Слайд 2

Introductory information

Surface Area: 603,6 1000 sq km

Population:

45,5 Millions of inhabitants - 2010 (estimates after 2008)

Current

GDP: 102,9 Billions of euros - 2010 (estimates after 2009)

GDP per capita: 2.262,7 Euros - 2010 (estimates after 2008)

Exports-to-GDP ratio: 36,1 % (2010)

Imports-to-GDP ratio: 43,5 % (2010)

Trade-to-GDP ratio: 79,7 % (2010)

Слайд 4

Export of goods

ferrous metals and nonferrous metals

fuel and

petroleum products

chemicals, machinery and transport equipment

food products

Слайд 5

EXPORTS OF SERVICES

Transportation

Travel

Construction services

Financial services

Communication services

Insurance services

Computer

and information services

Royalties and license fees

Advertising, market research

Research and

development

Architectural, engineering and other technical services

Legal, accounting, management consulting and public relations

Agricultural, mining and on-site processing services

Government services

Other services

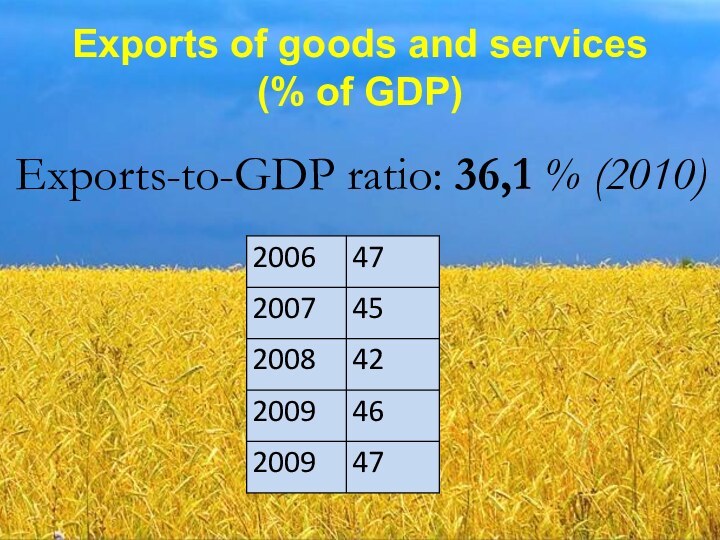

Слайд 6

Exports of goods and services (% of GDP)

Exports-to-GDP

ratio: 36,1 % (2010)

