consumer to changes in income and interest rates.

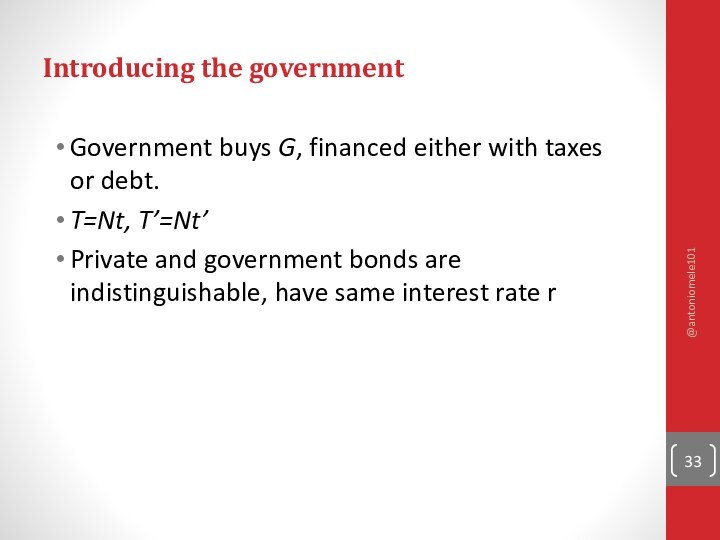

Government budget

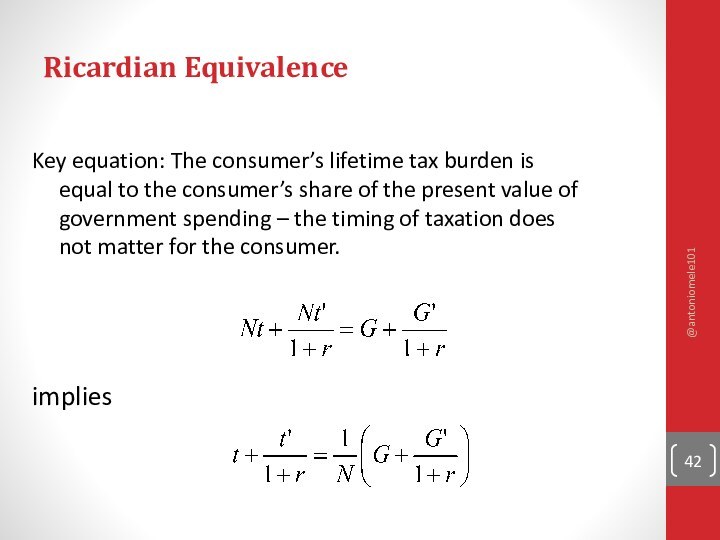

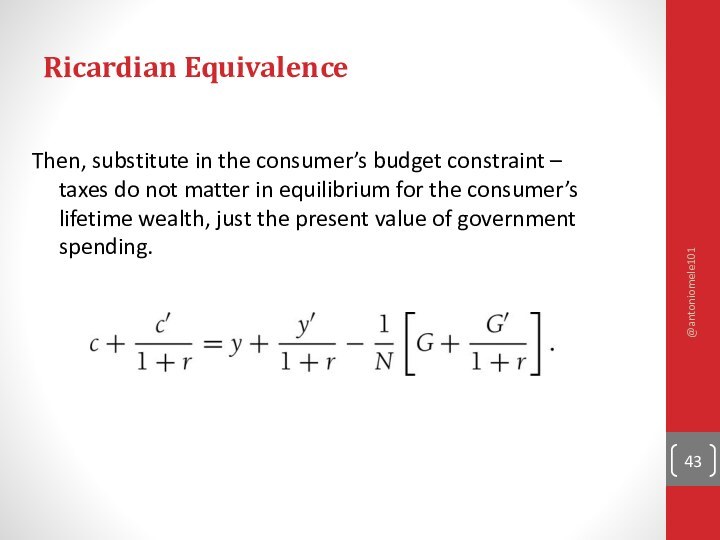

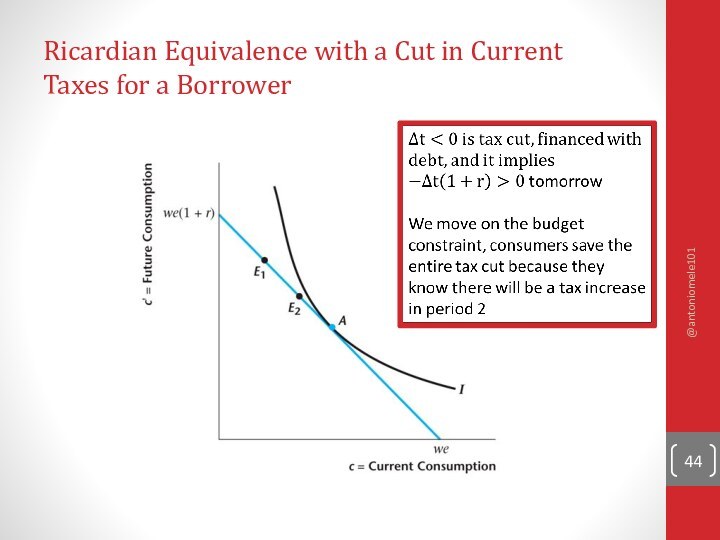

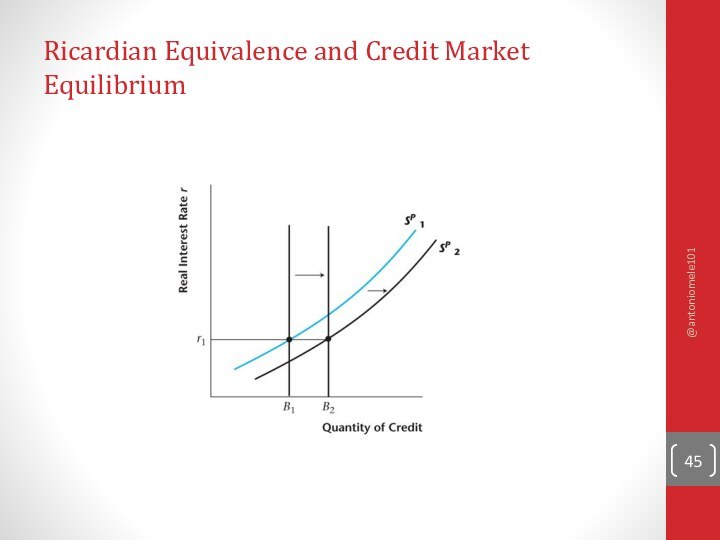

deficits and the Ricardian Equivalence Theorem.@antoniomele101

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101

@antoniomele101