Слайд 2

New institutional economics

institutions, understood as rules, practices and

routines of varying degrees of formality and embeddedness, matter

to economic performance (North, Aoki)

legal rules affect economic growth according to how far they support market access, contract enforcement and and the protection of property rights (La Porta et al.)

Слайд 3

‘Law matters’

A higher degree of shareholder protection through

law encourages stock market development and dispersed share ownership

(La Porta et al. 1998)

Rules protecting creditor rights promote banking development and the growth of private credit (Djankov et al, 2008)

Labour protection, by contrast, is mostly driven by rent-seeking (the protection of vested interests) and results in inefficiencies (higher unemployment and lower productivity, as well as a larger informal economy) (Botero et al., 2004)

Слайд 4

The ‘anti-director rights index’

6 core variables: ‘proxy by

mail allowed’, ‘shares not blocked before the meeting’, ‘cumulative

voting’, ‘oppressed minorities mechanism’, ‘pre-emptive rights to new issues’, and ‘share capital required to call an extraordinary shareholder meeting’.

Also: ‘one share one vote’ and ‘mandatory dividend’

On the basis of data collected for 49 countries in the mid-1990s, low scores on the ADRI were associated with higher concentration of ownership and a lower degree of stock market activity, in particular in French-origin systems

‘legal systems matter to corporate governance and … firms have to adapt to the limitations of the legal systems that they operate in’ (La Porta et al. 1998).

Слайд 6

The ‘labor regulation index’

Over 100 variables, covering employment

protection, collective labour relations, and social security law, for

85 countries, in the late 1990s

Common law systems have lower scores than civil law ones particularly in relation to employment protection

Higher scores on the labour regulation index are correlated with lower male employment rates, higher youth unemployment, and a larger informal economy (Botero et al., 2004)

Слайд 7

Updated measures (mid-2000s): anti self-dealing index, prospectus index,

creditor rights index

Higher scores on the anti-self dealing index

are correlated with increases in the stock-market/GDP ratio, the number of listed firms, and in ownership dispersion

The prospectus index scores are linked to lower control premia

Higher scores on the creditor rights index are correlated with an increase in the private credit/GDP ratio

Слайд 9

The ‘new comparative economics’

There are significant variations across

national regimes in all the areas of law which

have been examined using the coding methods developed by LLSV, and these differences map on to the divide between common law and civil law legal families

Systems of common law origin provide higher levels of shareholder and creditor protection than those of the civil law and regulate the labour market less intensively

Слайд 11

The legal origin hypothesis

The content of legal rules

is influenced by the infrastructure of the legal system,

i.e., the way that disputes are resolved, the relationship between the courts and the legislature, and the capacity of legal rules for adaptation. The nature of this ‘legal infrastructure’ varies across national systems, with the principal point of difference being the divide between the common law and civil law legal families (La Porta et al. 1997-2007).

Слайд 12

Different approaches to market regulation

‘We adopt a broad

conception of legal origin as a style of social

control economic life… Civil law is associated with a heavier hand of government ownership and regulation than common law…[and with] greater corruption, higher unemployment and larger informal economy… common law is associated with lower formalism of judicial procedures and greater judicial independence than civil law…[and] with greater contract enforcement and greater security of property rights’ (La Porta et al., 2008: 286).

Слайд 13

Aggregate economic outcomes

Mahoney: faster GDP growth in common

law countries than civilian ones post-1945

But, German-origin systems grew

faster than common law ones (with French-origin ones growing most slowly)

And Mahoney’s result largely disappears when standard controls (e.g. years of schooling) are put in (LLS, 2008)

Moreover, the result doesn’t hold for developed systems up to 1980 (Hall and Soskice)

Although common law systems have enjoyed faster growth than civil law ones since 1980, overall growth rates in 1980-2000 period are half those in the period 1960-1980 (Blankenburg and Plesch)

‘The Legal Origins Theory does not say that common law always works better for the economy (LLS, 2008: 309)

