Short Run Learning objectives

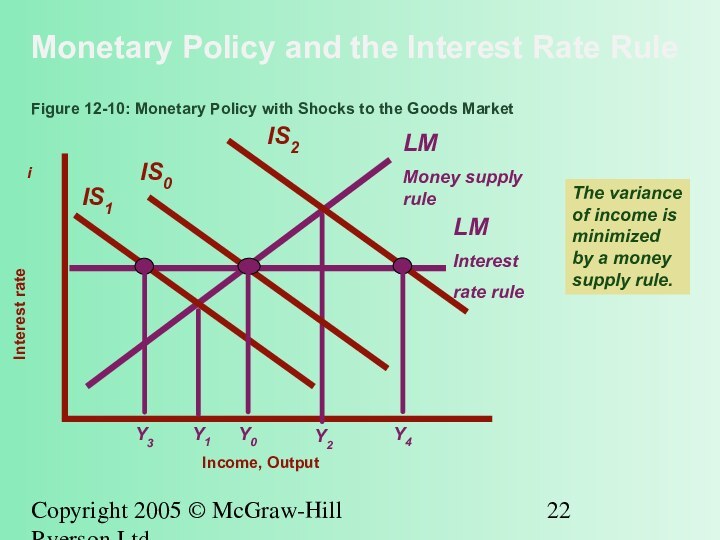

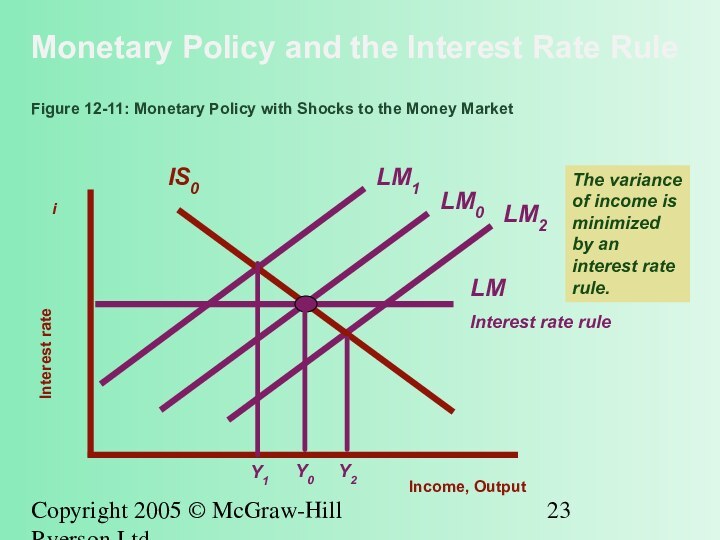

Understand that both fiscal and monetary

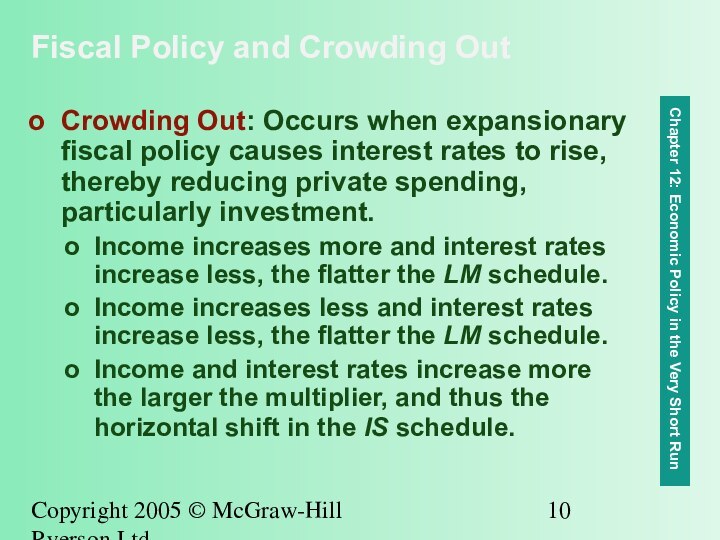

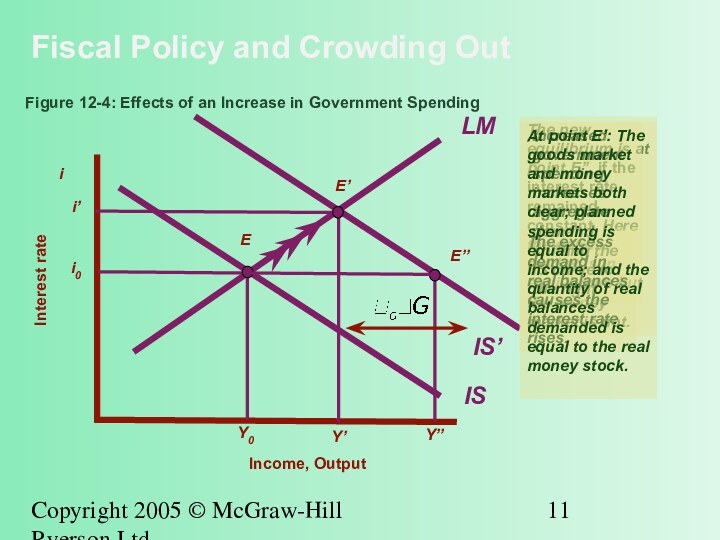

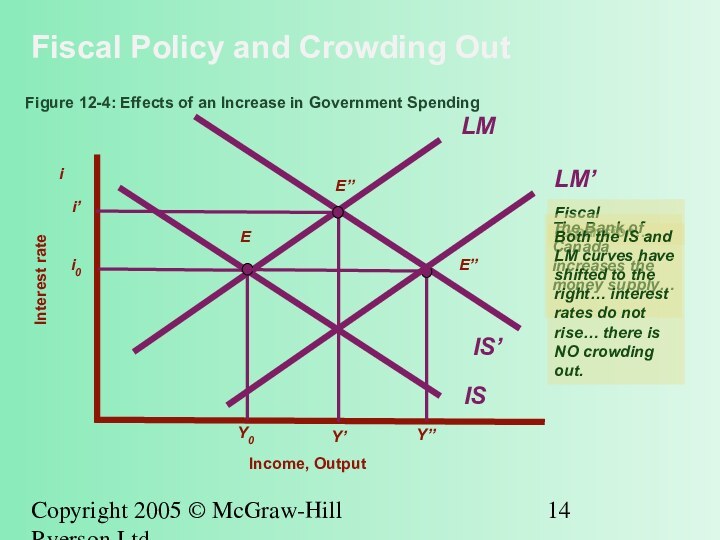

policy can be used to stabilize the economy in the short run.Understand that the output effect of expansionary fiscal policy is reduced by crowding out.

