- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Macro-prudential oversight within the European Union. The European Systemic Risk Board

Содержание

- 2. Overview26/04/2016Slide Establishment of the European Systemic Risk Board Tasks, organisation and accountability Recommendations and warnings

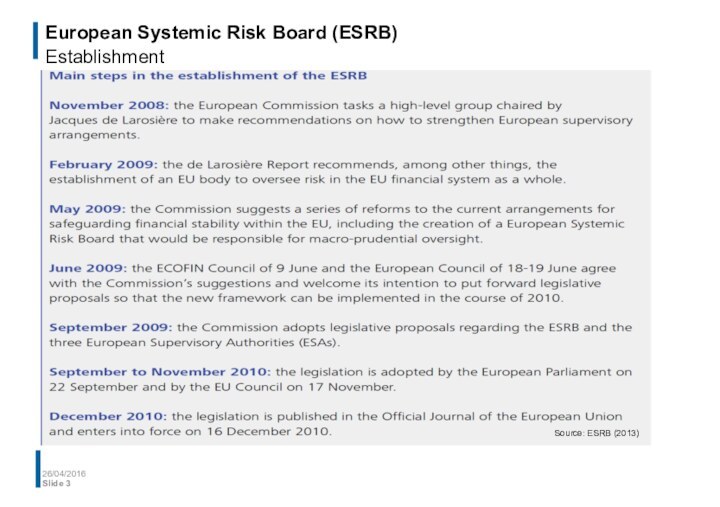

- 3. European Systemic Risk Board (ESRB) Establishment26/04/2016Slide Source: ESRB (2013)

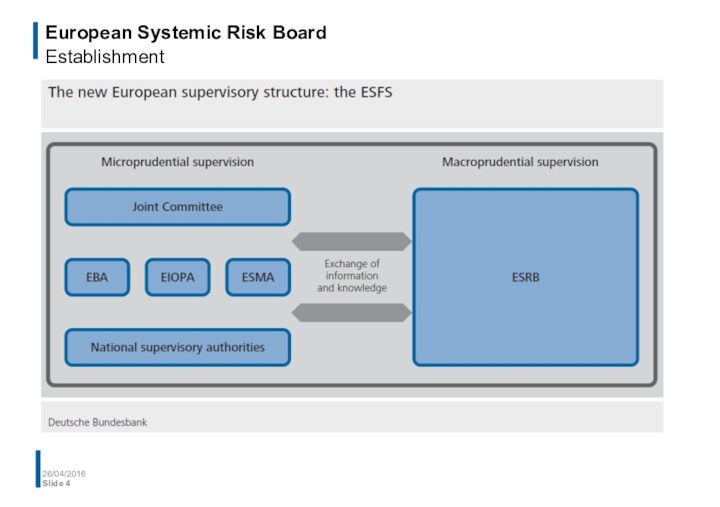

- 4. European Systemic Risk Board Establishment26/04/2016Slide

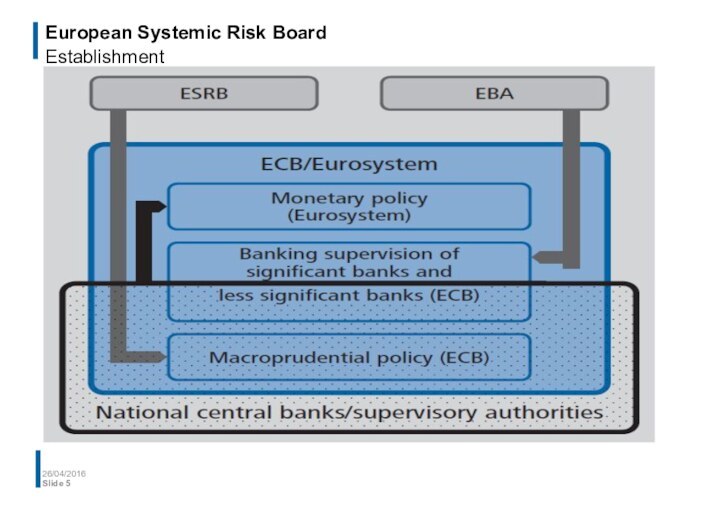

- 5. European Systemic Risk Board Establishment26/04/2016Slide

- 6. Overview26/04/2016Slide Establishment of the European Systemic Risk Board Tasks, organisation and accountability Recommendations and warnings

