- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему The model of perfect competition

Содержание

- 2. Key issuesThe meaning of perfect competitionCharacteristics of

- 3. Assumptions Behind a Perfectly Competitive MarketMany suppliers

- 4. Assumptions Behind a Perfectly Competitive MarketTransactions are

- 5. Examples of Perfectly Competitive Markets?It is rare

- 6. Examples of Perfectly Competitive Markets?Agricultural marketsPig farming,

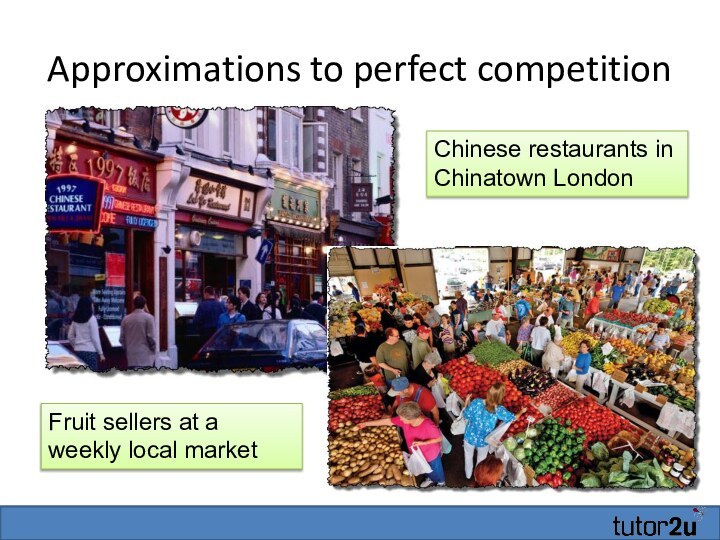

- 7. Approximations to perfect competitionThe law of one price with tens of bookmakers on a race course

- 8. Approximations to perfect competitionFruit sellers at a weekly local marketChinese restaurants in Chinatown London

- 9. Price Taking FirmsCompetitive firms in competitive markets

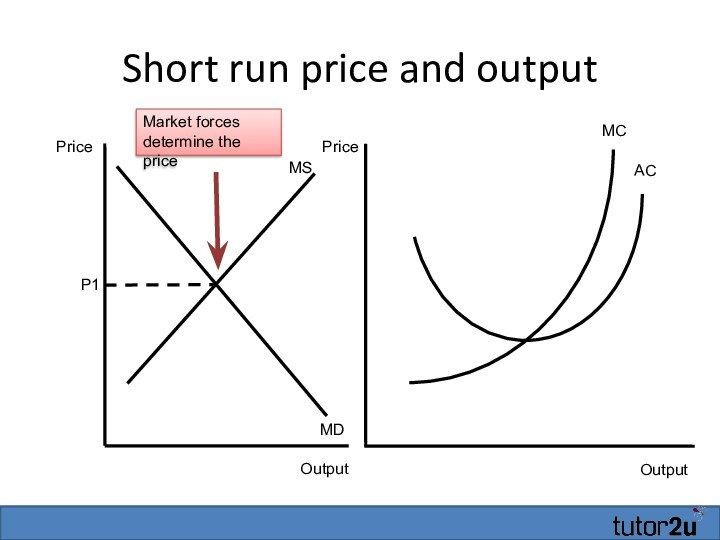

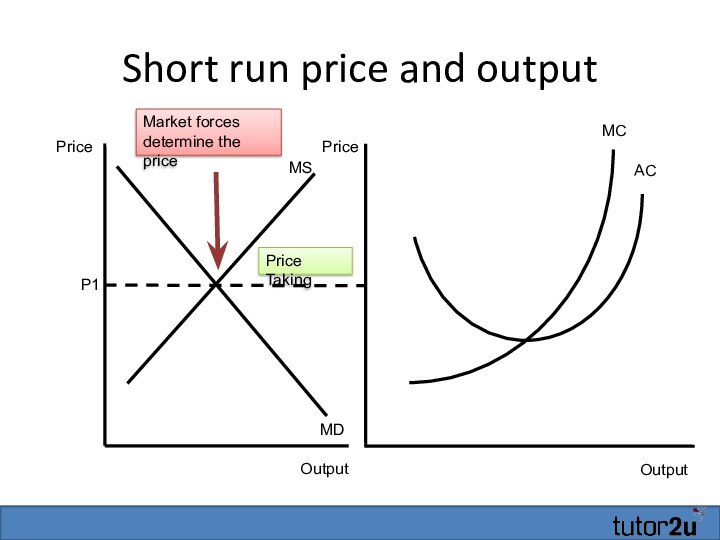

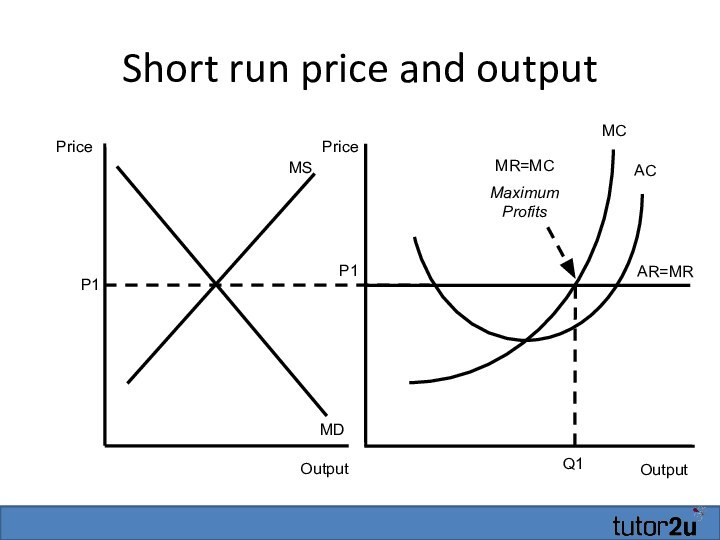

- 10. Short run price and outputOutputMCACOutputPricePriceP1MSMDMarket forces determine the price

