- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему International tax law & tax treaties

Содержание

- 2. AgendaIntroductionDomestic tax systems for cross border activitiesTax treatiesRole of tax treatiesApplication and interpretation issues

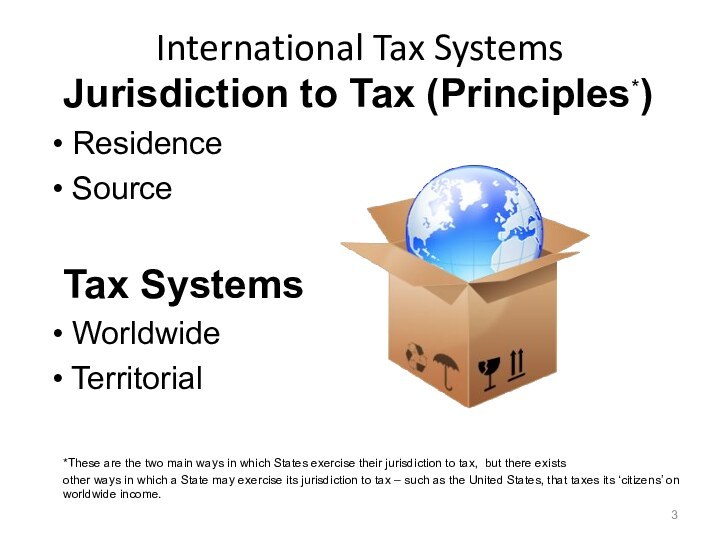

- 3. International Tax SystemsJurisdiction to Tax (Principles*) Residence

- 4. Concept of ResidenceResidence PrincipleThe jurisdiction to tax

- 5. Concept of SourceSource PrincipleThe jurisdiction to tax

- 6. Potential DifficultyIssues with determining/defining source…BANKINVESTORINVESTMENTSTATE ASTATE BSTATE CLoanInterest

