of depreciation on the firm’s cash flows.

Discuss the firm’s

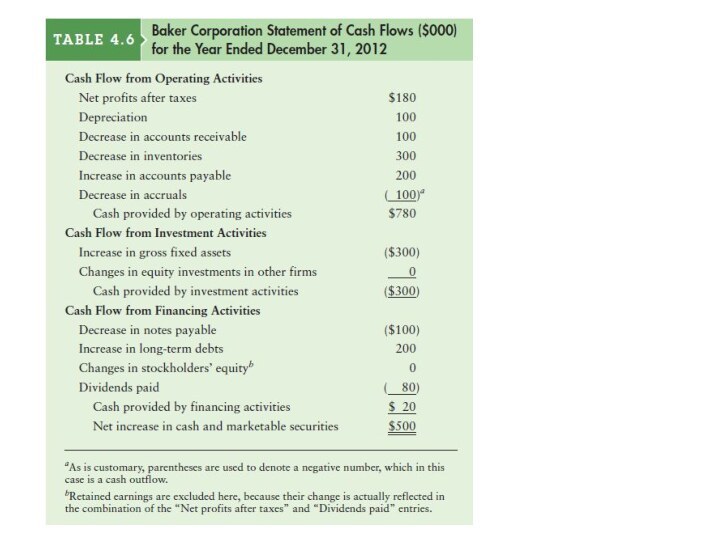

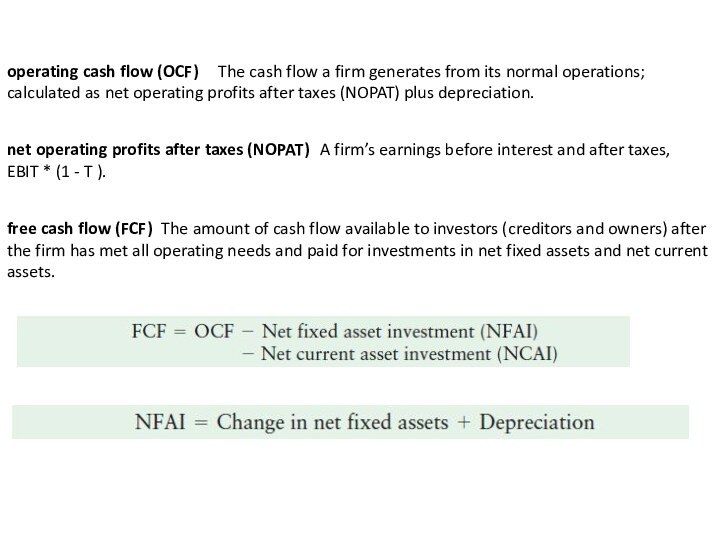

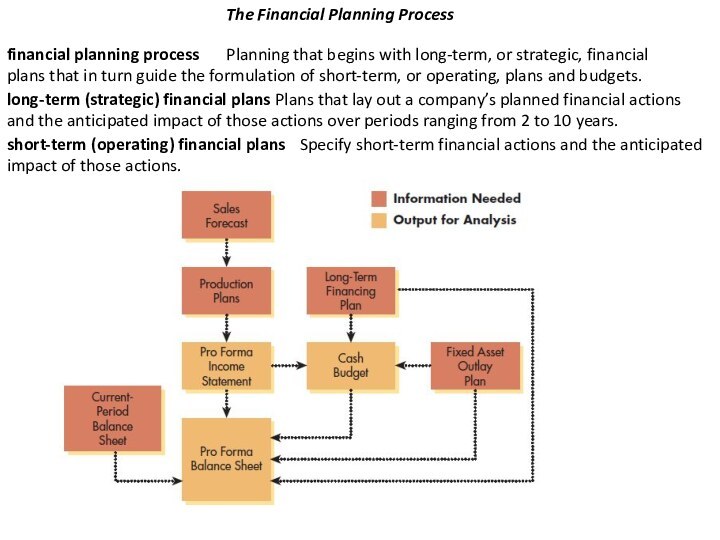

statement of cash flows, operating cash flow, and free cash flow.Understand the financial planning process, including long-term (strategic) financial plans and short-term (operating) financial plans.