- 7. European Systemic Risk Board Tasks Responsible for macro-prudential

- 8. European Systemic Risk Board Tasks Collecting and

- 9. European Systemic Risk Board Tasks26/04/2016Slide (1) Input

- 10. Overview26/04/2016Slide Establishment of the European Systemic Risk Board Tasks, organisation and accountability Recommendations and warnings

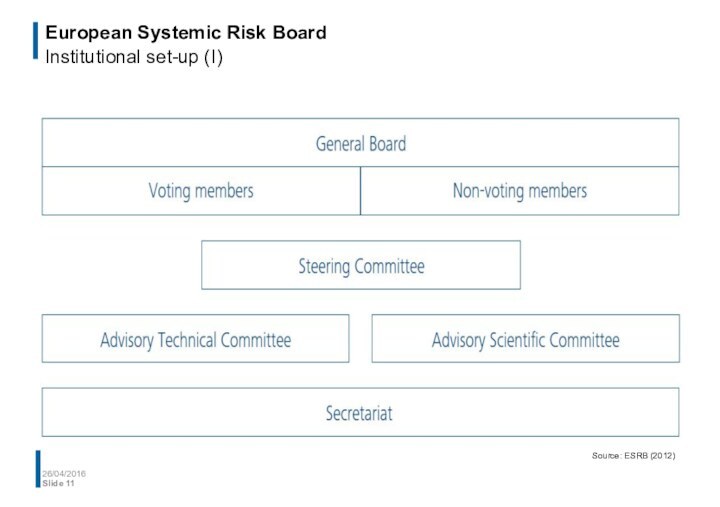

- 11. European Systemic Risk Board Institutional set-up (I)26/04/2016Slide Source: ESRB (2012)

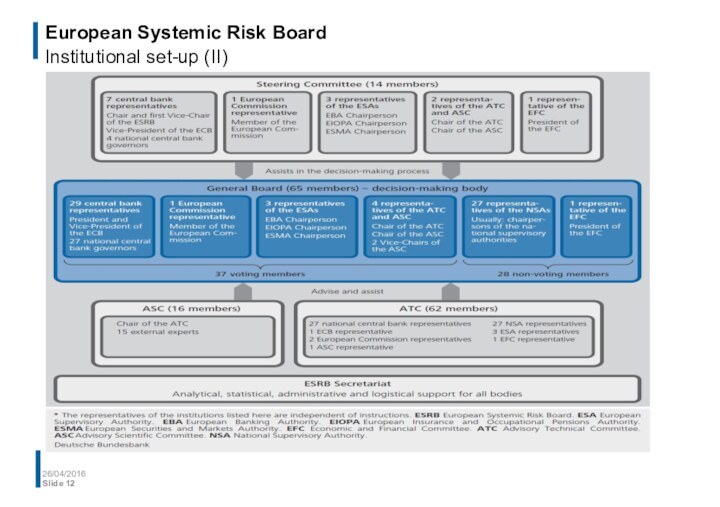

- 12. European Systemic Risk Board Institutional set-up (II)26/04/2016Slide

- 13. European Systemic Risk Board Institutional set-up (IV)26/04/2016Slide Source: ESRB (2012)