Слайд 7

Import

Energy

Machinery and equipment

Chemicals

Machinery and transport equipment

Textile and

clothes

Other products

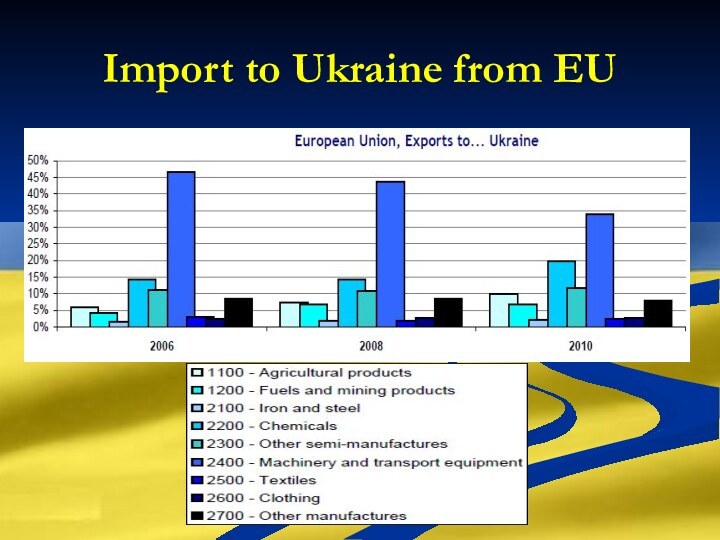

Слайд 8

Agricultural products

Ukrainian import

Fuel and mining products

Chemicals

Machinery and transport

equipment

Textile and clothes

Other products

Millions of euros

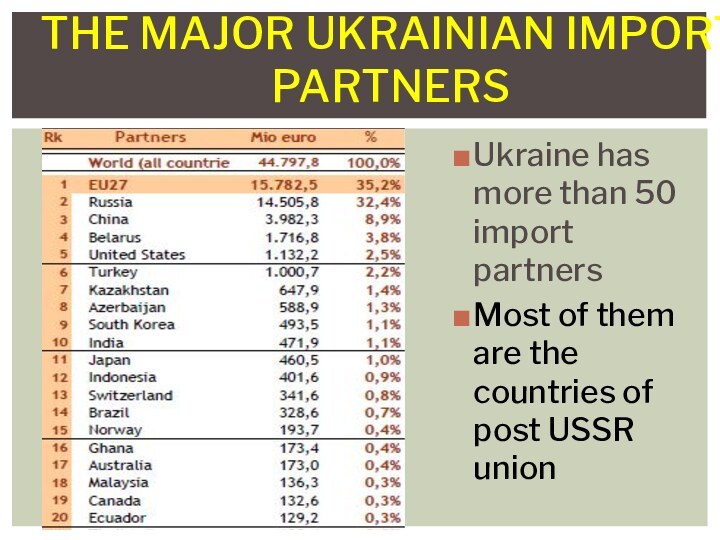

Слайд 10

Ukraine has more than 50 import partners

Most of

them are the countries of post USSR union

The major

Ukrainian import partners

Слайд 11

The major Ukrainian export partners

Слайд 12

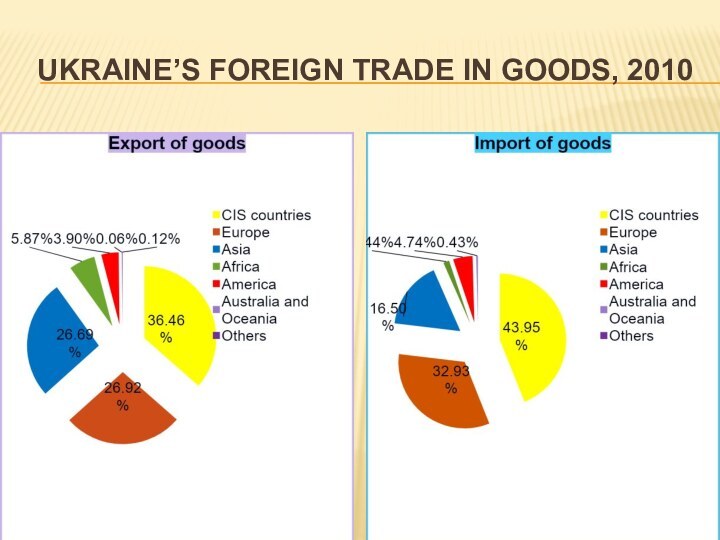

Ukraine’s Foreign Trade in Goods, 2010

Слайд 13

Dynamics of Ukraine’s Foreign Trade in Services (2005,

2010)

Слайд 14

Ukraine’s Foreign Trade in Goods, 2010

Слайд 15

Exports of Services

(2009, 2010)

Слайд 16

Imports of Services

(2009, 2010)

