Business Value on a Customer Case

Use Cases & Demo

& Moscow SQM PilotGlobal References & Why HUAWEI

Content

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

Content

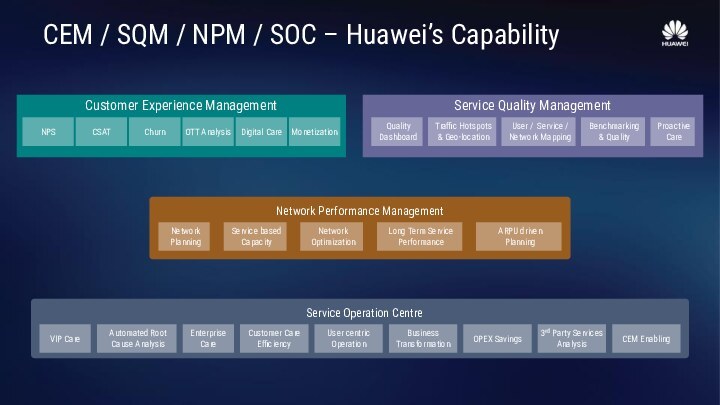

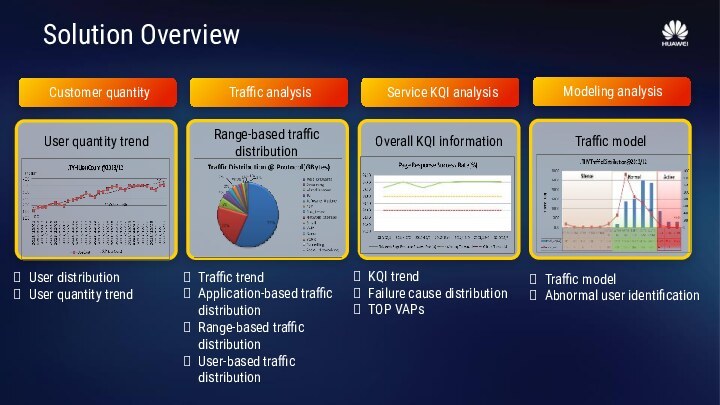

Set of platforms / tools, services and operation support to increase Operator’s value

