- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Risk and Return

Содержание

- 2. Topics CoveredMarkowitz Portfolio TheoryRisk and Return RelationshipTesting the CAPMCAPM Alternatives

- 3. Markowitz Portfolio TheoryCombining stocks into portfolios can

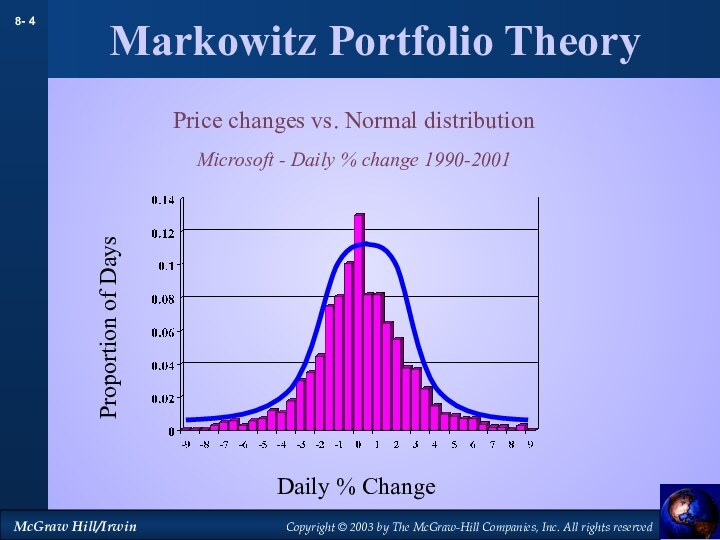

- 4. Markowitz Portfolio TheoryPrice changes vs. Normal distributionMicrosoft

- 5. Markowitz Portfolio TheoryStandard Deviation VS. Expected ReturnInvestment A % probability% return

- 6. Markowitz Portfolio TheoryStandard Deviation VS. Expected ReturnInvestment B % probability% return

- 7. Markowitz Portfolio TheoryStandard Deviation VS. Expected ReturnInvestment C % probability% return

- 8. Markowitz Portfolio TheoryStandard Deviation VS. Expected ReturnInvestment D % probability% return

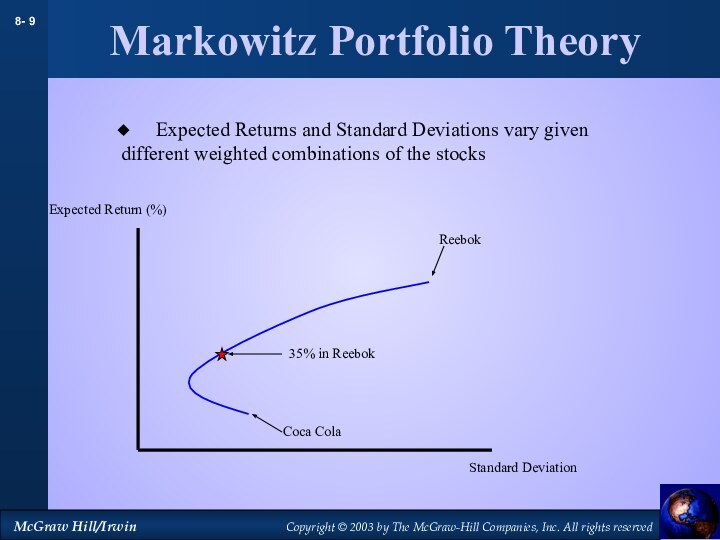

- 9. Markowitz Portfolio TheoryCoca ColaReebokStandard DeviationExpected Return (%)35%

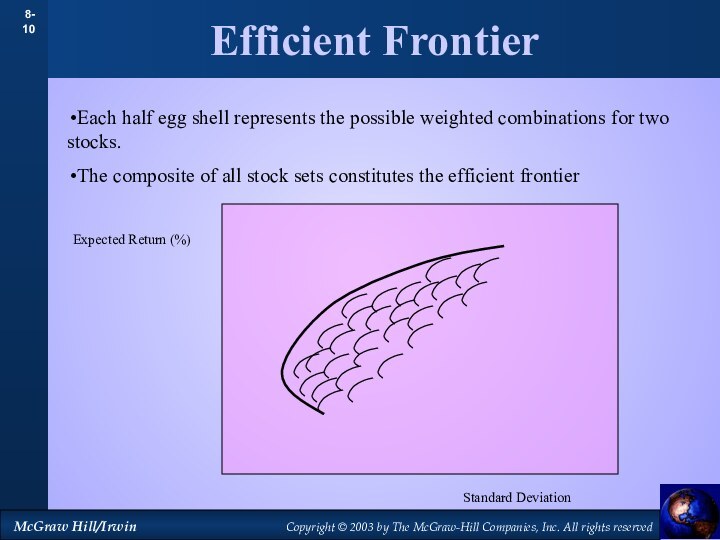

- 10. Efficient FrontierStandard DeviationExpected Return (%)Each half egg

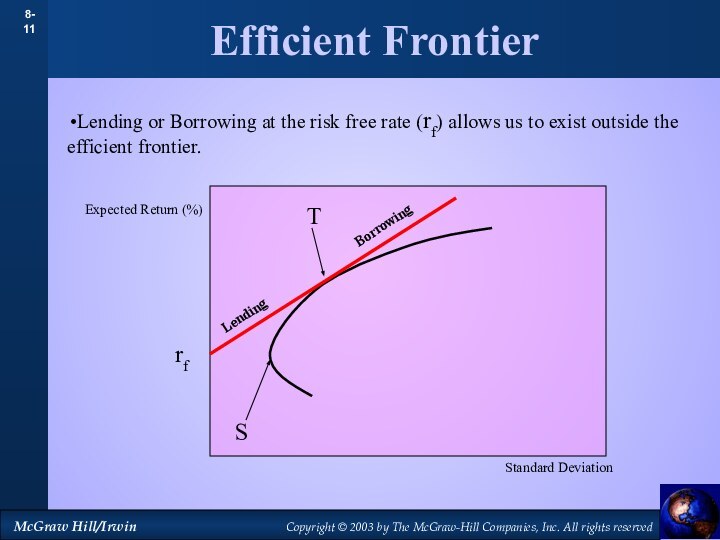

- 11. Efficient FrontierStandard DeviationExpected Return (%)Lending or Borrowing