Слайд 14

Criticisms of the methods used to generate the

empirical findings

Some values were incorrect and the approach to

coding inconsistent (Cools, Braendle, Spamann)

Implicit weightings in the LLSV indices were not explained (Ahlering and Deakin) (cf, LLS, 2008: 291: ‘an important feature of [the cross-country] studies is that all countries received the same weight’)

Selection bias in the definition of the core variables (Siems)

Original results disappeared with more consistent coding (Spamann)… new approaches were tried including use of questionnaire evidence, apparently restoring the findings (Djankov et al., 2008; La Porta et al., 2008)… but these new data sources are also open to question

Over-reliance on cross-sectional data (but see LLS 2008: 299, reviewing some recent longitudinal studies)

Слайд 15

Criticisms of the explanations given for the observed

effects

The description of the difference between the civil law

and common law systems given in the new comparative economics is a caricature: ‘a superficial and outdated image of the differences between the common law and the civil law’ (Mattei)

Legislation is highly significant as a source of norms for the common law systems in the area of economic regulation (Ahlering and Deakin; but see above, response of LLS).

Civil law judges arguably have greater power to control outcomes than their common law counterparts, through the use of general clauses and similar interpretive devices (Pistor)

Слайд 16

Tentative conclusions

Legal systems are autonomous institutional phenomena with

the potential to influence long-run patterns of economic development

But,

the conventional distinction between the common law and the civil law is too crude to bear the weight being placed on it

The strong-form legal origin hypothesis seems hard to support because of legal variation over time and the lack of a consistently clear link between law and economic outcome variables

There is no straightforward relationship between the degree of regulation and whether a country has a common law or civil law origin; much depends on the legal context (contrasting results for shareholder and worker protection)

A weak-form version of the legal origin hypothesis may be plausible: the origins of legal infrastructure in a given system may make a difference to the substance of rules and to economic outcomes, but legal systems are likely to be endogenous, to some extent, to the political and economic contexts within which they operate, and the implications of origin for efficiency are unclear a priori

Слайд 17

Some questions

Can we adequately quantify differences in the

content of legal rules?

What conclusions can be drawn from

econometric analysis of correlations between legal change and economic outcomes?

What are the normative implications of the legal origin hypothesis?

Слайд 18

Empirical case study: does company law influence economic

growth?

What is the contribution of financial markets to economic

growth in developed and developing countries?

What is the contribution of the legal system in general, and of corporate law/governance in particular, to financial development and economic growth?

Слайд 19

Governance, finance and growth: the critical questions

What is

the contribution of financial markets to economic growth in

developed and developing countries?

What is the contribution of the legal system in general, and of corporate law/governance in particular, to financial development and economic growth?

Слайд 20

Legal origin and growth

Firms grow faster where they

can access external finance (Levine, 1997)

Thus legal origin theory

supports the claims that (1) legal reform is a means of promoting financial and economic development, and that (2) common law systems are better placed than civil law ones to generate market-driven growth, underpinned by law

Слайд 21

How law influences finance

A higher level of shareholder

protection in a given country is correlated with more

dispersed share ownership, a larger listed company sector, and a higher ratio of stock market values to GDP (La Porta et al. 1998)

‘Legal systems matter to corporate governance and… firms have to adapt to the limitations of the legal systems that they operate in’ (ibid.)

High scores on creditor protection index linked to growth of private (bank-based) credit: Djankov et al., 2007

But, these findings mostly based on cross-sectional data and inadequate coding of laws

Слайд 22

Three hypotheses

Convergence hypothesis: systems are converging at the

level of formal law (formal convergence) and in terms

of effects of law on financial development (functional convergence)

Complementarity hypothesis: legal and financial institutions co-evolved in a complementary way, reflecting local diversity

Transplant hypothesis: transfer of legal models from common law world to civil law world likely to encounter resistance

Слайд 23

New evidence on law and financial development

The datasets

constructed by LLSV are deficient in presenting only a

cross-sectional view of differences in the law across countries, as well as suffering from some coding errors