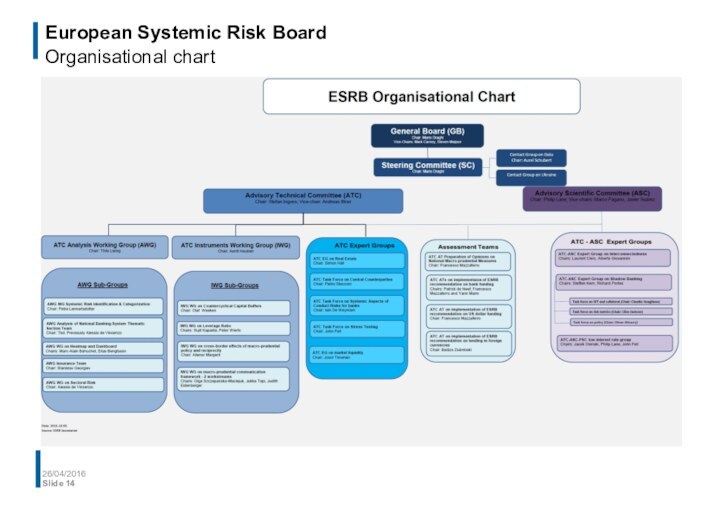

- 14. European Systemic Risk Board Organisational chart26/04/2016Slide

- 15. European Systemic Risk Board Warnings and recommendations Non-binding:

- 16. European Systemic Risk Board Accountability ESRB is an

- 17. Overview26/04/2016Slide Establishment of the European Systemic Risk Board Tasks, organisation and accountability Recommendations and warnings

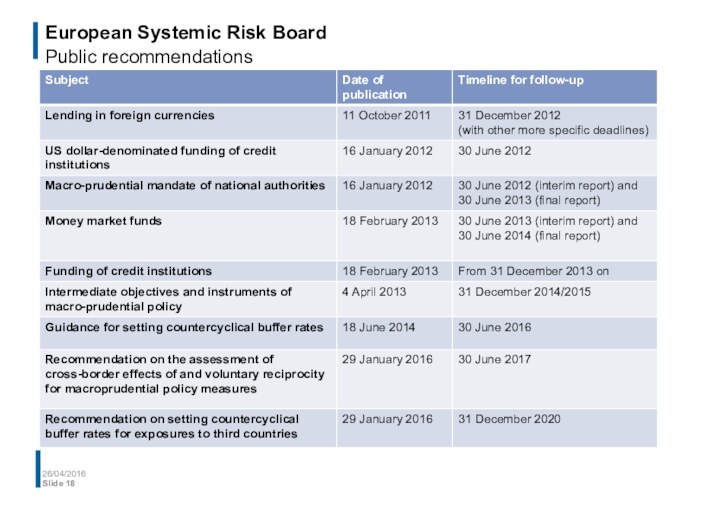

- 18. European Systemic Risk Board Public recommendations26/04/2016Slide

- 19. European Systemic Risk Board Recommendation on lending in foreign currencies26/04/2016Slide Source: ESRB (2012)

- 20. European Systemic Risk Board Recommendation on lending

- 21. European Systemic Risk Board Recommendation on lending in foreign currencies – Follow-up26/04/2016Slide Source: ESRB (2015)

- 22. European Systemic Risk Board Follow-up to ESRB recommendations26/04/2016Slide Source: ESRB (2013)

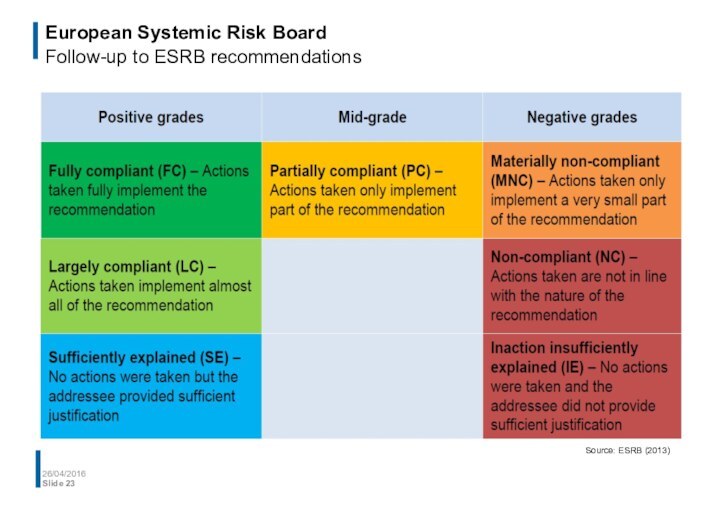

- 23. European Systemic Risk Board Follow-up to ESRB recommendations26/04/2016Slide Source: ESRB (2013)

