will see private sector lenders take haircuts of 20% – and extension to the European Financial Stability Facility (EFSF).

October 27 2011- Europe leaders agree new deals that slash Greek debt and increase the firepower of the main bailout fund to around €1 trillion.

November 6 2011- Prime Minister resigns

Слайд 14

Impact on the local economy

The Eurozone debt crisis

impacted market sentiment.

The country’s economic condition will remain sound—able

to withstand the effects of the lingering debt crisis in Europe and uncertainties in the United States

“2012 will be a tough one, with reduced global growth outlook due to global uncertainties.”

Trouble abroad curbed the country’s economic growth last year and dampened the market. The debt crisis in the euro zone rattled investors and heightened demand for safe haven and assets such as US dollars and bonds.

Слайд 15

Remedial Measures

Emergency loans have been extended as bailouts

mainly by stronger economies like France and Germany, as

also by the IMF.

The EU member states have also created the European Financial Stability Facility (EFSF) to provide emergency loans.

Restructuring of the debt

Austerity measures have been enforced.

Слайд 17

Reason

1

One of the reasons for the

debt crisis is because of the corrupt government.

Another reason

is the trade imbalance.

Proposed solutions:

First, citizens must elect uncorrupt government officials who care for the economic and political growth of the country.

The government must give lower wages given the economic situation the country is faced with.

They should reduce the trade imbalances.

Слайд 18

Reason

2

I find it inevitable to partnerships to

happen, most especially among powerful allies. However, when there's

even a bit of dependence on one on the other, it's inevitable that if the other falls, the one would fall as well, most especially if there's a great dependence. The US debt crisis may have affected Europe, but the mismanagement of allocation of funds, from the spending to the borrowing, is what I believe what brought the EDC to come about. A building requires support. If one of the supports fall, the building will be affected and other supports will inevitably lose their strength. If Greece hadn't lost itself to corruption, the EDC wouldn't have been this bad, not affecting the other 26 nations as much as it had in the present.