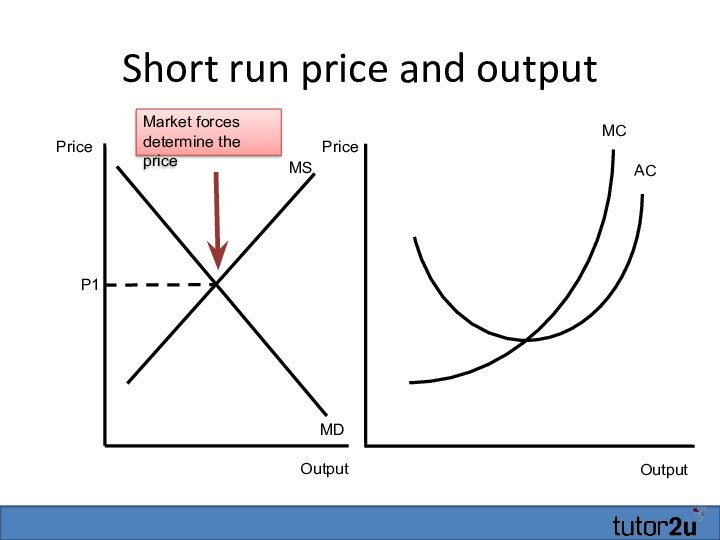

- 11. Short run price and outputOutputMCACOutputPricePriceP1MSMDMarket forces determine the price

- 12. Short run price and outputOutputMCACOutputPricePriceP1MSMDPrice TakingMarket forces determine the price

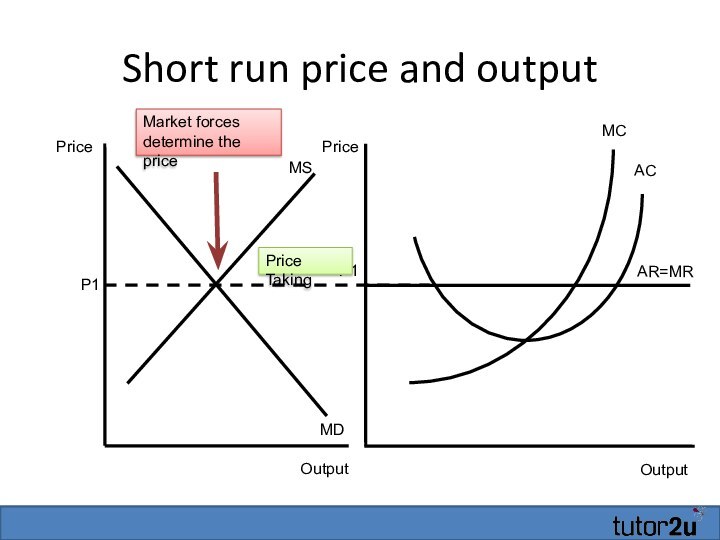

- 13. Short run price and outputOutputAR=MRMCP1ACOutputPricePriceP1MSMDPrice TakingMarket forces determine the price

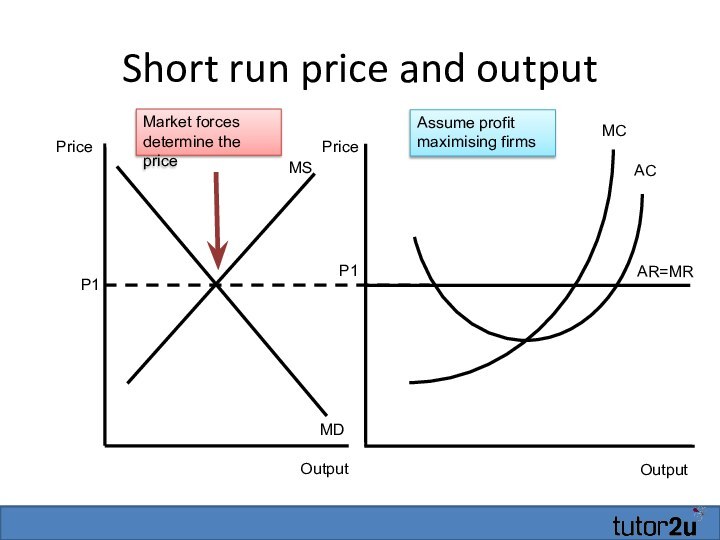

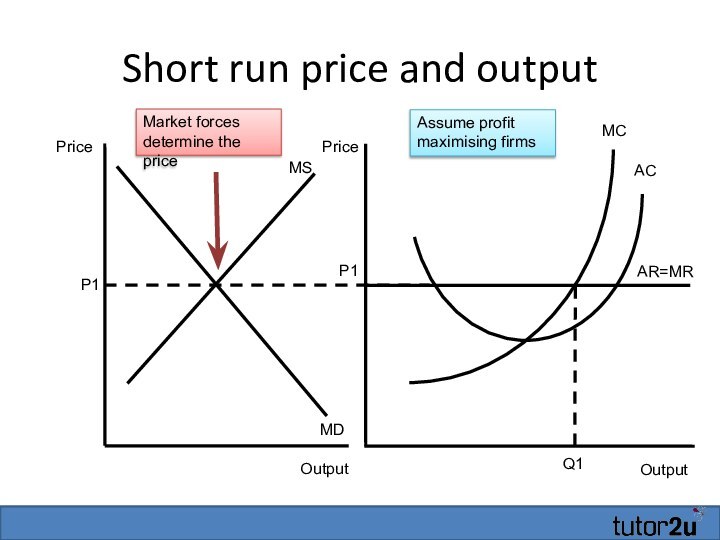

- 14. Short run price and outputOutputAR=MRMCP1ACOutputPricePriceP1MSMDMarket forces determine the priceAssume profit maximising firms

- 15. Short run price and outputOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMDMarket forces determine the priceAssume profit maximising firms