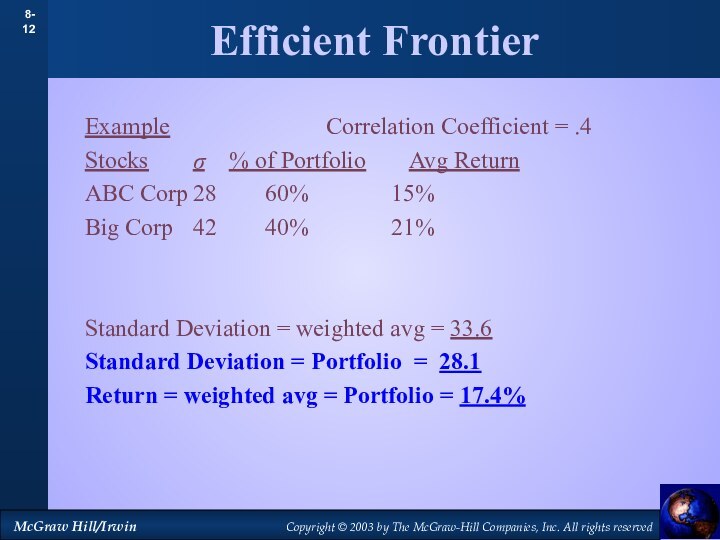

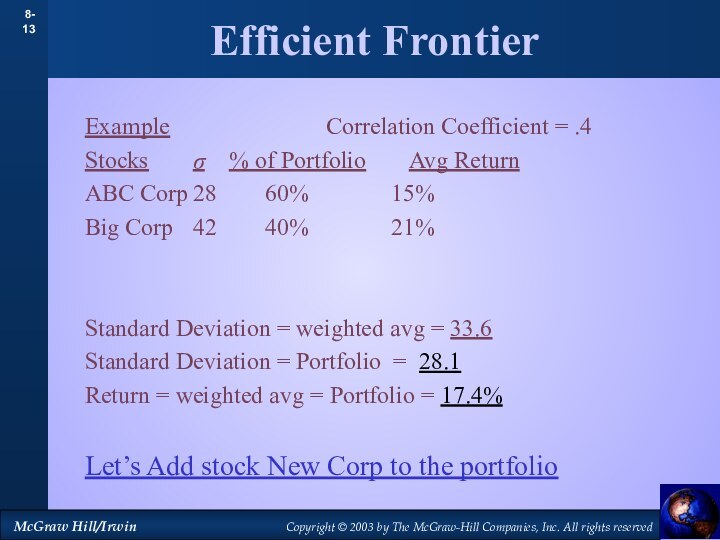

- 12. Efficient FrontierExample

- 13. Efficient FrontierExample

- 14. Efficient FrontierExample

- 15. Efficient FrontierExample

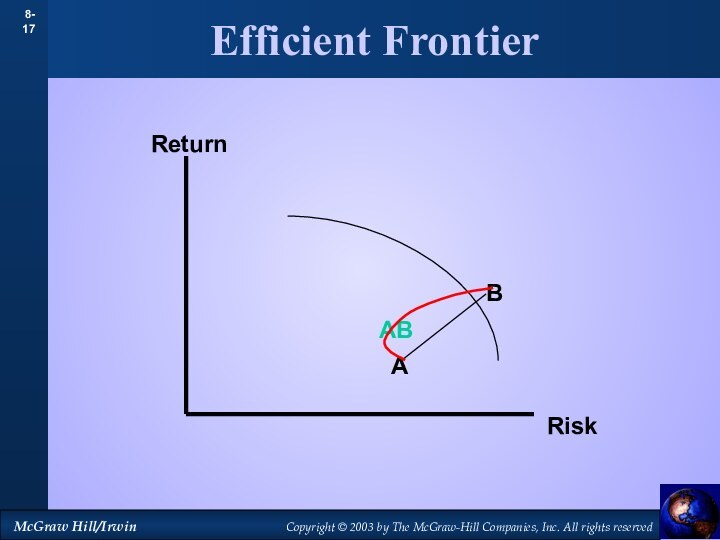

- 16. Efficient FrontierABReturnRisk (measured as σ)