Content

-0.5 Mio GBP

20.2 Mio GBP

Ramp-up period

Maximal value

By additional use cases, not requested in RFP

Huawei is happy to propose / demonstrate / discuss

Content

NPS

Churn

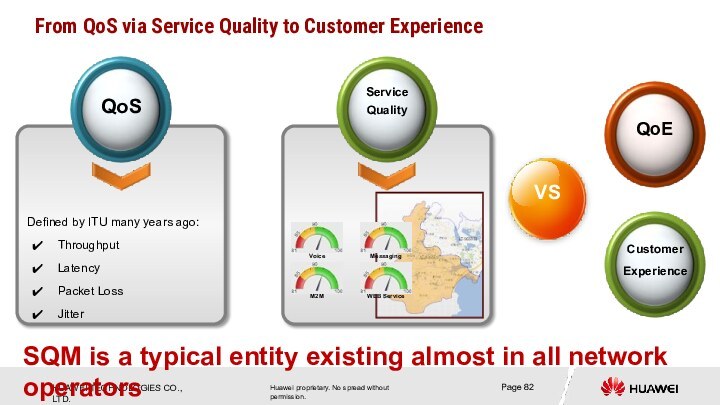

CEM vs SQM

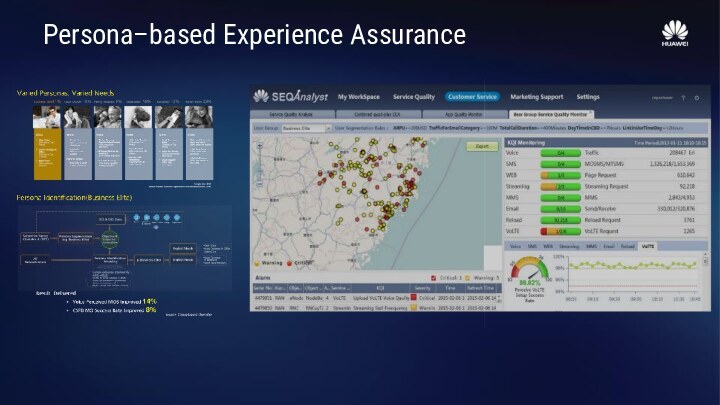

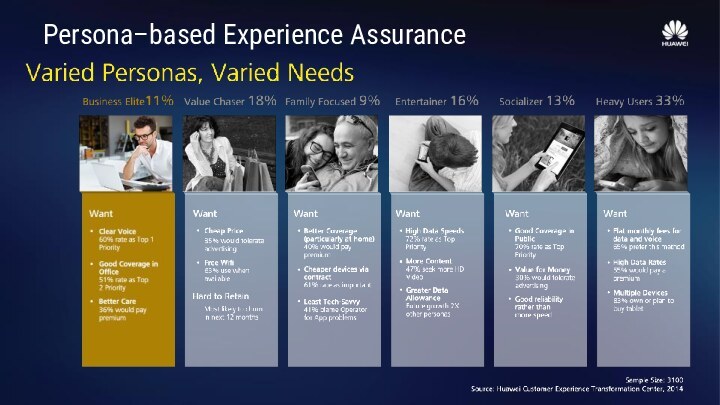

Persona Based Experience Assurance

Customer Care Assistance

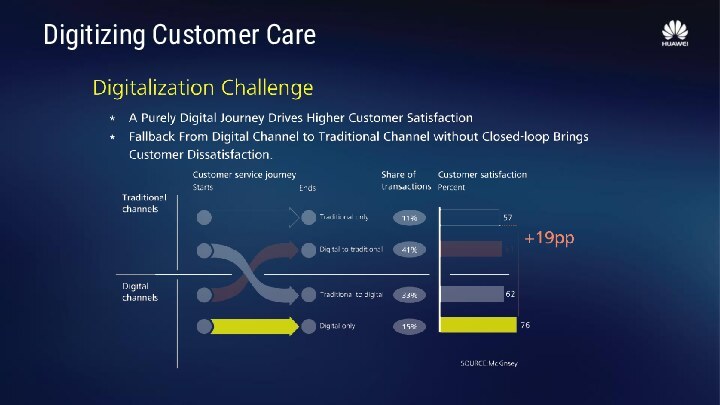

Digitizing Customer Care

ARPU Driven Network Planning

Enterprise (B2B) Service Quality Assurance

Value-Experience Matrix Migration

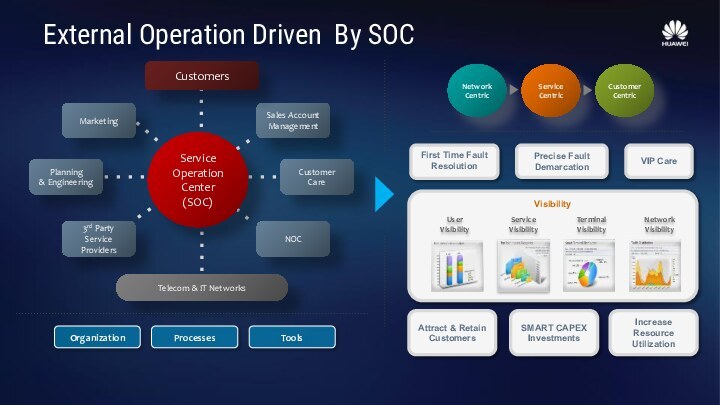

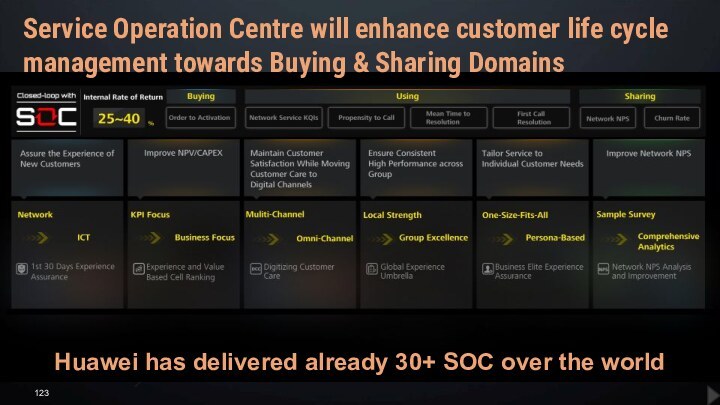

Service Operation Centre

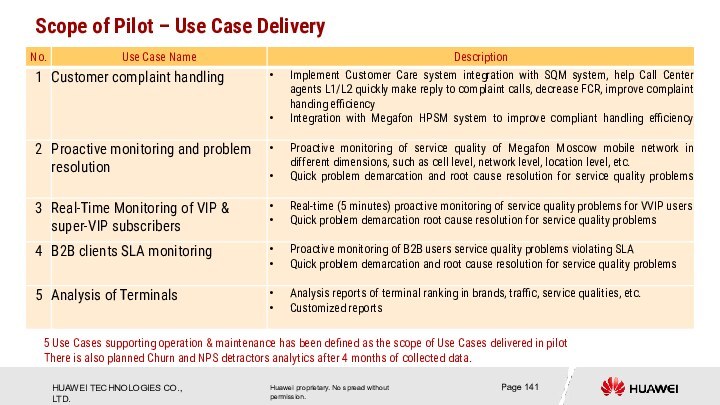

SQM Pilot Moscow

Content

Group

C

1.5 Mio

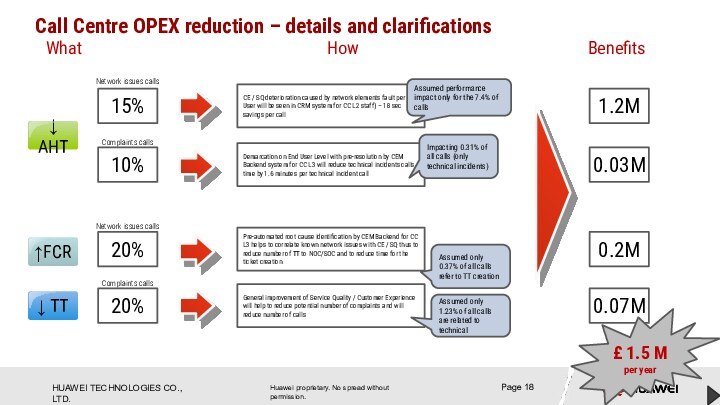

Detailed analysis and planning supported BC calculation for OPEX savings

Summary (details in further slides):

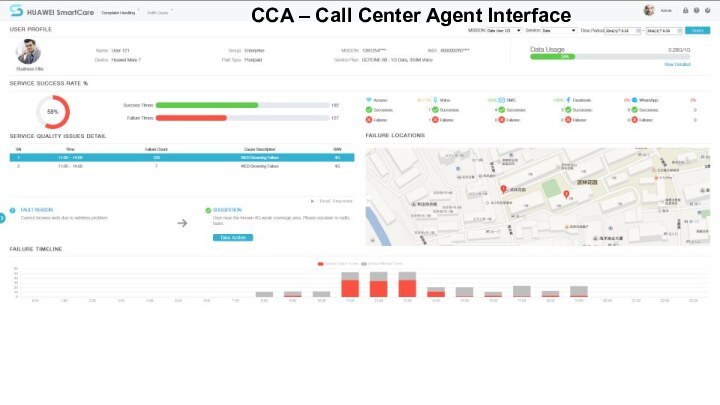

Reduction of AHT of massive network issues related calls by 15% (1 min savings per call)

Reduction of AHT of technical incident related calls by 10% (1.6 min per call)

Improved FCR by 20% by automated root cause analysis per End User

Improved SQ / CE leads to deduction of complaints by 20% with less complaints calls

Expected savings start from 1.5 Mio GBP per annum

Trouble Tickets 30%

Number of TT related Calls

Required Personnel

11.000

Staff

(CC & Retail)

Retail 8,500 (est.)

Call Centre 2,500 (est.)

