- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

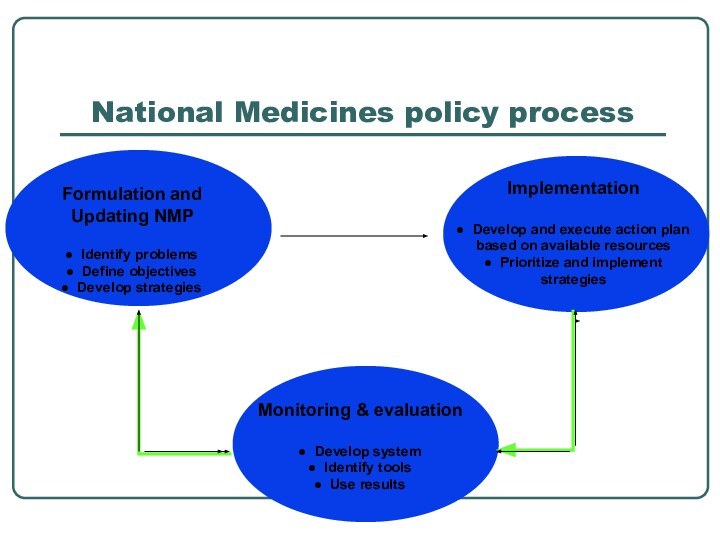

Презентация на тему Pharmaceutical monitoring and evaluation

Содержание

- 2. TopicsConcepts on pharmaceutical assessment/monitoring The WHO process

- 3. Pharmaceutical monitoring/ evaluationMonitoringReview of the progress re

- 4. Who can use the results from assessment

- 5. Develop implementation plans and identify strategies &

- 6. National Medicines policy process

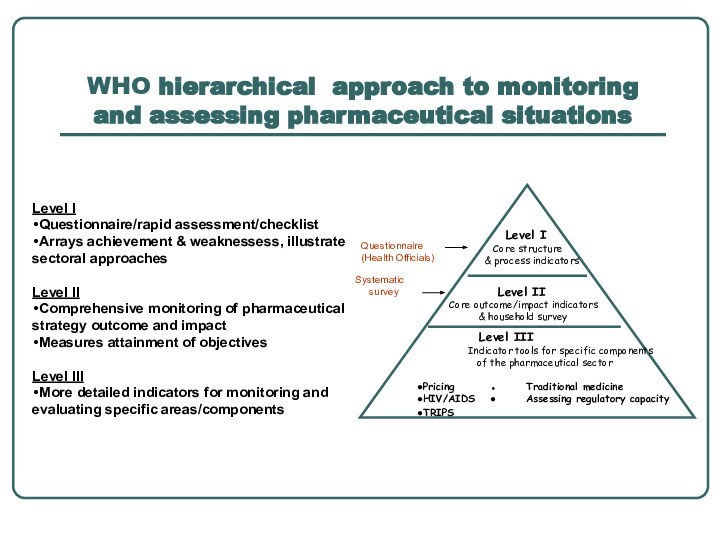

- 7. WHO hierarchical approach to monitoring and assessing

- 8. Level I indicators: structure and process indicatorsRegular

- 9. Level II- facility outcome and impactindicators: WHO

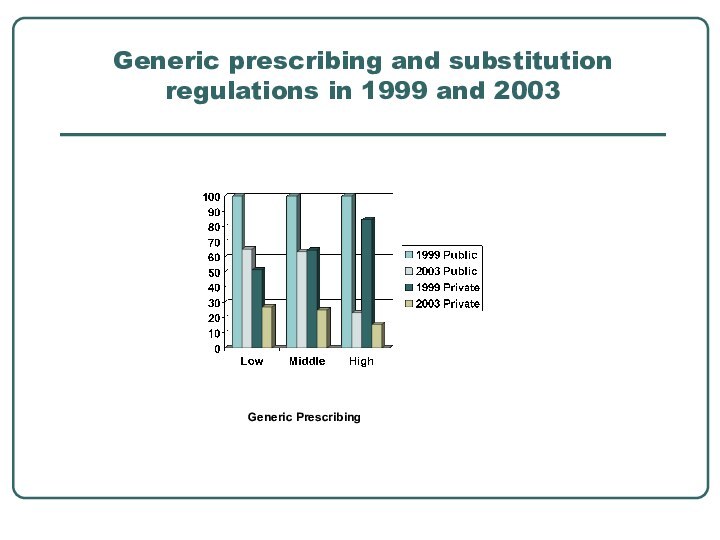

- 10. Generic prescribing and substitution regulations in 1999 and 2003 Generic Prescribing