Слайд 17

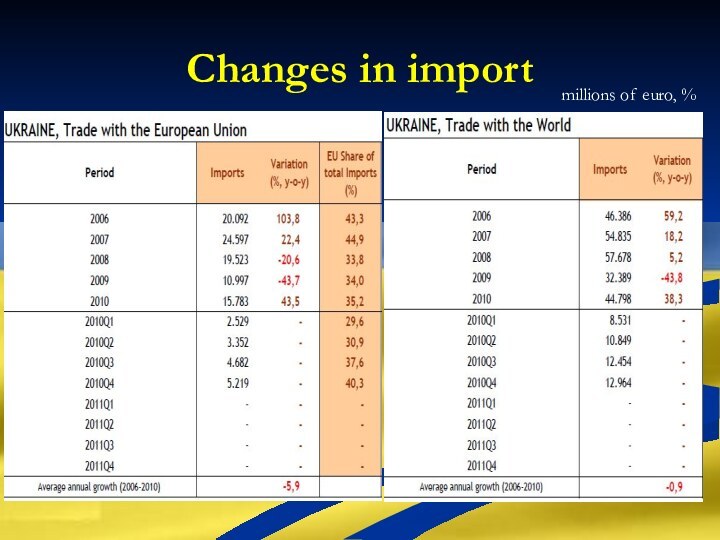

Changes in import

millions of euro, %

Слайд 18

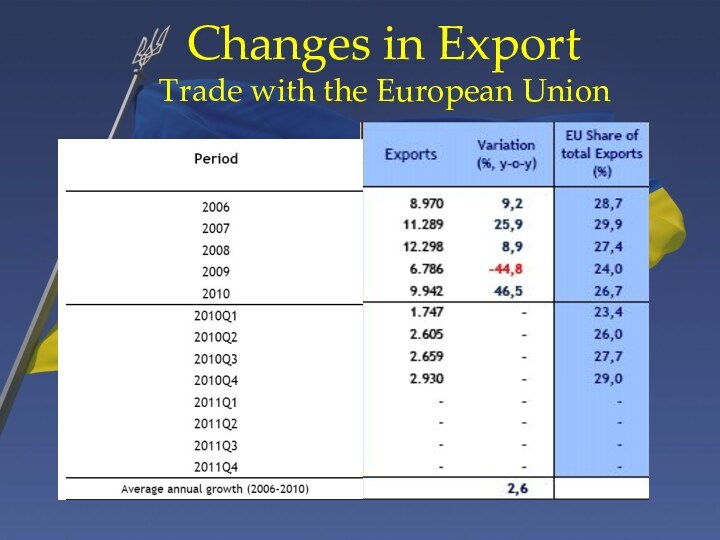

Changes in Export

Trade with the European Union

Слайд 19

Changes in Export

Trade with the World

Слайд 20

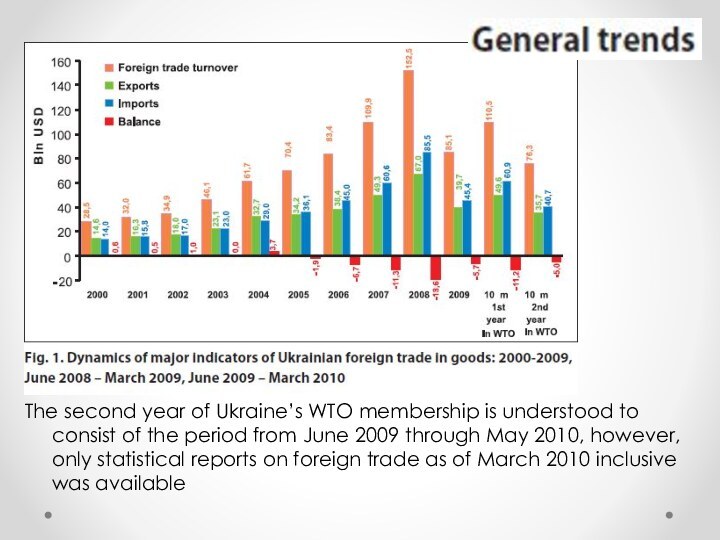

The result of two-year membership in WTO

Слайд 21

The second year of Ukraine’s WTO membership is

understood to consist of the period from June 2009

through May 2010, however, only statistical reports on foreign trade as of March 2010 inclusive was available

Слайд 23

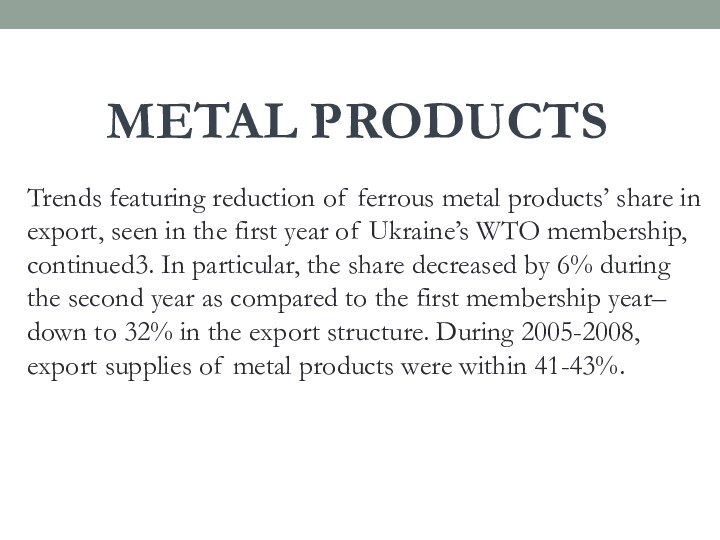

Trends featuring reduction of ferrous metal products’ share

in export, seen in the first year of Ukraine’s

WTO membership, continued3. In particular, the share decreased by 6% during the second year as compared to the first membership year– down to 32% in the export structure. During 2005-2008, export supplies of metal products were within 41-43%.