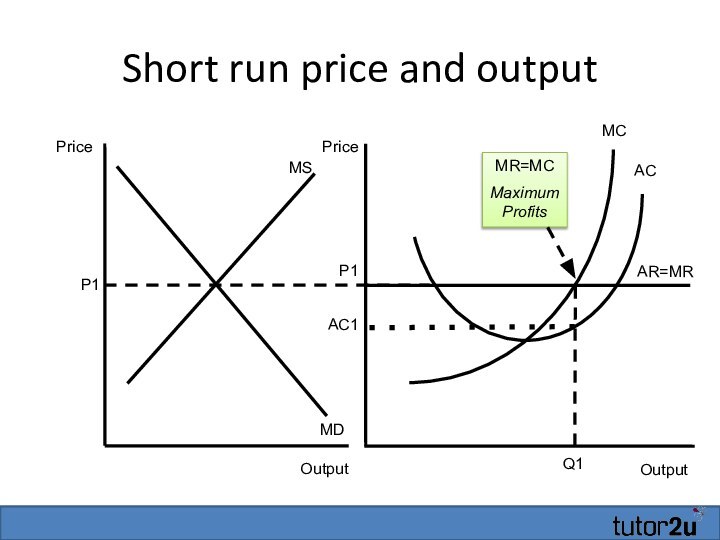

- 16. Short run price and outputOutputAR=MRMCMR=MCMaximum ProfitsP1ACQ1OutputPricePriceP1MSMD

- 17. Short run price and outputOutputAR=MRMCMR=MCMaximum ProfitsP1ACQ1AC1OutputPricePriceP1MSMD

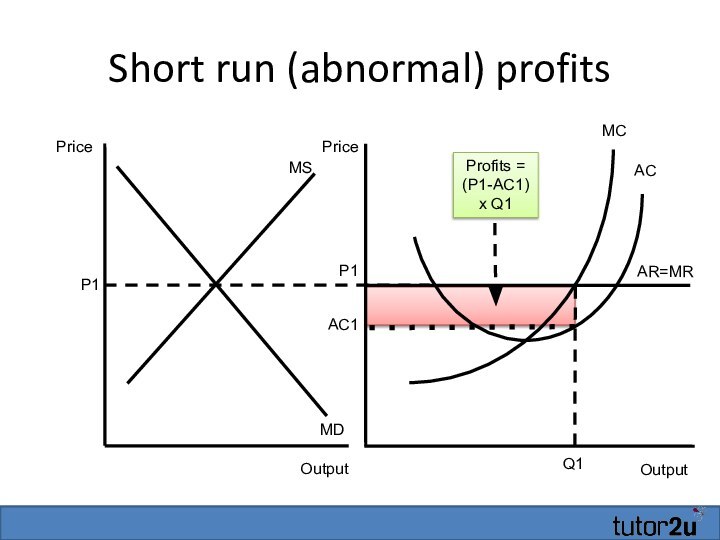

- 18. Short run (abnormal) profits OutputAR=MRMCProfits = (P1-AC1) x Q1P1ACQ1AC1OutputPricePriceP1MSMD

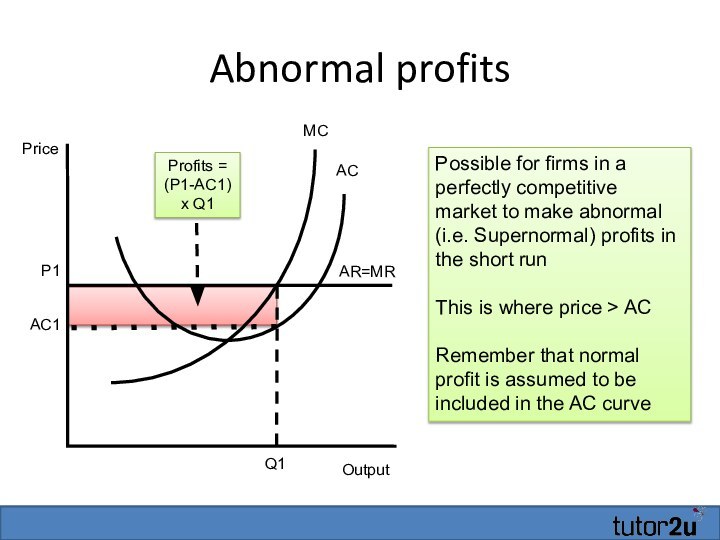

- 19. Abnormal profitsOutputAR=MRMCProfits = (P1-AC1) x Q1P1ACQ1AC1PricePossible for

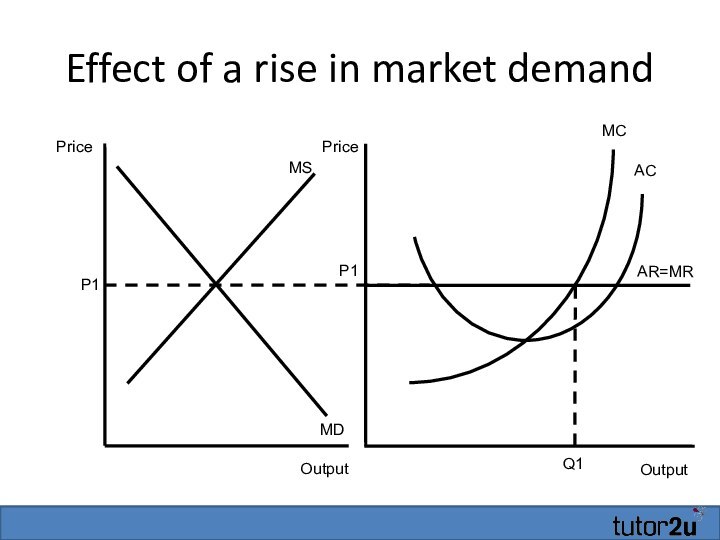

- 20. Effect of a rise in market demandOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMD

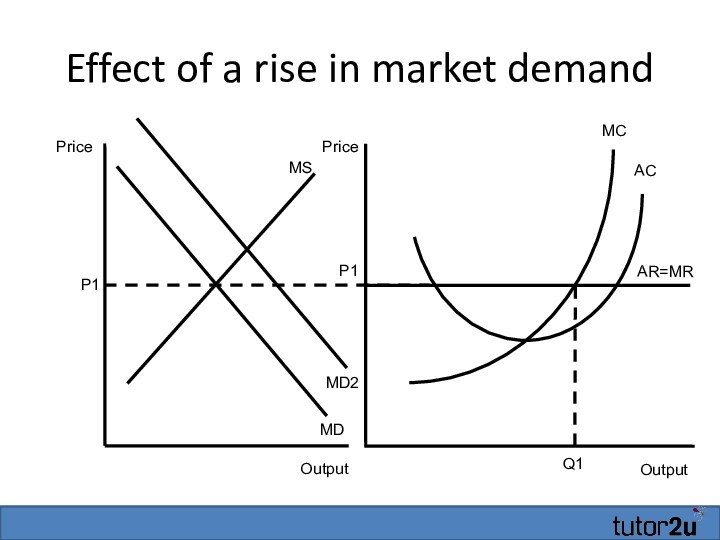

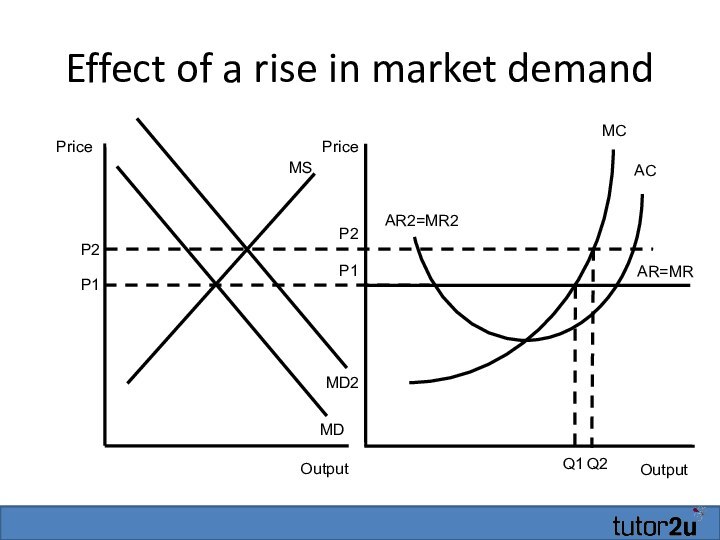

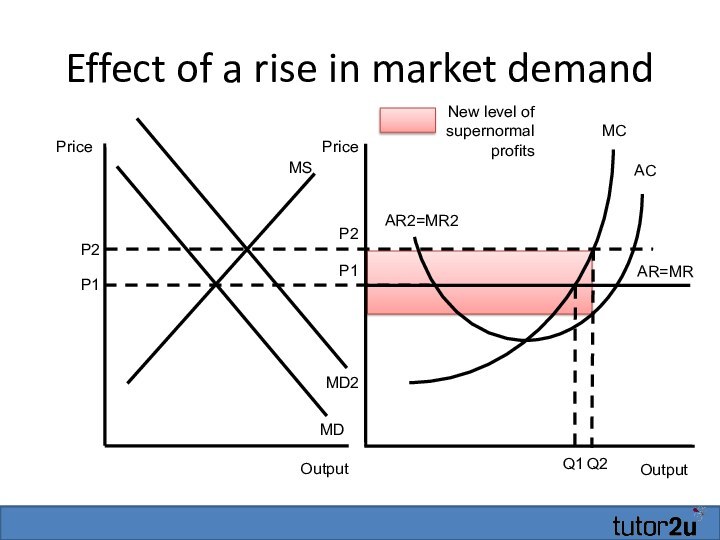

- 21. Effect of a rise in market demandOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMDMD2

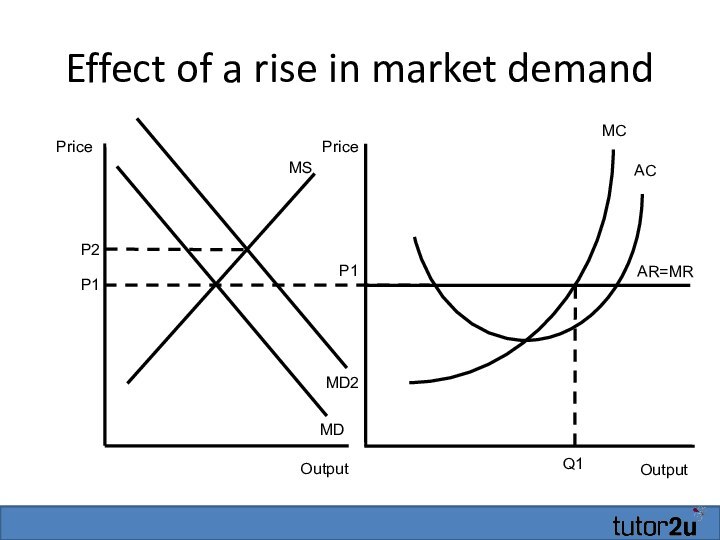

- 22. Effect of a rise in market demandOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMDMD2P2

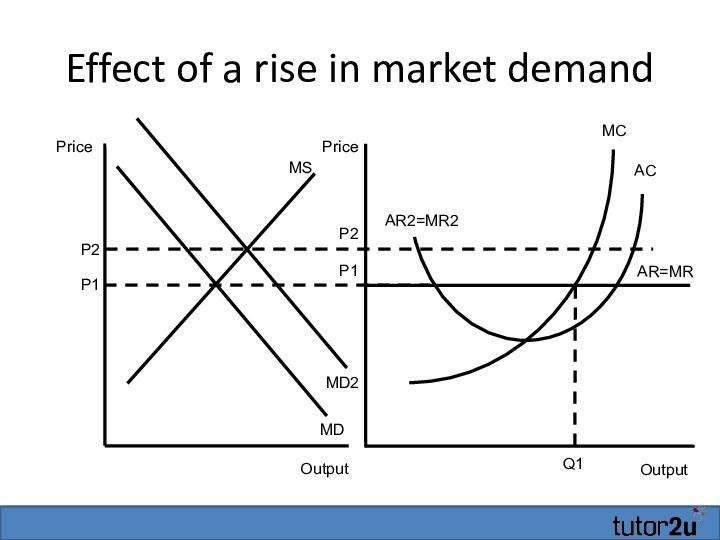

- 23. Effect of a rise in market demandOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMDMD2P2AR2=MR2P2