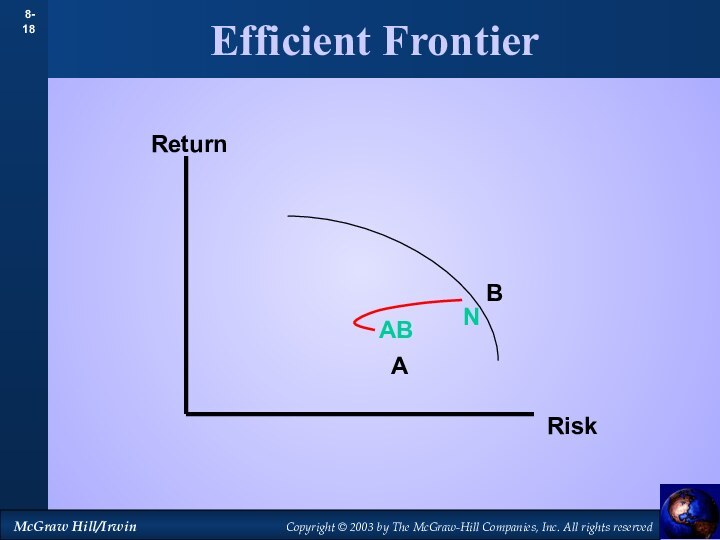

- 17. Efficient FrontierABReturnRiskAB

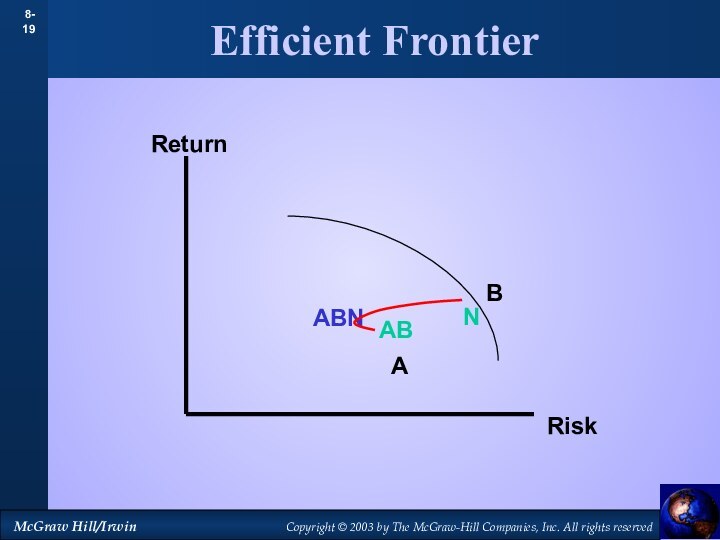

- 18. Efficient FrontierABNReturnRiskAB

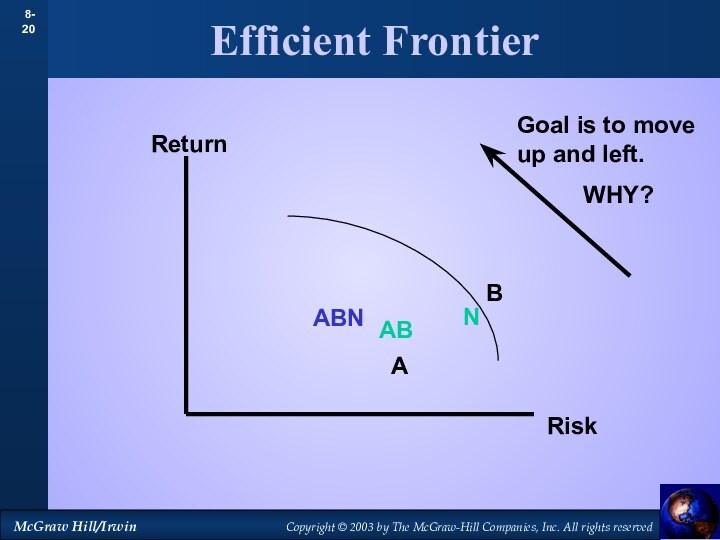

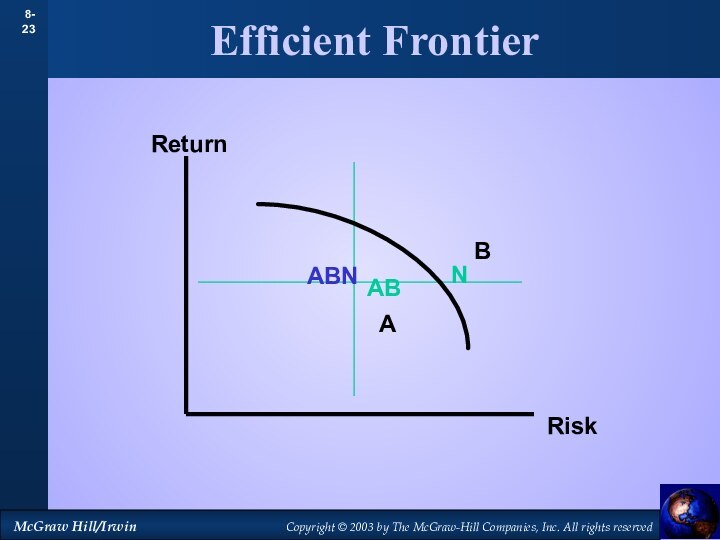

- 19. Efficient FrontierABNReturnRiskABABN

- 20. Efficient FrontierABNReturnRiskABGoal is to move up and left. WHY?ABN

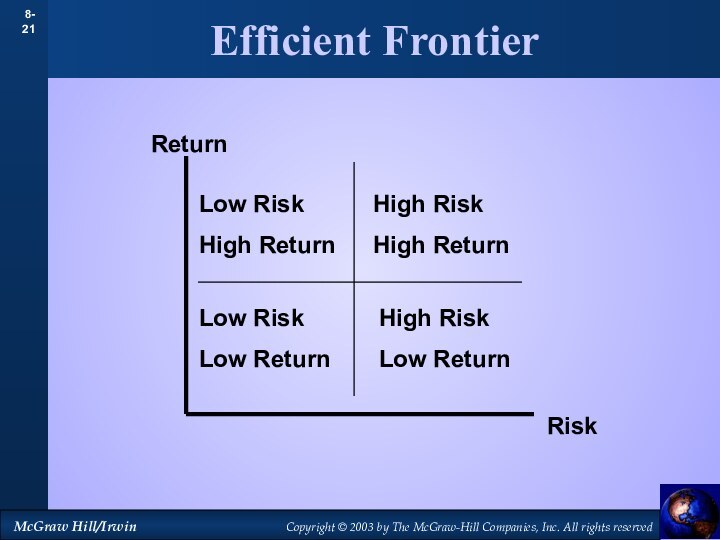

- 21. Efficient FrontierReturnRiskLow RiskHigh ReturnHigh RiskHigh ReturnLow RiskLow ReturnHigh RiskLow Return