AHT ~ 6.3 – 6.8 min

Marketing

Query /

Usage

Complex Issue

Incident

Call Time

6,677,196

min per year

4,928,407

min per year

+

Target

Benchmarks

Huawei expects significant savings in Call Centre by CEM Platform Implementation

Details – please see next page

Network issues calls

10%

Complaints calls

Assumed performance impact only for the 7.4% of calls

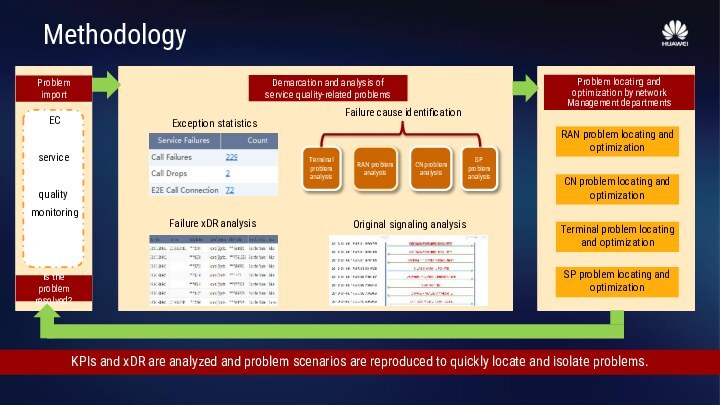

Demarcation on End User Level with pre-resolution by CEM Backend system for CC L3 will reduce technical incidents calls time by 1.6 minutes per technical incident call

How

Impacting 0.31% of all calls (only technical incidents)

20%

Network issues calls

20%

Complaints calls

Pre-automated root cause identification by CEM Backend for CC L3 helps to correlate known network issues with CE / SQ thus to reduce number of TT to NOC/SOC and to reduce time for the ticket creation

General improvement of Service Quality / Customer Experience will help to reduce potential number of complaints and will reduce number of calls

Assumed only 1.23% of all calls are related to technical

Assumed only 0.37% of all calls refer to TT creation

1.2M

0.03M

0.2M

0.07M

What

Benefits

£ 1.5 M per year

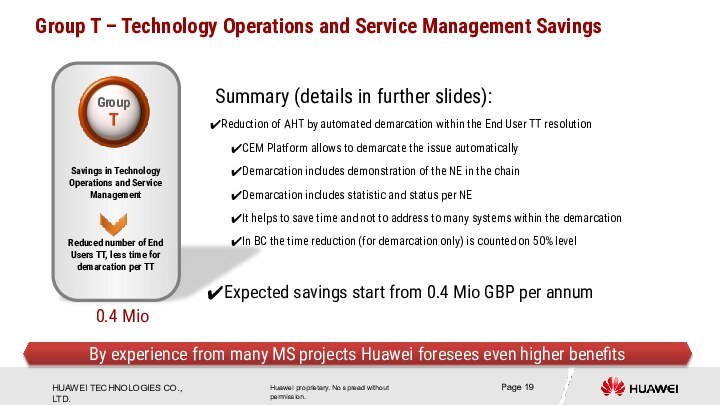

Summary (details in further slides):

Reduction of AHT by automated demarcation within the End User TT resolution

CEM Platform allows to demarcate the issue automatically

Demarcation includes demonstration of the NE in the chain

Demarcation includes statistic and status per NE

It helps to save time and not to address to many systems within the demarcation

In BC the time reduction (for demarcation only) is counted on 50% level

Expected savings start from 0.4 Mio GBP per annum

Applicable only for End User Trouble Tickets and reduces only demarcation time (it gives 13% of improvement time for the whole TT resolution time)

How

0.4M

Savings

£ 0.4 M per year

What

Summary (details in further slides):

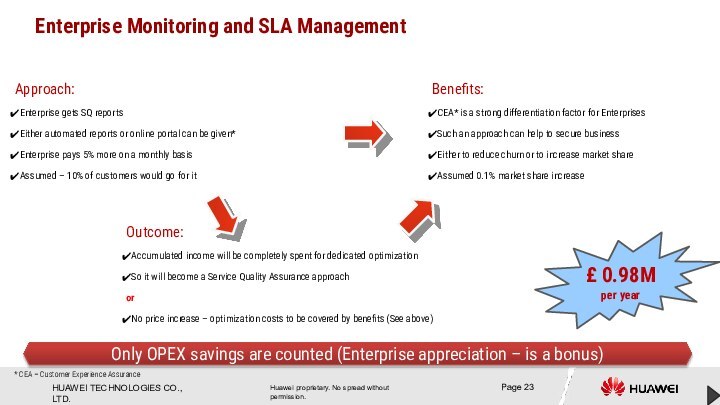

Enterprise Monitoring and SLA Management

Automated operations by CEM Platform will allow to significantly save OPEX

Additional revenue / benefits were not counted here:

Huawei has a dedicated Use Case Enterprise Assurance

Estimation of extra revenue by UC Enterprise Assurance requires more input from EE

Huawei suggests to have a workshop with EE to estimate additional value for EE

New SLA offers for EE Enterprise Customers (per year)

SLA and KQI* visibility for CE will be given to Enterprises

BC calculation includes expenses for the network optimization to fulfill SLA

Expected savings start from 1.3 Mio GBP per annum

* KQI – Key Quality Indicator

Platforms allows to load IMSI of Enterprise and to get all locations, NE, KPI, and KQI Indicators (otherwise it would be required to find all information, address, find cells and collect manually) – here is example for 100 Enterprises is shown

Major Savings

By CEM Platform alarms will be generated automatically for every VIP / Enterprise user. No need to monitor or to check reports on a daily basis (assumed manually it requires 20 minutes per day per Enterprise – so 4 people in parallel work)

CEM Platform will generate reports automatically on a weekly / monthly with minimal efforts per employee

Approach:

Enterprise gets SQ reports

Either automated reports or online portal can be given*

Enterprise pays 5% more on a monthly basis

Assumed – 10% of customers would go for it

* CEA – Customer Experience Assurance

Outcome:

Accumulated income will be completely spent for dedicated optimization

So it will become a Service Quality Assurance approach

or

No price increase – optimization costs to be covered by benefits (See above)

Benefits:

CEA* is a strong differentiation factor for Enterprises

Such an approach can help to secure business

Either to reduce churn or to increase market share

Assumed 0.1% market share increase

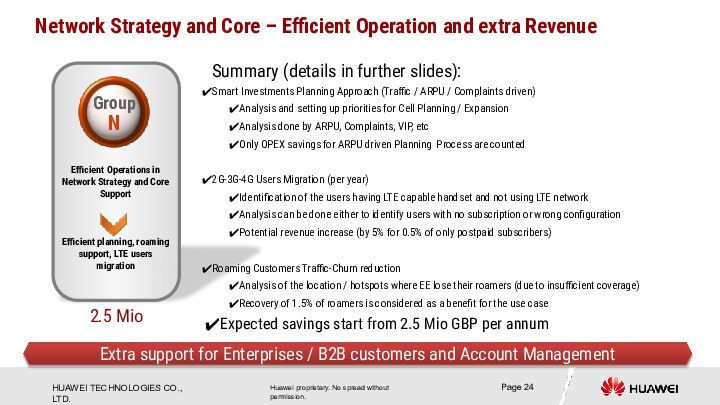

Summary (details in further slides):

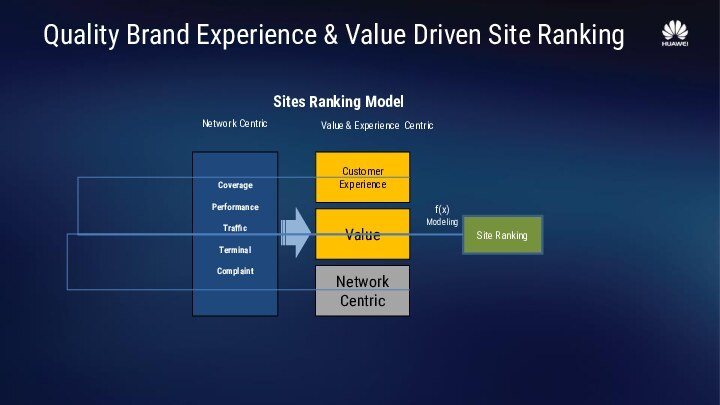

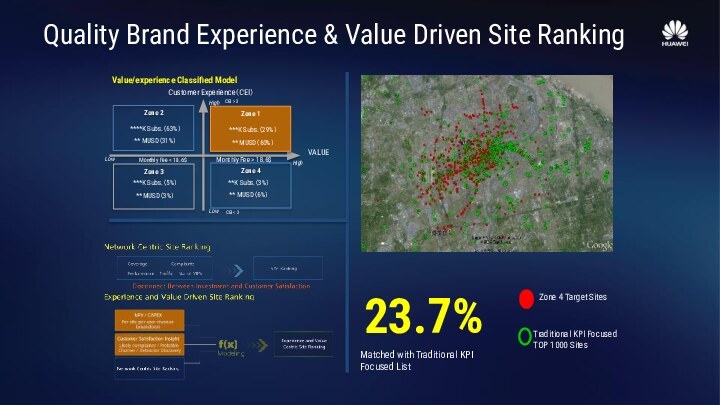

Smart Investments Planning Approach (Traffic / ARPU / Complaints driven)

Analysis and setting up priorities for Cell Planning / Expansion

Analysis done by ARPU, Complaints, VIP, etc

Only OPEX savings for ARPU driven Planning Process are counted

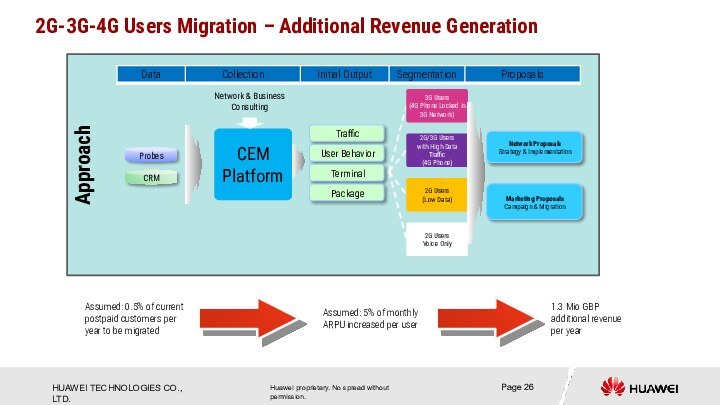

2G-3G-4G Users Migration (per year)

Identification of the users having LTE capable handset and not using LTE network

Analysis can be done either to identify users with no subscription or wrong configuration

Potential revenue increase (by 5% for 0.5% of only postpaid subscribers)

Roaming Customers Traffic-Churn reduction

Analysis of the location / hotspots where EE lose their roamers (due to insufficient coverage)

Recovery of 1.5% of roamers is considered as a benefit for the use case

Expected savings start from 2.5 Mio GBP per annum

Efficient Operations in Network Strategy and Core Support

Efficient planning, roaming support, LTE users migration

Group

N

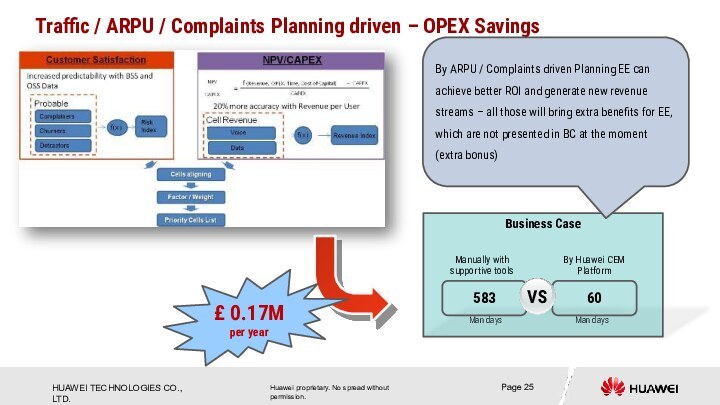

Man days

£ 0.17M per year

By ARPU / Complaints driven Planning EE can achieve better ROI and generate new revenue streams – all those will bring extra benefits for EE, which are not presented in BC at the moment (extra bonus)

This is expected to bring min 1 Mio GBP per year

Huawei CEM Platform can demonstrate areas with last roamers activity – areas of roamers losing

Group

D

0.9 Mio

This case requires more detailed analysis dependant on number of queries

Summary (details in further slides):

Data usage and network experience details to customers via MyEE and online:

Ability for end users to query / see data usage via EE online or App

Customer Care efforts reduction due to digital channels migration

Simplification of the data queries by CC Agent by only one tool (instead of existing three)

Assumed agent can query information from IT system by 2 minutes shorter than before

Applicable only for the data query calls (assumed 1.7% of all calls)