- 24. Effect of a rise in market demandOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMDMD2P2AR2=MR2Q2P2

- 25. Effect of a rise in market demandOutputAR=MRMCP1ACQ1OutputPricePriceP1MSMDMD2P2AR2=MR2Q2P2

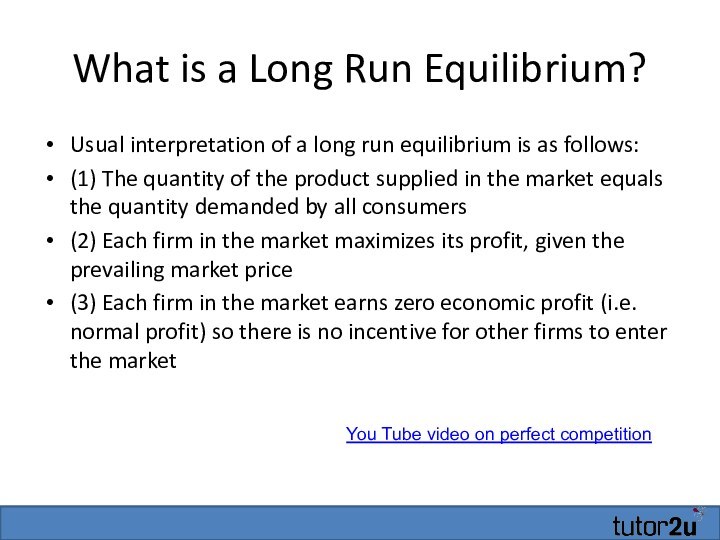

- 26. What is a Long Run Equilibrium?Usual interpretation

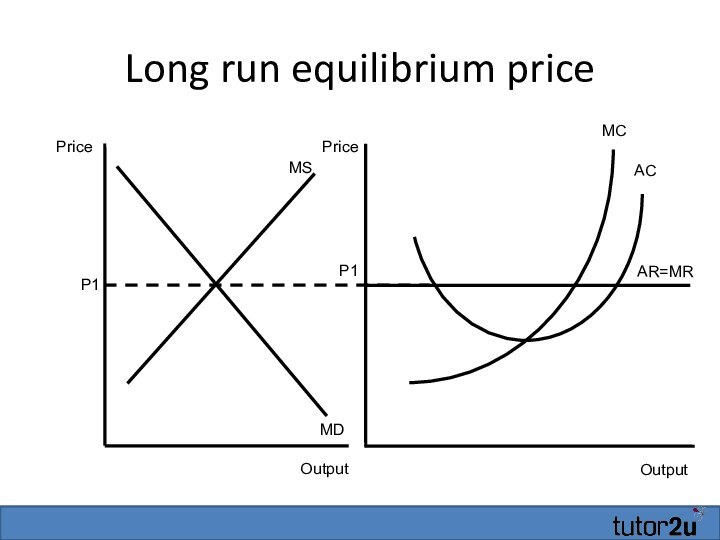

- 27. Long run equilibrium priceOutputAR=MRMCP1ACOutputPricePriceP1MSMD

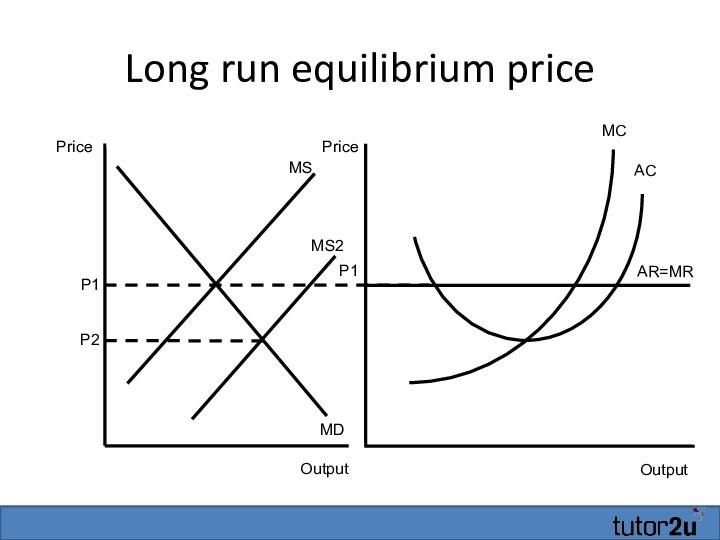

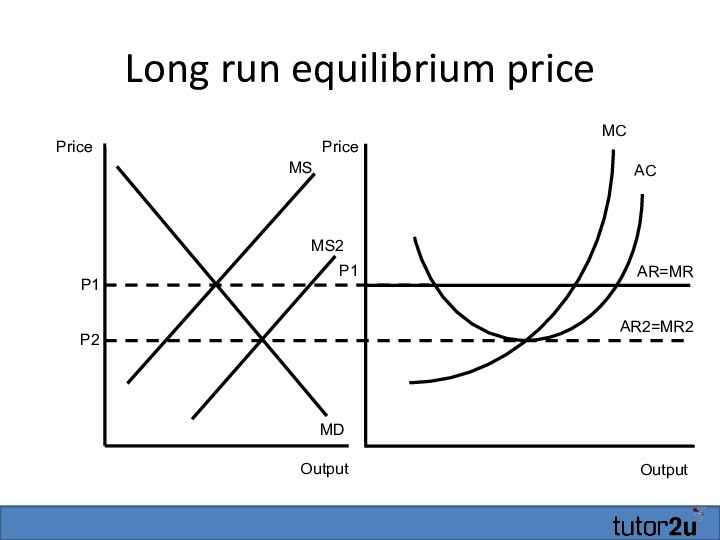

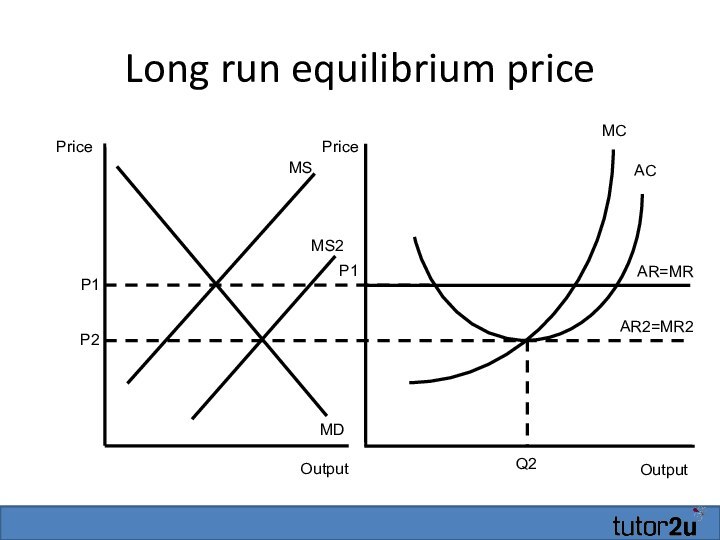

- 28. Long run equilibrium priceOutputAR=MRMCP1ACOutputPricePriceP1MSMDMS2P2

- 29. Long run equilibrium priceOutputAR=MRMCP1ACOutputPricePriceP1MSMDMS2P2AR2=MR2