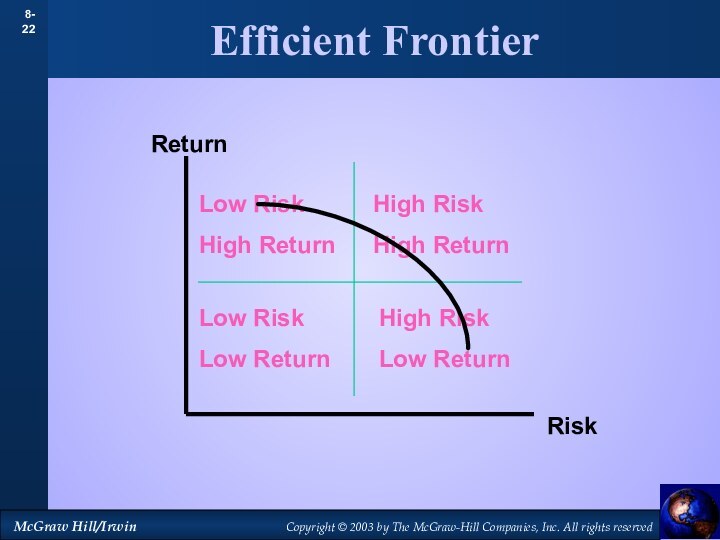

- 22. Efficient FrontierReturnRiskLow RiskHigh ReturnHigh RiskHigh ReturnLow RiskLow ReturnHigh RiskLow Return

- 23. Efficient FrontierReturnRiskABNABABN

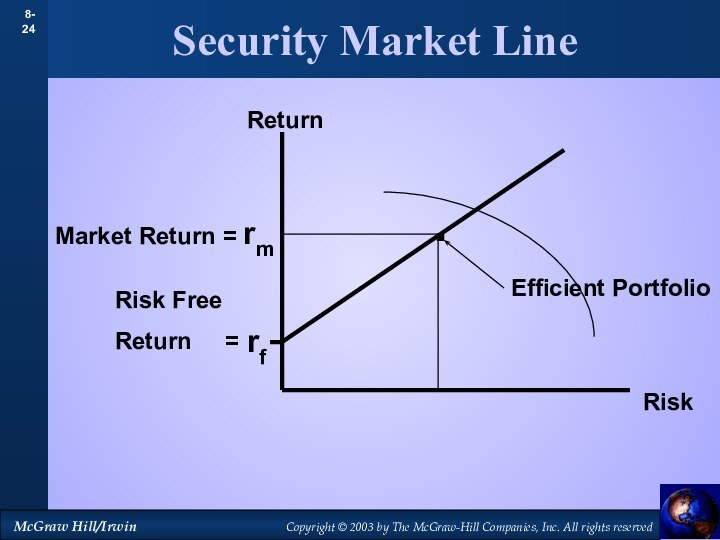

- 24. Security Market LineReturnRisk.rfRisk Free Return =Efficient Portfolio

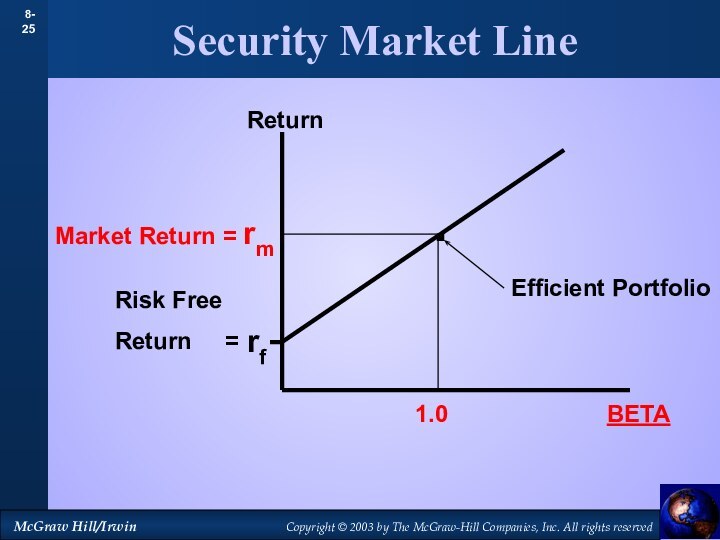

- 25. Security Market LineReturn.rfRisk Free Return =Efficient PortfolioBETA1.0

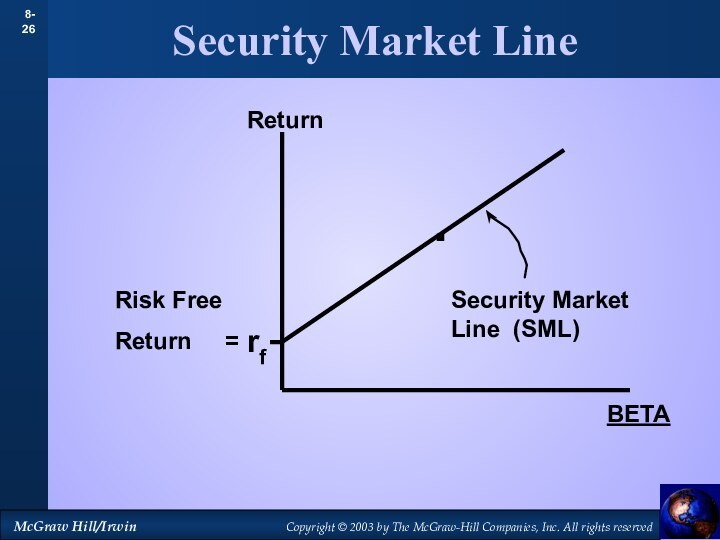

- 26. Security Market LineReturn.rfRisk Free Return =BETASecurity Market Line (SML)

