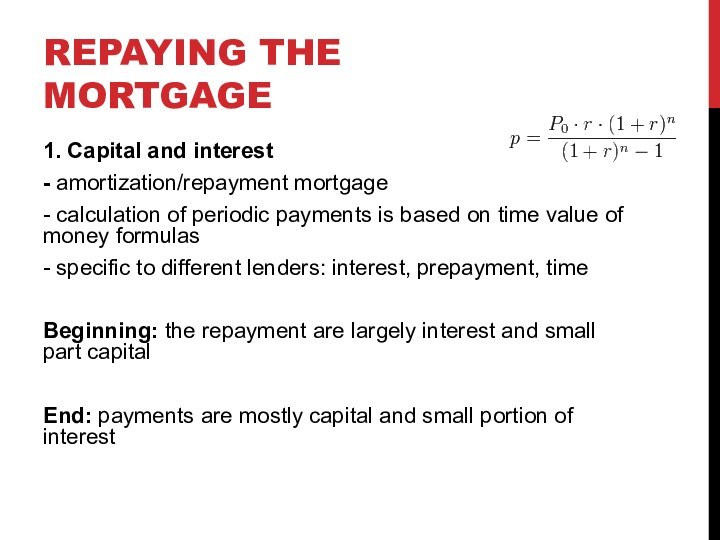

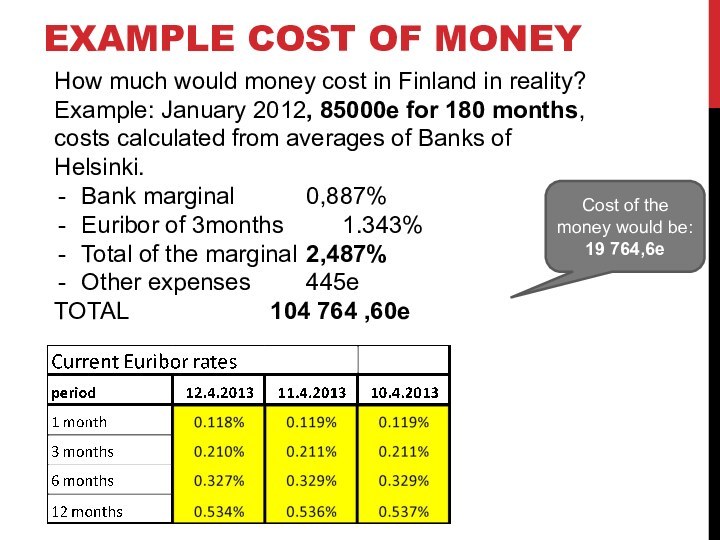

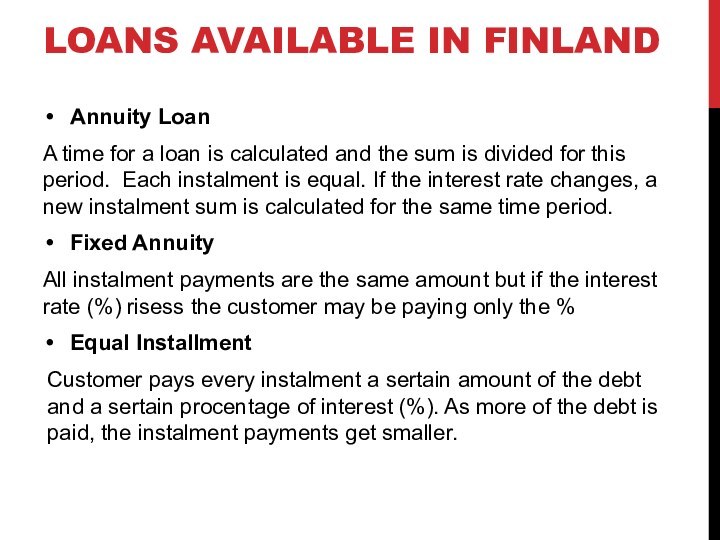

calculation of periodic payments is based on time value

of money formulas- specific to different lenders: interest, prepayment, time

Beginning: the repayment are largely interest and small part capital

End: payments are mostly capital and small portion of interest