- 30. Long run equilibrium priceOutputAR=MRMCP1ACQ2OutputPricePriceP1MSMDMS2P2AR2=MR2

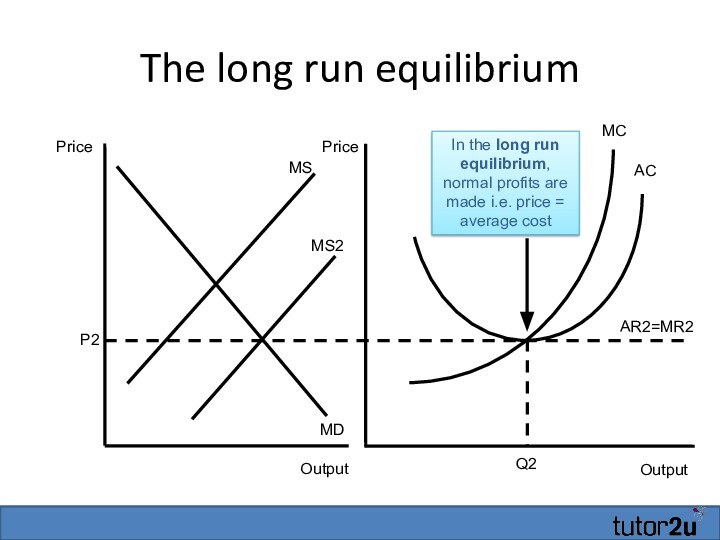

- 31. The long run equilibriumOutputMCACQ2OutputPricePriceMSMDMS2P2AR2=MR2In the long run

- 32. The long run equilibriumOutputMCACQ2AR2=MR2In the long run

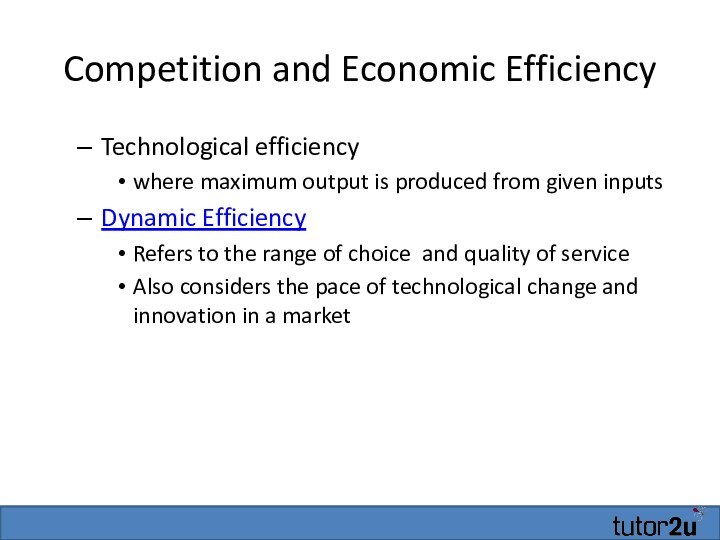

- 33. Competition and Economic EfficiencyEconomic efficiency has several

- 34. Productive EfficiencyOutputCost per unitAC1AC2AC3LRACQ1Q2Q3Productive efficiency occurs when

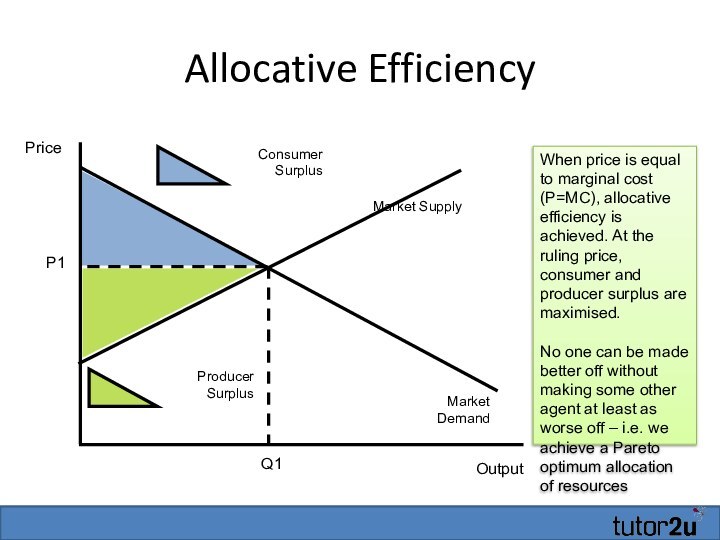

- 35. Allocative efficiency Allocative efficiency achieved when it

- 36. Allocative EfficiencyOutputPriceMarket DemandMarket SupplyP1Q1When price is equal