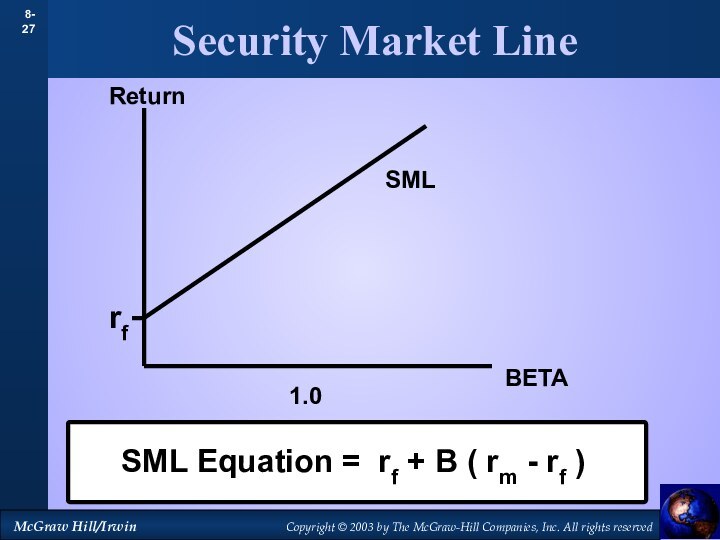

- 27. Security Market LineReturnBETArf1.0SMLSML Equation = rf + B ( rm - rf )

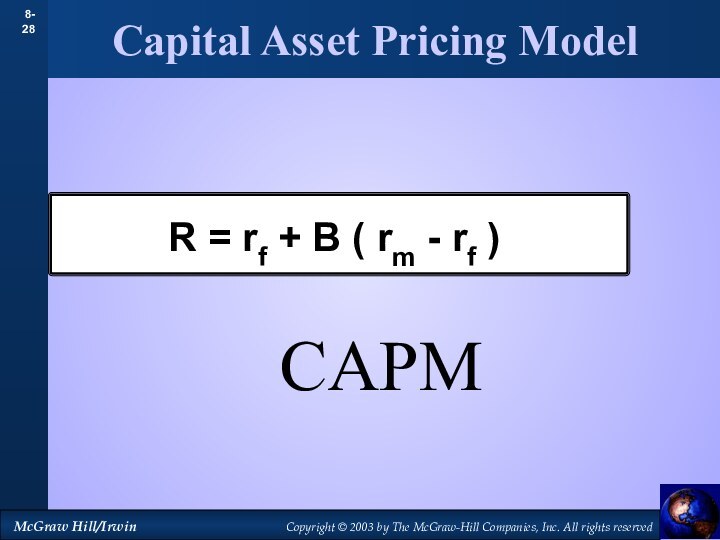

- 28. Capital Asset Pricing Model R = rf + B ( rm - rf )CAPM

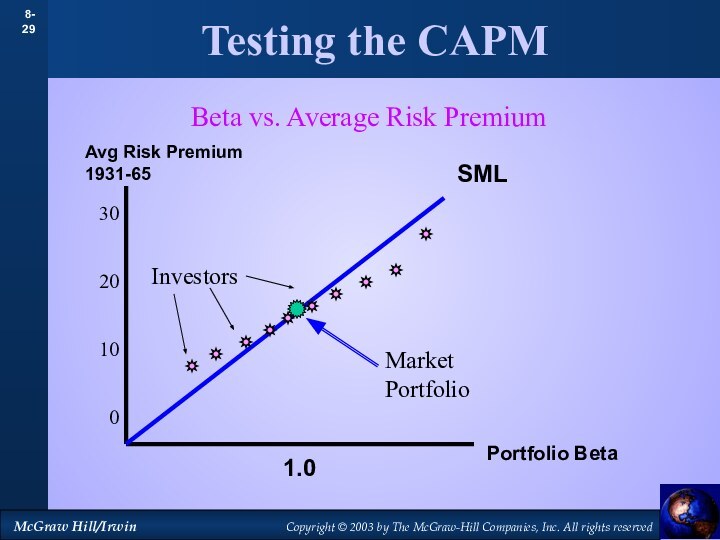

- 29. Testing the CAPMAvg Risk Premium 1931-65Portfolio Beta1.0SML3020100InvestorsMarket PortfolioBeta vs. Average Risk Premium

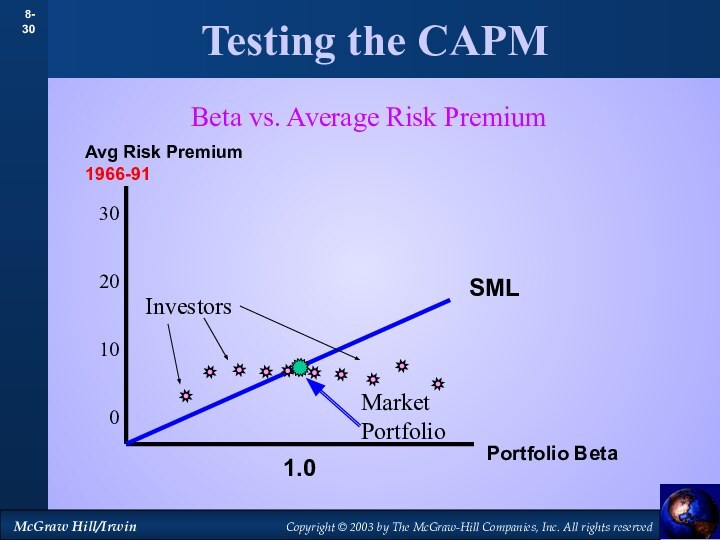

- 30. Testing the CAPMAvg Risk Premium 1966-91Portfolio Beta1.0SML3020100InvestorsMarket PortfolioBeta vs. Average Risk Premium