- 24. European Systemic Risk Board Recommendation on macroprudential

- 25. Recommendation on macroprudential mandate of national authorities Institutional framework of the national macro-prudential authority26/04/2016Slide

- 26. European Systemic Risk Board ESRB Risk

- 27. European Systemic Risk Board ESRB Risk Dashboard26/04/2016Slide Source: ESRB (2013)

- 28. References Bank for International Settlements, Committee on te

- 29. Скачать презентацию

- 30. Похожие презентации

Overview26/04/2016Slide Establishment of the European Systemic Risk Board Tasks, organisation and accountability Recommendations and warnings

Слайд 2

Overview

26/04/2016

Slide

Establishment of the European Systemic Risk Board

Tasks,

organisation and accountability

Слайд 6

Overview

26/04/2016

Slide

Establishment of the European Systemic Risk Board

Tasks,

organisation and accountability

Recommendations and warnings

Слайд 7

European Systemic Risk Board

Tasks

Responsible for macro-prudential oversight of

the financial system within the EU in order to

contribute to the prevention or mitigation of systemic risks to financial stability in the EU that arise from developments within the financial system and taking into account macro-economic developmentsEstablishes link between micro-prudential supervision and macro economy

Brings the systemic component into financial supervision

26/04/2016

Slide

Слайд 8

European Systemic Risk Board

Tasks

Collecting and analysing all

relevant and necessary information

Identifying and prioritising systemic risks

Issuing warnings

and recommendations for remedial action where systemic risks are deemed to be significant26/04/2016