The development of more recent, longitudinal datasets by the CBR (Cambridge Centre for Business Research) makes it possible to introduce time-series element into the analysis of law and financial development: http://www.cbr.cam.ac.uk/research/programme2/project2-20output.htm

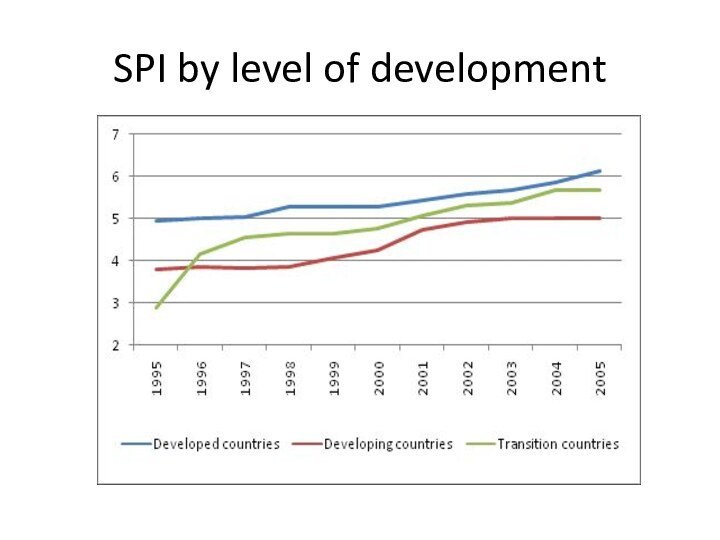

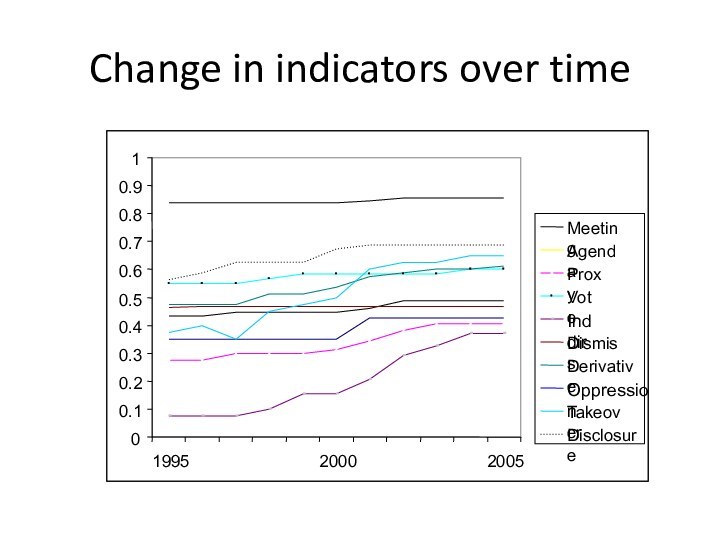

SPI and CPI, 25 countries, 1995-2005

Слайд 24

The business judgment rule

In the United States, the

courts have articulated the ‘business judgment’ rule, according to

which the courts will not, in general, review decisions of the board taken in good faith in the interests of the company, with adequate information, and according to normal standards of prudence (similar conventions operate in the UK).

But the rule will not apply where there is self-dealing; and takeover bids may be special cases.

