- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Risk management for banking

Содержание

- 2. Danger that a certain unpredictable contingency

- 3. Risk and uncertainty – risks may be

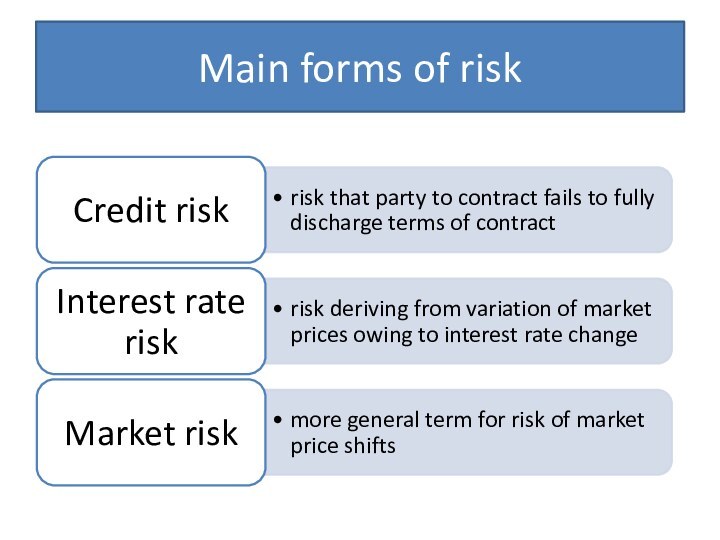

- 4. Main forms of risk

- 6. Other risks o operational risk o risk

- 7. Risks in secured lending - particular

- 8. Example of the consequences - Swedish

- 9. Risk Management Risk management system structure of

- 10. Delegation of responsibility and liabilities between supervising

- 11. Скачать презентацию

- 12. Похожие презентации

Danger that a certain unpredictable contingency can occur, which generates randomness in cash flow .What is risk?

Слайд 2 Danger that a certain unpredictable contingency can

occur, which generates randomness in cash flow .

risk?Слайд 3 Risk and uncertainty – risks may be described

using probability analysis (business cycle, company failures), while events

subject to uncertainty cannot (financial crises, wars etc.)

Слайд 6

Other risks

o operational risk

o risk of

fraud

o reputation risk

Systemic risk – that the

financial system may undergo contagious failure

following other forms of shock/risk

Слайд 7 Risks in secured lending - particular reference to

real estate

Why do banks overland to real estate?

-

alternatives? - Collateral

- Balance sheet growth

Issues

- externalities of lending severe

- potential “disaster myopia”

- vulnerability to macroeconomic

shocks

Слайд 8 Example of the consequences - Swedish banking crisis

Financial liberalisation – banks and

authorities unfamiliar with liberalised

regime

Growth in bank lending (140% 1985-90)

and private sector debt, particular focus

on real estate lending, encouraged by tax

deductibility

Market share competition among banks

Shocks - global recession, high interest

rates to hold exchange rate, tax reform

abolishing interest deductibility

Majority of banks insolvent, non

performing assets 14% of GDP

Cost of public rescue 4.5% of GDP

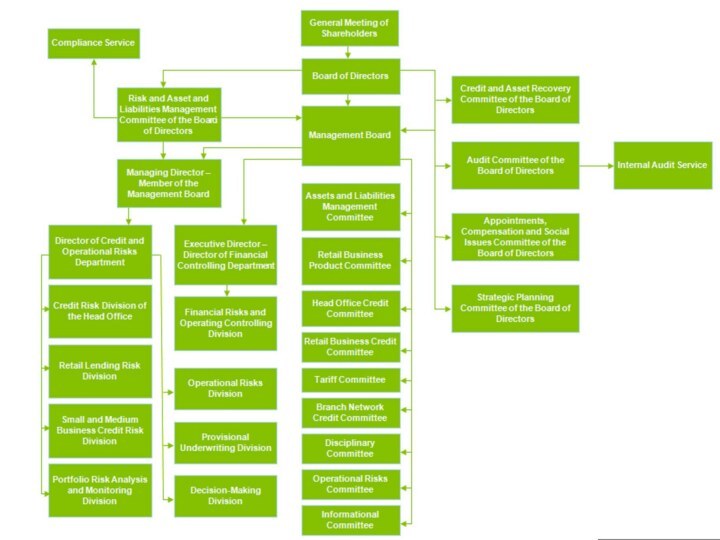

Слайд 9

Risk Management

Risk management system structure of BTA Bank

JSC as one of the main components of corporate

governance is focused on minimizing influence of any risk to the corporate financial status and its ability to perform assumed liabilities. BTA Bank JSC monitors and controls its risks in compliance with the main ethical principles and limits approved by the Board of Directors. The Board of Directors determines medium- and long-term strategies and supervises Company’s operations. Management Board, Risk and Asset and Liabilities Management Committee of the Board of Directors and other bodies responsible for risk management in due term submit reports on Company’s performance, information on risks and financial status for consideration and approval by the Board of Directors.Слайд 10 Delegation of responsibility and liabilities between supervising and

executive bodies in BTA Bank JSC is based on

the principles of corporate governance in order to monitor and control the following risks related to banking activities:Credit risk;

Country risk;

Market risk, including currency, interest and price risks;

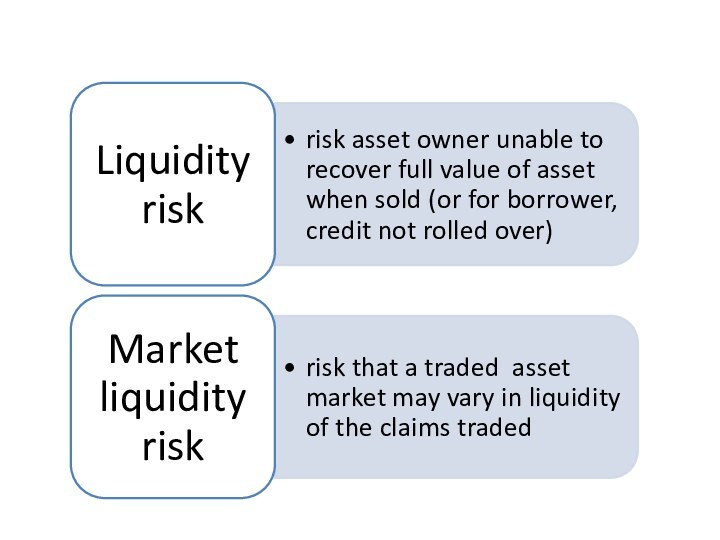

Liquidity loss risk;

Operational risk;

Compliance risk;

Legal risk;

Business reputation loss risk