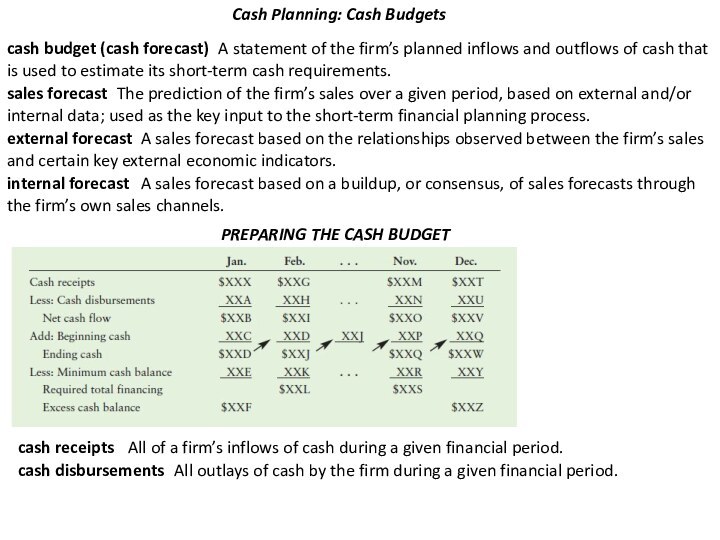

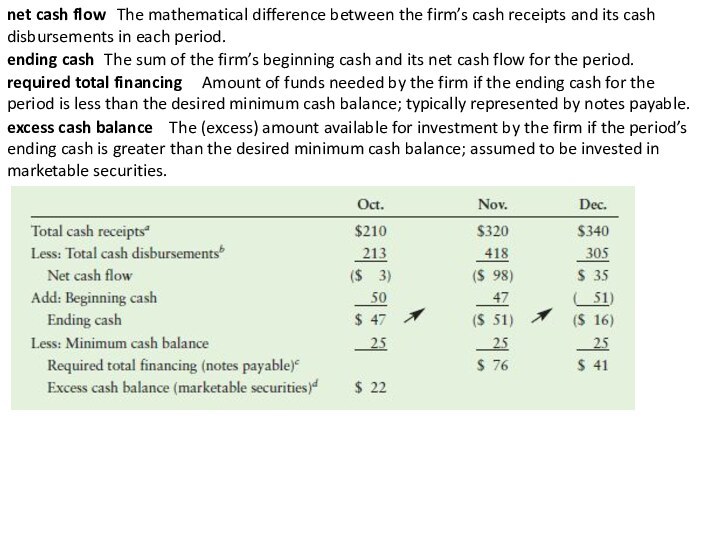

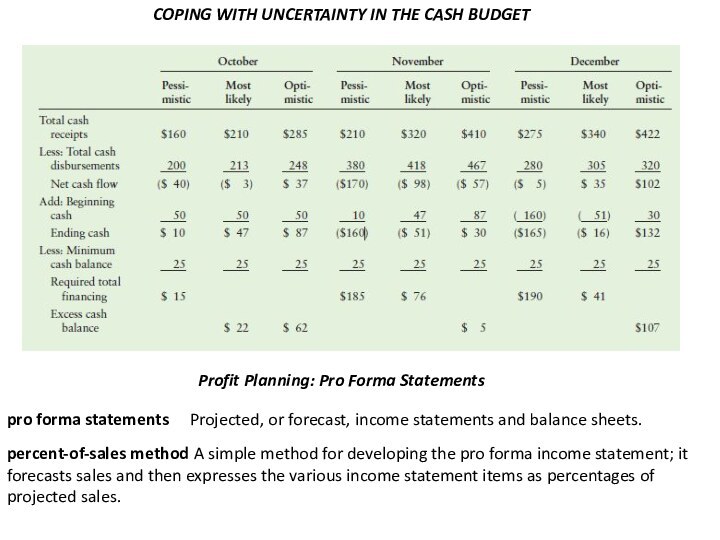

Discuss the cash-planning process and the preparation, evaluation, and use of the cash budget.

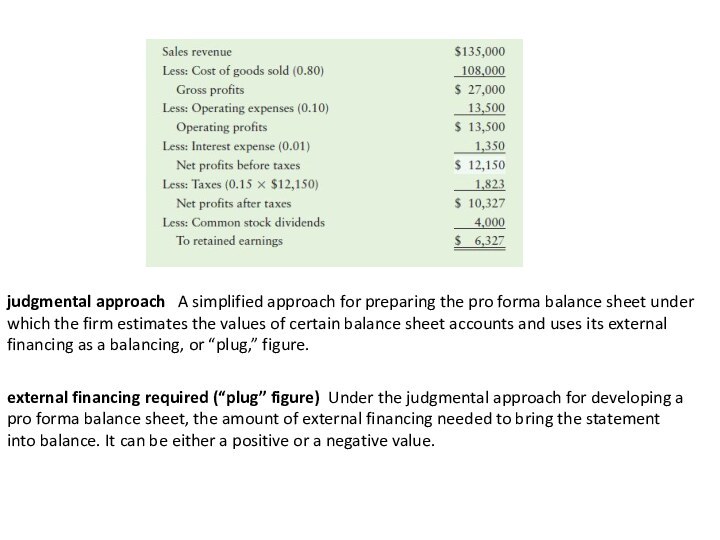

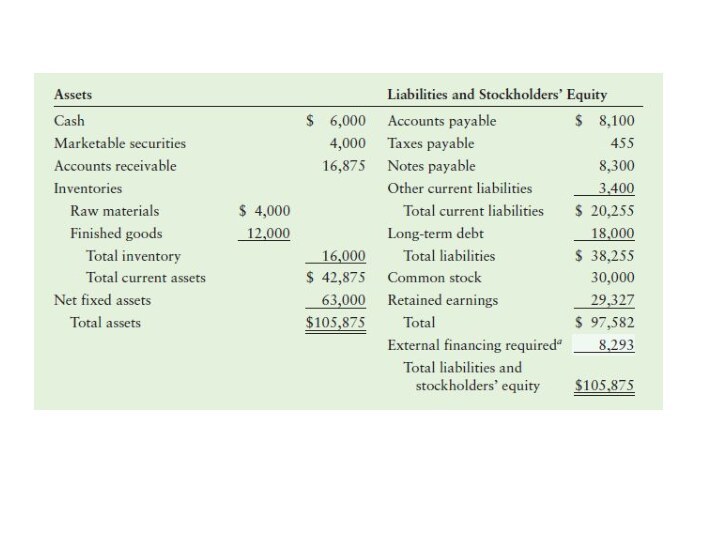

Explain the simplified procedures used to prepare and evaluate the pro forma income statement and the pro forma balance sheet.

Evaluate the simplified approaches to pro forma financial statement preparation and the common uses of pro forma statements.