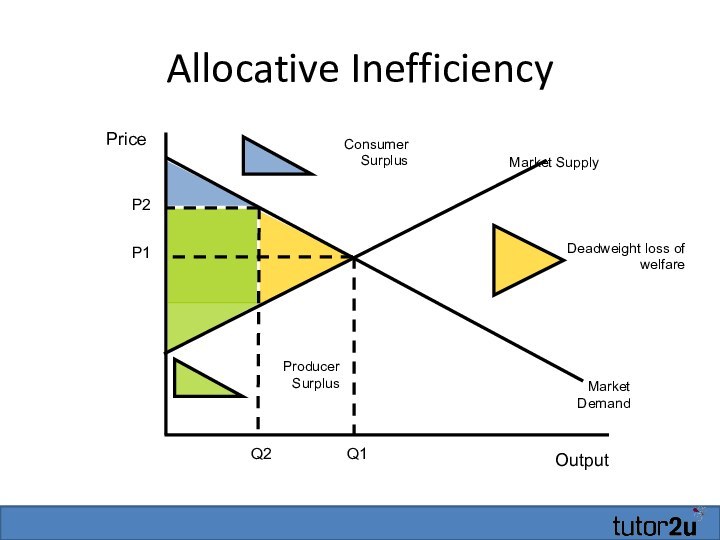

- 37. Allocative InefficiencyOutputPriceMarket DemandMarket SupplyP1Q1P2Q2

- 38. Competition and Economic EfficiencyTechnological efficiency where maximum

- 39. Importance of a Competitive EnvironmentThe standard view

- 40. How useful is model of perfect competition?Assumptions

- 41. Real world – imperfect competition!Most suppliers have

- 42. Скачать презентацию

- 43. Похожие презентации

Key issuesThe meaning of perfect competitionCharacteristics of perfect competitionPrice and output under competitionCompetition and economic efficiencyWider benefits of competition in markets

Слайд 2

Key issues

The meaning of perfect competition

Characteristics of perfect

competition

of competition in markets

Слайд 3

Assumptions Behind a Perfectly Competitive Market

Many suppliers -

each with an insignificant share of the market

Each firm

is too small to affect price via a change in market supply – each business is a price takerIdentical output produced by each firm – i.e. homogeneous products that are perfect substitutes for each other

Consumers have complete information about prices

Слайд 4

Assumptions Behind a Perfectly Competitive Market

Transactions are costless

- Buyers and sellers incur no costs in making

an exchangeAll firms (i.e. industry participants and new entrants) have equal access to resources (e.g. technology)

No barriers to entry & exit of firms in long run – the market is open to competition from new suppliers

No externalities in production and consumption

Слайд 5

Examples of Perfectly Competitive Markets?

It is rare to

find a pure example of perfect competitions

But there are

some close approximations:Foreign exchange dealing

Homogeneous product - US dollar or the Euro

Many buyers & sellers

Usually each trader is small relative to total market and has to take price as given

Sometimes, traders can move currency markets

Слайд 6

Examples of Perfectly Competitive Markets?

Agricultural markets

Pig farming, cattle

Farmers

markets for apples, tomatoes

Wholesale markets for vegetables, fish, flowers

Street

food markets in developing countries

Слайд 7

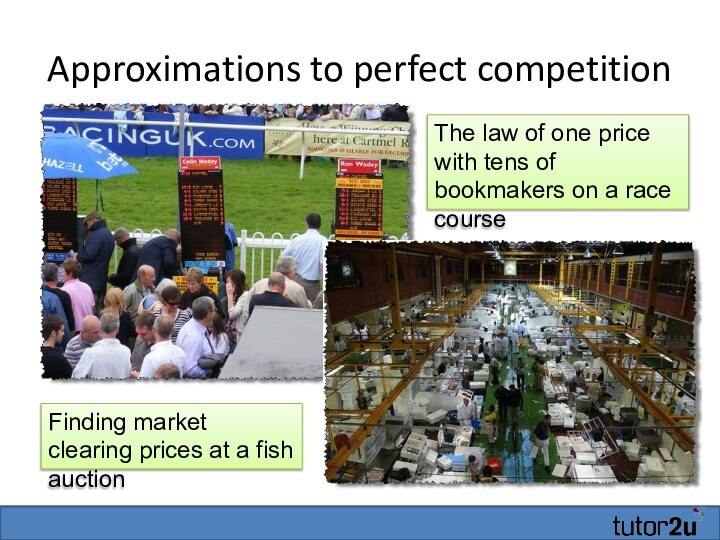

Approximations to perfect competition

The law of one price

with tens of bookmakers on a race course

Слайд 8

Approximations to perfect competition

Fruit sellers at a weekly

local market

Chinese restaurants in Chinatown London

Слайд 9

Price Taking Firms

Competitive firms in competitive markets have

little direct influence on the ruling market price

Examples of

price-taking behaviour:Local farmers selling to large supermarkets

A local steel firm selling as much as it can at the ruling international price of steel

The law of one price may hold true – most of the existing firms sell at the prevailing price

Слайд 10

Short run price and output

Output

MC

AC

Output

Price

Price

P1

MS

MD

Market forces determine the

price

Слайд 11

Short run price and output

Output

MC

AC

Output

Price

Price

P1

MS

MD

Market forces determine the

price

Слайд 12

Short run price and output

Output

MC

AC

Output

Price

Price

P1

MS

MD

Price Taking

Market forces determine

the price

Слайд 13

Short run price and output

Output

AR=MR

MC

P1

AC

Output

Price

Price

P1

MS

MD

Price Taking

Market forces determine

the price

Слайд 14

Short run price and output

Output

AR=MR

MC

P1

AC

Output

Price

Price

P1

MS

MD

Market forces determine the

price

Assume profit maximising firms

Слайд 15

Short run price and output

Output

AR=MR

MC

P1

AC

Q1

Output

Price

Price

P1

MS

MD

Market forces determine the

price

Assume profit maximising firms

Слайд 18

Short run (abnormal) profits

Output

AR=MR

MC

Profits = (P1-AC1) x

Q1

P1

AC

Q1

AC1

Output

Price

Price

P1

MS

MD

Слайд 19

Abnormal profits

Output

AR=MR

MC

Profits = (P1-AC1) x Q1

P1

AC

Q1

AC1

Price

Possible for firms

in a perfectly competitive market to make abnormal (i.e.

Supernormal) profits in the short runThis is where price > AC

Remember that normal profit is assumed to be included in the AC curve

Слайд 26

What is a Long Run Equilibrium?