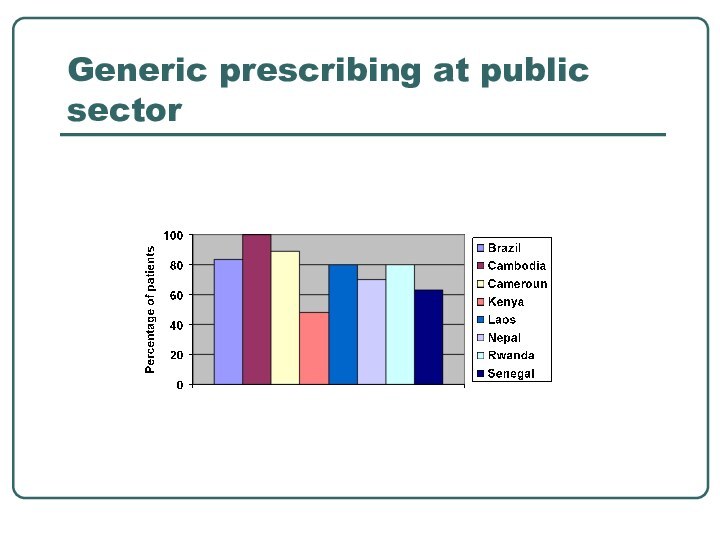

- 11. Generic prescribing at public sector

- 12. Measuring access to essential medicines ( Household

- 13. Importance of household survey Household situations How

- 14. Indicators: (few examples)AffordabilityAverage household medicine expenditures as