- 7. Design of International Tax SystemsWorldwide Taxation SystemA

- 8. Design of International Tax SystemsTerritorial Tax SystemA

- 9. IntroductionTaxation of Cross Border Activities

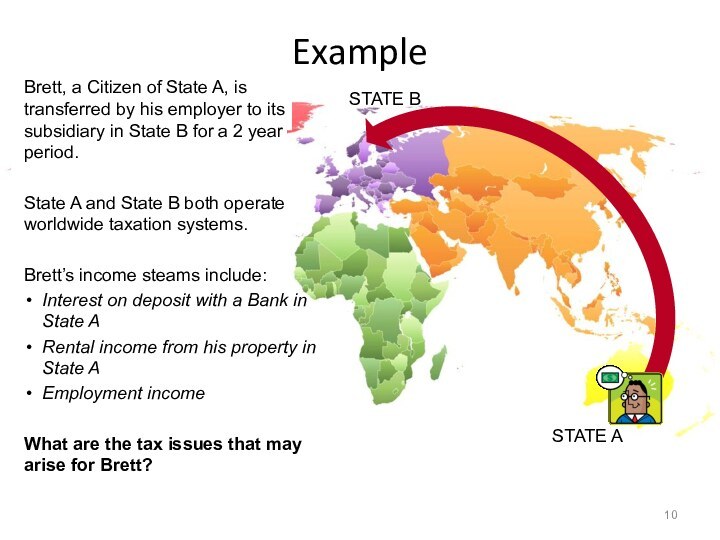

- 10. ExampleSTATE BSTATE ABrett, a Citizen of State

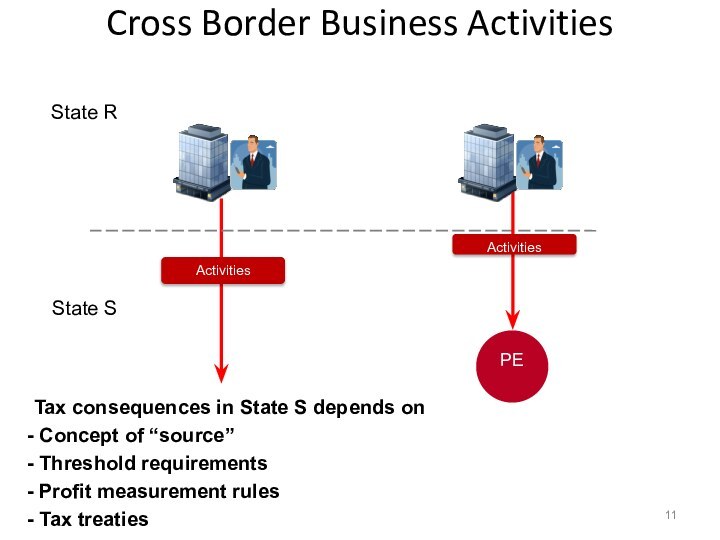

- 11. Cross Border Business ActivitiesState RState SPETax consequences

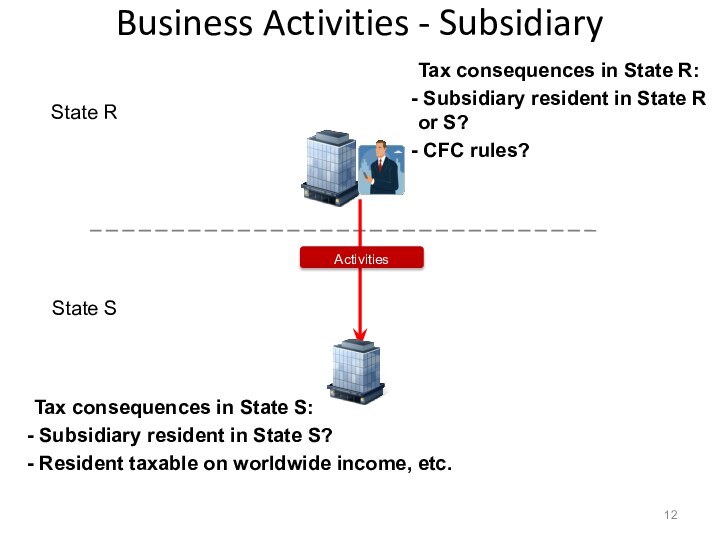

- 12. Business Activities - SubsidiaryState RState STax consequences

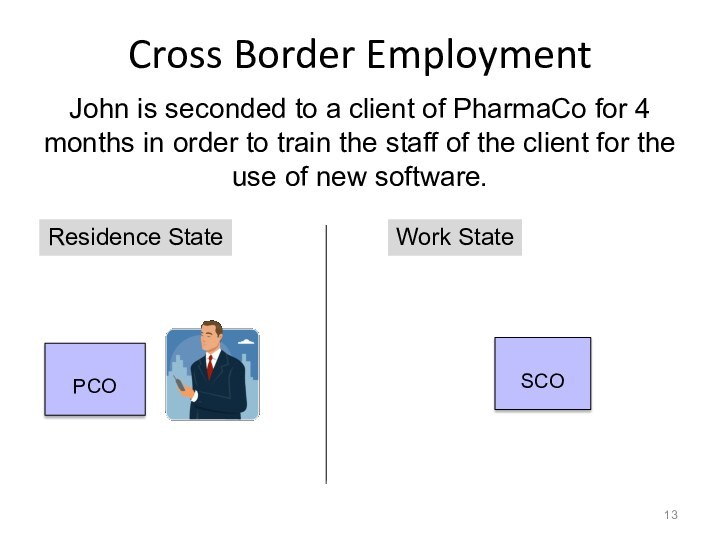

- 13. Cross Border Employment PCOSCOJohn is seconded to

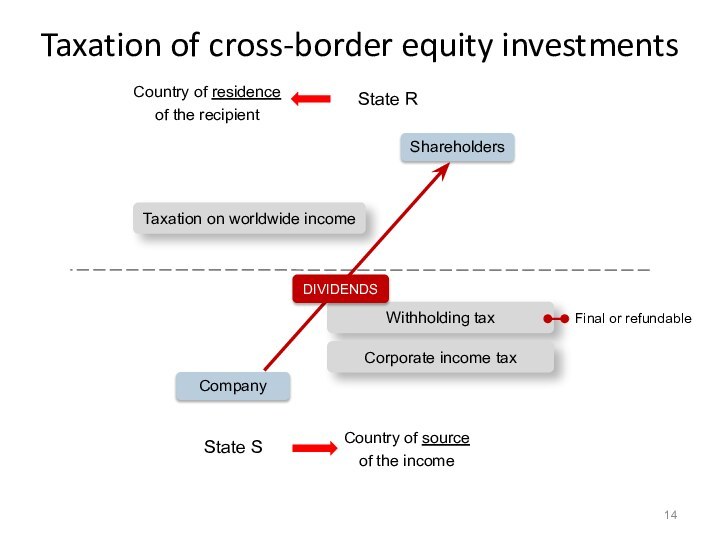

- 14. Taxation of cross-border equity investments Final or

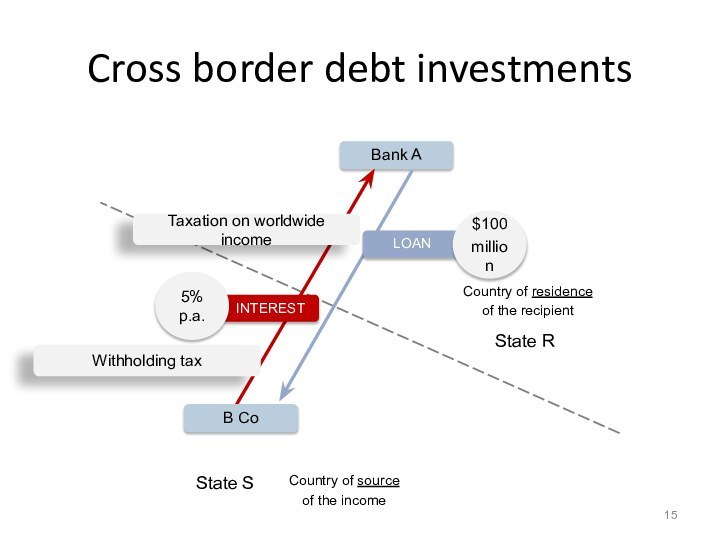

- 15. State RState SCross border debt investments Country

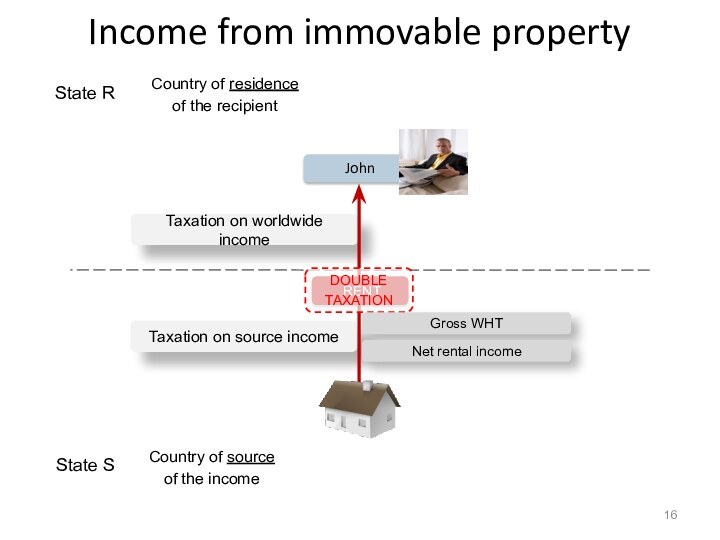

- 16. Income from immovable propertyState SState RTaxation on

- 17. Types of Double TaxationI) Juridical Double Taxation

- 18. Quiz: Juridical or Economic?COMPANY ACOMPANY A(a)(b)STATE X

- 19. Approaches to Double Tax ReliefCapital Import NeutralityNeutrality

- 20. Tax Treaties

- 21. Taxation of Cross Border ActivitiesIssue: Double TaxationWhy is it an issue?Solutions?

- 22. Taxation of Cross Border ActivitiesTax treaties as

- 23. Tax TreatiesVienna Convention on the Law of

- 24. Tax TreatiesRelation Treaties (International Law) – Domestic lawMonismDualism

- 25. Place of Treaties in the Legal Systems Place

- 26. Vienna Convention on the Law of TreatiesArticle

- 27. Tax Treaties - ObjectivesGeneral: Facilitate cross-border trade and investment eliminating tax impediments

- 28. Tax Treaties - ObjectivesOperational:Elimination of double taxationPrevention of tax evasion

- 29. Tax Treaties - ObjectivesAims of tax treaties“The

- 30. Tax Treaties - Objectives© 2010 IBFD International Tax AcademyAncillary:Elimination of discriminationExchange of informationAdministrative assistanceResolve disputes

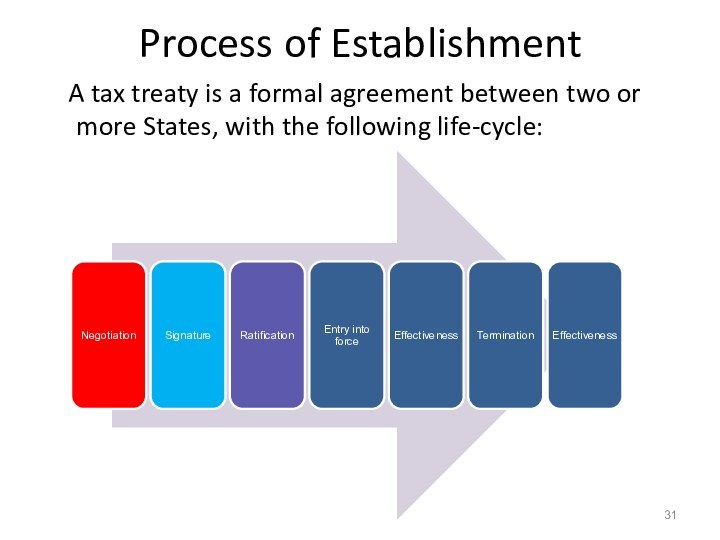

- 31. Process of Establishment A tax treaty

- 32. Model ConventionsWhat is a Model Convention?What is

- 33. Model ConventionsLeague of Nations Models 1928 –

- 34. ModelsOECDUN USA

- 35. ModelsOECD MCDraft 1963Revised 1977, 1992, 1994, 1997, 2000, 2002, 2008, 2010, 2014...Commentaries Favours capital exporting countries

- 36. ModelsUN Model TreatyFirst published 1980Revised 2001Revised 2011Commentary