Slide

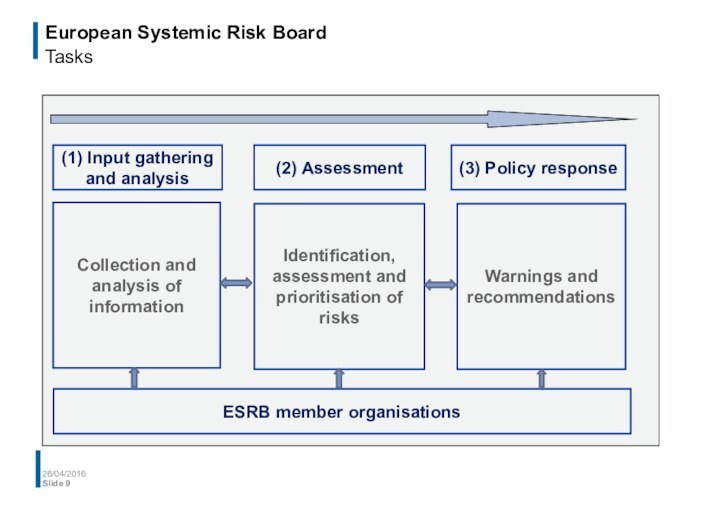

Слайд 9

European Systemic Risk Board

Tasks

26/04/2016

Slide

(1) Input gathering and

analysis

(2) Assessment

(3) Policy response

Identification,

assessment and

prioritisation of

risks

Warnings and recommendations

Collection and

analysis of informationESRB member organisations

Слайд 10

Overview

26/04/2016

Slide

Establishment of the European Systemic Risk Board

Tasks,

organisation and accountability

Recommendations and warnings

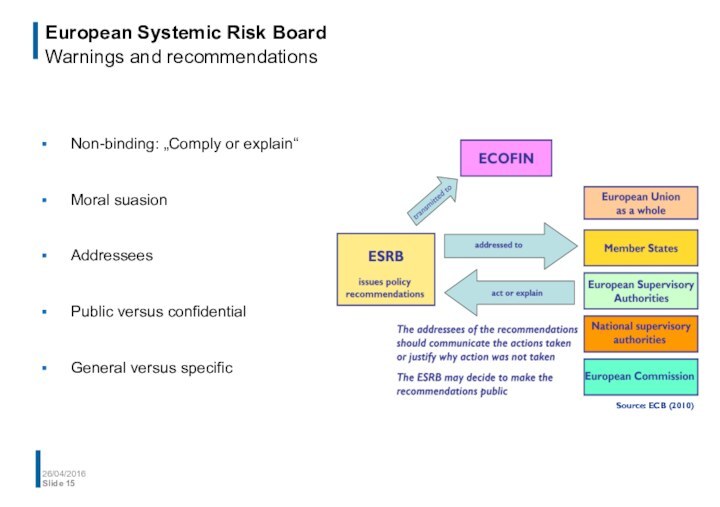

Слайд 15

European Systemic Risk Board

Warnings and recommendations

Non-binding: „Comply or

explain“

Moral suasion

Addressees

Public versus confidential

General versus specific

26/04/2016

Slide

Source: ECB (2010)

Слайд 16

European Systemic Risk Board

Accountability

ESRB is an independent EU

body

Accountability to the European Parliament (regular hearings)

26/04/2016

Slide

Слайд 17

Overview

26/04/2016

Slide

Establishment of the European Systemic Risk Board

Tasks,

organisation and accountability

Recommendations and warnings

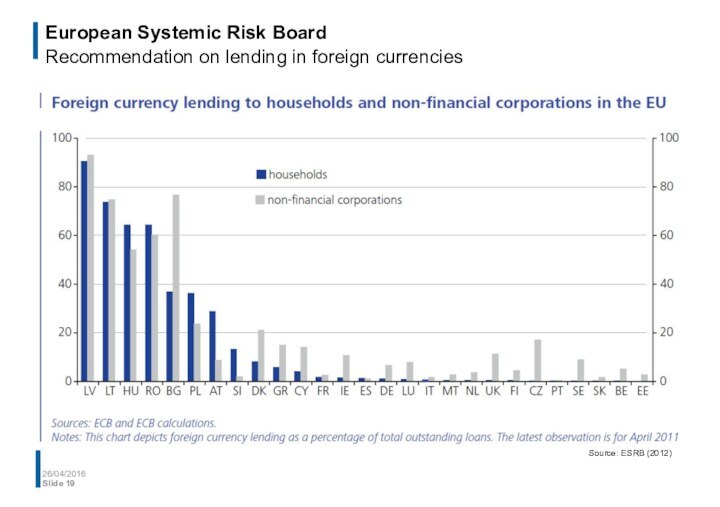

Слайд 19 European Systemic Risk Board Recommendation on lending in foreign

currencies

26/04/2016

Slide

Source: ESRB (2012)