- 15. Indicators: (few examples)Rational Use of MedicinesPercent of

- 16. Current issues on household survey processChallenge to

- 17. Level III IndicatorsSystematic survey and monitoringDrug price

- 18. Sampling issues for systematic surveyFollow specific procedures

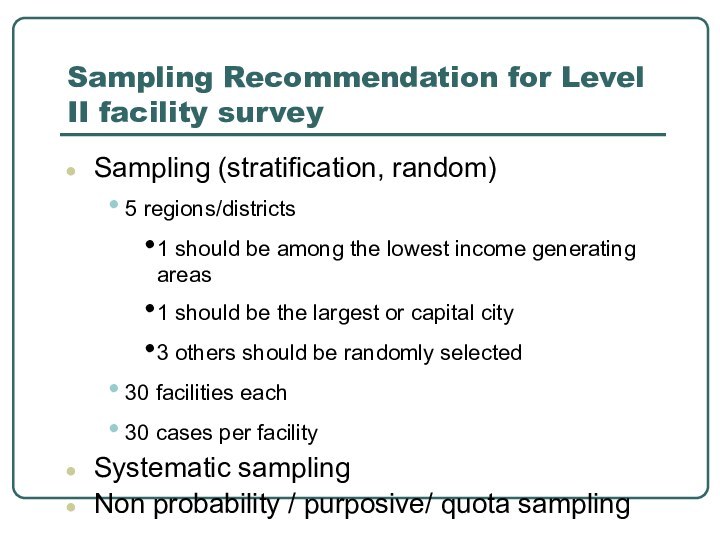

- 19. Sampling Recommendation for Level II facility surveySampling

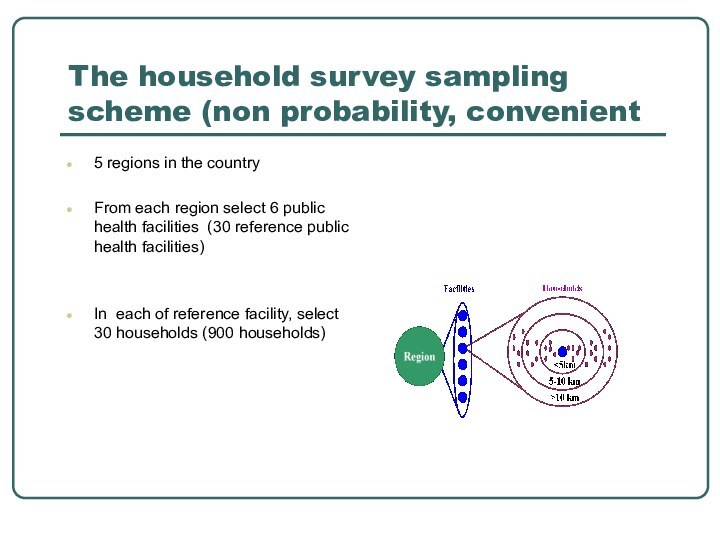

- 20. The household survey sampling scheme (non probability,

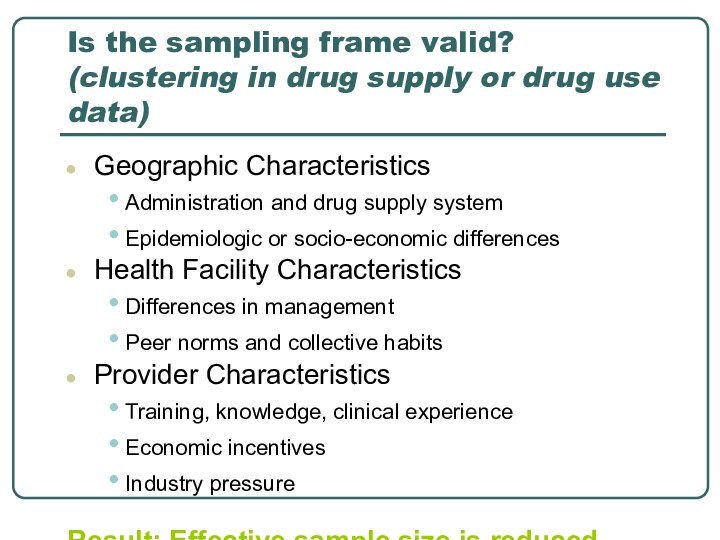

- 21. Is the sampling frame valid? (clustering in

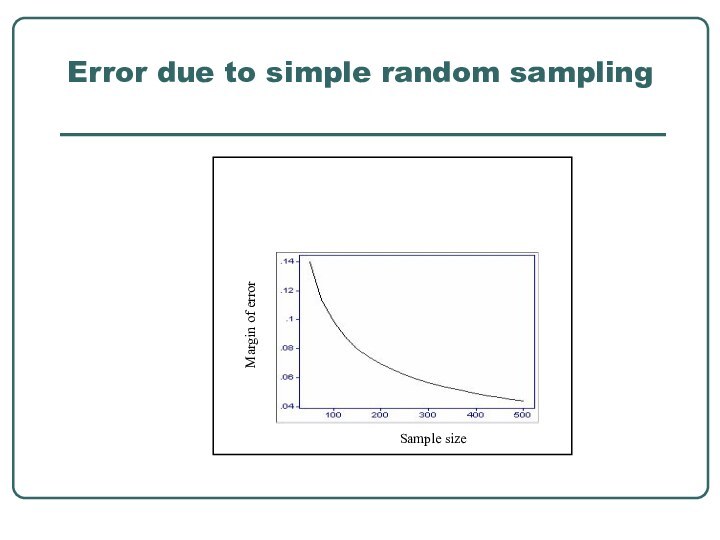

- 22. Error due to simple random sampling

- 23. Who can be trained to do the

- 24. Preparing and implementing systematic survey Administrative preparation:

- 25. Pharmaceutical indicatorsVariables that measure situations and changeNumerical

- 26. Why is it important to use indicators?Standard

- 27. Indicator allows comparison

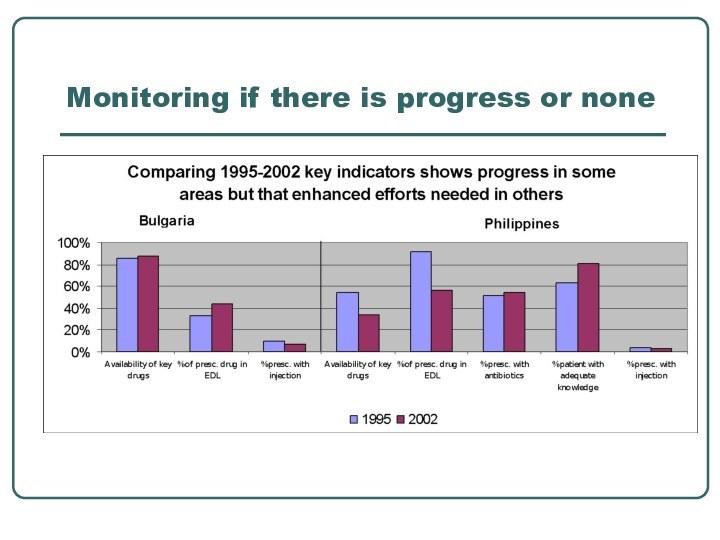

- 28. Monitoring if there is progress or none

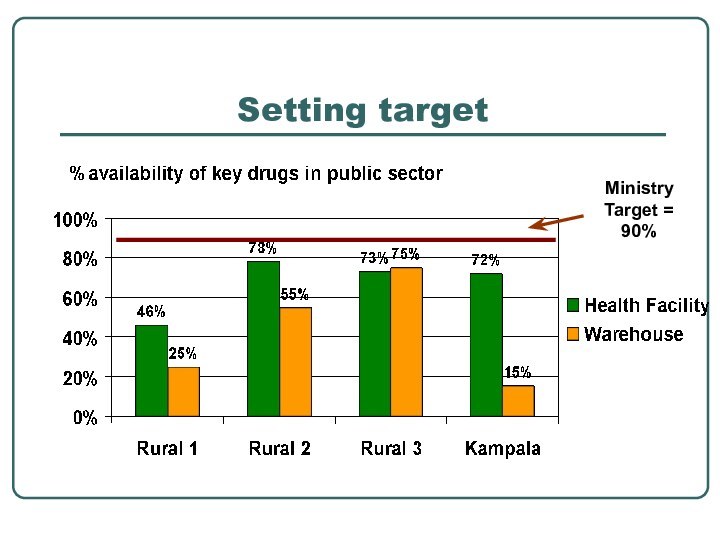

- 29. Setting target

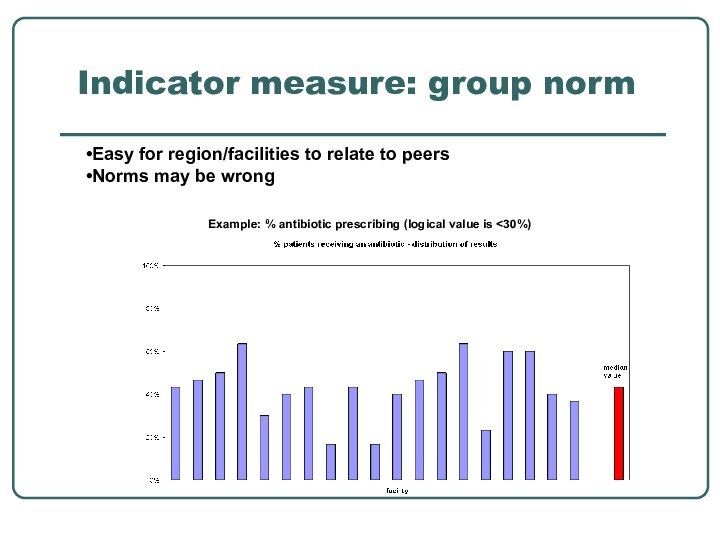

- 30. Indicator measure: group norm Example: % antibiotic prescribing (logical value is