- 37. ModelsOECD vs UN Model TreatyUN Model follows

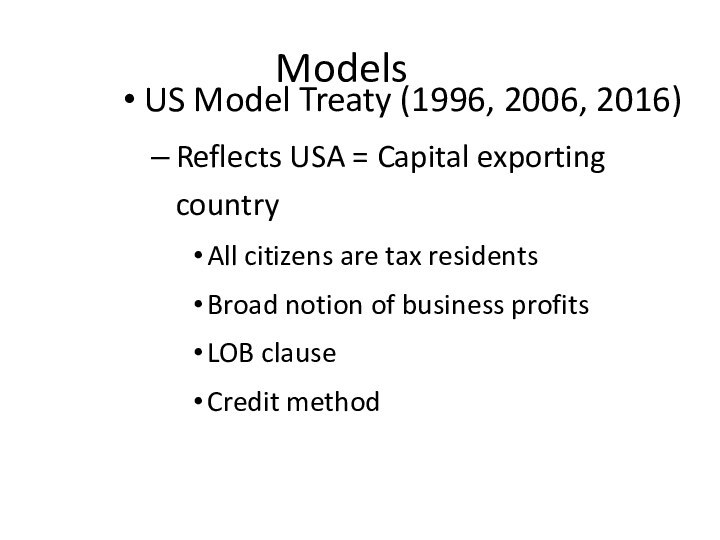

- 38. ModelsUS Model Treaty (1996, 2006, 2016)Reflects USA

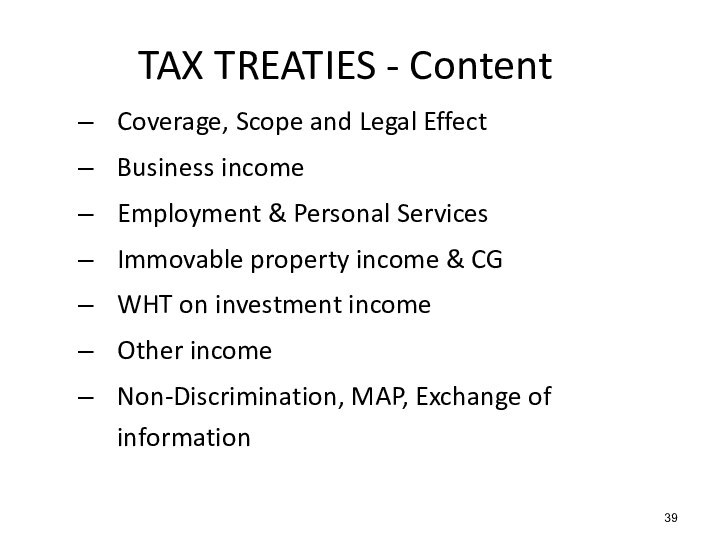

- 39. TAX TREATIES - ContentCoverage, Scope and Legal

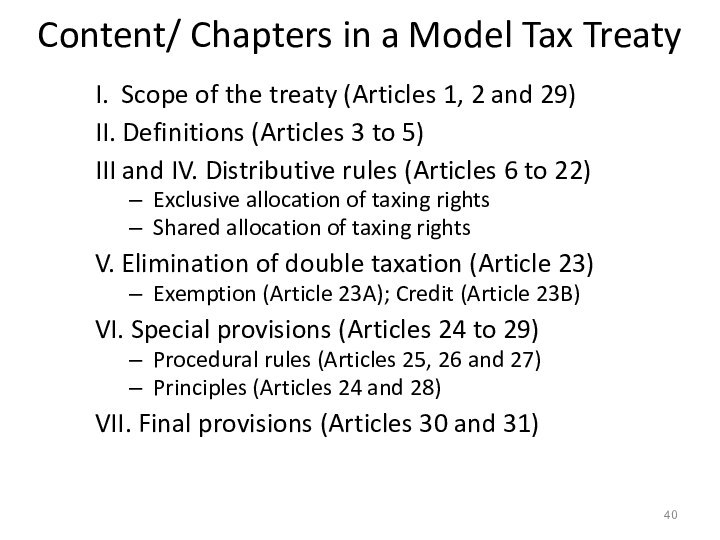

- 40. Content/ Chapters in a Model Tax TreatyI.

- 41. Application and interpretation of tax treaties

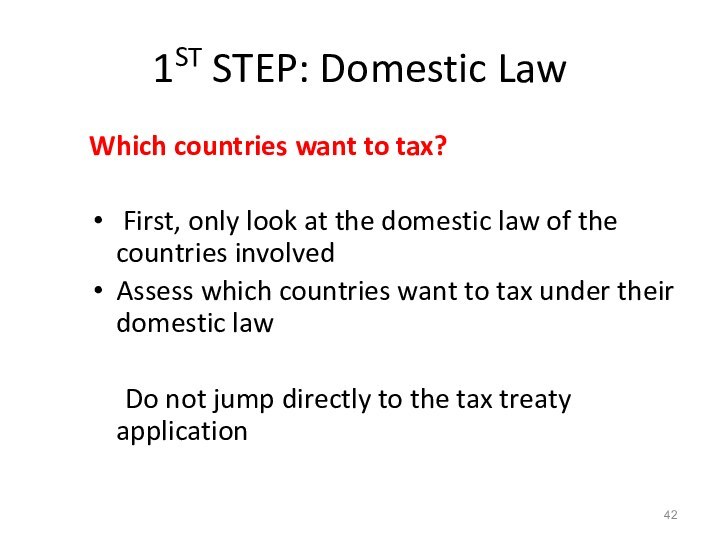

- 42. 1ST STEP: Domestic LawWhich countries want to

- 43. Person (Art. 3(1) (a)): individual, company and

- 44. Art. 4: Resident Art. 4 OECD/UN ModelStarting point

- 45. Treaty applicable to: Permanent establishments?Entities generally (characterization:

- 46. Art. 2(1) OECD: taxes on income (and

- 47. Contracting State:Land territoryTerritorial watersContinental shelfExclusive economic zone Art. 29:Territorial Scope

- 48. 3rd STEP: Which distributive rule is applicable?Purpose:

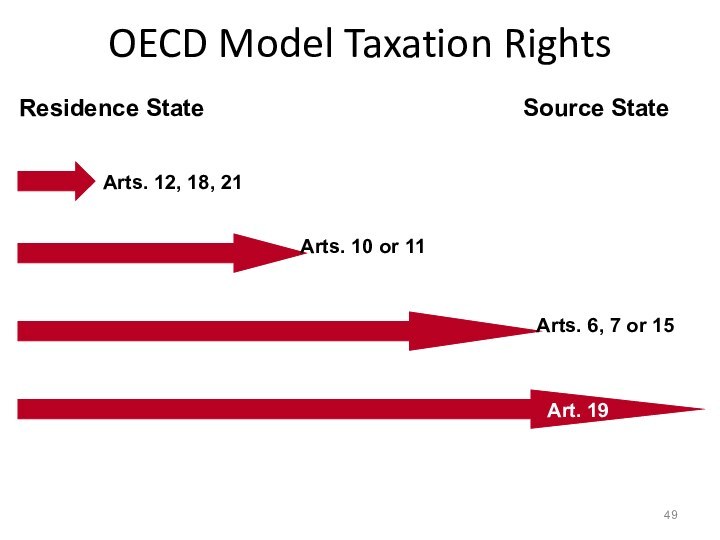

- 49. OECD Model Taxation RightsResidence StateSource StateArts. 12,

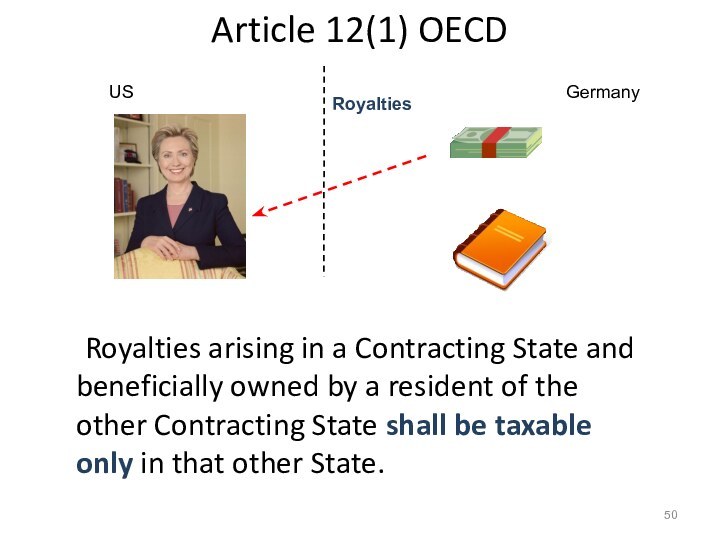

- 50. Article 12(1) OECD Royalties arising in a Contracting

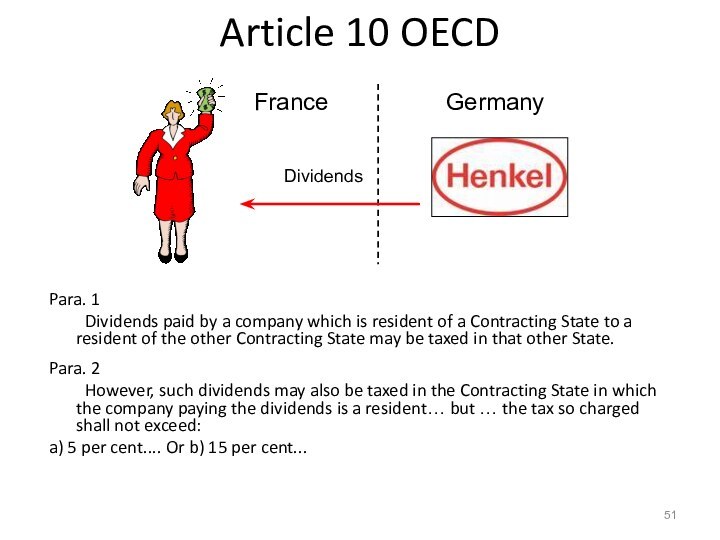

- 51. Article 10 OECDPara. 1 Dividends paid by a

- 52. Article 6(1) OECD Income derived by a resident

- 53. Article 19(1) OECD Salaries … paid by a

- 54. 4th STEP: Interpretation Issues?Customary lawVienna Convention on the Law of Treaties (VCLT)

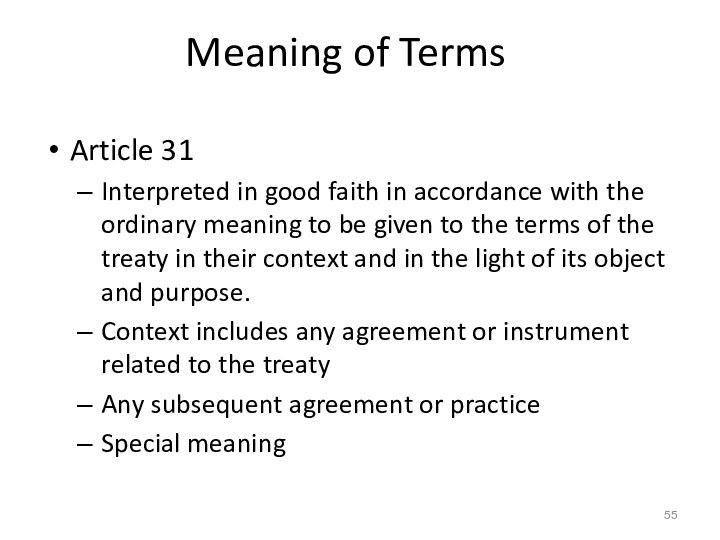

- 55. Meaning of TermsArticle 31Interpreted in good faith

- 56. 4th STEP: Interpretation Issues?Art. 31(1) of the

- 57. TAX TREATIESArt. 31(2) of the VCLT:The context

- 58. TAX TREATIESArt. 31(3) of the VCLT:There shall

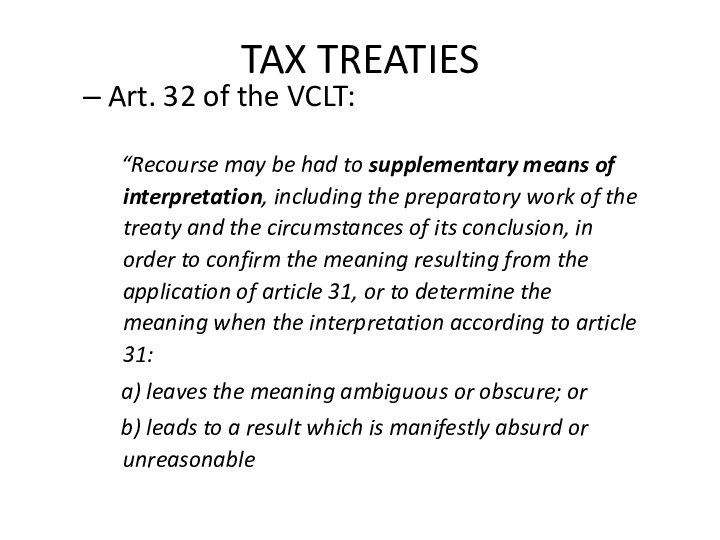

- 59. TAX TREATIESArt. 32 of the VCLT: “Recourse may

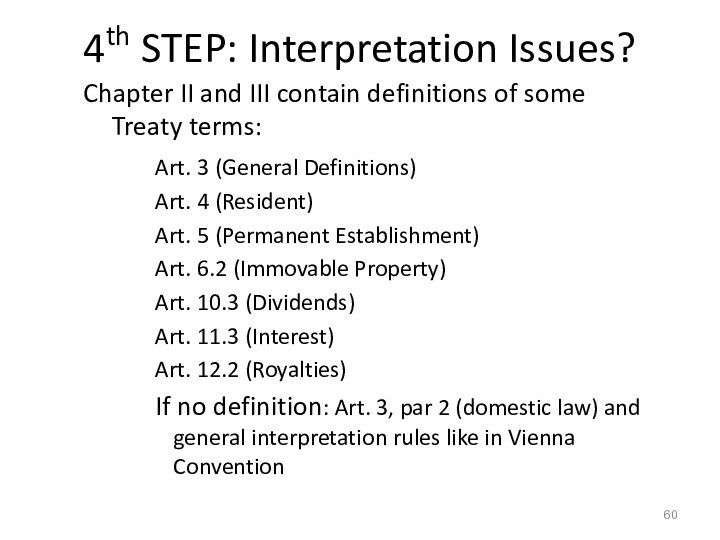

- 60. 4th STEP: Interpretation Issues?Chapter II and III

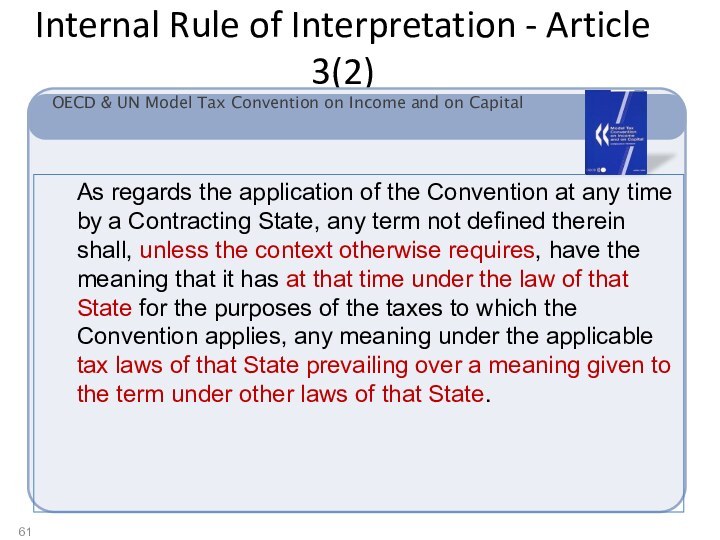

- 61. Internal Rule of Interpretation - Article 3(2)OECD

- 62. 4th STEP: Interpretation Issues?OECD MC. Interpretation CommentariesReservationsObservations

- 63. 4th STEP: Interpretation Issues?Legal status of the

- 64. Role of OECD CommentaryMuch debated!!Qualify as supplementary

- 65. 4th STEP: Interpretation Issues?OECD & UN Models:Internal rule of interpretation Art. 3(2) & CommentariesStatic approachAmbulatory approach