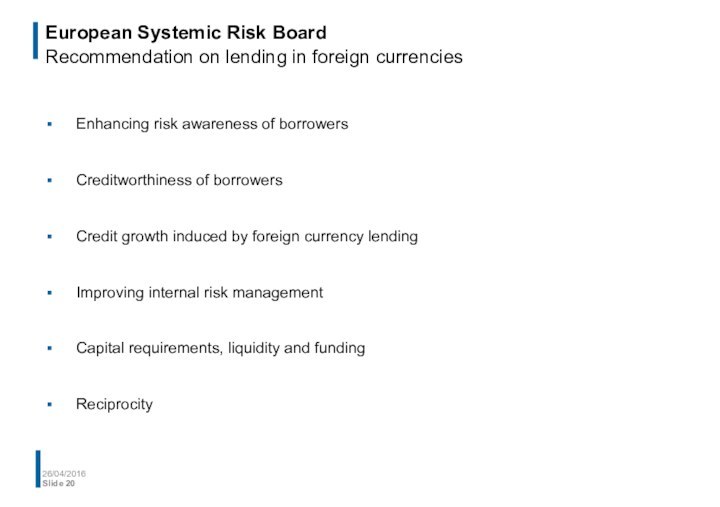

Слайд 20 European Systemic Risk Board Recommendation on lending in foreign

currencies

Enhancing risk awareness of borrowers

Creditworthiness of borrowers

Credit growth induced

by foreign currency lendingImproving internal risk management

Capital requirements, liquidity and funding

Reciprocity

26/04/2016

Slide

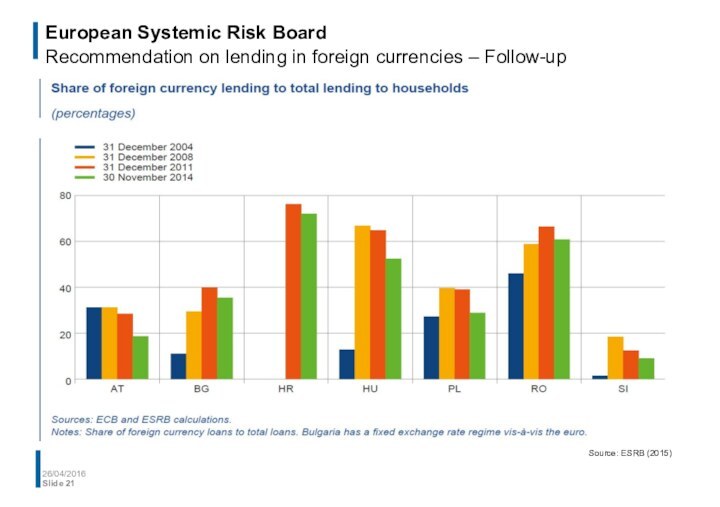

Слайд 21 European Systemic Risk Board Recommendation on lending in foreign

currencies – Follow-up

26/04/2016

Slide

Source: ESRB (2015)

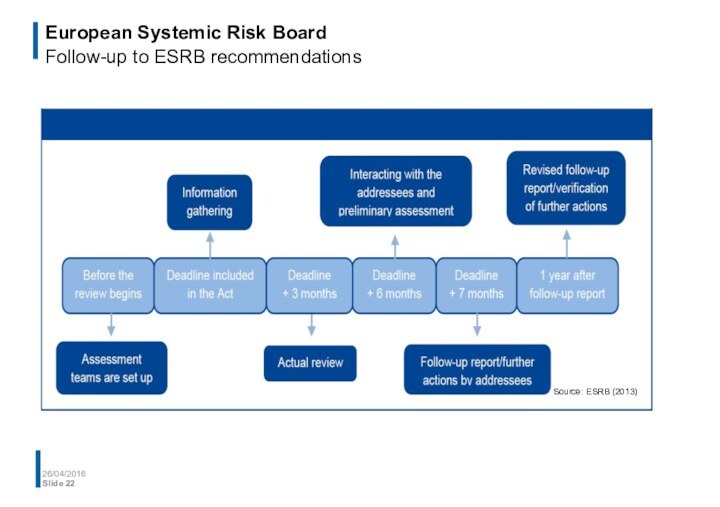

Слайд 22

European Systemic Risk Board

Follow-up to ESRB recommendations

26/04/2016

Slide

Source:

ESRB (2013)

Слайд 23

European Systemic Risk Board

Follow-up to ESRB recommendations

26/04/2016

Slide

Source:

ESRB (2013)

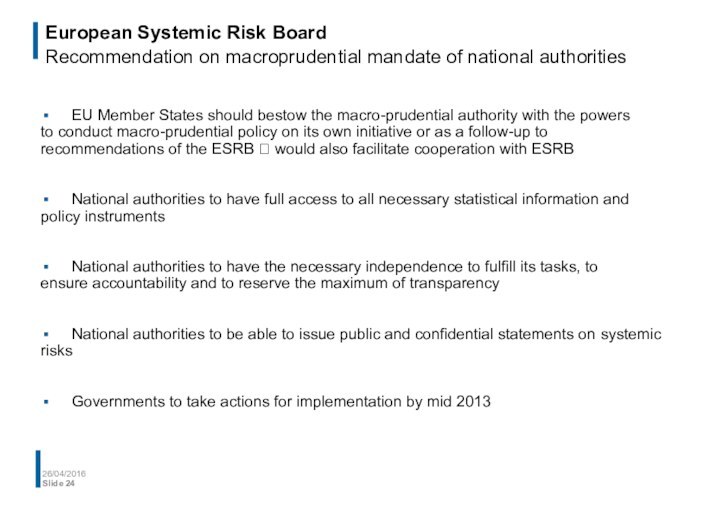

Слайд 24 European Systemic Risk Board Recommendation on macroprudential mandate of