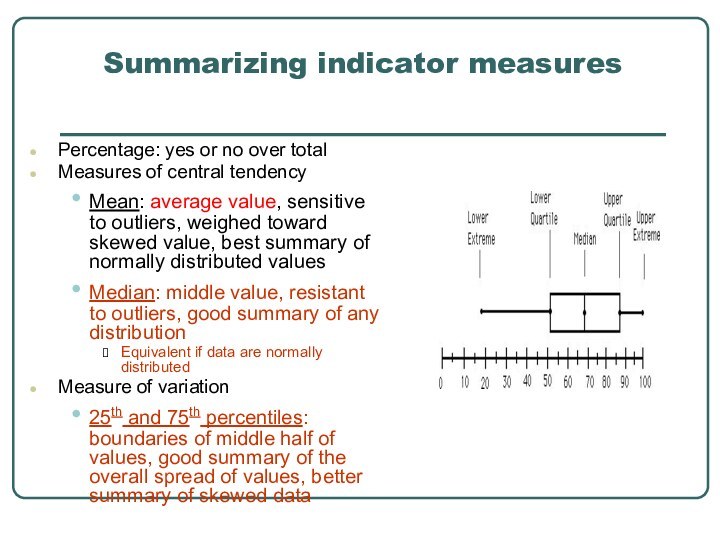

- 31. Summarizing indicator measuresPercentage: yes or no over

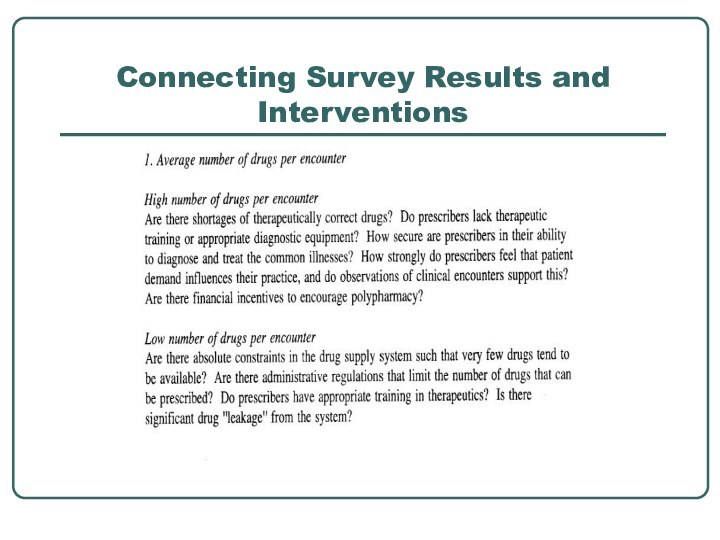

- 32. Indicator measure: Ideal/logical valuesLogical value exist for

- 33. Connecting Survey Results and Interventions

- 34. The way forward on country monitoringEvidence through

- 35. Скачать презентацию

- 36. Похожие презентации

Слайд 2

Topics

Concepts on pharmaceutical assessment/monitoring

The WHO process on

assessing and monitoring pharmaceutical situation

concepts on indicators

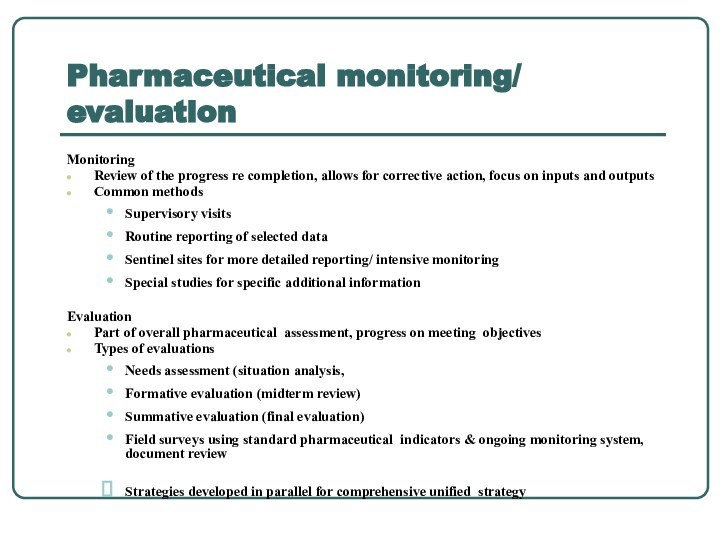

Слайд 3

Pharmaceutical monitoring/ evaluation

Monitoring

Review of the progress re completion,

allows for corrective action, focus on inputs and outputs

Common

methods Supervisory visits

Routine reporting of selected data

Sentinel sites for more detailed reporting/ intensive monitoring

Special studies for specific additional information

Evaluation

Part of overall pharmaceutical assessment, progress on meeting objectives

Types of evaluations

Needs assessment (situation analysis,

Formative evaluation (midterm review)

Summative evaluation (final evaluation)

Field surveys using standard pharmaceutical indicators & ongoing monitoring system, document review