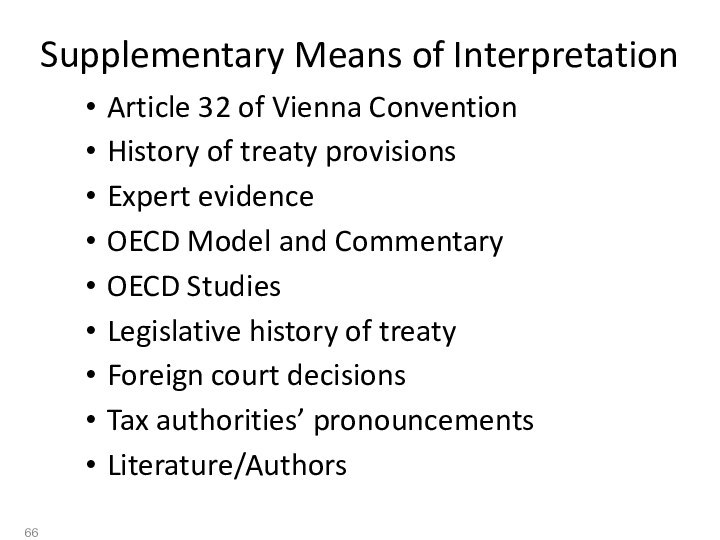

- 66. Supplementary Means of InterpretationArticle 32 of Vienna

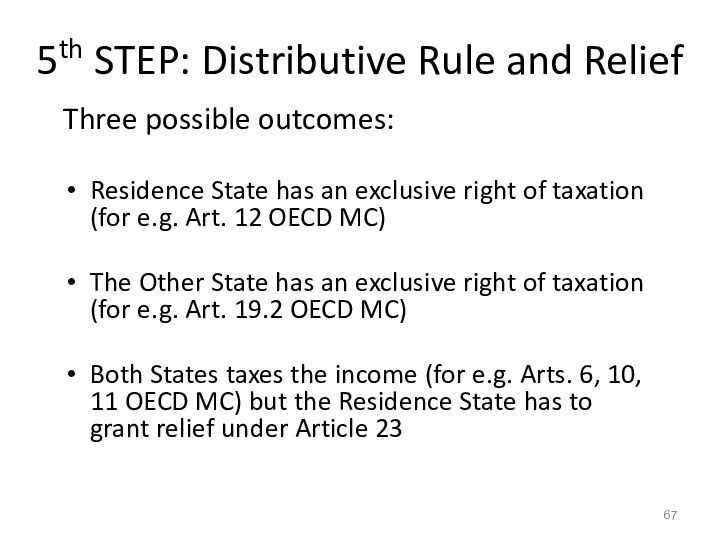

- 67. 5th STEP: Distributive Rule and ReliefThree possible

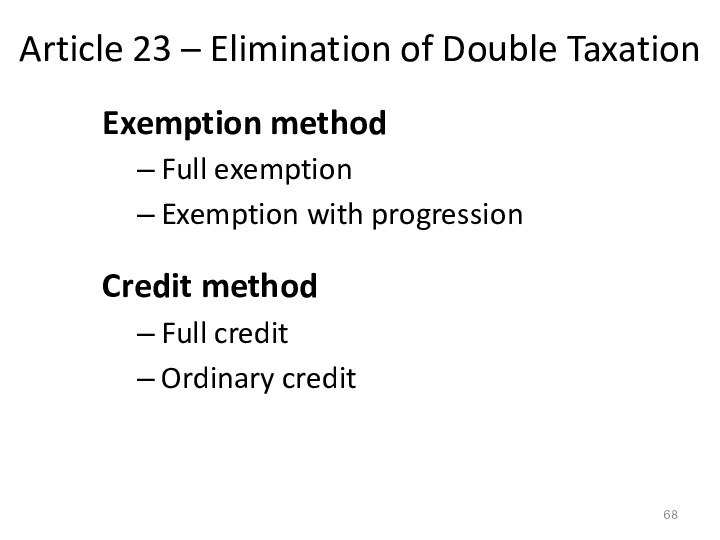

- 68. Article 23 – Elimination of Double TaxationExemption methodFull exemptionExemption with progressionCredit methodFull creditOrdinary credit

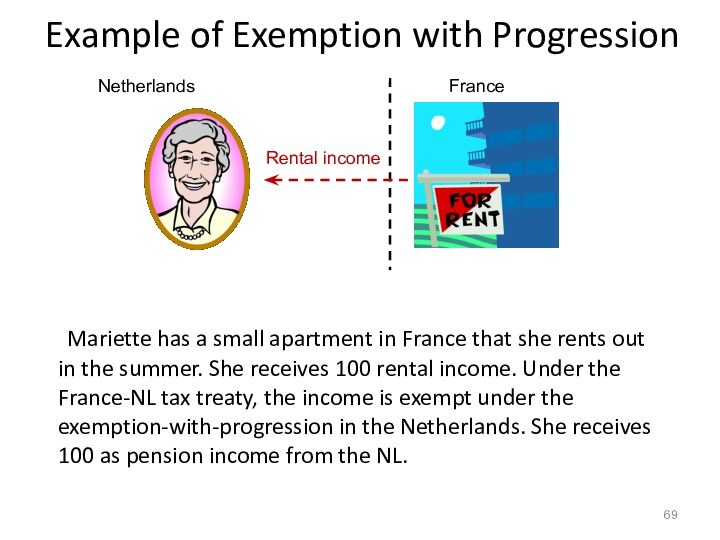

- 69. Example of Exemption with Progression Mariette has a

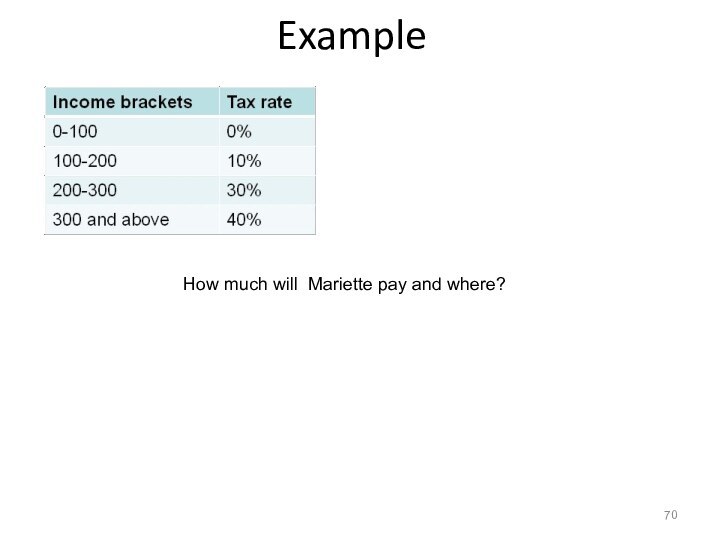

- 70. Example How much will Mariette pay and where?

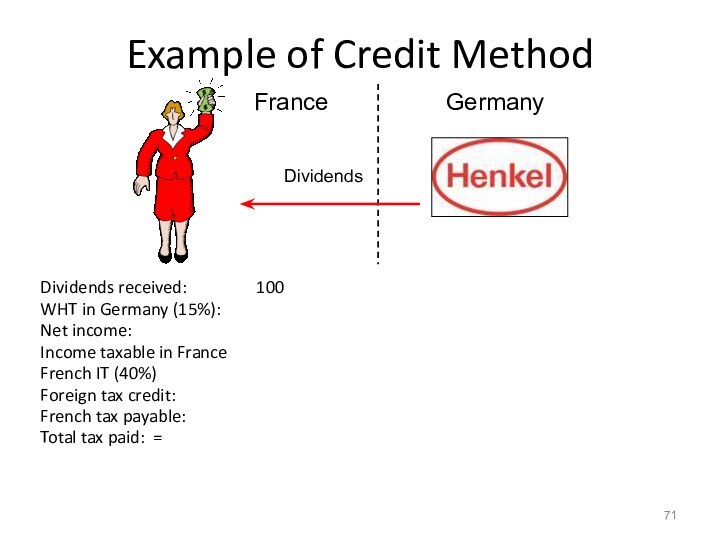

- 71. Example of Credit MethodDividends received: 100WHT in

- 72. Recap of Tax Treaty ApplicationStep 1: Domestic

- 73. Скачать презентацию

- 74. Похожие презентации

Слайд 2

Agenda

Introduction

Domestic tax systems for cross border activities

Tax treaties

Role

of tax treaties

Слайд 3

International Tax Systems

Jurisdiction to Tax (Principles*)

Residence

Source

Tax

Systems

Worldwide

Territorial

*These are the two main ways in

which States exercise their jurisdiction to tax, but there exists other ways in which a State may exercise its jurisdiction to tax – such as the United States, that taxes its ‘citizens’ on worldwide income.