Expected savings start from 0.9 Mio GBP per annum

* As there is no specific technical requirement in RFP for CEM tool to support MyEE or online complaint, MyEE or online complaint support is out of the proposal scope and needs further discuss with EE

How

Impacting 2% of all calls (only data usage queries)

10%

Data Query Calls

Online Portal or / and APP integrated to CEM Platform (to get query results) may help to reduce up to 10% of data usage requests

Impacting 2% of all calls (only data usage queries)

0.6M

0.29M

What

Benefits

£ 0.9 M per year

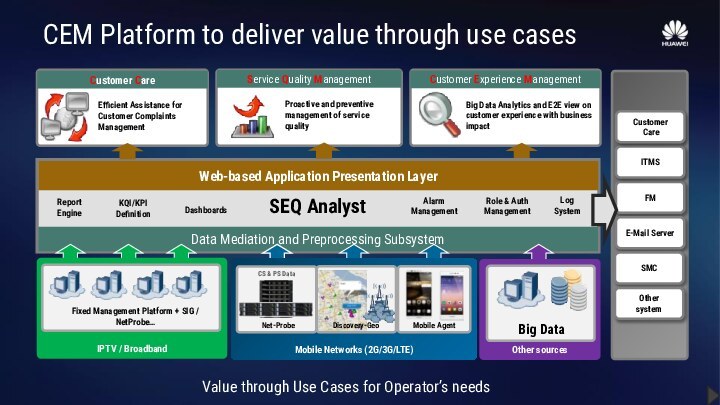

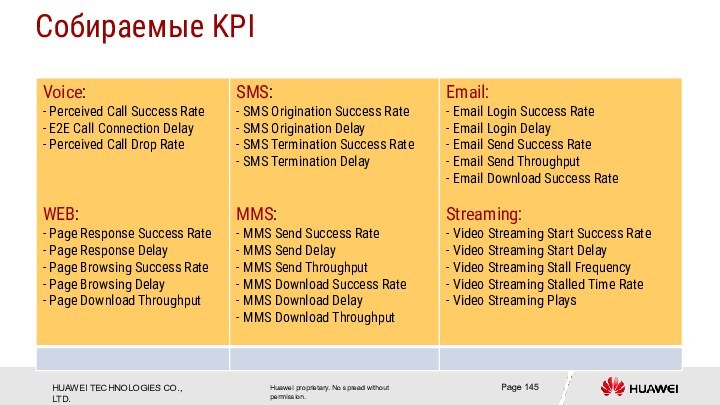

KQI/KPI

Definition

Alarm Management

Role & Auth Management

Log

System

Dashboards

Value through Use Cases for Operator’s needs

2

4G terminal locked in 2/3G subscriber

3

2/3G high traffic subscriber

5

2/3G high APRU subscriber

6

3G fall back subscriber

7

3G terminal locked

in 2G subscriber

8

No 3G contract subscriber

9

2/3G low traffic subscriber

10

3G Subscriber

11

Network optimization

Customer contact

Marketing activities

3

4G terminal locked in 2/3G subscriber

8

3G terminal locked in 2G subscriber

B

Terminal locked subscriber: 4G device model terminal locked in 2/3G network

4

No 4G contract subscriber

5

2/3G high traffic subscriber

6

2/3G high APRU subscriber

9

No 3G contract subscriber

C

Potential subscriber:Need marketing support

User Segmentation

Influence factors

Action

Network

Marketing

Terminal

Contract

Package

Terminal sales

promotion

Customer care & marketing

Package adjustment

Others

66% More Traffic Increase

PSPU capability

Device type correlated with traffic type

Segmentation base on subscriber behavior

G byte / day

36%

By Migration

800

1000

1.7 million of 2G subscribers migrated to 3G

Operator has 0 cost

Best Practice in Operator U

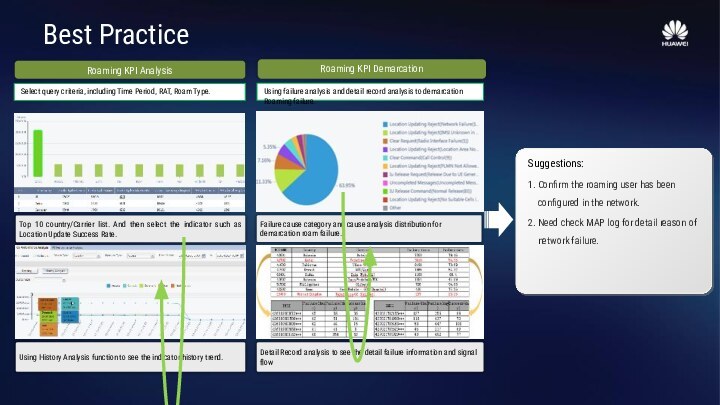

Background:

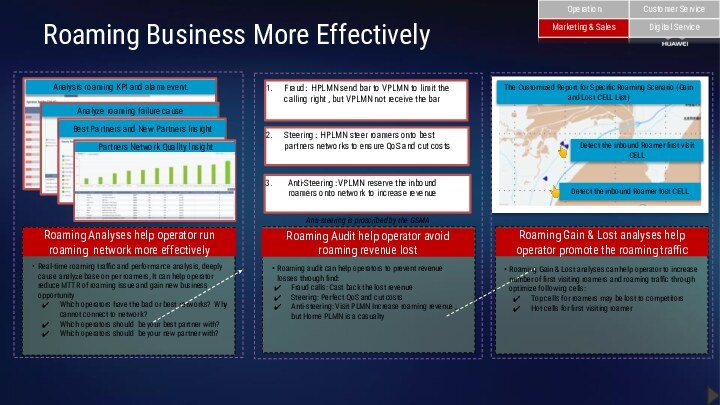

The right partnerships are critical for optimal roaming revenues(Best Roaming Experience and Appropriate Rate);

The operator need detailed, prioritized and actionable information to avoid roaming revenues lost;

The operator need finely solution to optimize network for increase roaming traffic

Value Proposition:

Increase roaming traffic

Fast fine and locate inbound roaming barriers

Indentify the outbound roaming destination gaps

Avoid roaming revenue lost

Detect roaming fraud behaviors

Provide proofs for controversial roaming billing settlement

Reduce MTTR of roaming issue

Real-time roaming traffic and performance monitoring

Deeply root cause analyze base on per roamers

Gain new business opportunity

Provide competitive SLA to gain more roaming partners

Up-sell promotion base on rich roaming service analysis

SEQ Analyst Platform

International Roaming Analysis

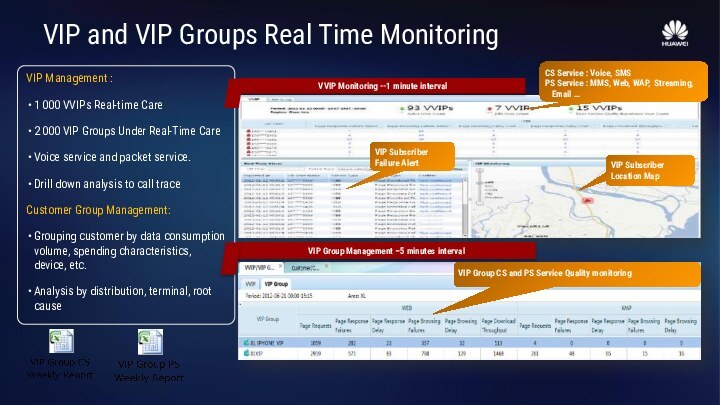

VIP Report

VIP Analysis

VIP Tracing

SQM

VIP Care

Customer Care

Churn Predict

NPS Analysis

CEI

VIP Subscriber

Location Map

VIP Subscriber

Failure Alert

CS Service : Voice, SMS

PS Service : MMS, Web, WAP, Streaming, Email …

VIP Group CS and PS Service Quality monitoring

Experience Insight

Discover VIP’s service abnormity within 1 minute

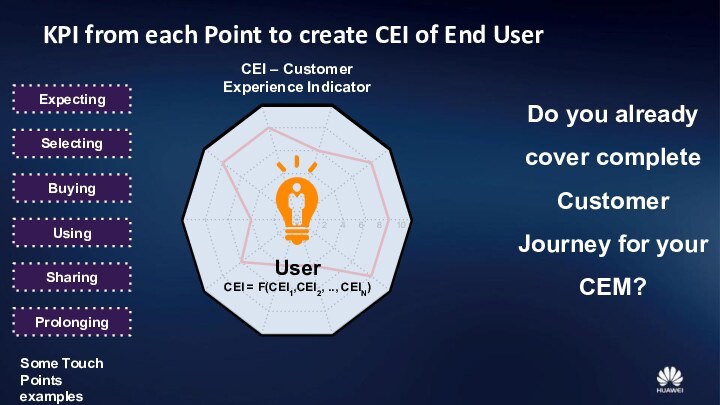

CEI – Customer Experience Indicator

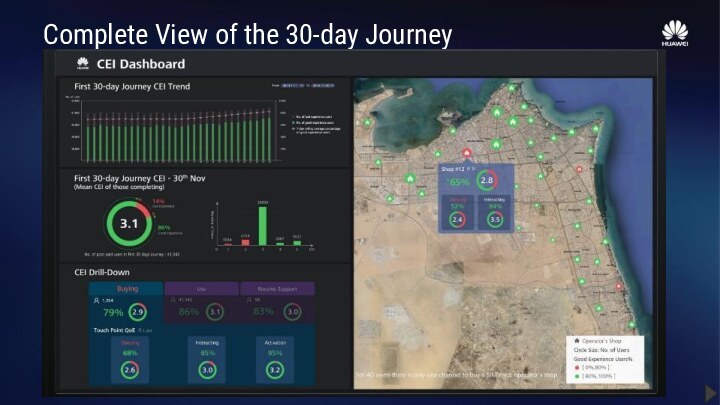

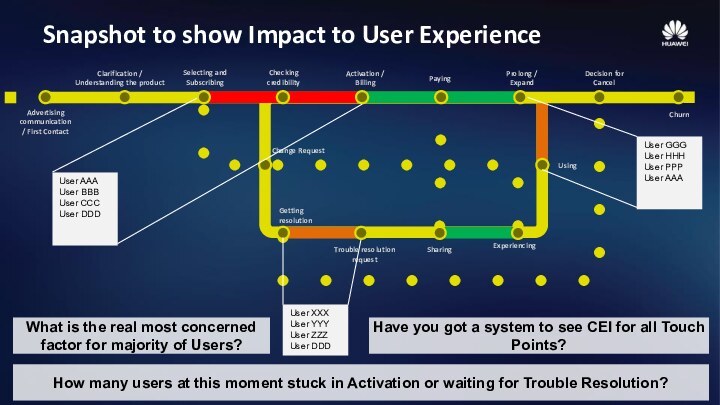

Do you already cover complete Customer Journey for your CEM?

Some Touch Points examples

User GGG

User HHH

User PPP

User AAA

How many users at this moment stuck in Activation or waiting for Trouble Resolution?

What is the real most concerned factor for majority of Users?

Have you got a system to see CEI for all Touch Points?

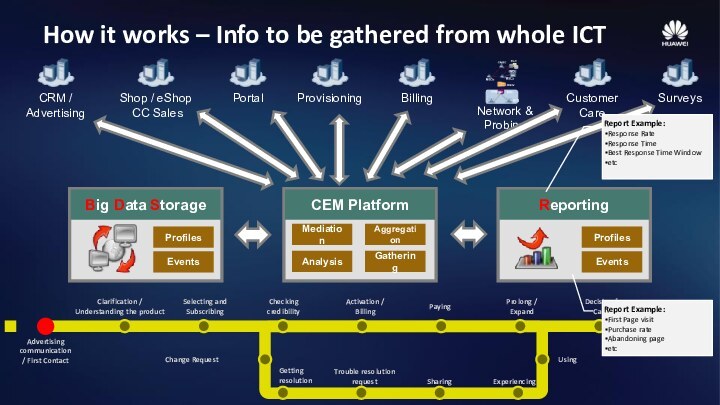

Report Example:

First Page visit

Purchase rate

Abandoning page

etc

Happy customers:

User XXX

User YYY

User ZZZ

User XYZ

YouTube?