METAL PRODUCTS

Слайд 24

Agriculture is the only

sector in Ukraine demonstrating growth during the financial and

economic crisis: for example, gross output growth in 2009 was 0.1% year-on-year. All other sectors demonstrated production decline indicators. Positive results of agricultural operations became possible due to successful export activities as well.

Agricultural products

Слайд 25

Industrial products

The country’s industrial development is determined by

the share of this sector’s products in the general

structure of export deliveries. Ukraine’s industry lost almost a half of its capacity during 1995-1999; for example, industrial output index was within 49-51% in that period if we take the 1990 figure as 100%. Such trends adversely affected competitiveness of Ukrainian-made industrial products at the global markets.

Слайд 26

Chemical industry products

In the period covering the second

year of Ukraine’s WTO membership, export deliveries of chemical

products dropped by 33% compared to the corresponding period of the previous year. This is the second position in terms of export volume decline after metallurgical complex products.

Слайд 27

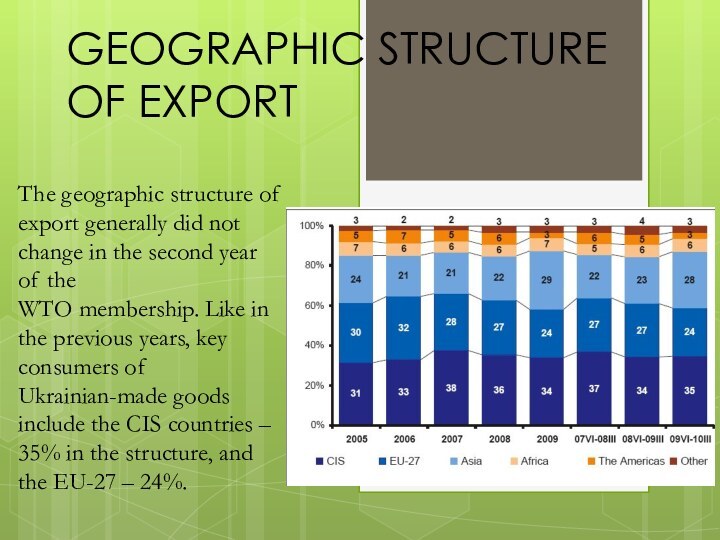

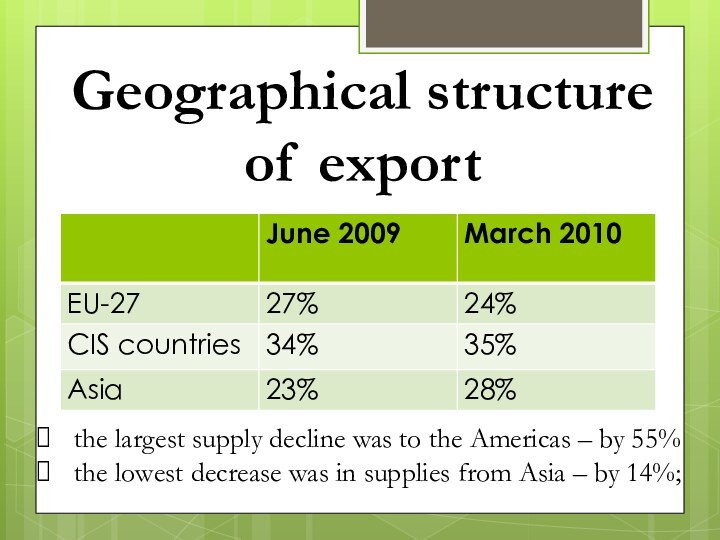

GEOGRAPHIC STRUCTURE OF EXPORT

The geographic structure of export

generally did not change in the second year of

the

WTO membership. Like in the previous years, key consumers of Ukrainian-made goods

include the CIS countries – 35% in the structure, and the EU-27 – 24%.