Usual interpretation of

a long run equilibrium is as follows:

(1) The quantity

of the product supplied in the market equals the quantity demanded by all consumers(2) Each firm in the market maximizes its profit, given the prevailing market price

(3) Each firm in the market earns zero economic profit (i.e. normal profit) so there is no incentive for other firms to enter the market

You Tube video on perfect competition

Слайд 31

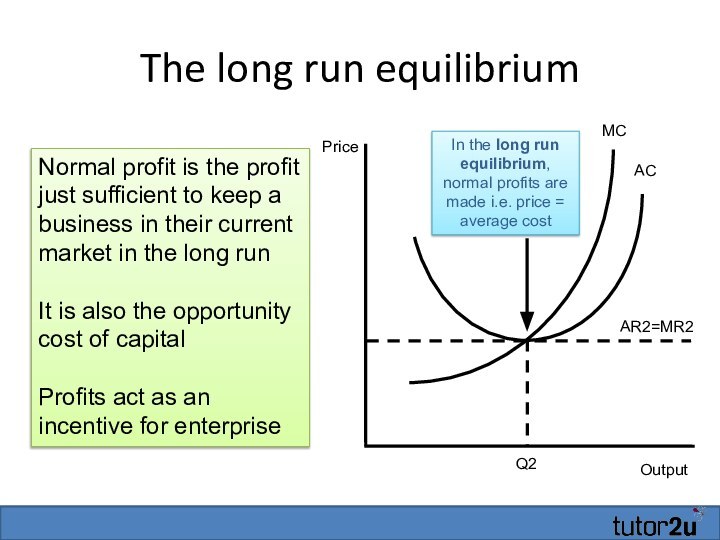

The long run equilibrium

Output

MC

AC

Q2

Output

Price

Price

MS

MD

MS2

P2

AR2=MR2

In the long run equilibrium,

normal profits are made i.e. price = average cost

Слайд 32

The long run equilibrium

Output

MC

AC

Q2

AR2=MR2

In the long run equilibrium,

normal profits are made i.e. price = average cost

Price

Normal

profit is the profit just sufficient to keep a business in their current market in the long runIt is also the opportunity cost of capital

Profits act as an incentive for enterprise

Слайд 33

Competition and Economic Efficiency

Economic efficiency has several meanings:

Productive

efficiency

when output is produced at the lowest feasible

average cost (either in the short run or the long run)Allocative efficiency

Achieved when the market provides goods and services that meet consumer needs and wants

Achieved when the price of output reflects the true marginal cost of production

This is where price=marginal cost

Слайд 34

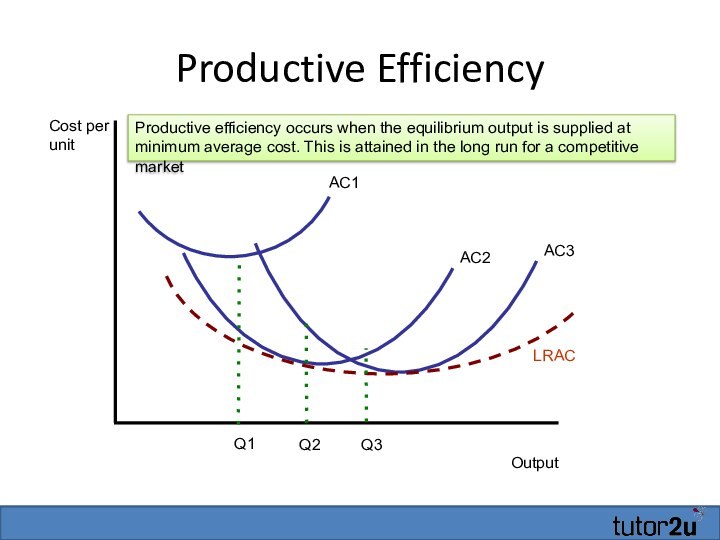

Productive Efficiency

Output

Cost per unit

AC1

AC2

AC3

LRAC

Q1

Q2

Q3

Productive efficiency occurs when the

equilibrium output is supplied at minimum average cost. This

is attained in the long run for a competitive market

Слайд 35

Allocative efficiency

Allocative efficiency

achieved when it is

impossible to make someone better off without making someone

else worse offAlso called Pareto Optimality

No trades are left that would make one person better off without hurting someone else

Occurs when price = marginal costs of production

This occurs in the long run under perfect competition

Слайд 36

Allocative Efficiency

Output

Price

Market Demand

Market Supply

P1

Q1

When price is equal to

marginal cost (P=MC), allocative efficiency is achieved. At the

ruling price, consumer and producer surplus are maximised.No one can be made better off without making some other agent at least as worse off – i.e. we achieve a Pareto optimum allocation of resources

Слайд 38

Competition and Economic Efficiency

Technological efficiency

where maximum output

is produced from given inputs

Dynamic Efficiency

Refers to the range

of choice and quality of serviceAlso considers the pace of technological change and innovation in a market

Слайд 39

Importance of a Competitive Environment

The standard view is

that competition drives an improvement in welfare and efficiency

Competition

forces under-performing firms out of the market and shifts market share to more efficient firms in the long runCompetition encourages firms to innovate and adopt best-practise techniques

Слайд 40

How useful is model of perfect competition?

Assumptions are

not meant to reflect real world markets where most

assumptions are not satisfiedPure competition is devoid of what most people would call real competitive behaviour by businesses!

The model provides a theoretical benchmark used to compare and contrast imperfectly competitive markets

Consider perfect competition as an interesting point of reference but one with few real world applications

Useful when considering

The effects of monopoly / imperfect competition

The case for free international trade

Слайд 41

Real world – imperfect competition!

Most suppliers have a

degree of control over market supply

Some buyers have monopsony

power against suppliers because they purchase a significant percentage of total demandMost markets have heterogeneous products due to product differentiation and constant innovation

Consumers nearly always have imperfect information and their preferences and choices can be influenced by the effects of persuasive marketing and advertising

Finally there may be imperfect competition in related markets such as the market for essential raw materials, labour and capital goods.