Aggregation in the touch point level and in the user level

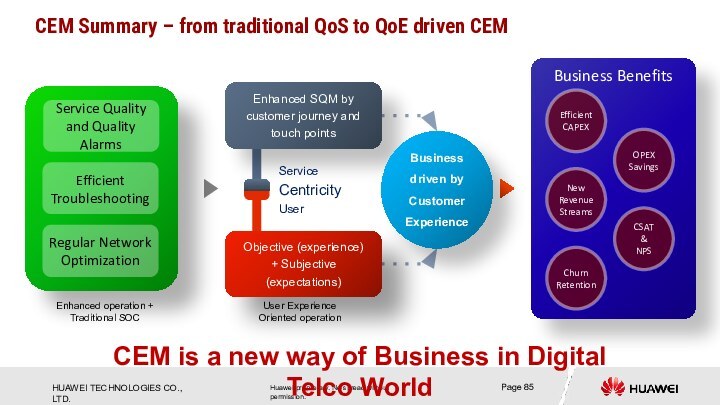

Merge of subjective and objective to have real CEI

Objective (experience) + Subjective (expectations)

Business driven by Customer Experience

Service

Centricity

User

CEM is a new way of Business in Digital Telco World

Enhanced operation + Traditional SOC

User Experience

Oriented operation

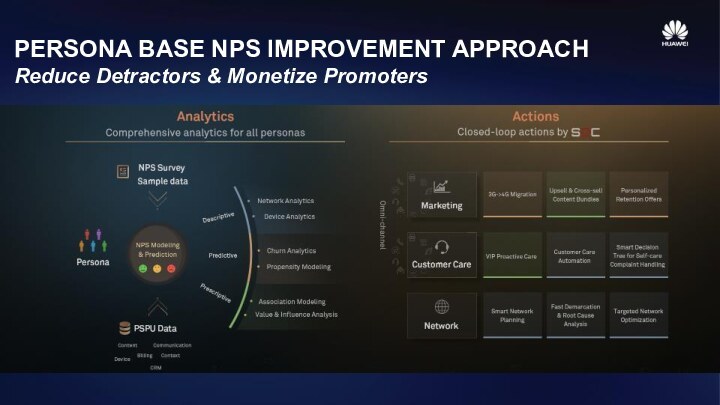

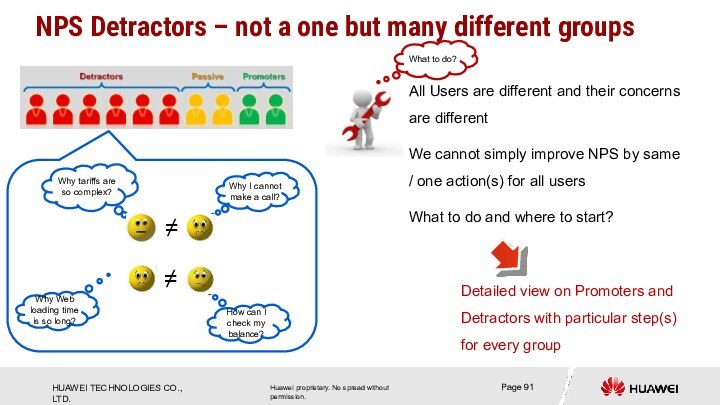

What to do?

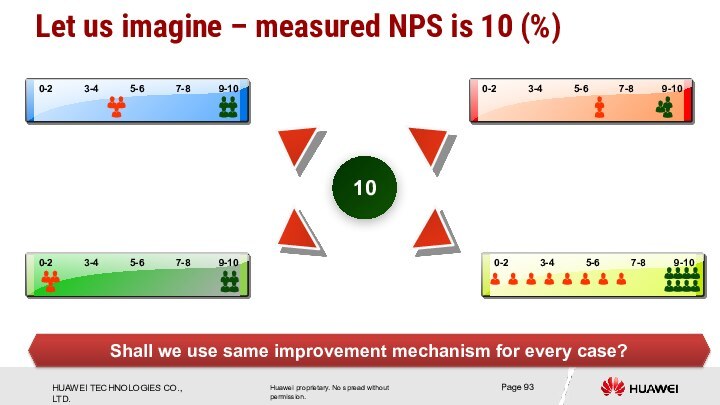

Detailed view on Promoters and Detractors with particular step(s) for every group

Why I cannot make a call?

Why tariffs are so complex?

Why Web loading time is so long?

How can I check my balance?