Слайд 28

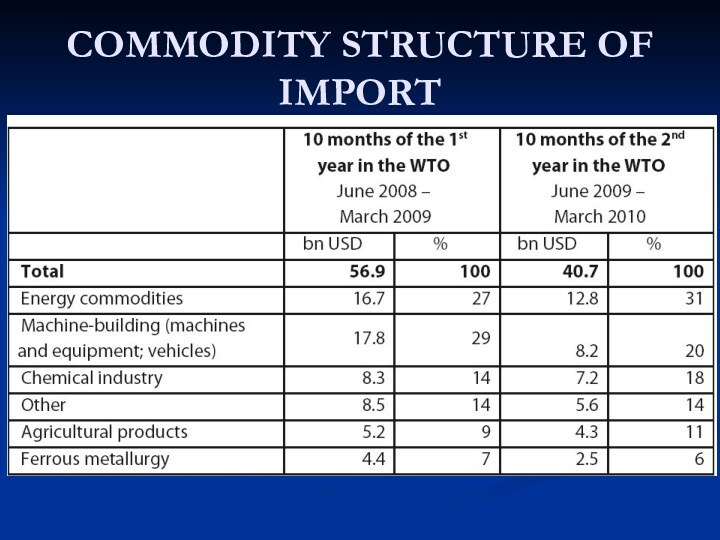

The dynamics and structure of import commodity deliveries

to Ukraine during its

second year of the WTO

membership were mainly determined by impacts of a global

financial crisis:

industrial output decline caused a decrease in Ukrainian enterprises’ demand for raw materials and energy resources;

decreasing investment activity affected reduction in the needs for import of

machine-building products, equipment, vehicles, and other technological goods;

abrupt contraction in consumer lending and people’s income caused a decline in importation of consumer goods: household appliances, motor cars, and foodstuffs;

restricted access to financial resources necessary to carry out import transactions;

hryvnia devaluation increased the cost of imported goods.

COMMODITY STRUCTURE OF IMPORT

Слайд 30

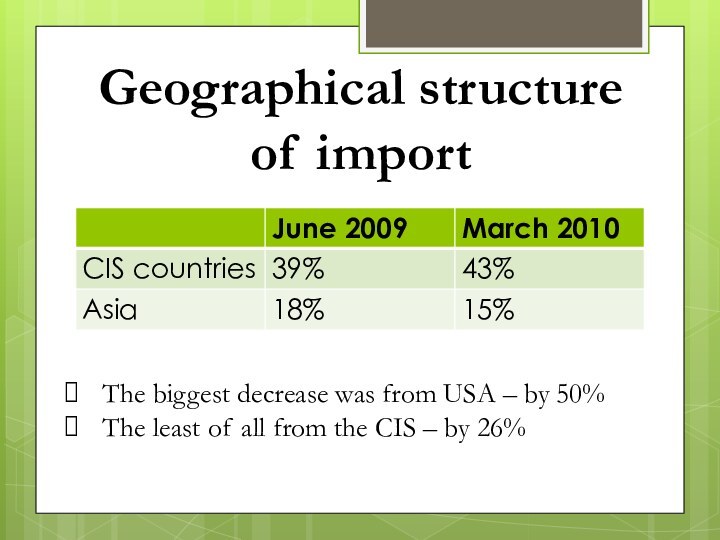

GEOGRAPHIC STRUCTURE OF IMPORT

The

global financial crisis also affected the geographic structure of

import commodity deliveries to Ukraine. A tendency toward decrease in the CIS share, seen in the previous year, stopped ; besides, imports to Ukraine from the CIS countries in value terms declined the least as compared with other regions of the world – by 26%, whereas total import reduction amounted to 33%.

Слайд 31

Internal taxes (VAT, excise)

Ensuring a national treatment

concerning internal taxation and regulation is a basic WTO

principle, i.e. imported goods shall be granted no less favourable treatment than domestic ones.