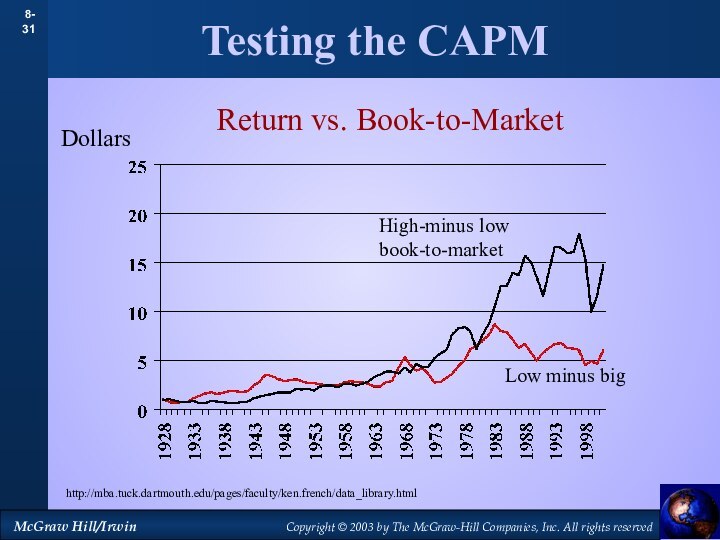

- 31. Testing the CAPMHigh-minus low book-to-marketReturn vs. Book-to-MarketDollarsLow minus bighttp://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

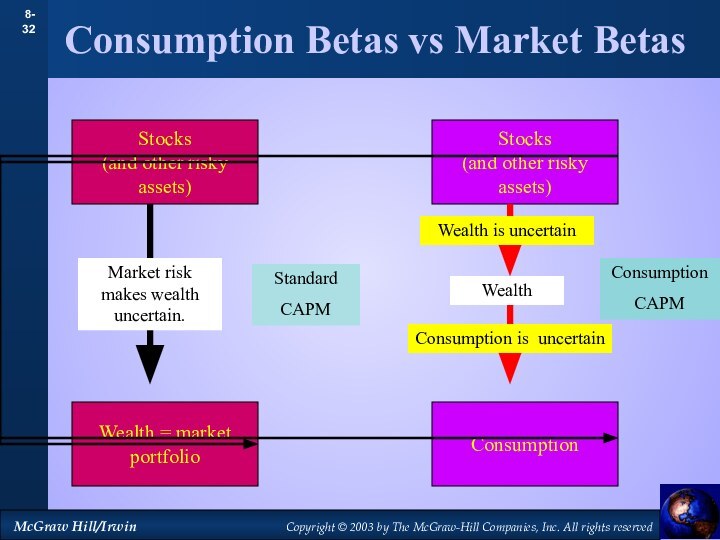

- 32. Consumption Betas vs Market BetasStocks (and other risky assets)Wealth = marketportfolio

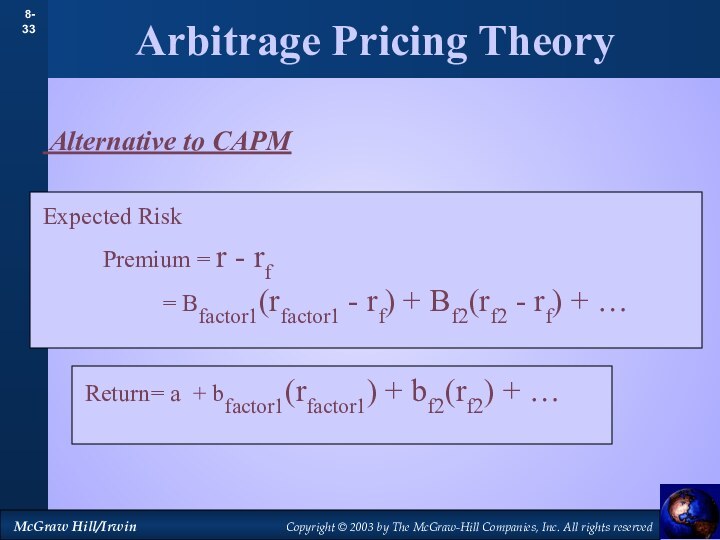

- 33. Arbitrage Pricing Theory Alternative to CAPMExpected Risk

- 34. Скачать презентацию

- 35. Похожие презентации

Topics CoveredMarkowitz Portfolio TheoryRisk and Return RelationshipTesting the CAPMCAPM Alternatives

Слайд 3

Markowitz Portfolio Theory

Combining stocks into portfolios can reduce

standard deviation, below the level obtained from a simple

weighted average calculation.Correlation coefficients make this possible.

The various weighted combinations of stocks that create this standard deviations constitute the set of efficient portfolios.