Strategies developed in parallel for comprehensive unified strategy

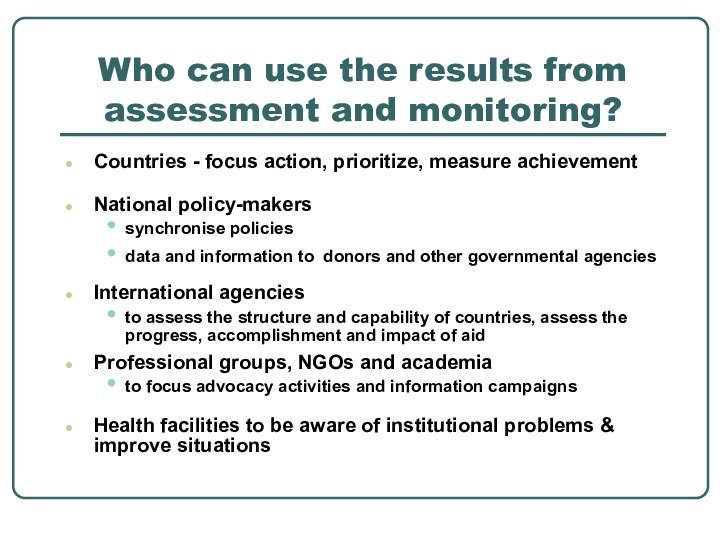

Слайд 4 Who can use the results from assessment and

monitoring?

Countries - focus action, prioritize, measure achievement

National policy-makers

synchronise policies

data and information to donors and other governmental agencies

International agencies

to assess the structure and capability of countries, assess the progress, accomplishment and impact of aid

Professional groups, NGOs and academia

to focus advocacy activities and information campaigns

Health facilities to be aware of institutional problems & improve situations

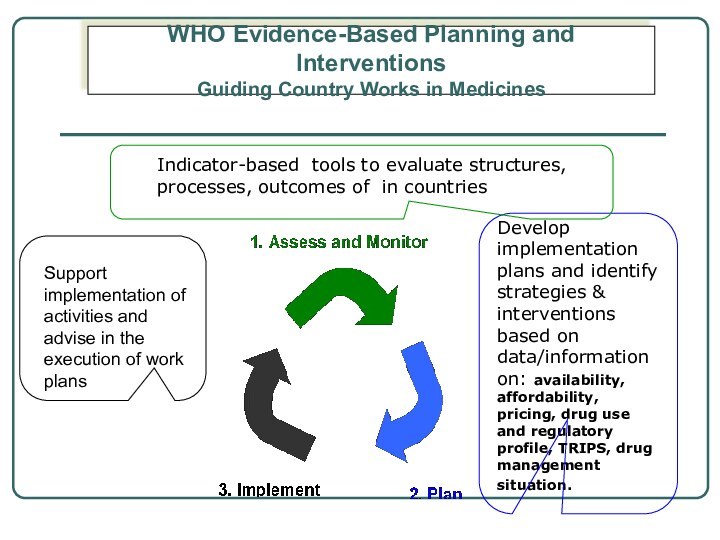

Слайд 5 Develop implementation plans and identify strategies & interventions

based on data/information on: availability, affordability, pricing, drug use

and regulatory profile, TRIPS, drug management situation.Support implementation of activities and advise in the execution of work plans

Indicator-based tools to evaluate structures, processes, outcomes of in countries

WHO Evidence-Based Planning and Interventions

Guiding Country Works in Medicines

Слайд 7 WHO hierarchical approach to monitoring and assessing pharmaceutical

situations

Level I

Core structure

& process indicators

Level II

Core outcome/impact indicators

& household survey

Level III

Indicator tools for specific components

of the pharmaceutical sector

Pricing ● Traditional medicine

HIV/AIDS ● Assessing regulatory capacity

TRIPS

Systematic

survey

Questionnaire

(Health Officials)

Level I

Questionnaire/rapid assessment/checklist

Arrays achievement & weaknessess, illustrate sectoral approaches

Level II

Comprehensive monitoring of pharmaceutical strategy outcome and impact

Measures attainment of objectives

Level III

More detailed indicators for monitoring and evaluating specific areas/components

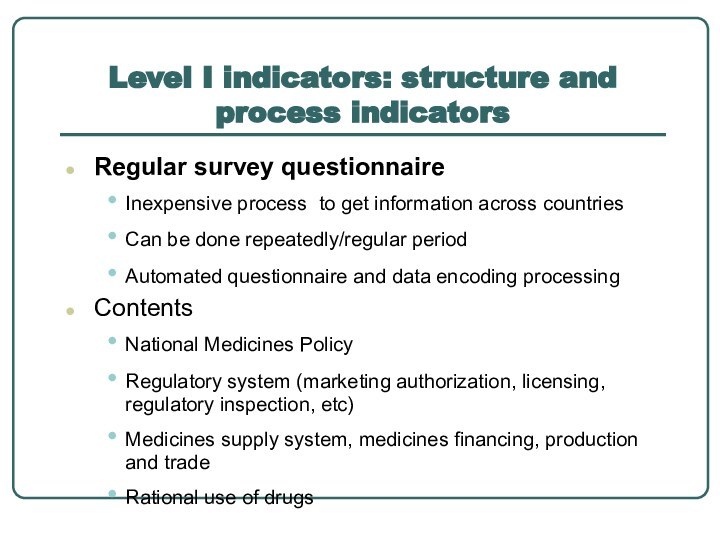

Слайд 8

Level I indicators: structure and process indicators

Regular survey

questionnaire

Inexpensive process to get information across countries

Can be done

repeatedly/regular periodAutomated questionnaire and data encoding processing

Contents

National Medicines Policy

Regulatory system (marketing authorization, licensing, regulatory inspection, etc)