Слайд 32

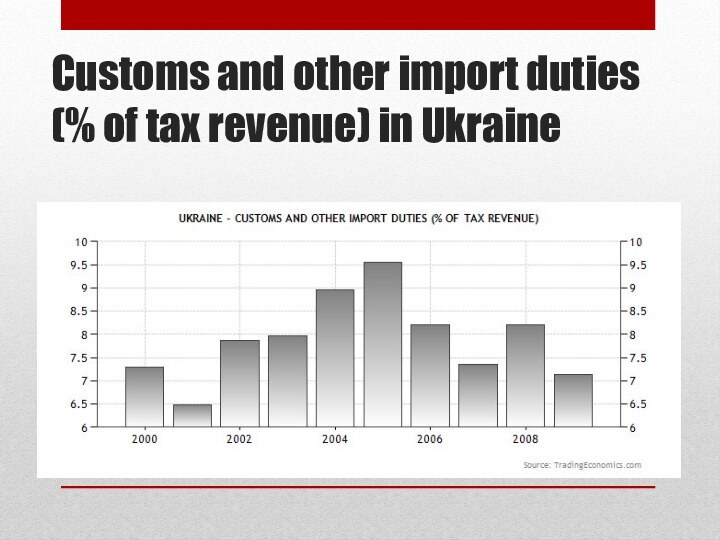

Customs and other import duties (% of tax

revenue) in Ukraine

Слайд 33

Taxes on international trade (% of revenue) in

Ukraine

Слайд 34

Taxes on exports (current LCU) in Ukraine

Слайд 35

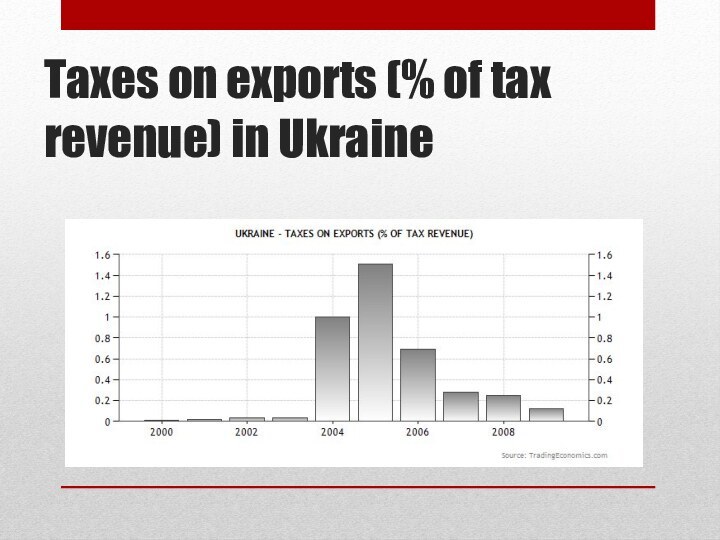

Taxes on exports (% of tax revenue) in

Ukraine

Слайд 36

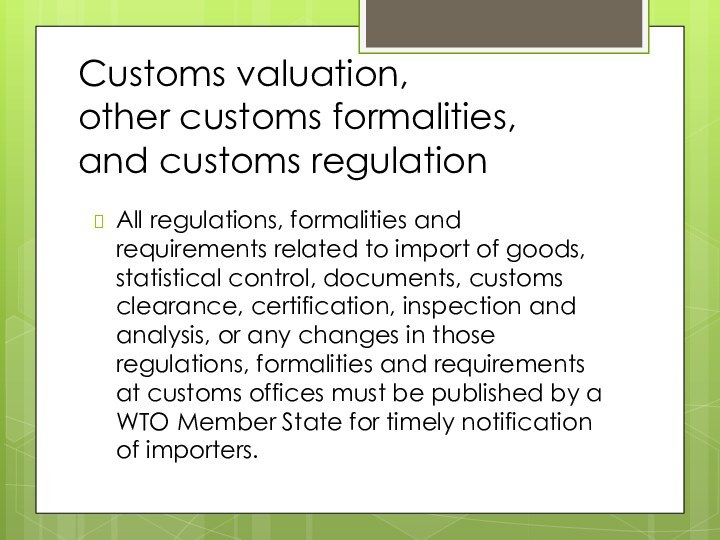

Customs valuation,

other customs formalities,

and customs regulation

All regulations,

formalities and requirements related to import of goods, statistical

control, documents, customs clearance, certification, inspection and analysis, or any changes in those regulations, formalities and requirements at customs offices must be published by a WTO Member State for timely notification of importers.

Слайд 37

Technical barriers to trade

Applying technical regulations and

standards for non-protectionist purposes based on scientific justification and

with no unnecessary obstacles to international trade.

All national and regional standards shall be voluntary except those referred to protect national security interests, prevent deceptive practices, protect human, animal or plant life or health and environment.