Слайд 25

Shareholder protection index

Powers of shareholder meeting

Agenda setting power

Proxy

voting facilitated

One share one vote

Independent directors

Director dismissal

Derivative action

Action against

majority shareholder

Mandatory bid

Block disclosure

Слайд 31

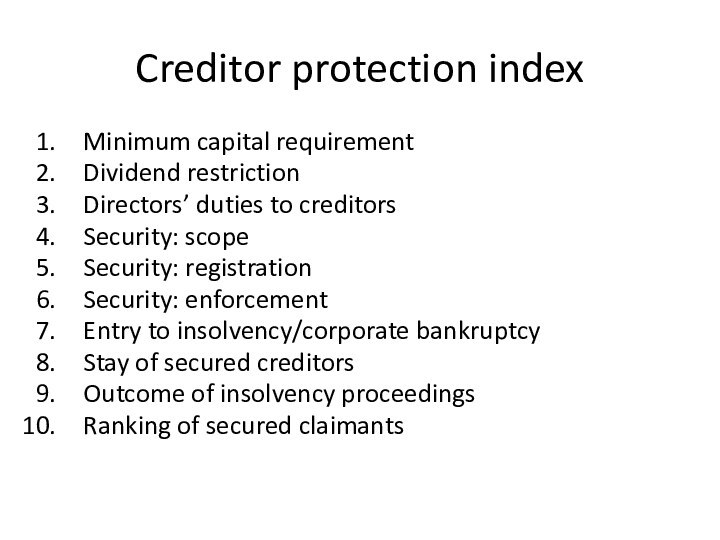

Creditor protection index

Minimum capital requirement

Dividend restriction

Directors’ duties to

creditors

Security: scope

Security: registration

Security: enforcement

Entry to insolvency/corporate bankruptcy

Stay of secured

creditors

Outcome of insolvency proceedings

Ranking of secured claimants

Слайд 34

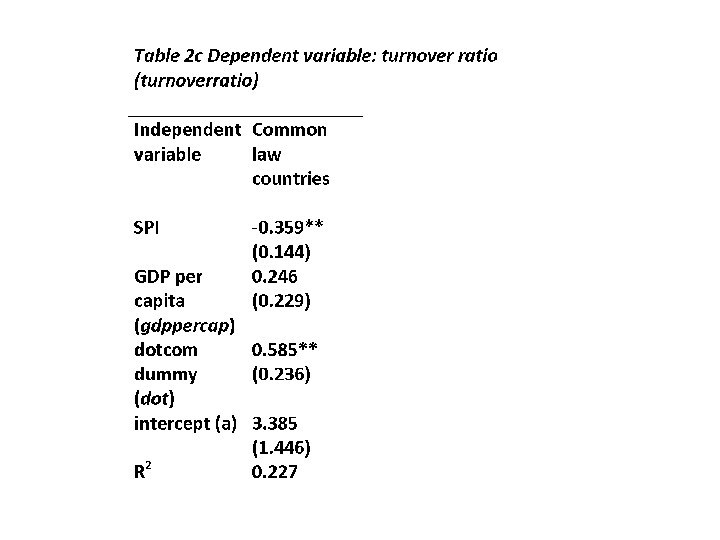

Econometric analysis

Panel VAR Granger causality tests carried out

to see whether changes in the SPI or CPI

cause or are caused by financial development (as measured by stock market capitalisation/turnover and bank credit respectively), after controlling for rule of law, GDP level

Panel data estimation (GMM) technique used to clarify the nature of impacts (positive or negative)

Слайд 35

Model

where Y is GDP per capita (in natural

log), LPCY, RULE is the rule of law index,

DOT is a dummy for dotcom bubble which takes the value zero for 1995-2000 and 1 for the period, 2001-2005, a is the fixed effect common across the panels and eit is the error term varying across time and panels. To choose the lags (p, q and r in the regression model) which indicate how many past years are to be considered, a number of possible approaches available (such as the sequential modified LR test statistic (LRM), the final prediction error approach (FPE), the Akaike information criterion (AIC), the Schwarz information criterion (SC), and the Hannan-Quinn information criterion (HQ)). Different criteria often choose different lag lengths and we have considered the maximum lag length. Similarly, to test whether X causes Z we interchange the position of X and Z in the above equation.

Слайд 36

Main finding

No evidence of law influencing financial development

(or vice versa) for sample as a whole, but

there are impacts if the sample is split by reference to level of development and legal origin

Слайд 37

Effects by level of development and legal origin

Increased

shareholder protection linked to stock market growth in developing

countries

But, increased shareholder protection linked to stock market bubbles in developed, common law countries