national authorities

EU Member States should bestow the macro-prudential authority

with the powers to conduct macro-prudential policy on its own initiative or as a follow-up to recommendations of the ESRB ? would also facilitate cooperation with ESRBNational authorities to have full access to all necessary statistical information and policy instruments

National authorities to have the necessary independence to fulfill its tasks, to ensure accountability and to reserve the maximum of transparency

National authorities to be able to issue public and confidential statements on systemic risks

Governments to take actions for implementation by mid 2013

26/04/2016

Slide

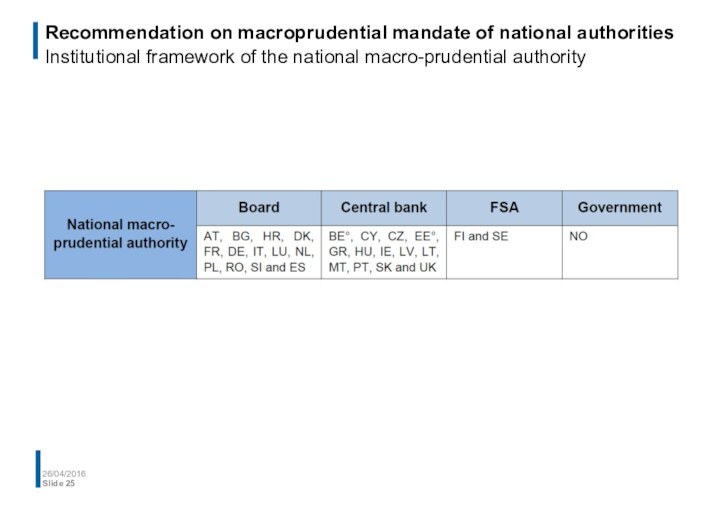

Слайд 25 Recommendation on macroprudential mandate of national authorities Institutional framework

of the national macro-prudential authority

26/04/2016

Slide

Слайд 26

European Systemic Risk Board

ESRB Risk Dashboard

Set of

quantitative and qualitative indicators to identify and measure systemic

risk in the EU financial systemOne of the input´s for the Board´s discussion on risks and vulnerabilities

Updated and revised on a regular basis

Not an early warning system! No reliance on indicators as a basis for any mechanical form of evidence!

26/04/2016

Slide

Слайд 28

References

Bank for International Settlements, Committee on te Global

Financial system, Operationalising the selection and application of macroprudential

instruments, CGFS Paper No 48, 2012Dierick, Frank: Systemic Risk and the ESRB, Internal paper, 27 October 2011

European Central Bank, Financial Stability Review, various issues

European Systemic Risk Board, Annual Report, various issues

European Systemic Risk Board, ESRB Risk Dashboard, various issues

European Systemic Risk Board, Flagship Report on Macro-prudential Policy in the Banking Sector, 2014

European Systemic Risk Board, Handbook on the follow-up to ESRB recommendations, 2013

European Systemic Risk Board, Macro-prudential Commentaries, various issues

European Systemic Risk Board, The ESRB Handbook on Operationalising Macro-prudential Policy in the Banking Sector, 2014

European Systemic Risk Board, Recommendations, various issues

International Monetary Fund, Macroprudential Policy: An Organizing framework, March 14, 2011

Lim, Costa, Kongsamut et al, Macroprudential policy: What instruments and how to use them?, IMF Working Paper, WP/11/238, 2011

26/04/2016

Slide