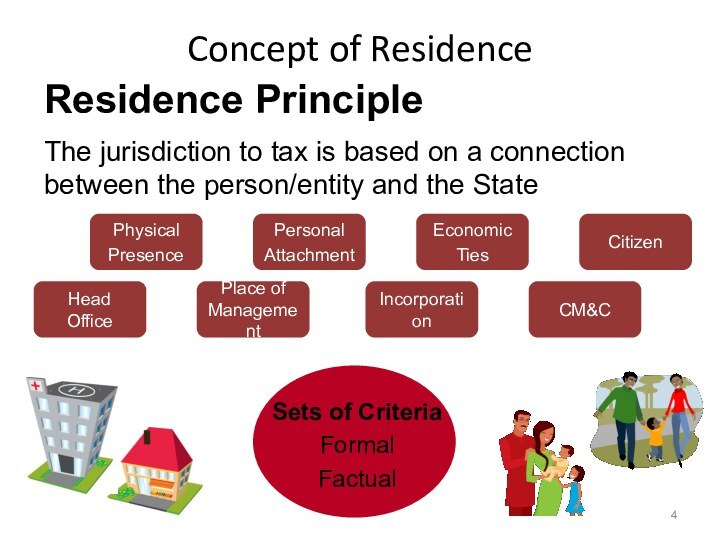

Слайд 4

Concept of Residence

Residence Principle

The jurisdiction to tax is

based on a connection between the person/entity and the

StatePhysical

Presence

Personal

Attachment

Economic

Ties

Citizen

Place of

Management

Incorporation

CM&C

Head Office

Sets of Criteria

Formal

Factual

Слайд 5

Concept of Source

Source Principle

The jurisdiction to tax is

based the income being from a source within the

StateExamples

Physical location of asset

Where capital is invested

Where the payer resides

Where the contract is signed

Слайд 6

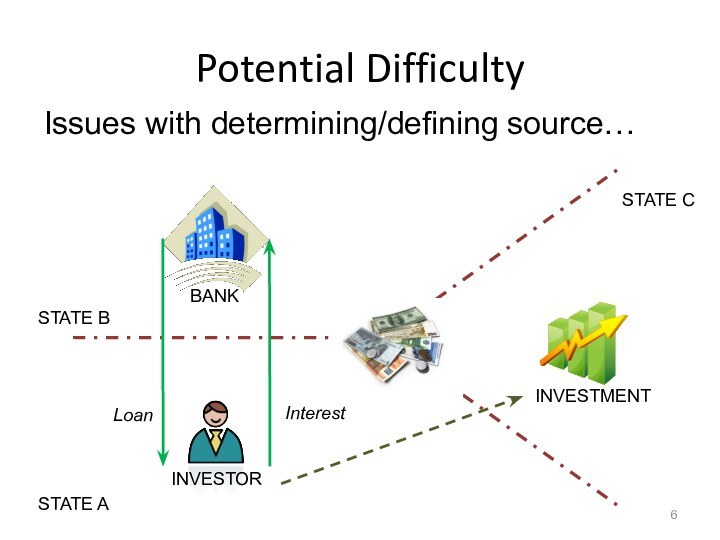

Potential Difficulty

Issues with determining/defining source…

BANK

INVESTOR

INVESTMENT

STATE A

STATE B

STATE C

Loan

Interest

Слайд 7

Design of International Tax Systems

Worldwide Taxation System

A State

subjects to tax:

Residents on their worldwide income

(i.e. income from all sources)Non-Residents on income derived from sources within the State

This is the most common tax system around the world

Examples: Australia, New Zealand, Italy, German, Spain, UK, Canada and many more…

Слайд 8

Design of International Tax Systems

Territorial Tax System

A State

subjects to tax both residents and non-residents on income

derived from sources within the State

Example: Hong Kong

Слайд 10

Example

STATE B

STATE A

Brett, a Citizen of State A,

is transferred by his employer to its subsidiary in

State B for a 2 year period.State A and State B both operate worldwide taxation systems.

Brett’s income steams include:

Interest on deposit with a Bank in State A

Rental income from his property in State A

Employment income

What are the tax issues that may arise for Brett?

Слайд 11

Cross Border Business Activities

State R

State S

PE

Tax consequences in

State S depends on

Concept of “source”

Threshold requirements

Profit measurement rulesTax treaties

Слайд 12

Business Activities - Subsidiary

State R

State S

Tax consequences in

State S:

Subsidiary resident in State S?

Resident taxable

on worldwide income, etc.Tax consequences in State R:

Subsidiary resident in State R or S?

CFC rules?

Слайд 13

Cross Border Employment

PCO

SCO

John is seconded to a

client of PharmaCo for 4 months in order to

train the staff of the client for the use of new software.Residence State

Work State

Слайд 14

Taxation of cross-border equity investments

Final or refundable

Shareholders

Taxation

on worldwide income

Withholding tax

State S

Country of source

of the

incomeState R

Country of residence

of the recipient

Corporate income tax

Company

DIVIDENDS

Слайд 15

State R

State S

Cross border debt investments

Country of

source

of the income

Country of residence

of the recipient

Bank A

LOAN

$100

million

INTEREST

5% p.a.

B

CoTaxation on worldwide income

Withholding tax

Слайд 16

Income from immovable property

State S

State R

Taxation on source

income

Taxation on worldwide income

John

RENT

DOUBLE

TAXATION

Country of residence

of the recipient

Country

of sourceof the income

Gross WHT

Net rental income

Слайд 17

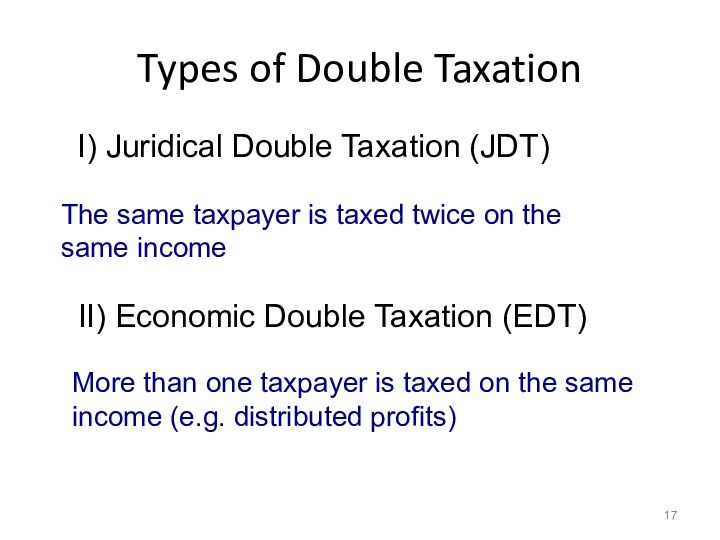

Types of Double Taxation

I) Juridical Double Taxation (JDT)

The

same taxpayer is taxed twice on the same income

II)