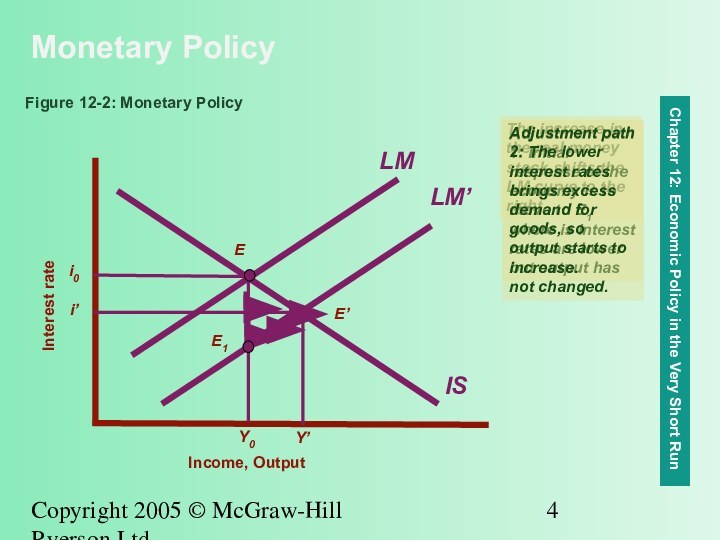

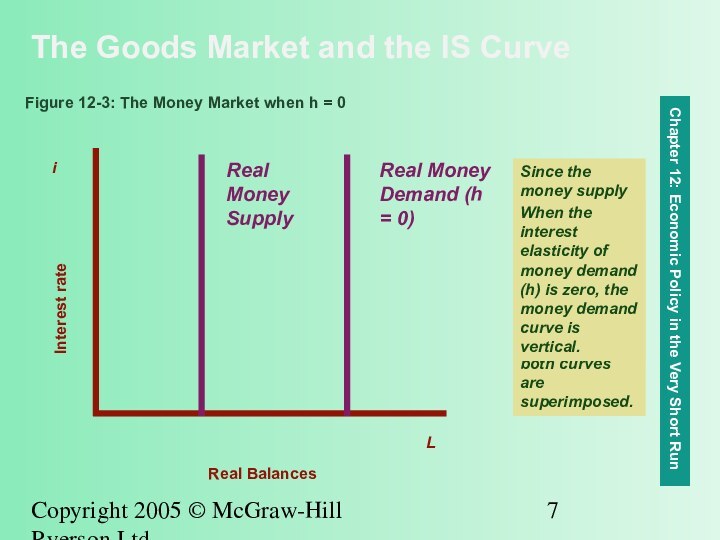

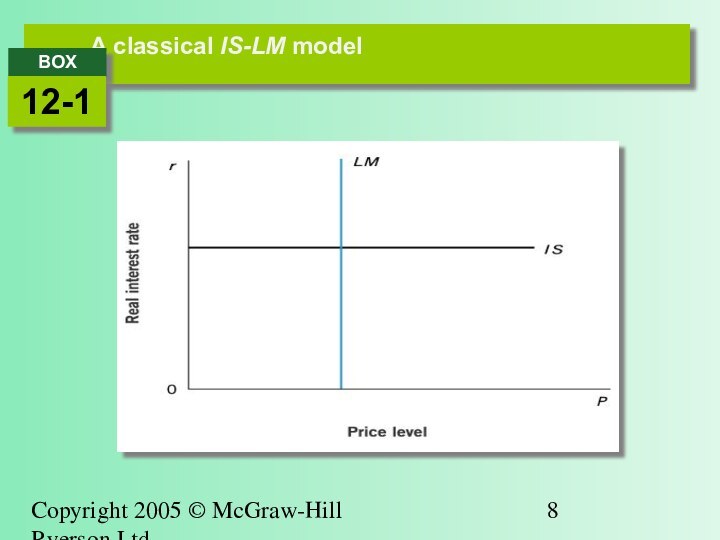

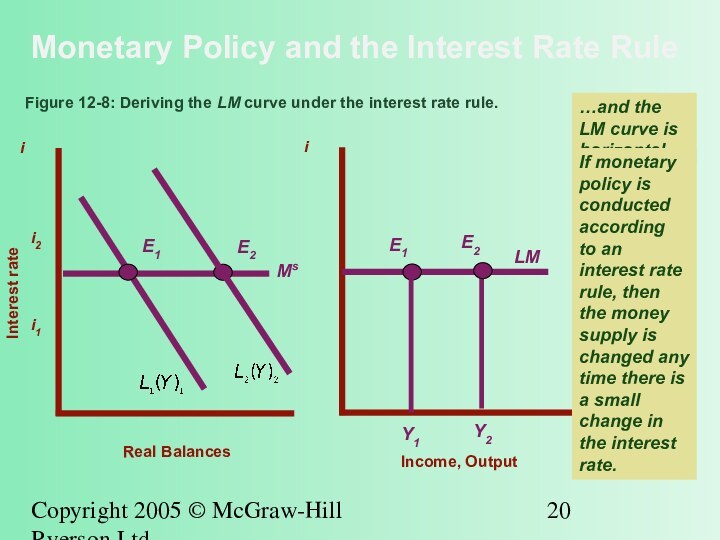

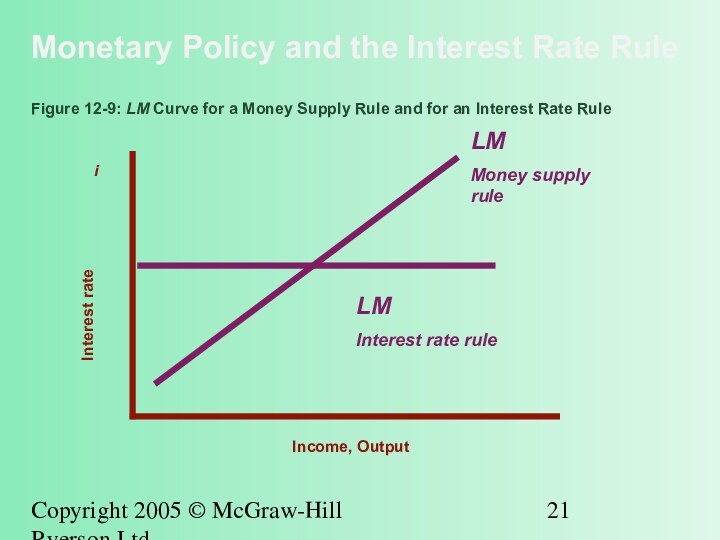

Understand that the slope of the LM curve has an important bearing on the effectiveness of fiscal and monetary policy.

PowerPoint® slides prepared by Marc Prud’Homme, University of Ottawa

Copyright 2005 © McGraw-Hill Ryerson Ltd.