Слайд 38

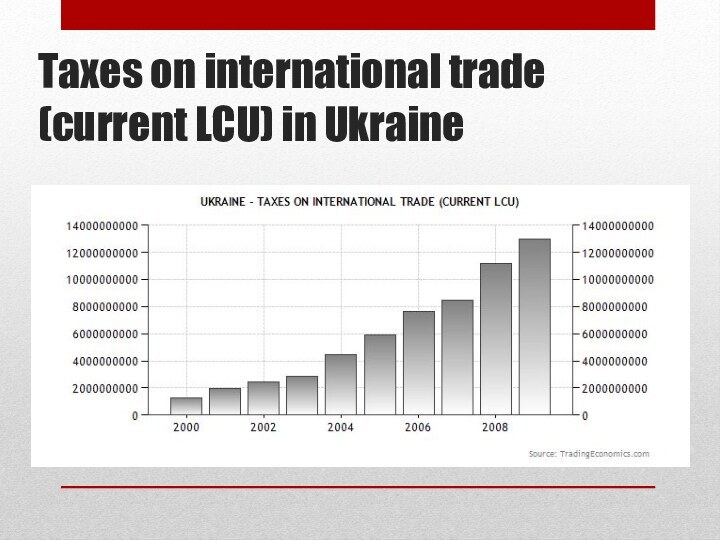

Taxes on international trade (current LCU) in Ukraine

Слайд 39

Customs Union

Ukraine’s accession to the Customs Union with

Russia, Belarus and Kazakhstan with no serious complication is

possible subject to the following conditions being met:

accession of Russia, Belarus and Kazakhstan to the WTO;

adoption by Russia, Belarus and Kazakhstan of trade tariff barriers to third-party countries at a level not higher than adopted by Ukraine when joining the WTO;

affiliation of Russia, Belarus and Kazakhstan, already as WTO members, to Ukraine’s negotiations on a free-trade area (FTA) with the EU. If Ukraine has already had a FTA with the EU at that moment, the FTA will be established on terms agreed between the five countries.

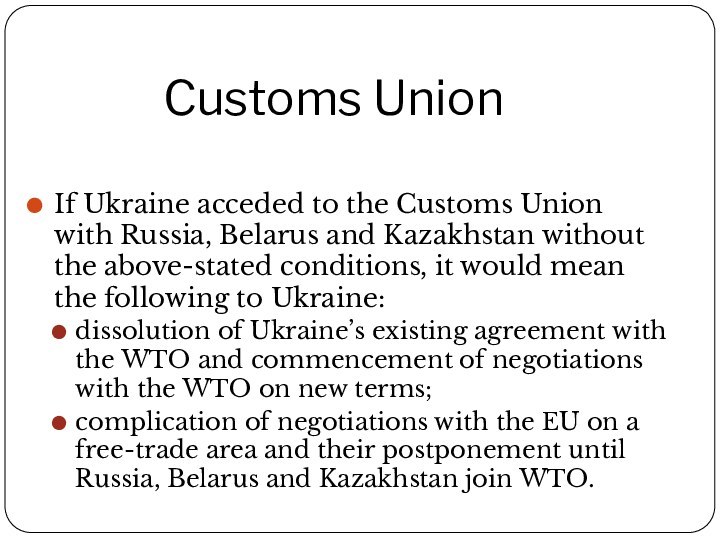

Слайд 40

Customs Union

If Ukraine acceded to the Customs Union

with Russia, Belarus and Kazakhstan without the above-stated conditions,

it would mean the following to Ukraine:

dissolution of Ukraine’s existing agreement with the WTO and commencement of negotiations with the WTO on new terms;

complication of negotiations with the EU on a free-trade area and their postponement until Russia, Belarus and Kazakhstan join WTO.

