- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Activity-based costing (abc)

Содержание

- 2. Activity-Based Costing (ABC) is that costing in

- 3. Stages in Activity-Based Costing:Identify the different activities

- 4. Difference Between Activity-Based Costing & Traditional Costing

- 5. Activity-Based CostingIt begins with identifying activitie sand

- 6. Activity-Based CostingVariable overhead is appropriately identified to

- 7. Traditional Costing It begins with identifying cost

- 8. Traditional Costing Costs may be allocated or

- 9. Advantages of Activity-Based Costing

- 10. Advantages of Activity-Based CostingIt brings accuracy

- 11. Advantages of Activity-Based CostingIt facilitates overhead

- 12. Скачать презентацию

- 13. Похожие презентации

Activity-Based Costing (ABC) is that costing in which costs begin with tracing of activities and then to producing the product.

Слайд 3

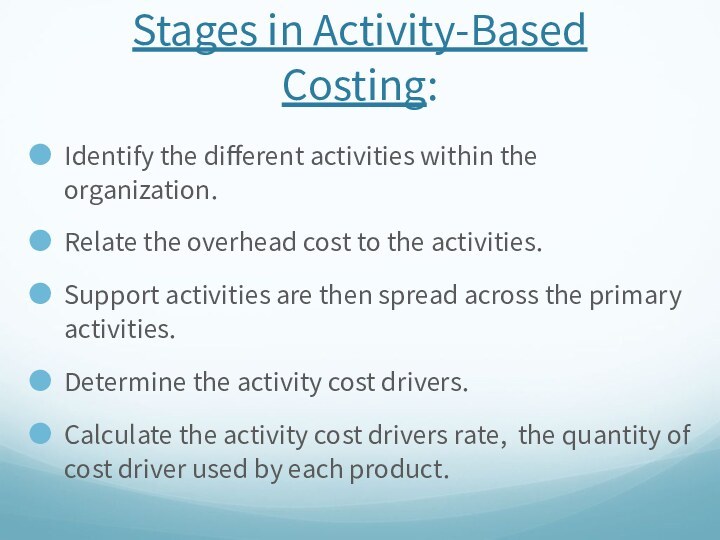

Stages in Activity-Based Costing:

Identify the different activities within

the organization.

Relate the overhead cost to the activities.

Support

activities are then spread across the primary activities.Determine the activity cost drivers.

Calculate the activity cost drivers rate, the quantity of cost driver used by each product.

Слайд 5

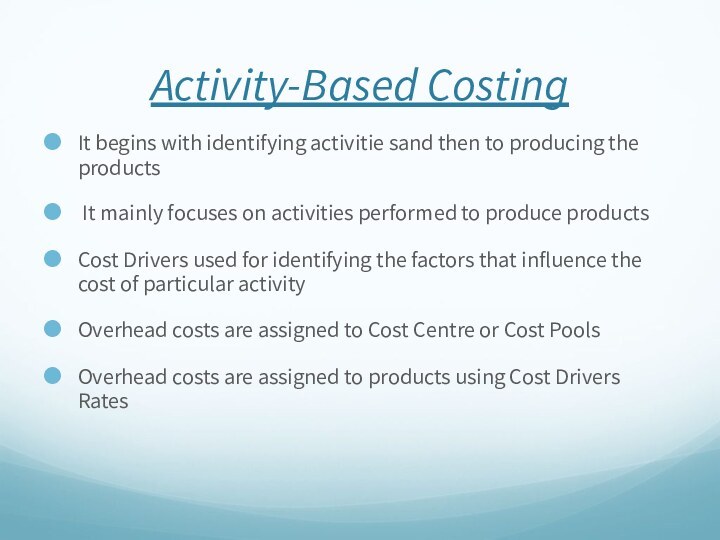

Activity-Based Costing

It begins with identifying activitie sand then

to producing the products

It mainly focuses on activities

performed to produce products Cost Drivers used for identifying the factors that influence the cost of particular activity

Overhead costs are assigned to Cost Centre or Cost Pools

Overhead costs are assigned to products using Cost Drivers Rates

Слайд 6

Activity-Based Costing

Variable overhead is appropriately identified to individual

products

In ABC many activity based on Cost Pools or

Cost Centre's are createdThere is no need to allocate and re- distribution of overhead of service departments to production departments

It assumes that fixed overhead costs vary in proportion to changes in the volume of output.

Слайд 7

Traditional Costing

It begins with identifying cost and

then to producing the products

It emphasizes mainly on ascertainment

of costs after they have been incurredCost unit is used for allocation and accumulation of costs

Overhead costs are assigned to production departments or service departments

Overheads allocated on the basis of departmental overhead allocation rate

Слайд 8

Traditional Costing

Costs may be allocated or assigned

either on actual cost incurred or on standard cost

basisOverheads are pooled and collected department wise

The process of allocation and re-distribution of the costs of the service departments to production department is essential to find out total cost of production

It assumes that fixed overheads do not vary with changes in the volume of output.

Слайд 10

Advantages of

Activity-Based Costing

It brings accuracy and reliability

of the costing data in determination of the cost

of the products.It facilitates cause and effect relationship to exercise effective cost control.

It provides necessary cost information to the management to take decisions on any matter, relating to the business

It is much helpful in fixing the cost and selling price of a product.

Слайд 11

Advantages of

Activity-Based Costing

It facilitates overhead costs allocate

directly to the specific product.

It enables to manage the

activities rather than costs.It helps to remove all types of wastages and inefficiencies.

It provides valuable information to evaluate on the relative efficiencies of various plants and machinery.

Cost Driver Rates will help in significant impact on the development of new products or modification of existing products.