Слайд 4

Markowitz Portfolio Theory

Price changes vs. Normal distribution

Microsoft -

Daily % change 1990-2001

Proportion of Days

Daily %

Change

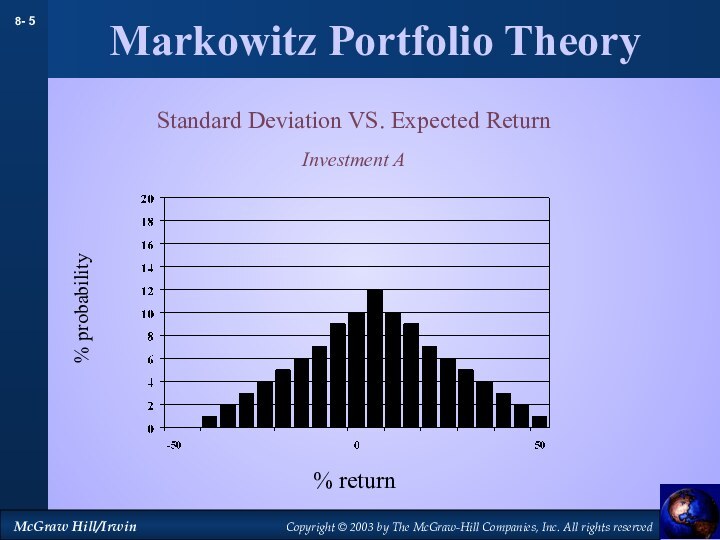

Слайд 5

Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment A

% probability

% return

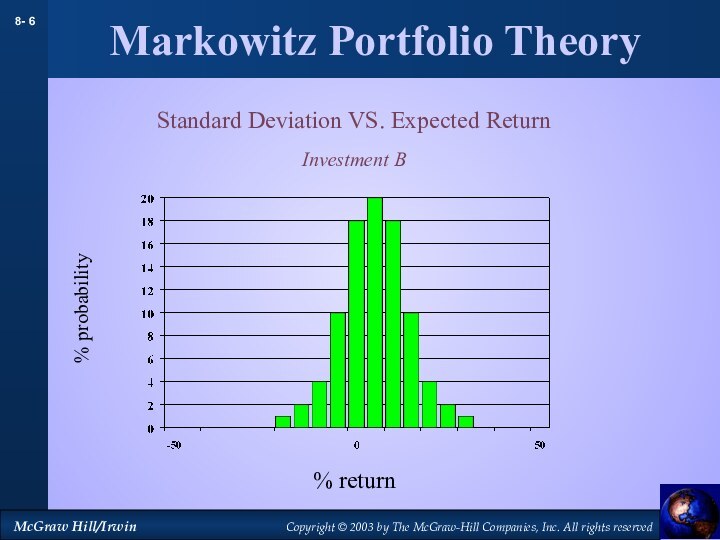

Слайд 6

Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment B

% probability

% return

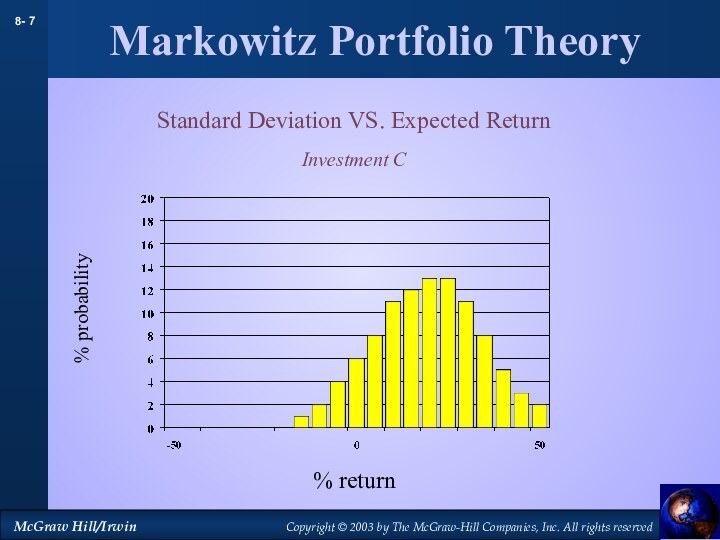

Слайд 7

Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment C

% probability

% return

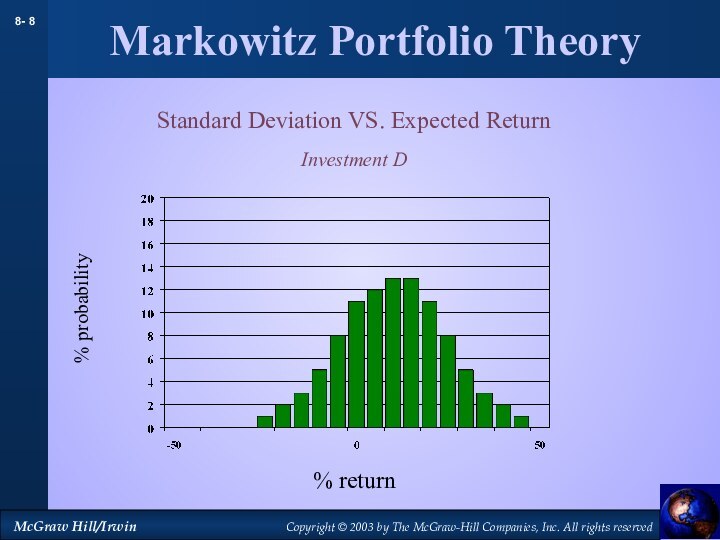

Слайд 8

Markowitz Portfolio Theory

Standard Deviation VS. Expected Return

Investment D

% probability

% return

Слайд 9

Markowitz Portfolio Theory

Coca Cola

Reebok

Standard Deviation

Expected Return (%)

35% in

Reebok

Expected Returns and Standard Deviations vary

given different weighted combinations of the stocks

Слайд 10

Efficient Frontier

Standard Deviation

Expected Return (%)

Each half egg shell

represents the possible weighted combinations for two stocks.

The composite

of all stock sets constitutes the efficient frontier

Слайд 11

Efficient Frontier

Standard Deviation

Expected Return (%)