Слайд 41

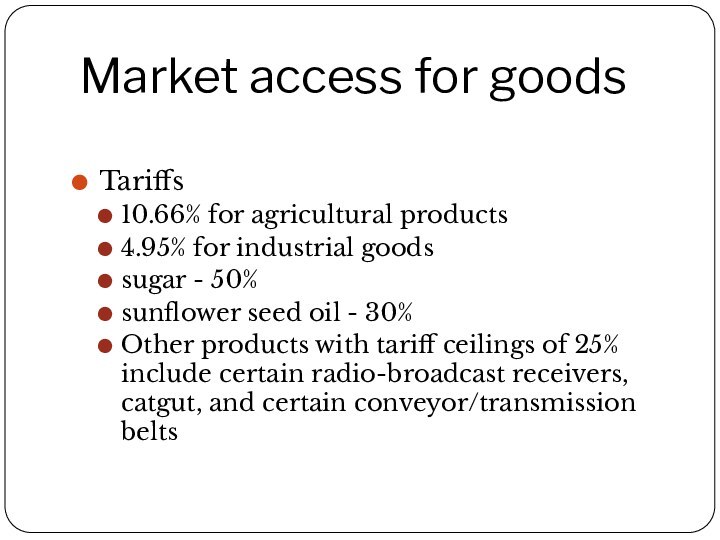

Market access for goods

Tariffs

10.66% for agricultural products

4.95% for industrial goods

sugar - 50%

sunflower seed oil -

30%

Other products with tariff ceilings of 25% include certain radio-broadcast receivers, catgut, and certain conveyor/transmission belts

Слайд 42

Market access for services

Ukraine has made specific

commitments in all 11 “core” service sectors

business services

communication

services

construction and related engineering services

Distribution

education and environmental services

financial services (insurance and banking)

health and social services

tourism and travel

Recreational

cultural and sporting services

and transport services

Слайд 43

Ukraine’s accession documents

Ukraine’s commitments on goods —

a 890-page list of tariffs, quotas and ceilings on

agricultural subsidies, and in some cases the timetable for phasing in the tariff cuts

Ukraine’s commitments on services — a 40-page document outlining the services in which Ukraine is giving access to foreign service providers on a non-discriminatory basis and any additional conditions, including limits on foreign ownership

The Working Party report — a 240 page document describing Ukraine’s legal and institutional set up for trade, along with commitments it has made in many of the areas covered by the report.

Слайд 44

Merchandise exports: USD38.368 billion

Merchandise imports: USD45.035 billion

Merchandise exports/imports

(2006)

Services exports/imports

(2006)

Commercial services exports: USD10.671 billion

Commercial

services imports: USD8.484 billion

Слайд 45

Trends in foreign trade in goods

during two years

of Ukraine’s membership

in the WTO

Слайд 46

Geographical structure

of export

the largest supply decline was to

the Americas – by 55%

the lowest decrease was

in supplies from Asia – by 14%;

Слайд 47

Geographical structure

of import

The biggest decrease was from USA

– by 50%

The least of all from the CIS

– by 26%

Слайд 48

high yields of grain and oil-bearing crops in

2008-2009;

favourable pricing environment at global markets;

hryvnia devaluation in 2008-2009

also improved competitiveness of Ukrainianmade

agricultural products;

due to the financial crisis, freight rates became substantially lower than before

the crisis;

lifting and non-introduction by the Ukrainian government of new quantitative

export restrictions for agriculture that do not comply with the WTO

requirements.

Reasons for the lowest decline

of export supplies

Слайд 49

Reasons of dynamics of import:

decreasing investment activity affected

reduction in the needs for import of

machine-building products, equipment,

vehicles, and other technological goods;

industrial output decline caused a decrease in Ukrainian enterprises’ demand for

raw materials and energy resources;

abrupt contraction in consumer lending and people’s income caused a decline in

importation of consumer goods: household appliances, motor cars, and foodstuffs;

restricted access to financial resources necessary to carry out import transactions;

hryvnia devaluation increased the cost of imported goods.

Слайд 50

Ukraine takes active part in the work of

the WTO committees and

subcommittees

Committee on Technical Barriers,

Committee on Intellectual

Property (TRIPS),

meetings of the Council for TRIPS,

Committee of Import Licensing,

Committee for Regional Trade Agreements,

Committee for Customs Valuation,

Committee for Balance of Payments,

Committee for Government Procurement,

Committee for Agriculture.

Слайд 51

Promising measures

Promotion of export of Ukrainian-made products to

foreign markets, drafting a law on financial support for

export (export insurance and lending);

expanding a range of Ukrainian export goods by increasing supplies of hi-tech products;

establishing a wide-scale information system on foreign trade, and encouraging small and medium-size business to export activities;

carrying out state monitoring of global prices in certain commodity markets as well as monitoring and forecasting of conditions in domestic and foreign markets of industrial and agricultural products and providing information to enterprises;

ensuring reformation of the national system of technical regulation according to the WTO and EU requirements;

increasing the expert level of domestic business associations, and intensifying their participation in the WTO activities.