Economic Double Taxation (EDT)More than one taxpayer is taxed on the same income (e.g. distributed profits)

Слайд 18

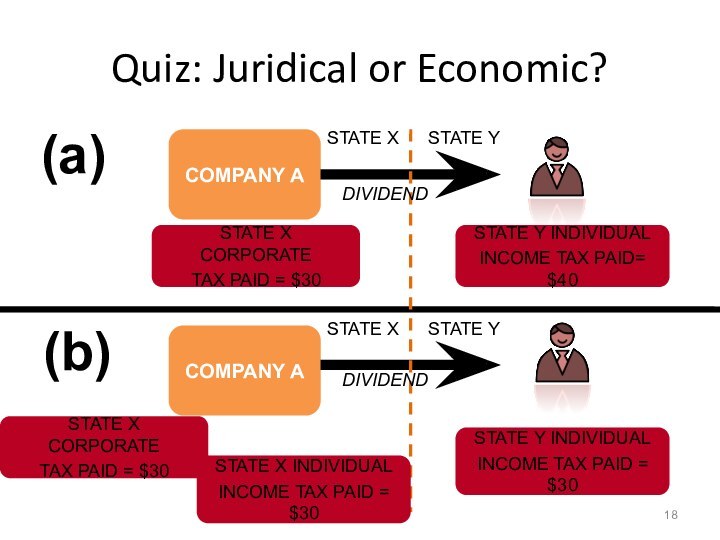

Quiz: Juridical or Economic?

COMPANY A

COMPANY A

(a)

(b)

STATE X CORPORATE

TAX

PAID = $30

STATE Y INDIVIDUAL

INCOME TAX PAID= $40

STATE

X INDIVIDUAL INCOME TAX PAID = $30

STATE Y INDIVIDUAL

INCOME TAX PAID = $30

STATE X

STATE X

STATE Y

STATE Y

DIVIDEND

DIVIDEND

STATE X CORPORATE

TAX PAID = $30

Слайд 19

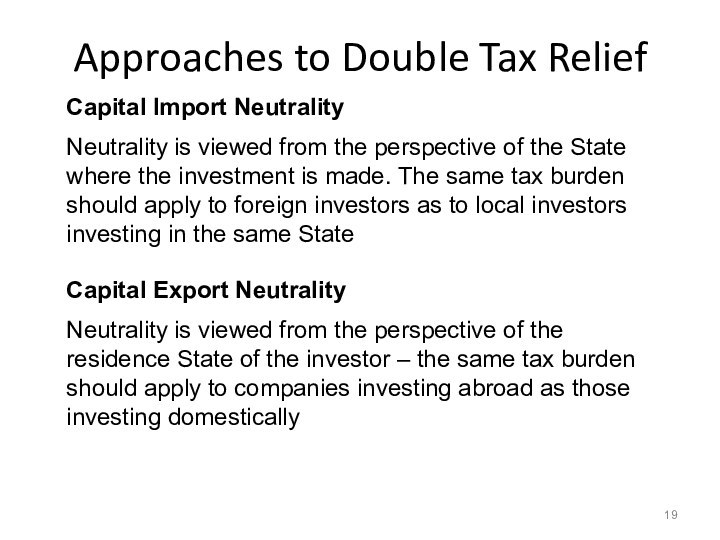

Approaches to Double Tax Relief

Capital Import Neutrality

Neutrality is

viewed from the perspective of the State where the

investment is made. The same tax burden should apply to foreign investors as to local investors investing in the same StateCapital Export Neutrality

Neutrality is viewed from the perspective of the residence State of the investor – the same tax burden should apply to companies investing abroad as those investing domestically

Слайд 22

Taxation of Cross Border Activities

Tax treaties as a

solution?

Agreement between States (Contracting States)

Avoidance of Double Taxation

Coordinate

the exercise of taxing rights by the Contracting States (allocation of taxing rights)Although it is an agreement between the States, it has direct effect towards taxpayers – “invoke treaty benefits”

Слайд 23

Tax Treaties

Vienna Convention on the Law of Treaties.

Art. 2:

A treaty is an international agreement in one

or more instruments, whatever called concluded between states and governed by international law

Слайд 25

Place of Treaties in the Legal Systems

Place of

treaties in the legal system of a state depends

on the country’s view on international lawMost countries: treaty prevails over domestic law

Some countries (e.g. US): treaty equals domestic law

States in EU are free to conclude tax treaties

But in case of conflict, EU law prevails over tax treaties

Слайд 26

Vienna Convention on the Law of Treaties

Article 26

VCLT Pacta sunt servanda

Binding and must be performed in

good faithOECD report on Tax Treaty Override (1989)

No treaty override

Seek bilateral or multilateral solutions to tax treaty problems

Слайд 27

Tax Treaties - Objectives

General:

Facilitate cross-border trade and

investment eliminating tax impediments

Слайд 28

Tax Treaties - Objectives

Operational:

Elimination of double taxation

Prevention of

tax evasion

Слайд 29

Tax Treaties - Objectives

Aims of tax treaties

“The Avoidance

of Double Taxation”

Focus on solving juridical double taxation

“The Prevention

of Fiscal Evasion”OECD Model - not in the text, but in the Commentary;

US DTA’s - “No double non-taxation intended” is in the text

© 2010 IBFD International Tax Academy

Слайд 30

Tax Treaties - Objectives

© 2010 IBFD International Tax

Academy

Ancillary:

Elimination of discrimination

Exchange of information

Administrative assistance

Resolve disputes

Слайд 31

Process of Establishment

A tax treaty is

a formal agreement between two or more States, with

the following life-cycle:

Слайд 32

Model Conventions

What is a Model Convention?

What is a

Commentary to a Model Convention?

Why do we need a

Model Convention and a Commentary?What is the legal value of a Model Convention and its Commentary?

Слайд 33

Model Conventions

League of Nations Models 1928 – 1946

OECD

Model 1963, 1977, 1992 and beyond

UN Model 1980, 2001

and 2011CIAT Model

ASEAN Model

Andean Group Model

National models (e.g. USA, Netherlands)

ILADT

USA Model 1996, 2006, 2016

Слайд 35

Models

OECD MC

Draft 1963

Revised 1977, 1992, 1994, 1997, 2000,

2002, 2008, 2010, 2014...

Commentaries

Favours capital exporting countries

Слайд 37

Models

OECD vs UN Model Treaty

UN Model follows the

pattern of OECD MC

Main difference: UN Model imposes fewer

restrictions to the source country

Слайд 38

Models

US Model Treaty (1996, 2006, 2016)

Reflects USA =

Capital exporting country

All citizens are tax residents

Broad notion of

business profitsLOB clause

Credit method

Слайд 39

TAX TREATIES - Content

Coverage, Scope and Legal Effect

Business

income

Employment & Personal Services

Immovable property income & CG

WHT on

investment incomeOther income

Non-Discrimination, MAP, Exchange of information

Слайд 40

Content/ Chapters in a Model Tax Treaty

I. Scope

of the treaty (Articles 1, 2 and 29)

II. Definitions

(Articles 3 to 5)III and IV. Distributive rules (Articles 6 to 22)

Exclusive allocation of taxing rights

Shared allocation of taxing rights

V. Elimination of double taxation (Article 23)

Exemption (Article 23A); Credit (Article 23B)

VI. Special provisions (Articles 24 to 29)

Procedural rules (Articles 25, 26 and 27)

Principles (Articles 24 and 28)

VII. Final provisions (Articles 30 and 31)

Слайд 42

1ST STEP: Domestic Law

Which countries want to tax?

First, only look at the domestic law of the

countries involvedAssess which countries want to tax under their domestic law

Do not jump directly to the tax treaty application

Слайд 43

Person (Art. 3(1) (a)): individual, company and any

other body of persons

Company (Art. 3(1) (b)): body corporate

or entity treated as body corporate for tax purposesResident (Art. 4): a person who is liable to tax in a State by reason of his domicile, residence, place of management or a similar criterion

Liable to tax

2nd 2nd STEP: Treaty applicable?: Treaty Applicable?