Medicines supply system, medicines financing, production and trade

Rational use of drugs

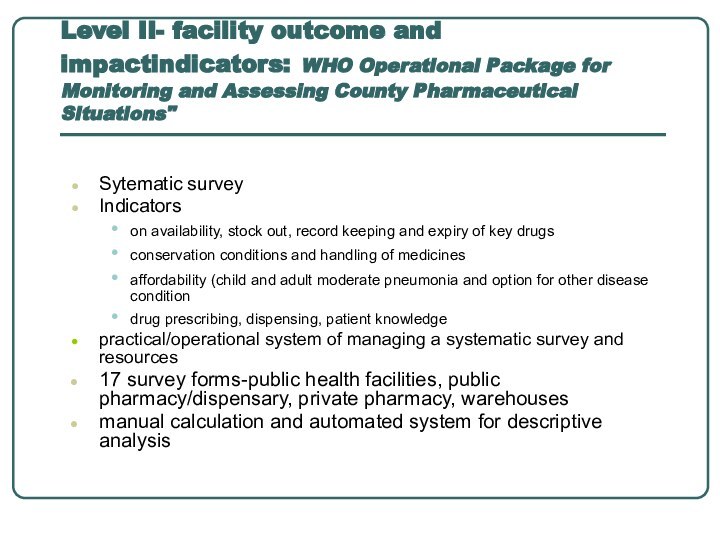

Слайд 9 Level II- facility outcome and impactindicators: WHO Operational

Package for Monitoring and Assessing County Pharmaceutical Situations"

Sytematic survey

Indicators

on availability, stock out, record keeping and expiry of key drugs

conservation conditions and handling of medicines

affordability (child and adult moderate pneumonia and option for other disease condition

drug prescribing, dispensing, patient knowledge

practical/operational system of managing a systematic survey and resources

17 survey forms-public health facilities, public pharmacy/dispensary, private pharmacy, warehouses

manual calculation and automated system for descriptive analysis

Слайд 12

Measuring access to essential medicines ( Household Survey)

Level

I and Level II- facility surveys do not measure

access from the patient/consumer perspective.Only household surveys can provide population-based information about how pharmaceutical policies affect the well-being of individuals.

Слайд 13

Importance of household survey

Household situations

How they

access their medicines, where they get them

How much they

payIdentify access and affordability in relation to socio economic indicators, barriers

Examine use of medicines (acute and chronic diseases)

Perceptions on access, use and quality; handling of medicines

Слайд 14

Indicators: (few examples)

Affordability

Average household medicine expenditures as %

of total/non-food/health expenditures

Average household medicine expenditures for a reported

illness (acute, chronic, by illness)% of households with at least partial medicine insurance coverage

Mixed Indicators of Access (availability)

Percent of households reporting a serious acute illness who sought care outside but did not take any medicine.

Percent of households who do not have at home a medicine prescribed to a chronically ill person.

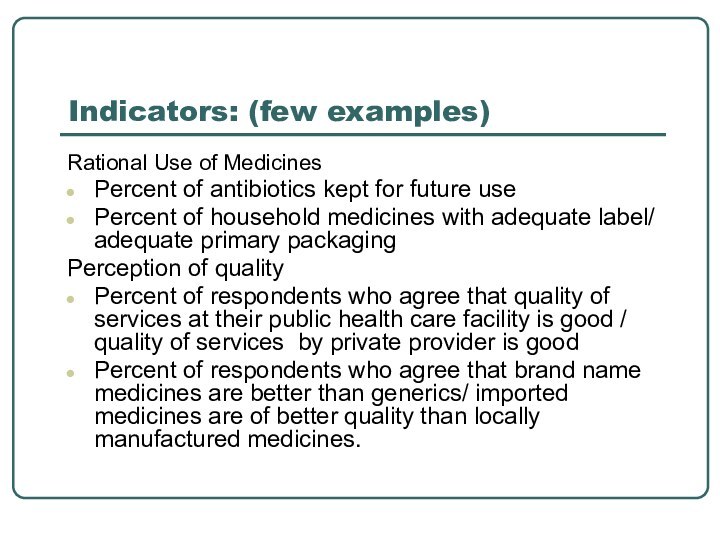

Слайд 15

Indicators: (few examples)

Rational Use of Medicines

Percent of antibiotics

kept for future use

Percent of household medicines with adequate

label/ adequate primary packagingPerception of quality

Percent of respondents who agree that quality of services at their public health care facility is good / quality of services by private provider is good

Percent of respondents who agree that brand name medicines are better than generics/ imported medicines are of better quality than locally manufactured medicines.