≠

≠

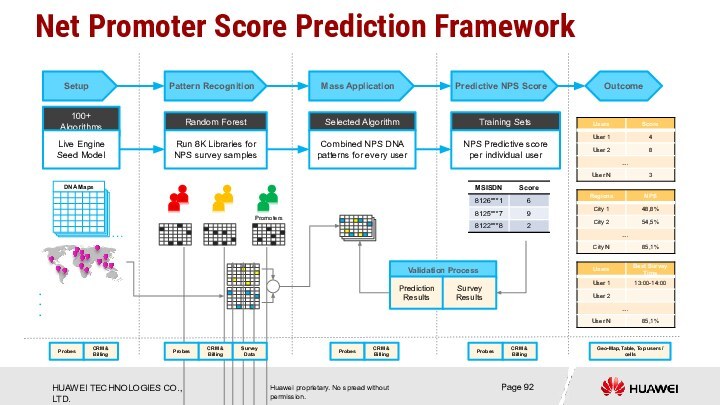

Pattern Recognition

Mass Application

Predictive NPS Score

Outcome

Geo-Map, Table, Top users / cells

Fast response

Pro-active care

Digital Channels

Communication & Resolution

Personalized services

Omni Channels

Innovative

Personalization &

Empathy

0 - 2

Actions

NPS Group

3 - 4

5 - 6

7 - 8

9-10

From Stable Performance

to Excellent Quality

User Oriented Operation

Best Network &

Best Operator

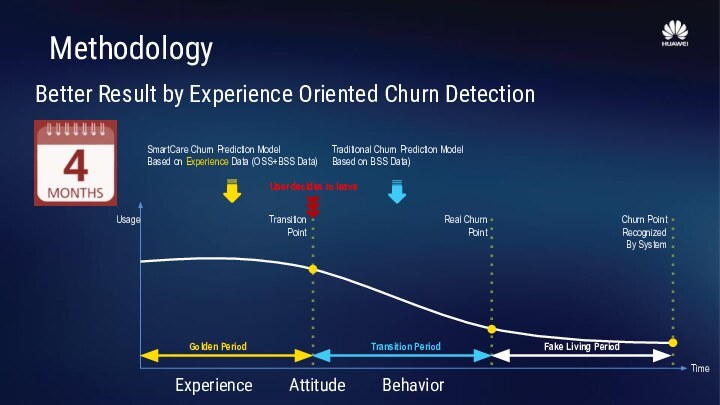

Usage

Time

Transition

Point

Real Churn

Point

Churn Point

Recognized

By System

User decides to leave

Golden Period

Transition Period

Fake Living Period

Experience

Attitude

Behavior

Change operator

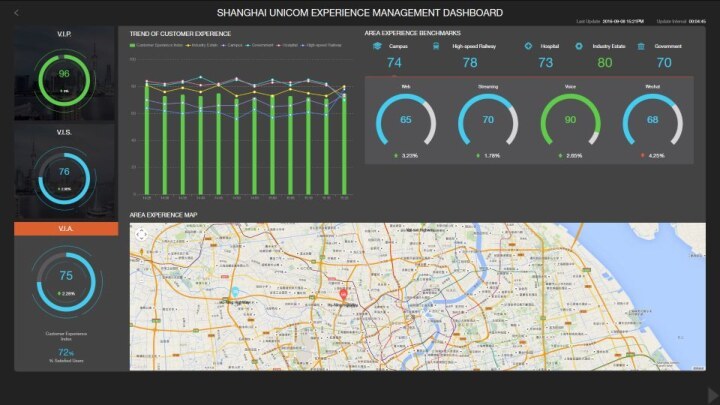

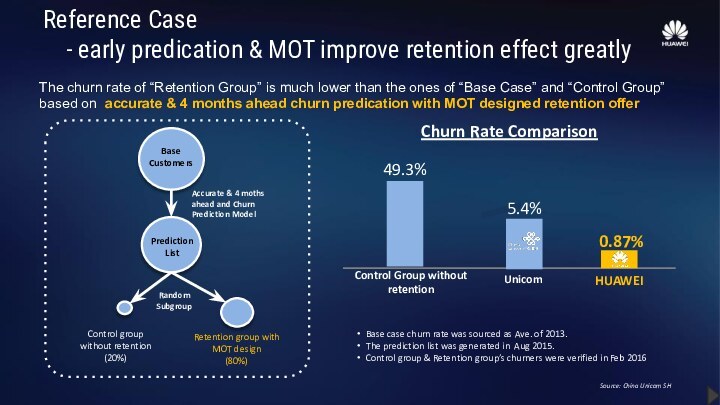

Source: China Unicom SH

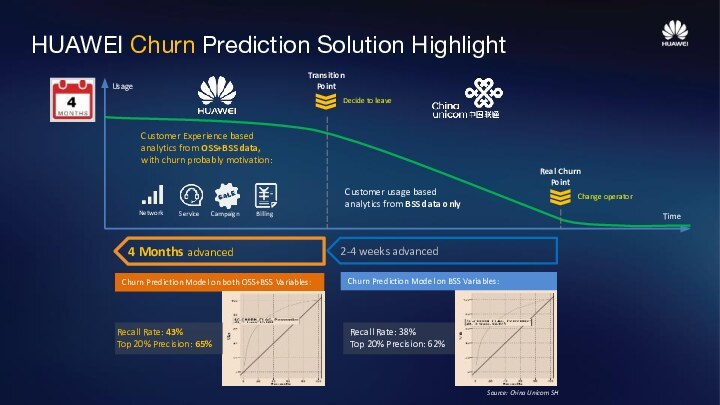

HUAWEI Churn Prediction Solution Highlight

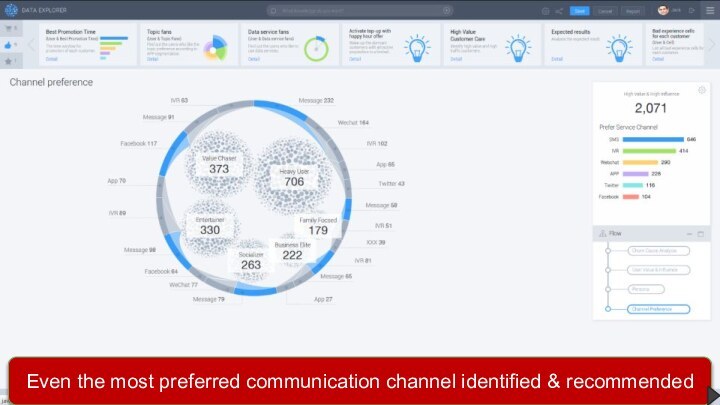

MOT Design 2: Various personalized retention offers for personas

Channel & Time

Inside-out Channel & Timing Allocation

MOT design 3: Outside-in preferred channel & time allocation

Current Value

Potential Value

Influence

Value Chaser

Entertainer

Socializer

Business Elite

Family Focused

Heavy User

persona

root cause

*IPR apply processing

Marketing Closed Loop

- Retention Process Consulting Enriched By Analytics

Source: China Unicom SH

Precision Rate : 77.0%

Recall Rate : 49.1%

Warning Period : 4 Months advance

Network

Closed loop

Marketing

Closed loop

SQDT

SQDT

(User & Service Impact)

User & Service Impact Request

Verification

Override TT with Service Impact information from SQDT

Create new TT and correlate with SQDT

Ticket Exists

No

Yes

Prioritize Ticket based on Service Impact

Before

After

11.01

12.01

Nov

Sep

Oct

01.13

09.01

May

05.01

We Are Here

10.01

Training

MGF Test

Dec

Cutover

Cutover got started on Apr 18, almost done, data check work didn’t start before project got stopped

Power-on & 3.1 Upgrade

Suspended

Jan

Feb

01.01

MegaFon requested to have preliminary trial results by end of Oct. 2016

It’s proposed to focus on Use Case 1 Complaint Handling delivery for phase 1, due to limited time left for delivery

3.1 upgrade is completed

UC 2 Implementation & Verification

MGF Test

UC 3 Implementation & Verification

MGF Test

UC 4 Implementation & Verification

MGF Test

UC 5 Implementation & Verification

MGF Test

Data Check

02.01

Выполненные работы

Текущие и запланированные работы