Art. 1 OECD MC (Persons Covered)

“This Convention shall apply to persons who are residents of one or both Contracting States”.

Слайд 44

Art. 4: Resident

Art. 4 OECD/UN Model

Starting point is

domestic legislation of Contracting States (Art. 4(1) OECD/UN)

Not a

resident if subjected only in respect of income from sources with a state, Art. 4(1)For treaty purposes, only resident of 1 State, therefore tiebreaker rules in Art. 4(2) for individuals and 4(3) for companies

Слайд 45

Treaty applicable to:

Permanent establishments?

Entities generally (characterization: transparent,

opaque, hybrid, check the box; consequences)?

Partnerships?

Pension funds/charities?

Governments / governmental

bodies?Diplomats?

Persons covered and Entity Qualification Entity Qualification

Слайд 46 Art. 2(1) OECD: taxes on income (and capital)

Irrespective of levying body

- Central government

- State/province

- MunicipalityExceptions/additions

Art. 2: Taxes Covered

Слайд 47

Contracting State:

Land territory

Territorial waters

Continental shelf

Exclusive economic zone

Art. 29:Territorial Scope

Слайд 48

3rd STEP: Which distributive rule is applicable?

Purpose: allocation

of taxing rights between the “Residence State” and the

“Other State”.Distributive rules are contained in Chapter III OECD MC from Art. 6 to Art. 21.

Слайд 49

OECD Model Taxation Rights

Residence State

Source State

Arts. 12, 18,

21

Arts. 10 or 11

Arts. 6, 7 or 15

Art. 19

Слайд 50

Article 12(1) OECD

Royalties arising in a Contracting State

and beneficially owned by a resident of the other

Contracting State shall be taxable only in that other State.US

Germany

Royalties

Слайд 51

Article 10 OECD

Para. 1

Dividends paid by a company

which is resident of a Contracting State to a

resident of the other Contracting State may be taxed in that other State.Para. 2

However, such dividends may also be taxed in the Contracting State in which the company paying the dividends is a resident… but … the tax so charged shall not exceed:

a) 5 per cent.... Or b) 15 per cent...

Germany

Dividends

France

Слайд 52

Article 6(1) OECD

Income derived by a resident of

a Contracting State from immovable property … situated in

the other Contracting State may be taxed in that other State.Spanish Costa del Sol

Russia

Слайд 53

Article 19(1) OECD

Salaries … paid by a Contracting

State … to an individual in respect of services

rendered to that State … shall be taxable only in that State.Salary

Слайд 54

4th STEP: Interpretation Issues?

Customary law

Vienna Convention on the

Law of Treaties (VCLT)

Слайд 55

Meaning of Terms

Article 31

Interpreted in good faith in

accordance with the ordinary meaning to be given to

the terms of the treaty in their context and in the light of its object and purpose.Context includes any agreement or instrument related to the treaty

Any subsequent agreement or practice

Special meaning

Слайд 56

4th STEP: Interpretation Issues?

Art. 31(1) of the VCLT:

“A

treaty shall be interpreted in good faith in accordance

with the ordinary meaning to be given to the terms of the treaty in their context and in light of its object and purpose”.

Слайд 57

TAX TREATIES

Art. 31(2) of the VCLT:

The context for

the purpose of the interpretation of a treaty shall

comprise, in addition to the text, including its preamble and annexes:a) any agreement relating to the treaty which was made between all the parties in connexion with the conclusion of the treaty;

b) any instrument which was made by one or more parties in connexion with the conclusion of the treaty and accepted by the other parties as an instrument related to the treaty

Слайд 58

TAX TREATIES

Art. 31(3) of the VCLT:

There shall be

taken into account, together with the context:

a) subsequent agreements

between the parties regarding the interpretation of the treaty or the application of its provisions;b) any subsequent practice in the application of the treaty which establishes the agreement of the parties regarding its interpretation

C) any relevant rules of international law applicable in the relations between the parties

Слайд 59

TAX TREATIES

Art. 32 of the VCLT:

“Recourse may be

had to supplementary means of interpretation, including the preparatory

work of the treaty and the circumstances of its conclusion, in order to confirm the meaning resulting from the application of article 31, or to determine the meaning when the interpretation according to article 31:a) leaves the meaning ambiguous or obscure; or

b) leads to a result which is manifestly absurd or unreasonable

Слайд 60

4th STEP: Interpretation Issues?

Chapter II and III contain

definitions of some Treaty terms:

Art. 3 (General Definitions)

Art. 4

(Resident)Art. 5 (Permanent Establishment)

Art. 6.2 (Immovable Property)

Art. 10.3 (Dividends)

Art. 11.3 (Interest)

Art. 12.2 (Royalties)

If no definition: Art. 3, par 2 (domestic law) and general interpretation rules like in Vienna Convention

Слайд 61

Internal Rule of Interpretation - Article 3(2)

OECD &

UN Model Tax Convention on Income and on Capital

As

regards the application of the Convention at any time by a Contracting State, any term not defined therein shall, unless the context otherwise requires, have the meaning that it has at that time under the law of that State for the purposes of the taxes to which the Convention applies, any meaning under the applicable tax laws of that State prevailing over a meaning given to the term under other laws of that State.

Слайд 62

4th STEP: Interpretation Issues?

OECD MC. Interpretation

Commentaries

Reservations

Observations

Слайд 63

4th STEP: Interpretation Issues?

Legal status of the OECD

MC and its Commentaries?:

Supplementary means of interpretation (Art. 32

VCLT)?Context (Art. 31 VCLT)?

Слайд 64

Role of OECD Commentary

Much debated!!

Qualify as supplementary means

Courts

have demonstrated willingness to pay attention to the Commentary

Wording

of the treaty provision must correspond to OECD ModelCan it apply to non-OECD countries?

Can 2008, 2010 & 2014 updates be applicable to treaties entered into before 2008?

Слайд 65

4th STEP: Interpretation Issues?

OECD & UN Models:

Internal rule

of interpretation Art. 3(2) & Commentaries

Static approach

Ambulatory approach

Слайд 66

Supplementary Means of Interpretation

Article 32 of Vienna Convention

History

of treaty provisions

Expert evidence

OECD Model and Commentary

OECD Studies

Legislative history

of treatyForeign court decisions

Tax authorities’ pronouncements

Literature/Authors

Слайд 67

5th STEP: Distributive Rule and Relief

Three possible outcomes:

Residence

State has an exclusive right of taxation (for e.g.

Art. 12 OECD MC)The Other State has an exclusive right of taxation (for e.g. Art. 19.2 OECD MC)

Both States taxes the income (for e.g. Arts. 6, 10, 11 OECD MC) but the Residence State has to grant relief under Article 23

Слайд 68

Article 23 – Elimination of Double Taxation

Exemption method

Full

exemption

Exemption with progression

Credit method

Full credit

Ordinary credit

Слайд 69

Example of Exemption with Progression

Mariette has a small

apartment in France that she rents out in the

summer. She receives 100 rental income. Under the France-NL tax treaty, the income is exempt under the exemption-with-progression in the Netherlands. She receives 100 as pension income from the NL.Netherlands

France

Rental income

Слайд 71

Example of Credit Method

Dividends received: 100

WHT in Germany

(15%):

Net income:

Income taxable in France

French

IT (40%) Foreign tax credit:

French tax payable:

Total tax paid: =

Germany

Dividends

France

Слайд 72

Recap of Tax Treaty Application

Step 1: Domestic law

Step

2: Treaty applicable?

Step 3: Which distributive rule is applicable?

Step

4: Interpretation issues?Step 5 : Application of the distributive rules and relief