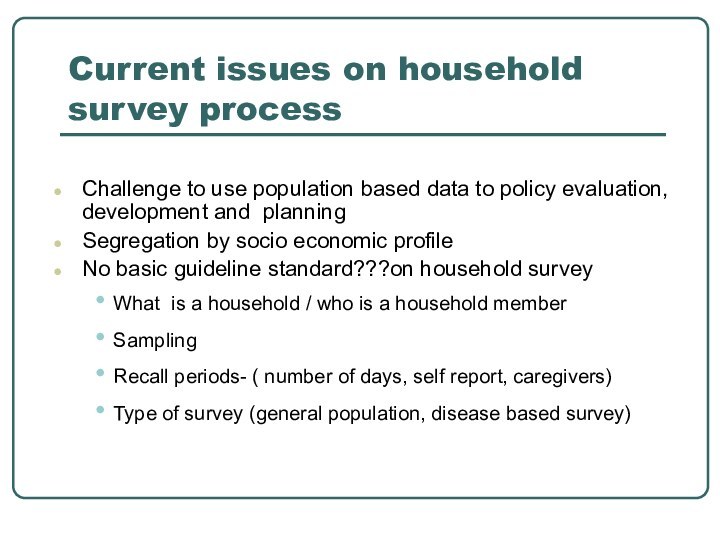

Слайд 16

Current issues on household survey process

Challenge to use

population based data to policy evaluation, development and planning

Segregation by socio economic profile

No basic guideline standard???on household survey

What is a household / who is a household member

Sampling

Recall periods- ( number of days, self report, caregivers)

Type of survey (general population, disease based survey)

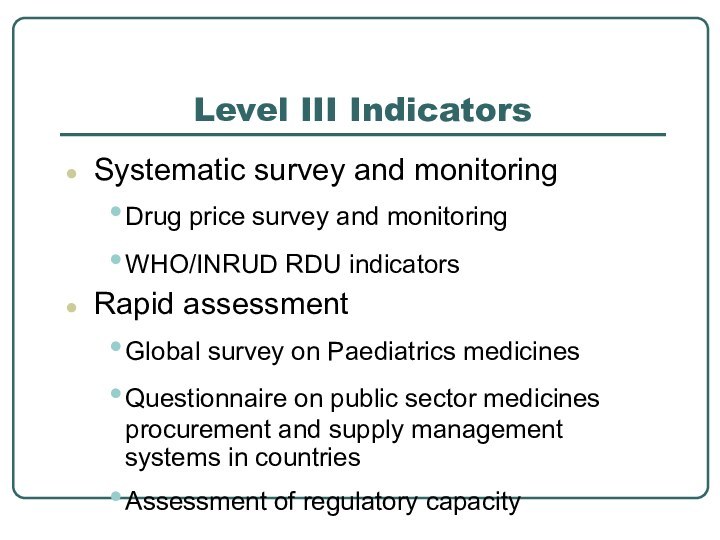

Слайд 17

Level III Indicators

Systematic survey and monitoring

Drug price survey

and monitoring

WHO/INRUD RDU indicators

Rapid assessment

Global survey on Paediatrics medicines

Questionnaire

on public sector medicines procurement and supply management systems in countriesAssessment of regulatory capacity

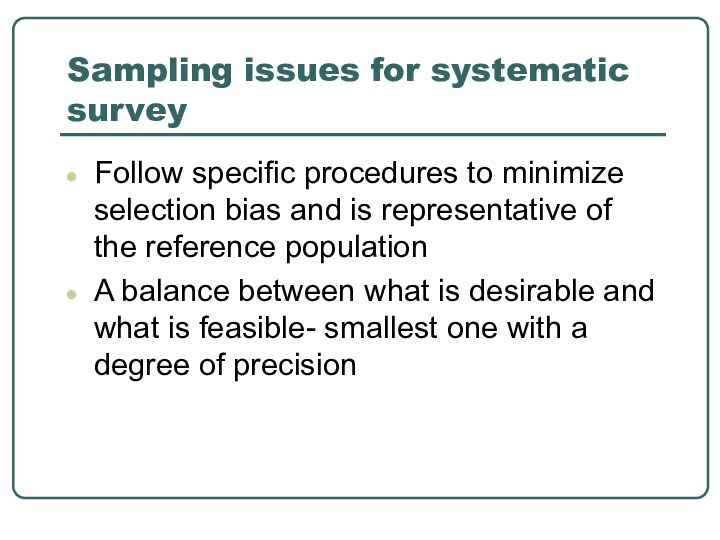

Слайд 18

Sampling issues for systematic survey

Follow specific procedures to

minimize selection bias and is representative of the reference

populationA balance between what is desirable and what is feasible- smallest one with a degree of precision

Слайд 19

Sampling Recommendation for Level II facility survey

Sampling (stratification,

random)

5 regions/districts

1 should be among the lowest income

generating areas1 should be the largest or capital city

3 others should be randomly selected

30 facilities each

30 cases per facility

Systematic sampling

Non probability / purposive/ quota sampling

Слайд 20

The household survey sampling scheme (non probability, convenient

5 regions in the country

From each region select 6

public health facilities (30 reference public health facilities)In each of reference facility, select 30 households (900 households)

Слайд 21 Is the sampling frame valid? (clustering in drug

supply or drug use data)

Geographic Characteristics

Administration and drug supply

systemEpidemiologic or socio-economic differences

Health Facility Characteristics

Differences in management

Peer norms and collective habits

Provider Characteristics

Training, knowledge, clinical experience

Economic incentives

Industry pressure

Result: Effective sample size is reduced

Слайд 23

Who can be trained to do the survey?