Lending or Borrowing at

the risk free rate (rf) allows us to exist

outside the efficient frontier.rf

Lending Borrowing

T

S

Слайд 12

Efficient Frontier

Example

Correlation Coefficient =

.4Stocks σ % of Portfolio Avg Return

ABC Corp 28 60% 15%

Big Corp 42 40% 21%

Standard Deviation = weighted avg = 33.6

Standard Deviation = Portfolio = 28.1

Return = weighted avg = Portfolio = 17.4%

Слайд 13

Efficient Frontier

Example

Correlation Coefficient =

.4Stocks σ % of Portfolio Avg Return

ABC Corp 28 60% 15%

Big Corp 42 40% 21%

Standard Deviation = weighted avg = 33.6

Standard Deviation = Portfolio = 28.1

Return = weighted avg = Portfolio = 17.4%

Let’s Add stock New Corp to the portfolio

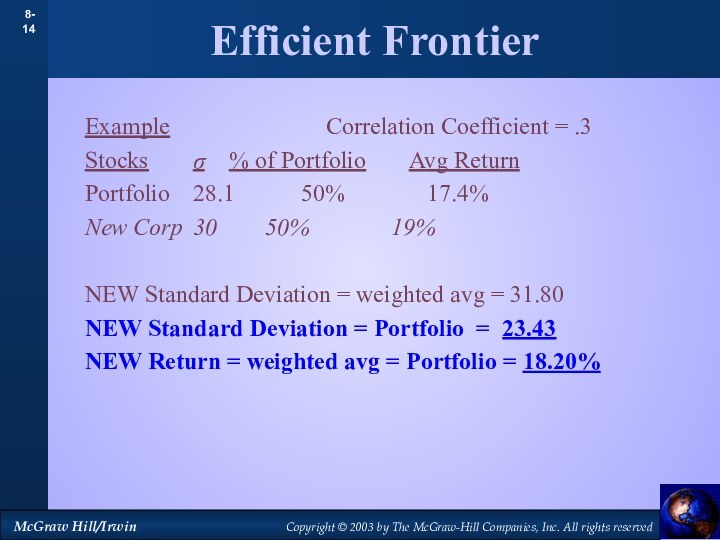

Слайд 14

Efficient Frontier

Example

Correlation Coefficient =

.3Stocks σ % of Portfolio Avg Return

Portfolio 28.1 50% 17.4%

New Corp 30 50% 19%

NEW Standard Deviation = weighted avg = 31.80

NEW Standard Deviation = Portfolio = 23.43

NEW Return = weighted avg = Portfolio = 18.20%

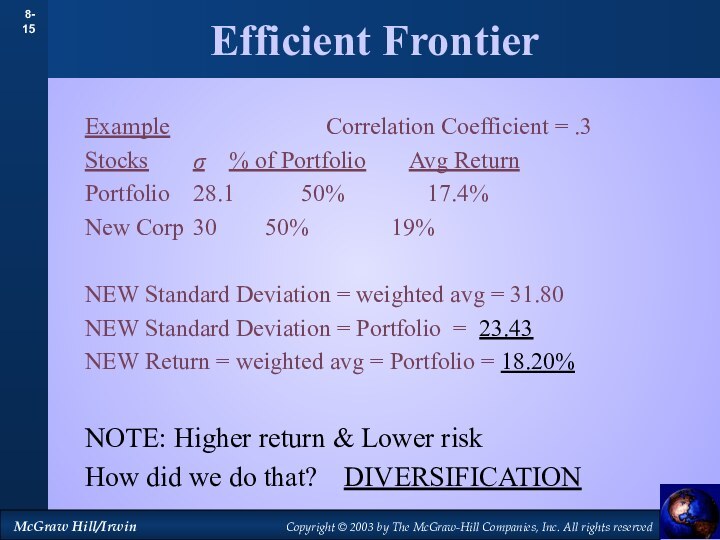

Слайд 15

Efficient Frontier

Example

Correlation Coefficient =

.3Stocks σ % of Portfolio Avg Return

Portfolio 28.1 50% 17.4%

New Corp 30 50% 19%

NEW Standard Deviation = weighted avg = 31.80

NEW Standard Deviation = Portfolio = 23.43

NEW Return = weighted avg = Portfolio = 18.20%

NOTE: Higher return & Lower risk

How did we do that? DIVERSIFICATION

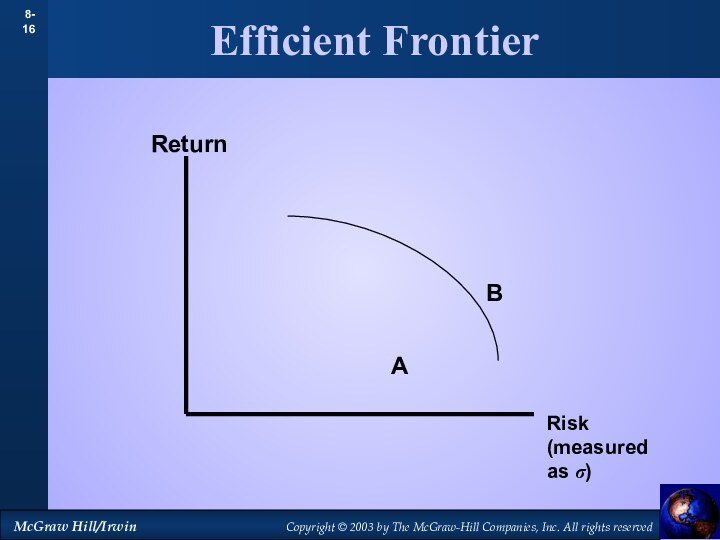

Слайд 21

Efficient Frontier

Return

Risk

Low Risk

High Return

High Risk

High Return

Low Risk

Low Return

High

Risk

Low Return

Слайд 22

Efficient Frontier

Return

Risk

Low Risk

High Return

High Risk

High Return

Low Risk

Low Return

High

Risk

Low Return

Слайд 29

Testing the CAPM

Avg Risk Premium 1931-65

Portfolio Beta

1.0

SML

30

20

10

0

Investors

Market Portfolio

Beta

vs. Average Risk Premium

Слайд 30

Testing the CAPM

Avg Risk Premium 1966-91

Portfolio Beta

1.0

SML

30

20

10

0

Investors

Market Portfolio

Beta

vs. Average Risk Premium

Слайд 31

Testing the CAPM

High-minus low book-to-market

Return vs. Book-to-Market

Dollars

Low minus

big

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Слайд 33

Arbitrage Pricing Theory

Alternative to CAPM

Expected Risk

Premium = r - rf

= Bfactor1(rfactor1 - rf) + Bf2(rf2 - rf) + …

Return = a + bfactor1(rfactor1) + bf2(rf2) + …