Physicians,

nurses, pharmacists or paramedical staff

Health ministry/department staff and temporary

employees (health related background and experience) data collectors from different parts of the country (language differences)

Слайд 24

Preparing and implementing systematic survey

Administrative preparation:

Coordinating

with WHO, ministry/department of health, public health facilities, private

drug outlets, warehousesMaking logistic arrangements and budget allocations

Technical requirements:

Tailoring the tool-specific items of the survey forms, e.g. key basket of medicines, treatment guidelines, etc.

Training data collectors to carry out the survey and use the survey and summary forms

Analyzing and computing the data

Preparing a report and using result

Слайд 25

Pharmaceutical indicators

Variables that measure situations and change

Numerical (

numbers, percentage, or averages)

Binomials (yes” and “no)”

Linked

to an important input, process, or outcomeWell-established indicators can be adapted/ modified to reflect the realities

Field test

Слайд 26

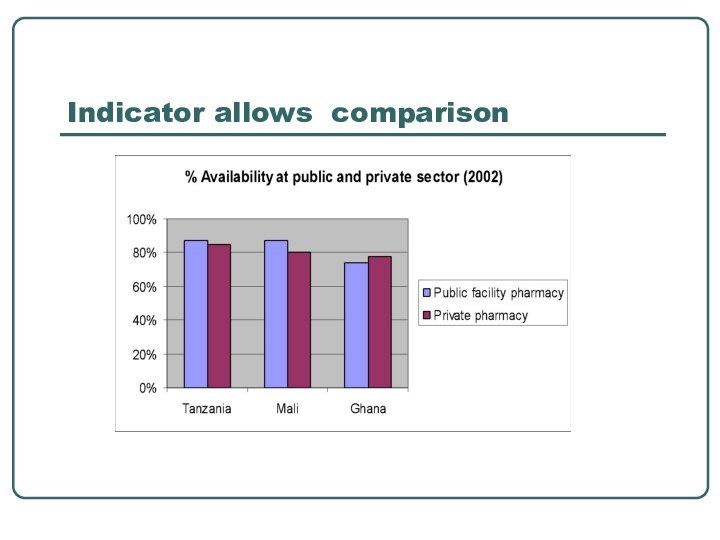

Why is it important to use indicators?

Standard indicators

facilitates:

comparing the performance of facilities, districts, urban vs rural,

private & public sector, overall situations in countriesseeing trends over time

setting target

Слайд 30

Indicator measure: group norm

Example: % antibiotic prescribing

(logical value is

peersNorms may be wrong

Слайд 31

Summarizing indicator measures

Percentage: yes or no over total

Measures of central tendency

Mean: average value, sensitive to outliers,

weighed toward skewed value, best summary of normally distributed valuesMedian: middle value, resistant to outliers, good summary of any distribution

Equivalent if data are normally distributed

Measure of variation

25th and 75th percentiles: boundaries of middle half of values, good summary of the overall spread of values, better summary of skewed data

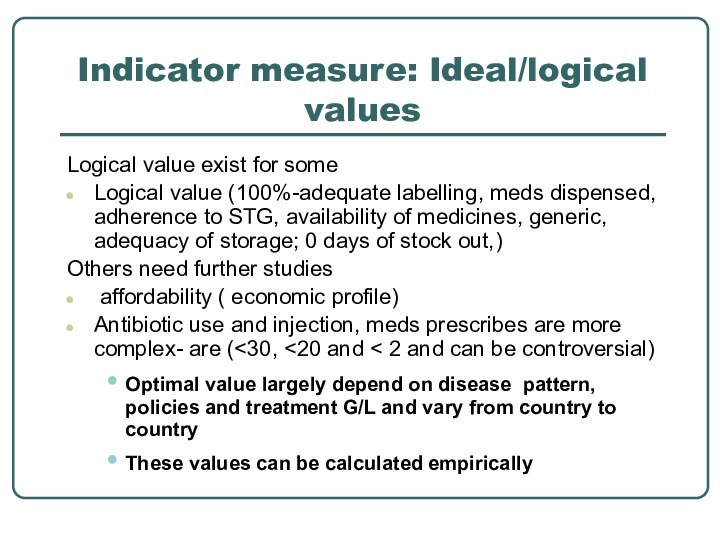

Слайд 32

Indicator measure: Ideal/logical values

Logical value exist for some

Logical

value (100%-adequate labelling, meds dispensed, adherence to STG, availability

of medicines, generic, adequacy of storage; 0 days of stock out,)Others need further studies

affordability ( economic profile)

Antibiotic use and injection, meds prescribes are more complex- are (<30, <20 and < 2 and can be controversial)

Optimal value largely depend on disease pattern, policies and treatment G/L and vary from country to country

These values can be calculated empirically

Слайд 34

The way forward on country monitoring

Evidence through systematic

but feasible data collection process is necessary in policy

making and activity implementation. This should include population based informationShould demonstrate that in the long run regular monitoring and evaluation is not difficult and can be done in a cost efficient manner

Portion of country support budget and project grants should be allotted to monitoring and evaluation using indicators

Timely report and information/data sharing